Plastic Films and Sheets Market Key Trends, Disruptions & Strategic Imperatives

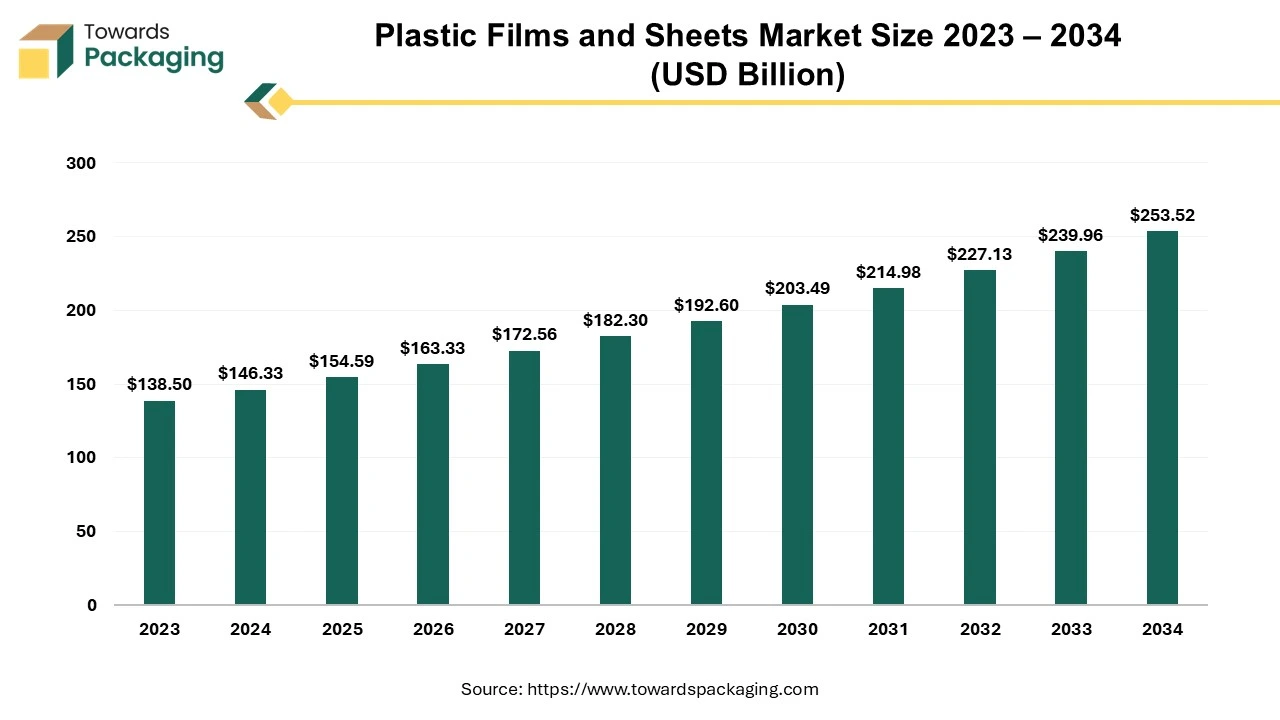

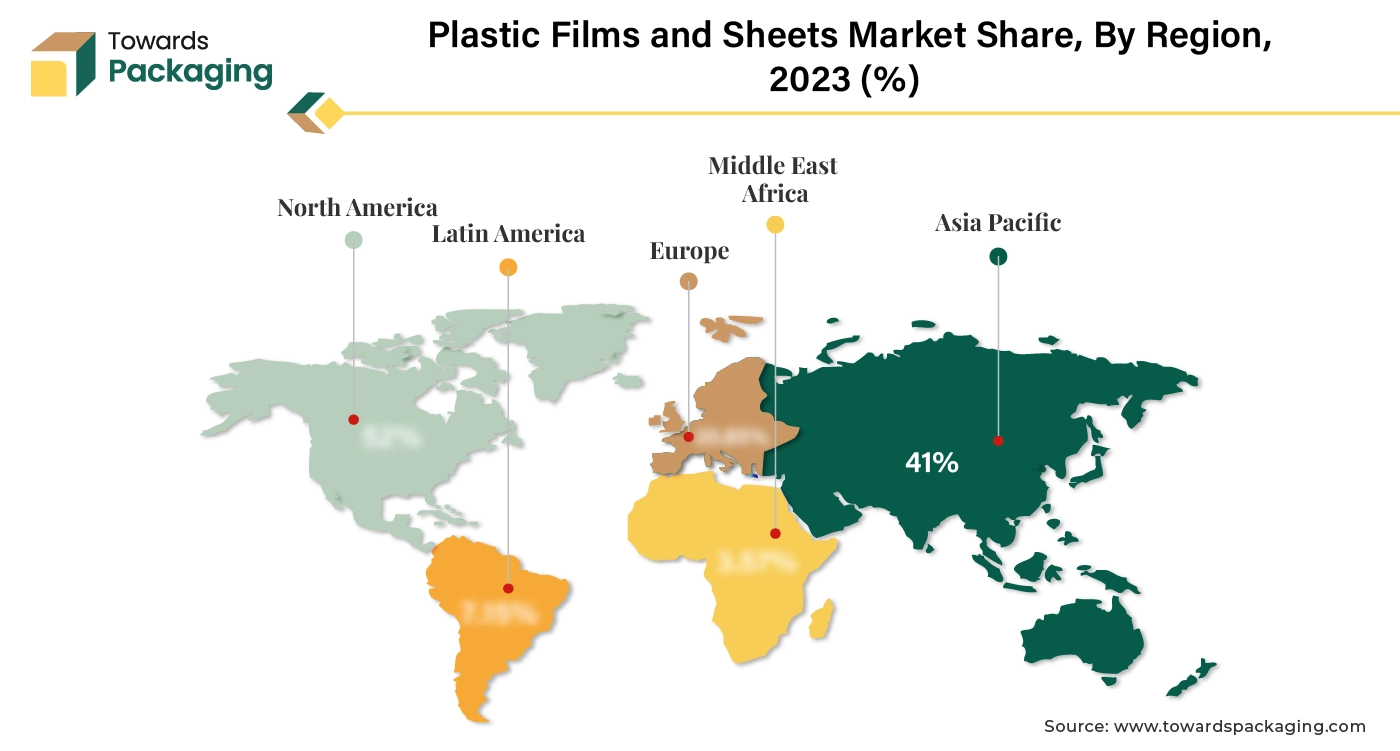

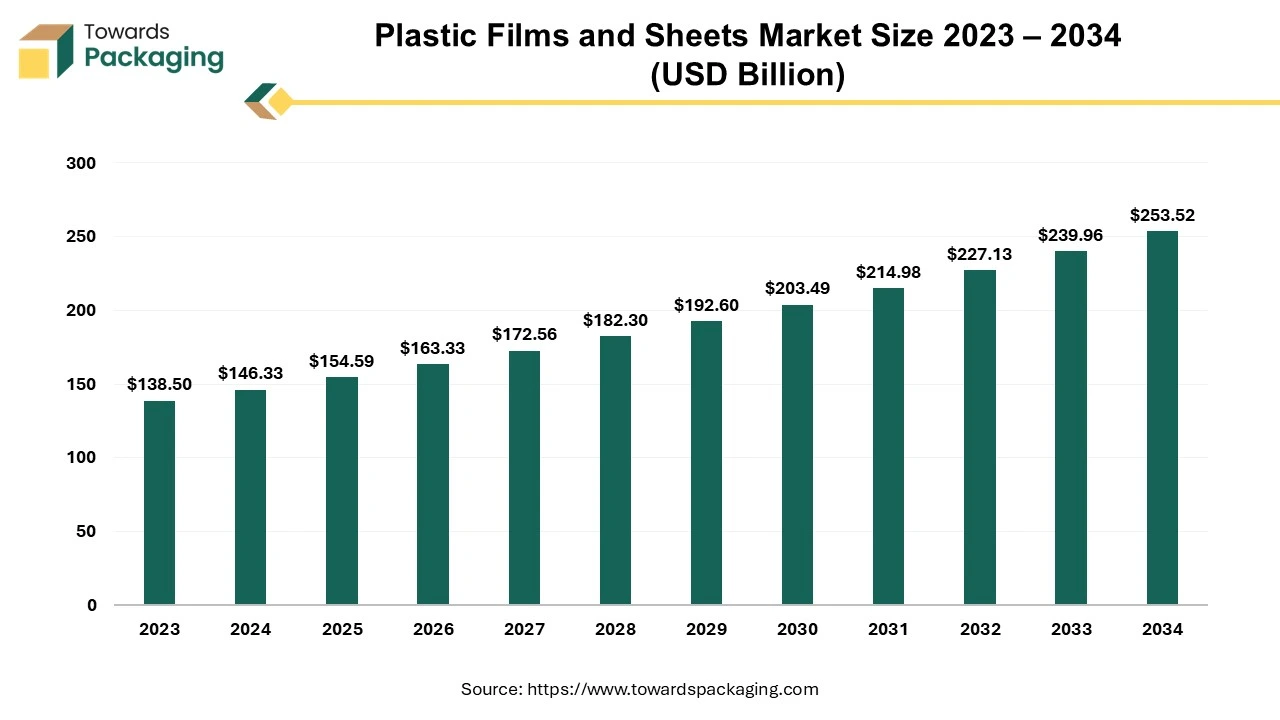

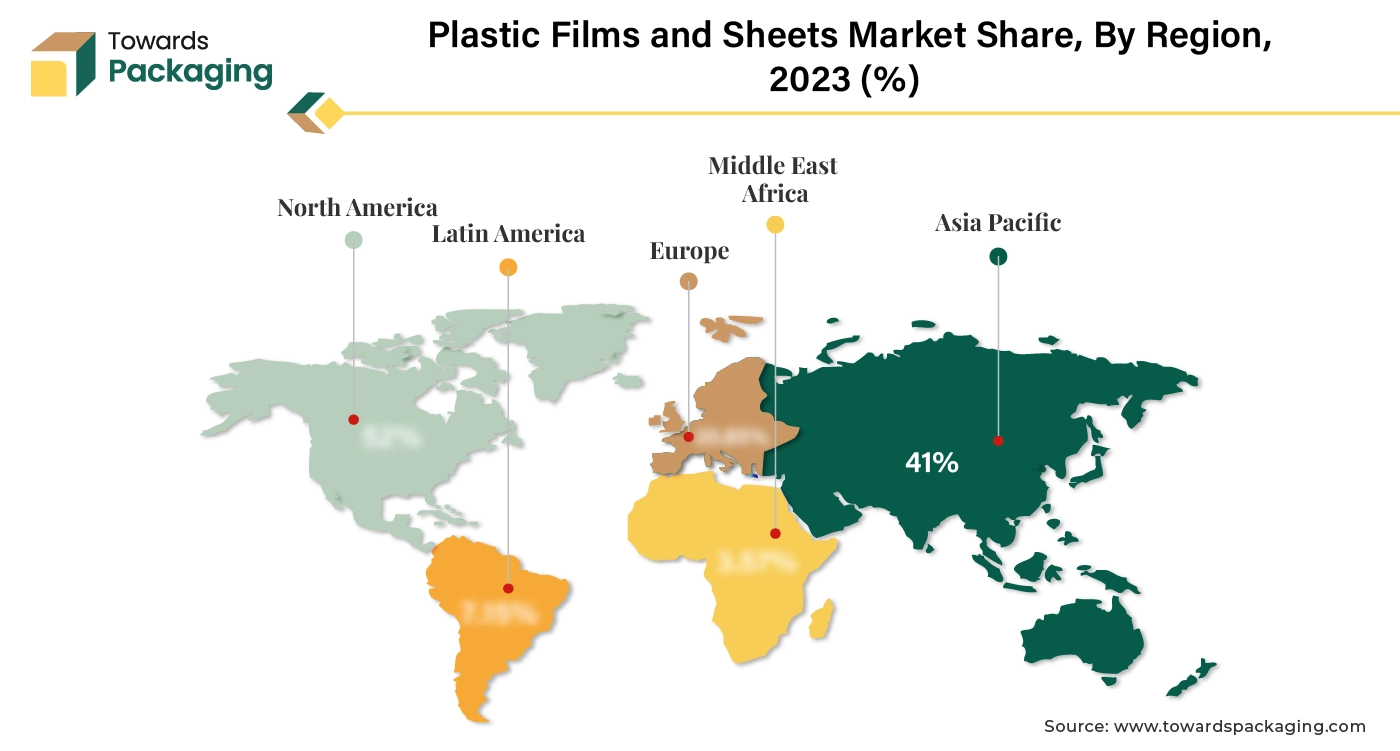

The plastic films and sheets market is forecasted to expand from USD 163.33 billion in 2026 to USD 267.85 billion by 2035, growing at a CAGR of 5.65% from 2026 to 2035. The report provides in-depth analysis of market trends, sustainability shifts, material innovations, and AI adoption, along with detailed segmentation by product type (LDPE/LLDPE, BOPP, PVC, HDPE, CPP, others) and application (packaging, food, medical, agriculture, construction, non-packaging). It covers regional insights across North America, Europe, Asia Pacific, Latin America, and MEA, highlighting Asia Pacific as the dominant region and North America as the fastest-growing.

The study includes company profiles, competitive benchmarking, value chain analysis, trade flows, pricing trends, manufacturers and supplier data, offering a complete strategic view of the global market.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing plastic films and sheets which is estimated to drive the global plastic films and sheets market over the forecast period.

Major Key Insights of the Plastic Films and Sheets Market

- Asia Pacific dominated the plastic films and sheets market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By product type, the LDPE/LLDPE segment dominated the market with the largest share in 2024.

- By application, the packaging segment dominated the plastic films and sheets market in 2024.

Plastic Films and Sheets Market: Durable Packaging Solution

Plastic films and sheets are thin, flexible materials manufactured from various types of plastic polymers, often utilized in an extensive range of industries for packaging, protection, insulation, and styling decorative purposes. These materials are typically characterized by their thinness (films being thinner than sheets) and are produced by extruding plastic into continuous, uniform rolls or flat pieces.

Generally, plastic films have a thickness of less than 1 mm and are often utilized for applications such as industrial protection, food packaging, agricultural purposes and medical packaging. Examples of common plastic films include polypropylene (PP), polyester (PET) and polyethylene (PE) films.

Plastic sheets are thicker than films, typically above 1 mm in thickness. They are used in applications that require more durability or rigidity, such as in signage, construction materials, or automotive components. Common materials for plastic sheets include polycarbonate, acrylic, and PVC (polyvinyl chloride).

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 154.60 Billion |

| Projected Market Size in 2035 |

USD 267.85 Billion |

| CAGR (2026 - 2035) |

5.65% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Product Type, By Application and By Region |

| Top Key Players |

Toray Industries, Inc., British Polythene Ltd., Toyobo Co., Ltd., Berry Global, Inc., SABIC. |

Market Trends

- Eco-Friendly Solutions and Sustainable Packaging

There is a growth in demand for plastic films and sheets that are biodegradable, recyclable, or manufactured from renewable resources. Manufacturers are investing in developing bioplastics (e.g., PHA, PLA) and recyclable PP and PE films to meet consumer and regulatory demands for sustainability. Brands are under heavy pressure from consumers to adopt eco-friendly packaging solutions. Many companies are now seeking to utilize compostable and recyclable films and minimize the carbon footprint of their packaging materials.

Governments, especially in Europe and North America, are implementing stricter regulations on plastic waste and encouraging the use of sustainable packaging. The European Union's Plastics Strategy and similar initiatives worldwide are driving manufacturers to innovate in terms of reducing plastic waste through recycled content and circular economy practices.

- Material Science and Advancements in Technology

Innovations in polymer chemistry have led to the development of high-performance plastic films that are lighter, stronger, and provide better barrier properties. For instance, multi-layer films combine different polymers to offer enhanced flexibility, strength, and resistance to environmental factors like oxygen, moisture, and light.

- Nanotechnology and Smart Films

Nanotechnology is being increasingly utilized to develop smart plastic films that can offer added functionality, such as temperature control, antimicrobial properties, and self-healing capabilities. For instance, nano-coated films are being developed for food packaging to extend shelf life and increase freshness.

- Expansion of the Agricultural Films Market

The utilization of plastic films in agriculture is expanding, driven by the growing need to improve crop yield and protect plants. Greenhouse films, mulch films, and silage films are extensively utilized to improve soil quality, reduce water consumption, and extend the growing season. The risen focus on sustainable farming practices is also boosting demand for biodegradable agricultural films.

The rise of vertical farming, indoor farming, and other controlled environment agricultural methods is increasing the demand for high-performance plastic films that can regulate light, temperature, and humidity, providing ideal conditions for crop growth.

Plastic Films & Sheets Supply for Packaging (Tonnes/Year)

| Material Type |

North America |

Europe |

| LDPE / LLDPE films |

7200000 |

6800000 |

| HDPE films |

3100000 |

2900000 |

| BOPP films |

2600000 |

3400000 |

| CPP films |

1800000 |

2100000 |

| PET films & sheets |

2400000 |

2700000 |

| Multilayer barrier films |

1900000 |

2300000 |

How Can AI Improve the Plastic Films and Sheets Industry?

The integration of artificial intelligence into the plastic films and sheets industry has ability to significantly improve efficiency, sustainability and innovation across various stages of operations and production. The integration of the AI in the plastic films and sheets industry can optimize manufacturing processes by providing predictive maintenance and optimize production processes. AI can analyze sensor data from machines and equipment to predict when maintenance or repairs are required, assisting to avoid unexpected downtimes and reduce maintenance costs. By utilizing predictive analytics, AI can monitor the health of machinery, detect anomalies, and schedule maintenance before critical failures occur.

AI can automate inventory management by tracking raw materials, finished products, and packaging materials in real time. Machine learning algorithms can forecast inventory needs, help manage stock levels, and prevent production delays due to shortages or excess inventory. With AI’s ability to analyze vast amounts of market data, consumer preferences, and competitive products, manufacturers can develop customized plastic films that meet specific demands in packaging, medical, or agricultural applications. AI-driven design tools can speed up the process of creating customized films with specific attributes like moisture resistance, UV protection, or biodegradability.

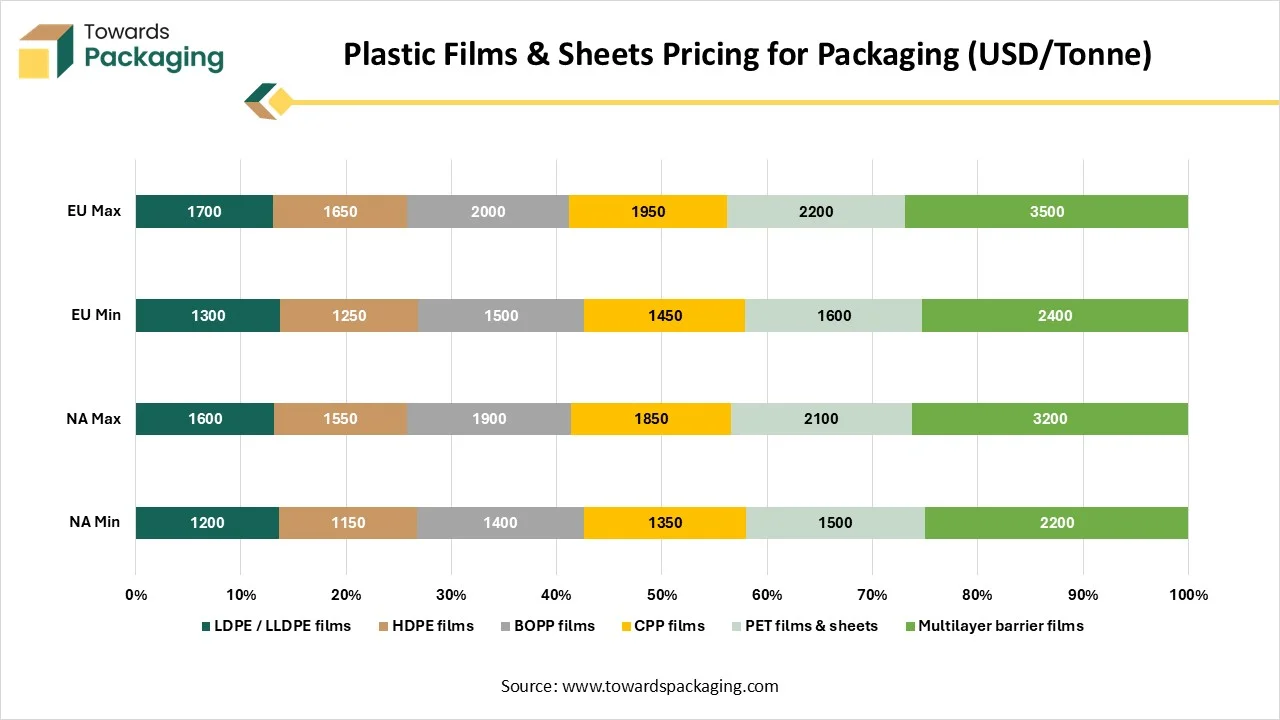

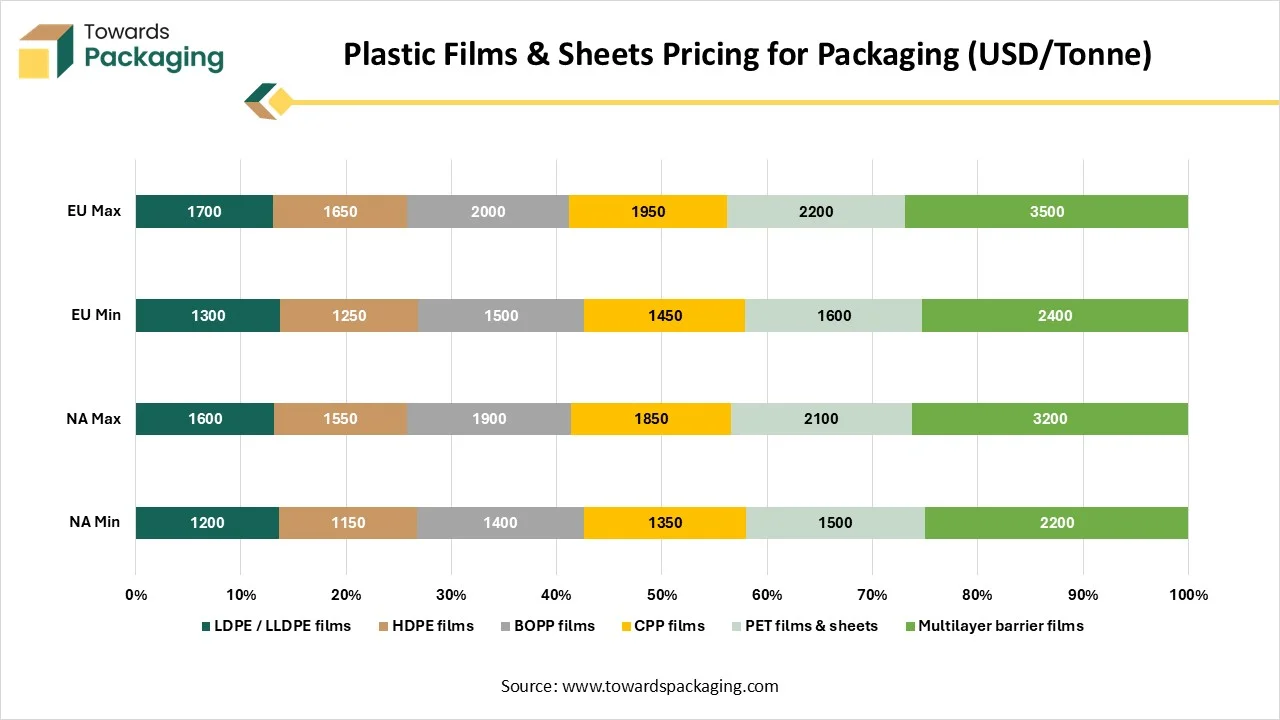

Plastic Films & Sheets Pricing for Packaging (USD/Tonne)

| Material |

NA Min |

NA Max |

EU Min |

EU Max |

| LDPE / LLDPE films |

1200 |

1600 |

1300 |

1700 |

| HDPE films |

1150 |

1550 |

1250 |

1650 |

| BOPP films |

1400 |

1900 |

1500 |

2000 |

| CPP films |

1350 |

1850 |

1450 |

1950 |

| PET films & sheets |

1500 |

2100 |

1600 |

2200 |

| Multilayer barrier films |

2200 |

3200 |

2400 |

3500 |

Driver

Rising Demand for Flexible Packaging & Increased Demand from the Food and Beverage Sector

Flexible packaging made from plastic films is increasingly popular due to its lightweight, cost-effectiveness, and convenience. It provides better protection for products while being more cost-efficient in terms of transportation and storage compared to rigid packaging. There is rising preference for flexible and lightweight packaging that reduces waste and transportation costs, especially in the food and beverage industry, which is a major consumer of plastic films. Plastic films and sheets are essential in the packaging of food products, especially to extend shelf life, protect freshness, and preserve taste and nutritional value. The food and beverage industry is a significant driver of demand for high-performance, barrier films that can provide oxygen, moisture, and UV protection. With the rising demand for portion-controlled, ready-to-eat, and single-serve packaged foods, there is an increase in demand for flexible plastic packaging solutions that cater to consumer convenience. Rising adoption of inorganic growth strategies like partnership and collaboration to develop plastic film for food industry has estimated to drive the growth of the global plastic films and sheets market over the forecast period.

- For instance, in March 2024, INEOS, chemical company, & the several partners announced the introduction new film packaging with 50% recycled plastic. The introduction of this new circular packaging was made possible by the cooperation of numerous partners throughout the whole supply chain: GreenDot made sure that post-consumer plastic packaging waste was sourced and supplied. Plastic Energy's technology was then used to turn the garbage into TACOIL (pyrolysis oil).

In the UK, PepsiCo introduced the Sunbites packaging using these innovative polypropylene films. PepsiCo Positive (pep+), the company's end-to-end transformation initiative, includes the cooperation. By 2030, it hopes to eradicate virgin fossil-based plastic from crisp and chip bags in Europe. Through the International Sustainability and Carbon Certification (ISCC PLUS) program, an impartial third party certifies that the recycled polymer content has been traced using mass balancing principles throughout the production process.

Restraint

Availability of Biodegradable Alternatives and Recycling Challenges

The key players operating in the market are facing challenges in procuring raw material at lower cost as well as competition from the alternative packaging solutions, which may restrict the growth of global plastic films and sheets market in the near future. The push for more sustainable and eco-friendly packaging materials has led to increased interest in biodegradable alternatives, such as plant-based films or compostable plastics. These alternatives are gradually replacing conventional plastic films and sheets.

Alternative materials, like paper, aluminum, and glass, are increasingly being used for packaging and protective sheets, especially in industries like food and beverage or electronics, where consumers are more focused on reducing plastic consumption. Fluctuations in the prices of raw materials, such as petroleum and natural gas, which are essential for plastic production, can increase production costs and potentially reduce market demand.

Manufacturer Adoption Benchmarks Plastic Films & Sheets (%)

Image

| Packaging Format |

North America |

Europe |

| Mono-material films |

35 – 55 |

45 – 65 |

| Multilayer barrier films |

30 – 45 |

25 – 40 |

| Recyclable-ready structures |

25 – 40 |

40 – 60 |

| PCR-content films |

15 – 30 |

25 – 45 |

| High-barrier specialty films |

10 – 20 |

15 – 25 |

Market Opportunity

Growth of E-commerce

The rapid growth of e-commerce is a key driver for the plastic films market. With the growth of online shopping, there is a surge in the need for protective packaging, including shrink wraps, poly mailers, bubble wraps, and stretch films, to ensure safe delivery of products. The need for customized packaging for e-commerce products is also on the rise, fueling the demand for plastic films and sheets tailored to specific product shapes, sizes, and branding requirements.

According the data published by the United States Business Association of E-Commerce, in the second quarter of 2024, US commerce sales totalled US$291.6 billion, up 6.8% from the same period the year before and 0.82% from the previous quarter.

As of the first half of 2024, this amounts to US$579.45 billion in total e-commerce sales in the nation. Sales are expected to reach US$1.26 trillion by year's end and US$1.72 trillion by 2027, according to experts. About 22.6% of all US retail sales will occur online by that time.

LDPE/LLDPE Segment to Led the Market in 2024

The LDPE/LLDPE segment held a dominant presence in the global plastic films and sheets market in 2024. As LDPE is highly flexible and can be easily stretched, which makes it perfect for producing thin, lightweight films that retain strength and durability under various conditions. LDPE is resistant to moisture, which assists protect the contents from environmental factors like water and humidity. This is particularly valuable for packaging food items, medical supplies, or electronics. It also resists a range of chemicals, which makes it suitable for packaging items that may come into contact with various substances during handling and transport. LDPE is relatively inexpensive to produce and can be made in large quantities, making it an economical choice for manufacturers looking to produce cost-effective packaging.

Rapid Industrialization Supports the Dominance of the Packaging Segment

The packaging segment registered its dominance over the global plastic films and sheets market in 2024. As plastic films and sheets has barrier properties it is widely used for packaging food, pharmaceutical products and consumer goods. Plastic films can effectively protect food and pharmaceutical products from moisture, oxygen, and other gases, which helps extend shelf life and maintain product integrity. For example, in food packaging, this helps preserve freshness, flavor, and nutritional content. Some plastic films, like those with UV-blocking properties, protect products from light degradation, which is particularly important for sensitive pharmaceuticals and light-sensitive food items.

In both food and pharmaceuticals, extending shelf life is crucial. Plastic films can be used in modified atmosphere packaging (MAP), where the internal atmosphere is altered to slow down spoilage or degradation processes. This helps in preserving food and ensuring the potency of pharmaceutical products over time. Many plastic films offer easy-to-use packaging solutions like resealable pouches, single-serving packs, or blister packs, which add convenience for consumers while keeping the product safe and fresh.

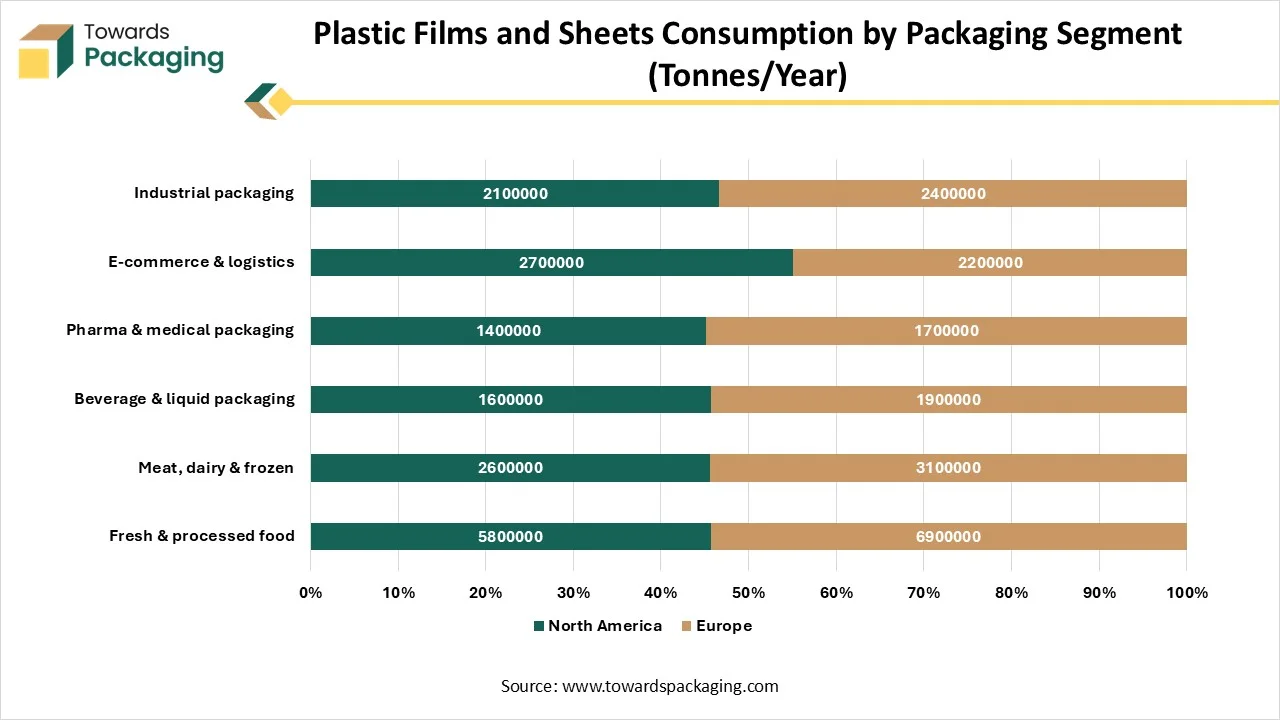

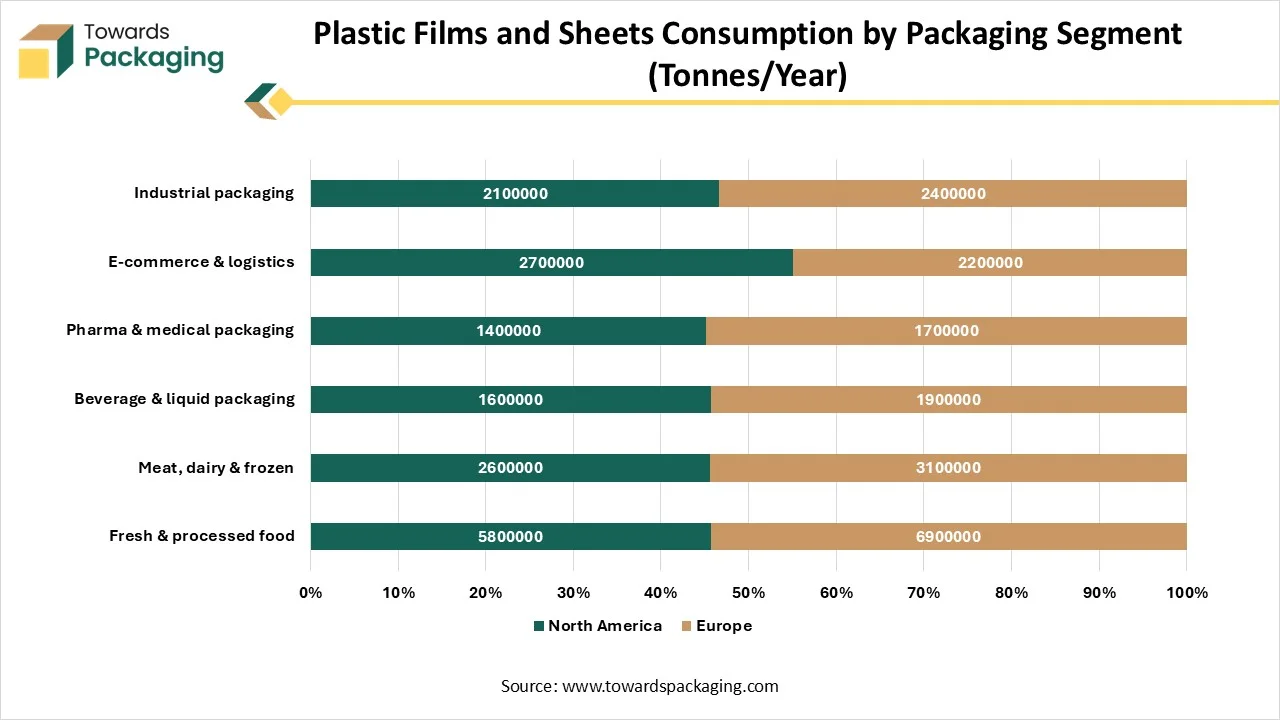

Plastic Films & Sheets Consumption by Packaging Segment (Tonnes/Year)

| Packaging Segment |

North America |

Europe |

| Fresh & processed food |

5800000 |

6900000 |

| Meat, dairy & frozen |

2600000 |

3100000 |

| Beverage & liquid packaging |

1600000 |

1900000 |

| Pharma & medical packaging |

1400000 |

1700000 |

| E-commerce & logistics |

2700000 |

2200000 |

| Industrial packaging |

2100000 |

2400000 |

Asia Pacific’s Well Established Pharma Sector to Support Dominance

Asia Pacific region dominated the global plastic films and sheets market in 2024. The Asia Pacific region is a key hub for pharmaceutical manufacturing and consumption, particularly in countries like China and India. As the pharmaceutical sector grows, there is a parallel increase in the demand for packaging materials, including plastic films and sheets. The expanding middle class and increasing healthcare spending in these countries contribute to the growth of both the pharma and packaging markets. The expanding pharmaceutical sector in Asia Pacific drives the demand for plastic films and sheets due to their cost-effectiveness, protective properties, regulatory compliance, and innovations in packaging technology, all of which align with the sector's growing needs.

Countries like China, India, and Japan have well-established manufacturing sectors, making the Asia Pacific region a global hub for plastic production. These countries have high production capacities for plastic films and sheets, driven by large-scale manufacturing capabilities. The Asia Pacific region has the largest population in the world, with expanding urbanization and middle-class segments. This drives demand for consumer goods, packaging, and disposable products, all of which require plastic films and sheets for packaging and protection.

Many governments in the region, particularly in India and China, have launched policies to promote industrial growth and ease of doing business, attracting both domestic and international investments in plastic manufacturing. These policies also support infrastructure development, further boosting the plastic films and sheets market.

According to the Plastic Export Promotion Council, Indian exports of plastic film and sheets have witnessed a 15.9% growth, increasing from US$1,750 million to US$2028 million in FY 2024-25.

China Market Trends

China's plastic films and sheets market is driven by the massive production capacity and scale in the country. China significantly drives the plastic films and sheets market through a potent combination of massive capacity, diverse, strong domestic demand, technological advancement, environmental regulation compliance, clustered specialization, targeted policy support, and tight global supply chain integration. China produces over 131 million tonnes of primary-form plastics annually, accounting for about one-third of global output. As the world’s largest e-commerce market, China uses vast quantities of plastic packaging materials. Shift toward specialized, high-performance films: e.g., multi-layer barrier films, nano-films, biodegradable variants, and heat-seal, microwave-safe solutions.

Government regulations increasingly favour recyclable, eco-friendly packaging to curb plastic waste. Policies like ‘Operation National Sword’ restrict waste imports, pushing domestic supply chains toward clean production and recycling infrastructure. Film production is concentrated in Zhejiang, Guangdong, Henan, Jiangsu, and Fujian, with Zhejiang alone accounting for ~19% of national output. China’s plastics sector is deeply embedded in global supply chains from petrochemical inputs to finished packaging, electronics, agriculture, and construction materials.

North America region is anticipated to grow at the fastest rate in the global plastic films and sheets market during the forecast period. North American companies invest heavily in research and development (R&D) to innovate in plastic film technologies. This includes advancements in barrier properties, sustainability (biodegradable plastics), and multi-layered films with specialized features such as anti-static properties, UV protection, and tamper-evident packaging. The U.S. is one of the largest pharmaceutical markets globally.

The demand for plastic films and sheets for packaging pharmaceuticals—ensuring product safety, tamper resistance, and maintaining drug integrity is significant. Plastic packaging offers the flexibility, customization, and protective qualities needed in pharmaceutical applications. The rapid expansion of e-commerce in North America, particularly in the U.S. and Canada, increases the demand for durable and efficient plastic packaging solutions. Online retailing requires robust packaging materials for the safe delivery of products, including food, electronics, and personal care items.

The U.S. is one of the largest pharmaceutical markets globally. The demand for plastic films and sheets for packaging pharmaceuticals ensuring product safety, tamper resistance, and maintaining drug integrity is significant. Plastic packaging offers the flexibility, customization, and protective qualities needed in pharmaceutical applications.

North America saw notable growth in the value of non-cellular plastic plates, sheets, films, foils, and strips of plastic exports, rising to $1.8 billion in 2024. The average export price for these products increased by 41% compared to 2023, reaching $29,270 per ton.

U.S. Market Trends

The U.S. plastic films and sheets market is driven by robust end-use industries in the country. The U.S. leads in high-performance film technologies, including multi-layer barrier films, biodegradable plastics, and specialty engineered films. The U.S. has a well-established Research and Development infrastructure, backed by companies like DuPont, Berry Global, and 3M, which innovate in optical films, shrink films, and medical-grade sheets. The U.S. has strong demand from key sectors like food and beverage packaging, medical/ pharmaceutical packaging, agriculture, and automotive interiors.

A mature but growing e-commerce industry in the U.S. drives demand for protective plastic packaging films, bubble wraps, and tamper-evident sheets. U.S. regulations encourage the development of recyclable, compostable, and bio-based films. The U.S. has advanced infrastructure to support the full plastic films supply chain, including petrochemical feedstock supply, converting facilities, and distribution networks. The U.S. market attracts global investors due to its stable regulations and large consumer base.

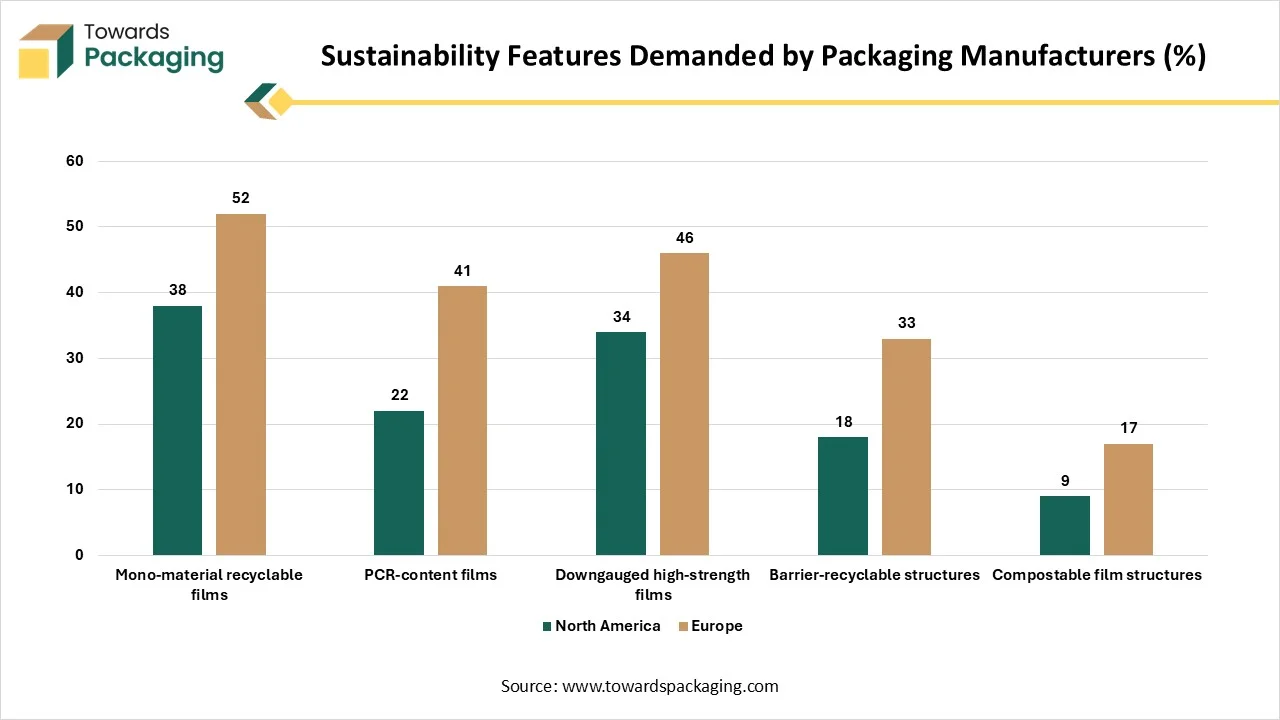

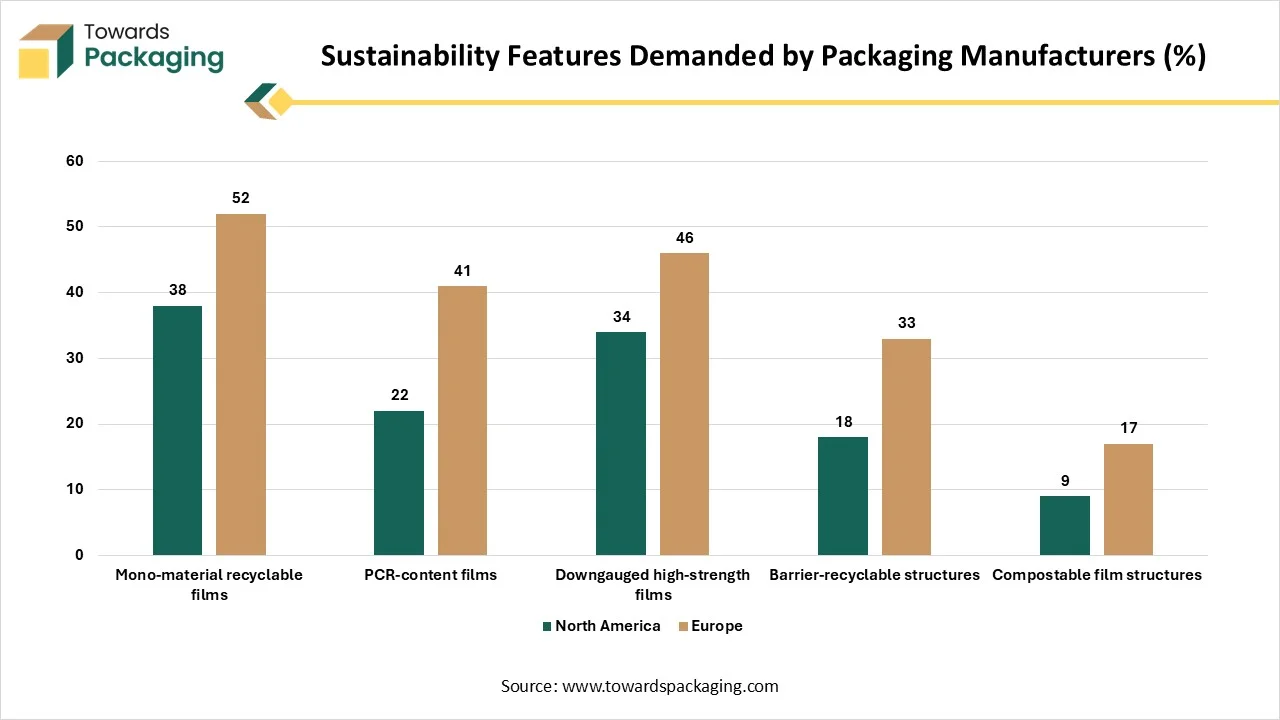

Sustainability Features Demanded by Packaging Manufacturers (%)

| Feature |

North America |

Europe |

| Mono-material recyclable films |

38 |

52 |

| PCR-content films |

22 |

41 |

| Downgauged high-strength films |

34 |

46 |

| Barrier-recyclable structures |

18 |

33 |

| Compostable film structures |

9 |

17 |

Global Plastic Films and Sheets Market Key Players

Latest Announcements by Plastic Films and Sheets Industry Leaders:

- In June 2024, A new project is added to the repertoire of Anton Debatin GmbH and Prezero Flexible Packaging GmbH's long-standing collaboration. The latter's experience allows DEBATIN to further improve the sustainability of its packaging solutions.

Thomas Rose, CEO of DEBATIN, packaging solutions providing company stated that, significant amount of company’s goods, which comprise over 80% PCR, have been using films created from PCR material for years. The new final product includes 60% PR material, with 50% originating from materials gathered through the home recycling system, such as mixed recyclables and plastic packaging, due to PreZero's experience. Even if the raw material used to make PR films is frequently contaminated, PreZero can still use its domestic waste streams. Frank Rieker, Managing Director of PreZero Polymers International GmbH, continues to state that the company can turn domestic waste streams into PCR plastics for DEBATIN by using company’s own sorting and recycling equipment. This indicates that even this very challenging-to-process garbage is making its way into recycling, promoting a more sustainable economy.

New Advancements in Plastic Films and Sheets Industry

- In April 2025, SC Johnson launched the film in a series of human-interest pieces that highlight the global plastic pollution crisis and how it impacts people around the world.

- In February 2025, IPG unveils its new American brand, Plastic Sheeting, available in Ultra and Performance films, designed for superior surface protection.

- In February 2025, Shiva Polymers showcased a 3-micron PVC lamination film for specific printing applications, particularly for "kela patta" (banana leaf) printing and dona plate making, at PrintPack 2025.

- In November 2024, Sumitomo Bakelite developed a mono-material film for medical device packaging, the mass production and sales planned for the fiscal year 2025. The film is made from a polyethylene-based material and aims to improve recyclability and offer other benefits.

- In March 2024, TOPPAN Speciality Films Private Limited (TSF) based in India and TOPPAN Inc. (TOPPAN), a TOPPAN Group company and a fully owned subsidiary of TOPPAN Holdings Inc. (TY0: 7911), have created GL-SP, a barrier film that uses biaxially oriented polypropylene (BOPP) as the substrate. Production and sales of the film are soon to begin. With a dominant market position worldwide, the TOPPAN Group's GL BARRIER1 family of transparent vapor-deposited barrier films now includes GL-SP as a new solution for sustainable packaging. Sales of GL-SP for the packaging of dry contents will begin in April of this year by TOPPAN and TSF, with an emphasis on markets in the Americas, Europe, India, and ASEAN.

- In January 2024, At Pharmapack 2024, TekniPlex Healthcare, plastic films and pouch material manufacturing company and Alpek Polyester, a company producing Alpek Polyester will present the "world's first" pharmaceutical-grade PET blister film with post-consumer recycled content.

Global Plastic Films and Sheets Market Segments

By Product Type

- LDPE/LLDPE

- PVC

- PA

- BOPP

- HDPE

- CPP

- Others

By Application

- Packaging

- Food

- Consumer Goods

- Medical

- Others

- Non-packaging

- Construction

- Healthcare

- Agriculture

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait