Stick Packaging Market Research, Consumer Behavior, Demand and Forecast

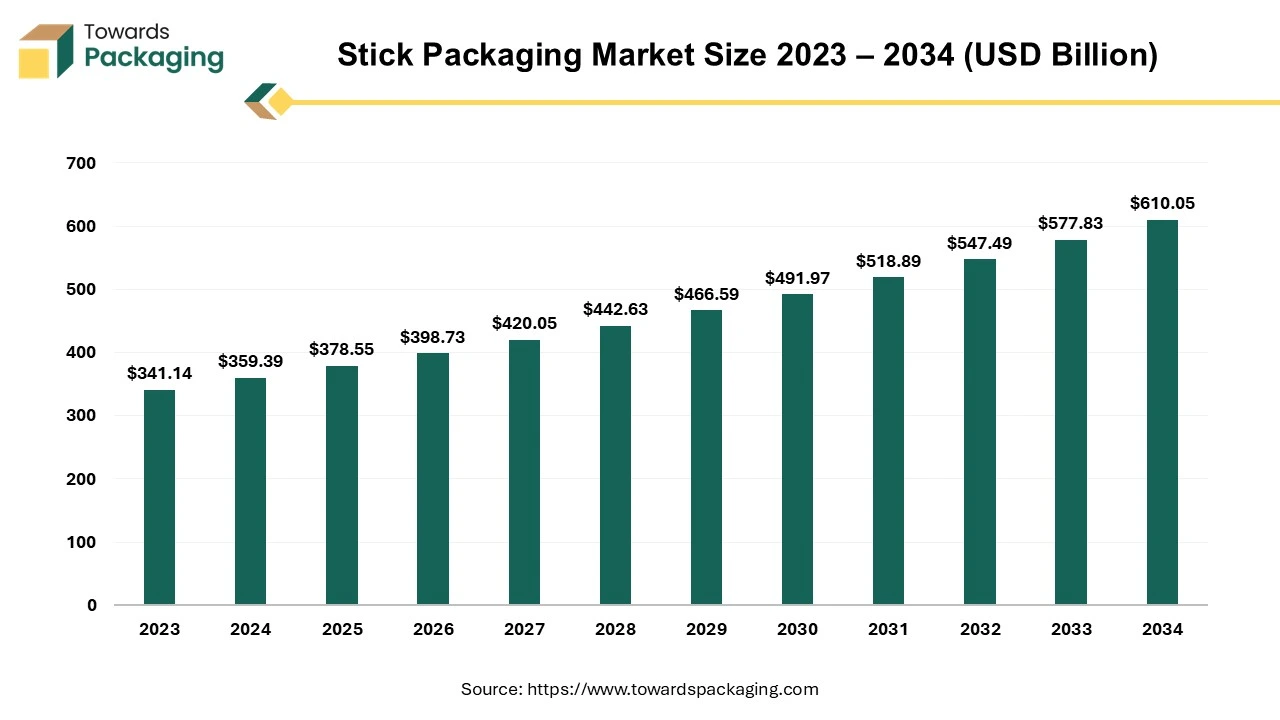

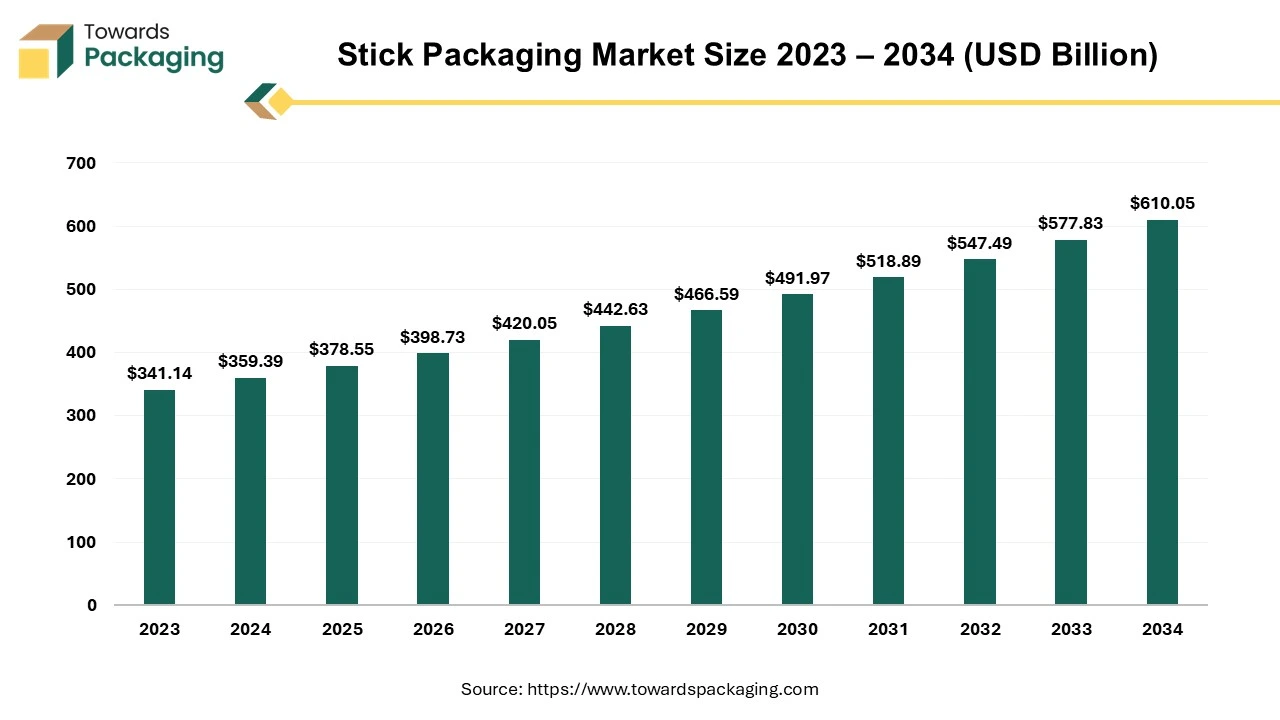

The stick packaging market is forecasted to expand from USD 399.25 billion in 2026 to USD 640.93 billion by 2035, growing at a CAGR of 5.4% from 2026 to 2035. This report provides a comprehensive analysis of market, highlighting the growing importance of eco-friendly materials like paper, the surge in on-the-go products, and innovations in packaging technologies.

Report Highlights: Key Revelations in the Stick Packaging Market

- The stick packaging market is projected to grow from USD 378.80 billion in 2025 to USD 640.93 billion by 2035, with a CAGR of 5.4%.

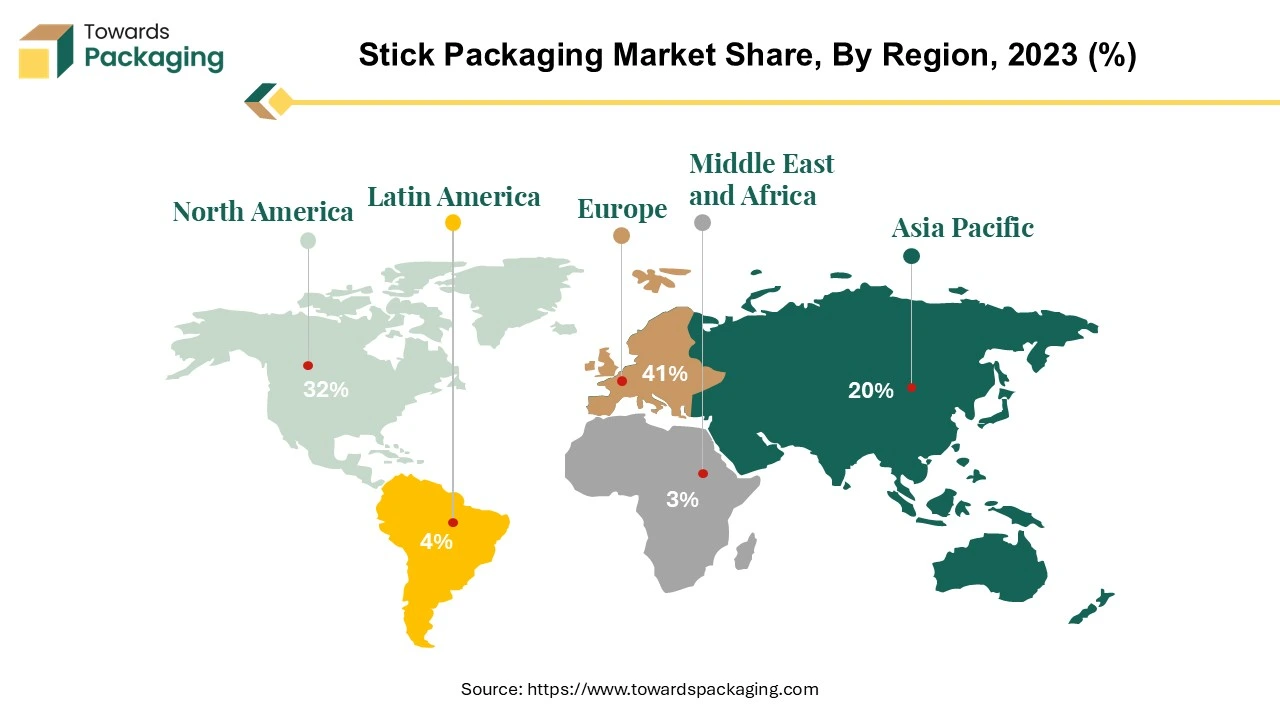

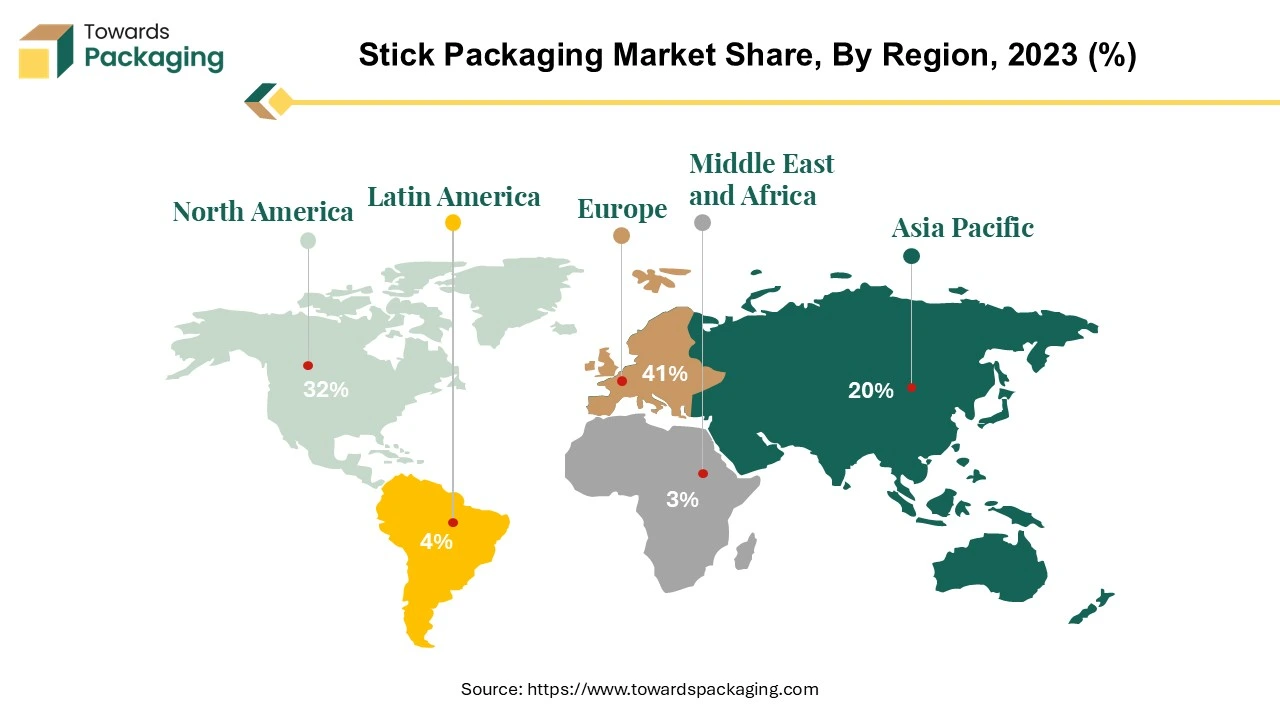

- The Asia Pacific region holds a 41% market share, driven by urbanization, growing disposable incomes, and the rise of e-commerce.

- The market’s growth is fueled by the demand for eco-friendly packaging, with paper-based materials becoming dominant due to their sustainability appeal.

- Stick packaging leads innovation in the food and beverage sector, offering convenience and efficient branding opportunities.

- Leading players like Amcor plc and Constantia Flexibles dominate the market, driving growth through innovation, sustainability, and strategic partnerships.

- Companies are embracing paper-based packaging to meet consumer demand for eco-friendly options, with brands like Mondi leading in sustainable packaging solutions.

Stick pack pouches represent a specialized category of flexible packaging distinguished by their compact dimensions and slender configuration. Specifically designed for the containment of dry powders, though occasionally suitable for powder, gel, solid and liquids, these pouches offer a practical solution for on-the-go consumption. Their narrow and elongated form makes them well-suited for single-serve applications, sample sizes, and products strategically positioned for point-of-purchase display in retail settings.

In 2021, a staggering 16 billion stick packs were procured, underscoring the robust demand for this packaging format. The stick pack packaging market is poised for substantial and profitable expansion. Projections indicate a promising year-over-year growth rate for stick packs, ranging between 5% and 7%. This optimistic forecast suggests a flourishing market with increasing consumer preference for the convenience and versatility of stick packaging solutions. The primary utility of stick pack pouches lies in their convenience and portability. Catering to the modern lifestyle characterized by a demand for quick and hassle-free solutions, these pouches are tailor-made for individuals seeking efficient, single-serving packaging. Stick packs are commonly used for products like instant coffee, sugar, condiments, and pharmaceutical powders, so stick packs ensure easy dispensing and controlled portions, enhancing user experience.

Moreover, stick pack pouches are strategically advantageous for marketing and brand promotion. The elongated surface area provides an opportunity for impactful branding and the inclusion of essential product information. This feature makes stick packs a functional packaging solution and a powerful marketing tool, helping companies establish brand identity and communicate key messages to consumers. The unique attributes of stick pack pouches, including their small size, narrow shape, and suitability for single-serve applications, position them as an optimal choice for businesses aiming to meet consumers evolving preferences who prioritize convenience and on-the-go functionality. These pouches offer a versatile and effective packaging solution, particularly in industries where portability, portion control, and impactful branding are paramount.

Stick Packaging Market: Leading Manufacturers Market Shares (2024)

| Manufacturer |

Estimated Market Share (%) |

| Amcor plc |

15.0% |

| Constantia Flexibles |

12.5% |

| Glenroy, Inc. |

10.0% |

| Losan Pharma |

8.0% |

| Catalent, Inc. |

7.5% |

| Fres-co System USA, Inc. |

6.0% |

| GFR Pharma |

5.5% |

| ARANOW Packaging Machinery |

5.0% |

| ePac Holdings, LLC |

4.5% |

| Others |

16.0% |

Manufacturer Insights:

- Amcor plc (15.0%): A global leader in flexible packaging, Amcor's significant share is attributed to its extensive product portfolio and strong presence in the food and beverage sector.

- Constantia Flexibles (12.5%): Known for its innovative packaging solutions, Constantia Flexibles has a robust market position, particularly in the European region.

- Glenroy, Inc. (10.0%): Specializing in flexible packaging, Glenroy's market share reflects its focus on high-quality, custom packaging solutions.

- Losan Pharma (8.0%): A key player in the pharmaceutical packaging industry, Losan Pharma's share is driven by its specialization in medical and pharmaceutical applications.

- Catalent, Inc. (7.5%): Catalent's market presence is bolstered by its comprehensive service offerings in drug development and delivery technologies.

- Fres-co System USA, Inc. (6.0%): Fres-co's share is supported by its expertise in flexible packaging solutions for the food and beverage industry.

- GFR Pharma (5.5%): GFR Pharma's position is strengthened by its focus on nutraceutical and dietary supplement packaging.

- ARANOW Packaging Machinery (5.0%): As a manufacturer of stick pack machines, ARANOW's share reflects its niche role in the packaging machinery sector.

- ePac Holdings, LLC (4.5%): ePac's market share is attributed to its digital printing capabilities and quick turnaround times.

- Others (16.0%): This category encompasses various regional and specialized manufacturers contributing to the remaining market share.

Leading Packaging Suppliers: EBITDA Percentages (2024)

| Supplier |

Estimated EBITDA Margin (%) |

| Smurfit WestRock |

15.2% |

| Mondi Group |

14.2% |

| Amcor plc |

13.3% |

| Graphic Packaging Holding |

19.1% |

| Vidrala |

27.8% |

Supplier EBITDA Insights:

- Smurfit WestRock (15.2%): Formed by the merger of Smurfit Kappa and WestRock, this entity leads in fiber-based packaging, with a strong presence in Europe and North America.

- Mondi Group (14.2%): Mondi's focus on sustainable packaging solutions contributes to its robust EBITDA margin, reflecting efficient operations and product innovation.

- Amcor plc (13.3%): Amcor's diverse product range and global footprint support its solid EBITDA margin, highlighting effective cost management and market reach.

- Graphic Packaging Holding (19.1%): Known for its sustainable consumer packaging, Graphic Packaging's high EBITDA margin is indicative of its operational efficiency and strong market demand.

- Vidrala (27.8%): A leading glass packaging manufacturer, Vidrala's exceptional EBITDA margin reflects its strong market position and operational excellence.

Growth Factors

- Cutting-edge material breakthrough: Advanced material growth will have a major impact on different industries, with an emphasis on developed performance, sustainability, and smart functionality. As businesses make ecologically safe replacements for conventional plastics and other harmful substances, sustainable materials are at the forefront.

- Inventive production technologies: The year 2024 will witness a change in production due to technological growth, with a reinforcement of AI integration, sustainable practices, and smart factories. Siemens is one of the examples of how digital twin technology and intelligent production systems are allowing manufacturers to make more appraised decisions based on data and to make product-related content more quickly.

- Personalized brand experiences: Retailers are utilizing facial recognition technology to tailor in-store experiences. Ruti, which is a boutique apparel retailer, has witnessed a notable growth in sales as a result of personalized suggestions. This tendency also applies to loyalty platforms, as 74% of users say that the most crucial aspect of brand honesty is feeling respected and understood.

- Global Economic landscape: As the world shifts towards a system of greater trend inflation and interest rates, equity markets must encounter issues that could cause volatility and cause expectations for earnings growth to transform. On the other hand, opportunities are displayed in different fields, that adds artificial intelligence, emerging markets, healthcare, and Japan.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD .59.39 Billion |

| Projected Market Size in 2034 |

USD 610.05 Billion |

| CAGR (2025 - 2034) |

5.4% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material, By Application, By End Use and By Region |

| Top Key Players |

Sonoco Products Company, Catalent Inc., ProAmpac LLC, Huhtamaki Oyj, Constantia Flexibles Group |

Opportunity

Rising Demand for Portion-Controlled Packaging

Stick pack packaging offers a key advantage in space efficiency and portion control, as each packet is pre-measured to deliver the exact amount needed. This format can help reduce packaging waste and promote mindful consumption, particularly valuable in sectors like food and beverage, where precise measurements are crucial for achieving optimal results. For businesses, this translates into better alignment with consumer expectations and enhances brand loyalty by offering the convenience of ready-to-use portions.

Restraint

Challenges with Barrier Properties and Shelf Life

Challenges with barrier properties and shelf life significantly restrain the stick packaging market by limiting the ability to effectively protect sensitive contents from moisture, oxygen, and light, which can degrade product quality. Inadequate barrier performance leads to shorter shelf life, reducing consumer trust and increasing product waste. This constraint is especially critical for food, pharmaceutical, and cosmetic products that demand longer preservation periods. As a result, manufacturers face higher costs and complexity in developing advanced materials that meet both barrier and sustainability requirements, slowing market growth.

Market Outlook

- Industry Growth Overview: Consumers desire for portable single-serve and convenient product formats is growing. It is extensively utilized in the food, pharmaceutical, nutraceutical, and personal care industries. Stick packs are preferred by brands because they offer portion-controlled delivery and minimize packaging waste. Adoption is being accelerated by the expansion of ready-to-mix drinks and health supplements.

- Sustainability Trends: Lightweight structures, bio-based plastics, and recyclable non-material films are becoming more popular among manufacturers. To comply with sustainability regulations and increase recyclability, brands are cutting back on multilayer laminates. In food and nutraceutical applications paper paper-based stick packs and PCR-based films are growing in popularity. For low-barrier applications, businesses are also looking into compostable films.

- Global Expansion: Asia Pacific growth due to rising consumption of portable food products and expanding nutraceutical markets. North America and Europe dominate in premium and sustainable stick packaging solutions.

How is AI Driving Innovation in the Stick Packaging Market?

Artificial Intelligence is playing a growing role in the stick packaging market by enhancing production efficiency, quality control, and material optimization. By monitoring filling accuracy, sealing quality, and line performance in real-time, AI-driven systems assist manufacturers in cutting down on waste and downtime. High-speed high-volume stick pack production is supported by predictive analytics, which improves demand forecasting and inventory planning. AI also facilitates more intelligent material usage and design optimization, which helps brands reduce operating costs while increasing packaging consistency.

How Is Resilience Enhancing Growth in the Stick Packaging Market?

Resilience is becoming a critical factor in the stick packaging market as manufacturers adapt to supply chain disruptions, fluctuating raw material availability, and changing consumer demand. To guarantee continuous operations, businesses are implementing flexible production lines, multi-source material strategies, and robust packaging designs. Additionally, resilient stick packaging formats facilitate quick filling and tight sealing, which minimizes product loss during storage and transit. These actions assist brands in controlling expenses, ensuring a steady supply, and enhancing long-term operational stability

Trends in Stick Packaging Market

- Eco-friendly Packaging: As sustainability becomes a major focus, eco-friendly stick packs use biodegradable or recyclable materials, reflecting both a commitment to the environment and stylish design. This shift goes beyond a trend, it's a movement toward sustainable living. Environmentally conscious consumers are driving demand, and companies embracing eco-friendly stick packaging are directly responding to this growing priority.

- Sleek and Minimalistic Aesthetics: Sometimes, simplicity speaks volumes. These stick packs feature minimalist designs with clean lines and neutral colors, creating a sophisticated and timeless look. Minimalism isn’t just about appearance; it enhances functionality by reducing distractions and emphasizing the essentials, allowing brands to communicate precision and purpose through their packaging.

- Interactive Designs for User Experience: Incorporating elements like augmented reality and QR codes into stick packs transforms packaging into an engaging, interactive experience. By blending technology with packaging, brands can extend the user experience beyond the physical product and deepen consumer connection.

- Bold and Vibrant Colors: Some brands opt for bold, eye-catching colors and dynamic designs to make their stick packs stand out on crowded shelves.

- Colors evoke emotions and create instant connections, with bright, lively packaging capturing attention even in busy environments.

- Pocket-Sized Convenience: Stick packs are designed to fit perfectly in a pocket, catering to on-the-go lifestyles. Their compact size meets the demand for convenience, seamlessly fitting into the fast pace of everyday life.

Future Demands

- Rising demand for portion-controlled, convenient, and travel-friendly stick packs in beverages, supplements, and personal care. More brands will shift to sticks to reduce wastage and enhance portability.

- Growth in nutraceuticals, vitamins, and functional powders will boost adoption as stick packs offer hygiene, precision, and easy consumption.

- Increasing shift toward recyclable mono-material and paper-based stick packs driven by sustainability commitments. Regulations will push brands to adopt eco-friendly formats.

- Higher usage of stick packaging for liquid sachets in cosmetics and skincare (serums, oils, lotions) for sampling and trial packs.

- Expansion of multi-stick bundles and subscription models as D2C brands promote everyday-use supplements and drink mixes.

Key Technological Shifts

- Mono-material films are replacing multilayer laminates to simplify recycling while maintaining heat-sealing strength. Brands will increasingly adopt PE-PE or PP-PP structures.

- High-barrier coatings and EVOH-free alternatives are improving oxygen and moisture protection for food and nutraceutical products. These help extend shelf life without complex laminates.

- Paper-based stick pack innovations with advanced coatings for dry powders and low-moisture foods. These solutions help brands meet plastic reduction targets.

- High-speed vertical FFS (form-fill-seal) machines improve productivity, precision dosing, and seal integrity. Automation will dominate production lines

- Digital printing and QR-enabled packs allow short-run customization, traceability, and interactive consumer engagement.

How Does Stick Packaging Deliver Strong ROI for Brands?

Stick packaging allows for more economical production, less material consumption, and quicker packing times. It offers a high return on investment (ROI). Its small size and light weight reduce storage and transportation expenses and increase shelf utilization. Automated stick pack lines boost productivity and reduce labor costs, which increases profitability even more. Furthermore, portion control and product protection help brands achieve faster payback and consistent cost savings by reducing waste.

Regional Insights

The Asia Pacific dominates the stick packaging market, commanding a 41% market share. Following closely, North America holds a 32% market share, while Europe and LAMEA account for 20% and 7%, respectively. The Asia-Pacific region stands out as the leading force, pivotal in shaping the market dynamics. The region's dominance is attributed to a convergence of factors contributing to the robust growth and widespread adoption of stick packaging solutions.

Firstly, the burgeoning population and rapid urbanization in countries like China and India have significantly altered consumer lifestyles, fostering a demand for convenient, on-the-go packaging. Stick packaging, with its compact and single-serve nature, perfectly aligns with consumers preferences in these densely populated regions who seek efficiency and portability in their daily lives. Moreover, the rise of e-commerce and increasing disposable incomes in Asia Pacific further propels the stick packaging market. The adaptability of stick packs to a diverse range of products makes them particularly well suited for the vast array of goods distributed through online retail platforms.

Additionally, the cultural shift towards western-style snacks and beverages, coupled with a growing awareness of sustainable packaging, has fueled the popularity of stick packaging in the region. As consumers become more environmentally conscious, the eco-friendly attributes of paper-based stick packaging resonate well with their preferences. Manufacturers in the Asia-Pacific region actively embrace technological advancements in stick packaging, introducing innovations like notched and easy-open versions. These enhancements enhance user experience, providing consumers with hassle-free and user-friendly packaging solutions.

- In January 2024, Asia-based company Asahi launched a new stick packed coffee concentration in Vietnam, which follows the concept of ready-to-serve.

The Asia-Pacific region emerges as a dynamic hub for stick packaging, driven by demographic trends, economic developments, changing consumer behaviours, and a commitment to sustainability. As the market continues to evolve, the region's influence is expected to persist, making it a focal point for industry players and businesses aiming to capitalize on the growing demand for stick packaging solutions.

As an emerging region in the stick packaging market, North America is increasingly establishing itself as a key player in shaping the trajectory of this dynamic industry. While traditionally recognized for its well established retail infrastructure and consumer driven market, North America is now witnessing a notable surge in the adoption of stick packaging across various sectors. The region's consumers are evolving in preference for on-the-go and single serving packaging solutions, aligning with their fast paced lifestyles.

Additionally, North America's heightened focus on sustainability and eco-conscious practices is propelling the popularity of stick packaging, which offers reduced material usage and enhanced environmental friendliness. The emergence of innovative and diverse applications across industries such as food and beverages, pharmaceuticals, and personal care products further contributes to North America's standing as an influential player in the global stick packaging arena. With a commitment to technological advancements, consumer-centric strategies, and sustainable practices, North America is poised to play a pivotal role in the ongoing evolution and growth of the stick packaging market.

- In November 2023, BERRY Global announced the release of a refill version of their Exclusive stick, which is touted as 'perfect' for a variety of personal care applications such as deodorants and solid formula face and body care products.

Stick Packaging Market in China as an Opportunistic Business Base

China stands as a dominant player in the region’s growth due to the rapid industrialization that is attracting more support from the government. The stick packaging market is expanding rapidly due to the expansion of processed food and beverages in the country. The Chinese government is also playing an influential role by supporting eco-friendly packaging that is anticipated to attract more investments in the long run. Additionally, the country is expected to mark significant revenue due to the expansion of nutraceutical industries in the coming years.

North America has been a significant contributor to the stick packaging market due to the higher convenience packaging demand in countries like the United States and Canada. The changing lifestyle dynamics are one of the factors which are raising the demand for on-the-go consumption products. The region is also a major player in the food, beverage, and pharmaceutical sector, which has significantly raised several business opportunities in the market growth. The region has also been marking significant growth due to the established technological base, which helps in boosting the manufacturing practices.

United States Stick Packaging Market Trends

The United States has been a prominent player in the region’s growth due to the rising health-conscious population. The companies in the country are also investing in R&D, which innovates sustainable solutions which can be used in the pharmaceutical sector. Additionally, the rising demand for health supplements is leading towards innovation in multiple products, which are gaining global popularity. The automated packaging solutions in the country are anticipated to attract more investments which can further help in generating more revenue.

Stick Packaging Unpacking the Dynamic Drivers Behind Growing Market Demand

The surge in demand for stick packaging stems from the intersection of on-the-go consumer lifestyles and a preference for eco-friendly solutions. This innovative, flexible packaging, tailored to narrow web formats, aligns seamlessly with modern consumer needs.

- The rise of online retailing significantly contributes to this demand, as the flexibility of stick packs accommodates the diverse product offerings prevalent in e-commerce. The adaptability of stick packaging positions it as a preferred solution in the digital marketplace.

- Furthermore, the popularity of stick packs is amplified by the versatility of notched and easy-open versions, enhancing user experience and catering to those valuing hassle free packaging.

- This trend underscores the industry's responsiveness to contemporary consumer preferences, solidifying stick packaging as a leading player in the evolving packaging landscape.

Powder Stick Packaging: Redefining Convenience and Usability in Modern Markets

The foremost application segment in stick packaging is dedicated to powders, presenting a highly convenient alternative for diverse consumers. They are particularly appealing to individuals with a kettle at home or those who are constantly on the move and still desire their regular beverage; powder stick packaging caters to the evolving lifestyle preferences of modern consumers.

The convenience of powder stick packaging extends beyond its portability, making it an excellent option for customers seeking precise measurements and portion control. This is especially advantageous for those conscious of their intake or requiring accurate quantities for their specific needs. The individual packaging format ensures the preservation of the product's freshness and facilitates an easy way for customers to carry their favourite beverages without taking up excessive space.

While the small, pocket-sized convenience of powder stick packaging is evident, a closer examination reveals many additional benefits. The individualized packaging not only safeguards the integrity of the product but also minimizes the risk of contamination, ensuring that each serving remains pristine. This aspect is particularly crucial for products like pharmaceutical powders or dietary supplements where accuracy and purity are paramount.

The compact and lightweight nature of powder stick packaging aligns seamlessly with the preferences of consumers who prioritize convenience in their daily routines. The easy, tear-open feature enhances accessibility, providing a hassle free experience for users who want a quick and effortless way to enjoy their beverages or supplements. In essence, powder stick packaging addresses the practical aspects of on-the-go consumption and aligns with the broader consumer demand for precision, convenience, and product integrity.

- In October 2023, Herbaland Naturals recently launched Daily Probiotic Powder Sticks, easy-melt powders for adults and children aged three and up.

Stick Packaging Leads the Way: Unwrapping Innovation in the Food and Beverage Industry

The stick packaging market has emerged as a frontrunner in the food and beverage sector, establishing itself as a leading packaging solution for a myriad of products in this industry. The slender and compact design of stick packs offers unparalleled convenience, making them an ideal choice for single-serve applications, condiments, instant beverages, and a variety of other consumables. In the food and beverage sector, where consumer preferences are continually evolving towards on-the-go convenience and portion control, stick packaging provides a perfect fit.

Production of Cheese around the globe in the year of 2022-2023, Cheese is go-to food product which has the global recognization. Production capacity of cheese varies with the regional and global demand.

The versatility of stick packs extends to various formats, including sachets, tubes, and pouches, accommodating an extensive range of products. Moreover, the appeal of stick packaging lies not only in its practicality but also in its branding potential. The elongated surface area allows for impactful product messaging and branding, enhancing the visual appeal of the packaged goods. As manufacturers and consumers alike recognize the benefits of this packaging format, the stick packaging market continues to lead in the food and beverage sector, setting new standards for convenience, innovation, and brand presentation.

- In January 2024, Nestlé Vietnam has launched NESCAFE coffee in a liquid stick shape for convenient application.

| Most Popular Espresso-Based Drinks in the USA |

| Type of Drink |

Percentage of Coffee Crinkers |

| Cappuccino |

17% |

| Latte |

17% |

| Espresso |

16% |

| Mocha |

13% |

| Americano |

14% |

| Macchiato |

9% |

| Flat White |

6% |

- In the USA, the most popular espresso-based drinks are Cappuccino and Latte, each favoured by 17% of coffee drinkers, followed by Espresso (16%), Mocha (13%), Americano (14%), and others.

Paper's Dominance in Driving the Stick Packaging Revolution: Sustainable and Innovative Solutions

The global paper-based packaging market, valued at a substantial USD 416.5 billion in 2022, is on the brink of noteworthy expansion, with projections indicating a climb to USD 503.1 billion by 2028. This remarkable surge underscores a vibrant market landscape shaped by evolving consumer preferences and an escalating emphasis on sustainability.

In response to a profound shift in consumer priorities, sustainability has emerged as a pivotal value driver, with a staggering 50% of consumers now ranking it among their 'top 5 value drivers.' 34% of consumers are willing to pay a premium for products and services that prioritize sustainability. This burgeoning inclination towards eco-conscious choices extends beyond the core product and prominently encompasses the realm of packaging. Paper-based packaging stands out as a reasonable alternative, aligning with the growing demand for sustainable practices in the business landscape.

- In December 2022, Mondi developed recyclable, paper-based secondary packaging for Angulas Aguinaga's Krissia brand chilled surimi sticks to lower plastic content and enhance recyclability.

Contrary to the common perception of paper-based packaging being synonymous solely with paper bags, its versatility extends far beyond. This packaging solution manifests in various forms, including corrugated cardboard, folding cardboard boxes, pulp-moulded packaging, cartons, mailers/pouches, and cushioning. Notably, the paper takes the lead as the predominant material segment in stick packaging, where consumers and manufacturers favour its use for its convenience and aesthetic appeal. In essence, the trajectory of the paper-based packaging market encapsulates a narrative of dynamic evolution, with sustainability at its core. As consumers increasingly seek eco-friendly options, businesses are pivoting towards paper-based solutions that meet these demands and offer a versatile array of packaging formats catering to diverse industry needs.

- In February 2023, Volpak introduced the Enflex PHS Series, which manufactures flexible packaging, particularly stick pack packaging, for the pharmaceutical and healthcare industries.

Comparative Landscape

The stick packaging market is currently experiencing a highly competitive landscape characterized by the active participation of key industry players striving for market dominance. Among these players, Amcor plc emerges as a formidable global leader in packaging solutions, encompassing a diverse range of products, with stick packaging being a prominent segment. Amcor's influence extends globally, and the company leverages its extensive technological capabilities to maintain a competitive edge in the market. With a commitment to innovation, Amcor continuously introduces cutting-edge solutions to meet the evolving demands of various industries.

Constantia Flexibles Group GmbH is another significant player in the stick packaging market, focusing on flexible packaging solutions. Recognized for its dedication to sustainability and innovation, Constantia Flexibles has carved a niche in the industry. The company's emphasis on eco-friendly packaging aligns with the growing consumer preference for sustainable practices. Constantia Flexibles strategic approach involves combining quality and innovation, ensuring its solutions meet industry standards and contribute to environmental conservation.

The presence of other key players further enriches the competitive landscape of the stick packaging market, each contributing to the industry's growth and development. These players often differentiate themselves by emphasizing specific aspects such as technological advancements, product diversification, or sustainable practices. As consumer preferences shift towards more convenient and eco-friendly packaging options, critical players in the market continue to adapt and innovate to meet these changing demands.

In this dynamic environment, strategic positioning is essential for sustained success. Companies invest in research and development to stay ahead regarding product offerings and technology. Collaborations and partnerships are becoming increasingly common to pool resources and expertise for mutual benefit. The competitive landscape, therefore, reflects not only individual companies' capabilities but also their ability to navigate and leverage industry trends effectively.

New Advancements in the Stick Packaging Industry

- In January 2025, Safety Shot, Inc. announced the release of its Sure Shot On-the-Go Powder Stick Packs, marking a significant advancement in portable wellness products. Designed to disrupt the rapidly expanding wellness sector, which is expected to reach over USD 2 billion by 2033, this unique format offers the first alcohol-reducing solution in the world in a portable and practical form.

- In February 2025, USA: Berry Global, a plastic packaging producer based in the U.S., expanded its Stick and Refill line of cosmetics, lip care, deodorant, and suncare products to include three compact sizes. To ensure uniformity in look and sustainability, the new additions keep the larger sticks' conical shape, straight base, and top, and recyclable materials. PET and PP are used to make the newest Stick and Refill alternatives, which are perfect for deodorants, sunscreen, and face and body care formulae.

Recent Developments in the Stick Packaging Market: Innovations and Strategic Shifts

- In September 2024, Gatorade has disclosed the launch of Gatorade Hydration Mixer, which is a new electrolyte drink mix in terms of stick pack packaging, crafted to be a perfect all-day hydration hero. (Source: Packaging Strategies)

- In February 2025, Karma Pioneer, which is a functional wellness beverage, is confident that disturb the rapidly expanding stick pack market with the launch of new Karma Probiotic stick packs and Karma Energy Stick. (Source: PR Newswire)

- In February 2025, US US-based company, Berry Global, expanded their stick packaging line with smaller, recyclable and refillable options, which are made from monomaterial polypropylene.

- In October 2024, ProAmpac introduced sustainable and intelligent packaging innovations, which included moisture-control stick pack solutions.

- In April 2023, Huhtamaki Oyj introduced sustainable, flexible packaging. It offers a one-of-a-kind mix of best-in-class protection, complete recyclability, and affordability.

- In April 2022, Amcor Plc demonstrated its dedication to producing eco-friendly packaging solutions by launching a series of sustainable high-shield laminates for pharmaceutical sachets, stick packs, and strip-pack packaging.

- In June 2022, WePackItAll was acquired by Akoya Capital Partners, LLC, in collaboration with Trinity Investors, New Spring Mezzanine, and other investors. Stick packs, gummy bottles, sachets, tablet bottles/powder, and multipacks are among WPIA's core packaging solutions.

- In December 2022, Skye Pharma expanded its oral solid dosage form offering by acquiring a stick pack filling company operation. They can be stuffed with powder, pellets, or granules.

Value Chain Analysis

Raw Materials Sourcing

Raw material sourcing in the stick packaging market mainly includes paper, aluminum foil, and flexible plastic films. Manufacturers focus on barrier properties, seal strength, and material consistency while increasingly adopting recyclable and lightweight materials to improve sustainability.

Key Players: Amcor, Mondi Group, Huhtamaki, Berry Global

Logistics and Distribution

Efficient logistics are essential for stick packaging due to high-volume, lightweight shipments across the food, pharmaceutical, and personal care sectors. Optimized packaging design improves palletization, reduces transport costs, and supports fast-moving retail and e-commerce channels.

Key Players: Smurfit Kappa, DS Smith, Sonoco Products Company, WestRock

Recycling and Waste Management

Recycling efforts focus on mono-material stick packs, reduced material usage, and improved collection systems. Manufacturers are aligning with circular economy goals to minimize waste and meet regulatory sustainability requirements.

Key Players: Amcor, Mondi Group, Constantia Flexibles, Berry Global

Stick Packaging Industry Leaders

Stick Packaging Industry Segments

By Material

-

- Paper

- Kraft paper sticks

- Coated paper sticks

- Paper–foil laminated sticks

- Plastic

- PET

- PE

- PP

- Multi-layer plastic laminates

- Aluminium

- Aluminium foil sticks

- Aluminium–plastic laminated sticks

- Others

- Bio-based & compostable materials

- Cellulose-based films

By Application

- Powder

- Instant coffee & tea

- Protein powders

- Nutraceutical powders

- Seasonings & spices

- Solid

- Sugar sticks

- Sweeteners

- Confectionery inclusions

- Liquid

- Honey & syrups

- Energy shots

- Liquid supplements

- Pharmaceutical liquids

By End Use

- Food & Beverage

- Beverages (coffee, tea, drink mixes)

- Condiments & sweeteners

- Functional food products

- Pharmaceuticals

- Oral dosage sticks

- Nutraceutical sachets

- OTC medication sticks

- Personal Care

- Shampoo & conditioner samples

- Cosmetic creams & serums

- Oral care products

- Others

- Household products

- Industrial & specialty chemicals

By Region

- North America

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa