Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Size and Regional Production Analysis

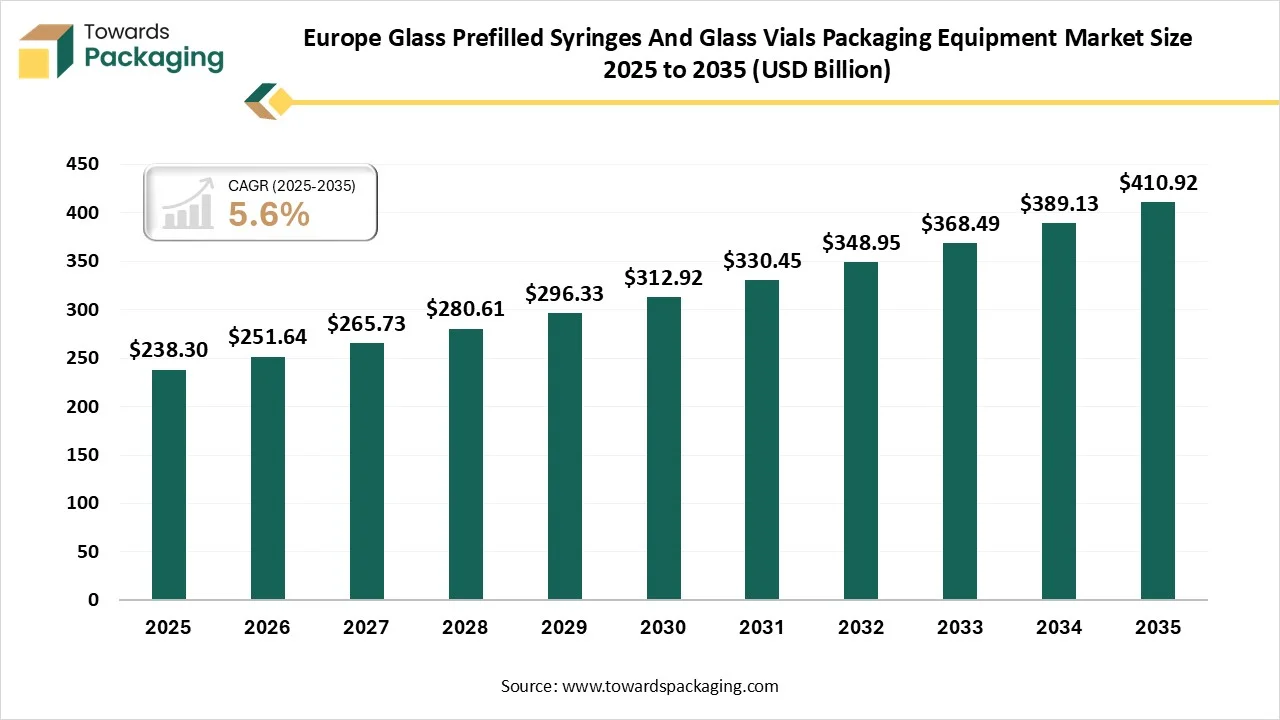

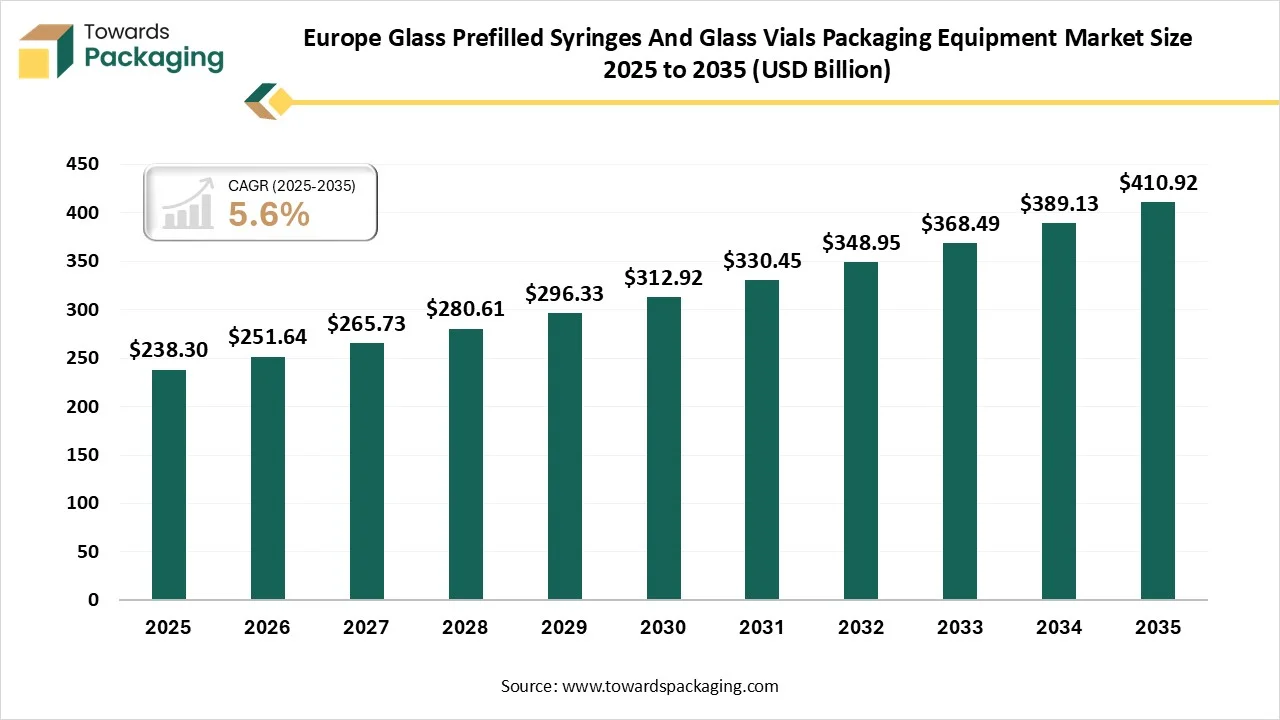

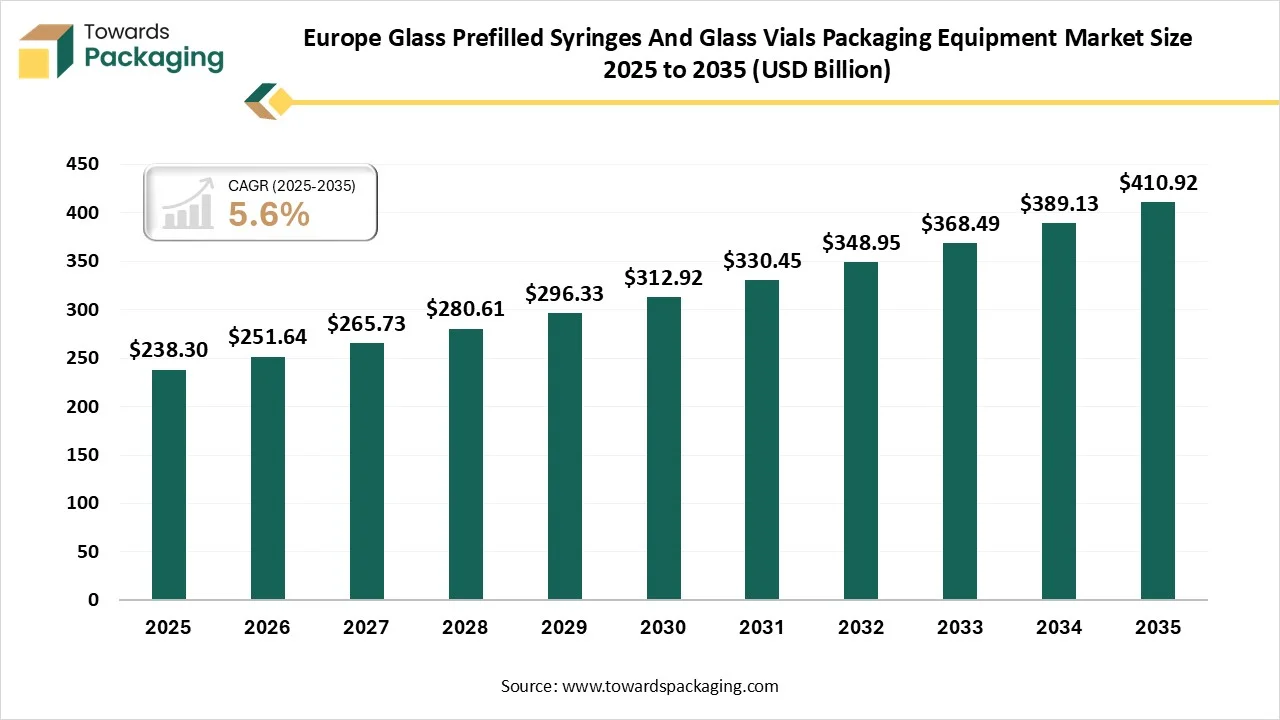

The Europe glass prefilled syringes and glass vials packaging equipment market is forecasted to expand from USD 251.64 million in 2026 to USD 410.92 million by 2035, growing at a CAGR of 5.6% from 2026 to 2035. The market is segmented by equipment type, including cleaning machines, filling machines, and labeling machines, with the cleaning machines segment holding the largest share of 38% in 2024. By application, vaccines contribute the largest share of 50%, while the prefilled syringes segment dominates the packaging type category with 55% market share. The market outlook includes detailed regional insights into Germany, Switzerland, and other European countries, reflecting diverse trends and investments.

Key Highlights

- In terms of revenue, the market is valued at USD 238.30 Billion in 2025.

- The market is predicted to reach USD 410.92 Billion by the year 2035.

- Rapid growth at a CAGR of 5.6% will be officially experienced between 2025 and 2034.

- By equipment type, the cleaning machines segment has the biggest share of 38% in 2024.

- By equipment type, the filling machines segment will rise at a notable CAGR of 26% between 2025 and 2034.

- By end-use industry, pharmaceutical manufacturers segment has contributed to the biggest share of 45% in 2024.

- By end-use industry, the contract packaging segment will grow at a notable CAGR in between 2025 and 2034.

- By application, the vaccines segment will contribute to the largest share of 50% in 2024.

- By application, monoclonal antibodies segment will rise at a notable CAGR in between 2025 and 2034.

- By packaging type, prefilled syringes segment have the biggest share of 55% in 2024.

- By packaging type, glass vials segment will grow at a notable CAGR in between 2025 and 2034.

What Do You Mean By The Glass Prefilled Syringes And Glass Vials Packaging Machine Market?

Europe glass prefilled syringes and glass vials packaging equipment market covers specialized machinery and systems for filling, capping, labelling, inspecting, and handling glass prefilled syringes and vials. This includes equipment for washing, sterilizing, filling, sealing, and automated inspection of pharmaceutical containers, ensuring compliance with regulatory requirements, sterile handling, and operational efficiency. The market addresses pharmaceutical manufacturers, biotechnology companies, CMOs, and research organizations, supporting injectable drug production, vaccines, biologics, insulin, and other therapeutics.

Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Outlook

- Industry Growth Overview: The worldwide industry for glass prefilled syringes is forecast to grow substantially, which is being driven by the growing acceptance of chronic diseases and the urge for self-administered and convenient injectable drugs. Likewise, the glass vials packaging machine industry is growing, driven by the current demand for good-quality sterile packaging for vaccines and biologics.

- Sustainability Trends: As the pharmaceutical sector meets with global sustainability goals, glass packaging plays a crucial role. Glass is 100% recyclable, which makes it an environmentally friendly choice that lowers environmental impact. As per the Glass Packaging Institute, recycled glass can be smoothly reused without loss of purity and quality, which assists circular economy initiatives.

- Global Expansion: The worldwide industry for the glass prefilled syringes and glass vial packaging machines is expanding due to a developing urge for biologics, injectable drugs, and biosimilars. Main trends in this expansion count increased investment in the latest manufacturing facilities, technological advancements, and a move towards pre-sterilized “ready-to-use” products, with main growth in the Asia-Pacific and other developing markets.

- Major Investors: For organisations that generate prefilled vials and syringes, the main investors are specifically big, classified institutional investors and finance firms, instead of venture capital forms. This is due to the industry that is dominated by big, established medical technology and pharmaceutical production companies.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 238.30 Million |

| Projected Market Size in 2035 |

USD 410.92 Million |

| CAGR (2026 - 2035) |

5.6% |

| Market Segmentation |

By Equipment Type, By End-Use Industry,By Application and By Packaging Type |

| Top Key Players |

Becton Dickinson (BD), SGD Pharma, Ompi (Stevanato Group), Ypsomed, Bormioli Pharma, Vetter Pharma, Roche, etc. |

Key Technological Shifts in Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market

The current PFS design now frequently includes safety mechanisms that automatically revoke the needle or cover it after every usage. These inventions lower the risk of needlestick injuries, which remain a serious occupational hazard for healthcare workers. These syringes enable the storage of lyophilized drugs and diluents independently, which are only integrated at the time of management.

This is specifically advantageous for the biologics and vaccines that have constant things in liquid form. Development in digital health has led to the growth of auto-injectors, which include smart features like injection reminders, dose tracking, and Bluetooth Connectivity with health apps. This tech-developed strategy assists perfect medication adherence, particularly for chronic disease management.

Regular glass syringes are now being substituted or supplemented with cyclic olefin polymer (COP) and Cyclic olefin copolymer alternatives. These materials have developed better compatibility, break resistance, and have fragile biologics that lower down communication with drug formulations and lower the risk of particulate contamination.

Trade Analysis of Packaging for Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market: Import & Export Statistics

- The world imported 129 shipments of Glass syringes from India during the period October 2023 to September 2024. These imports were being supplied by 26 Indian exporters to 46 World buyers, which marks a growth rate of -10% as compared to the previous twelve months.

- Within this time, in September 2024 alone, the World has imported 8 Glass Syringe shipments. This marks a year-on-year development of 33% as compared to September 2023, and a 0% series increase from August 2024.

- The world has officially imported most of the Glass Syringes from the United States, Mexico, and India.

- Globally, the top three importers of the Glass Syringe are Mexico, the United States, and China. The United States tops the world in Glass Syringe imports, having 8,389 shipments, followed by Mexico with 1,452 shipments, and China taking the third position with 694 shipments.

Value Chain Analysis of the Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market

- Material Processing and Conversion: The material processing and conversion of glass into pharmaceutical vials and prefilled syringes have followed similar primary steps of raw material and glass melting, but differ during the making and final-stage complete procedure. Syringes need more intense, high-accuracy molding and further treatments like siliconization, while vials are transferred into final packaging via various sealing and filling methods.

- Package Design and Prototyping: For the packaging design and prototyping of the glass prefilled syringes and vials, the main considerations are preventing the sensitive glass, ensuring sterility, which tracks temperature for the cold-chain items, and complying with strong pharmaceutical regulations.

- Logistics and Distribution: By serving glass prefilled syringes (PFS) and the glass vials that count, navigating different logistical issues linked to sterility, fragility, and temperature control. While PFS serves perfect convenience and safety for end-users, vials remain a cost-effective and flexible packaging option, particularly for multidose uses and lyophilized drugs.

Emerging Trends in the Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market

- Patient Safety and Risk Reduction: By avoiding manual preparation steps, prefilled designs mainly reduce the risk of medication errors like improper dilution, incorrect dosing, and contamination too. This is important in emergency situations and intensive care, in which delays can mean the difference between recovery and cardiac arrest.

- Reduced Adverse Events and Side Effects: With accurate dosing and sterile making, prefilled designs limit dosing variability and pollutant risk, which could cause serious side effects, allergic reactions, or other adverse events.

- Ease of Use and Human Factors: prefilled selections are crafted with human elements that are studied in mind, making sure ease of use for the healthcare providers and self-injection by patients at home. They often count ergonomic grips, instructions for usage, and updated needle systems, which make administration straightforward.

- Extended Shelf Life: High-level materials and sterile manufacturing procedures allow long shelf life at room temperature, assisting in tracking crucial safety information about potency and stability until the expiration date. The usage of good-quality materials and water is necessary to assist the validated production procedure and ensure product safety.

- Improved Lubrication and Coating technologies: latest coating techniques like silicone-free or baked-on silicone lubricants, lowering the friction during injection and ensuring soft plunger movement, constant dose delivery, and lower risk of contamination or delamination.

Equipment Type Insights

How Did The Cleaning Machines Segment Dominate The Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market?

The cleaning machines segment has dominated the market with a 38% share in 2024, as machines that clean prefilled syringes for packaging are specifically mixed into a bigger, automated pharmaceutical line. The latest manufacturing lines for the pre-filled syringes often do not need cleaning equipment, as they use sterilised, nested syringes which are ready for fast filling.

Hence, for lines that use the glass syringes that are not pre-sterilized, washing and cleaning are important steps. These cleaning machines utilise steps. These cleaning equipment utilise techniques such as ultrasonic baths and pressurized washing to ensure sterility before filling.

The filling machine segment is expected to be the fastest in the market with a 26% CAGR during the forecast period. Many pharmaceutical sector machine produces filling machines for the glass pre-filled syringes. These highly technical machines run in aseptic conditions and frequently need several stages, such as vacuum filling, automatic syringe loading, and stoppering. Several PFS Filling machines are constructed with stainless steel elements for spaces that contact with product and crafted to run within isolated, cleanroom surroundings to prevent pollution. Automated systems are utilised to process ‘nested’ syringes which come in trays. The machine can automatically remove the protective liner and carry the syringes without human contact to track sterility.

Several systems are crafted as a complete production line that can include ensuing procedures like labelling and plunger rod insertion.

End-Use Industry Insights

How Did The Pharmaceutical Manufacturers Segment Dominate The Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market?

The pharmaceutical manufacturers segment has dominated the market with a 45% share in 2024 as they use glass vials for bulk storage of injectable and other drug products, while prefilled glass syringes are filled with a single, pre-measured dose for direct administration. Both are produced from chemically inert, constant borosilicate glass to protect against drug degradation and pollution, too.

During the production procedure, vials are being sterilised through washing and dehydrogenation before entering an aseptic filling suite. They are then filled with the drug product and packed with a rubber stopper having a crimped aluminum cap. Type 1 borosilicate glass is chemically filled and highly resistant to temperature updates, which makes it perfect for keeping sensitive biotech drugs and vaccines that need cold-chain storage.

The contract packaging segment is expected to be the fastest in the market with a 28% share during the forecast period. Packaging plays a crucial role in glass syringes and glass vials by delivering several functions such as promotion, presentation, information dissemination, compliance, and identification of a drug product. It also ensures protection during storage, distribution, sale, and consumption. One main factor that drives the industry is the growing urge for complicated packaging products, customised and specifically biologics, personalized medicines. These items make the compulsion of tailored packaging due to their different characteristics. Contract packaging suppliers have given feedback by developing their technical expertise and resources to meet these intricate packaging needs and demands.

Application Insights

How Did The Vaccines Segment Dominate The Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market?

The vaccines segment has dominated the market with a 50% share in 2024 as prefilled syringes are sterile packaging that carries pre-measured doses of drugs, which are ready for immediate usage. It is crafted to save time and nursing costs by enabling pre-loading medication into syringes. This also assists in making sure accuracy when halting, making time by 50%. They are perfect for dermal fillers, vaccines, or fragile biopharmaceuticals -ensuring safety, consistency, and the fastest workflows. The Prefillable syringes are updating drug delivery for the business globally.

The monoclonal antibodies segment is predicted to be the fastest in the market with a 22% share during the forecast period. Monoclonal antibodies are the same molecules that are derived from a single B Cell, which are crafted to recognise a single specific antigen. Just like polyclonal antibodies, which communicate with several epitopes on the same antigen, monoclonal antibodies bind to just one defined epitope. This focused strategy develops the consistency and reliability of outcomes across various experimental uses such as western blotting, immunohistochemistry, enzyme immunoassays, and immunoprecipitation.

Packaging Type Insights

How Has The Prefilled Syringes Segment Dominated The Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market?

The prefilled syringes segment dominated the market share of 55% in 2024 as prefilled design specifically includes a syringe needle, needle cover, plunger, and sometimes developed with a lure lock or other lined devices for secure drug delivery system attachment. They may be created from glass syringes or polymer materials; each is selected to update human factors, shelf life, and reliability with the biological items. For instance, prefilled syringes need less handling than regular syringe and vial systems, which smooths the fulfilment procedure and reduces the risk of medication errors.

The glass vials segment are predicted to be the fastest growing in the market with a 20% share during the forecast period. Tubular pharmaceutical vials for the injectable medicines are specifically made from the Type 1 borosilicate glass, which can come in several tubing designs. 51 stretched borosilicate glass tubing is the most prevalent, although 33 expansion borosilicate is a long-term =term storage solution for healthcare with different capabilities in order to maintain the pharmaceutical making.

Country Insights

How Has Germany Dominated The Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market?

In Europe, glass prefilled syringes are a dominant but transforming industry, which is being driven by the development of injectable biologics but experiencing competition from high-level plastic alternatives. On the other hand, glass is still chosen for its perfect barrier characteristics, plastic serves greater reliability and is catching a greater share of the market for uses. The factors that drive the growth of injectable biosimilars and biologics in Europe are a major driver.

Biologics are Fragile Drugs that Need a Container that Won’t Interact with the Environment, Making Glass the Selected Material.

The German region has dominated the market with a 32% share in 2024, as the trend for glass prefilled syringes in the German region is one of rapid development and continued dominance over plastic alternatives, which is being driven by the growing demand for an aging population and biologics. While plastic syringes are also developed, glass remains a selected choice material for high-value drug formulation due to its superior chemical inertness and stability. Struct European Union regulations, including the Needlestick-Injury Directive, are pushing the acceptance of prefilled syringes with mixed safety features.

Additionally, the trend towards home-based and outpatient diagnosis drives the growth of safe and user-friendly devices that allow for patient administration. The urge for highly fragile biologic drugs that need a constant and inert container is an initial driver for glass syringes. Biologics are predicted to account for over 30% of pharmaceutical sales by the year 2030.

The Switzerland region is predicted to be the fastest in the market with a 22% share during the forecast period. In Switzerland, as in the huge European market, the demand for glass prefilled syringes is classified by continued dominance, but with the rising uptake of high-level polymer alterations. The market is being driven by the high healthcare standards, a high-level pharmaceutical sector, and a concentration on administration for chronic diseases.

Switzerland’s high-level healthcare infrastructure and high standards for drug safety and invention market the usage of advanced drug delivery systems like PFS. Switzerland tends to meet with EU regulations for integrated and medical devices.

Country-Level Investments & Funding Trends for Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market

- Investments in glass vials and pre-filled syringes in Europe are being driven by the development in the biologics industry, the push for sustainable and high-value solutions, and the demand for easy drug delivery systems.

- Complicated drugs derived from living organisms often need high-quality and specialized glass packaging, like prefilled syringes, to track the efficacy and stability.

- The trend towards RTU cartridges and valves is gaining attention. These ready-to-fill and sterile designs lower down the production complexities and checking timelines for the healthcare companies, which involve labor-intensive processes.

- Organizations are heavily investing in circular economy initiatives and eco-friendliness, too. These cunt use recycled glass and make lighter-weight, reusable glass items to meet consumer demands and regulatory requirements too.

Recent Developments

- In August 2025, SCHOTT Pharma, a top player in drug pollutant solutions and delivery machines, will reveal the sector’s primary ready-to-use polymer cartridge, which combines with ISO dimensions. This innovative invention has different and tight production tolerances, which serve to develop design flexibility for the device manufacturer and pharmaceutical organisations.

- In December 2024, Gerresheimer has been generating drug delivery systems, medicinal products, and drug delivery systems created from the plastic on ground 14,600 m² at this website.

- In April 2025, PCI Pharma Services, which is a top global contract development and production organisation (CDMO) that is concentrated on inventive biopharma therapies, is gaining a complete equity stake in Ajinomoto Althea, Inc.

Top Vendors in the Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market and their Offerings

- Gerresheimer AG: Gerresheimer is an inventive systems and solution provider and worldwide partner for the biotech, pharma, and cosmetic sectors. The organisation serves an overall profile of the pharmaceutical packaging, medical devices, drug delivery systems, and digital solutions.

- Schott AG: Schott AG is a German Multinational glass company that is an expert in the production of glass and glass-ceramics. It is headquartered in Mianz, Rhineland-Palatinate, Germany, and is owned by the Carl Zeiss Foundation.

- Stevanato Group: Stevanato Group is a top global supplier of drug contamination, diagnostic solutions, and drug delivery to the pharmaceutical, life sciences, and biotechnology industries. The group serves a mixed, end-to-end profile of products, services, and procedures that solve customer needs across the complete drug life cycle at every development stage.

- Nipro PharmaPackaging: Nipro Pharma packaging is a top global producer of glass primary packaging for the pharmaceutical industry. The company grows and produces a cutting-edge profile of Japanese quality products, including vials, pre-filled syringes, and ampoules, too.

- West Pharmaceutical Services, Inc.: West Pharmaceutical Services is a designer and producer of injectable pharmaceutical packaging and delivery machines. It was founded in the year 1923 by Herman O.West and J.R. Wike of Philadelphia.

Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Key Players

Tier 1

Tier 2

Tier 3

Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Segmentation

By Equipment Type

- Cleaning Machines

- Container washers

- Sterilization tunnels

- Filling Machines

- Piston-based fillers

- Peristaltic pumps

- Capping Machines

- Screw capping

- Crimp capping

- Labeling Machines

- Pressure-sensitive labeling

- Wrap-around labeling

- Inspection Machines

- Visual inspection systems

- Leak detection systems

By End-Use Industry

- Pharmaceutical Manufacturers

- CMOs / Contract Packaging: the glass vials

- Biotechnology Companies

- Research Institutions

By Application

- Vaccines

- Monoclonal Antibodies

- Insulin

- Other Biologics

By Packaging Type

- Prefilled Syringes

- Glass Vials

- Ampoules

- Cartridges