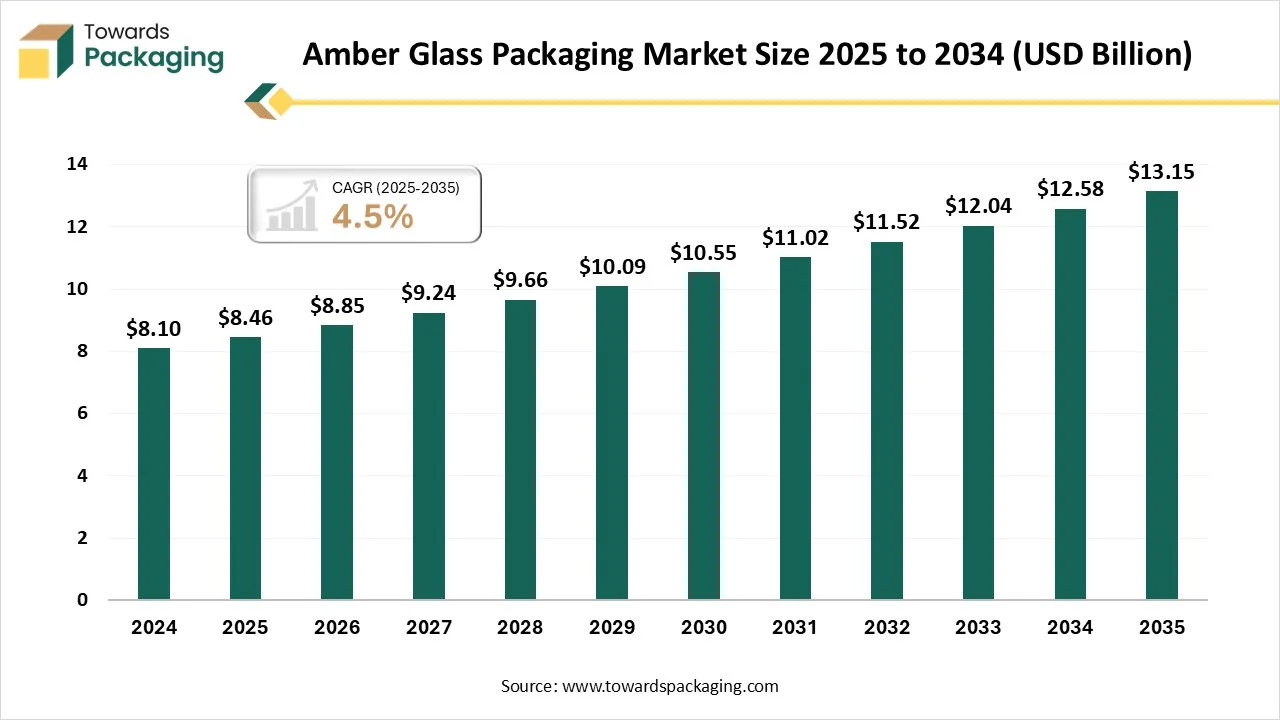

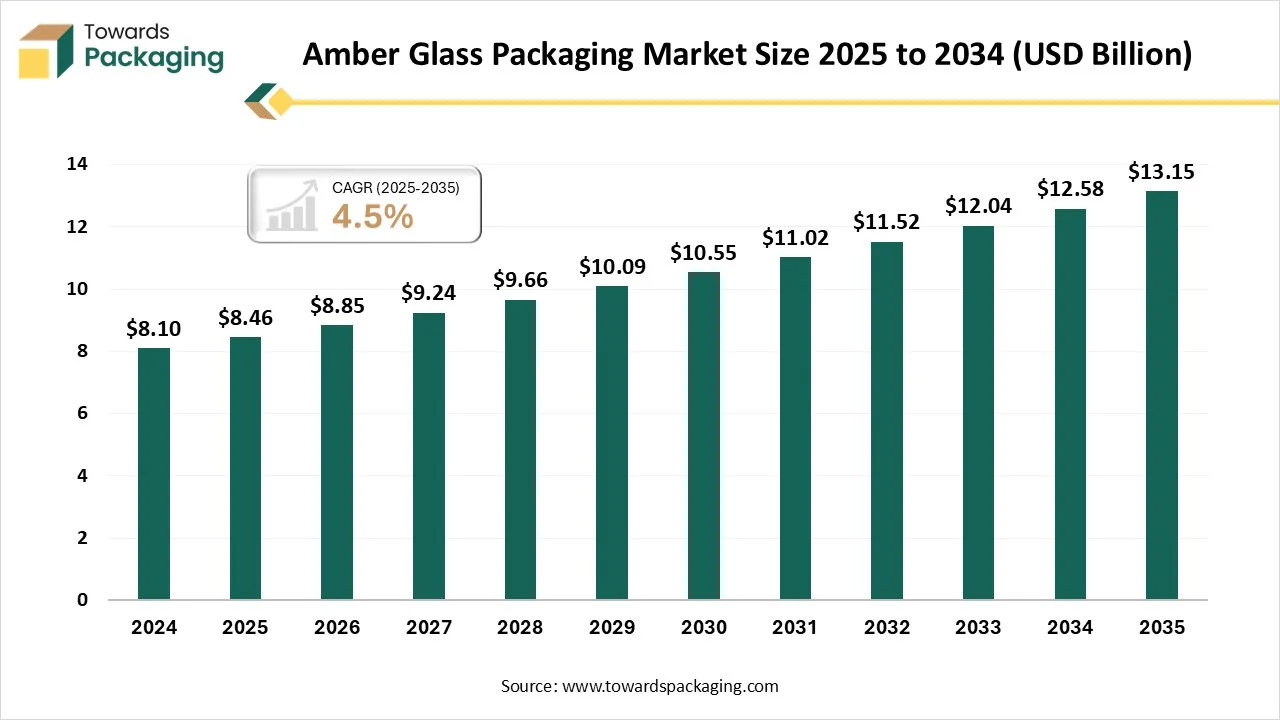

The amber glass packaging market is forecasted to expand from USD 8.85 billion in 2026 to USD 13.15 billion by 2035, growing at a CAGR of 4.5% from 2026 to 2035. This market is influenced by demand for UV shield and sustainable choices. Its exclusive properties make it an ideal option across several end-use segments, mainly for light-sensitive goods. Strict guidelines and the requirement to preserve the efficiency of light-sensitive vaccines, drugs, and several other medicines make amber glass a normal and frequently mandated option.

Amber glass packaging is specialty glass coloured during manufacture to block UV and short-wavelength light, protecting light-sensitive contents (pharmaceuticals, essential oils, beer, cosmetics). It’s valued for chemical inertness, barrier performance, recyclability and premium appearance. The market is segmented by product type (bottles, jars, vials, ampoules, others), end-use (pharmaceuticals, food & beverage, personal care, household, industrial), distribution channel (direct, distributors, e-commerce) and region. Growth is driven by pharma (biologics/vials), sustainability and premiumization in beverages and cosmetics.

The significant technological transformation in amber glass packaging comprises sustainability initiatives, advanced manufacturing, lightweight materials, and smart packaging integration. Producers are utilizing advanced manufacturing techniques to decrease the thickness of amber glass without compromising strength. This decreases material and transit charges and decreases the carbon footprint. Technology is incorporated for additional value and safety. This comprises facilities like QR codes, tamper-evident seals, and NFC tags for goods authenticity, tracking, and customer engagement.

China is the single largest global exporter of glass bottles and related glassware, with export values in the low billions of US dollars in 2023. Germany and Italy are the next largest exporters by value, reflecting Europe’s strength in premium and specialty glass packaging for cosmetics, pharmaceuticals and beverages. These three supplying regions account for the majority of value trade in glass bottles worldwide.

Shipment trackers that report on amber glass bottles show a different pattern from general glass-bottle trade. In the Oct 2023–Sep 2024 tracker window, India accounted for the largest share of amber glass bottle shipments, with roughly 1,371 shipments recorded, followed by China with about 258 shipments. Major importers for amber glass in that window included Nepal, India (re-imports) and Kenya, reflecting strong regional demand and niche trade routes for amber packaging.

Import demand for amber glass packaging is driven by beverage, pharmaceutical and cosmetic users that value amber glass for UV protection and product stability. Large consumer markets in Europe and North America import high volumes of premium glass containers, while regional markets in South Asia, East Africa and parts of Latin America import amber bottles for local bottling and retail needs. Trade flows therefore combine global shipments of high-clarity and specialty bottles with regional trade in standard amber containers.

Amber glass packaging trades as finished bottles, jars and closures, and as semi-finished glassware that is later finished or decorated in destination markets. Freight economics favour shipping nestable bottles or bulk pallets to reduce volume, while high-value decorated or coated amber jars are commonly sourced from nearby specialised producers to reduce transit damage and duty complexity. Packaging for fragile glass shipments and country-specific labelling requirements add to landed cost and supplier selection.

Regulatory measures on packaging waste, recycling targets and extended producer responsibility in the EU and other markets are shifting buyer preferences toward recyclable glass and recycled-content glass. Exporters able to demonstrate recycled content, closed-loop supply relationships and lower carbon footprint gain competitive advantage in regulated markets. These policy drivers are influencing which suppliers receive preference for long-term contracts.

The major raw materials utilized in this market are silica sand, colorant, cullet, soda ash, and limestone. These inputs determine the strength, clarity, and protective qualities of amber glass, especially its ability to shield products from light exposure. Consistent sourcing of high-quality materials helps manufacturers maintain uniform color and structural integrity in pharmaceutical, food, and beverage packaging.

The component manufacturing in this market comprises melting silica sand, soda ash, and other materials with iron, sulfur, and carbon. This high-temperature process creates molten glass that is shaped into bottles, jars, and vials designed for durability and UV protection. Controlled melting and precise formulation ensure that amber glass meets regulatory standards for sensitive products such as medicines and essential oils.

This segment is growing focus on handling to manage the material's fragility and weight. Amber glass packaging requires careful transportation, specialized storage, and protective packaging solutions to avoid breakage during transit. Efficient logistics systems help deliver glass containers safely to pharmaceutical companies, beverage manufacturers, and cosmetic brands across domestic and international markets.

The bottles segment dominated the market with highest share of 52.5% in 2024 due to increasing concern towards product protection. These are important for shielding light-sensitive medicines, fulfilling strong supervisory standards and confirming product firmness and shelf life. Bottles are used for a wide variety of products, including sauces, juices, oils, and beverages such as spirits, beer, and wine, to protect quality and flavour. It is sometimes utilized for perfumes, creams, and serums to preserve product quality and offer an aesthetic application.

The vials & ampoules segment is expected to grow at the fastest 5.6% CAGR during the forecast period of 2025 to 2034. This segment is growing due to the increasing need for storage of injectable drugs. Amber vials are utilized to protect organic models that can be damaged when exposed to light. These are utilized in laboratories to defend unstable or reactive chemical solutions and reagents from light-induced degradation. These protect medications that are damage when unprotected to light, protecting their efficiency over time.

The jars & containers are the fastest-growing in the amber glass packaging market, as it comprise protective properties for light-sensitive products. These are famous for skincare items such as essential oils, creams, and lotions. The finest feel and aesthetic of glass also align with the branding plans of many premium beauty labels. The development of the e-commerce sector has resulted in a preference for injury-barrier packaging and, larger containers.

The pharmaceuticals & biotechnology segment dominated the market, accounting for 46.5% of the market share in 2024, driven by demand for UV protection and product stability. It extends the shelf life of medicines by shielding them from degradation processes such as oxidation and hydrolysis. It upholds strong industry values in drug security and efficiency, making it a preferred and widely recognized resource for pharmaceutical use. It is utilized for several applications, including topical preparations, oral dosages, and injectables. There is a growing demand for packing resolutions that offer excellent suppression for new and cutting-edge therapies.

The food & beverage (beer, specialty drinks, sauces) segment is expected to grow at the fastest 5.7% CAGR during the forecast period of 2025 to 2034. This segment is growing due to the need for preservation of product quality. The main functional benefit of amber glass is its ability to block harmful UV light, which can damage light-sensitive components and shorten product shelf life. The increasing customer demand for sustainable, reusable, and infinitely recyclable packaging favors glass over single-use plastics, boosting the entire glass packaging industry.

Personal care & cosmetics are seeing significant growth in the amber glass packaging market, as it offers a wide range of products and provides product protection. It transports a sense of premium and integrity, which is important in the viable beauty sector, and often upsurges the professed value of the goods. The segment comprises a wide range of goods, including essential oils, creams, serums, and fragrances, packaged in jars and bottles.

The distributors/wholesalers segment dominated the market, accounting for 52.8% of the market share in 2024, driven by increasing demand for specialized distribution. It comprises sales to specialty suppliers and to large retailers such as hypermarkets and supermarkets. For commercial and industrial clients, this often includes direct contact with distributors to manage logistics and inventory. The growth of the e-commerce sector has driven significant development in online distribution. This comprises both company-owned sites and the third-party e-commerce sector that connects customers and sellers, providing a wide variety of choices, from large bottles to small vials.

The e-commerce / online marketplaces segment is expected to grow at the fastest 5.8% CAGR during the forecast period of 2025 to 2034. This segment is growing due to increasing demand for sustainability, logistics, and durability. This packaging market offers excellent UV protection, preserving the quality of light-sensitive goods such as essential oils, pharmaceuticals, and some food & beverage products. This defensive property is important for goods transported under several conditions in the e-commerce distribution chain.

Direct sales (to manufacturers/OEMs) are seeing significant growth in the amber glass packaging market, as they offer customization, quality control, volume checks, and scale. It requires large, reliable volumes of packing, which are best managed through direct, frequently long-term contracts. Direct engagement enables the development of specialized or bespoke packaging solutions, such as specific vial sizes or exclusive bottle shapes, to create brand differentiation.

North America held the largest share, 43.5%, of the amber glass packaging market in 2024, driven by the presence of major pharmaceutical companies. The pharmaceutical sector is a major customer of amber glass packaging for its ability to shield light-sensitive medicines from photochemical degradation, a need to safeguard security and efficiency. Enhanced customer health consciousness has influenced the dietary supplement sector, with several natural extracts used in these products requiring protection from light and prompting the use of amber glass. It is also in huge demand for cosmetic and personal care products packaging that comprises ingredients that are sensitive to light.

Huge adoption across several industries has driven demand for amber glass packaging in the U.S. It is extremely effective at blocking UV light, which helps preserve the integrity and extends the shelf life of delicate items such as essential oils, medications, and a few beverages. Major industries, particularly beverages and pharmaceuticals, depend heavily on amber glass packaging to meet stringent regulatory requirements for product security, efficiency, and stability. As customers and businesses shift away from single-use plastics, the high recyclability of amber glass packaging makes it a favored sustainable substitute, influencing demand and market growth. Customers are increasingly seeking premium packaging that preserves product quality, and amber glass packaging offers a sense of quality and protection that aligns with this preference.

Huge manufacturing and innovation have raised the demand for the amber glass packaging market. Corporations are increasing production and the innovation process to meet demand. The worldwide and regional shift toward sustainable packaging is promoting amber glass packaging, which is inert and recyclable. This is inspiring a shift away from some substitute plastic. Rising disposable incomes and urbanization are driving increased demand for the finest cosmetic, food, and beverage products. Amber glass packaging is selected for these goods to convey a sense of integrity and exclusiveness while providing protection against light.

Continuous changes in consumer habits have accelerated development in the amber glass packaging market in China. There is a growing customer preference for sustainable, environmentally friendly packaging, which favours glass over plastic. Companies are also responding to customers' wishes for the finest, artisanal goods in the cosmetics and beverage industries. The rapidly growing food & beverage sector is a major driver, with amber glass packaging used for products like beer and other beverages that benefit from UV protection. The growth of the e-commerce sector means that goods must be packed for transit. Amber glass packaging is durable and defends against light exposure, making it an appropriate option.

The major factors influencing the growth of the amber glass packaging market in Europe are strict regulatory standards, strong consumer preference, and the rising pharmaceutical sector. This packaging efficiently blocks harmful UV light, which is important for defensive light-sensitive contents from deprivation. These are utilized across a wide range of applications, including pharmaceuticals, cosmetics, and food & beverages, enabling the industry to supply to varied market requirements. Maintaining goods' potency, efficiency, flavor, and shelf life is of paramount importance and is frequently legally mandated by regulatory bodies.

The rising demand for chemical stability and UV light resistance has fuelled the development of the amber glass packaging market in Germany. It effectively blocks damaging UV light, which can destroy or degrade sensitive goods such as essential oils, medications, and some drinks. Strict guidelines in the European Union and Germany administer improved goods security, making superior-quality glass packaging a favored option. A rising customer preference for environmentally friendly packaging is inspiring corporations to choose sustainable options like glass over plastic alternatives. The arrival of amber glass packaging can transport a finest or superior-quality image, which is helpful for branding in industries such as essential oils, spirits, and beer.

By Product Type

By End-Use / Application

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026