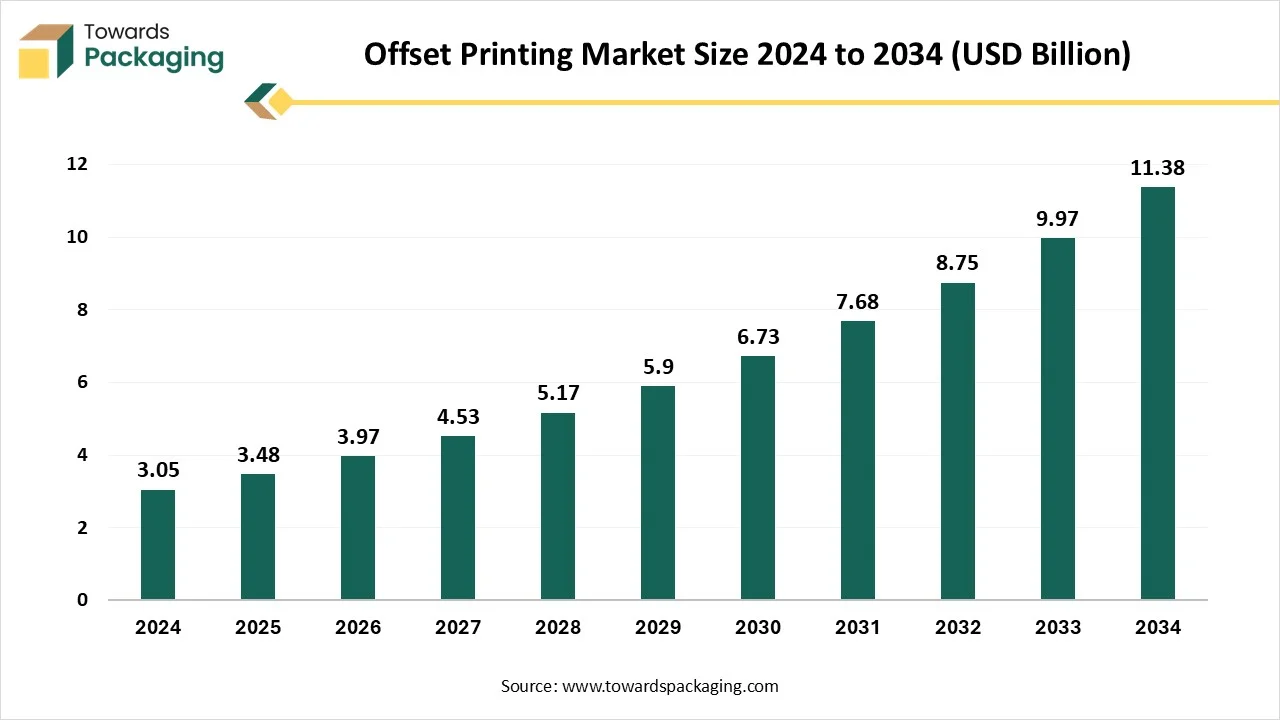

The offset printing market is forecasted to expand from USD 3.97 billion in 2026 to USD 13.05 billion by 2035, growing at a CAGR of 14.13% from 2026 to 2035. This report covers complete insights into market size, segment breakdown (LCDs, RFID chips, sensors, displays, lighting, photovoltaics, batteries, OLEDs and others), regional performance across North America, Europe, Asia Pacific, Latin America and the Middle East & Africa, and the competitive presence of key manufacturers. The study includes in-depth value chain analysis, trade data, supply chain mapping, and supplier landscape, highlighting how emerging economies and packaging demand are reshaping production, distribution and technological adoption.

The market is also experiencing significant growth, driven by the rapid expansion of the e-commerce sector and growing consumer demand for personalized print products. LCDs continue to dominate the global offset printing market. Sustainability is becoming a key focus, and companies are increasingly adopting eco-friendly practices, such as recycled paper, vegetable-based inks, and waterless printing techniques, to meet environmental concerns. Additionally, the market is expanding in emerging regions, particularly Asia Pacific, fuelled by rapid economic growth and ongoing technological enhancements that boost both productivity and efficiency.

Offset printing, also commonly known as offset lithography. This method uses a sequence of rotating cylinders to stamp ink onto the receiving media, mostly paper. Offset printing is a multi-step process that widely uses etched metal plates, water-repellent inks, blanket cylinders, water, and impression cylinders. It is a method used to print longer runs of books, magazines, brochures, manuals, direct-mail pieces, posters, letterhead, paper-based labels, and packaging. In offset printing, each color of the print is applied separately, mainly depending on the four colors, such as magenta, cyan, yellow, and black. The offset printing method’s efficiency makes it most preferable for print orders of more than 1,000 copies.

| Metric | Details |

| Market Size in 2025 | USD 3.48 Billion |

| Projected Market Size in 2035 | USD 13.05 Billion |

| CAGR (2025 - 2035) | 14.13% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Application and By Region |

| Top Key Players | AGAL, GSSE, Haverer Group Ltd, Heidelberger Druckmaschinen AG |

As AI technology continues to grow, Artificial intelligence integration holds great potential to reshape the landscape of the printing industry by improving efficiency, reducing the risk of human error, boosting sustainability, and optimizing material usage. The integration of AI in the printing industry has paved the way for new opportunities in creativity, personalization, and efficiency. AI-powered workflow management tools simplify the entire print production process. Several printing companies that integrating AI into their processes and business units to remain competitive in the long run and meet the evolving demand for environmentally friendly solutions in the printing industry. AI also assists in reducing the company's environmental footprint. The optimization of printing processes results in minimizing the wastage, leading to responsible behaviour in production.

Growing Demand From the Packaging Industry

The rapid expansion of the packaging industry is expected to boost the growth of the offset printing market during the forecast period. In the packaging industry, offset printing is a widely used and versatile technique owing to its high-quality and cost-effective printing solutions. Offset printing is widely used for producing high-quality, vibrant, detailed, and durable packaging materials such as folding cartons, labels, corrugated boxes, and other flexible packaging solutions. In almost every industry, such as food products, consumer goods, or luxury items, offset printing offers detailed designs and consistent branding to improve the product’s appeal. Additionally, the printing of product details on solid boxes for storing finished goods is anticipated to create attractive growth prospects for manufacturers.

High Initial Capital

The high initial capital associated with offset printing presses is expected to hamper the market's growth. The market often faces the challenge of the high initial capital requirements for equipment and skilled labor. In addition, the popularity of digital printing may hinder the growth of the global offset printing market during the forecast period. Digital printing boasts quicker turnaround times and is cost-effective for shorter print runs.

Increasing Emphasis on Sustainability

The rising focus on sustainability is projected to offer lucrative growth opportunities to the offset printing market in the coming years. Consumer preferences are rapidly evolving and shifting toward sustainable packaging solutions. The adoption of eco-friendly inks and recycled paper, with water-based systems, significantly reduces environmental impact and boosts sustainability. Moreover, certain printing operations extensively use vegetable-oil-based ink, recycled paper, and waterless printing techniques to produce more biodegradable packaging to meet the evolving needs of eco-conscious consumers. These developments align with environmental standards while maintaining the high-quality efficiency, versatility, and durability of offset printing.

The LCDs segment accounted for a significant share of the offset printing market as it is widely used as a crucial component in control panels and displays for operating and monitoring the printing process. LCD screens enable operators with a visual interface to manage various settings, monitor progress, and resolve and troubleshoot issues. On the other hand, the radio frequency identification (RFID) chipsets segment is expected to grow at a notable rate during the projection period. RFID chips are used in offset printing for creating smart cards, tags, and labels that can be read without the need for physical contact.

Asia Pacific held the dominant share of the offset printing market in 2024. The growth of the region is attributed to the increasing need for high-quality printing solutions across various industries such as consumer goods, food products, or luxury items, rising technological improvements, rapid expansion of the e-commerce sector, favourable government regulations, growing trend for personalized print products, and rising adoption of eco-friendly practices in the printing industry. Offset printing plays a crucial role in the printing industry, owing to its high quality, efficiency, versatility, durability, and cost-effectiveness, which has increased its usage in a diverse range of applications from books and magazines to packaging and corporate collateral.

Asia Pacific has a well-established printing infrastructure, which has led to an increasing demand for high-volume production of magazines and newspapers, marketing brochures & catalogs, corporate reports, posters & banners, educational publications, product leaflets, cards, and product labels for cartons or boxes. These factors are propelling the market’s expansion during the forecast period.

On the other hand, North America is expected to grow at the fastest CAGR, rising demand for high-quality printed materials, rising consumer preferences shift toward visually appealing and sustainable packaging solutions, rising trend for premium printed products, rapid technological innovation, such as the introduction of waterless offset printing, and growing demand for offset printing from various industries, The region has a robust presence of the packaging sector supporting food & beverage, household, and personal care industries, prominent users of offset printing solutions.

The rising focus on sustainability in print production encourages offset printing companies to adopt eco-friendly practices, such as using vegetable-based inks, recycled paper, and waterless printing techniques to lower their carbon footprints and meet environmental standards. In addition, the rising expansion of the e-commerce industry significantly increases the demand for offset printing solutions, boosting the growth of the offset printing market in the region. For instance, according to the article published by the Census Bureau of the Department of Commerce in May 2025, e-commerce sales in the first quarter of 2025 accounted for 16.2 percent of total sales. Such factors are likely to support the growth of the offset printing market in the region.

By Application

By Region

February 2026

February 2026

February 2026

January 2026