The Europe flexible films market is booming, poised for a revenue surge into the hundreds of millions from 2026 to 2035, driving a revolution in sustainable transportation. This market is influenced by factors such as growing demand from the food & beverage and healthcare industries and an emphasis on sustainable, high-barrier film technologies. There is a strong shift toward recyclable, biodegradable, and compostable films driven by customer demand and stringent regulations. Advancements in high-barrier packaging that extend shelf life are important for pharmaceutical and food applications.

Europe flexible films market encompasses the production and use of lightweight, adaptable polymer-based films primarily for packaging, agriculture, construction, and industrial applications. These films are valued for their barrier properties, durability, printability, and potential for sustainability. They are manufactured from materials such as polyethylene (PE), polypropylene (PP), polyamide (PA), polyethylene terephthalate (PET), and biodegradable polymers. Increasing demand for recyclable and bio-based films, extended shelf-life packaging, and energy-efficient construction materials are driving growth across the region. The market is undergoing rapid innovation toward circular-economy solutions, with an emphasis on post-consumer recyclate (PCR) and mono-material structures.

The growing demand for integrating advanced technology and improved production processes has driven growth in the Europe flexible films market. There is a rapid shift toward multilayer barrier films to provide excellent protection, prolonged shelf life, and tailored properties for specific products. Inventions focus on growing barrier properties against moisture, oxygen, and other materials to preserve product protection and integrity. Technological advancements are enabling the use of post-consumer recycled materials in new, high-value applications, substituting for some virgin resource use.

The major raw materials utilized in this market are polyethylene (PE) and polypropylene (PP).

The component manufacturing in this market comprises plastics, aluminum foil, and paper.

This segment involves manufacturers to converters, and end-user industries.

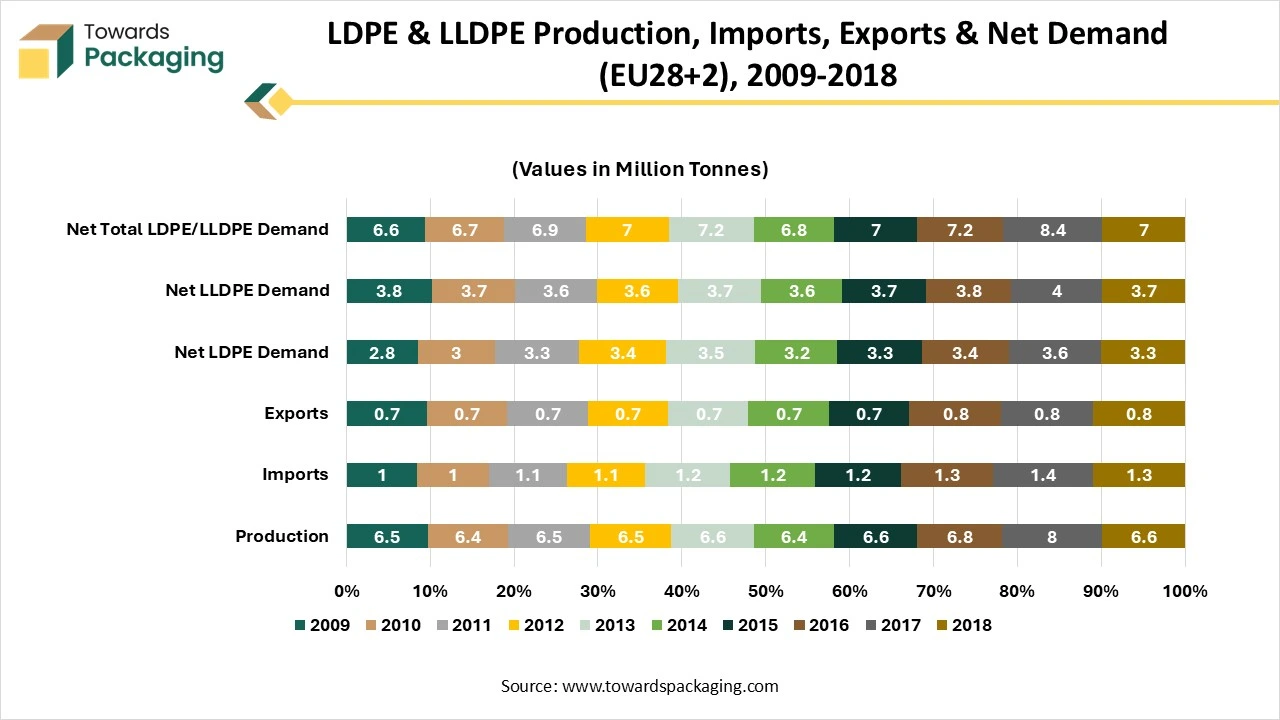

The data shows the trend in production and use of LDPE and LLDPE-the main polymers used in flexible packaging films in the EU28+2 region over the past decade. Production levels remained relatively stable between 6.1 and 6.7 million tonnes, except for 2017, when production peaked at 8 million tonnes before returning to typical levels in 2018. Net demand for LDPE and LLDPE stayed steady between 6.5 and 7.1 million tonnes, exceeding production by about 0.5 million tonnes in 2018, which had to be covered through imports.

In 2018, the total demand for PE flexible films was estimated at 8.5–9 million tonnes, of which 1.2–1.3 million tonnes came from recycled material. When including other polymers such as PP, multilayer materials, PET, PVC and biodegradable plastics, the overall flexible film market reached 13–15 million tonnes. PP and multilayer films each accounted for 2–2.5 million tonnes.

The polyethylene (PE) films segment dominated the market, accounting for 39% in 2024, due to its heat-sealing potential, durability, and flexibility. It comprises linear low-density (LLDPE) and low-density (LDPE), and can be personalized for precise applications, like LDPE for clarity and LLDPE for a perforation barrier in heavy-duty bags. They provide robust moisture resistance, which is important for food packaging to extend shelf life and defend against pollution. It also has the exclusive capability to seal without added coatings and superior low-temperature performance.

The biodegradable & compostable films segment is expected to grow at the highest CAGR of 14% during the forecast period of 2025 to 2034. This segment is growing due to strong regulatory pressure. This segment is considered a shift away from traditional plastics, with notable development in food packaging. The food & beverage sector is a wide customer of bio-based films, utilizing them for goods that need security, a protracted shelf life, and suitability. The market is anticipated to grow steadily as more guidelines are implemented and sustainability becomes a more central focus across businesses.

The polypropylene (PP) films are the fastest-growing in the Europe flexible films market, as they comprise sustainability and recyclability. These are widely used for snacks, dairy products, and ready-to-eat meals because of their ability to preserve product integrity and quality. Biaxially-oriented PP (BOPP) is mainly favoured for its durability and resistance properties. There is a sturdy emphasis on emerging advanced films with improved barrier properties, such as multilayer assemblies, to enhance sustainability and heat resistance.

| Product/Application Segment | Share of PE Flexible Films (%) | Approx. Volume (Mt) |

| Non-Food Packaging Films | 41% | 3.48 – 3.69 |

| Food Packaging | 23% | 1.96 – 2.07 |

| Bags & Sacks | 22% | 1.87 – 1.98 |

| Agricultural Films | 7% | 0.60 – 0.63 |

| Building & Construction Films | 2% | 0.17 – 0.18 |

| Other | 5% | 0.42 – 0.45 |

| Total | 100% | 8.50 – 9.00 Mt |

| Sub-Category | Share % | Approx. Volume (Mt) |

| Stretch Film | 18% | 1.53 – 1.62 |

| Shrink Film | 14% | 1.19 – 1.26 |

| Film on Reel | 9% | 0.77 – 0.81 |

| Product Category | EU28 Trade Status | Quantity | Value Impact |

| LLDPE (Primary form) | Net Importer | +720 Kt imports | Negative trade balance |

| LDPE (Primary form) | Net Exporter | +330 Kt exports | Positive impact |

| Combined LDPE/LLDPE | Net Importer | - | –€200M |

| Film & Sheet | Net Exporter | - | +€950M |

| Sacks & Bags | Net Importer | - | –€700M |

| Major sources/destinations | Imports: Saudi Arabia | Exports: China, Turkey | - |

(Values based on PRE market estimates and polymer purity assumptions: Household 70%, Commercial 85%, Agricultural 50%) Polyethylene (PE) flexible films such as packaging films, agricultural films, and commercial wrapping are widely used, but recycling performance varies greatly depending on their source.

In 2018, about 8.5 million tonnes of PE flexible films were placed on the market across Europe. Out of this, 2.6 million tonnes of sorted film bales were collected and sent to recycling facilities. However, due to contamination and the presence of non-PE materials, only 2.01 million tonnes of actual PE content reached recyclers resulting in an overall recycling rate of just 23%.

Recycling efficiency differs by sector:

This data highlights that improving collection systems, reducing contamination, and designing mono-material packaging will be key to increasing recycling rates.

The food packaging segment dominated the market, accounting for 43% in 2024, driven by shelf-life extension, convenience, and sustainability. There is a growing trend toward compostable and biodegradable films to meet sustainability demands. Flexible films are used in several formats, with bags and pouches being the leading formats due to their cost-effectiveness and lightweight nature. These are fast-growing because of their shelf appeal and convenience. The need to protect food integrity and security, and to extend shelf life for both processed and fresh foods, continues to be a major driver.

The agricultural films segment is expected to grow at a 9% CAGR during the forecast period of 2025 to 2034. This segment is growing due to protection, storage, and increasing crop safety concerns. The rising demand for portable, convenient, and ready-to-consume meals is driving market growth. This segment is rising because of the acceptance of modern farming, the necessity for water conservation, better crop yields, and allowances for increasing seasons. Amplified government help for sustainable choices also boosts development.

The industrial packaging segment is the fastest-growing in the Europe flexible films market, as it offers durability and cost-effectiveness. This segment is driven by several factors, such as EU recycling, the growth of e-commerce, and the need for durable, heavy-duty packaging, leading to innovations in high-barrier and sustainable materials. There is a robust emphasis on emerging, more sustainable choices, including mono-material and bioplastic films that are easier to recycle. Other inventions comprise high-resistance, high-quality packaging films that provide better protection and monitoring for delicate industrial goods.

The food & beverages segment dominated the market with a 45% share in 2024, driven by the growth of food delivery platforms. Shifting customer urbanization and lifestyles are increasing the requirement for suitable food packaging. These are progressively replacing traditional metal and glass packaging due to benefits such as low cost, light weight, and improved resistance properties. Strict EU guidelines and an increasing customer preference for environmentally friendly choices are driving the market toward more sustainable packaging, such as compostable and recyclable films.

The e-commerce & retail packaging segment is expected to grow at the fastest CAGR of 9% during the forecast period of 2025 to 2034. This segment is growing due to strict regulatory guidelines and consumer trends. Increasing customer demand for goods, convenience, and portability, with a prolonged shelf life, supports the use of several flexible formats, such as sachets and pouches. Inventions in smart packaging, barrier properties, and digital printing technologies are improving the appeal and functionality of the flexible films.

The pharmaceutical & healthcare is the fastest-growing segment in the Europe flexible films market, as it comprises safe, lightweight, and sterile packaging. The necessity for tamper-proof, sterile, tamper-evident packaging to confirm product security, integrity, and authenticity is an important driver. The portable, lightweight nature of flexible packaging makes it well-suited to single-dose formats, which are more suitable for patients. There is a robust trend toward more sustainable resources, with notable growth in demand for biodegradable and recyclable flexible films.

The direct sales to converters segment dominated the market, with the highest share of 52% in 2024, driven by integration and scale. Direct agreements stabilize supply chain risks and resin charge familiarity, which are important for high-volume construction. Flexible films need precise technical properties, which often require direct partnership between the converter and the supplier to confirm that the product fulfills precise conditions. It primarily operates on a business-to-business (B2B) model, with film producers or distributors entering into direct, long-term agreements and joint development contracts with converters.

The online/e-commerce segment is expected to grow at the fastest CAGR of 12% during the forecast period of 2025 to 2034. This segment is growing due to stringent environmental regulations and the rise of e-commerce. Their logistical networks and scale are major aspects shaping the industry. E-commerce logistics mandate packing that can protect goods at the time delivery, which is a major purpose of flexible films. The requirement for advanced solutions that are effective for shipping and pack is high. It is due to their large e-commerce sector and proactive environmental guidelines. Major factors comprise the growing demand for recyclable and sustainable packaging.

The wholesalers & distributors are the fastest-growing in the Europe flexible films market, as it comprises supply chain management and product availability. The development of e-commerce has clearly increased demand for flexible films, and suppliers are key to distribution. This dominance stems from their important role in ensuring broad product availability, managing efficient supply chains, and enabling producers to enter markets by connecting them with a diverse range of engineering and retail end-users.

Germany held the largest share in the Europe flexible films market in 2024, due to supply chain management and product availability. The development of e-commerce has significantly increased demand for flexible films, which are supplied by key providers. Distributors are increasingly involved in distributing and supplying recyclable and sustainable packaging options, driven by stricter regulations. They substitute robust associations with both producers and end-users, which supports offering personalized choices and bulk acquiring benefits.

The rise of the circular economy and sustainability has increased demand for the Europe Flexible Films market, especially from Nordic nations, which are expected to grow at an 8% CAGR. The strong personal care, food & beverage, and pharmaceutical industries in the Nordic countries are the main customers of high-presentation barrier films to confirm product quality, safety, and protracted shelf life. There is a robust emphasis on research and expansion in the region, with an association between film producers and polymer specialists to develop resistance technologies and advance sustainable solutions that balance performance with environmental goals. It underscores the need for durable, flexible, and lightweight packaging that protects products during transportation while reducing logistics costs.

The major factors influencing France's market growth are regulatory pressure, e-commerce growth, technological advancement, and sustainability. Producers are investing heavily in R&D to advance smart packaging standards, advanced resistance film technologies, and superior-quality printing for enhanced aesthetic visuals. These inventions permit films to defend sensitive goods and comply with supervisory standards while being cost-operative. The strong development of the food & beverage sector, cosmetics and personal care, and the pharmaceuticals /healthcare industry in France are the main catalysts for the European flexible films sector, as these users rely highly on the customizable and protective features of flexible films.

By Material Type

By Application

By End User

By Distribution Channel

By Country

February 2026

January 2026

January 2026

January 2026