Contract Packaging Market Insights Forecast and Competitive Strategies

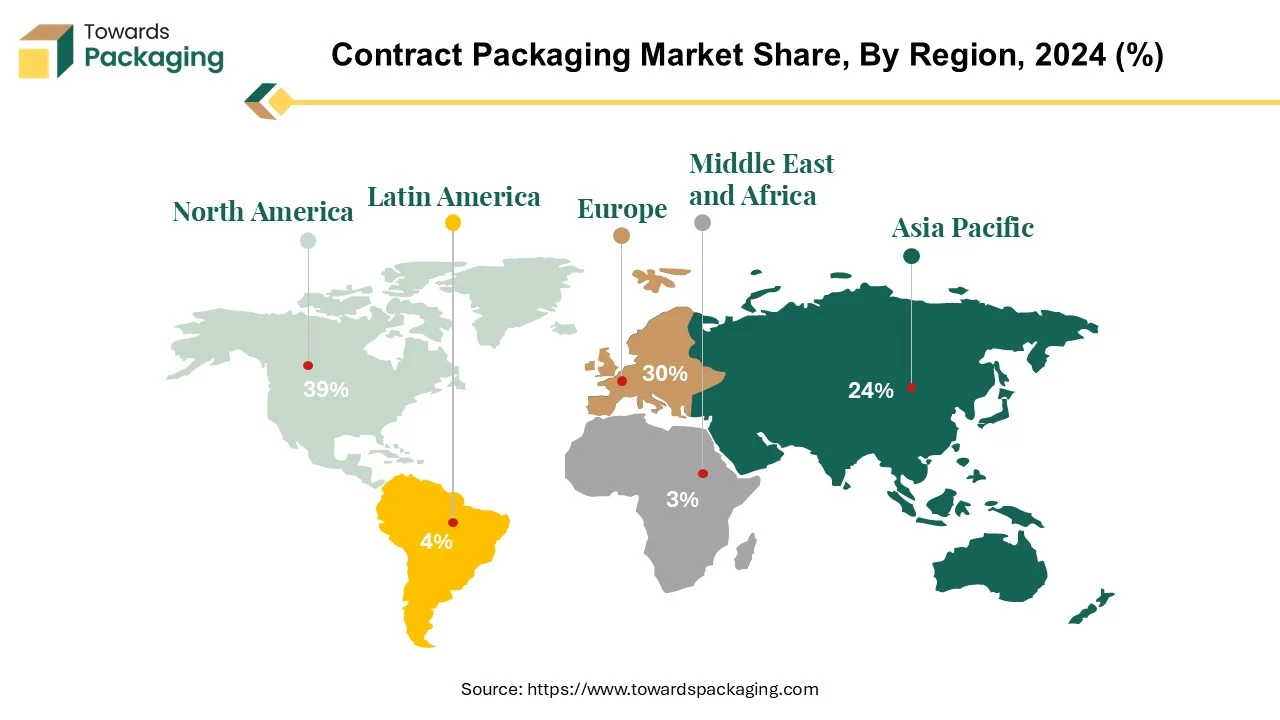

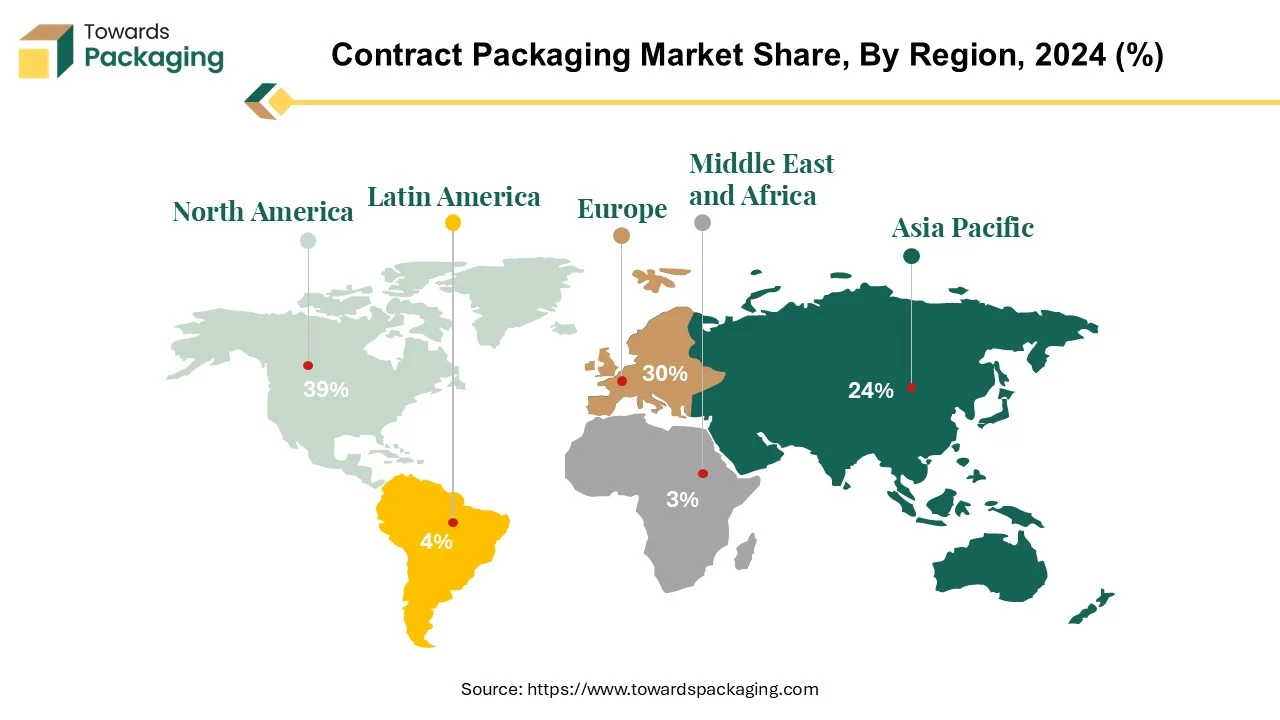

The contract packaging market is forecasted to expand from USD 104.84 billion in 2026 to USD 213.09 billion by 2035, growing at a CAGR of 8.2% from 2026 to 2035. Our report quantifies opportunity across regions North America (leading), Europe, Asia Pacific, Latin America, and Middle East & Africa while detailing segmentation by Material (Plastic, Paper & Paperboard, Metal, Glass, Aluminium), Packaging (Primary, Secondary, Tertiary), End User (Food & Beverage, Pharmaceutical, Cosmetic & Personal Care, Household, Industrial, Chemicals, Electronics), and Services (Bottling & Filling, Bagging/Pouching, Lot/Batch/Date Coding, Boxing & Cartoning, Wrapping & Bundling, Labelling, Clamshells & Blisters, Others).

It profiles manufacturers and suppliers, benchmarks top companies (Aaron Thomas Company, Unicep Packaging, Green Packaging Asia, Multi-Pack Solutions LLC, Reed Lane, CCL Industries, Stamar Packaging Inc, Sharp Corporation, DHL, Wepackit Inc., Kelly Products, Sonic Packaging, Genco, Budelpack Poortvliet BV, Driessen United Blender, Cygnia Logistics Ltd, Complete Co-Packaging Services Ltd., Harke Packserve GMBH), maps the value chain from material sourcing to fulfillment, and analyzes trade data (imports/exports, lanes, tariff contexts) alongside competitive strategies in automation, robotics, AI, sustainability, and e-commerce enablement.

Report Highlights: Important Revelations

- Continued expansion in the North American contract packaging sector.

- Harnessing industry 4.0 innovations within the European contract packaging industry.

- Exploring the potential of plastic contract manufacturing.

- Significance of primary packaging in the contract packaging sector.

- Strategies for thriving in the competitive pharmaceutical contract manufacturing arena.

- Utilizing contract packaging services for bottling and filling requirements.

The contract packaging market, which may be conducted through contract packing companies or co-packers, is a means of outsourcing packaging needs, thus allowing the business to save on resources and the time needed to maximize the activity. Co-packers, as their name suggests, are primary in the field of packaging and labeling for different stuff from the food and beverages to clothes, cosmetics, and other products as well.

Businesses can assign all packaging tasks such as supplies management and shipping to third-party co-packers, who will help in this process. It means that clients can put their efforts on their strong spots in marketing, branding and sales, while outsourcing packaging matters to us. Co-packers can handle various necessities in packings area be it the simple tasks of barcode stickers or the more when it comes to custom packaging designs and productions.

In general, the co-packers supply additional services such as for instance, preparation of ingredients and use of machinery to make the final product available for packaging. Consequently, the clients get a comprehensive solution from manufacturing to packaging. Being able to deal with things in this way allows businesses to fulfill tasks and packaging operations both quickly and efficiently.

The co-packing packaging alternatives are diverse ranging from bottles, jars and bags to boxes and cans which in turn make it possible for the customers to select packaging which is in line with the product and branding strategy. This means that packaging is adapted for products so that they are totally market-oriented and the consumers can accept them.

Co-packing outsourcing of packaging tasks for the businesses not only exempts business owners from load but also makes the business efficient and scalable. When employees who have packaging experience assume the rooftop, companies could be allowed to concentrate on innovation, market expansion, and growth. That is why co-packers are a key player in the business figure as they provide packaging solutions in client's specific needs and in a more reliable and efficient way.

For Instance,

- In October 2023, Ryder System, Inc., a leader in supply chain, dedicated transportation, and fleet management solutions, announces it entered into a definitive agreement in the third quarter to acquire all of the outstanding equity of IFS Holdings, LLC, also known as Impact Fulfillment Services (IFS).

Key Metrics and Overview

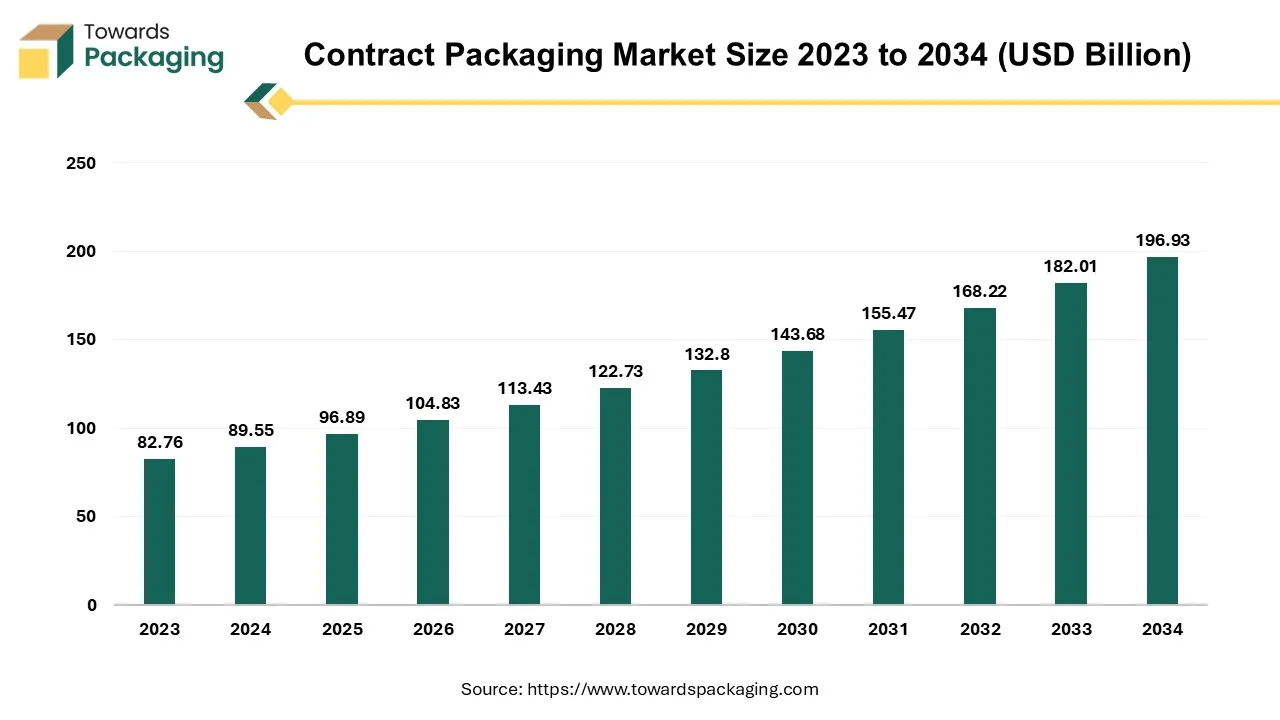

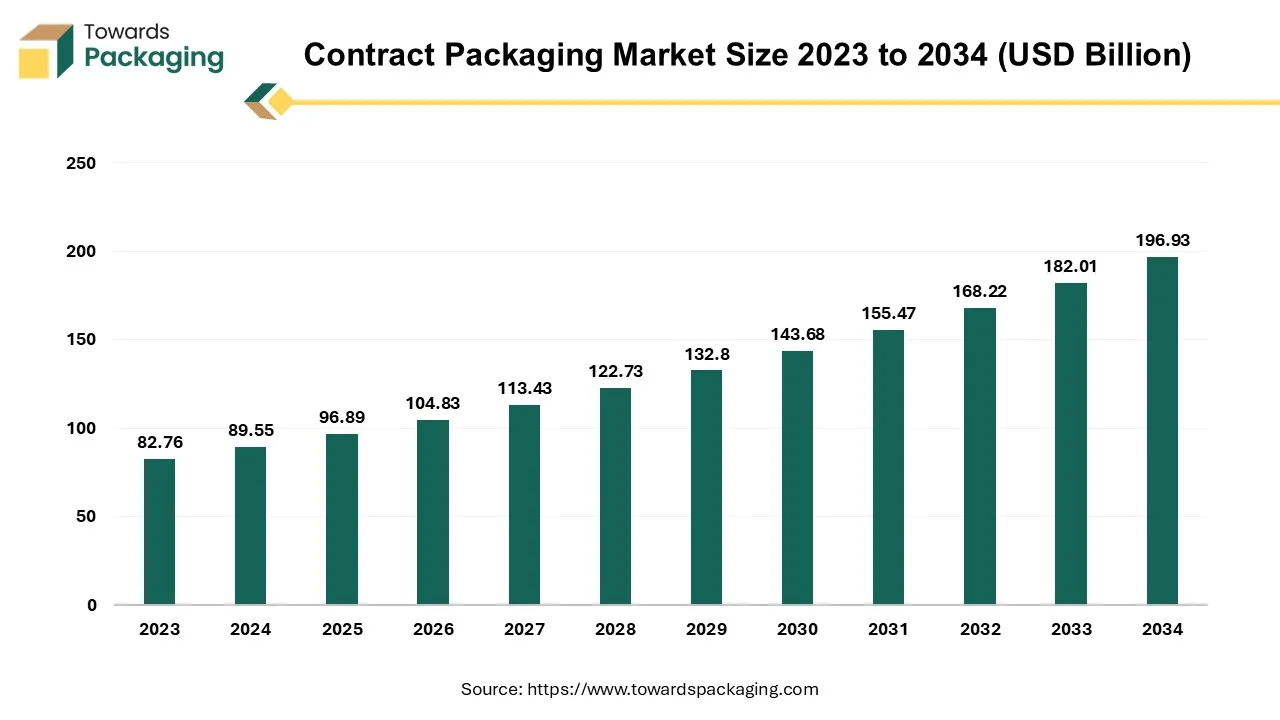

| Metric |

Details |

| Market Size in 2025 |

USD 89.55 Billion |

| Projected Market Size in 2035 |

USD 196.93 Billion |

| CAGR (2025 - 2035) |

8.2% |

| Leading Region |

North American |

| Market Segmentation |

By Material, By Packaging, By End User, By Services and By Region |

| Top Key Players |

Aaron Thomas Company, Unicep Packaging, Green Packaging Asia, Multi-Pack Solutions LLC, Reed Lane |

Key Factors Influencing Trends in Contract Packaging Market

- Automation and Robotics: Automation and Robotics are the main elements in terms of modern contract packaging by taking over repeat and complicated tasks as they ensure quicker and more accurate contract packaging that lessers errors and labor costs.

- AI and Data Analysis: Artificial intelligence and data analysis are rechanging this sector and how businesses move toward these technologies examines historical data, identifying designs that serve actionable insights, and updating every stage of the process.

- Sustainability in contract packaging: Governments, consumers, and businesses are heavily expecting eco-friendly practices and contract packaging services are stepping up to align with those urges.

- Recyclable and biodegradable materials: The move towards biodegradable and recyclable material in contract packaging has been changing. Companies now watch these materials not just as a procedure to lessen their environmental effect but also as a competitive benefit.

- Extended producer responsibility( EPR): Extended producer responsibility is transforming business strategy towards packaging decisions. Under these regulations and legislations, manufacturers bear operational and functional responsibility for the waste generated by their products.

Strategic initiatives

Skilled labor development initiatives: The constant skills in gap production have caused forward-thinking contract manufacturers to grow comprehensive training programs and educational collaborations. Investments in upskilling current workers to operate heavily standard equipment and systems pay dividends in quality, productivity, and employee maintenance.

Contract Packaging Market Trends

- Robots: Robots in co-packaging inventions are transforming the industry by providing precision, speed, and adaptability to the packaging. Pick and place robots excel in picking up items from one particular location to another by keeping them in another, making them perfect for tasks like assembly, sorting, and packaging. Their precision and speed are ideal for high-volume operations.

- Artificial Intelligence: Artificial Intelligence is changing contract packaging by creating operations that are smarter, more adaptable, and faster, too. By utilizing real-time data and machine learning algorithms, AI can update everything from production schedules to inventory management, lowering waste and developing efficiency.

- End-to-End Visibility: Having an accurate understanding of many operations is important for making informed decisions. For instance, enabled devices and sensors for actual time tracking, business intelligence dashboards, and integrated warehouse and inventory management systems are the tools that we get in a front-row seat to every step of the contract packaging system.

- Driving Efficiency and Sustainability in CO2: Sustainability is changing the packaging sector, stimulating invention and collaboration as companies seek to reduce CO2 emissions and waste and adopt clean energy.

- E-commerce development requires higher volumes of contract packaged services. Contract packagers are transforming their systems to be able to pack for online orders, including kitting, bundling, and package customization for direct-to-consumer shipment.

- Sustainability has become a vital element of the contract packager's scope as the brands and consumers alike give importance to environment friendly packaging solutions. Packaging contractors are introducing sustainable packaging practices, as in adopting recyclable materials, decreasing packaging wastes, and optimizing packaging designs to avoid environmental impacts.

- The contract packaging is being used by the brands to create attractive customized and personalized packaging solutions that will blend in with the needs of their target market.

- Contract packagers are integrating the technology to create the more efficient mechanisms, increase the quality of packaging control and to be less vulnerable to production challenges.

Artificial Intelligence in Contract Packaging

Artificial Intelligence is increasingly transforming contract packaging by developing efficiency, accuracy, and customization in the production process. AI-powered systems are used for predictive maintenance, quality control, and real-time monitoring, lowering errors and downtime. In packaging design and operations, AI enables optimization of materials, automated filling, and adaptive help manufacturers forecast demand, manage supply chains, and personalize packaging solutions.

Continued Growth of the North American Contract Packaging Market

The North American contract packaging market has been accumulating a substantial growth in the previous years due to some pivotal reasons Yet another factor towards this aspect is the incremental demand for the outsourcing packaging service by companies who are eager to minimize their operations and focus the major roles within the firm. The reason for North America's boom is that it has the largest s and industrialization. Moreover, North America, with its already mature manufacturing platforms and logistics infrastructure, represents a perfect setting for contact packaging businesses to maintain their leading positions. Herein lies the bedrock of the logistics operations since it provides for rapid material acquisition, manufacturing processes and processes, and speedy delivery of products to the market.

More sophisticated and a more various package design, which has been fueling businesses which provide respective packaging services, have been produced by an increased number of products for consumers. Top companies are growing the sales of contract packaging for their suppliers. Through that contract packing companies in North America became diversified by having an ability to offer a selection of packaging services which cover custom packaging design, labeling and meet of regulatory requirements. This can is a great facility to offer individualized packaging to a wide range of industries, hence, spinning the market.

Packing for North American consumers gives the chance for contact packers to seize upon their lucrative market. Consumers' tastes and value for their purchases change, as well as the trend of convenience and sustainability, subsequently, businesses aim to offer packaging’s which are unusual to grab customers’ attention. In terms of contract packers, North America has got several firms that offer up-to-date packaging packages and utilize innovative green technologies.

The contract packaging market in North America is thriving due to factors such as strong manufacturing infrastructure, increasing demand for specialized packaging solutions, growing consumer market, and the shift towards e-commerce. As businesses continue to prioritize efficiency and innovation, the demand for contract packaging services is expected to further drive market growth in the region.

U.S. Market Trends

U.S. contract packaging market is driven by the strict regulatory standards and strong infrastructure. The U.S. has one of the largest and most diverse consumer bases, driving demand for flexible, custom, and high-volume packaging solutions especially in food & beverage, pharmaceuticals, and personal care. American contract packaging firms widely adopt automation, robotics, and smart packaging technologies, increasing efficiency, consistency, and scalability. Integration of IoT and AI for real-time monitoring and predictive maintenance enhances operational performance. U.S. companies operate under rigorous standards (FDA, USDA, cGMP, ISO), making them attractive partners for brands that prioritize quality, safety, and compliance, particularly in healthcare and food.

The U.S. has a highly developed logistics network (road, rail, air, and ports) and widespread access to cold chain and just-in-time delivery, which supports fast, reliable packaging and distribution. U.S. firms invest heavily in materials science, sustainable packaging, and customization, keeping them ahead in innovation. Many consumer goods, electronics, and pharmaceutical companies in the U.S. prefer outsourcing packaging to focus on core competencies, fueling demand for contract packaging services. With rising demand for eco-friendly packaging, U.S. companies are leading in adopting biodegradable, recyclable, and reusable packaging formats, responding to both consumer and regulatory pressure. The U.S. serves as a key export hub to Canada, Latin America, Europe, and Asia. Many multinational firms use U.S.-based contract packagers to serve global markets with regional customization.

For Instance,

- In April 2024, Veritiv Corporation, a leading specialty distributor of value-added packaging, facility solutions and print products and solutions, announced today that it has acquired substantially all the assets of Ameripac, LLC, and Ameripac Pennsylvania, LLC a leading provider of turnkey contract packaging and fulfillment services with annual revenues of approximately $60 million.

Latin America

The manufacturing of contract packaging in Latin America is witnessing constant growth, driven by increasing demand from the food and beverage, personal care, and pharmaceutical industries. Countries like Brazil and Mexico are leading hubs, offering cost-effective production, skilled labor, and access to raw materials. Companies are outsourcing packaging operations to specialized contract manufacturers to develop efficiency, reduce capital expenditure, and focus on core business activities. The market is also witnessing the adoption of innovative and sustainable packaging solutions, including flexible packaging, automated filling, and eco-friendly materials, aligning with both user choice and regulatory requirements.

Middle East and Africa

The production of contract packaging in the Middle East and Africa is growing steadily, driven by development in the food and beverage, cosmetics, and pharmaceutical sectors. Countries like the UAE, Saudi Arabia, and South Africa are emerging as main hubs due to their industrial infrastructure, skilled workforce, and strategic travel locations. Organizations increasingly outsource packaging procedures to specialized contract manufacturers to update efficiency, lower costs, and focus on core operations.

Industry 4.0 Advancements in European Contract Packaging Market

Co-packing market in Europe is enjoying an upward trend. The 81% of co-packing companies are willing to expand operations, 30% are planning to invest in additional packaging lines within the next three years. This was the outcomes of a market study performed by the European Co – Packers Association (ECPA) and conveyed at their third symposium held in Eindhoven, The Netherlands. The majorly factor guiding the growth of the sector in the EU is the use of Industry 4.0 advancements, which raise efficiency, lower operating expenses, and promote sustainability. As co-packers need to fulfil more orders, there is a shift in business strategy now to achieving profitability and decreasing the current acute shortage of skilled employees.

Major brand owners like Mars, Unilever, and Kraft are in the forefront of this transformation in the industry by requesting for ECPA members to broaden their scope beyond contract packaging to also include materials procurement, logistics, and even handling of the basic raw materials. A larger percentage of the co-packers surveyed offer the full-service formulation, which quite simply adds value to their offerings and makes them comprehensive solution providers.

Providing the comprehensive service has its constraints, where one should contemplate the addition storage, the risks and their complexity. Not all co-packers have the capabilities to meet the demands that this compliance may entail. The association recommends that taking this step, co-packers smoothen out manufacturers’ assembly process up to the point where they become one-stop shops that satisfy the continuous needs of manufacturers most efficiently.

There is approximately a thousand active co-packeries in Europe and just 60 of them is a part of ECPA association. On average, about 40% of these specialty co-packers are small-sized companies. Among the primary objectives of the association is to increase the number of participants in the system for sharing knowledge among co-packers, thereby create traffic of contracts in the European contract packaging market.

For Instance,

- In April 2024, International Paper and DS Smith Plc announced that they have reached agreement on the terms of a recommended all-share combination (the "Combination"), creating a truly global leader in sustainable packaging solutions.

China Market Trends

China contract packaging market is driven by the booming manufacturing and export sector which has driven the market growth. China’s role as a global manufacturing powerhouse increases demand for contract packaging, especially for electronics, pharmaceuticals, cosmetics, and consumer goods destined for international markets. China offers lower labor and operational costs compared to many Western countries, making it attractive for outsourcing packaging tasks. The Chinese market values speed-to-market and product customization. Contract packagers are well-equipped to meet this demand, especially for seasonal or promotional campaigns.

Contract Packaging Market, DRO

Demand:

- Contract packaging services provide cost-cutting solutions which are beneficial to businesses seeking for efficient packaging operations and lessening fixed expenses. Outsourcing packing ornamentation to third-party packers covers the cost of in-house facilities, procurement of devices and labour expenses, thus instigating massive savings for the clients.

Restraint:

- Product quality maintenance, product consistency, and rules which must be obeyed, represent a vital problem in contract packaging operations. The clients may be faced with quality control among other issues like traceability and accountability when they outsource the packaging activities to third party providers.

Opportunity:

- Contract packagers can be competitive in the market by offering placement services for the packaged products in the local stores as well as showroom of big contracts. The services that may be rendered can be packaging design, regulatory compliance assistance, sustainability consultation, and supply chain optimization, which are all directed at the comfort and loyalty of clients.

The Power of Plastic Contract Manufacturing

Plastic contract manufacturing presents a comprehensive solution to end-to-end plasma production, offering bespoke services from contract manufacturers upon request. Oftentimes, product companies require contract manufacturers as these guys handle plastic production tasks. Therefore, it becomes a common thing for these companies to be involved in the projects that may involve multiple stakeholders. According to forecast, the output value of global plastics market will be $457.73 billion in 2022. Approximately 40% of the production of plastics is also required in the production of plastic packaging.

Contract manufacturers hold in their arm a variety of industries and product type expertise that is vast. They hire professionals with the areas of materials, tooling and processes as well as equipment, which allows them to solve the specific tasks that arise in the course of the plastic production process. Through its expertise and experience, an OEM thus allows businesses to benefit greatly in terms of the quality and cost effectiveness of post plastic processing.

Single-use plastics are more popularly used because of the convenience they provide, their portability feature and also because of the durability of the product. Such features therefore make them a good match for packaging applications which is turning contract packaging into an increasingly popular and convenient way to package various products. Hence, the plastic sector in contract packaging continues its record-breaking progress, since more and more companies turn their attention to contracting plastic production and leave them to specialties contract manufacturers.

Contract manufacturing of plastic offers the most effective and comprehensive strategy for the production of the plastic items using the services of the contract manufacturers in order to fulfill the vast range of requirements of the clients, especially in the area of contract packaging where single-use plastic objects play a key role in propelling market expiration.

For Instance,

- In January 2024, Plastic blow moulder Container Services Inc (CSI) has acquired US-based manufacturer Apex Plastics for an undisclosed amount.

Role of Primary Packaging in Contract Packaging Market

Primary packaging is the first layer of packaging that touches the products. The focus of primary packaging is containment, protection, and preservation of the products. The goal of primary packaging is a defence against contamination and defects. Blister packaging for over-the-counter pharmaceuticals would be a good example of primary packaging. These materials protect the product. They also alert consumers to contamination if it has occurred. Primary packaging will often be the last material removed by the consumer.

Primary packaging offers both protective and branding capabilities, which enhances product appeal. Blister packaging is a term for several types of pre-formed plastic packaging used for small consumer goods, foods and pharmaceuticals. Clamshell Packaging is similar to a blister pack in that it is made of a shaped plastic material. Clamshells, however, consist of two (usually) plastic halves connected by a hinged area. Skin packaging, like blister packaging, involves the product being backed by a paperboard backing. Poly Bagging is a simple form of primary packaging in which the product is deposited into a polythene bag and heat sealed to protect from dust and damage during transit and storage.

For Instance,

- In February 2024, SGD Pharma launches new range of Type I injectable vials in tubular glass Pharmaceutical molded glass primary packaging provider SGD Pharma has launched a new range of Type I injectable vials in tubular glass.

Navigating the Competitive Landscape in Pharmaceutical Contract Manufacturing

The pharmaceutical firms are uncovering the fact that they can succeed in reducing their research and manufacturing spending by outsourcing. This phenomenon is derived from several aspects such as patent lapses, generics impact on market competition and the efficiency aspect of the research and development operations. Therefore, outsourcing the pharma manufacturing to the contract manufacturing organizations (CMOs) is becoming very profitable. Bio-pharmaceutical industry is witnessing a dramatic growth, largely enjoyed by an increasing number of Food and Drug Administration (FDA) approval and clinical trials. This growth has also reinforced the need for the contract pharmaceutical manufacturing services increasing the demands of the same even more.

It has grown more competitive, giving a particular place to generic pharmaceuticals. The more and more opened access to developed markets such as the US, Germany, France, as well as the UK for enterprises, especially in the Asia-Pacific region, is a prime setting where companies possibly expect to find new opportunities. The upcoming generic drug manufacturers will be on the backside of several patents in the imminent future, which will create another window of opportunity for the industry to prosper. Patent expiry rates are then followed by generic alternatives to the drug competing in the marketplace, which in turn may drive reduction of cost for the consumer.

The pharmaceutical industry observes a transfer of operations to contract manufacturing along with higher competition, with this form of production being crucial in the market and in providing innovation as well as cost efficiency.

For Instance,

- In October 2022, German packaging supplier Gerresheimer and pharmaceutical company Merck have jointly created a digital twin solution to ‘transform’ the pharmaceutical supply chain.

Leveraging Contract Packaging for Bottling and Filling Needs

A contract packaging bottling and filling service refers to that segment of contract packaging industry in which the bottling and filling products in bottles, containers or other packaging formats for clients. These services are the pillar of everyday mechanisms used be it in beverages ingestion or in making cosmetics, pharmaceuticals and for household goods.

Bottlers and filling contractors rare cover specific settings like liquid filling, powder filling and filling of semi-solid goodies. They are using the most advanced shields, sensors and equipment and technologies to guarantee proper fill amount and continuous quality and fast production cycle.

It is generally the case that these services being from hand are very useful for those companies that do not have the resources or infrastructure to do bottling and filling jobs by hand. The business hourly logistics such as the product packing can be handled by the contract packagers which in return save the business time, reduce costs, and let entrepreneurs to channel their focus into functionally related core processes like product development, marketing, and distribution.

The services of contract packagers are most often characterized by the option of customization which involves labeling, capping, and the choice of a specific packaging scheme so that the client’s products are distinguished and in compliance with the given requirements. Hence, the services provided by contract packagers like bottling and filling stages are instrumental in bringing those products to the market, and such measures facilitate efficient and effective ways of doing business.

Key Players and Competitive Dynamics in the Contract Packaging Market

The competitive landscape of the contract packaging market is dominated by established industry giants such as Aaron Thomas Company, Unicep Packaging, Green Packaging Asia, Multi-Pack Solutions LLC, Reed Lane, CCL Industries, Stamar Packaging inc, Sharp Corporation, DHL, Wepackit Inc., Kelly Products, Sonic Packaging, Genco, Budelpack Poortvliet BV, Driessen United Blender, Cygnia Logistics Ltd, Complete Co-Packaging Services Ltd., and Harke Packserve GMBH. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Aaron Thomas Company Takes Pride in its contract packaging services which are rendering solution to clients packaging needs; through its packaging establishment, assembly, labeling and fulfillment services. Customize concepts and produce corresponding products and services to match client's unique needs and demands.

For Instance,

- January 2024, Ashton Thomas recruits $2bn advisory team and Asher Nachshon parent acquires a $1bn broker dealer ARAX Investment Partners announces the addition of a $2bn wealth team and a broker-dealer that will go by the name of Ashton Thomas Securities.

Green packaging Asia offers different solutions which are considered sustainable in which they wouldn't put at risk the environment through the whole packaging process. Choice of sustainable practices while taking into account clients' satisfaction. WCommunication Task: Humanize the given sentence. mountainous terrain of places like Switzerland or Italy makes up for this gain with its glorious nature.

For Instance,

- January 2022, SIG declared that it had just sold its Pactiv Evergreen Inc.'s business in the Asia Pacific Area. The chilled operations area was rightly named “Evergreen Asia.” Reform proceed and consolidated.

New Advancements in Contract Packaging Industry

- In May 2025, the Board of Directors of Graphic Packaging Holding Company, a leader in environmentally friendly consumer packaging worldwide, authorized a new US$1.5 billion share repurchase. By adding this permission to the July 27, 2023 share repurchase authorization, which still has US$365 million outstanding, the total amount of authorization that is available as of April 30, 2025, is US$1.865 billion. The new authorization permits periodic share repurchases through privately negotiated transactions, open market repurchases, and Rule 10b5-1 arrangements in compliance with relevant securities regulations. Market circumstances, the company's financial health, debt maturities, and cash flow are some of the variables that will affect when repurchases, if any, take place.

- In January 2025, AeroFlexx, a pioneer in environmentally friendly packaging, has partnered with Chemipack Sp. z0.o., a blending and filling business with its headquarters located in Lowicz, Poland. By placing its in-house filling machine at Chemipack's manufacturing facility, AeroFlexx has made it easier for European firms to implement cutting-edge packaging technologies. AeroFlexx and Chemipack are well-positioned to meet the expanding need for environmentally friendly liquid packaging formats in the larger European market thanks to this strategic alliance. The family-run liquid concentrate supplier Chemipack has a track record of extremely effective on-site blending and filling processes, and it can produce and fill more than 100 million liters of liquids a year.

- In March 2025, Aenova, a manufacturer and contract developer for the healthcare and pharmaceutical sectors, has increased the size of its Bad Ailing location. The site provides a high-volume, contemporary infrastructure for the production of blister packaging and effervescent products, with a total investment of almost 20 million euros in new production and packaging lines. The investment will be used to upgrade the equipment at the Bad Aibling location, the competence center for third-party and blister packaging, and the large production volumes of effervescent goods within the Aenova network.

Recent Developments

- Kenco, a top company in third-party logistics services, revealed the official launch of its Contract Packaging Division, an investment approach covering secondary packaging. This stretch of the company’s contract packaging delivers further simplification and operations that strengthen Kenco’s position as a one-stop shop for supply chain management.

- On 5 July 2025, Sanner revealed its production in Greensboro, NC. The latest facility is dedicated to generating complicated-injected elements for medical devices and pharmaceutical packaging, as well as the desiccant industry.

- On 2 May 2025, the CCT TRUETemp Natural sippers became a curbside recyclable, universal solution that integrates robust thermal performance, cost-effectiveness, and operational efficiency, all while reinforcing CCT's commitment to invention and sustainability in cold chain logistics.

- On 4 June 2025, Matryoshka which is an iconic Russian nesting doll with Chairing the Contract Packaging Organization and Contract Development And Manufacturing Organization manage at the Pharmapack-2025.

- On 28 October 2024, Himalaya Food International Ltd which is officially known as India’s largest frozen and canned food sector procedure company with a concentration on generating high-quality French Fries and other food products as the company is loyal to serving clean and every natural products that users want to consume.

Contract Packaging Market Companies

Contract Packaging Market Segments

By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Aluminium

By Packaging

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By End User

- Food & Beverage

- Pharmaceutical

- Cosmetic & Personal Care

- Household

- Industrial

- Chemicals

- Electronics

By Services

- Bottling and Filling

- Bagging/Pouching

- Lot/Batch and Date Coding

- Boxing and Cartoning

- Wrapping and Bundling

- Labelling

- Clamshells and Blisters

- Others

By Region

- North America

- Asia Pacific

- Europe

- LA

- MEA