Vaccine Packaging Market Size and Regional Growth Rate

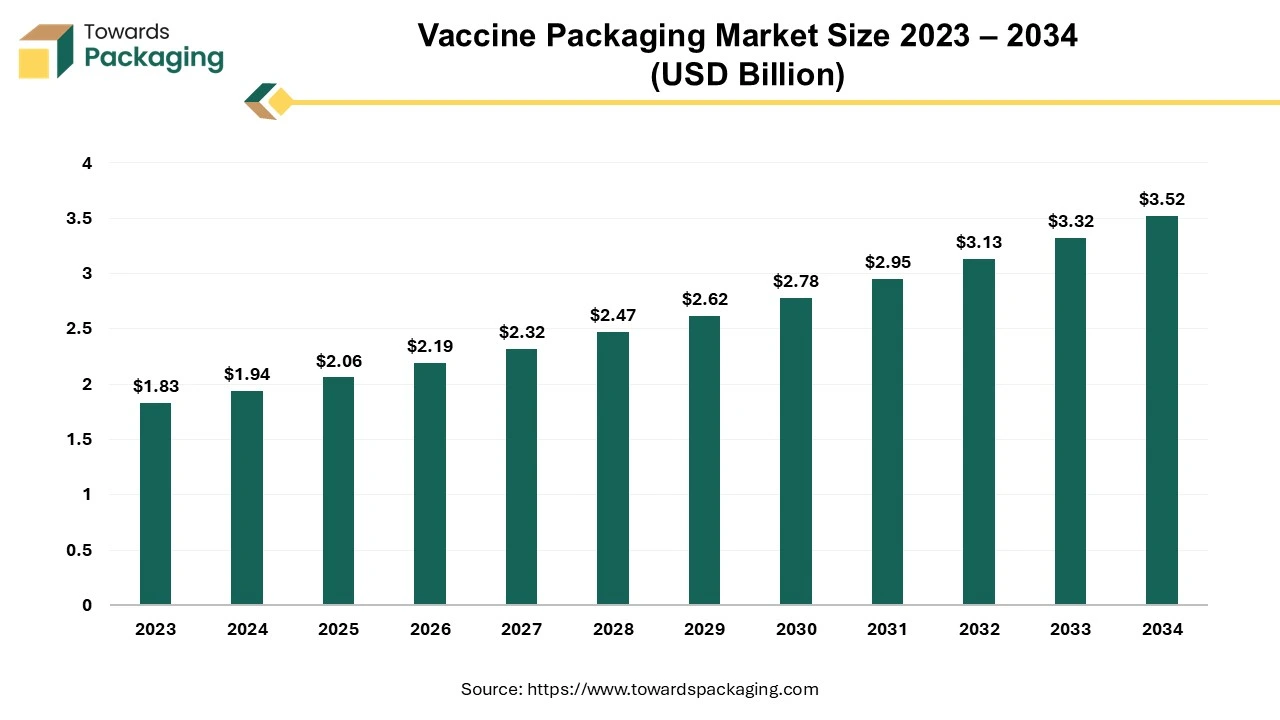

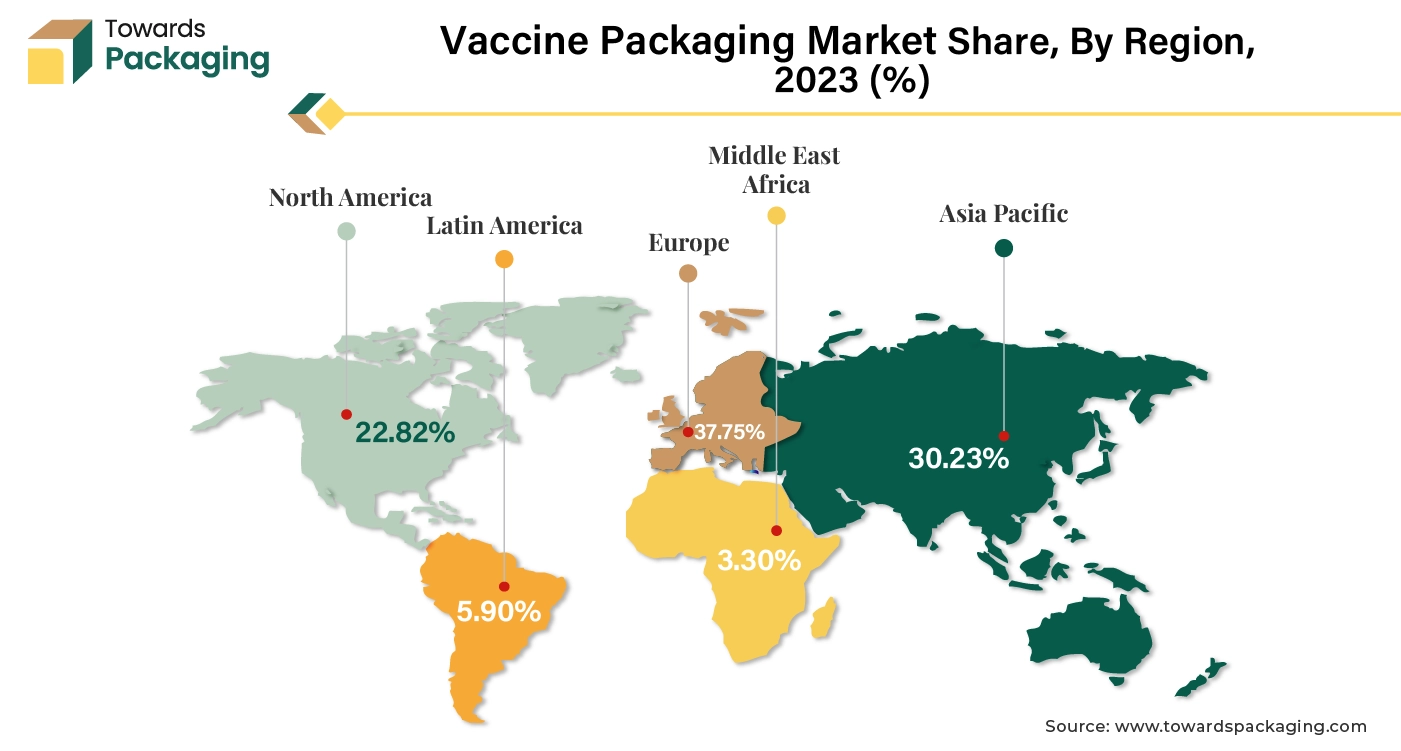

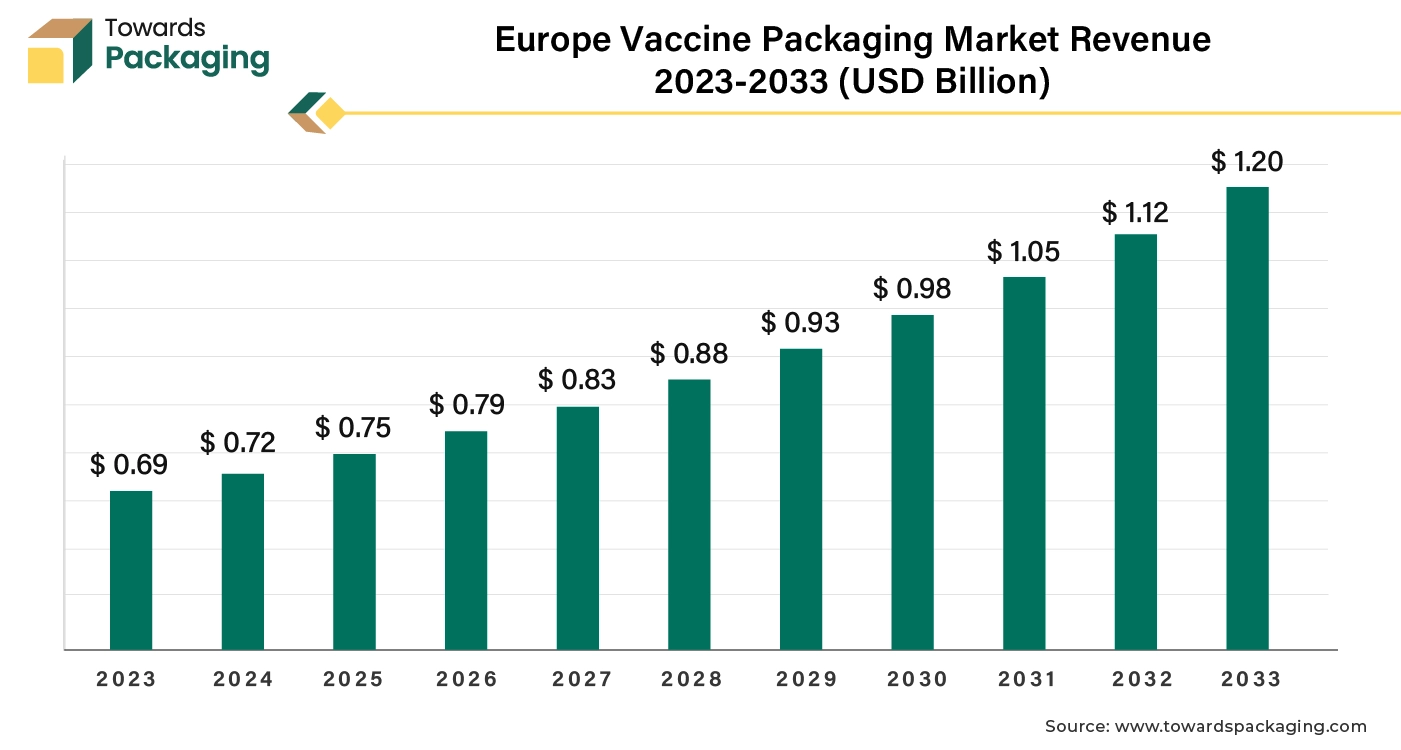

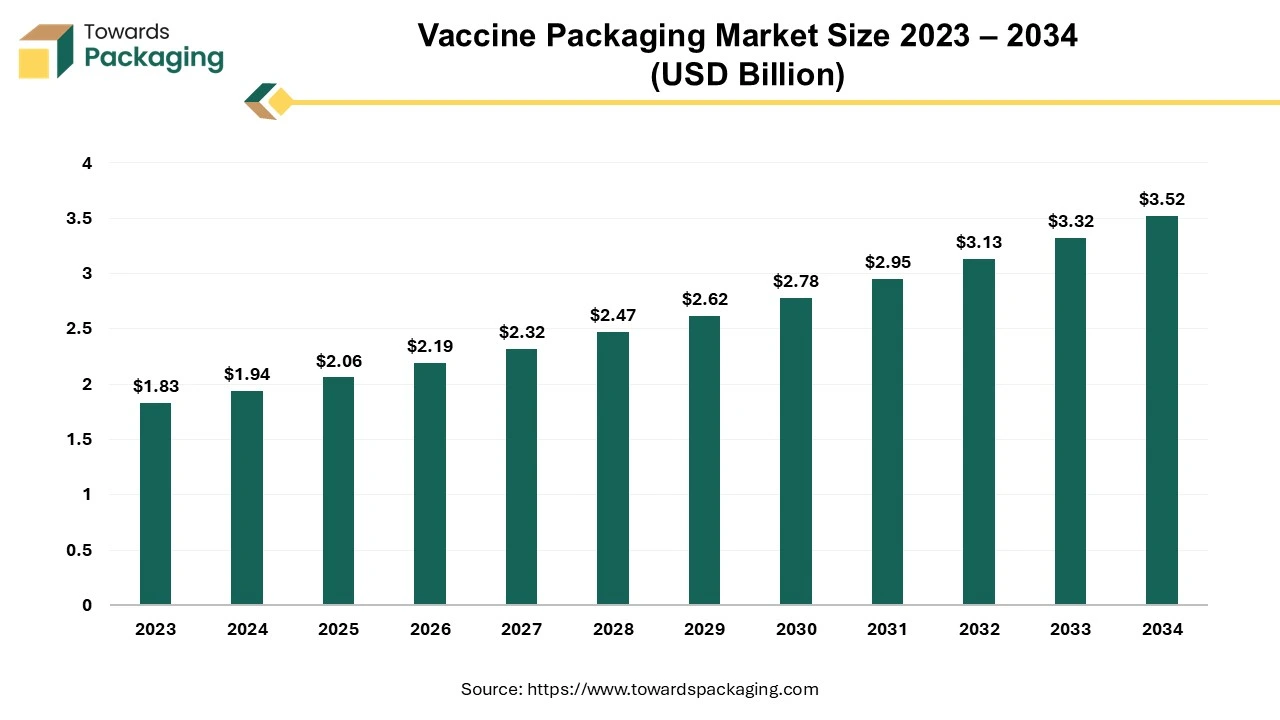

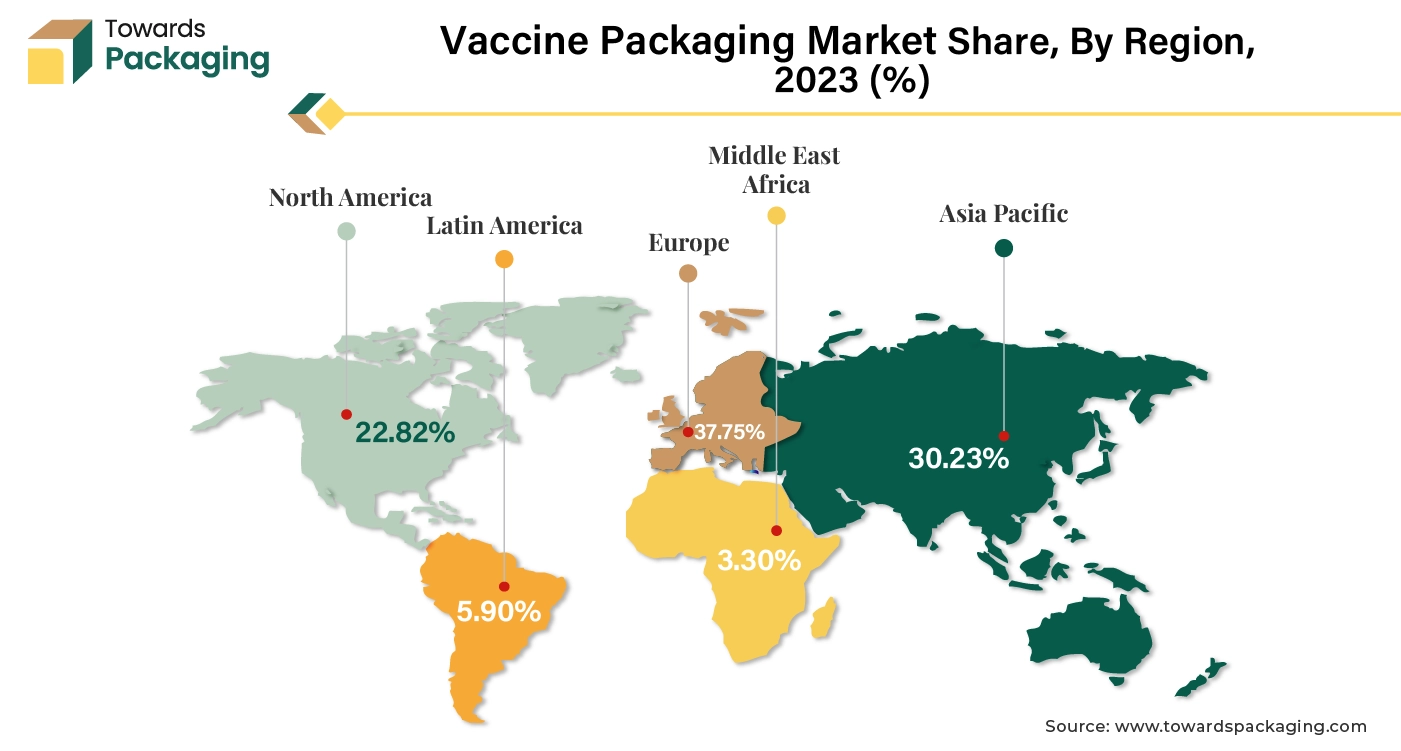

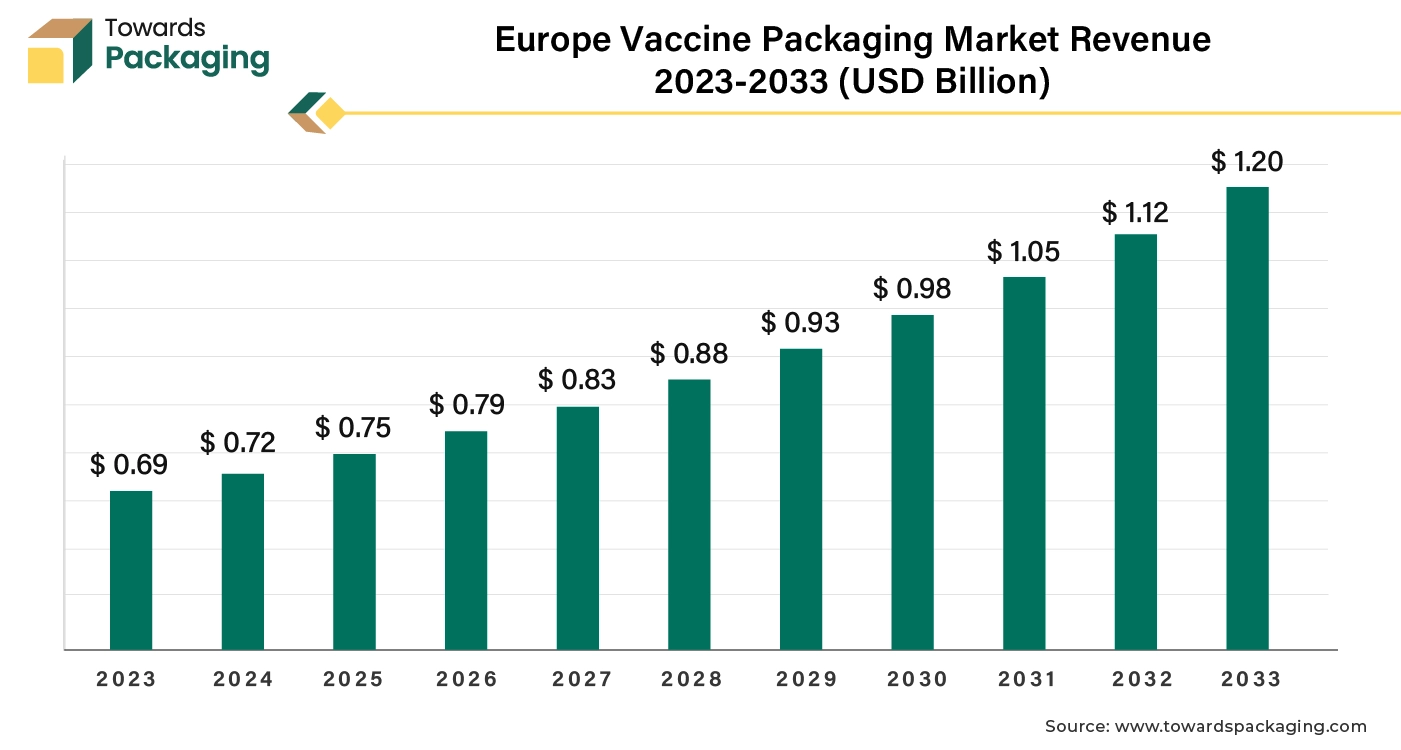

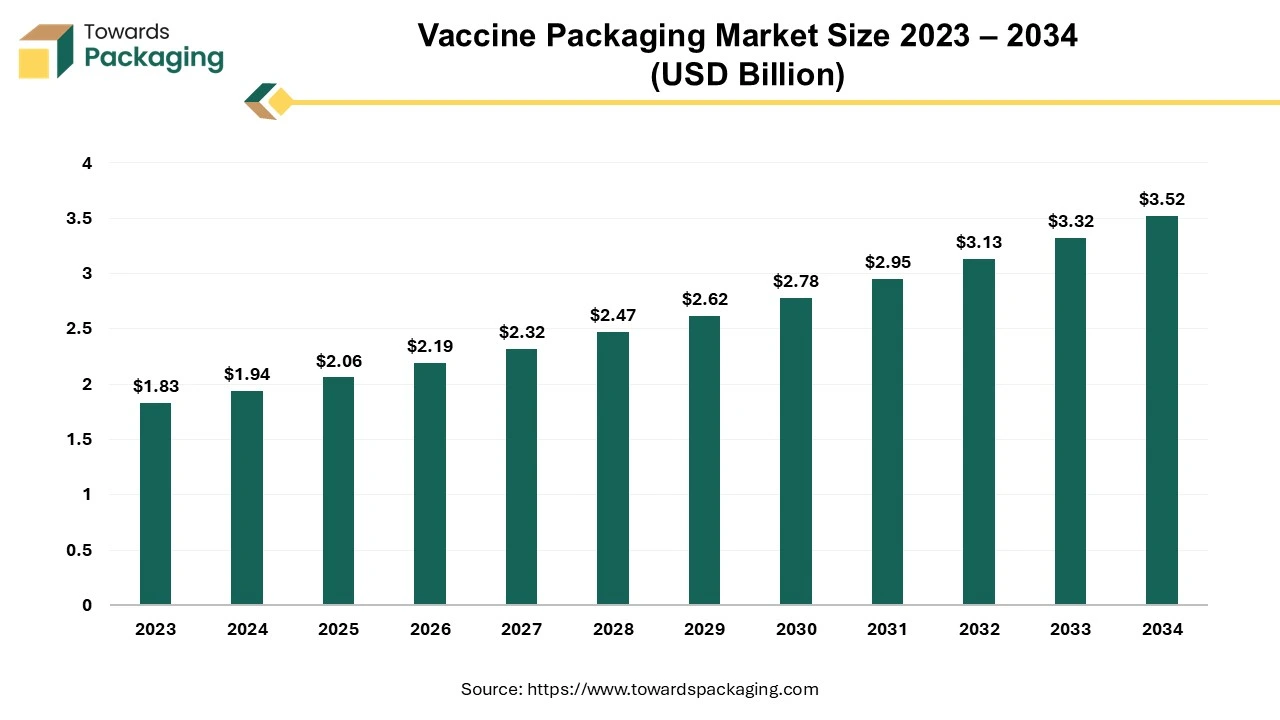

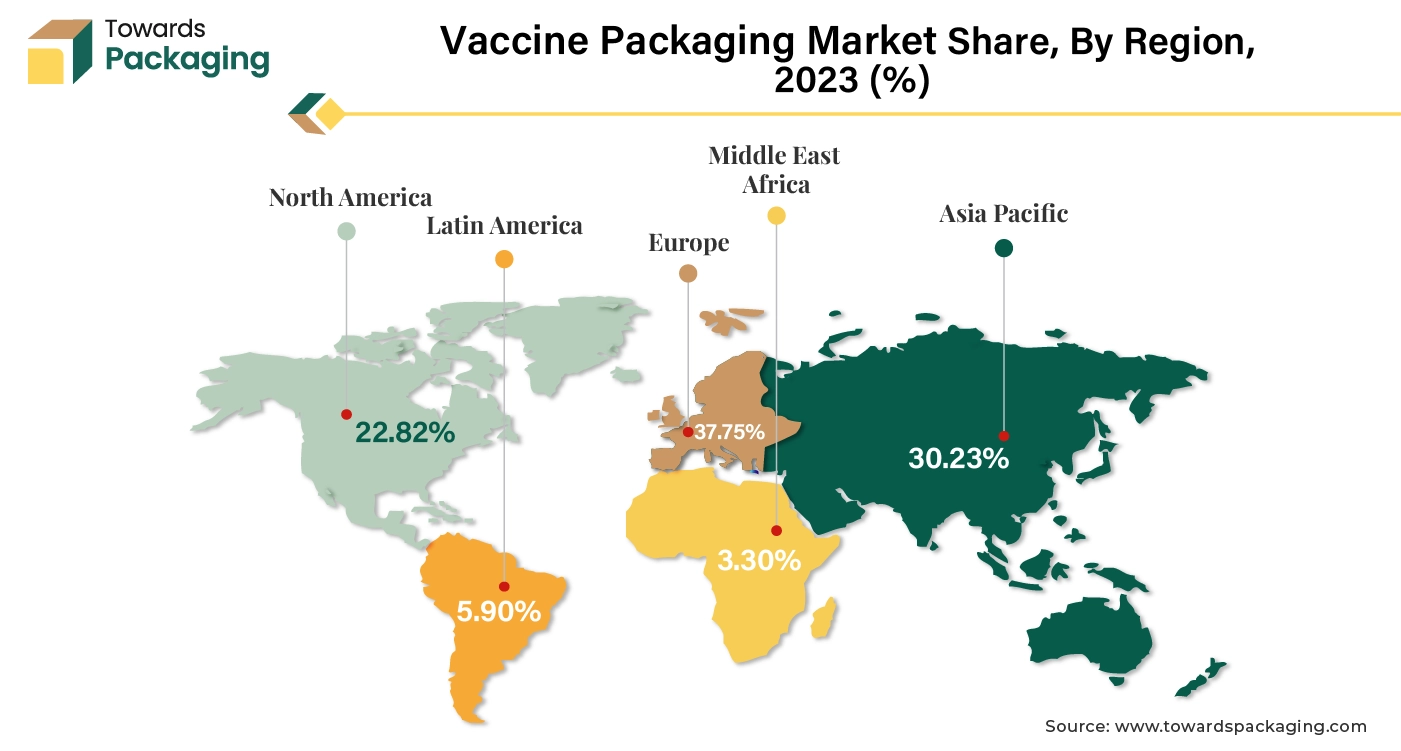

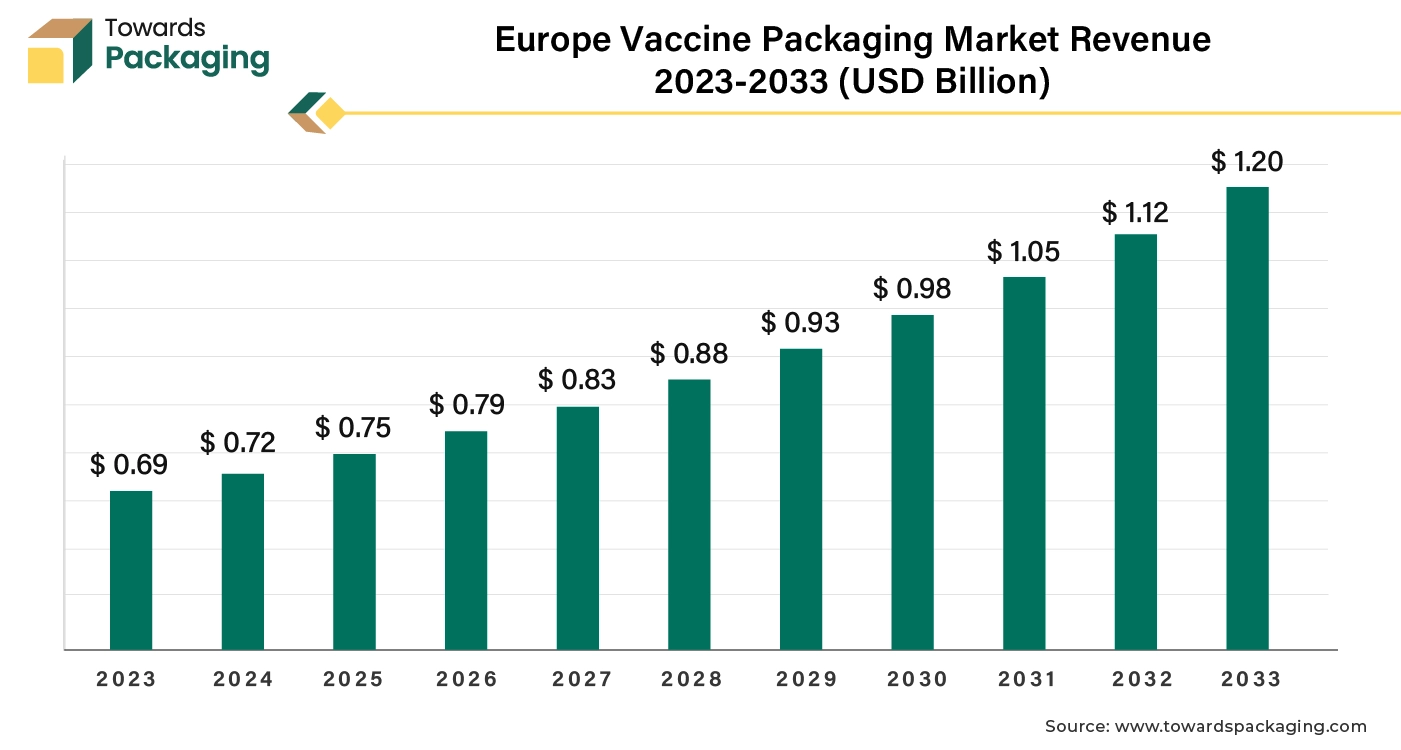

The vaccine packaging market is forecasted to expand from USD 2.19 billion in 2026 to USD 3.74 billion by 2035, growing at a CAGR of 6.14% from 2026 to 2035. This report presents detailed segments by material, type and end‑use; regional data covering North America, Europe (which held ~37.75% share in 2024), Asia Pacific (expected fastest CAGR ~8.29%), Latin America and MEA; profiles of leading companies (such as Schott AG, Gerresheimer AG, Stevanato Group, SGD Pharma); a full competitive analysis; value‑chain mapping from raw‐materials to finished packaging; trade data on import/export flows; and detailed manufacturer & supplier insights.

The vaccine packaging market is set to expand substantially over the forecast timeline. Innovations in vaccine packaging may have an effect on user acceptance and adoption as well as the supply chain. The benefits of these innovative package designs for public health are evident in their simplicity in use, increased safety, and improved logistics of supply and uptake that creates new chances for vaccination. Furthermore, there appears to be strong user acceptance at the national level. Stakeholders worldwide are interested in two packaging innovations currently that are the dual-chamber delivery devices and the compact pre-filled auto-disable devices (CPADs).

The rising incidence of infectious diseases, such as influenza, measles and COVID-19 along with the growing global immunization programs is expected to augment the growth of the vaccine packaging market during the forecast period. Furthermore, the advancements in biotechnology as well as the expansion of the cold chain logistics sector driven by the need to transport temperature-sensitive vaccines safely are also anticipated to augment the growth of the market.

Additionally, the rising investments in healthcare infrastructure and the shift toward single-dose vaccines is increasing the demand for unit-dose packaging formats is also projected to contribute to the growth of the market in the years to come.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 2.06 Billion |

| Projected Market Size in 2035 |

USD 3.74 Billion |

| CAGR (2026 - 2035) |

6.14% |

| Leading Region |

Europe |

| Market Segmentation |

By Material, By Type, By End-Use and By Region |

| Top Key Players |

Schott AG, Gerresheimer AG, Stevanato Group, SGD Pharma |

Key Trends and Findings

- Single-dose vaccines are becoming increasingly popular due to their convenience and lower risk of contamination. This has resulted in a surge in demand for unit-dose packaging formats such as vials and ampoules, which improve vaccination delivery efficiency and safety.

- With the growth of mRNA vaccines, particularly for COVID-19, ultra-cold chain packaging has become an important trend. When compared to conventional vaccination methods, which require large amounts of viruses to be cultured and may require between five and ten years to develop, vaccines based on mRNA can be created quickly. These vaccines must be stored at extremely low temperatures, requiring the development of packaging options capable of maintaining these temperatures during transport and storage.

- Several pharmaceutical corporations are already using traceability and authentication systems. For instance, Johnson & Johnson utilizes vials with traceability features and security seals on vaccination packaging. Glass manufacturer Corning is preventing counterfeiting by adding black-light verification to vials. In addition to these authentication methods, a vaccine vial monitor (VVM) is now commonly affixed to vaccination vials.

- Most of the companies are currently focusing on creating packaging that is suitable for various vaccinations.

- For instance, West Pharmaceutical Services continues to be working collaboratively with their partners in the vaccine production industry to rethink packaging and create vials that are multi-vaccine compatible.

- Asia-Pacific is expected to grow at a fastest CAGR of 8.29% during the forecast period owing to the increasing government investments in healthcare, expanding vaccine production capacities and a rising focus on immunization programs.

- Europe held largest market share of 37.75% in 2024. This is due to the presence of stringent regulations and a well-established pharmaceutical industry as well as the strong R&D investments.

Artificial Intelligence (AI) in Vaccine Packaging Industry

Artificial Intelligence (AI) has already integrated itself into the healthcare and pharmaceutical industry in the last few years. It is being widely used in drug development and processing vast amounts of data to help researchers work smarter and faster. The vaccine packaging industry has been slowly finding applications for AI into their infrastructure. AI helps improves overall efficiency of operations, that helps in streamlining production processes. Consistent quality and anomaly detection can be accomplished by utilizing AI-based technologies.

With any health-related packaging, regulation compliance plays an important part. AI can ensure that all compliances are being met during the production with quality control. Supply chain optimization is crucial to conduct proper logistics as these are essential goods. AI combined with Internet of Things (IoT), can help track and optimize routes for delivery ensuring the process runs smoothly. Artificial Intelligence’s full potential is yet to be explored in the vaccine packaging industry and is anticipated to help this market’s growth during the forecast period.

Market Drivers

Expanding Vaccine Production Capacities

The expansion of vaccine production capacities is expected to fuel the growth of the vaccine packaging market within the estimated timeframe. This is owing to the rise of infectious diseases, pandemics like COVID-19 and the need for routine immunization programs. Thus, pharmaceutical companies and governments are rapidly increasing their vaccine production capacity.

For instance,

- In April 2024, In accordance with the recent mpox outbreak in Africa and the possibility of it spreading across other economies, Bavarian Nordic revealed strategies to improve the manufacturing of its vaccine, Jynneos. As per the company, it has the potential to manufacture up to ten million doses before the end of 2025 and can already supply up to two million extra vaccine doses before the end of 2024. To guarantee the "constant equitable access" to Jynneos, Bavarian Nordic is collaborating with the Africa Centers for Disease Control and Prevention (CDC).

- In January 2024, to promote quicker, flexible as well as more equitable reactions to the upcoming epidemics of the public health diseases, the Serum Institute of India Pvt. Ltd. (SII) is joining the rapidly growing CEPI network of vaccine makers in the Global South. SII's addition to the CEPI production network will have a major impact on vaccine manufacturing initiatives in Global South regions, bringing the world in a better position to meet the 100 Days Mission, which requires developing innovative vaccines against identified or unknown infectious diseases in three months of a global epidemic threat being identified. With an investment of up to $30 million, CEPI plans to strengthen SII's capacity to quickly supply experimental vaccines in the event of an epidemic or pandemic, building on the company's demonstrated history of fast responding to infectious disease outbreaks.

These expansions are not just aimed to fulfill urgent demands, but also to prepare for possible future pandemics and epidemics. As manufacturing capacity increases, so does the demand for efficient, dependable and scalable packaging. The increase in production, particularly in developing countries, is likely to drive the demand for high-volume packaging materials such as vials, prefilled syringes and ampoules.

Market Restraints

Supply Chain Instabilities

The disruptions in the global supply chain for raw materials like glass, plastics and polymers is expected to limit the growth of the market during the forecast period. Geopolitical issues such as the war in Israel, the US-China rivalry, the Russian invasion of Ukraine and elections, had a substantial impact on the global supply chain, particularly on the essential raw materials used by numerous industry verticals. Sharp price increase and the production delays across industries are being caused by constraints on the supplies of certain raw materials, mainly polypropylene (PP), polyethylene (PE) and monoethylene (MEG). These chemicals are utilized to make plastics that are found in almost every type of the product such as equipment and packaging.

Moreover, global epidemics and the possibility of new variations increasing could result in labor shortages and border closures that worsen interruptions to the packaging material supply chain. All of these factors focus on the complicated connection that exists among geopolitical stability and the seamless functioning of international supply networks in the packaging industry.

Furthermore, the daily operations of plastics manufacturing firms as well as other organizations outside the sector have been directly impacted by these issues with the raw material supply chain. This material is utilized for manufacturing a multitude of products considered essential for health and wellbeing such as gloves, syringes and medical equipment. This industry is directly and severely impacted by the disruption in the supply chain today. Additionally, the lack of resin has led to an increase in the resin costs globally. Pharmaceutical companies sometimes bear the burden of these higher costs, which may restrict their capacity to mass-produce packaging for vaccines. Consequently, the market's capacity to grow is limited by the general instability of the supply chain, especially in regions with inadequate infrastructure.

Market Opportunities

Advancements in Vaccine Technologies

The developments and advancements in the vaccine technologies are anticipated to augment the growth of the vaccine packaging market in the near future. The landscape of vaccine production has changed due to the emergence of novel immunization techniques as viral vector and mRNA vaccines. A recent advancement incorporates the successful application of mRNA as a protective vaccination. The addition of 5' Kozak and cap sequences, 3' poly-A sequences, codon optimization, altered nucleosides to increase mRNA stability and reduce detection by innate immune cell receptors, intradermal injection to minimize the RNA degradation and the production of thermostable mRNA are some of the methods that can increase the effectiveness of mRNA vaccines.

Some of the recent developments in the new vaccines include

- In July 2024, a new initiative was launched with the goal of accelerating research and development and making human avian influenza (H5N1) messenger RNA (mRNA) vaccine candidates more accessible to manufacturers in low- and middle-income nations. This initiative will be led by the Argentine producer Sinergium Biotech, which will make use of the Medicines Patent Pool (MPP) mRNA Technology Transfer Programme and the World Health Organization (WHO).

- In June 2024, The U.S. Food and Drug Administration (FDA) received an amended Emergency Use Authorization for Novavax, Inc.'s revised JN.1 COVID-19 vaccine (NVX-CoV2705) for use in people 12 years of age and older. The proposal complies with the World Health Organization's (WHO), European Medicines Agency's (EMA), and U.S. FDA's guidelines to focus on the JN.1 lineage. The JN.1 vaccine from Novavax has shown broad cross-neutralizing antibodies against a variety of variant strains, such as KP.2 and KP.3, suggesting that it may be able to defend against forward drift variations.

- In May 2024, Moderna, Inc. declared that mRESVIA (mRNA-1345), an mRNA respiratory syncytial virus (RSV) vaccine was authorized by the U.S. Food and Drug Administration (FDA) to defend against lower respiratory tract sickness in the adults sixty years of age and above that is brought on by RSV infection. The approval, which becomes Moderna's second approved mRNA product, was given under the category of breakthrough therapy. The RSV vaccine that comes in a pre-filled syringe which is intended to be as simple to use as possible, saving vaccinators time and lowering the possibility of administrative errors is mRESVIA.

The packaging sector is likely to gain from the growing complexity of vaccines as they continue to develop, creating a higher need for specialized, cutting-edge, and dependable packaging options. This trend presents substantial opportunities for packaging companies to innovate and provide value-added solutions for the next generation of vaccines.

Key Segment Analysis

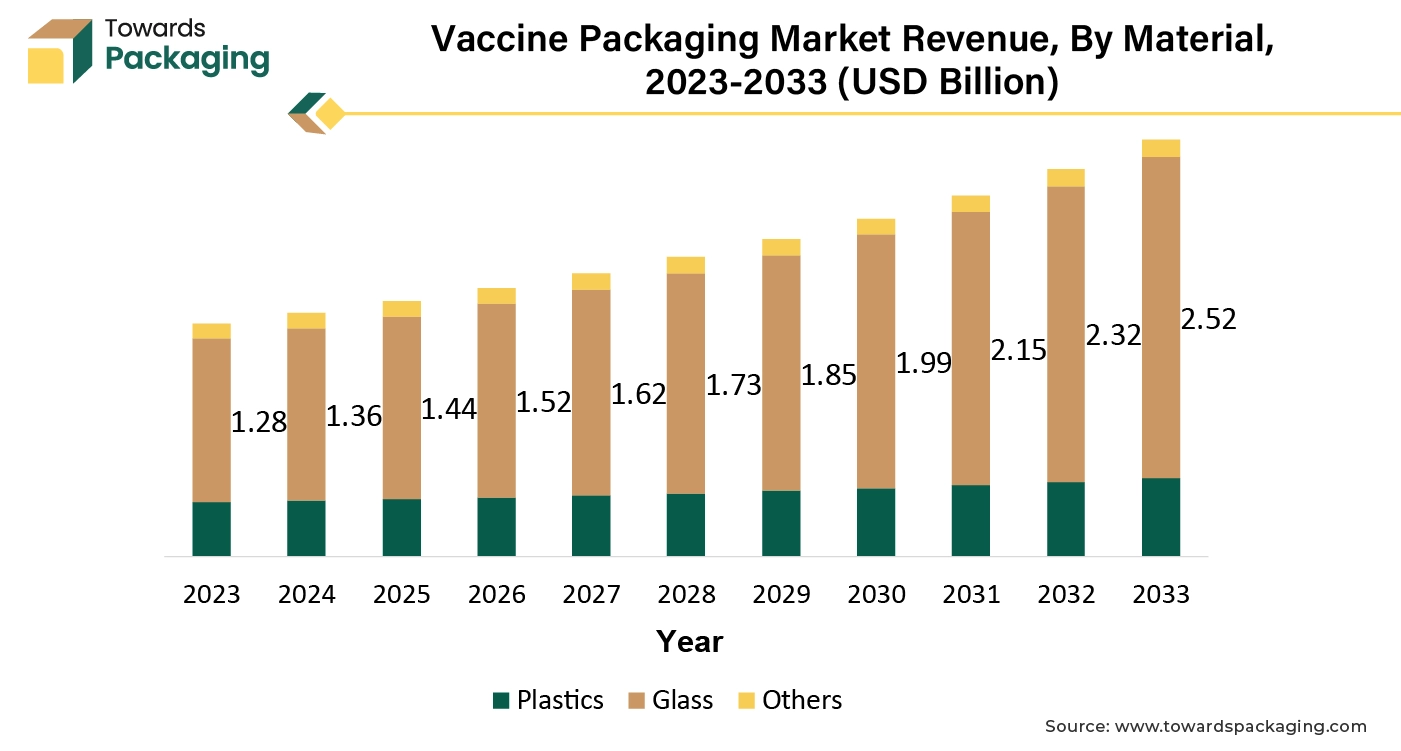

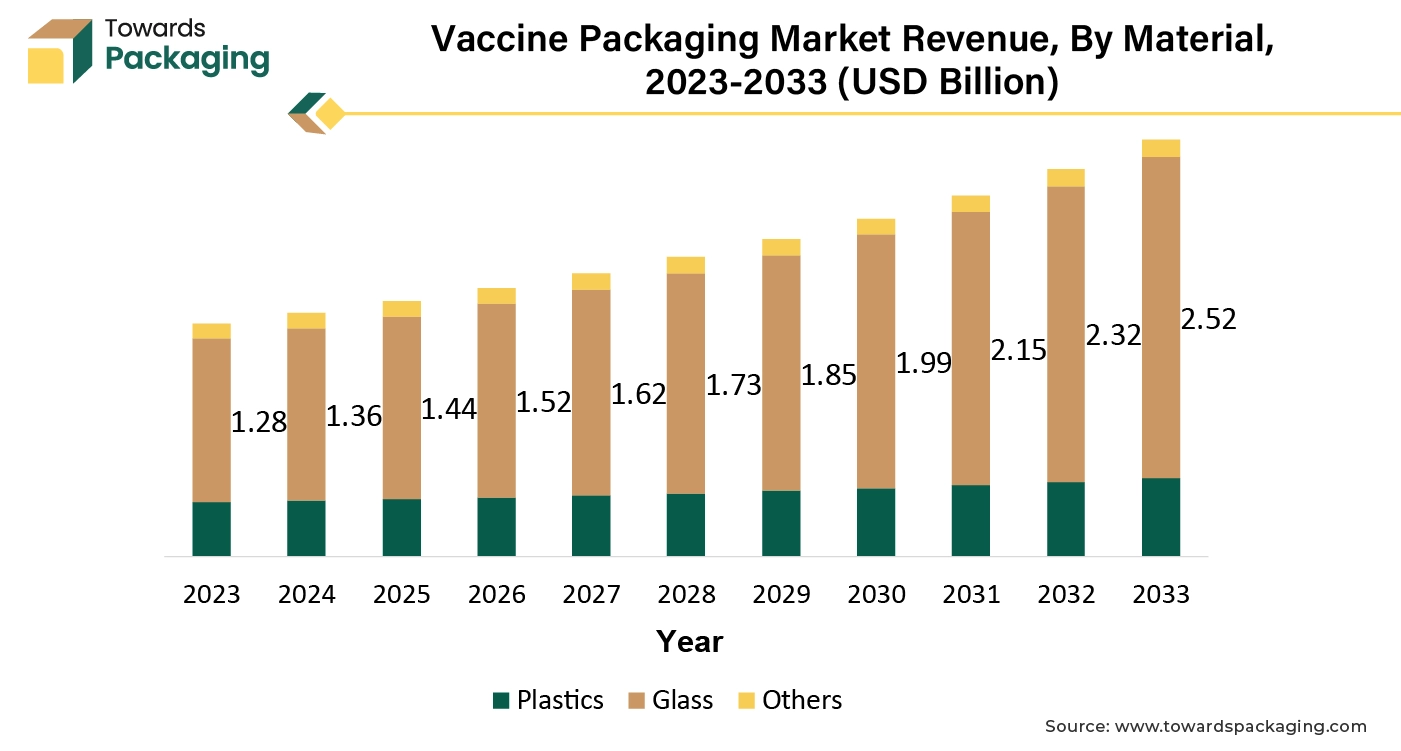

Material Segment Analysis Preview

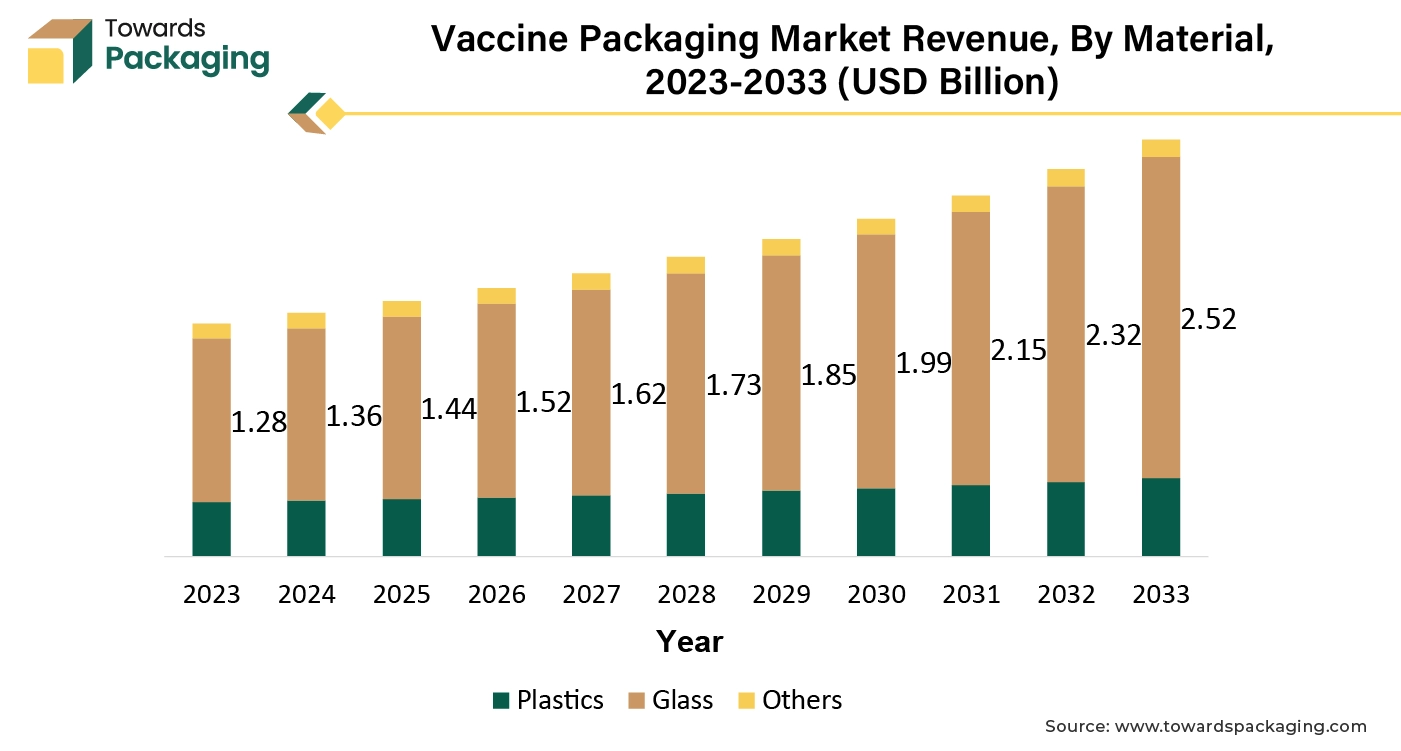

The glass segment captured largest market share in 2024. This is due to its unmatched properties that make it the preferred material for vaccine packaging. As it is inert, borosilicate glass is the most common material utilized for packaging vaccines. The ability of this unique glass to withstand chemicals as well as, in particular, heat from the outside is essential for preserving the vaccine. The vaccination within the glass bottles is therefore kept as durable and optimally protected as possible due to the glass only minimally expands in response to variations in the outside temperature.

Further, the packaging used for vaccines needs to be resilient to both the risks associated with international shipping and extremely high temperatures. As a result, glass is the material most frequently used to make vaccine vials since it is strong and can withstand high temperatures. Certain vaccine makers are likely to stick with the current packaging type, even though better packaging is still needed as COVID-19 vaccines require different storage conditions than regular glass vials.

Type Segment Analysis Preview

The vials segment held the largest market share in 2024. Glass vials are preferred for their ability to preserve the stability as well as effectiveness of the vaccines over long periods. Globally, over fifty billion glass vials are made and sold for a variety of uses. SCHOTT, having 20 authorized glasses and factories worldwide, is one of the biggest producers of pharmaceutical packaging units. SCHOTT vials were utilized by three of the four vaccine studies that are undergoing the clinical testing for their vaccination campaigns. It generates approximately eleven billion glass vials annually in total.

Major participants in the pharmaceutical glass vial industry such as SCHOTT, Gerresheimer, Stevanto group, Corning and DWK Life Sciences have expanded their production capacity and quality in response to the continuous demand. Furthermore, vials also comply with the strict regulatory requirements for pharmaceutical packaging, providing the safety required for large-scale vaccination campaigns.

Regional Insights

Europe held the largest market share of 37.75% in the world in 2024. This is due to the well-established and highly advanced healthcare system that supports large-scale vaccine production and distribution across the region. Furthermore, the presence of the most stringent regulatory requirements for vaccine packaging, governed by agencies like the European Medicines Agency (EMA) as well as the expansion of vaccine production capacities is also expected to contribute to the regional growth of the market.

Germany Vaccine Packaging Market Trends:

Germany is experiencing robust growth, and the growth is driven by the advancement in vaccine development, like single-dose vials and prefilled syringes reduce vaccine wastage and enhance safety, so there is a shift towards single-dose packaging. The expansion of cold chain facilities, particularly in the developing nations, is crucial for maintaining the efficacy of temperature-sensitive vaccines. These factors drive the growth of the market.

For instance,

- The EU expanded its support for Rwandan vaccine production as the country's first mRNA plant officially opened. As part of the Team Europe Initiative on production and access to vaccines, medications, and health technology in Africa (MAV+), the European Union expanded its Global Gateway investments in the nation. A financial agreement of €40 million was signed by President Paul Kagame and President Ursula von der Leyen of the European Commission, strengthening Rwanda's ecosystem for producing health products and advancing African healthcare from within. Also, the high vaccination rates, supported by strong government-led immunization programs are further expected to support regional growth of the market in the years to come.

Asia Pacific is likely to grow at fastest CAGR of 8.29% during the forecast period. This is owing to the increasing vaccine production in economies like China and India. As per the data by the Invest India, India has emerged as a dominant force in vaccines for diseases such as measles, Bacillus Calmette–Guérin (BCG), and Diphtheria, Tetanus and Pertussis (DPT).

Asia Pacific is poised to be the fastest expanding market for vaccine packaging in the forecast period. In India, for example, the pharmaceutical and healthcare industry expansion is on the rise. The government of India is taking constant efforts and making investments in improving the healthcare and pharmaceutical sector paving the way for new opportunities. The growing population directly increase the need for vaccines. India is leading innovation and development in drugs and medicine at a lower cost for various diseases. The country could become a growth opportunity for the vaccine packaging market in the Asia Pacific region during the forecast period.

India Vaccine Packaging Market Trends

India is seeing robust growth in the packaging market due to its rising vaccine production in the country, expanding immunization programs like the universal immunization programme are increasing vaccine uptakes, which require an increase in the supply of vaccine to different areas, and advancements in packaging technologies like innovation in packaging materials and cold chain logistics enhancing vaccine shelf life and distribution efficiency. These factors help the market to grow.

For instance,

- Almost 90% of the world's market for the measles vaccination comes from India. India now holds a dominant position in the market, providing 65–70% of the vaccines required by the World Health Organization (WHO). Currently, Telangana's life sciences ecosystem provides about 33% of the vaccines supplied in India, which meets about 60% of the world's vaccine demand. Biologicals and formulations (which include vaccines) make for 77.5% of India's exports of medicines. Additionally, the growing healthcare infrastructure is also anticipated to promote the growth of the market in the region in the years to come.

North America is the dominant region in the vaccine packaging marke

Supported by reliable vaccination programs and robust pharmaceutical production capabilities. The region is steadily expanding due to the strong demand for glass vials, prefilled syringes, and packaging options that are compatible with cold chains. Advanced tamper-evident and traceable packaging formats are becoming more popular due to strict regulatory standards and quality requirements. Furthermore, ongoing investments in smart packaging, technological, and cold chain logistics are bolstering the region's market dominance.

The U.S. plays a critical role within the North American vaccine packaging market because of its extensive vaccine production, sophisticated healthcare systems, and robust regulatory oversight. High-quality primary and secondary packaging solutions are becoming more and more necessary as the demand for temperature-sensitive vaccines and booster programs rises. Manufacturers are being compelled by FDA regulations to improve safety, sterility, and compliance standards.

Latin America is experiencing steady growth in the market

Driven by growing immunization programs and the enhancement of the infrastructure of healthcare. Growing consumer demand for cold chain-compatible packaging, glass vials, and ampoules is fueling market growth. The need for dependable and legal packaging solutions is growing as governments and healthcare institutions throughout the region bolster vaccine distribution networks.

Brazil is a key market for vaccine packaging in Latin America backed by extensive public immunization campaigns and the capacity to produce vaccines domestically. The demand for premium primary packaging like vials and prefilled syringes is rising in the nation's pharmaceutical industry. Tamper-evident and compliance-focused packaging solutions are being driven by ANVISA regulatory oversight. Furthermore, investments in healthcare infrastructure and cold chain logistics are boosting the market for vaccine packaging in Brazil.

Value Chain Analysis

Raw Materials Sourcing

Vaccine packaging relies on medical-grade glass, plastics, rubber stoppers, and aluminum seals to ensure sterility and product integrity. Growing vaccine production is increasing demand for high-quality, temperature-resistant, and contamination-free materials.

Key Players: Schott, Corning, Gerresheimer, West Pharmaceutical Services, AptarGroup

Logistics and Distribution

Cold-chain logistics are critical for vaccine packaging to maintain efficacy during storage and transport. Rising global immunization programs and temperature-sensitive vaccines are driving demand for insulated and traceable packaging solutions.

Key Players: DHL, UPS Healthcare, FedEx, Kuehne + Nagel, DB Schenker

Recycling and Waste Management

Sustainable vaccine packaging is gaining focus to reduce medical waste and environmental impact. Manufacturers are adopting recyclable materials and safe disposal solutions for used vials and syringes.

Key Players: Veolia, Stericycle, Clean Harbors, Sharps Compliance, Daniels Health

Recent Developments by Market Companies

- On April 18, 2025, LakeShore Biopharma Co., Ltd. successfully hosted its 2025 CSO (Contract Sales Organization) Annual Meeting alongside the official launch of its YSJA rabies vaccine (Vero cell), featuring a novel packaging solution with a liquid drug transfer device. The event took place in Changsha, Hunan Province. Following regulatory approval for lot release on April 15, the company is set to begin nationwide distribution of the new formulation across China. The innovative packaging aims to address significant safety concerns in the administration of vaccines.

- In February 2024, Medidata, a Dassault Systèmes company known for its clinical trial solutions, announced a new collaboration with Sanofi Vaccines. The partnership aims to leverage Medidata’s electronic Clinical Outcome Assessment (eCOA) platform for use in vaccine studies. This initiative builds on the companies’ established relationship and successful use of Medidata’s Rave EDC (Electronic Data Capture) system, enhancing data collection and trial efficiency in the life sciences sector.

- January, 2024: SCHOTT Pharma announced the launch of new glass vials intended for deep-cold medicine storage. EVERIC® freeze vials can tolerate the -80°C storage temperatures required for vaccinations, gene therapy, and mRNA medications. New vials with strength-optimized design lowers breaking risk avoid losing life-saving drugs and expensive downtime.

- In August 2024, several pharmaceutical companies, including Unilever, Abbott, and Merck, announced significant investments in the Mexican market. These developments are expected to drive a surge in demand for packaging machinery in the region, as companies ramp up production and require advanced packaging solutions to meet growing market needs.

- February, 2023: West Pharmaceutical Services, Inc. expanded its partnership with Corning Incorporated to include exclusive distribution rights for Corning Valor® Glass vials. The company additionally unveiled its initial offering, West Ready Pack™ with Corning Valor® RTU Vials making use of SG EZ-fill® technology.

Vaccine Packaging Market Companies

Some of the key players in vaccine packaging market Schott AG, Gerresheimer AG, Stevanato Group, SGD Pharma, Nipro Corporation, Corning Incorporated, West Pharmaceutical Services, Inc., AptarGroup, Inc., Becton, Dickinson and Company (BD), and Catalent, Inc., among others.

Vaccine Packaging Market Segments

By Material

- Plastics

- Polypropylene (PP)

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Cyclic Olefin Polymer/Copolymer (COP/COC)

- Glass

- Type I Borosilicate Glass

- Type II Treated Soda Lime Glass

- Type III Soda Lime Glass

- Others

- Elastomers

- Aluminum

- Paper & Paperboard

By Type

- Glass Vials

- Single-dose vials

- Multi-dose vials

- Lyophilized vaccine vials

- Prefillable Syringes

- Glass prefilled syringes

- Plastic prefilled syringes

- Safety syringes

- Vial Closures

- Rubber stoppers

- Aluminum seals / flip-off caps

- Secondary Vaccine Packaging

- Cartons

- Labels

- Trays & blisters

- Cold chain packaging

- Others

- Ampoules

- Dual-chamber packaging

- Smart packaging

By End-Use

- Diagnostic Centers

- Public diagnostic centers

- Private diagnostic centers

- Clinical Research Organizations (CROs)

- Early-stage clinical trials

- Late-stage clinical trials

- Others

- Hospitals

- Pharmaceutical & biopharmaceutical companies

- Government & public health agencies

By Region

- North America

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa