Aluminum Oxide Coated Film Market Size, Share, Trends and Forecast Analysis

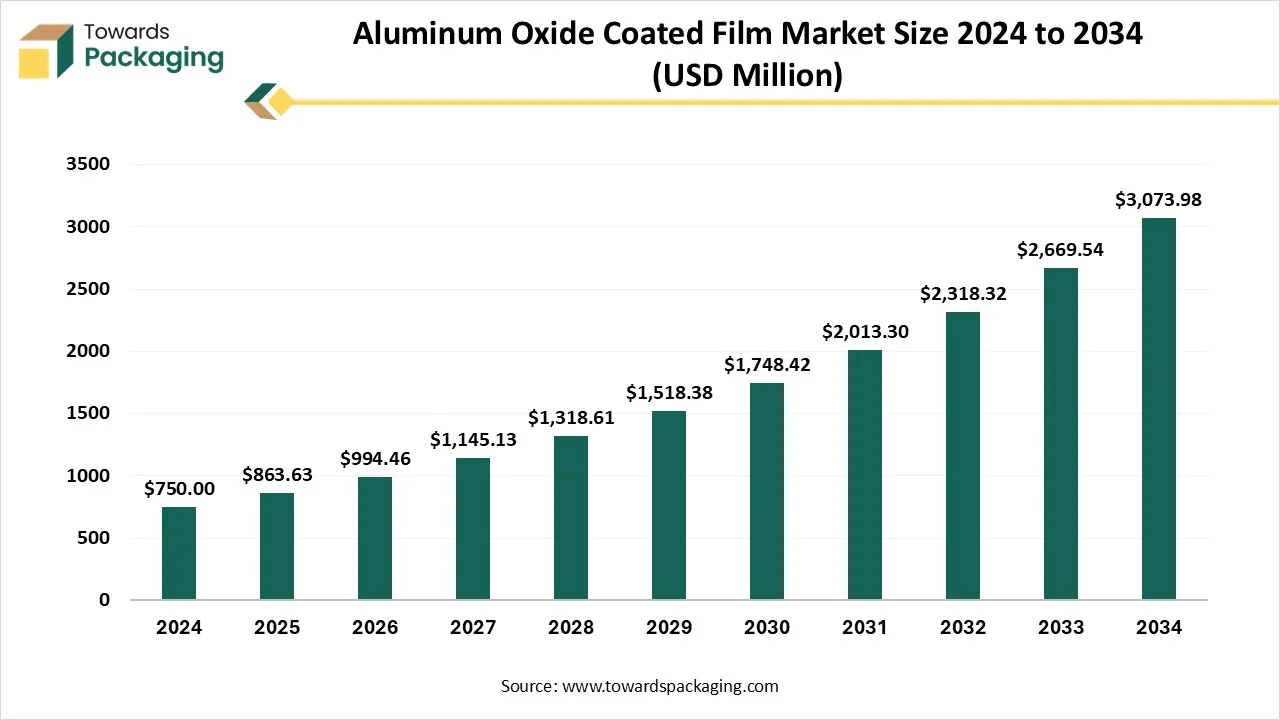

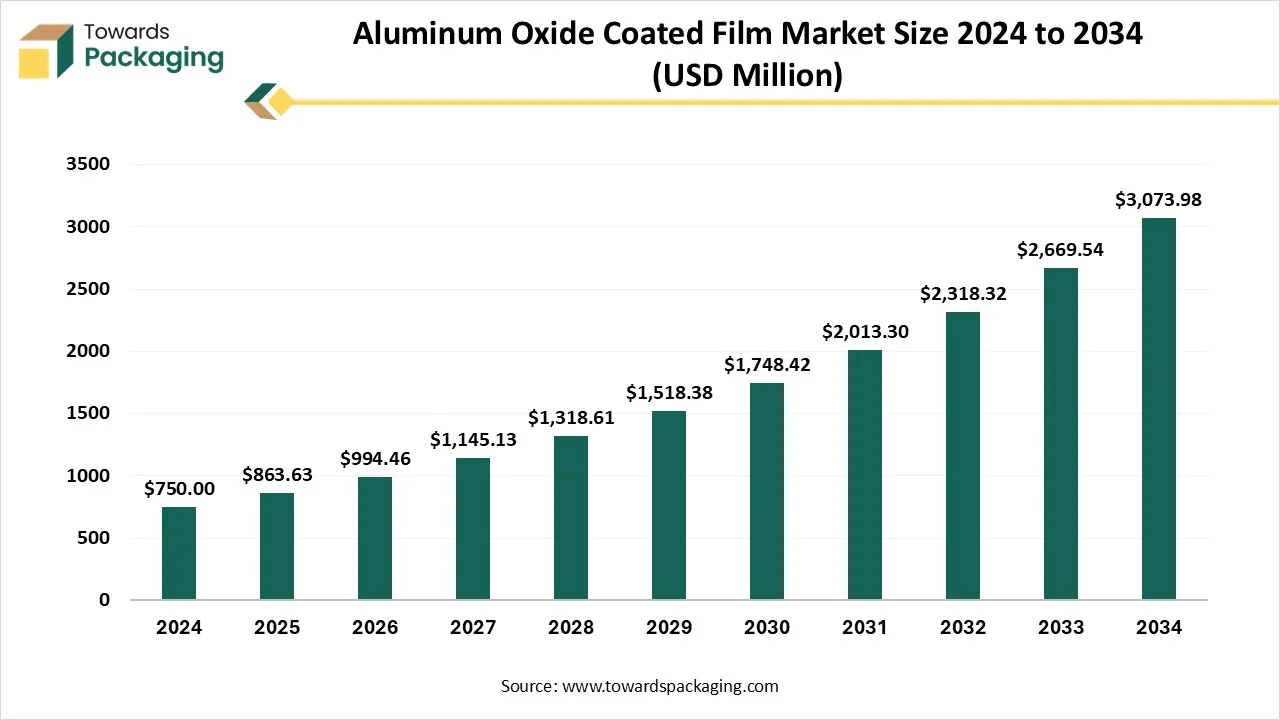

The aluminum oxide coated film market is projected to reach USD 3,539.69 million by 2035, growing from USD 863.63 million in 2025, at a CAGR of 15.15%. The market is segmented by substrate film (BOPET, BOPP, BOPA), coating technology (Vacuum PVD, Roll-to-Roll ALD), application (Food & Beverage, Electronics, Pharmaceuticals), and structure (PET-based laminates, Mono-PP laminates). The Asia Pacific region held the largest market share of 46% in 2024 and is expected to continue dominating, while Europe is set to experience significant growth due to stricter packaging regulations. Key players include Amcor, Mondi, Dupont Teijin Films, and 3M.

Major Key Insights of the Aluminum Oxide Coated Film Market

- In terms of revenue, the market is valued at USD 863.63 million in 2025.

- The market is projected to reach USD 3,539.69 million by 2035.

- Rapid growth at a CAGR of 15.15% will be observed in the period between 2025 and 2034.

- By region, Asia Pacific dominated the global market by holding highest market share of 46% in 2024.

- By region, Europe are expected to grow at a notable CAGR from 2025 to 2034.

- By substrate film, the BOPET (PET) segment contributed the biggest market share of 58% in 2024.

- By substrate film, the BOPP (PP) segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By coating technology, the vacuum PVD segment contributed the biggest market share of 82% in 2024.

- By coating technology, the Roll-to-Roll ALD / PE-ALD segment is expected to expand at a significant CAGR between 2025 and 2034.

- By application, the food & beverage flexible packaging segment contributed the biggest market share of 54% in 2024.

- By application, the electronics & energy segment is expanding at a significant CAGR between 2025 and 2034.

- By structure / recyclability pathway, the PET-based laminates segment contributed the biggest market share of 62% in 2024.

- By structure / recyclability pathway, the Mono-PP laminates segment is expanding at a significant CAGR in between 2025 and 2034.

- By end-use format, the pouches & sachets segment contributed the biggest market share of 48% in 2024.

- By end-use format, the lidding & flow wrap segment is expanding at a significant CAGR between 2025 and 2034.

What is Aluminum Oxide Coated Film Market?

Aluminum oxide (AlOx) coated films are transparent, high-barrier polymer webs created by depositing nanometric Al₂O₃ onto substrates to dramatically reduce oxygen and moisture ingress while preserving optical clarity and printability. Using vacuum PVD (reactive evaporation/sputtering) or roll-to-roll ALD, a dense inorganic layer achieves low WVTR and OTR without the opacity of metallized films, enabling see-through packaging, metal-detector compatibility, and microwaveability. Core substrates include BOPET, BOPP, and BOPA; protective topcoats and optimized primers help retain barrier through lamination, pouch forming, and thermal processes (including selected retort conditions).

AlOx supports mono-material redesigns (mono-PP/mono-PE) and PCR/bio-based content, aligning with recyclability goals and EPR policies. Primary applications span snacks and coffee, retortables, pharma lidding and diagnostics, personal care, and fast-growing electronics/energy uses like OLED encapsulation and battery protection. Value is realized across a supply chain of substrate producers, vacuum coaters, adhesive/ink suppliers, and converters, validated by barrier, haze, adhesion, flex-crack, and sterilization performance metrics.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 863.63 Million |

| Projected Market Size in 2035 |

USD 3,539.69 Million |

| CAGR (2026 - 2035) |

15.15% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Substrate Film, By Coating Technology, By Application, By Structure / Recyclability Pathway, By End-Use Format and By Region |

| Top Key Players |

Amcor, Mondi, Dupont Teijin Films, 3M, Berry Global, Reynolds Group, Sealed Air Corporation, UFlex (Flex Films), Polyplex Corporation, SKC, Toray Industries, Jindal Poly Films, Taghleef Industries, Cosmo First, SRF, Vacmet India, Kolon Industries, Tera Barrier Films, Klöckner Pentaplast |

Aluminum Oxide Coated Film Market Outlook

- Rising Technologies: The continuous research and development in the film quality to enhance the barrier potential has increased the demand for these coatings.

- Sustainability Focus: Development of sustainable packaging goal among major market players has enhanced the innovation in this market to meet the demand of the consumers.

- Digitalization: The incorporation of advanced supply chain technology is enhancing traceability and encourage the demand for optimization of the entire market operation.

- Startup Ecosystem: The major focus is to develop superior transparent barrier against moisture and oxygen which enhance the shelf life of the pharmaceuticals and foods.

Key Technological Shifts in Aluminum Oxide Coated Film Market

The aluminum oxide coated film market is undergoing key technological shifts influenced by the advanced technologies that help to produce ultra-thin aluminum oxide layers that enhance the flexibility of the film with improving the barrier characteristics. The increasing shift towards mono-materials based packaging to enhance the recycling process of the packages. Majority of start up companies are focusing towards developing substitutes of several coatings to improve the recyclability process. Advanced nanotechnology helps in generating ultra-high barrier properties to enhance flexibility.

Trade Analysis of Aluminum Oxide Coated Film Market: Import & Export Statistics

- India has huge import and export value of the coated film its 12 months record is import of 2,800 shipments of aluminum oxide.

- Germany has reported huge import and export of aluminum oxide coated film, the imported value is around $518 million and exported value is $821 million in 2023.

Aluminum Oxide Coated Film Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are polyethylene (PE), polyester (PET), and polypropylene (PP).

- Key Players: Rio Tinto, RUSAL

Component Manufacturing

The major components used in this market are base film, pre-coating surface preparation, post-coating treatment, and precursors.

- Key Players: Cosmo Films, Uflex Ltd

Logistics and Distribution

This segment is highly focused towards handling and delivering high-barrier materials.

- Key Players: DUNMORE Corporation, Cosmo Film Ltd.

Provisional Production (in Tonne) of Aluminium During 2022-23 and 2023-24

| Name of the Company |

2022-23 |

2023-24 |

| Bharat Aluminium Co. Ltd. |

568549 |

582987 |

| Hindalco Industries Ltd. |

1321579 |

1331427 |

| National Aluminium Co. Ltd. |

459564 |

463427 |

| Vedanta Ltd. |

1716767 |

1781003 |

Market Opportunity

Advancement in Coating Technology

Advancement in the manufacturing technology has raised several opportunities for development of the market. The Aluminum oxide coated film sector is advancing from incessant progressions in technologies of coating, which improve the performance and durability of the films. Inventions in the engineering procedures permit for the growth of the coatings that provide excellent resistance to UV light, moisture, and oxygen, meaningfully refining product conservation. New techniques allow the manufacturing of ultra-thin films that decrease material charges while enhancing performance. Furthermore, progressions have resulted in the formation of more adaptable films that can provide to varied application requirements, improving their versatility in several market segments, therefore enhancing market demand more.

Market Challenges and Restraints

Limited Awareness and Adoption

Limited awareness and adoption of such film have hindered the development of the market. Several businesses may not be completely informed regarding the advantages and usages of Alox Coated Films, ensuing in slower market diffusion. Educational exertions and marketing policies must be strengthened to highpoint the benefits of these goods, like improved durability, presentation, and flexibility.

Substrate Film Type Insights

Why BOPET (PET) Segment Dominated the Aluminum Oxide Coated Film Market In 2024?

The BOPET (PET) segment dominated the market with 58% share in 2024 due to its durability and clarity. It has enhanced barrier properties against oxygen and moisture. It provides excellent tensile strength and resistance to tears and puncture, contributed towards the strength of the film. It exhibits excellent heat resistance that is important for several manufacturing procedure. Increasing demand for eco-friendly packaging has enhanced the demand for this market.

The BOPP (PP) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its high-performance barrier potential. It offers several benefits at a low charge due to less raw material charges. This material decreases the risk of damage at the time of handling and storing. Enhanced barrier performance and improved surface adhesion has raised the demand for this segment.

Coating Technology Type Insights

Why Vacuum PVD (reactive evaporation / sputtering) Segment Dominated the Aluminum Oxide Coated Film Market In 2024?

The Vacuum PVD (reactive evaporation / sputtering) segment dominated the market with 82% share in 2024 due to advancement in medical device, electronics, and automotive sector. Its versatility and precision which dominates reactive sputtering majorly for high purity usage. This segment is majorly utilized in cutting tools, electronics, optical industry, automotive, aerospace, and medical devices. The huge demand for electronic equipment majorly portable devices is highly utilized this segment. The requirement for improved resources properties like thermal stability, durability, and corrosion resistance.

The Roll-to-Roll ALD / PE-ALD segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to cost-effective deposition high quality films. It has emphasis on enabling the regular cost-effectual deposition of flexible substrate for utilization. The capacity to regularly deposit high-quality films which are flexible resources which has influenced the acceptance of high value special applications.

Application Type Insights

Why Food & Beverage Flexible Packaging Segment Dominated the Aluminum Oxide Coated Film Market In 2024?

The food & beverage flexible packaging segment dominated the market with 54% share in 2024 due to its excellent resistance and high-barrier properties. High transparency and visibility allow optical scanning and metal detecting at the time of packaging procedure. The major benefit is their potential to microwave make this film suitable for packaging of food products. The growing consumption of ready-to-eat food products has influenced the development of this segment.

The electronics & energy segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its heat resistance and corrosion resistance properties. Increasing miniaturization of the electronic devices raise the demand for more protective and insulating films. The rising electronics industry has boosted advancement in this sector for enhanced protection of the equipment.

Structure / Recyclability Pathway Insights

Why PET-based Laminates Segment Dominated the Aluminum Oxide Coated Film Market In 2024?

The PET-based laminates segment dominated the market with 62% share in 2024 due to eco-friendly and transparent packaging demand. These coatings offer high barrier from oxygen and moisture which enhance its demand in various sectors. These are considered as metal detector friendly which enhance the quality of the packaging as well as its adoption by various brands. Major brands are adopting transparent and eco-friendly packaging which raise the demand for this film.

The mono-PP laminates segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its sustainability and durability. The increasing demand for mono-material packaging to improve the recyclability possibility of the packages. The huge demand for microwavable packaging has also boosted the production and innovation in this market. Mono-PP are highly recyclable and cost-efficient packaging solution.

End-Use Type Insights

Why Pouches & Sachets Segment Dominated the Aluminum Oxide Coated Film Market In 2024?

The pouches & sachets segment dominated the market with 48% share in 2024 due to its portability and durability. Transparent packaging allows consumers to observe the quality of snacks, cheese, nuts, and dried fruit. The rising shift towards rigid to flexible packaging due to its lightweight and convenient packaging. These are used in the packaging of food & beverages and pharmaceuticals sector.

The lidding & flow wrap segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its recyclability, high-barrier properties, and transparency. The increasing consumption of ready-to-consumption and frozen food demand has enhanced the production of these coatings. It helps in extending the shelf-life of the food products.

Regional Insights

Rising E-commerce Industry in Asia Pacific Promote Dominance

Asia Pacific held the largest share of the aluminum oxide coated film market in 2024, due to rising e-commerce industry and rapid growth of industrialization. Continuous innovation in designing of products and manufacturing of sustainable packaging has influenced the growth of the market. With the increasing number of working individuals and changing lifestyle has raised the demand of these films in the food industry due to its oxygen and moisture resistance properties. Rising government investment towards this market has raised the demand for innovation in this sector.

Huge Investment in Infrastructure in China Enhance Aluminum Oxide Coated Film Market

There is a huge upsurge in the construction of infrastructure with high investment in China has boosted the market growth. Continuous advancement in the manufacturing technology has also improved the demand for these films. Rising concern towards eco-friendly packaging of the products influence development in the coated film market.

Europe’s Strict Packaging Guidelines Enhance Market Demand

Europe expects significant growth in the market during the forecast period. This market is growing due to the presence of strict packaging guidelines of this region. Such strict guidelines result in the innovation of the eco-friendly and highly recyclable packaging of the products. This coating procedure is progressively used to enhance the durability of the product and resistance to ecological factors such as UV radiation and moisture. The huge demand for these coatings is swiftly growing as industries are working to fulfil both performance ideals and sustainability ambition. With aluminum oxide coated films' excellent properties, producers are trying this technology to decrease waste production, enhanced product durability, and achieve competitive returns in the market.

Technological Advancement in Germany Promote Aluminum Oxide Coated Film Market

Rapid advancement in the manufacturing technology promotes the demand of the market in Germany. Increasing demand for packaging which is sustainable and can be recycled easily influenced the demand for this market. The increasing awareness towards ecological issues has raised the adoption of packaging that can be recycled and biodegradable.

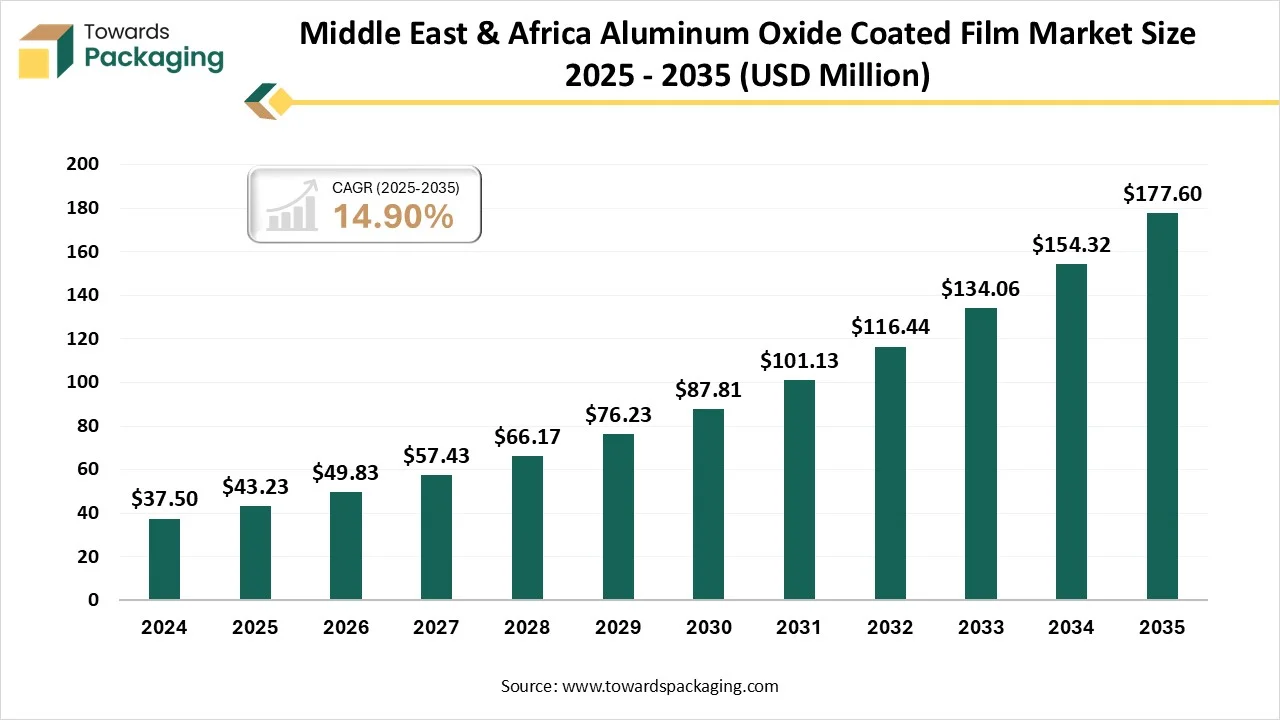

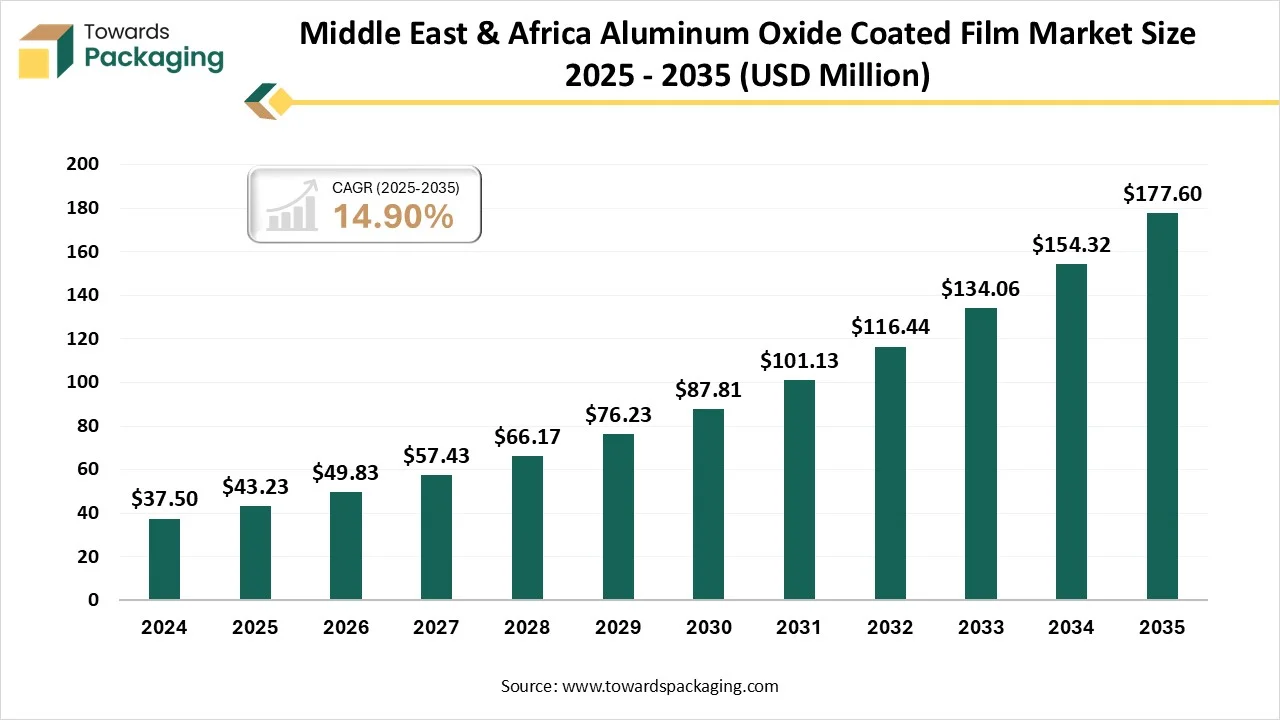

Middle East & Africa Aluminum Oxide Coated Film Market Size 2025 - 2035

Recent Developments

- In December 2024, Ball Corporation collaborated with Dabur India Limited to introduce Real Bites which is a completely recyclable aluminum cans. These packaging offers enhanced experience to the consumers with fruit chunks in it.

- In August 2025, RUSAL which is a largest aluminum producer in the world collaborated with AB InBev Efes to develop sustainable packaging for beverages. It has ultra-low carbon footprints.

Top Companies in the Aluminum Oxide Coated Film Market

- Toppan: It is a global producer of integrated solution in several sectors which comprises packaging. It offers superior barrier as well as transparency.

- Toray Industries: It is a major market for packaging producers and uses advanced technology to generate unique designs.

- Mitsubishi Chemical Group (Mitsubishi Polyester Film): It is one of the major polyester film producers. It produces a wide range of packaging with enhanced facilities.

- Taghleef Industries: The company actively promoting the acceptance of recyclable packaging solutions.

- Jindal Poly Films: It offers a huge variety of high-barrier packaging. The company majorly produce flexible packaging.

Aluminum Oxide Coated Film Market Key Players

Tier 1

- Amcor

- Mondi

- Dupont Teijin Films

- 3M

- Berry Global

- Reynolds Group

- Sealed Air Corporation

Tier 2

Tier 3

- Cosmo First

- SRF

- Vacmet India

- Kolon Industries

- Tera Barrier Films

- Klöckner Pentaplast

- Dupont Teijin Films (depending on specific market focus)

Aluminum Oxide Coated Film Market Segments Covered

By Substrate Film

- BOPET (PET)

- 8–15 μm PET

- Heat-stabilized PET

- BOPP (PP)

- BOPA (Nylon)

- PEN / PI (technical, high temperature)

By Coating Technology

- Vacuum PVD (reactive evaporation / sputtering)

- Roll-to-Roll ALD / PE-ALD

- Hybrid inorganic–organic top-coat systems

By Application

- Food & Beverage Flexible Packaging

- Dry snacks, confectionery, coffee

- Retortables, dehydrated foods

- Pharmaceutical & Medical Packaging

- Personal & Home Care

- Electronics & Energy

- Flexible displays/OLED encapsulation

- Solar backsheets, battery protection layers

- Industrial & Specialty

By Structure / Recyclability Pathway

- PET-based Laminates

- Mono-PP (BOPP-centric) Laminates

- Mono-PE Laminates

- PET/AlOx with Bio-based or PCR Content

By End-Use Format

- Pouches & Sachets

- Lidding & Flow Wrap

- Label & Sleeve Films

- Roll-to-Roll Technical Webs

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait