Can Coatings Market Outlook Scenario Planning & Strategic Insights for 2034

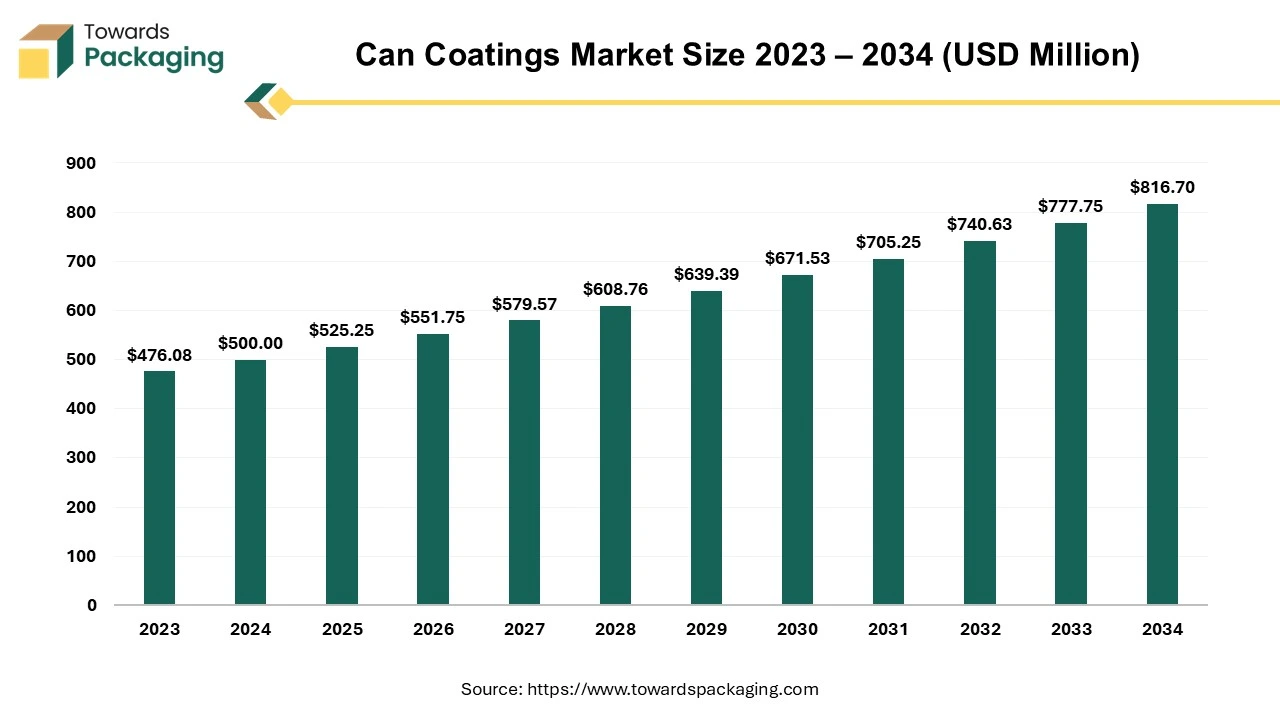

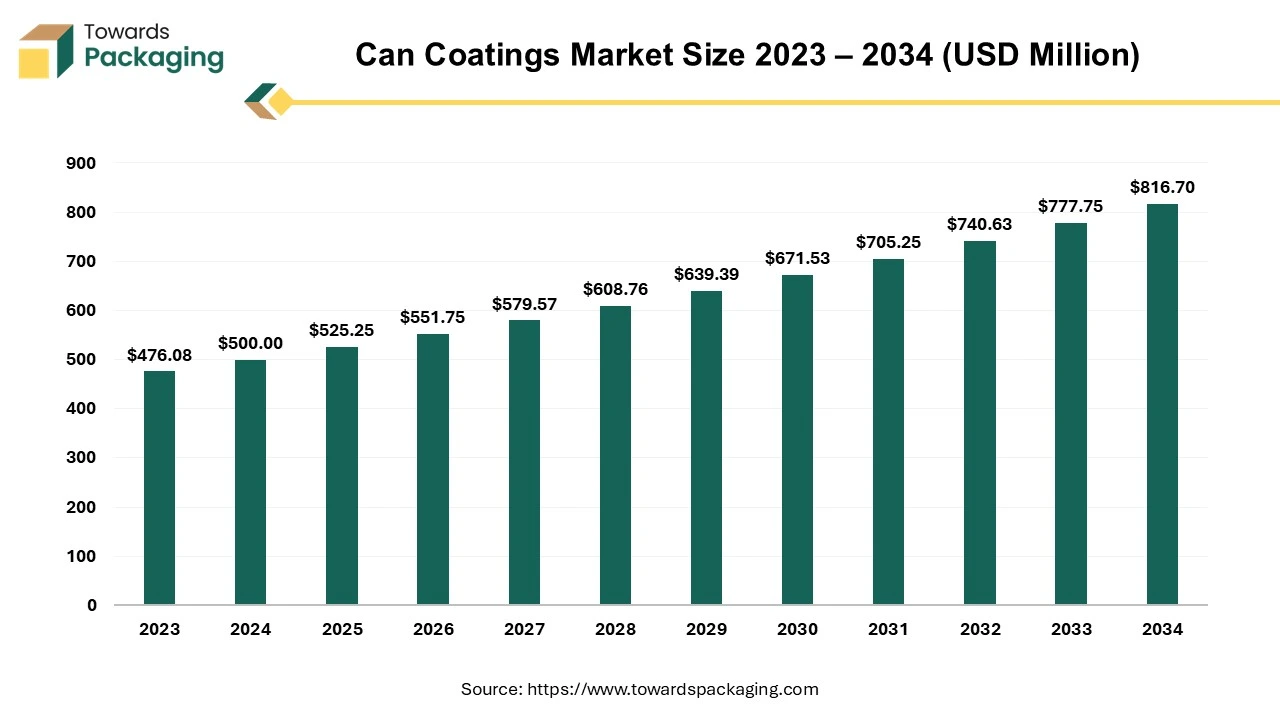

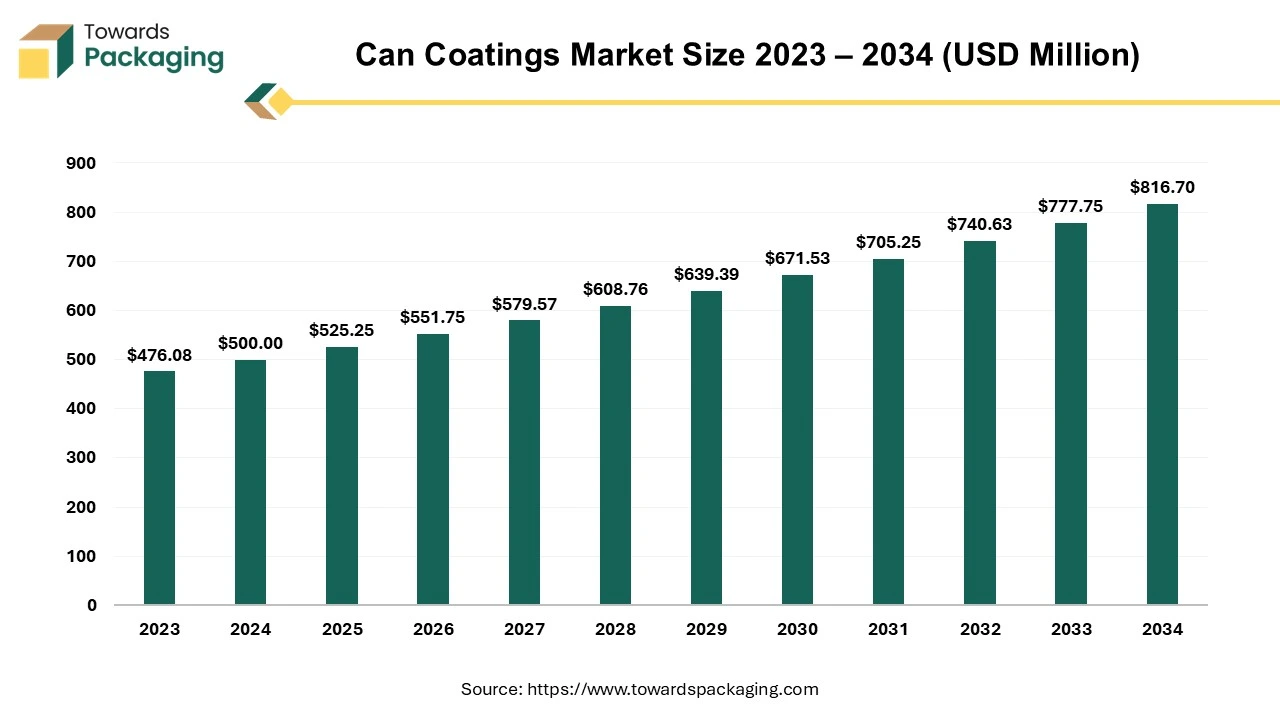

The can coatings market is forecasted to expand from USD 551.78 billion in 2026 to USD 859.66 billion by 2035, growing at a CAGR of 5.05% from 2026 to 2035. It also includes competitive analysis of key players such as Sherwin-Williams, PPG, AkzoNobel, Axalta, and Kansai, in-depth value chain mapping, trade and supply demand data, and a full breakdown of manufacturers, suppliers, and technological innovations like BPA-NI, nanocoatings, UV-curable systems, and AI-enabled quality optimization.

Key Takeaways

- North America led the can coatings market with the highest share in 2024.

- By region, Asia Pacific is expected to witness the highest CAGR during the forecast period.

- By resin, the acrylic segment dominates the market share in 2024.

- By end-use, the beverage segment dominates the market share in 2024.

Market Overview

The can coatings market is playing a significant role in the packaging industry majorly in the food & beverage industry due to safety as well as convenience. These are widely used for the preservation of food products. Can coatings are majorly used in the packaging of food products in schools, supermarkets, hospitals, and kitchens. The rising trend for canned food in the ready-to-eat food products section is driving the market to grow rapidly. Growing demand for the consumption of healthy food products in changing lifestyles has compelled market players to bring innovation to the can coatings market.

These can coatings are the organic layers which protect from any chemical reaction between cans and food. These cans preserve the nutritional value of food, provide longer storage, and protect from contamination due to external factors which increases the demand for this market. Some of the major factors such as National Paints Factories Co. Ltd., VPL Coatings GmbH & Co KG, Axalta Coating Systems, RPM International, Axalta Coating Systems, and several others are continuously introducing innovations which boost the market growth.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

US$ 525.25 Billion |

| Projected Market Size in 2035 |

US$ 859.66 Billion |

| CAGR (2025 - 2035) |

5.05% |

| Market Segmentation |

Resin Type, End-use Type and By Region Covered |

| Top Key Players |

The Sherwin-Williams Company, CSC BRANDS, L.P., Ball Corporation, Axalta Coating Systems, Kansai Nerolac Paints Ltd., National Paints Factories Co. Ltd. |

Can Coatings Market Trends

- The rising concern for food safety has allowed the market to grow rapidly as coating protects from metal leaching into food products.

- It protects the integrity of the food products such as taste, texture, and colour by creating a barrier between food and metals.

- It prevents food from spoilage due to the presence of coating it enhances the duration of food storage.

- These cans are highly recyclable which makes them eco-friendly packaging for food products.

AI Integration in the Can Coatings

In the can coatings market, there is a huge impact of AI as it is used in the formulation of coatings, enhancing the quality of the coating to avoid any damage to the food products, and decreasing the waste products by analysing the production requirement. The optimization in the formulation by collecting huge data and identifying properties to make the best combination of the coatings. The incorporation of advanced technology reduces the trial method which decreases time and efficiency during the manufacturing process of the coating of cans.

It can predict the shelf life and protect products before any malfunction takes place. It can detect easily any damage such as scratches, uneven coatings, and imperfections which enhances the reliability of the market in several sectors that prefer coated cans for packaging. It can enhance customer experience by identifying gathered data and by developing visual colours. With technologies such as machine learning and several others, it enhances the efficiency of production.

Market Outlook

- Industry Growth Overview: The market for can coatings is expanding because of increased demand for corrosion-resistant metal packaging and canned food and beverage consumption. Increasing adoption of BPA-free and high-performance coatings also supports steady market expansion. Market demand is further increased by rising urban consumption of ready-to-eat goods.

- Sustainability Trends: Bio-based resins, recyclable metal packaging, and BPA-NI coatings are key components of sustainability. As safer, more environmentally friendly options, waterborne and power coatings are becoming more popular. To cut emissions, manufacturers are gradually replacing solvent-based chemistries.

- Startup Economy: Bio-based solvent-free high-barrier coatings for food and drink cans are the focus of startups. Many are collaborating with packaging converters to create safer technologies that replace BPA. Additionally, innovations in natural resin solutions are being supported by accelerators.

Key Technological Shifts

- Shift to BPA-NI coatings to meet rising regulatory pressure and consumer safety concerns; this shift is accelerating global reformulation strategies.

- High-performance acrylic and polyester coatings offer superior corrosion protection; their versatility enables use across beverage, food, and aerosol cans.

- Growth of UV-curable and water-based coatings reduces VOC emissions; these solutions also lower energy consumption during curing.

- Nanotechnology-enhanced coatings improve hardness, adhesion, and chemical resistance; they extend shelf life even in aggressive filling conditions.

- Smart coating technologies integrate sensors for quality monitoring; they reduce production defects and improve operational efficiency.

Value Chain Analysis

- Raw Materials Sourcing: Can coatings rely on epoxy resins, acrylics, polyester resins, BPA-NI chemistries, solvents, and pigments sourced from global chemical manufacturers. Supply stability depends on petrochemical feedstocks and high-purity additives.

Key Players: DSM, AkzoNobel, Dow, PPG Industries.

- Logistics & Distribution: Coatings are distributed through direct supply agreements with can manufacturers, regional distributors, and industrial chemical networks. Temperature-controlled handling ensures product quality.

Key Players: PPG, Sherwin-Williams, Kansai Paint, Axalta.

- Recycling & Waste Management: Metal cans are highly recyclable, and modern coatings are designed to be compatible with recycling streams. Waste reduction focuses on solvent recovery and eco-friendly formulations.

Key Players: European Metal Packaging (Empac), Novelis, Ardagh Group.

Future Ready Can Coatings: Demand Drivers That Will Reshape the Market

| Future Demand Factor |

Summary |

| Shift to BPA-Free Coatings |

Brands will expand the adoption of BPA-free epoxy alternatives due to stricter global regulations and rising consumer safety concerns. |

| Growth in Beverage Cans |

High demand from carbonated drinks, energy drinks, and ready-to-drink beverages is accelerating can coating consumption. |

| Rise in Recyclable Coatings |

Demand will surge for coatings compatible with infinitely recyclable aluminum and steel cans, boosting sustainability goals. |

| Expansion in Food Preservation |

The increasing need for long-shelf-life packaged food will drive advanced corrosion-resistant and anti-microbial coatings. |

| Adoption of high-performance UV/ Waterborne coatings |

Eco-friendly UV curable and water-based systems will gain traction due to lower emissions and fast curing. |

Market Dynamics

Growing Food & Beverages Industry, Market’s

The can coatings market is growing rapidly due to rising demand from the food & beverages sector for enhanced packaging to improve the shelf life of the food items. Enhancing the lifestyle of the consumers increases the demand for mobile food facilities with extended shelf life which fuels the market to grow rapidly. One of the major factors influencing can coatings market is sustainability. The rising consciousness about ecological issues due to the packaging of products and waste has inclined the market players to use cans for food and beverage packaging.

Another major factor in the market is the growing demand for packaged food products. In this world, customers are looking for suitability in their changing lifestyles, resulting in the growing trend in the direction of packaged foods & beverages. This varying consumer behaviour has shaped an important chance for can coatings that play a vital role in conserving the superiority and cleanliness of packaged food & beverages.

Food & beverage cans need coatings to protect against corrosion and contamination, confirming the security and durability of the products. Identifying the status of customer health and security, governments universally have applied severe guidelines concerning food packaging resources. These guidelines have additionally fueled the request for enhanced-quality can coatings that fulfil the essential values.

Coating skills have experienced quick progress over a few times due to continuous innovation in the can coatings sector. These coatings are precisely intended to deliver a combination of improved functionalities, with extraordinary corrosion resistance quality, higher adhesion belongings, and a desirable aesthetic demand that captivates consumers.

Rising Demand for Innovation in Coating Technology: Market’s Largest Potential

The progressions in coating technology have boosted an ever-growing request for can coatings, mainly in the flourishing food & beverage sector. With the rising importance of ecological sustainability, the market players have observed the appearance of environment-friendly can coatings. These innovative coatings are created from bio-based resources, confirming they have no harmful components such as Bisphenol A (BPA). This market moves in the direction of sustainable substitutes, and the demand for environment-friendly can coatings is the primary focus of the market players, influencing the entire development of the market.

Furthermore, the incorporation of nanotechnology has an entirely new realm of potential for can coatings. Nanocoating with its extraordinary possessions along with high resistance to heat, scratches, and stains, has become extremely required-after in the market. The request for nanocoating improves the durability of cans and makes them more attractive in the food & beverage industry. Innovation continues to flourish in the can coatings sector, with the arrival of smart coatings instead of another advanced trend. These advanced technology coatings are introduced to vigorously change their possessions in response to ecological circumstances. Smart coatings enhance the worth of packaged products, providing an exceptional customer experience and uplifting brand status.

Moreover, the incorporation of digital skills in coating procedures has transformed the market, allowing exact regulation over the coating procedure. With digitalization, producers confirm reliable quality and improve overall efficacy, driving the development of the can coatings industry.

These noteworthy revolutions in the coating industry are playing a crucial role in influencing the can coatings sector worldwide. The segment is observing an upsurge in cutting-edge coating technologies, nanocoatings, environment-friendly coatings, smart coatings, and the digitalisation of coating procedures. As these revolutions continue to grow and develop, they are anticipated to deliver further push to the development of the can coatings industry, driving it to new edges.

There is a lack of raw materials available in the market to fulfil can coatings demand, which has enhanced the price of these coatings, such as polyester and vinyl coatings. These are mainly based on petroleum, which increases their charges and hinders the growth of the market.

Segmental Insights

Superior Performance Characteristics: Acrylic Segment Led in 2024

The acrylic segment dominated the market in 2024 due to its high-quality performance. The can coatings provide resistance against corrosion, UV light, and chemical exposure. Acrylic can coatings are widely used for long-lasting protection and durability, hence their high demand in the food and beverage industries. These are the types of coatings made up of formaldehyde polymerisation and are utilized to protect cans from electrical, mechanical, chemical, and thermal.

These coatings are also used by several other sectors such as automotive & transportation, machinery, consumer & goods, and electrical & electronics. This wide utilization by the industries has influenced the growth of the market rapidly as these improve the scope of improvement and continuous innovation in this market.

Technological Advancement in Formulation of Coatings: Beverages Segment Led in 2024

The beverages segment dominated the market in 2024 due to its advanced technologies used for the formulation of the can coatings. These coatings protect any reaction between packaged beverages and metal used for making cans which increases its demand in this sector as there is a huge requirement for packaging that enhances the shelf life of the products. The rising consumption of beverages worldwide has also influenced the demand for can coatings as there is a high production of beverage cans which require customization to provide aesthetic appearances of the cans. There are factors such as changing lifestyles, rising demand for energy drinks, increasing middle-class population, and many such reasons contributing to the growth of the market in the beverage sector.

Advanced Product Development: North America to Sustain as a Leader

North America is estimated to generate the highest revenue over the forecast period. This is due to the superior quality of texture and improve the experience of the customers in this market. The changing lifestyle and rising working population have raised the demand for canned food products which have a high shelf life leading to the enhanced demand for such coatings which provide enhanced protection to the food products.

The growing demand for electricity and electrical equipment in countries such as the U.S. and Canada has raised the demand for coating products ultimately influencing this market. The growing demand for high-quality packaging in the cosmetic industry has also influenced the market players to introduce innovation in this field.

The North American paints and coatings market is expected to grow specifically in the commercial sector. Government initiatives into public infrastructure and rising construction activities that will contribute to this development over the upcoming years. Apart from this , Sustainability is also a driving factor in the paint and coating industry. There is a regulatory push which affects the industry to lesser volatile organic compounds (VOC) which can expand shelf life and improve durability but also badly affect air quality and human wellbeing.

Rapid Urbanization and Growing Middle-Class Population: Asia-Pacific to be the Fastest Growing

Asia Pacific witnessed the fastest-growing revenue share for the year 2024. There is a huge shift of the population towards urban areas and the economic growth of the middle-class population has influenced the demand for can coatings. The growing popularity of carbonated drinks among urban people in countries such as India, China, Japan, Thailand, and South Korea has raised the demand for can coatings to increase the shelf life of the drinks. The growing awareness towards ecological issues has influenced the can coatings market to develop eco-friendly formulations and develop the demand of this industry.

Middle East and Africa Can Coatings Market Trends

Manufacturing paints in the harsh climate of UAE (United Arab Emirates) is filled with climatic conditions, challenges which have specific impact on the way paint products are produced and shipped from the manufacturing location to the customer. The UAE is known for its dynamic, exciting and challenging markets for domestic, worldwide coating producers and suppliers.

Can Coatings Market Top Companies

Latest Announcements by Market Leaders

- In February 2025, Henrik Kristensen who is the CSO sales at Tresu expressed, “We held an open house in Denmark, and several companies were invited. We received excellent feedback.”

Recent Development

- On 5 February 2025, At PrintPack 2025, Tresu revealed Ink Flex linked to whole range of coating circulators and as the organization has its flexo innovator generation tool ,the Duck ink Deck.

- On 2 April 2025, Florida Paints is amplifying its line of protective paints and coatings with having three latest products to make sure that buildings look their best all year long.

- AkzoNobel revealed Accelshield 300 which is a good quality internal coating for aluminium cans which grows safety and regulatory compliance that can be manufactured which are forced to take advantage from AkzoNobel innovative approach having a high-performance internal coating technology.

- In February 2025, Tresu announced the launch of Ink Flex, which is to contribute to the whole range of coating circulators. This company also launched its flexo innovator generation tool, the Dual Ink Deck.

- In December 2024, Qemtex Chemical Holding announced the launch of its latest powder coatings plant in the United Arab Emirates.

- On 10 September 2024, Kamdhenu Ventures Ltd which is India’s top brand in Indian Decorative Paints Segment as it has expanded its main product line with the introduction which has launched its Wood Coating Range.

Can Coatings Market Segments

Resin Type

- Epoxy

- Polyester

- Acrylic

- Polyolefins

End-use Type

By Region Covered

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait