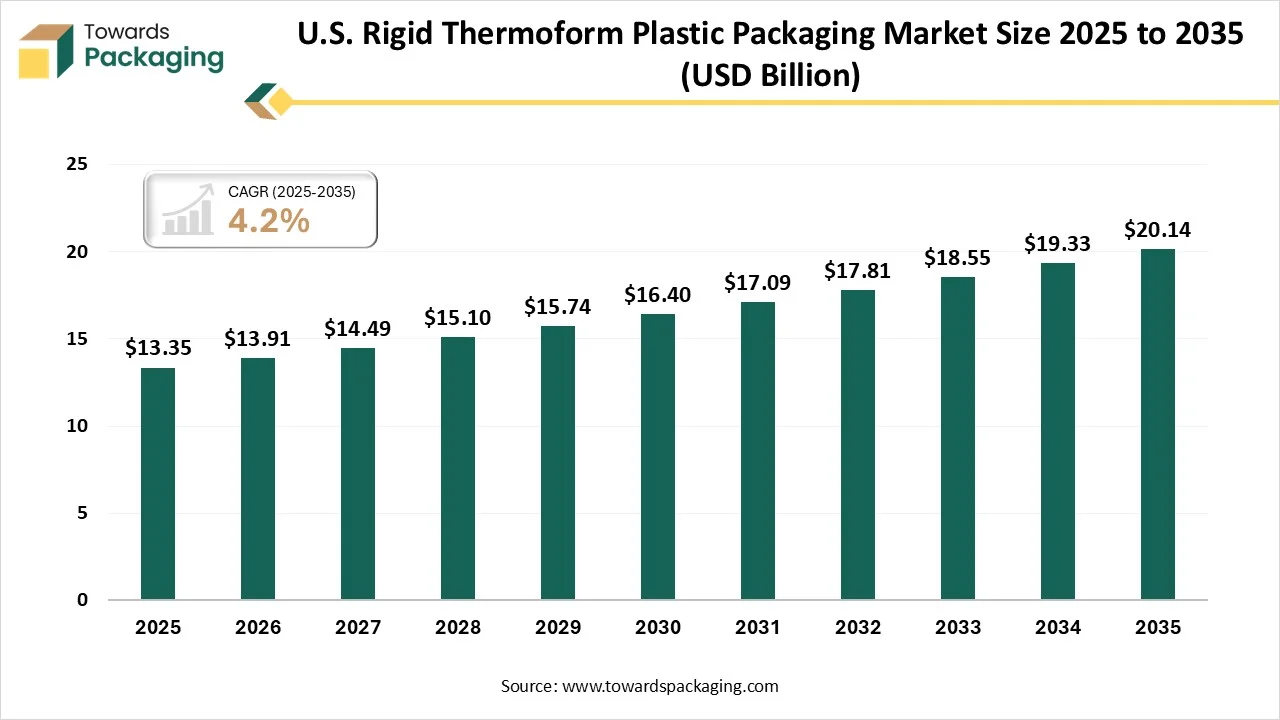

The U.S. rigid thermoform plastic packaging market is forecasted to expand from USD 13.91 billion in 2026 to USD 20.14 billion by 2035, growing at a CAGR of 4.2% from 2026 to 2035. The growth and demand for such packaging is that it delivers to various sectors, which include food and beverages, where it ensures safety and freshness. In personal care and cosmetics, it serves as functional and attractive packaging that enhances product appearance.

- In terms of revenue, the market is valued at USD 13.35 billion in 2025.

- The market is projected to reach USD 20.14 billion by 2035.

- Rapid growth at a CAGR of 4.2% will be observed in the period between 2026 and 2035.

- By material, the polyethylene terephthalate (PET) segment dominated the market with a 44.8% share in 2025.

- By material, the biobased/compostable segment will be growing at a significant CAGR between 2026 and 2035.

- By product type, the clamshells segment dominated the market with 36.2% share in 2025.

- By product type, the containers segment will be developing at a main CAGR between 2026 and 2035.

- By application, the food and beverages segment dominated the market with 52.4% share in 2025.

- By application, the pharmaceutical segment will be growing at a significant CAGR between 2026 and 2035.

The U.S. market is a global leader in thermoforming adoption, driven by a highly mature food retail sector and a massive pharmaceutical base. Unlike other regions where flexible packaging is gaining ground for weight reduction, the U.S. maintains a strong preference for rigid formats due to the high demand for "shelf-ready" packaging, tamper-evidence, and product protection during long-haul logistics.

- New forming Techniques: Inventive thermoforming procedures are updating how producers shape plastic materials like PET and polypropylene into complicated elements. Such procedures develop accuracy and surface finish that enable engineers to produce blister packs and medical devices for the healthcare sector with more complex designs.

- Machine learning is updating thermoforming by enabling higher precision, defect detection, and manufacturing efficiency. Organizations can now utilize data analytics and artificial intelligence to update their procedure. This innovation counts in order to develop productivity and enable businesses to remain ahead in an excessively competitive sector.

- Advanced Simulation Software: Advanced simulation software enables producers to design polymer behavior during the forming and heating process that has unmatched accuracy. By using such technology, engineers can foretell energy usage by lowering fuel usage and cutting down waste before any physical manufacturing starts.

- Sustainable Materials: The overall move towards sustainable materials in terms of thermoforming is being driven by a higher urge for eco-friendly products across different sectors. Inventions in bio-based thermoplastics and recyclable polymers assist in avoiding surrounding problems caused by plastic pollution.

- Hybrid Techniques: Hybrid production techniques integrate regular thermoforming with high-level technologies such as 3D printing to improve design reliability. This strategy enables producers to generate complicated polymer elements with an accurate geometry and less waste, which advantages the procedure of unlimited sectors.

As the food sector shifts towards a more sustainable future, thermoforms are proving to be a necessary machine in lowering the environmental impact. On the other hand, updating material usage to assist in biodegradable and recyclable packaging for developing energy efficiency, thermoforms assist in food production that aligns with both consumer expectations and regulatory needs for sustainability. For food processing procurement and engineering specialists, time is needed to check how thermoforming technology can develop sustainability efforts.

- As per thermoform plastic packaging import data between June 2024 and May 2025, as buyers globally imported 193 shipments.

- Such shipments were being facilitated by 193 exporters and bought by 179 official worldwide buyers, which shows 215% development as compared to the last twelve months.

- Uruguay, Mexico, and Colombia come up as the top three thermoform plastic packaging importing countries.

- The United States, Argentina, and Mexico are the leading three exporting countries.

- The United States has exported a total of 1,000 shipments, Argentina has exported 922 shipments, and Mexico has exported 812 shipments.

- Package Design and Prototyping: As compared to other plastic forming technologies, such as injection molding, thermoforming is less costly and faster to install. Tooling amounts are lower, which is specifically perfect for small or mid-sized runs or organizations that redesign the packaging patterns on a regular basis.

- Recycling and Waste Management: In thermoforming or sheet extrusion uses, a skeletal waste or an edge trim is made in these procedures, which is ground directly next to the machine. Such granulators can be easily fitted with roller feeding services that are utilized to automatically feed the material and provide an accurate solution in such cases.

- Logistics and Distribution: Thermoforming machines play a crucial role in current logistics by smoothing the packaging procedure and lowering the management period. By generating durable, lightweight, and tailored packaging, such machines assist organizations in protecting the products, speeding up distribution, and updating the storage.

Segmental Insights

Material Insights

How Polyethylene Terephthalate (PET) Segment Dominated the U.S. Rigid Thermoform Plastic Packaging Market in 2025?

The Polyethylene Terephthalate (PET) segment dominated the U.S. rigid thermoform plastic packaging market with 44.8% share in 2025, as polyethylene terephthalate (PE) is initially the material most in demand in terms of thermoforming synthetic packaging industry. It is an exceptional element that is perfect for a transparent nature, which is like that of glass and its feature advantage for its big mechanical power that enables the manufacturing of constant rigid packaging with likely small wall thickness, which is perfect for oxygen barrier qualities that make it perfect for fresh foodstuffs.

The biobased/compostable segment is projected to witness the fastest CAGR during the forecast period. It is a plant-based and compostable bioplastic created from fermented sugars like sugarcane, corn, or cassava. It serves stiffness, good clarity, and food contact safety, which makes it famous for clamshells, cold cups, and 3-printing filaments. Due to industrial composting conditions, PLA can be separated into C02, biomass, and water that assist in reducing the dependency on fossil-based plastics. Hence, it has restricted heat resistance, which demands recycling or a composting design.

Product Type Insights

How Clamshells Segment Dominated the U.S. Rigid Thermoform Plastic Packaging Market in 2025?

The clamshells segment dominated the U.S. rigid thermoform plastic packaging market with 36.2% share in 2025, as PET (polyethylene terephthalate) is among the most conventional plastics that are utilized for clamshell containers. Such materials are famous in the food sector because of their durability, clarity, and potential to prevent ingredients from contaminants and moisture. The incredible usage of such PET clamshell blister packaging is often used for fruit, bakery products, and sandwiches. Their transparent feature displays the product before buying, which develops trust and the possibility of a sale.

The containers segment is projected to witness the fastest CAGR during the forecast period. Once the shaping procedure is completed, the plastic should be cool to mold its design. Cooling systems, such as water sprays or fans, assist in speeding up such a procedure. Once the plastic material becomes hard, extra plastic is cut down to make a finished and clean product. Trimming makes sure the container aligns with accurate dimensions and is then ready for application. The thermoforming process ensures that every container meets strong industry standards for safety and hygiene.

End-User Insights

How the Food & Beverages Segment Dominated the U.S. Rigid Thermoform Plastic Packaging Market in 2025?

The food & beverages segment dominated the U.S. Rigid thermoform plastic packaging market with 52.4% share in 2025, as the current thermoforming machine serves a series of characteristics that are crafted to develop smoothness and accuracy in the food packaging solutions. Advanced control systems enable operators to track pressure, temperature, and timing with an accuracy that ensures unity in each manufactured unit. Elements such as servo-driven transportation and automatic sheet stretching have reduced waste and developed product consistency. Furthermore, the potential to generate a variety of packaging designs with a single machine makes such machines a reliable choice for US manufacturers.

The pharmaceuticals segment is projected to witness the fastest CAGR during the forecast period. The thermoforming procedure uses heat to soften plastic films like VDC-coated PVC, PVC, or PET, which are then formed into blisters. Such a procedure is flexible and fast, and enables the development of product visibility, which can be reviewed and checked for both pharmacists and patients. Thermoform blister packaging is a necessary solution in the current landscape of pharmaceutical packaging solutions, which serves not only clarity but is also crucial for tamper-evident packaging characteristics, which makes our product safe. The application of a thermoformed plastic in this process guarantees that each kind of packaging is personalized to align with the particular demands of the product while tracking effectiveness and reliability.

State Level Analysis

The U.S. rigid thermoform plastic packaging market is expected to grow notably in California because this state is witnessing a higher growth driven by macroeconomic moves, which include growing demand for sustainable materials and lightweight packaging solutions. As users select a pivot in terms of environmentally friendly products, producers are progressively outsourcing thermoforming procedures to tailor subcontractors that can deliver cost-efficient and innovative eco-friendly solutions. This trend is further reimplemented by the current digitization of production, which allows real-time tracking, fast prototyping, and hence reduces lead times.

- In May 2025, NOVA Chemicals introduced its primary polyethylene (PE) film recycling facility named SYNDIGO1, which is in Connersville, Indiana, US. It is a facility that is meant to be one of the highest-level of its type worldwide, spread across 450,000ft2 area.

- In June 2025, E.Hofman Plastics Inc, a rigid packaging supplier located in Orangeville, Ontario, invested US$ 43 million to formally establish its first manufacturing facility in the U.S.

- In October 2024, ExxonMobil introduced its latest Signature Polymers portfolio brand, made for offering the best partnership and services in the polymer industry. the company made fully recyclable thermoformed packaging solution which offers high optics and puncture resistance, and an excellent oxygen barrier with maintaining aseptic and hot fill applications.

- Amcor plc

- Pactiv Evergreen Inc.

- Sonoco Products Company

- Berry Global Inc

- Dart Container Corporation

- Silgan Holdings Inc.

- Placon Corporation

- Anchor Packaging LLC

- Sabert Corporation

- Genpak LLC

- D&W Fine Pack LLC

- Inline Plastics Corporation

- Plastic Ingenuity Inc.

- Lacerta Group, Inc.

- Winpak Ltd.

By Material

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS) & Others

- Bio-based/compostable

By Product Type

- Clamshells

- Containers

- Trays & Lids

- Blister Packs

Application Type

- Food & Beverages

- Pharmaceuticals

- Electronics

- Personal Care & Homecare