The rigid thermoform plastic packaging market is booming, poised for a revenue surge into the hundreds of millions from 2026 to 2035, driving a revolution in sustainable transportation. The rising demand for a suitable and easy-to-handle packaging option. Major factors include the demand for suitable and sustainable packaging across healthcare, food, and consumer goods businesses, as well as advancements in the retail and e-commerce sectors. Rising emphasis on sustainable and environment-friendly packaging choices, along with pressure to utilize recycled contented.

Rigid thermoform plastic packaging is a type of strong, durable plastic packaging manufactured by heating a plastic sheet until it becomes flexible, then shaping it in a mold to create a rigid structure. This method allows manufacturers to achieve consistent shapes, smooth surfaces, and reliable strength across high production volumes. It is widely used in sectors such as food, electronics, healthcare, and consumer goods because it maintains product protection while offering clear visibility.

It can be moulded into a wide variety of forms and is used to make a wide range of items. Common examples include trays, clamshells, blisters, and protective inserts that are tailored to fit specific products. According to the U.S. Environmental Protection Agency, plastics continue to account for a growing share of packaging materials due to their versatility and formability, which has supported the adoption of thermoformed designs.

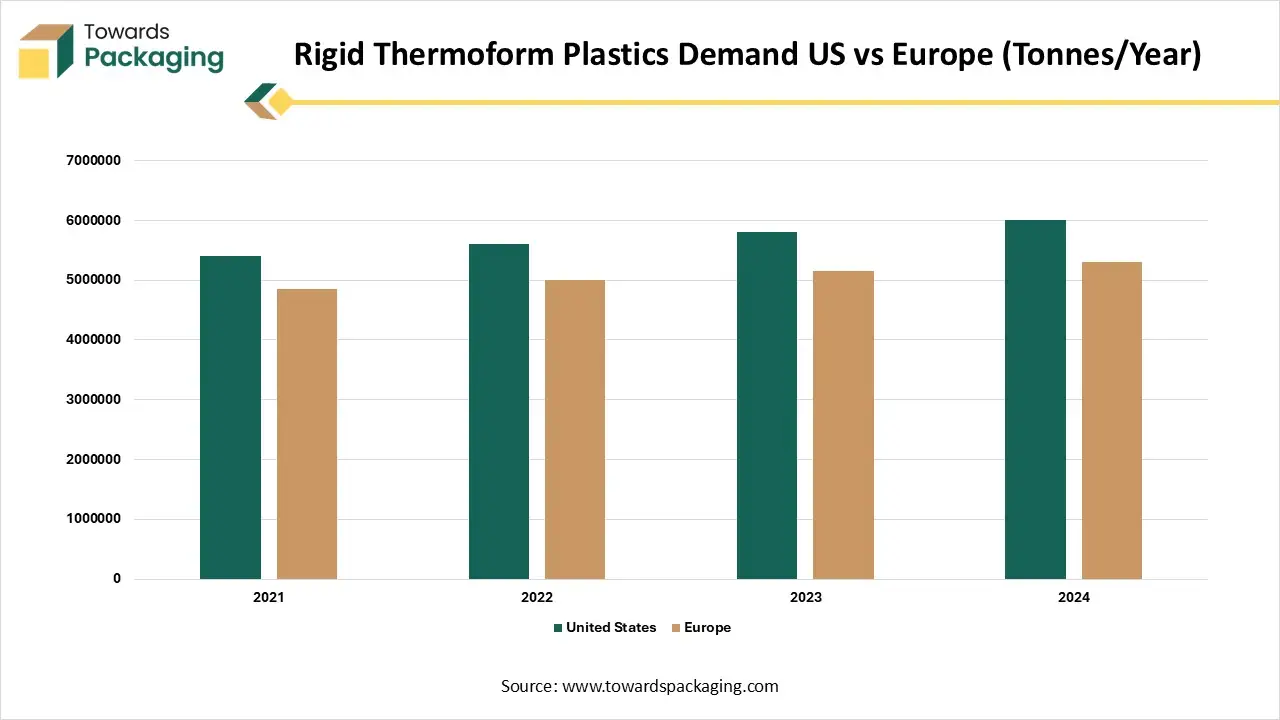

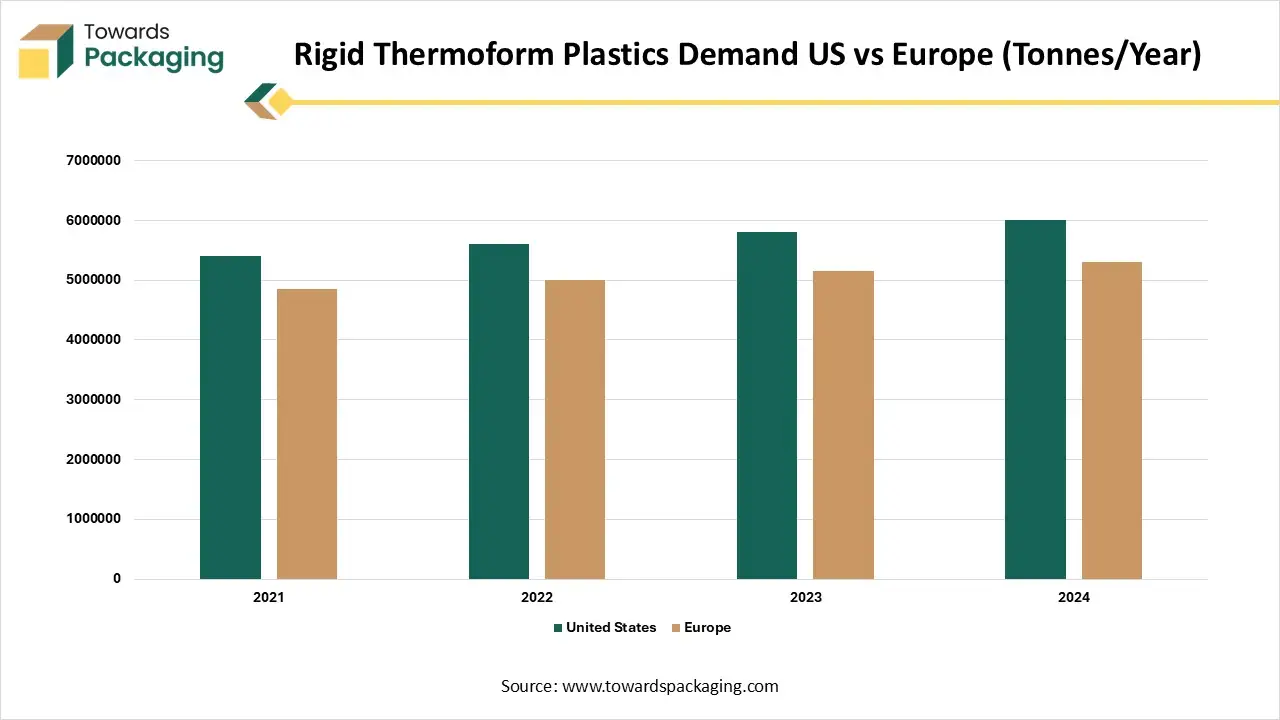

| Year | United States | Europe |

| 2021 | 5400000 | 4850000 |

| 2022 | 5600000 | 5000000 |

| 2023 | 5800000 | 5150000 |

| 2024 | 6000000 | 5300000 |

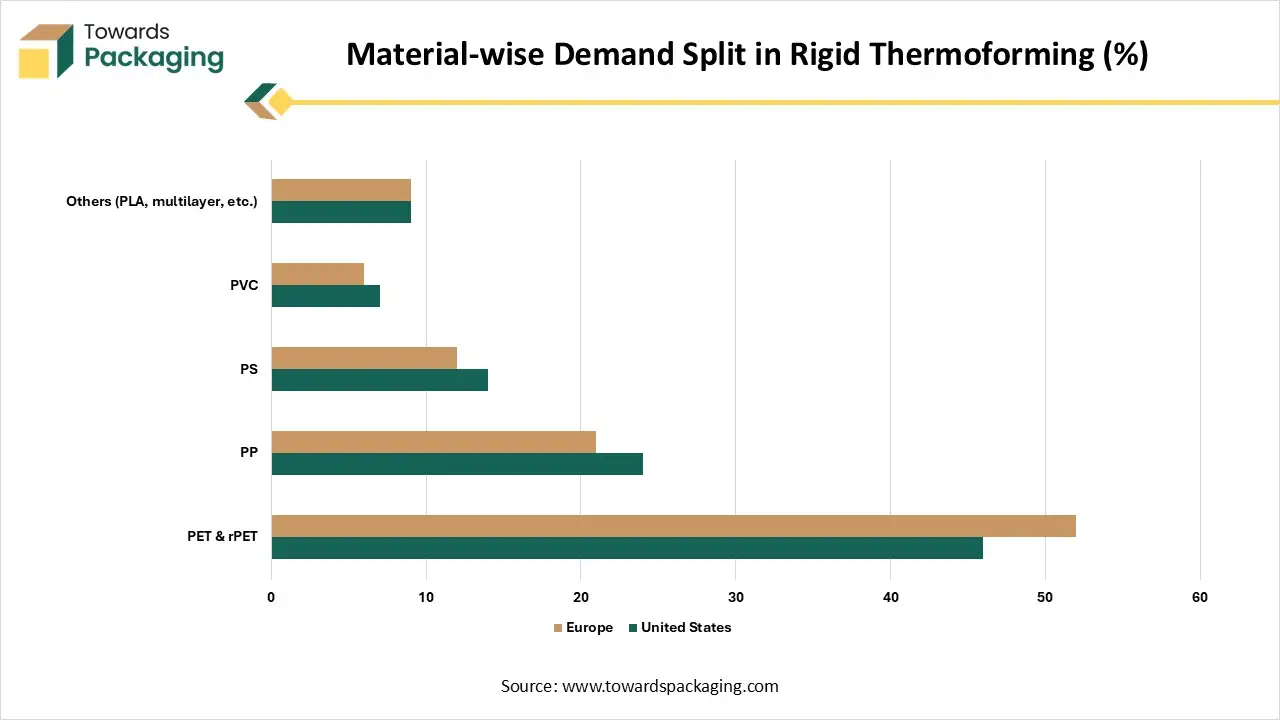

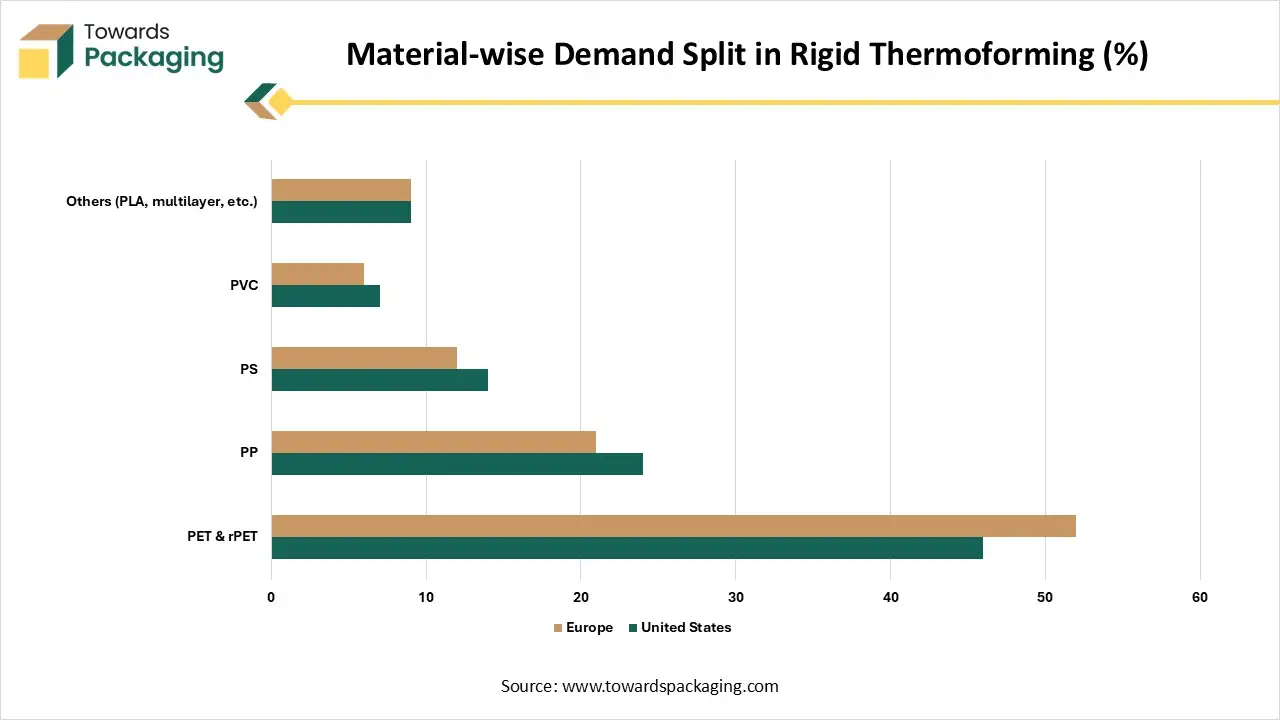

| Material | United States | Europe |

| PET & rPET | 46 | 52 |

| PP | 24 | 21 |

| PS | 14 | 12 |

| PVC | 7 | 6 |

| Others (PLA, multilayer, etc.) | 9 | 9 |

Technological transformation in rigid thermoform plastic packaging market plays a significant role in its expansion. Inventions in engineering processes, such as automation and advanced molding methods, are improving production efficiency and reducing costs. The market is anticipated to see increased adoption of smart packaging machinery that integrates indicators and sensors to monitor product integrity. It enhances the customer experience and extends product shelf life, thereby reducing food waste.

Trade in rigid thermoform packaging includes finished products such as:

Many shipments also include semi-finished thermoform sheets or stackable trays that reduce freight volume. Countries with strict food safety rules often import high-barrier or medical-grade packaging from specialised manufacturers in the United States and Europe.

New rules on packaging waste, recyclability and plastic reduction in the European Union, Canada, parts of Latin America and Southeast Asia are influencing trade patterns. Buyers increasingly prefer suppliers that can provide:

Publicly available trade summaries show:

| Material | Price Range |

| PET / rPET | 1800 - 2600 |

| PP | 1600 - 2300 |

| PS | 1500 - 2100 |

| PVC | 1700 - 2400 |

| Bio-based plastics | 2400 - 3800 |

The major raw materials utilized in this market are polyethylene terephthalate (PET), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), and polyethylene (PE).

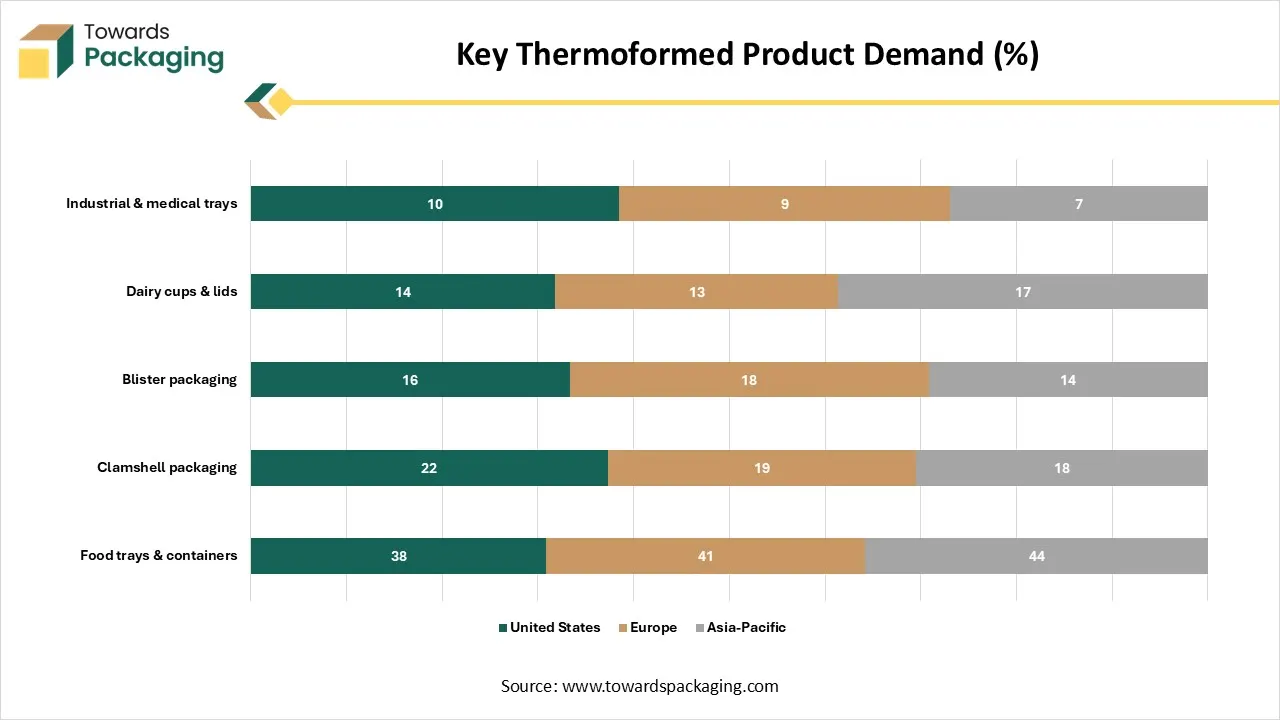

The component manufacturing in this market comprises blisters, clamshells, containers, trays, and lids.

This segment is growing focus on durability, cost-effectiveness, and increasingly, sustainability.

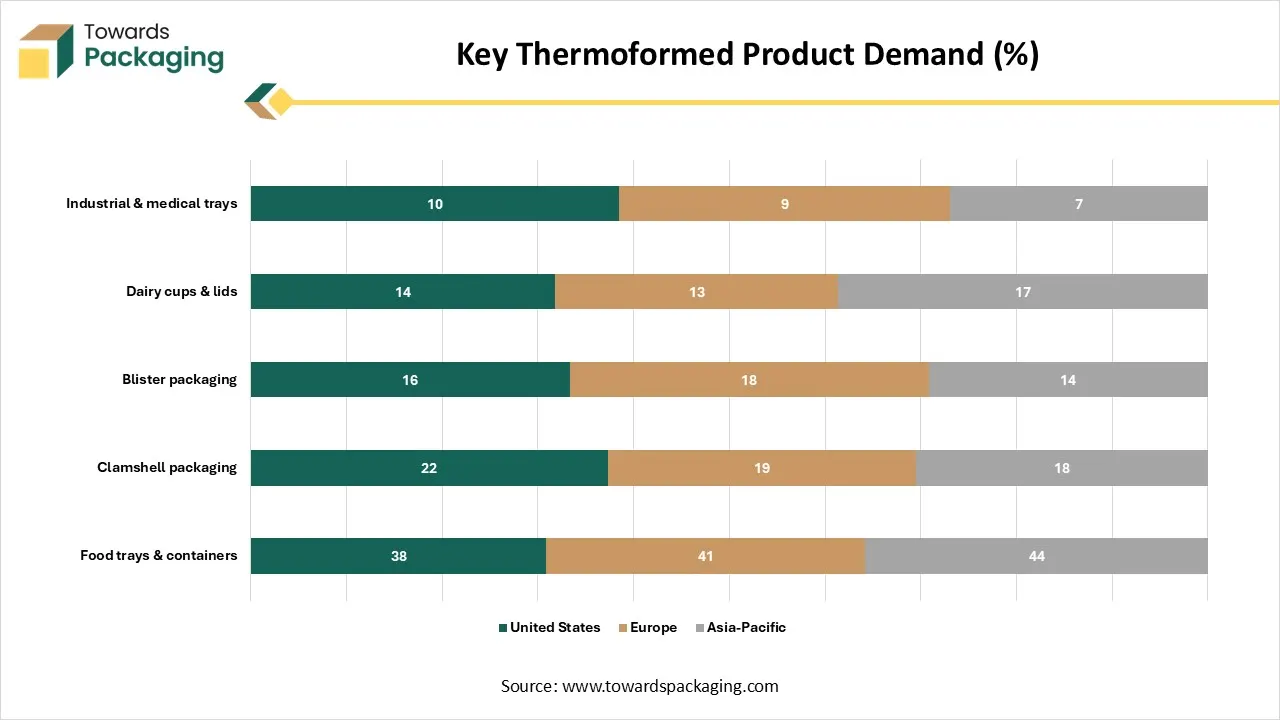

| Product Type | United States | Europe | Asia-Pacific |

| Food trays & containers | 38 | 41 | 44 |

| Clamshell packaging | 22 | 19 | 18 |

| Blister packaging | 16 | 18 | 14 |

| Dairy cups & lids | 14 | 13 | 17 |

| Industrial & medical trays | 10 | 9 | 7 |

The polyethylene terephthalate (PET) segment dominated the market with the highest share in 2024 due to recyclability, excellent clarity, and strength. It is favoured for its recyclability, which aligns with the growing demand for sustainable packaging choices and is a key factor in its sustained dominance. The capability to utilize high quantities of recycled PET (rPET) in thermoforming, with no compromise to food security, fuels its sustainability identifications. It is adaptable in use and is prevalent across several segments, including healthcare, food, beverages, and personal care. It is a top in the rigid thermoform plastic packaging sector, because of its required properties such as chemical resistance, strength, and clarity.

The polyvinyl chloride (PVC) segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to durability, cost-effectiveness, and versatility. It is a reasonable resource, making it an inexpensive choice for packing. It can be produced in both flexible and rigid forms and modified into several sizes and shapes to fulfil different requirements. It provides good shielding and is appropriate for long-term packaging solutions. It is often used for clamshell and blister packaging, which are suitable for customers' small household items, electronics, and toys because of their protective and transparent properties.

Polystyrene (PS) is the fastest-growing in the rigid thermoform plastic packaging market, as it offers affordability, clarity, and rigidity. This development is moderated by ecological concerns, leading to an emphasis on expanding recycling options and developing biodegradable alternatives to meet global sustainability goals. It helps several decoration and printing methods, which makes it flexible for branding.

The clamshell segment dominated the market with the highest share in 2024 due to increasing requirements for tamper barrier, convenience, and product protection. It is driven by trends toward sustainability, such as the growth of environmentally friendly and recyclable resources. It is widely utilized for packed foods to preserve quality, extend shelf life, and provide convenience to customers. It is used for medical equipment and products where cleanliness and product quality are crucial. These are easy and popular options available for both producers and customers.

The containers segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to the packaging's versatility, reliability, and efficiency. It is widely used across sectors such as electronics, food, personal care products, pharmaceuticals, and consumer goods. These reduce the risk of damage during the transportation and storage of products.

The blisters are the fastest-growing in the rigid thermoform plastic packaging market, as it provide protection and visibility against light, moisture, and various other ecological factors. The rising pharmaceutical industry, specifically for oral medicines, is the topmost factor, fuelled by an aging population and growing healthcare spending. This packaging provides excellent protection against physical damage, environmental factors, and pollution, thereby confirming product quality. The sealed nature of blister packages provides a tamper-evident seal, which enhances customer confidence in product security and authenticity.

The food & beverages segment dominated the market with the highest share in 2024, driven by extended shelf life, portability, and convenience. It is driven by trends toward lightweight, sustainable, and recyclable designs. It is important to consider the shelf life of goods such as bakery, dairy, and meat products by using substitutes to resist contaminants, oxygen, and air. It also confirms hygiene and the integrity of goods during transportation. Producers are emphasizing lightweight patterns that decrease resource utilize and transportation charges, resulting in smaller carbon footprints.

The personal care & cosmetics segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to consumer trends and economic factors. The expansion of online retail increases demand for safe, durable packaging that can withstand the rigors of delivery and transportation. It allows for high aesthetic visual and complex patterns, which are important for attracting customers in the beauty industry.

The pharmaceutical is the fastest-growing in the rigid thermoform plastic packaging market, as it comprises increasing patient safety and adherence. It is extensively utilized for pharmaceuticals because their capability to shield single-use doses, preserve quality, and provide high perceptibility for visual review. It is driven by the need for patient safety and medication adherence, particularly for specialized biologics and other drugs.

North America held the largest share of the rigid thermoform plastic packaging market in 2024, driven by growing demand from the food and beverage industry and strict regulations promoting sustainable packaging options. Rising consumption of ready-to-eat meals, packaged produce, and convenience food products has increased the need for sturdy, lightweight packaging that maintains freshness and safety. Regulatory bodies such as the U.S. Food and Drug Administration and the Canadian Food Inspection Agency continue to enforce stringent packaging and hygiene standards, which support the use of high-quality thermoformed materials.

The upsurge in the e-commerce sector and the necessity for effective packaging options further catalyse market extension. Growth in online retail has increased demand for protective, impact-resistant packaging that withstands transportation and handling. Thermoformed trays, inserts, and clamshells are widely adopted because they offer consistent strength, low weight, and versatile design features suited to a broad range of shipped products.

The growing focus on eco-friendly packaging has increased demand for rigid thermoformed plastic packaging in Canada. This shift is supported by national and provincial sustainability goals that encourage recyclable materials and reduced environmental impact, which has led both retailers and manufacturers to adopt more responsible packaging formats. As consumer awareness of waste and recycling continues to rise, companies are increasingly choosing thermoformed solutions that balance durability with lighter material usage.

The demand for one-time serve and portion-measured arrangements further boosts the need for focused trays and containers that are easy to manage and shield. These formats are widely used in ready-to-eat meals, bakery items, and fresh produce, making them essential for both household consumption and foodservice operations. Their ability to maintain product visibility and hygiene also supports adoption across quick-service and retail environments.

Rapid economic and population growth has increased demand for rigid thermoformed plastic packaging. These trends drive higher consumption of packaged goods, particularly in fast-growing economies where rising household incomes encourage greater use of convenience foods, personal care items, and other consumer products. As purchasing power grows, manufacturers increasingly rely on durable, lightweight packaging solutions to support distribution and product safety.

Shift towards urban areas and the upsurge in industrial development are driving engineering activities, necessitating more packaging options for finished products. Urban markets require consistent quality, better shelf presentation, and stronger supply chain protection, which increases reliance on thermoformed trays, containers, and protective inserts. Industrial expansion also strengthens demand for packaging used in electronics, automotive components, and small appliances.

Enhanced customer demand, driven by a rising economy, rapid urbanization, and a growing middle class, has boosted the market development of rigid thermoform plastic packaging in China. As disposable incomes rise and household consumption patterns shift, more consumers are purchasing packaged foods, personal care items, and ready-to-use products that rely heavily on durable, lightweight packaging formats. This expanding consumer base continues to strengthen demand across retail and foodservice sectors.

An enhancement in urbanization results in a greater requirement for convenient and packaged food choices that can be effortlessly carried and consumed while travelling. With more people living in cities and commuting longer distances, ready-to-eat meals, portion-controlled trays, and grab-and-go packs have become essential. These formats depend on thermoformed packaging to maintain freshness, hygiene, and portability.

The major factors influencing the growth of rigid thermoform plastic packaging market are increasing regulatory pressure, acceptance of sustainable resources, and innovative designs. These drivers are becoming more important as governments strengthen rules on waste reduction, recycling targets, and responsible material use, pushing manufacturers to rethink traditional packaging practicess. Many regions are introducing stricter compliance requirements for plastics, encouraging companies to shift toward cleaner, more efficient packaging solutions.

These guidelines compel producers to adopt more sustainable practices and to use packaging that is manufactured from recycled materials or is recyclable. This shift is reinforced by national recycling policies, consumer expectations for eco-friendly products, and the need to reduce packaging's environmental footprint. As a result, companies are increasing the use of post-consumer recycled plastics and adopting design standards that improve sorting and recovery rates.

The rising demand for durable, cost-effective, lightweight, and protection has fuelled the development of the rigid thermoform plastic packaging market. This trend aligns with the broader shift toward materials that offer strong performance while keeping production and transportation expenses low. Many industries prefer rigid thermoform packaging because it balances strength with affordability, making it suitable for mass-market and premium products alike.

It comprises thermoformed goods like blister packages, is extremely effective at defensive goods from moisture, air, and physical harm, which is critical for pharmaceuticals and food. These features help maintain product integrity during storage, handling, and distribution, especially in applications where hygiene and freshness are essential. This level of protection is a major driver of adoption in sectors that depend on strict safety and quality standards.

By Material

By Type

By Application

By Geography / Region

February 2026

February 2026

February 2026

February 2026