Nonwoven Fabrics Market Analysis, Demand and Growth Rate Forecast

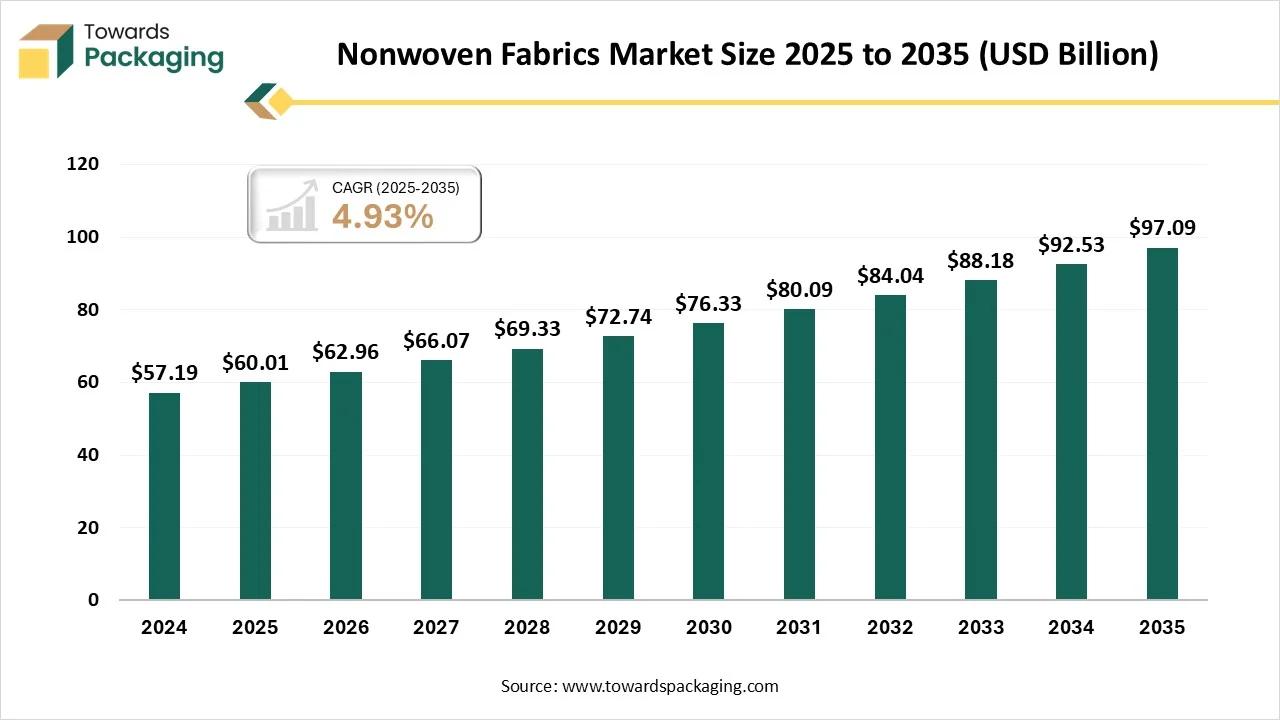

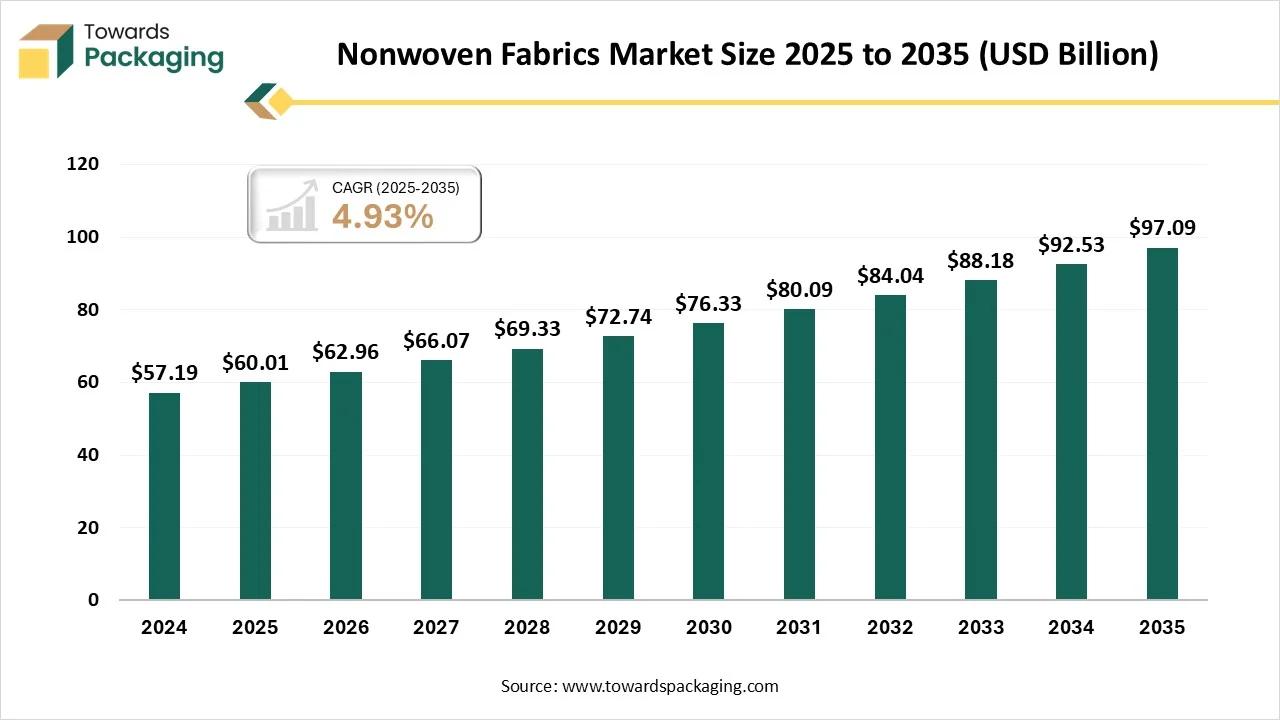

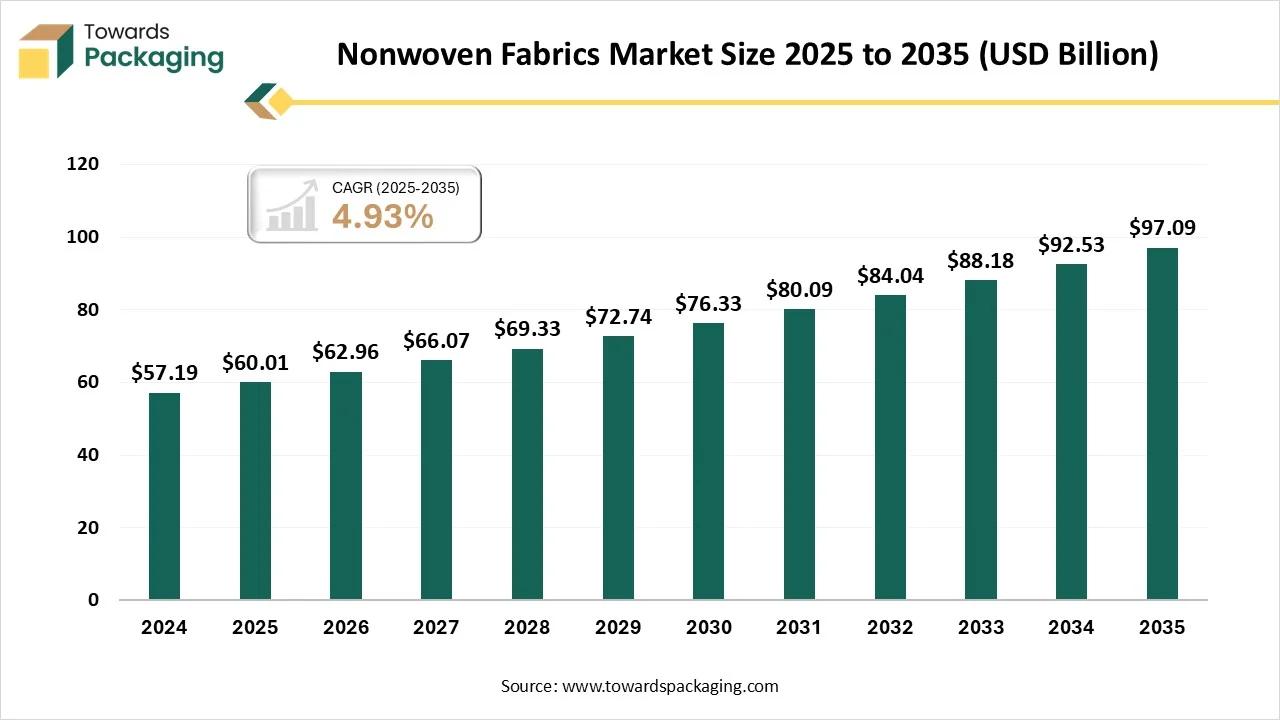

The Nonwoven Fabrics Market is projected to grow from USD 62.96 billion in 2026 to USD 97.09 billion by 2035, registering a CAGR of 4.93% during the forecast period from 2026 to 2035. The report provides detailed insights on market size, segment data by material, technology, function, and end-use industries, along with regional data across major global markets.

It also includes competitive analysis, key company profiles, manufacturers and suppliers data, trade statistics, and value chain analysis. Market growth is supported by the increasing demand for disposable hygiene products, expanding healthcare expenditure, sustainable and recyclable nonwoven solutions, and rising applications in automotive lightweighting and construction.

Key Highlights

- In terms of revenue, the market is valued at USD 62.96 Billion in 2026.

- The market is predicted to reach USD 97.09 Billion by the year 2035.

- Rapid growth at a CAGR of 4.93% will be officially experienced between .

- By region, Asia Pacific dominated the region, having the biggest share of 50 % in 2025.

- By region, North America is expected to rise at a notable CAGR between 2026 to 2035.

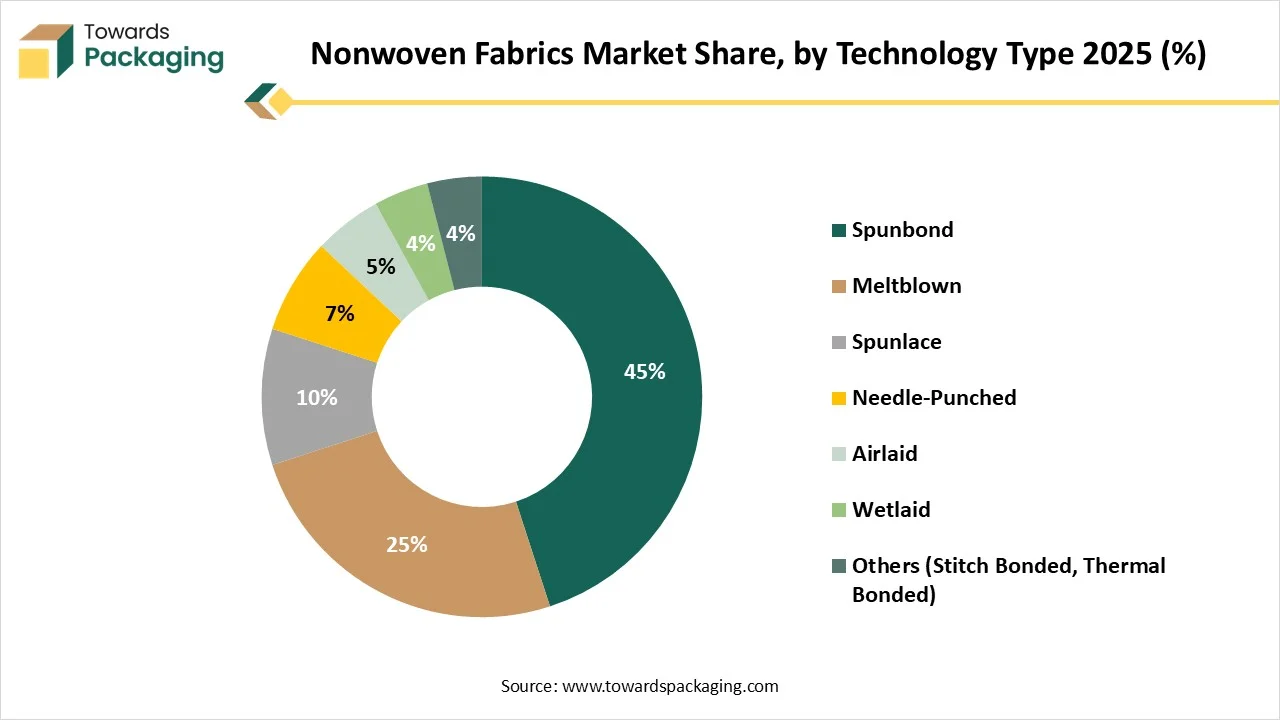

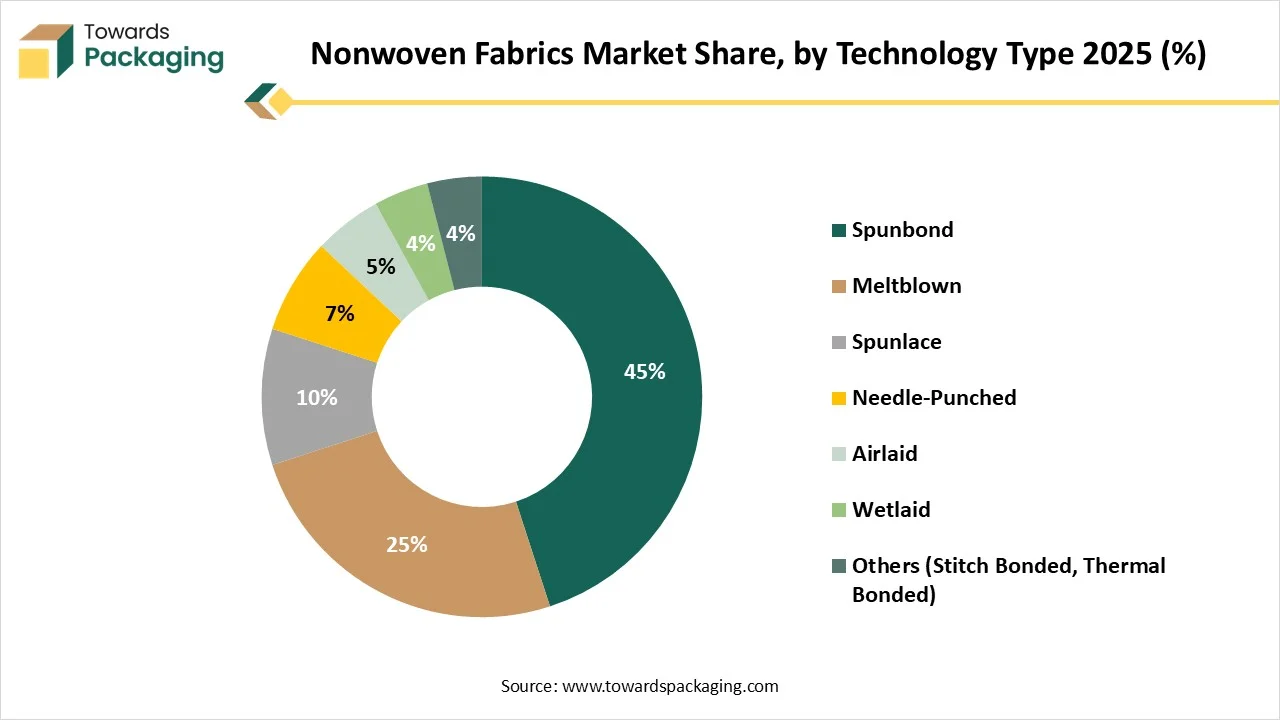

- By technology, the spunbond segment has contributed to the biggest share of 45% in 2025.

- By technology, the meltblown segment will grow at a notable CAGR between 2026 to 2035.

- By material, the polypropylene (PP) segment has invested the largest share of 55% in 2025.

- By material, the biodegradable polymers segment will grow at a notable CAGR between 2026 to 2035.

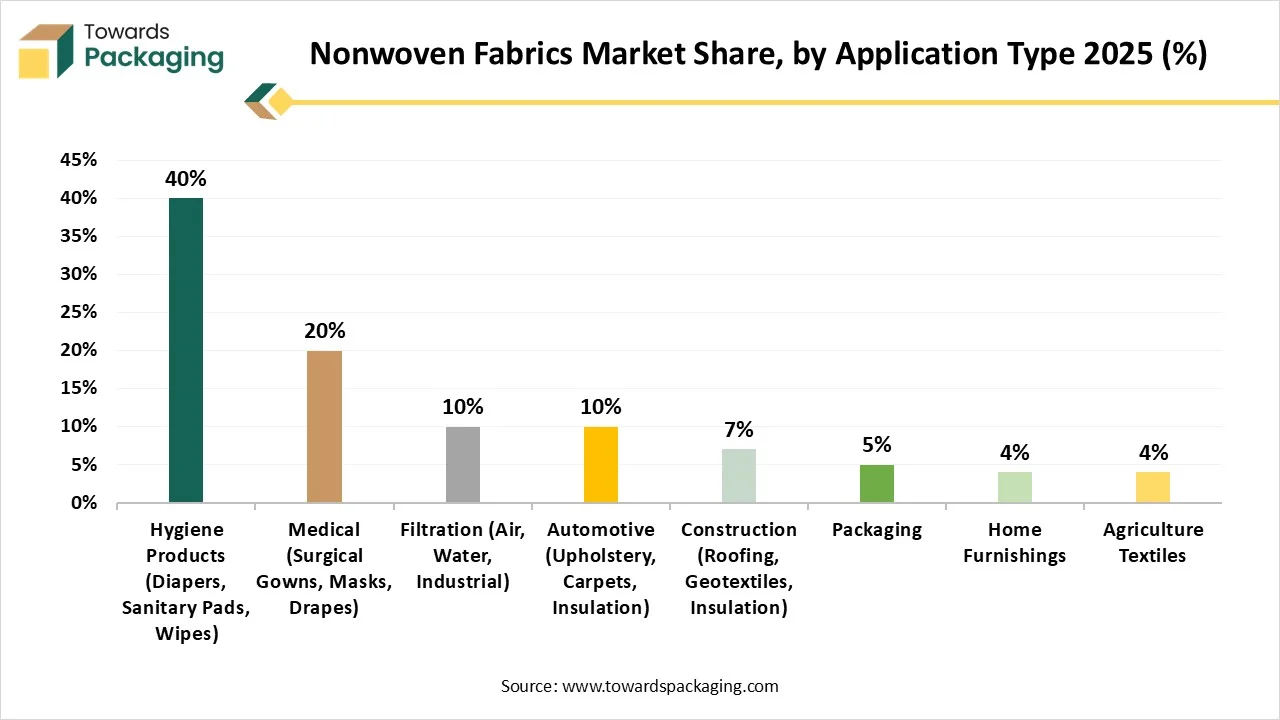

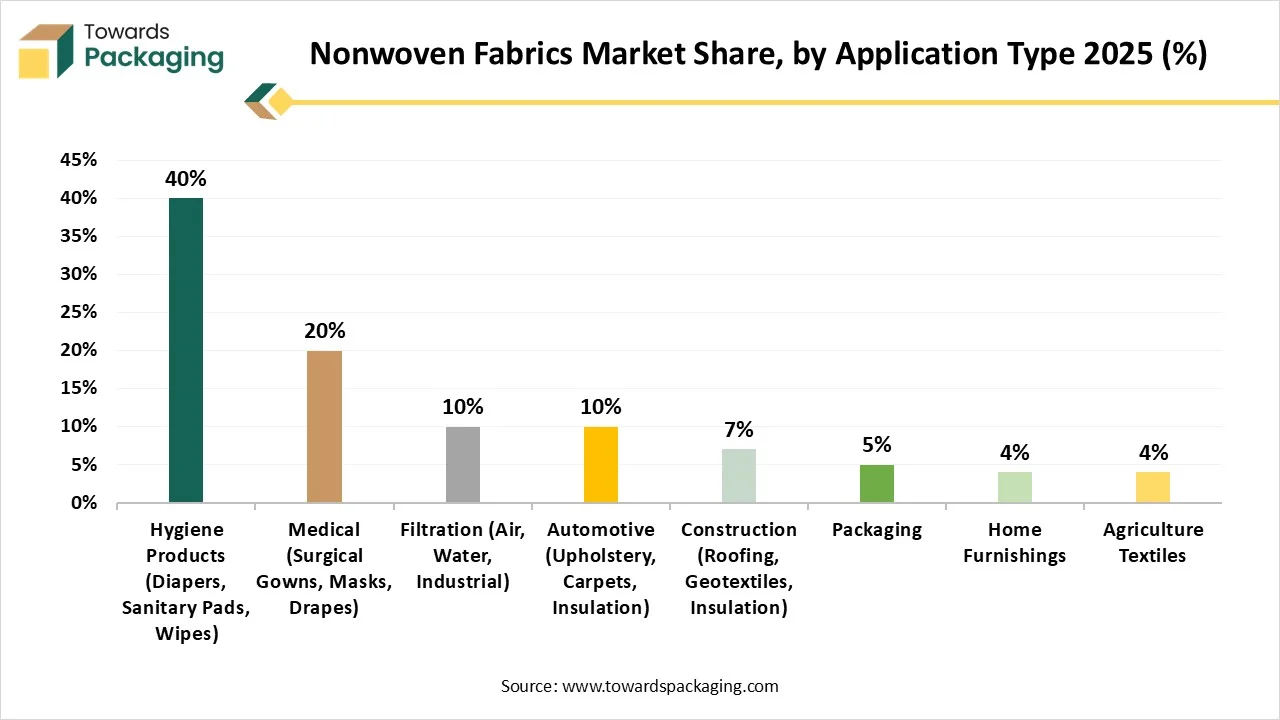

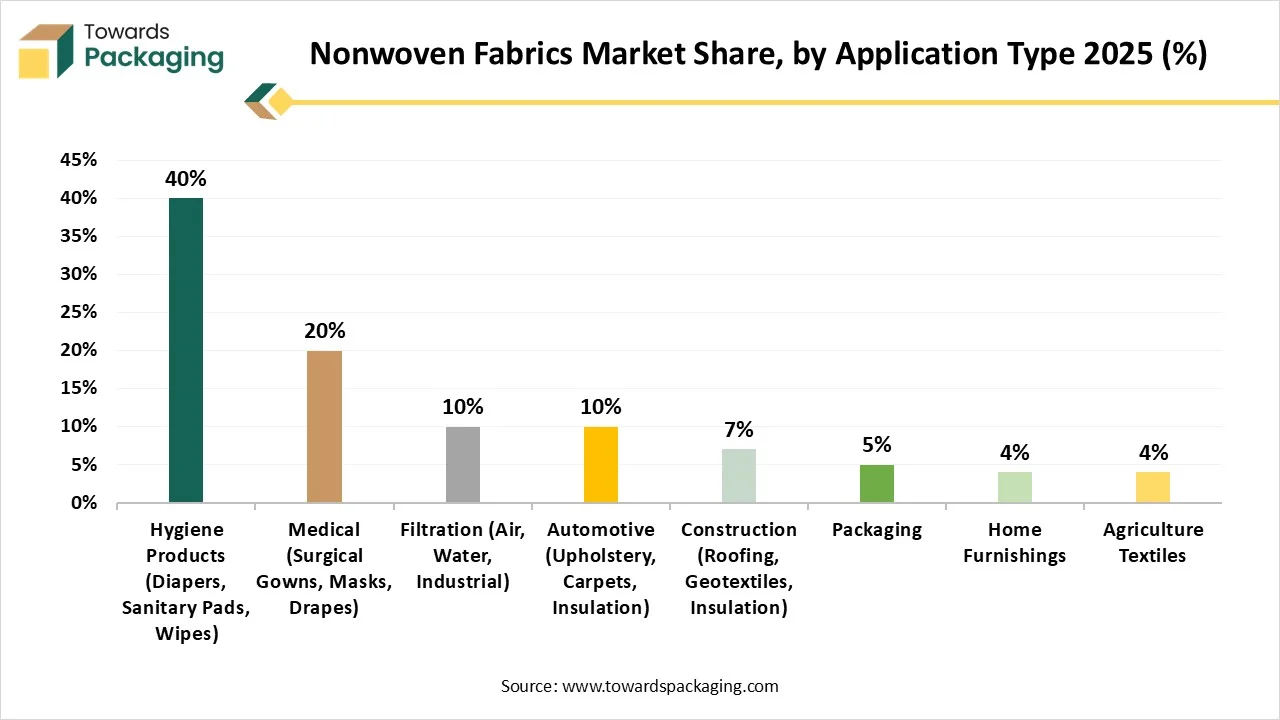

- By application, the hygiene products segment has contributed to the biggest share of 40% in 2025.

- By application, the medical textiles segment will grow at a notable CAGR between 2026 to 2035.

- By end-use industry, the healthcare and hygiene segment has invested the largest share of 48% in 2025.

- By end-use industry, the automotive segment will rise at a notable CAGR between 2026 to 2035.

What Do You Mean By Nonwoven Fabrics?

The nonwoven fabrics market encompasses engineered fabrics manufactured by bonding fibers through mechanical, chemical, or thermal processes rather than traditional weaving or knitting. These fabrics are widely used in hygiene products, medical textiles, filtration, automotive, construction, and packaging due to their lightweight nature, cost-effectiveness, durability, and versatility.

Nonwoven Fabrics Market Outlook

- Industry Growth Overview: Between 2025 and 2034, the market is predicted to reach a high, with the Asia Pacific region at the forefront in terms of growth. This path is being driven by a demand from the hygiene and medical sectors, growing interest in sustainable items, and technological inventions.

- Sustainability Trends: Sustainable nonwovens are a cutting-edge solution for users, sectors, and the environment. It is created from bio-based and recycled materials, which can mainly lower its environmental impact. They can also be crafted to last longer in usage, reducing the demand for steady new product production. It also has technical benefits such as breathability, high wear resistance, and moisture retention.

- Global Expansion: The global expansion of nonwoven fabrics is due to growing demand for performance materials, rising user spending in emerging economies, and strong encouragement towards biodegradable and sustainable products. Main companies are concentrating on invention, strategic partnerships, and cost optimization to capitalize on market opportunities and solve issues like raw material price volatility.

- Major Investors: The major investors counted in nonwoven fabrics are Avgol Industries, Berry Global Inc., Ahlstrom, DuPont, and Freudenberg Performance Materials, too. The other investors included in the nonwoven fabrics are Johns Manville, Glatfelter Corporation, and Kimberly-Clark Corporation, too.

Key Technological Shifts in the Nonwoven Fabrics Market

At the research frontline, companies like the National Institute of Standards and Technology 9NIST) are making autonomous laboratories, in which robotics and AI execute, design, and track experiments without human involvement. X-ray images and microscopy, which once needed meticulous manual review, are now analyzed by machine -learning models, which have the potential of flagging faults or structural characteristics in real time.

For nonwovens, these points of view at a future in which AI could grow and develop the biodegradable fibers, which are PFAS-free, free diagnosis, or antimicrobial finishes that speed up the R&D cycles from years to months. In reality, it serves as a space for how material invention may be redeveloped.

Furthermore, to align with the urgent needs of sectors like construction and automotive, high-performance synthetic fibres have been developed. These fibres serve durability, superior power, and resistance to heat and chemicals.

- Aramid Fibres: With high resistance to heat and abrasion, aramid fibres are used in automotive elements, protective clothing, and aerospace uses.

Trade Analysis of Nonwoven Fabrics Market: Import & Export Statistics

- AS per the current data, in 2024, nonwovens manufacturing in Greater Europe has grown in volume by 2,06% to 2.976,400 tonnes, and by 2.9% in surface area, resulting in 851.1 billion square meters of nonwovens that are being manufactured.

- Also, Thailand’s nonwoven fabrics industry is developing, which is driven by invention and a move towards sustainable technologies. The country’s manufacturing capacity of 162,000 tonnes per year makes it a regional powerhouse.

Emerging Trends in Nonwoven Fabrics Market

- The potential for Biodegradable Nonwovens: There is a main capability for the biodegradable nonwoven sector. Nonwovens can be created from a huge variety of fibres, including those from organic feedstocks. Organic materials for nonwoven fibres now range from novel options like chitin, a natural material found in the shells of sea creatures, to more regular materials like cotton. These biodegradable selections serve as a feasible alternative to petrochemical fibres that dominate the nonwoven industry currently.

- The Future of recycled and compostable nonwoven: There is a huge possibility for developing the carbon footprint of synthetic nonwovens. Even when nonwovens are created from petrochemical-based fibres, they can be obtained from recycled plastics. This move towards using recycled materials is already taking place in the nonwoven sector, with some producers leading the path by including recycled polyester waste.

- Functional geotextiles with mixed sensors for real-time tracking of soil strain, moisture, or corrosion in production.

- Ultrasonic binding procedures and designed spunlace enable more complicated feel and textures in nonwovens without heavy usage of adhesives, which is crucial in the nonwoven fabrics industry.

- Multi-layer composite nonwovens are being combined with several bonding or procedure techs like integrating methblown, spunbond, and hydrogenated layers too to personalise filtration, barrier, power, and soft hand.

- There is usage of biodegradable or bio-based nonwovens like cellulose, PLA, and chitosan in spaces beyond hygiene, like agriculture, packaging, or building geotextiles.

Value Chain Analysis of Nonwoven Fabrics Market

- Material Processing and Conversion: The primary step in the manufacture of nonwovens is the making of the fibres. It starts with the opening of the fibre bales, which plan to classify and homogenise the fibres and create a steady precursor for the nonwoven manufacturing. For this, one should make especially coordinated machine units. This step is important for a constant distribution and mixing of the various fibres and is also determined by the quality of the complete nonwoven.

- Package Design and Prototyping: Textile prototyping is the technique of making a model of an actual fabric or product created from fabric. The aim of the prototype is to assist people in comprehending the value of any creation. There have been numerous textile inventions over recent years with uses that benefit the user, commercial, and industrial markets too.

- Logistics and Distribution: The logistics and distribution for nonwoven fabrics must solve product characteristics like vulnerability to pollutants, lightweight bulk, and modifications in user needs and demands. Smooth and cost-effective supply chain management is important, as the industry is heavily competitive and delivers to different sectors, from automotive to medical.

Technology Insights

How Did The Spunbond Segment Dominate The Nonwoven Fabrics Market?

The spunbond segment has dominated the nonwoven fabrics market with a 45% share in 2024, as the spunbond procedure is widely used to generate nonwoven fabrics. The procedure of creating spunbond fabrics integrates the manufacturing of fabrics with the production of filaments. Elements of a spunbond procedure typically include an extruder, polymer feed, a die assembly, a web formation, and winding too. High procedure smoothness and perfect properties of these fabrics have made them acceptable in various areas of application, such as in medical and disposable uses, filtration, automotive industry, packaging, civil engineering, and carpet backing too. As it avoids fast steps, it is the shortest textile path from fabrics to polymer in one stage and offers possibilities for developing manufacturing and reducing costs. In the past years, spun bond nonwoven has grown rapidly due to its perfect characteristics and high process smoothness.

The meltblown segment is expected to grow at the fastest CAGR during the forecast period. The meltblown technology is one of the most productive techniques for manufacturing fine, highly smooth filter media. Meltholon fibres can receive diameters of less than 10 microns, accurate to 12th the size of the human hair and 15th the size of the cellulose fibre, which enables perfect filtration performance. The procedure starts with raw synthetic thermoplastic materials such as polyethylene tetraphthalate, polypropylene, or polybutylene terephthalate 9PBT). These kinds of materials are being extruded and melted through a die having various microscopic nozzles.

Material Insights

| Material Segments |

Market Share 2025 (%) |

| Polypropylene (PP) |

55% |

| Polyester (PET) |

20% |

| Polyethylene (PE) |

10% |

| Rayon/Viscose |

5% |

| Wood Pulp & Natural Fibers |

5% |

| Biodegradable Polymers (PLA, PHA, etc.) |

5% |

How Did Polypropylene Segment Dominate The Nonwoven Fabrics Market?

The polypropylene segment has dominated the nonwoven fabrics market with a 55% share in 2024, as they are material created from polypropylene fibers that are integrated together through different techniques instead of being knitted or woven. This bonding can be achieved through chemical, mechanical, or thermal procedures, which results in a fabric with unique properties. Just like regular fabrics, which are made by knitting or weaving threads, non-woven fabrics are made from fibres. The polypropylene fibres are being organised, which serve the fabric with its exceptional characteristics and texture.

The biodegradable polymers segment are predicted to rise at the fastest CAGR during the forecast period. Biodegradable nonwoven fabric shows an inventive strategy in the textile sector, which is a replica of the rising awareness of environmental sustainability. Just like regular woven fabrics, which count interlaced threads, nonwoven fabrics are created by bonding fibers collectively through thermal, mechanical, and chemical procedures. This comes in a fabric that is perfect for a huge range of uses, such as medical supplies, hygiene products, and environmentally friendly bags. The different patterns of nonwoven fabrics enable adaptability in functionality and design, which makes them a preferred choice in different sectors.

Application Insights

How Did The Hygiene Products Segment Dominate The Nonwoven Fabrics Market?

The hygiene products segment has dominated the market with a 40% share in 2024, as these fabrics are crafted textures designed particularly for healthcare and personal care applications. Just like woven fabrics, nonwovens are created by integrating fibres collectively through different procedures. This production flexibility enables personalised characteristics such as absorbency, softness, breathability, and barrier protection too. These fabrics are utilised in products like wipes, disposable masks, surgical drapes, and incontinence products. The urge for hygiene nonwovens is driven by rising health awareness, strict hygiene standards globally, and aging populations, too. Their disposable nature assists infection control and lowers cross-pollution risks.

The medical textiles segment is expected to rise at the fastest CAGR during the forecast period. The medical industry is constantly developing, with inventions proposed to improve safety, patient care, and hygiene. One of the most updated materials in this field is non-woven fabric, which has changed the manufacturing of medical disposables. From surgical masks to gowns, wipes, drapes, and non-woven fabrics are now indispensable in ensuring effectiveness and safety in medical textiles. As technology develops, these materials are meant to play an even more complicated role in healthcare, making sure sustainable and safer solutions for professionals and patients.

End-User Industry Insights

| End-Use Industry Segments |

Market Share 2025 (%) |

| Healthcare & Hygiene |

48% |

| Automotive |

15% |

| Construction & Infrastructure |

12% |

| Filtration & Industrial Processing |

10% |

| Consumer Goods & Home Care |

7% |

| Agriculture |

8% |

How Have Healthcare And Hygiene Segment Dominated The Nonwoven Fabrics Market?

The healthcare and hygiene segment has dominated the market with a 48% share in 2024 as nonwoven fabrics are utilised to generate gowns which protect healthcare workers and patients from cross-pollutants. These gowns are crafted to be lightweight yet provide complete comfort and coverage. With the growing demand for personal protective equipment 9PPE0, nonwoven fabrics have been widely used to produce face masks and complete PPE kits. These masks serve protection and filtration while being breathable and comfortable. Nonwoven fabrics are a perfect choice for bath wipes and wound care products, which serve comfort and softness while also being disposable and absorbent. Other necessary items, such as show covers, medical gloves, and bed sheets, are also prevalently created from nonwoven fabrics, ensuring patient safety and hygiene too.

The Automotive segment is predicted to rise at the fastest CAGR during the forecast period. Nonwoven materials are heavily utilised in the automotive sector, driven by the rising demand for lighter, more sustainable materials that develop both comfort and vehicle performance. As automotive designers concentrate on lowering weight, developing acoustics, and assisting eco-friendly goals, nonwovens are heavily classified as a solution. The development of electric vehicles also opens up new possibilities for these materials, as top manufacturers and suppliers predict an intensified role for nonwovens in the future.

Regional Insights

How Has The Asia Pacific Region Dominated The Nonwoven Fabrics Market?

Asia Pacific dominated the market with a 50% share in 2024, as this region is witnessing a fast trend, driven by growing demand in the medical, hygiene, and automotive fields. Market expansion is further developed by technological development in production and a rising focus on sustainability. India and China are the main players in the region due to their robust manufacturing bases and substantial populations. Growing health consciousness and growing disposable incomes in the Asia Pacific are fulfilling the urge for disposable hygiene products such as sanitary napkins, diapers, and adult incontinence products. The COVID-19 pandemic has also led to an increase in the use of nonwovens for medical supplies, such as face masks and surgical gowns. The reliability and acceptability of nonwoven fabrics, specifically polypropylene-dependent materials, make them perfect for a huge range of uses. The spunbond technology is known for its high efficiency, which dominates the market.

China Nonwoven Fabrics Market Trends

The nonwoven fabrics market in China is sizable and expanding. Key growth drivers include rising healthcare infrastructure, increasing demand for eco-friendly and high-performance nonwovens, and innovation in green technologies like biodegradable and nanofiber nonwovens. However, environmental pressures and regulatory policies are pushing manufacturers toward more sustainable raw materials.

North America is expected to be the fastest-growing in the market during the forecast period. The medical and hygiene industries are the biggest drivers of nonwoven fabric usage in North America. The market is being fulfilled by growing health awareness, specifically in the post-pandemic era. An ageing population, which drives the consumption of adult non-constant items. Urge for disposable items like feminine hygiene products, diapers, wipes, and surgical gowns. Manufacturers are moving new capacity towards “long-life sustainable uses”, such as reliable materials that are crafted for recyclability, as per the Association of the Nonwoven Fabrics Industry.

United States Nonwoven Fabrics Market Trends

The nonwoven fabrics market in the United States is sizable and steadily growing. Key drivers include disposable nonwovens, especially for hygiene and medical applications, which are the largest revenue segment. Polypropylene is a major raw material.

Europe expects the notable growth in the market. Europe’s nonwoven fabrics market is also increasingly driven by sustainability: manufacturers are under pressure from EU circular economy policies and consumer demand to use bio-based and recycled fibres. Demand is diversified: disposable nonwovens (like hygiene and medical) dominate revenues, while applications in construction, filtration, and automotive are expanding.

UK Nonwoven Fabrics Market Trends

The UK nonwoven fabrics market is projected to grow significantly. Disposable nonwovens (e.g., hygiene, medical) dominate the market. Increasing demand for sustainable nonwovens including biodegradable and recycled materials is a key trend, driven by environmental awareness and regulatory pressures.

The nonwoven fabrics market in the Middle East & Africa (MEA) is growing strongly. Growth is largely driven by the disposable segment, especially in hygiene and medical applications. In Africa, expanding healthcare infrastructure (rising hospital-acquired infections) and construction investments are key demand drivers. In the automotive sector, MEA’s nonwoven fabrics market (especially spunbond) is also rising, supported by the need for lightweight, cost-efficient materials.

UAE Nonwoven Fabrics Market Trends

The UAE nonwoven fabrics market is estimated to grow at notable rate. Demand is driven largely by hygiene and healthcare applications like diapers, medical gowns, and masks as well as filtration and automotive uses. Spunbond technology is especially important, but meltblown is growing rapidly, largely due to its use in filtration and medical products.

The nonwoven fabrics market in Latin America is projected to grow significantly. Disposable nonwoven fabrics (used in hygiene and medical) are the largest and fastest-growing segment. Brazil is expected to show the strongest growth in the region. Demand is driven by rising healthcare infrastructure, hygiene awareness, and import activity, especially in countries like Mexico and Brazil.

Brazil Nonwoven Fabrics Market Trends

Brazil’s nonwoven fabrics market is strong and growing. Growth is largely fueled by the disposable segment, especially hygiene and medical applications. Polypropylene nonwovens are especially prominent, driven by rising demand for diapers, PPE, and other hygiene products. Other key application areas include automotive interiors, construction geotextiles, and filtration.

Recent Developments

- In September 2025, Lenzing Group, a top global manufacturer of regenerated cellulosic fibers, disclosed the Lenzing Pro, which is a one-stop digital platform for the textile and nonwovens supply chains. It is crafted as a central hub for business users; the stage smooths the branding procedure and certification too.

- In October 2025, Elixrr Industries has disclosed Elixrr NonWovens, a cutting-edge venture in pulp-dependent sustainable nonwovens, which is crafted for the future. With a deep loyalty to performance, circularity, and invention. Elixir Nonwovens is ready to set the latest benchmark for responsibility and quality in the same industry.

- In May 2025, Aquapak introduced a water-soluble, non-toxic, and marine-safe polymer, which is crafted to “update” disposable hygiene products like sanitary pads and wet wipes by making them dissolvable, fully flushable, and free from fatbergs and microplastics, causing residues.

Top Vendors In Nonwoven Fabrics Market And Their Offerings

Berry Global Group, Inc

Corporate Information

- Name: Berry Global Group, Inc. (formerly Berry Plastics Group, Inc.)

- Founded: 1967 (originally as Imperial Plastics)

- Headquarters: Evansville, Indiana, USA

- Number of Employees: ~42,000 (as per its last reports)

- Parent / Ownership: Berry was acquired by Amcor plc in 2025.

History and Background

- Began in 1967 as Imperial Plastics a small plant in Evansville with just one injection-molding machine.

- In 1983, Jack Berry Sr. acquired the company, and it started expanding.

- Over the decades, Berry has grown via acquisitions, buying many companies including: Mammoth Containers, AEP Industries, Clopay, Laddawn, and notably the RPC Group in 2019.

Key Developments and Strategic Initiatives

- Spin-off and Merger: As noted, Berry combined its HHNF business with Glatfelter to form Magnera, scaling its nonwovens / specialty materials business.

- Sustainability / Circular Economy: The company has a stated target (under its Impact 2025 program) to make 100% of its packaging reusable, recyclable, or compostable by 2025.

Mergers & Acquisitions

Acquisition by Amcor (2024–2025)

- In November 2024, Berry Global agreed to be acquired by Amcor plc in an all-stock deal valued at about US$ 8.43 billion.

- Under the deal, Berry shareholders receive 7.25 Amcor shares for each Berry share.

Partnerships & Collaborations

- Nestlé Purina (PetCare): Berry collaborated with Nestlé Purina to create 100% recycled PET packaging for Friskies Party Mix cans, reducing virgin plastic use.

- Circular Economy Alliances: Berry works closely with organizations like the Association of Plastic Recyclers (APR) and RecyClass to develop recyclable and recycled-content packaging.

Product Launches / Innovations

- DecoFusion™ Tubes: Packaging tubes that allow 360° high-quality decorative printing, with a high percentage of recycled content.

- ClariPPil™ Jars: Designed for allergyrelief products; optimized for both performance and recyclability.

Key Technology Focus Areas

- Sustainability / Circular Plastics: Recycled content (PCR), reuse, and design for recyclability.

- Advanced Films & Blown Film Technology: Investment in multilayer blown-film lines to support e-commerce, food, and beverage packaging.

- Healthcare / Medical Packaging: Precision components for medical devices, inhalers, injectables, nasal systems via its India R&D/manufacturing hub.

R&D Organisation & Investment

- R&D Spend & Scale: In the Amcor-Berry combined entity, there is reported annual R&D spend of approximately US$180 million, supported by ~1,500 R&D professionals across ~10 innovation centers.

- Innovation Footprint: The India facility (Sira) includes a “Centre of Excellence” for healthcare packaging, combining design, engineering, and manufacturing.

SWOT Analysis

Strengths:

- Very diversified product portfolio (rigid packaging, films, engineered materials).

- Strong global manufacturing presence.

- Commitment to sustainability (circular packaging, PCR content).

- Large-scale R&D infrastructure and innovation capability (both before and after Amcor merger).

Weaknesses:

- High dependence on raw-material (resin) price fluctuations, which can impact margins.

- Significant debt load (especially given its aggressive M&A strategy). Analysts have pointed out margin pressure risk.

- Integration risk post-mergers (e.g., combining with Amcor, spin-off with Glatfelter).

Opportunities:

- Growing demand for sustainable packaging solutions in consumer markets.

- Expansion in emerging markets (e.g., via its India facility) to serve global healthcare and FMCG customers.

- Innovation in circular materials, advanced film structures, and healthcare packaging.

Threats:

- Regulatory scrutiny relating to plastic waste, recycling, and environmental policy.

- Increasing competition from both large packaging firms and smaller, more nimble sustainable-materials startups.

- Economic cycles and raw-material cost volatility.

Recent News & Strategic Updates

- Spin-off and Creation of Magnera (Nov 2024): Berry’s nonwoven & film business merged with Glatfelter to form Magnera Corp, which began trading under “MAGN.”

- Amcor Acquisition: The all-stock deal (~US$ 8.43B) with Amcor was completed in April 2025.

Other Top Companies

- Freudenberg Group: Freudenberg Group is the best technology group that stretches its users and society long-term through forward-looking inventions. Together with its partners, research institutions, and customers, the Freudenberg Group grows leading-edge technologies and perfect products and services.

- Kimberly-Clark Corporation: Kimberly-Clark Corporation is an American MNC of user goods and personal care products, which generates mostly paper-based products. The company produces sanitary paper products, surgical instruments, and surgical supplies too.

- Ahlstrom-Munksjö: Ahlstrom is the main leader in the fiber-based specialty materials. Their aim is to purify and protect with each fiber, for a suitable World. It is a perfect sustainable specialty materials company for all our stakeholders.

- DuPont de Nemours, Inc.: It is an American multinational chemical company that serves different technology-based materials and solutions to various industries, including water, electricity, and protection and safety too.

- Fitesa S.A.

- Glatfelter Corporation

- Suominen Corporation

- Toray Industries, Inc.

- Johns Manville (Berkshire Hathaway)

- Hollingsworth & Vose

- TWE Group

- Sandler AG

- Low & Bonar PLC

- Pegas Nonwovens

Segmentation of the Nonwoven Fabrics Market

By Technology share

- Spunbond

- Meltblown

- Spunlace

- Needle-Punched

- Airlaid

- Wetlaid

- Others (Stitch Bonded, Thermal Bonded)

By Material

- Polypropylene (PP)

- Polyester (PET)

- Polyethylene (PE)

- Rayon/Viscose

- Wood Pulp & Natural Fibers

- Biodegradable Polymers (PLA, PHA, etc.)

By Application

- Hygiene Products (Diapers, Sanitary Pads, Wipes)

- Medical (Surgical Gowns, Masks, Drapes)

- Filtration (Air, Water, Industrial)

- Automotive (Upholstery, Carpets, Insulation)

- Construction (Roofing, Geotextiles, Insulation)

- Packaging

- Home Furnishings

- Agriculture Textiles

By End-Use Industry

- Healthcare & Hygiene

- Automotive

- Construction & Infrastructure

- Filtration & Industrial Processing

- Consumer Goods & Home Care

- Agriculture

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA