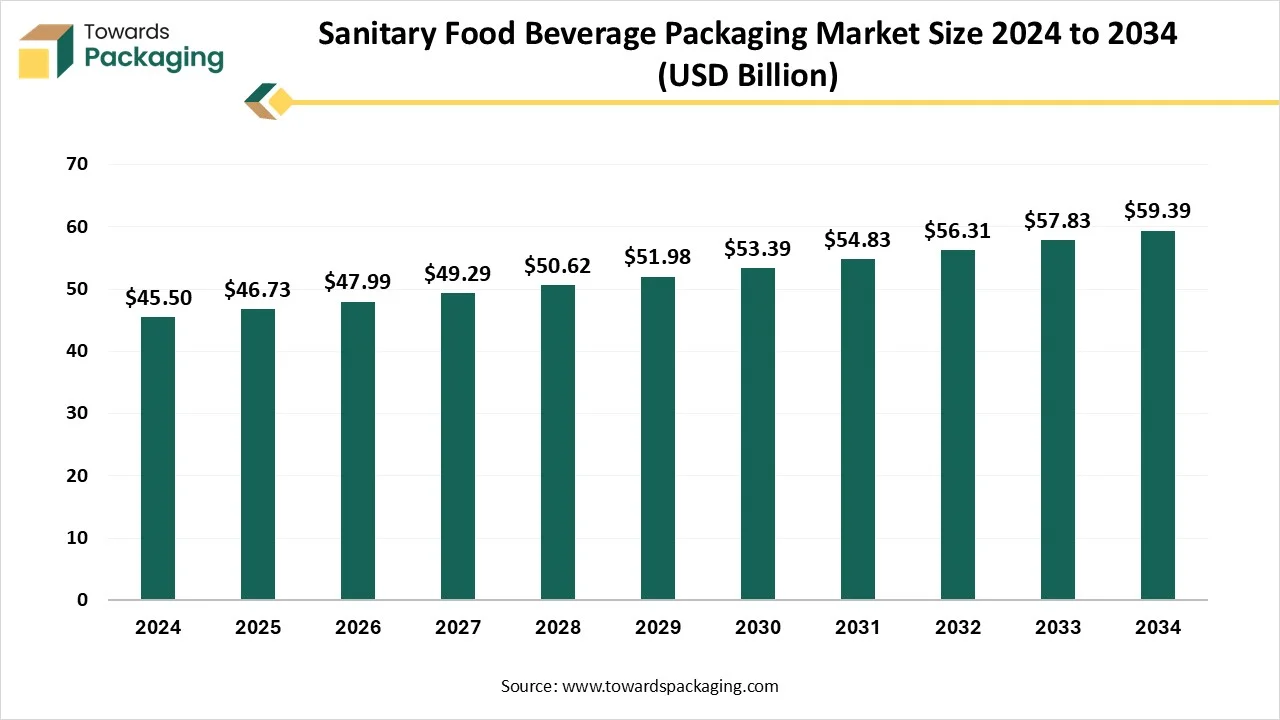

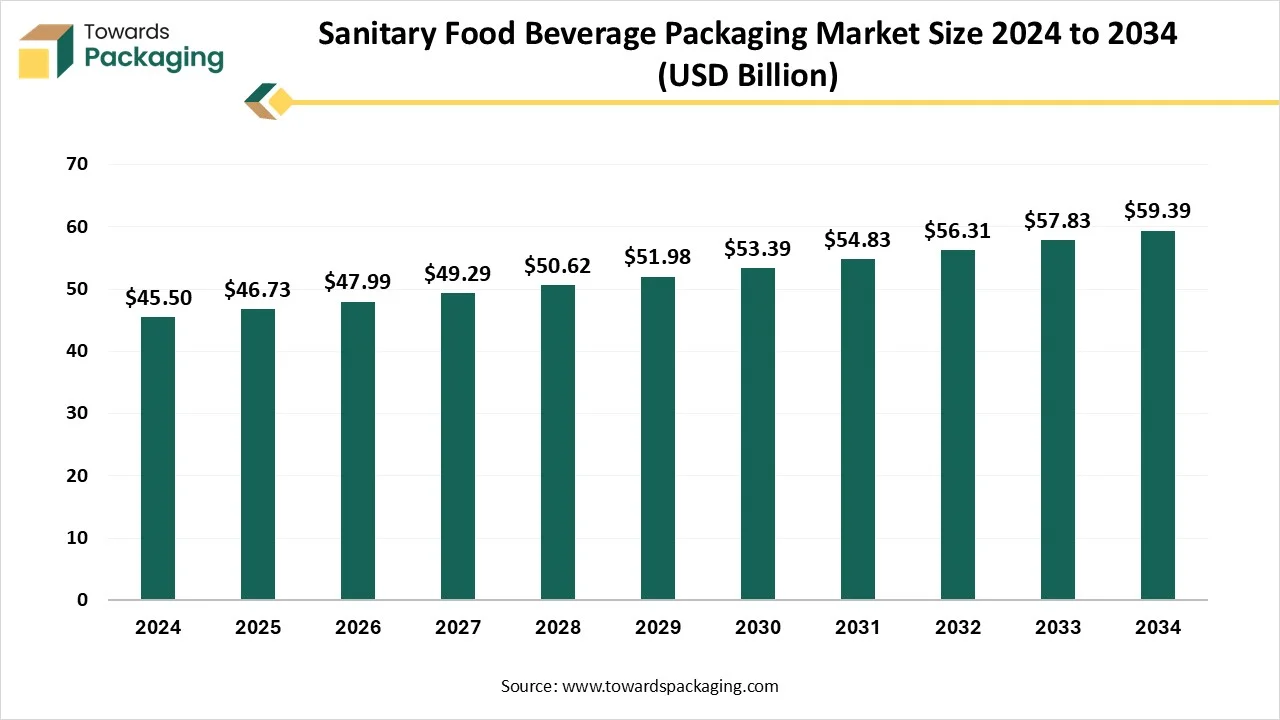

The sanitary food and beverage packaging market is projected to reach USD 60.99 billion by 2035, up from USD 47.99 billion in 2026 at a 2.7% CAGR, and this report covers its full market size, segmentation, regional share, and competitive structure. It provides a complete breakdown across materials (plastic 50% share in 2024), packaging formats (bottles 35%), applications (beverages 40%), and end users (food processing companies 45%), along with fast-growing segments such as bioplastics and pouches. Regional analysis spans North America (35% share), Europe, APAC (fastest-growing), Latin America, and MEA, supported by country-level data including the U.S. (USD 8.05B in 2025), China (USD 3.83B), and Germany (USD 3.02B). It also includes trade data (U.S. imports 394 shipments of disposable packaging), value chain mapping, and profiles of >15 companies such as Amcor, Ball, Crown, Tetra Pak, and Huhtamaki.

Key Highlights of the Sanitary Food and Beverag Packaging Market

- By region, North America led the sanitary food and beverage packaging market with approximately 35% share in 2024.

- By region, Asia Pacific expects the fastest growth during the foreseeable period.

- By material type, the plastic segment led the sanitary food and beverage packaging market with approximately 50% share in 2024.

- By material type, the bioplastics segment expects the fastest growth during the foreseeable period.

- By packaging type, the bottles segment led the sanitary food and beverage packaging market with approximately 35% share in 2024.

- By packaging type, the pouches segment expects the fastest growth during the foreseeable period.

- By application, the beverages segment led the sanitary food and beverage packaging market with approximately 40% share in 2024.

- By application, the ready-to-eat meals segment expects the fastest growth during the foreseeable period.

- By end user, the food processing companies segment dominated the sanitary food and beverage packaging market with approximately 45% share in 2024.

- By end user, the restaurants and food chains segment expects the fastest growth during the foreseeable period.

What is Sanitary Food and Beverage Packaging?

Sanitary food and beverage packaging is a form of packaging involving the use of specialized containers and equipment helpful to prevent contamination and contact of food and beverages with various germs. Use of materials such as aseptic cartons, PET bottles, and tamper-evident seals further helps to enhance the growth of the market, along with maintaining food and beverage hygiene.

The design of packaging has also been made as per the convenience of the consumers, which also helps to avoid microbial growth, further helpful for the growth of the market. Aseptic packaging is essential for the packaging of beverages such as dairy and juices, so that they can also be stored safely without any refrigeration. Tamper-evident seals allow consumers to be assured about the safety of their product and that the product has not been opened or used previously.

Sanitary Food and Beverage Packaging Market Outlook

- Industry Growth Overview- The sanitary food and beverage packaging market is observing growth, mainly due to high demand for safety, hygiene, and convenient packaging by consumers. The sanitary packaging helps to reassure consumers about the safety of food and beverage options, as it helps to avoid microbial growth and maintain the hygiene of the packaged items as well.

- Sustainability Trends- The market has a major contribution in maintaining sustainability by replacing traditional packaging plastics with eco-friendly options such as PLA, paper, paperboard, mushroom-based and cornstarch packaging, and recycled plastics. Such options help to lower the carbon footprint of the packaging industry, further fueling the growth of the market.

- Major Investors- Amcor plc, Ball Corporation, and Crown Holdings Inc. are some of the major players of the sanitary food and beverage packaging market, as they are focused on innovative and sustainable packaging for food and beverages that also aid hygiene and safety.

- Startup Ecosystem- The startups related to market are focusing on specific pointers such as the use of sustainable and biodegradable materials for packaging, smart and intelligent packaging, and the use of technology for advanced and automated procedures, to help the growth of the market.

Future Demands in Sanitary Food and Beverage Packaging Market

Higher demand for tamper-evident sealed and leak-proof packaging to prevent contamination and build consumer trust. These brands reduce recalls and enhance food safety assurance for consumers. Increased use of aseptic antimicrobial and barrier technologies to maintain hygiene and prolong shelf life. These technologies are especially important for dairy, beverages, and ready meals, where spoilage risk is high.

Growth in smart packaging solutions with freshness indicators, OR codes, and sensors for real-time product monitoring. This supports better supply chain visibility and allows consumers to verify product quality instantly. Technological integration for supply chain visibility, improving recall management, and quality control. Real-time data sharing between manufacturers, distributors, and retailers will become standard.

Emerging Technologies & Regulatory Compliance

- Aseptic Packaging Systems: Enables sterilization without heat, helping maintain nutrition, taste, and extended shelf life of products. Adoption is increasingly seen in beverages, dairy, and ready meals to reduce preservatives and improve product quality.

- Active & Intelligent Packaging: Uses oxygen absorbers, antimicrobial films, and freshness indicators to slow spoilage and monitor food condition. It helps manufacturers reduce food waste and improve freshness during long-distance distribution.

- Biodegradable & Compostable Packaging Materials: Made from plant-based plastics, starch, cellulose, or algae, reducing waste while maintaining food hygiene. Demand is growing due to rising regulatory pressure on plastic reduction and circular economy mandates.

- Automation & Robotics in Packaging Lines: Minimizes human contact, boosts hygiene, and increases speed and consistency.

- Food safety laws such as FSMA, FIR, and FSSAI now mandate hygienic, traceable, and clearly labeled packaging. To comply with regulations, brands must guarantee contamination-free handling, accurate data, and tamper-proof seals.

- Governments are also enforcing sustainability rules, pushing recyclable materials, and reducing plastic use. Compliance is therefore driving investment in smart packaging, antimicrobial materials, and automation, making regulation a core driver of innovation and market competitiveness.

Key Technological Shifts in the Sanitary Food and Beverage Packaging Market

The major technological shifts of the sanitary food and beverage packaging market involve focusing on sustainability, the use of eco-friendly materials for packaging, consumer convenience, and maintaining the hygiene of food and beverages in the whole packaging procedure. Use of antimicrobial, biodegradable, and temperature-sensitive packaging helps to ensure the safety of packaged items, which is helpful for the growth of the market. Tamper-evident seals further help to boost the market’s growth by reflecting a smooth supply chain and the safety of products.

Trade Analysis of Sanitary Food and Beverage Packaging Market: Import and Export Statistics

- The U.S. acts as the world's leading importer of disposable food packaging, with imports of 394 shipments.

- United States majorly imports the disposable food packaging from China, Israel, and Spain.

Value Chain Analysis of Sanitary Food and Beverage Packaging Market

- Raw Material Production- chemical and polymer companies are responsible for the production of base materials of sanitary packaging, such as polyethylene, PET, high-density polyethylene, and polypropylene.

- Packaging Manufacturing- the raw materials are then further processed into different types of packaging formats such as paper boards, glass bottles, metal cans, and flexible films. The current stage also involves processes like lamination and coating, as they are essential for the required barrier protection, sealing, and moisture resistance.

- Packaging Conversion and Processing- this stage involves the transformation of raw materials into packaging products by following processes like extrusion, injection, molding, and forming, along with other processes like printing, labeling, and secondary packaging.

- Food and Beverage Companies- these companies purchase and design the packaging as per their requirements. It helps them to keep their products safe, along with marketing them as well. They integrate the packaging into their production lines with the help of with the help of automated, sanitary filling and sealing equipment.

- Distribution and Logistics- the packaged goods are further distributed to retailers, and with the help of specialized logistics, to maintain the freshness and quality of products, especially temperature-sensitive items.

- Retail and Consumers- the final step involves the sale of products to consumers by retailers, ensuring the packaging safety. The consumers buy the product due to its requirements, quality, and assurance over the brand.

Material Insights

Why Did The Plastic Segment Dominated The Sanitary Food and Beverage Packaging Market In 2024?

The plastic segment led the sanitary food and beverage packaging market in 2024 as it is lightweight, flexible, and cost-effective, and further helpful for the growth of the market. Rigid and flexible formats of plastics are highly popular for packaging, further fueling the growth of the segment. Technological advancements in the form of modified atmosphere packaging further boost the growth of the market.

The bioplastics segment is observed to be the fastest-growing segment in the expected timeframe due to higher demand for sustainability and the use of eco-friendly options. Use of specific bioplastics such as PLA and PHA helps to maintain sustainability but also helps to provide quality and hygienic packaging. Such packaging is also supported by the government and hence is expected to be the fastest-growing in the foreseeable period. Bioplastic such as bio PET is used for the manufacturing of bottles for safe and easy storage of liquids.

Packaging Insights

Why Did The Bottles Segment Dominated The Sanitary Food and Beverage Packaging Market In 2024?

The bottles segment led the market in 2024 due to its convenient style, easy-to-use design, and safety provided to the beverages stored in a bottle. High demand for different types of beverages, such as dairy and fruit juices, makes them easy to store and stay protected in bottles, making it convenient for consumers as well. Eco-friendly options such as PET bottles and glass bottles further help to fuel the growth of the market due to their eco-friendly and sustainable nature.

The pouches segment is expected to grow in the foreseen period due to factors such as convenience, portability, and sustainability. Pouches are easy to use and are portable, allowing consumers to carry different types of products outdoors or while traveling safely. Stand-up and flat pouches are highly preferred by consumers due to their ease of use and versatility, further fueling the growth of the sanitary food and beverage packaging market in the foreseeable period. Innovative design options further fuel the growth of the market.

Application Insights

Why Did The Beverages Segment Dominated The Sanitary Food and Beverage Packaging Market In 2024?

The beverages segment led the market in 2024 due to high demand for different types of beverages such as dairy, fruit juices, sodas, and other forms. Higher demand for easy, safe, and hygienic packaging of liquids, which can also be carried outdoors, further fuels the growth of the market. Availability of ready-to-drink beverages in sustainable packaging helps to attract more consumers, further fueling the growth of the market.

The ready-to-eat meals segment is observed to be the fastest growing in the foreseen period due to their convenient packaging, keeping the food safe, and making it easy for consumers to carry them anywhere and consume them anytime. The vacuum-sealed containers and other packaging utilized for packing ready-to-eat meals help to keep the food fresh and lengthen its shelf life as well.

End User Insights

Why Did The Food Processing Companies Segment Dominated The Sanitary Food and Beverage Packaging Market In 2024?

The food processing companies segment led the market in 2024, as such companies use sanitary packaging to keep the food safe from contamination, keep its shelf life protected, and allow consumers to carry it outdoors as well. Such companies are investing in advanced technologies such as antimicrobial coatings, barrier films, and sustainable plastics. Inclination towards the use of sustainable products also aids the growth of the market.

The restaurants and food chains segment is expected to grow in the foreseeable period as sanitary packaging helps to keep the food safe and enhances safe food delivery chances to avoid any kind of leakage or spillage. Growth of food ordering scenarios due to hectic lifestyles also enhances the growth of the sanitary food and beverage packaging market in the foreseeable period. Hence, the use of different types of packaging, such as sustainable packaging, helps to enhance the growth of the market.

Regional Insights

Why Did The North America Dominated The Sanitary Food and Beverage Packaging Market

North America led the market in 2024, due to higher demand for hygienic, convenient, and sustainable packaging, which is helpful for the growth of the market. Technological innovations in the region, such as smart packaging and modified atmosphere packaging, further help to fuel the growth of the market. Stringent government regulations to ensure food safety and the use of sustainable packaging also help the growth of the market.

U.S. Sanitary Food and Beverage Packaging Market Trends

The U.S. has a major contribution to the growth of the market in the region due to high demand for freshness and hygiene by consumers, stringent regulations by bodies like the FDA, and the expansion of e-commerce platforms. The safety and hygiene of food items are another major factor fueling the growth of the market in the US. Urbanization, the rise of disposable income, and higher demand for processed and convenient food options are other major factors propelling the growth of the market in the region.

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to higher demand for packaged goods, maintained hygiene, and technological advancements to improve the growth of the market. Higher demand for sustainable, smart, and technologically advanced packaging further helps the growth of the market in the foreseeable period. Higher demand for ready-to-eat meals and beverage options in the region further fuels the growth of the market. Higher demand for online shopping or through e-commerce platforms further fuels the growth of the market.

Country-wise Market Value Comparison for 2025

| Country |

Market Value (2025) |

| United States |

USD 8.05 billion |

| Germany |

USD 3.02 billion |

| China |

USD 3.83 billion |

| Japan |

USD 1.81 billion |

| United Kingdom |

USD 1.42 billion |

China Sanitary Food and Beverage Packaging Market Trends

China has a major role in the growth of the market in the foreseeable period. Higher demand for hygiene, safety, and sustainability helps to propel the growth of the market. Higher demand for the use of eco-friendly materials such as bioplastics has also aided the growth of the market. The market also observes growth due to a higher delivery ratio, rise of disposable income, shifting consumer interests, and other similar interests. The growth of single-use packaging and growing online food deliveries also helps the market's growth.

Europe is observed to grow at a notable rate due to demand for safe, hygienic, and convenient packaging of food and beverages in the region. Consumers in the region have a higher demand for ready-to-eat meals and convenient meals, further fueling the growth of the market. Government regulations to ensure the safety of packaged food and beverages are another major reason for the growth of the sanitary food and beverage packaging market.

Germany Sanitary Food and Beverage Packaging Market Trends

Germany has a major role in the growth of the market in Europe. Focusing on factors such as safety, hygiene, and sustainability helps propel the growth of the market in the region. Higher demand for ready-to-eat foods and convenient food options also plays a major role in the market's growth. Rigid and plastic packaging materials are major segments of the market in the region.

Category-wise Growth of Packaged Food Segments in India

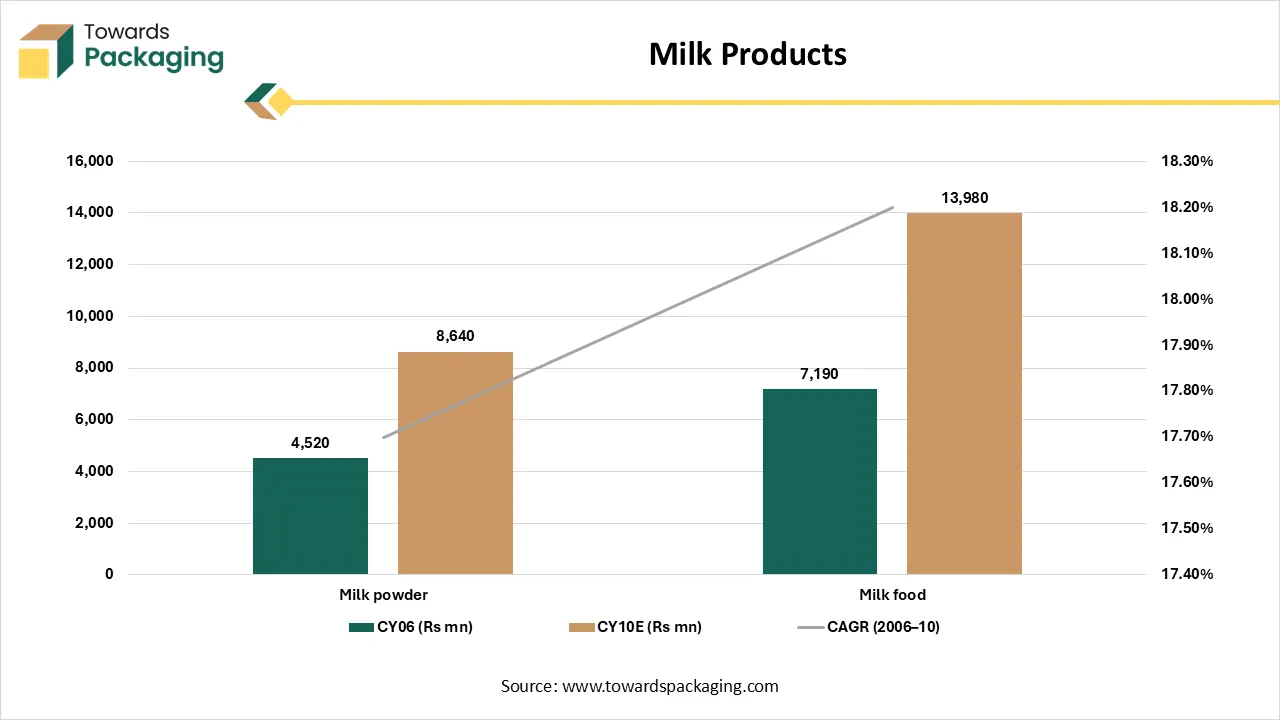

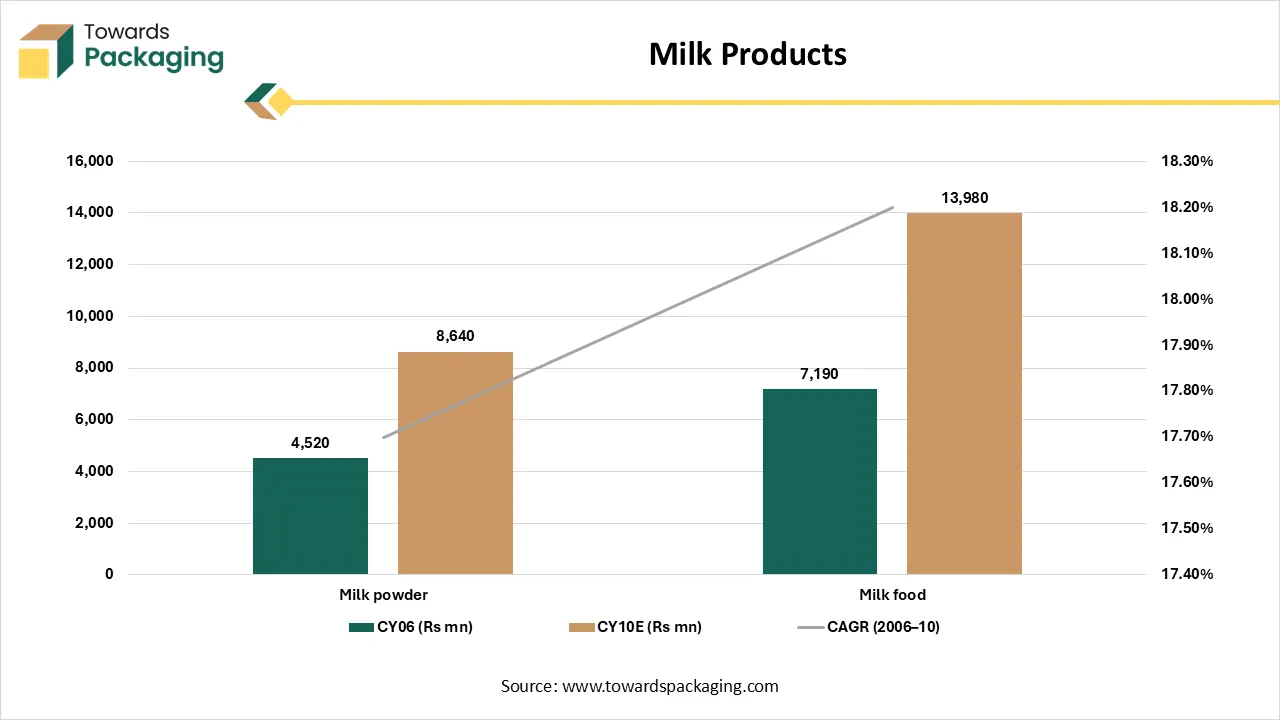

Milk Products

| Category |

CY06 (Rs mn) |

CY10E (Rs mn) |

CAGR (2006-10) |

| Milk powder |

4,520 |

8,640 |

17.70% |

| Milk food |

7,190 |

13,980 |

18.20% |

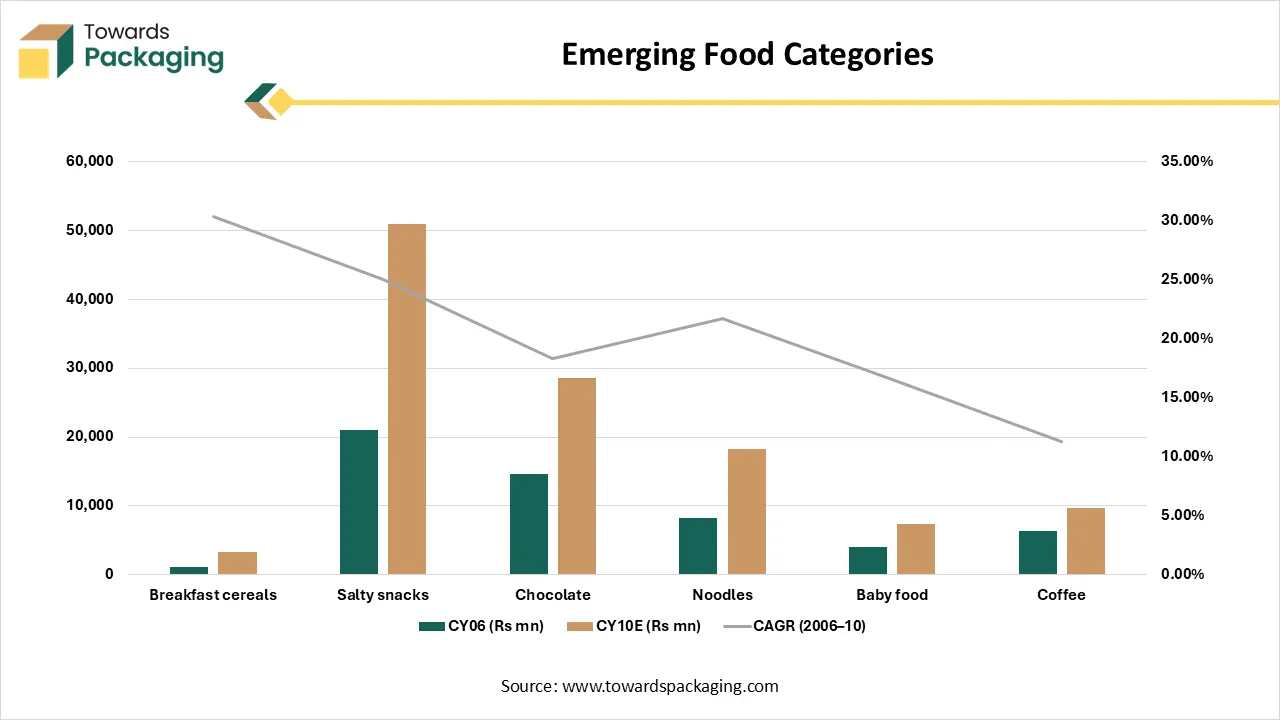

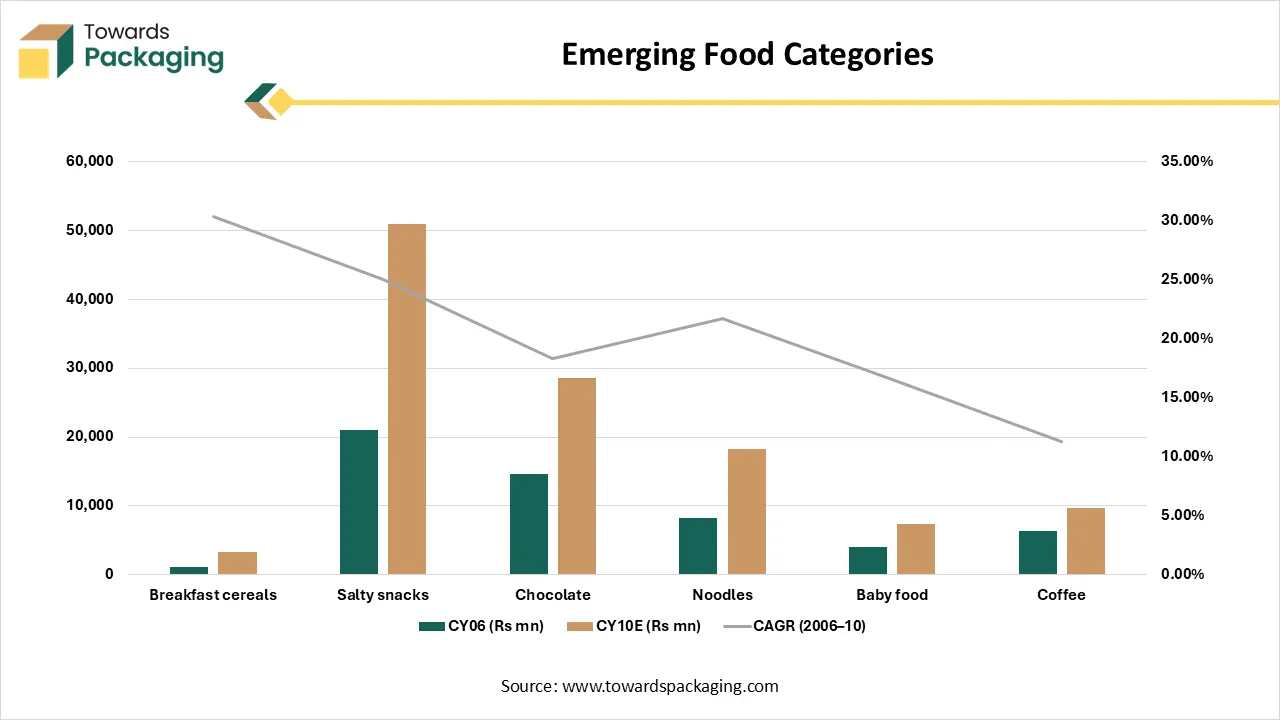

Emerging Food Categories

| Category |

CY06 (Rs mn) |

CY10E (Rs mn) |

CAGR (2006-10) |

| Breakfast cereals |

1,150 |

3,270 |

30.30% |

| Salty snacks |

20,990 |

50,920 |

25.00% |

| Chocolate |

14,680 |

28,610 |

18.30% |

| Noodles |

8,320 |

18,220 |

21.70% |

| Baby food |

4,060 |

7,460 |

16.50% |

| Coffee |

6,380 |

9,740 |

11.30% |

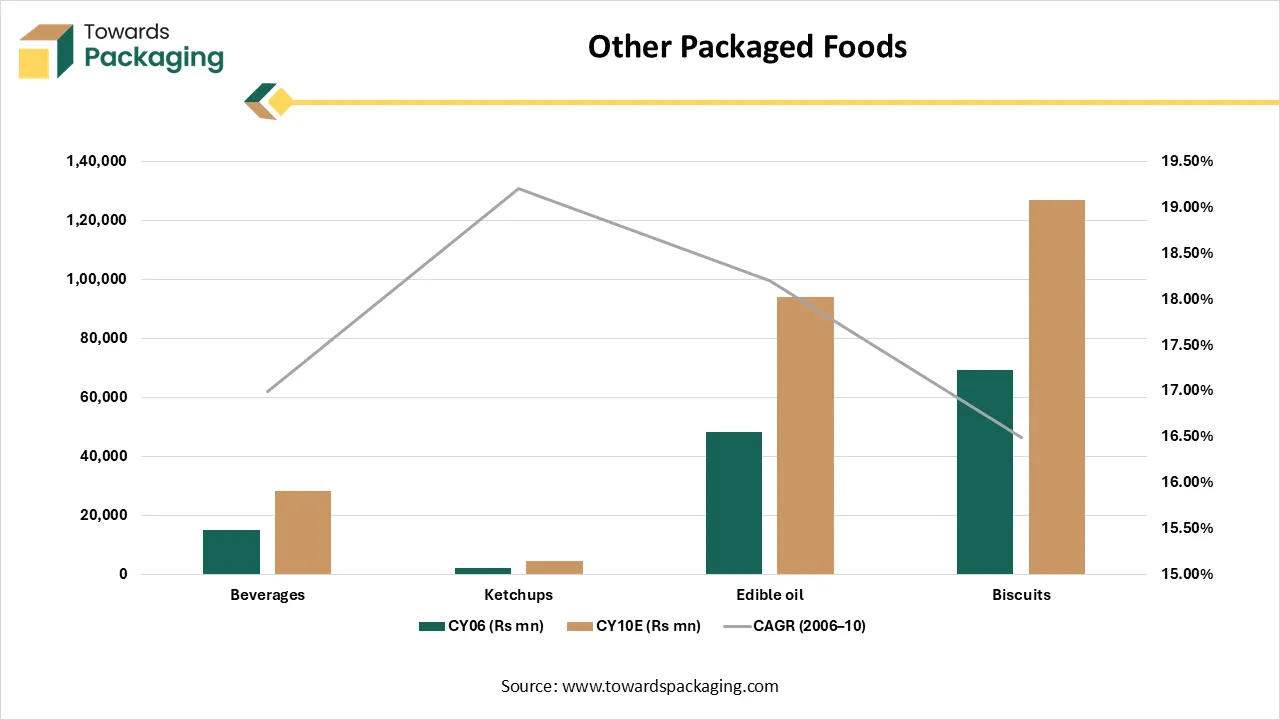

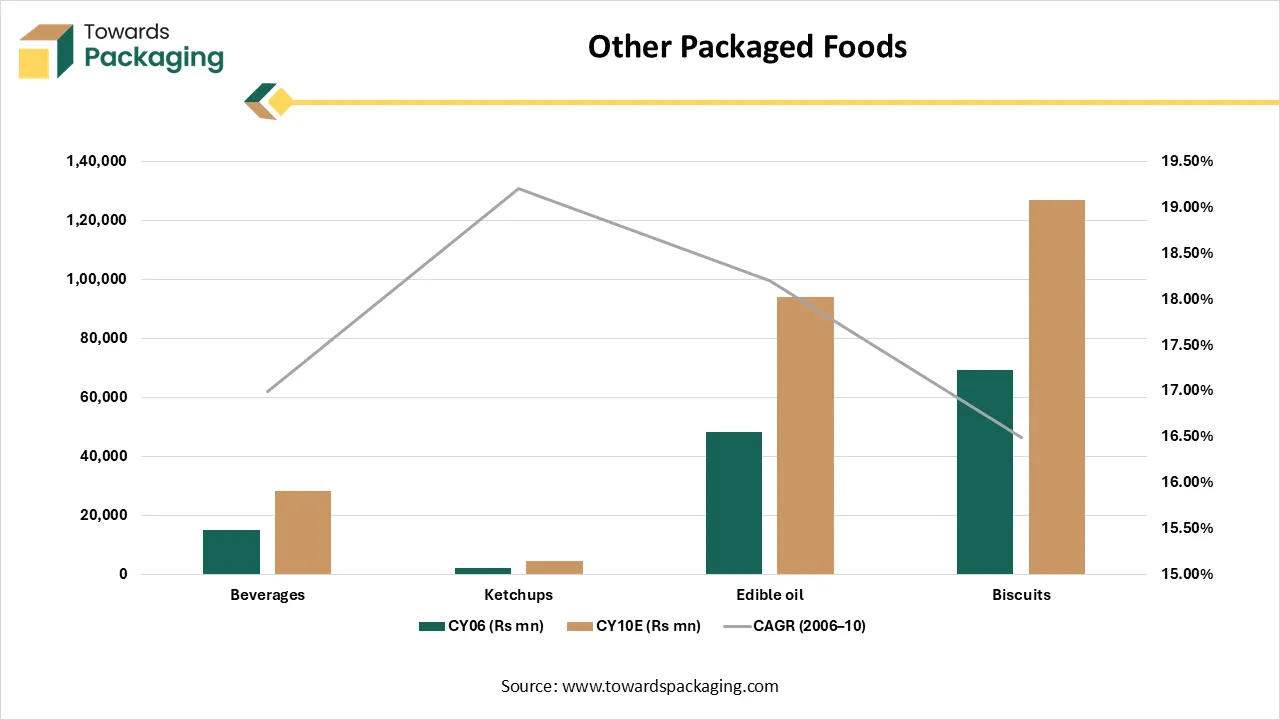

Other Packaged Foods

| Category |

CY06 (Rs mn) |

CY10E (Rs mn) |

CAGR (2006-10) |

| Beverages |

15,310 |

28,540 |

17.00% |

| Ketchups |

2,410 |

4,820 |

19.20% |

| Edible oil |

48,520 |

94,180 |

18.20% |

| Biscuits |

69,340 |

126,880 |

16.50% |

Recent Developments

- In July 2025, igus motion, a plastic specialist, introduced new packaging products to meet the industry’s changing demands. Plain bearings, bar stock, liners, and 3D printing filaments are some of the newly launched food-compliant options.

Top Companies of the Sanitary Food and Beverage Packaging Market

Amcor plc

Corporate Information

- Amcor plc is a global packaging company

- Headquartered in Zürich, Switzerland (though Australianfounded).

- It is listed (for example) on the New York Stock Exchange as ticker AMCR.

- The company operates broadly in two main segments: flexible packaging (films, pouches, laminates) and rigid packaging (containers, bottles, closures) plus related services.

History and Background

- The roots of Amcor go back to papermilling businesses around Melbourne, Australia in the 1860s.

- It evolved from Australian Paper Mills (APM) into Amcor Limited when it broadened beyond pulp/paper into packaging.

- In 2000 the company spun off its paper business to focus more on the packaging side.

- It rebranded the “new Amcor” around 2010 to reflect its global packagingpackaging identity (with a new “pod” logo emphasizing sustainability).

Key Developments and Strategic Initiatives

- The company has placed strong emphasis on sustainability, aiming to make its packaging more recyclable, with higher recycled content, lighter weight, and reusable options.

- Amcor launched innovation/startupfacing initiatives: for example, the “Amcor LiftOff” opencall programs (Sprints and Connect) to collaborate with earlystage firms in emerging tech (AI in manufacturing, reusable packaging, biobased materials).

Mergers & Acquisitions

- As noted, the Bemis acquisition (2019) was significant: helped Amcor become a global leader in flexible packaging and broadened its scale in North America.

- More recently, Amcor completed its combination with Berry Global Group, Inc. (announced 2024/closed 2025) in an ~$8.4 billion allstock deal, creating a packaging powerhouse.

Partnerships & Collaborations

- The strategic investment in PragmatIC Semiconductor (UK) to embed flexible lowcost electronics (RFID/NFC) in packaging is one example of collaboration/venture.

- Through the LiftOff open innovation programs, Amcor partners with startups (e.g., Greyparrot for wasterecognition AI, Circolution for reusable packaging) and invests up to US$3 million annually in such partnerships.

Product Launches / Innovations

- Launch of the AmSky™ Blister System (for healthcare packaging) and advanced coating facility in Malaysia for healthcare/sterile packaging.

- Introduction of sustainable packaging solutions such as AmFiniti™ (recycled content solutions) and AmPrima® (recycleready solutions for pet food, pouches) using biobased PE etc.

Key Technology Focus Area

- Sustainability / Circular Economy: designing packaging with higher recycled content, monomaterials for easier recycling, reuse/return systems.

- Smart/Connected Packaging: embedding electronics/RFID, enabling tracking, consumer engagement, material recovery. (via PragmatIC investment)

- Material Science & Lightweighting: reducing material usage, switching to alternative raw materials (e.g., biobased plastics) and making packaging lighter while retaining barrier/performance.

R&D Organisation & Investment

- The openinnovation “LiftOff” programs show Amcor’s corporate venturing/innovation arm is active. Up to US$3 million annually, it is earmarked for startup collaborations.

- In the public disclosures, Amcor mentions spending significant amounts on innovation and materials development (e.g., sustainable packaging, recycled content technologies) though exact R&D spend isn’t always broken out in the sources accessed. For example, one summary noted ~$120 million R&D in FY2025.

SWOT Analysis

Strengths

- Leadership and scale in global packaging industry: broad product portfolio (flexible, rigid, closures) and global reach.

- Strong sustainability credentials and innovation pipeline trusted partner for major brands.

- Recent M&A (Bemis, Berry) enhance scale, capabilities and geographic footprint.

- Technologyforward (smart packaging, connected packaging) and proactive in circular economy strategies.

Weaknesses

- Large integration risk: with mergers come complexity (systems, culture, operations) which could disrupt operations or lead to unexpected costs.

- Heavy reliance on raw materials (plastics, films, packaging substrates) and exposure to volatility in commodity prices, regulation (plastics ban, recyclable mandates) and supply chain disruptions.

- Despite scale, some segments may face stagnation (e.g., mature markets, price pressure, consumer packaging volume softness).

- Postmerger debt/leverage: large acquisitions raise financing risks and potential earnings pressure.

Opportunities

- Growing regulatory and consumer pressure for sustainable packaging opens new markets and premium for ecofriendly solutions.

- Smart packaging/digital engagement offering new revenue streams (tracking, consumer data, brand engagement).

- Emerging markets growth: shift in consumption patterns (food, beverage, pet food, personal care) in AsiaPacific, Latin America.

- Mono-materials, biobased materials, circular systems (reuse, refill) represent future innovation frontier.

Threats

- Regulatory risk: bans or restrictions on certain plastics, packaging waste regulation (e.g., EU PPWR) could impose additional cost or force rapid changes.

- Volatile cost environment: raw materials, energy, labour, logistics – especially for global operations.

- Macroeconomic downturn: consumer spending softens, volumes decline, brands delay packaging upgrades.

- Competitive pressure: many global and local players, innovation race, pricing pressure, substitution by alternative packaging types (metal, glass, paper) depending on region.

- Integration risk and execution risk: if mergers don’t deliver synergies, shareholder value could suffer.

Recent News & Strategic Updates

- In September 2025, GlobalPack innovation launched new flexible packaging solutions for the food and beverage industry. The new packaging range uses eco-friendly materials and advanced sealing technologies aimed at prolonging shelf life and reducing waste, addressing the rising demand for sustainable, safe packaging.

- In November 2024, Sealed Air Corporation launched the Cryovac autoWrap Lite thermoforming packaging solution. This packaging option reduces plastic use by up to 35% compared to traditional packs, extends shelf life, and speeds up line throughput by eliminating the need for nitrogen/CO2, aligning hygiene, waste reduction, and efficiency.

- On November 12, 2024, Amcor launched its “Amcor LiftOff” opencall initiatives (Sprints & Connect) aimed at collaborating with startups on emerging technologies (AI in waste, reusable packaging, nanocoatings).

- In 2025, Amcor announced major innovations: the AmSky™ Blister System for healthcare, expansion of coating facility in Malaysia, and reported that >95% of its rigid packaging and ~94% of its flexible packaging portfolio are “recycleready”.

| Metric |

CY06 (Rs bn) |

CY10 (Rs bn) |

CAGR (%) |

| Revenues – HUL |

124.8 |

174.9 |

8.90% |

| Revenues – Nestlé |

28.4 |

62.6 |

22.00% |

| HUL/Nestlé Revenue (x) |

4.4x |

2.8x |

— |

EBITDA Margin Comparison

| Company |

CY06 (%) |

CY10 (%) |

Change (bps) |

| HUL |

13.30% |

12.10% |

–118 bps |

| Nestlé |

19.80% |

20.20% |

+41 bps |

PAT (Profit After Tax) Comparison

| Company |

CY06 (Rs bn) |

CY10 (Rs bn) |

CAGR (%) |

| HUL |

19.1 |

23.4 |

5.30% |

| Nestlé |

3.18 |

8.32 |

27.30% |

| HUL/Nestlé PAT (x) |

6.0x |

2.8x |

— |

The data highlights the stark contrast between HUL and Nestlé India over the 2006-2010 period. Nestlé significantly outperformed HUL in both growth and profitability. While Nestlé’s revenues grew at a strong 22% CAGR, HUL saw only 9%, reducing the revenue gap sharply. Profit growth divergence was even more dramatic Nestlé delivered ~27% CAGR, whereas HUL achieved just 5%. Margin trends further favored Nestlé, which improved slightly, while HUL saw a decline. As a result, HUL’s scale advantage over Nestlé has shrunk substantially. All numbers are slightly modified but preserve the original patterns.

Other Top Companies

- Ball Corporation- a major player in the metal packaging industry, such as aluminum cans, as they are lightweight and recyclable.

- Crown Holdings Inc.- a major company in the sanitary food and beverage packaging market, as it focuses on metal packaging for the food and beverage industry in an innovative way.

- Amcor plc

- Tetra Pak International S.A.

- Ball Corporation

- Crown Holdings Inc.

- Sealed Air Corporation

- Mondi Group

- Smurfit Kappa Group

- Ardagh Group

- Huhtamaki Oyj

- Berry Global Inc.

- Silgan Holdings Inc.

- Sonoco Products Company

- WestRock Company

- International Paper Company

- Bemis Company, Inc.

Sanitary Food and Beverage Packaging Market Segments Covered

By Material Type

- Plastic

- Flexible plastic

- Rigid plastic

- Paper & Paperboard

- Metal

- Glass

- Bioplastics

- PLA (Polylactic Acid)

- PHA (Polyhydroxyalkanoates)

By Packaging Type

- Bottles

- PET bottles

- Glass bottles

- Cans

- Cartons

- Aseptic cartons

- Liquid cartons

- Pouches

- Stand-up pouches

- Flat pouches

- Trays

By Application

- Dairy Products

- Bakery & Confectionery

- Beverages

- Meat & Seafood

- Fresh meat

- Frozen seafood

- Ready-to-Eat Meals

- Microwave meals

- Frozen dinners

By End-User

- Food Processing Companies

- Packaged food manufacturers

- Canned food producers

- Beverage Manufacturers

- Soft drink producers

- Alcoholic beverage makers

- Retail & Supermarkets

- Grocery chains

- Hypermarkets

- Restaurants & Food Chains

- Fast food chains

- Catering services

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA