Automatic Labeling Machine Market Insights: Size Forecast, Trends, Segments, Regional Dynamics (NA, EU, APAC, LA, MEA), Value Chain & Supplier Ecosystem Analysis

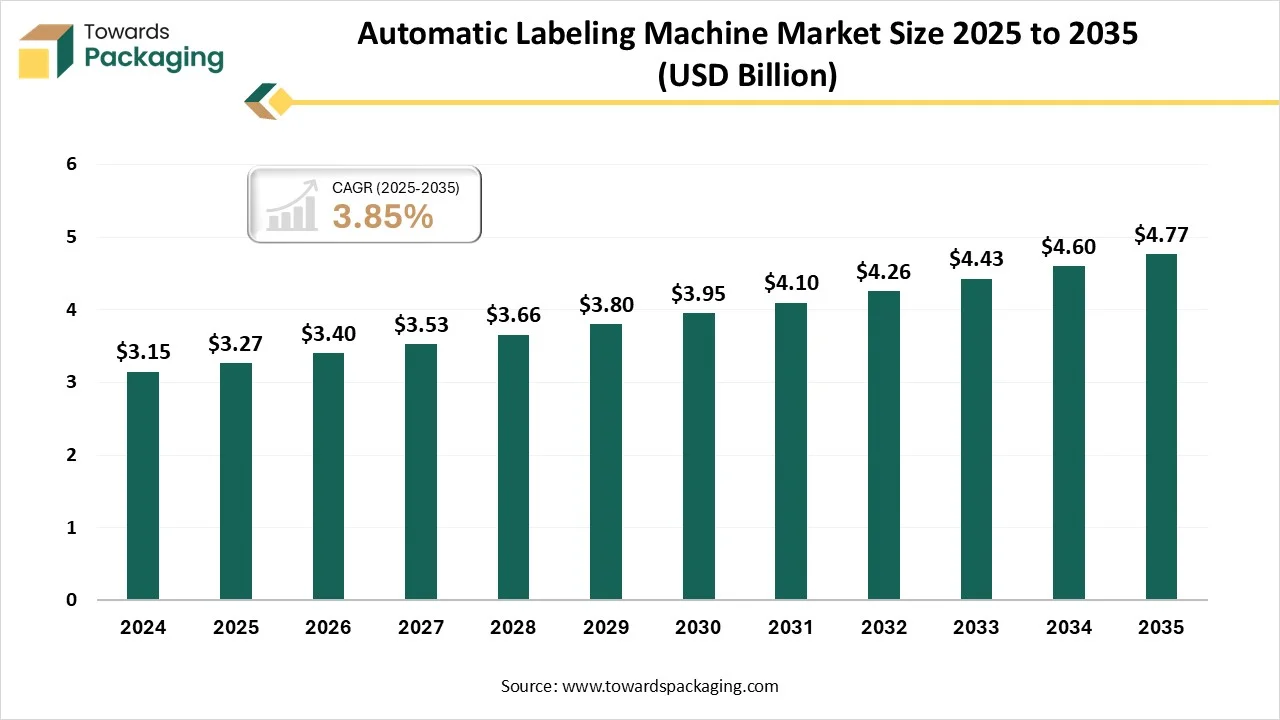

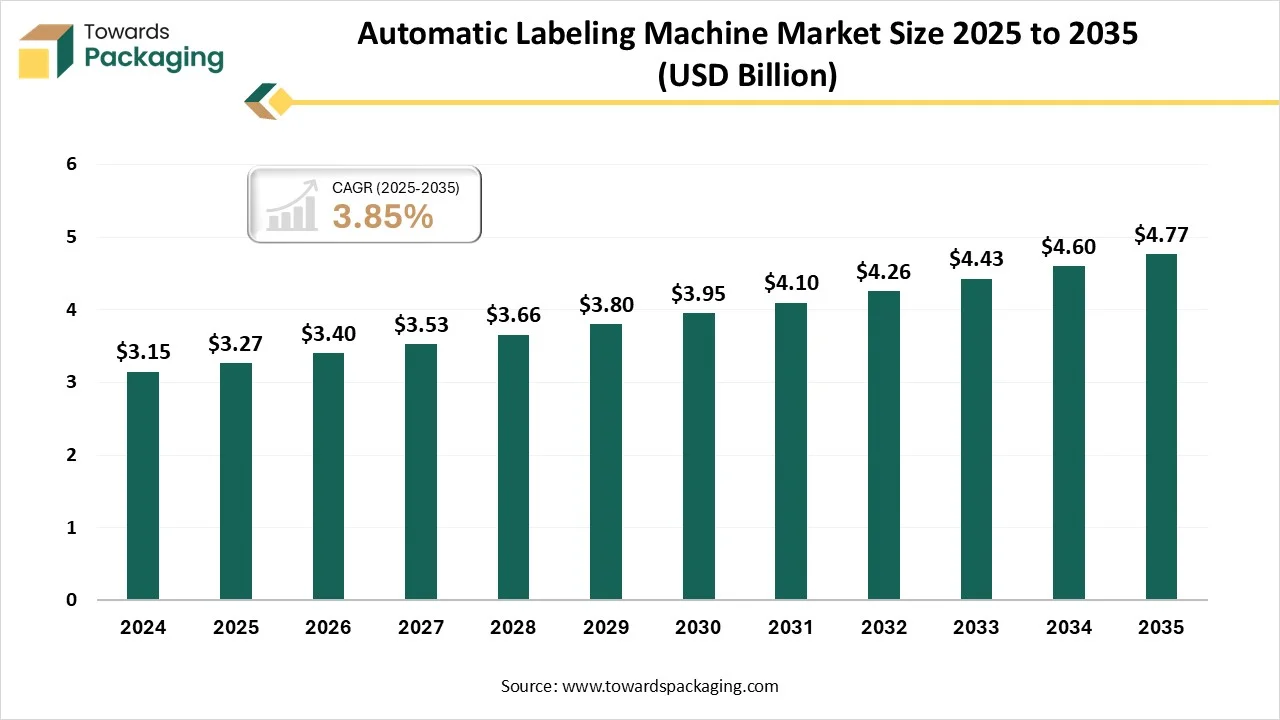

The automatic labeling machine market is projected to expand from USD 3.4 billion in 2026 to USD 4.77 billion by 2035, achieving a CAGR of 3.85%. Self-adhesive labeling systems hold a 39% market share, while shrink-sleeve systems are growing fastest at 5.6% CAGR, supported by rising demand in beverages and FMCG. Fully automatic machines dominate with 62% share, driven by industries where automation adoption exceeds 71%.

Regionally, Asia Pacific leads with 42% of total market share, fueled by China’s manufacturing output growing at 9.4% annually. Europe follows with 28%, supported by strict labeling regulations driving 14% annual increases in compliance technology investments. Latin America shows the fastest rise with a 6.7% CAGR, driven by Brazil and Mexico where F&B automation adoption is now above 54%.

Trade data highlights major importers like Mexico (18,912 shipments), Ukraine (17,964), and Argentina (6,871). These three countries account for over 34% of global labeling machine import flows. The competitive landscape includes companies such as Krones AG (serving >150 countries), HERMA (holding 11% European share), KHS (over 5,000 installed systems), Sacmi (operating across 80+ global markets), and ProMach (with 40+ product brands).

Major Key Insights of the Automatic Labeling Machine Market

- In terms of revenue, the market is valued at USD 3.4 billion in 2026.

- The market is projected to reach USD 4.77 billion by 2035.

- Rapid growth at a CAGR of 3.85% will be observed in the period between 2025 and 2035.

- By region, Asia Pacific dominated the global market by holding highest market share of 42% in 2024.

- By region, Latin America is expected to grow at a notable CAGR from 2025 to 2035.

- By labelling type, the self-adhesive labeling machines segment contributed the biggest market share of 39% in 2024.

- By labelling type, the shrink-sleeve labeling machines segment will be expanding at a significant CAGR in between 2025 and 2035.

- By automation level, the fully automatic labeling machines segment contributed the biggest market share of 62% in 2024.

- By automation level, the semi-automatic labeling machines segment will be expanding at a significant CAGR in between 2025 and 2035.

- By end use industry, the food & beverage segment contributed the biggest market share of 38% in 2024.

- By end use industry, the pharmaceuticals segment will be expanding at a significant CAGR in between 2025 and 2035.

- By control technology, the servo-driven / electronic systems segment contributed the biggest market share of 52% in 2024.

- By control technology, the electromechanical systems segment is expanding at a significant CAGR in between 2025 and 2035.

What is Automatic Labeling Machine?

The Automatic Labeling Machine comprises high-speed, precision systems designed to automatically apply labels to a wide variety of packages and containers. These machines are integrated into packaging lines across food, beverage, pharmaceutical, cosmetic, and chemical industries for product identification, traceability, and branding. They utilize multiple labeling formats self-adhesive, sleeve, wet-glue, and in-mould combined with servo drives, machine vision, and PLC/HMI automation. Market growth is driven by manufacturing automation, compliance with serialization and barcode standards, and increasing demand for energy-efficient, digital-ready labeling solutions.

Automatic Labeling Machine Market Outlook

- Market Growth Overview: The automatic labelling machine market is progressing rapidly due to huge demand for automation and efficiency, increasing e-commerce sector, regulatory compliance, branding and product differentiation.

- Global Expansion: Regions such as Latin America, North America, Asia Pacific, Europe, South America, Middle East & Africa are witnessing rising automation demand, advanced technologies, regulatory compliance, and growing e-commerce sector which are the major factors behind the growth of this market.

- Major Market Players: Automatic labelling machine market includes Herma, Krones AG, Sidel, ProMach, Sacmi, and KHS.

- Startup Ecosystem: The startup industries play an important role in smart technology integration, regulatory compliance, sustainability, e-commerce and logistics, and modularity and flexibility.

Future Demands

- The demand for automatic labeling machines will steadily rise as industries move toward faster, cleaner, and more reliable packaging operations. Manufacturers are under pressure to replace manual labeling with automated machinery to increase output while reducing human error.

- A significant factor in driving demand will be the expansion of the food, beverage, pharmaceutical, and cosmetic industries, where goods require precise information like ingredients, expiration dates, and regulatory labels. Companies will also need machines that can handle multiple product sizes, short production runs, and frequent label changes, especially with the rise of customized and private label products.

- The need for adaptable, fast labeling systems that can print variable data and have quick turnaround times will increase due to the growth of contract manufacturing and e-commerce. Furthermore, the growing use of smart packaging components like tracking labels, barcodes, and QR codes will increase demand for sophisticated integrated labeling technology.

Emerging Technologies

- AI and Machine Vision: To guarantee precise label placement and quality, modern labeling machines use machine vision and artificial intelligence. Cameras and AI algorithms can detect misaligned labels, print errors, or defects in real time and automatically reject faulty packages. This reduces errors of waste and the need for manual inspections.

- IoT and Remote Monitoring: Labeling machines are increasingly connected to the cloud via IoT. This enables manufacturers to remotely carry out predictive maintenance to track production data and monitor performance. Any potential issues can be detected early by reducing downtime and maintenance costs.

- Flexibility and Multi-Format Handling: New machines are designed to handle different packaging types of bottles, cartons irregular shapes, and can quickly switch between products because of this modularity; manufacturers can operate multiple SKUs without the need for separate machines, which speeds up and improves production.

- Smart Labels and Traceability: The demand for smart labels with QR codes, RFID tags, or serialization is growing. These labels can be applied precisely by modern labeling machines supporting supply chain tracking, anti-counterfeiting, and regulatory compliance, all of which are crucial for food and pharmaceutical products.

The growing demand for smart technology for clear and visible information has influenced advancement in the automatic labelling machine market. Allow machines to acquire from information, enhance label placement exactness, sense and correct mistakes separately, and predict preservation requires. Permits for real-time data gathering on machine presentation, accurateness, and health, which can be utilized to enhance production and decrease downtime. Machines are intended to manage an extensive variety of goods sizes, shapes, and label resources.

Trade Analysis of Automatic Labeling Machine Market: Import & Export Statistics

- Mexico: It is considered as the top most importer of the labelling machines in the world with 18,912 shipments.

- Ukraine: It is the second top most importer of the labelling machines in the world with 17,964 shipments.

- Argentina: It is in the third spot of major importers of the labelling machine in the world with 4,211 shipments.

Automatic Labeling Machine Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are stainless steel, aluminum, plastic, and electronic components.

- Key Players: JK Labels, Duralabel

Component Manufacturing

The component manufacturing in this market comprises stainless steel, digital servo motors for precise placement, and advanced sensors.

- Key Players: Auto Labeler Technologies Co., Ltd., Altech Labelers Co.

Logistics and Distribution

This segment comprises improved efficacy, accuracy, and traceability.

- Key Players: DHL Supply Chain, Ekart Logistics

Key Statistical Indicators for the Global Labeling Equipment & Automation Market

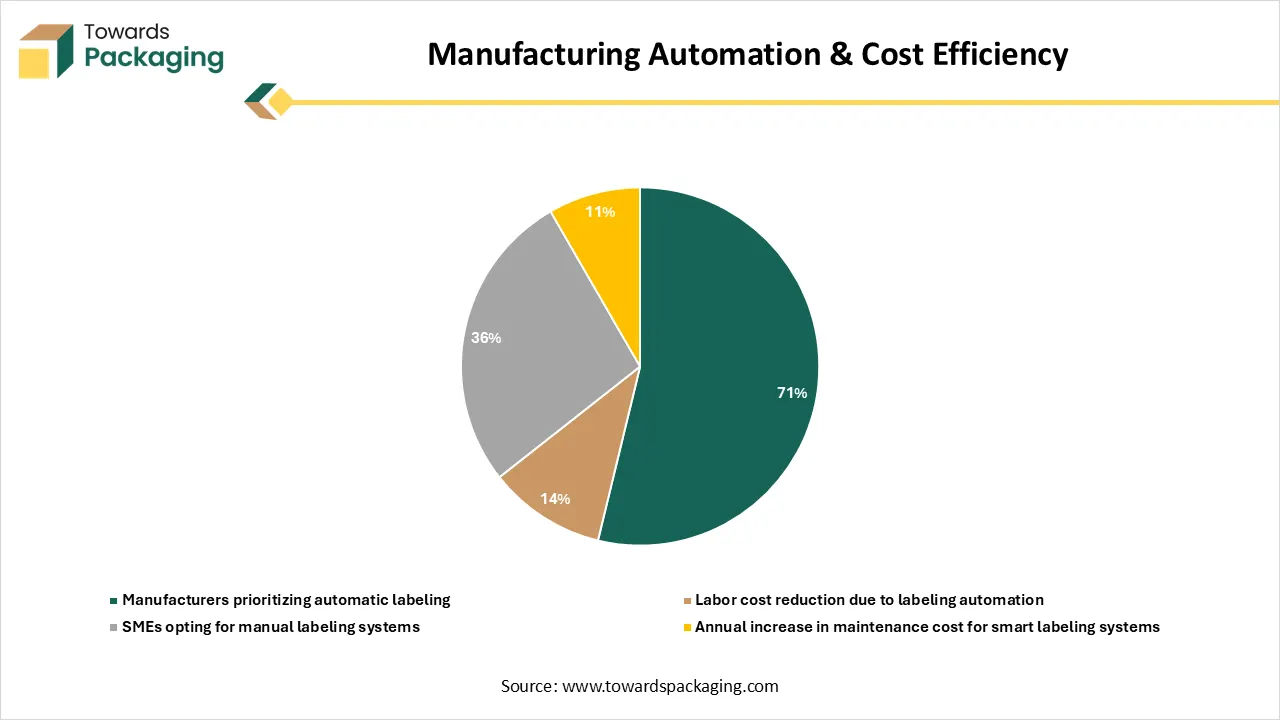

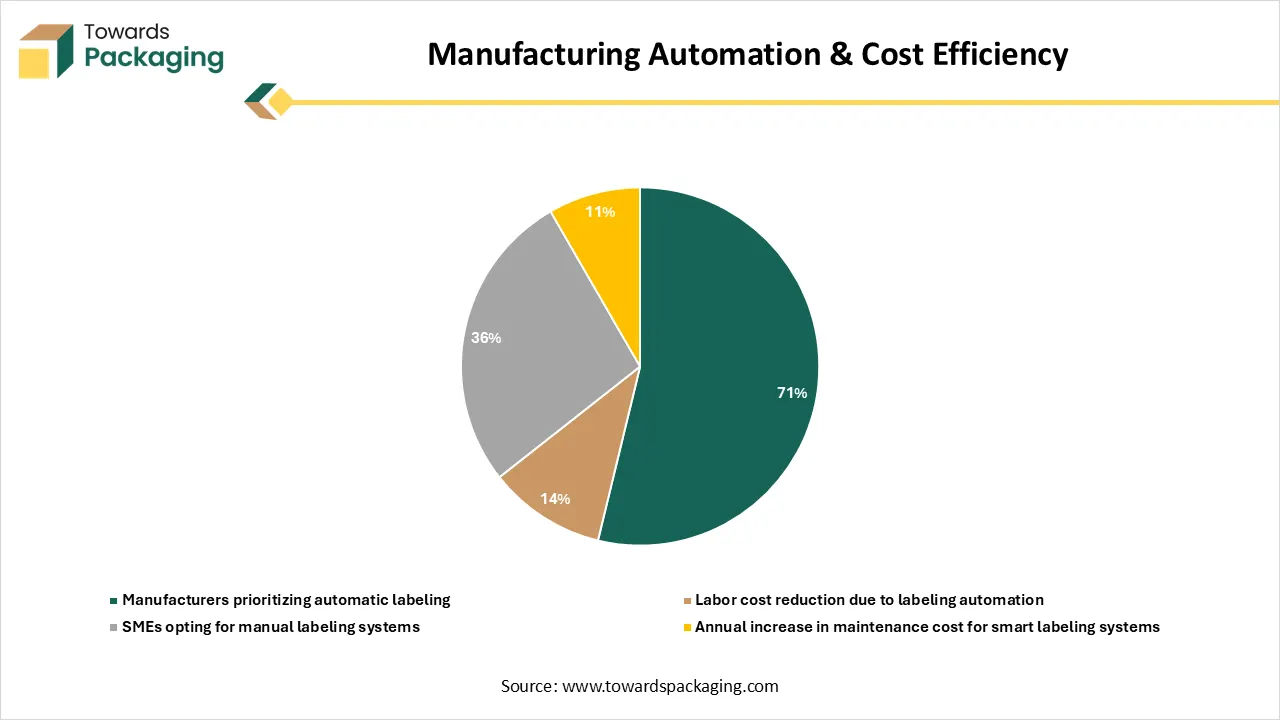

Manufacturing Automation & Cost Efficiency

| Indicator |

Value |

| Manufacturers prioritizing automatic labeling |

71% |

| Labor cost reduction due to labeling automation |

14% |

| SMEs opting for manual labeling systems |

36% |

| Annual increase in maintenance cost for smart labeling systems |

11% |

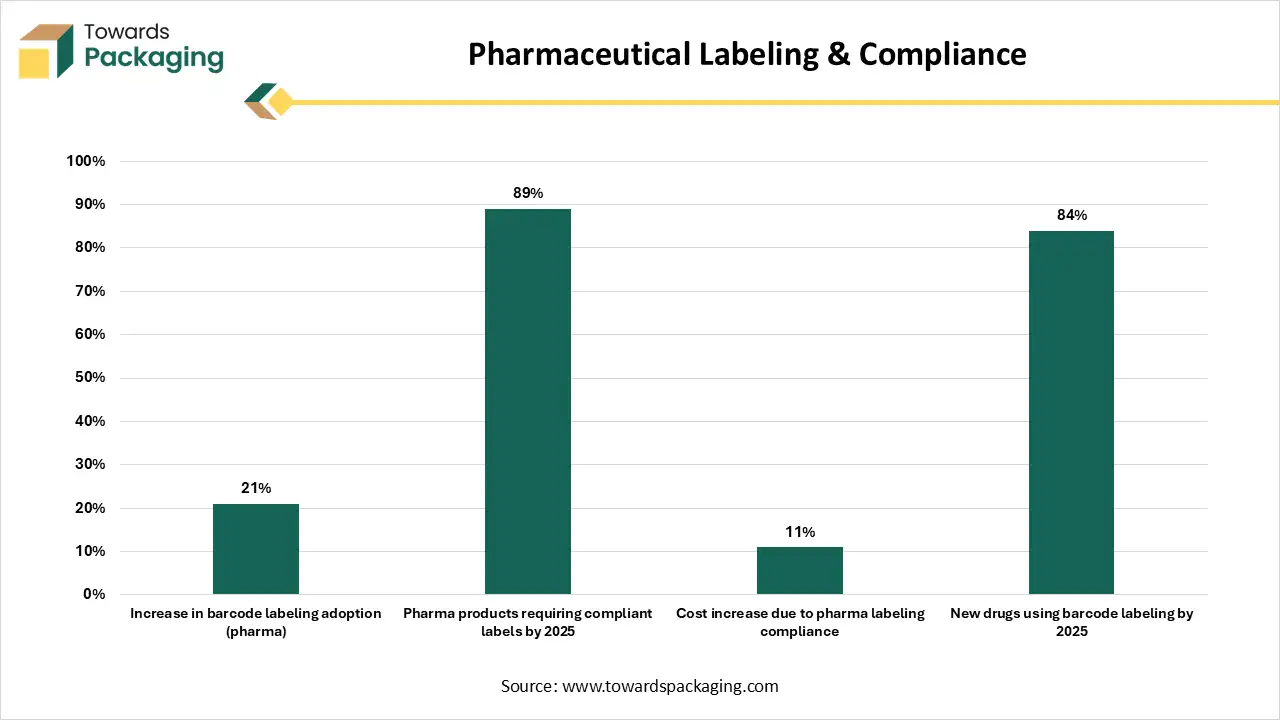

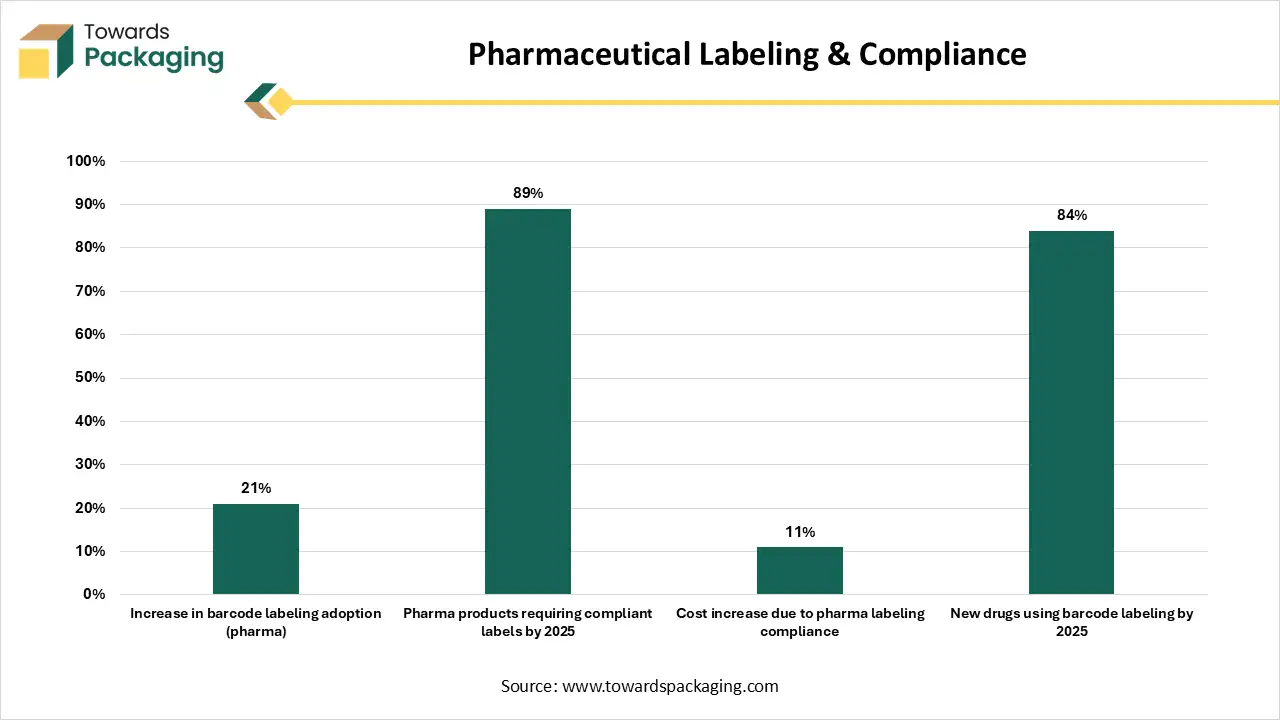

Pharmaceutical Labeling & Compliance

| Indicator |

Value |

| Increase in barcode labeling adoption (pharma) |

21% |

| Pharma products requiring compliant labels by 2025 |

89% |

| Cost increase due to pharma labeling compliance |

11% |

| New drugs using barcode labeling by 2025 |

84% |

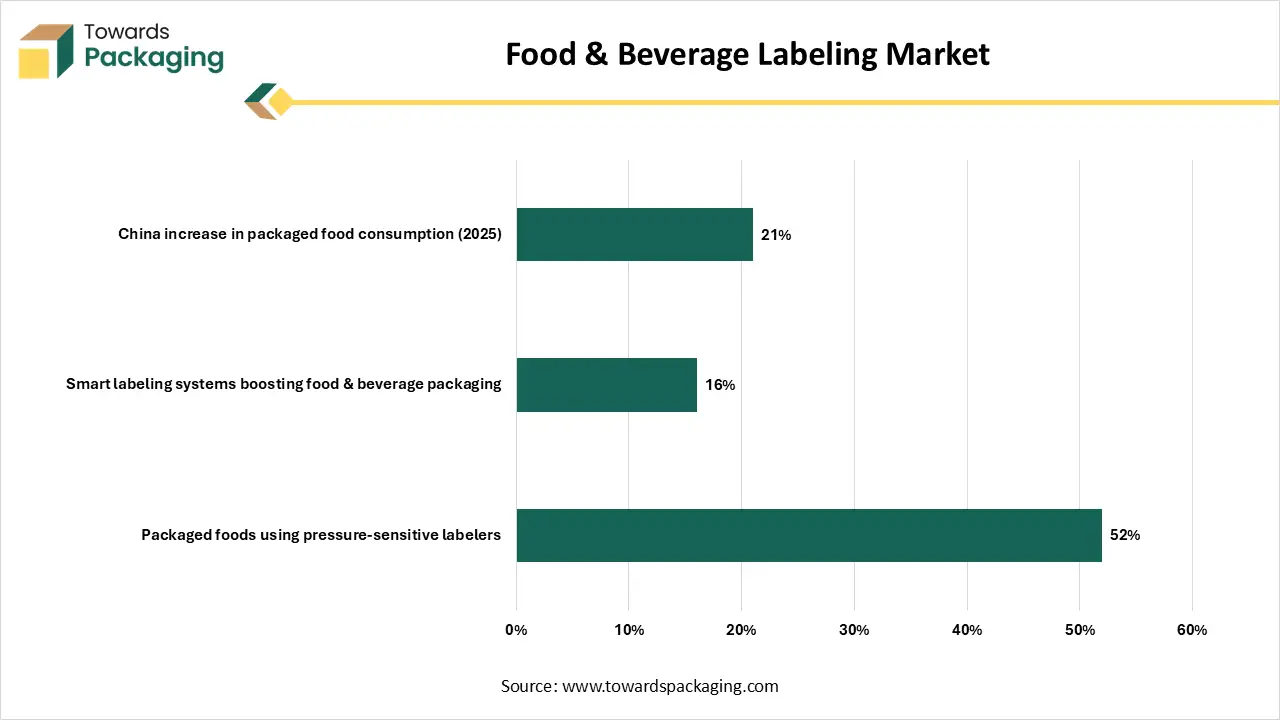

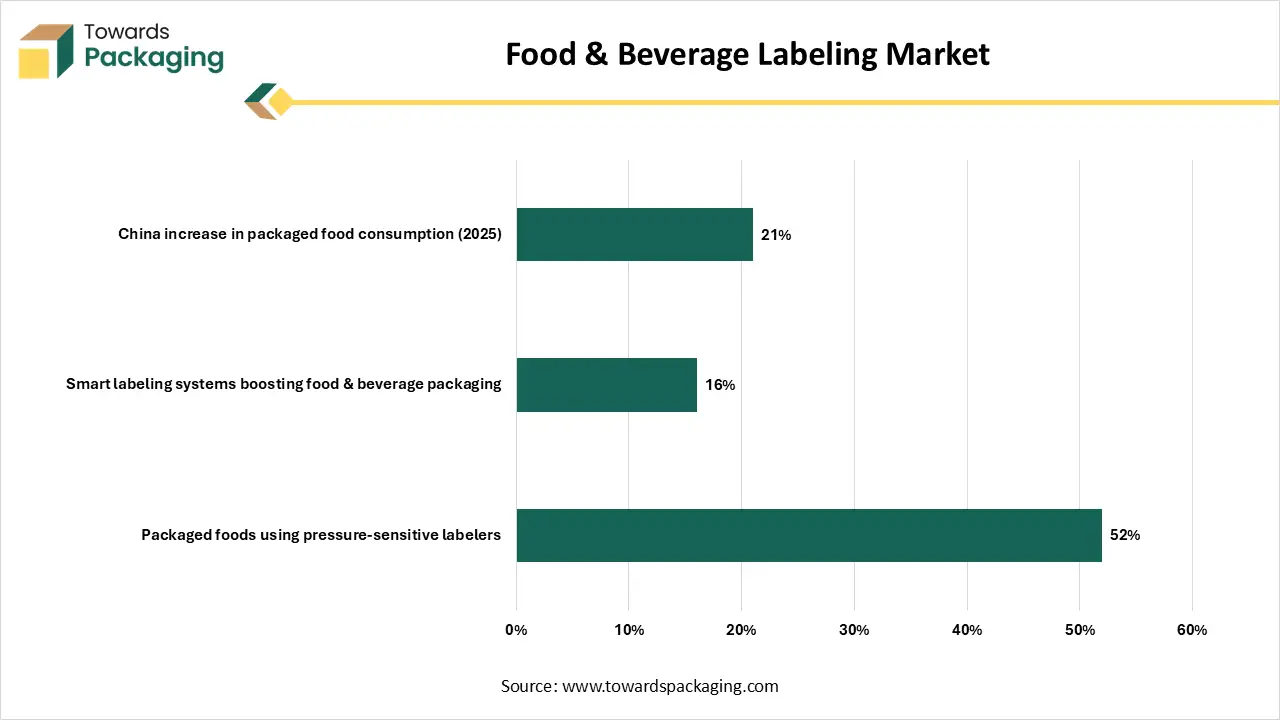

Food & Beverage Labeling Market

| Indicator |

Value |

| Packaged foods using pressure-sensitive labelers |

52% |

| Smart labeling systems boosting food & beverage packaging |

16% |

| China increase in packaged food consumption (2025) |

21% |

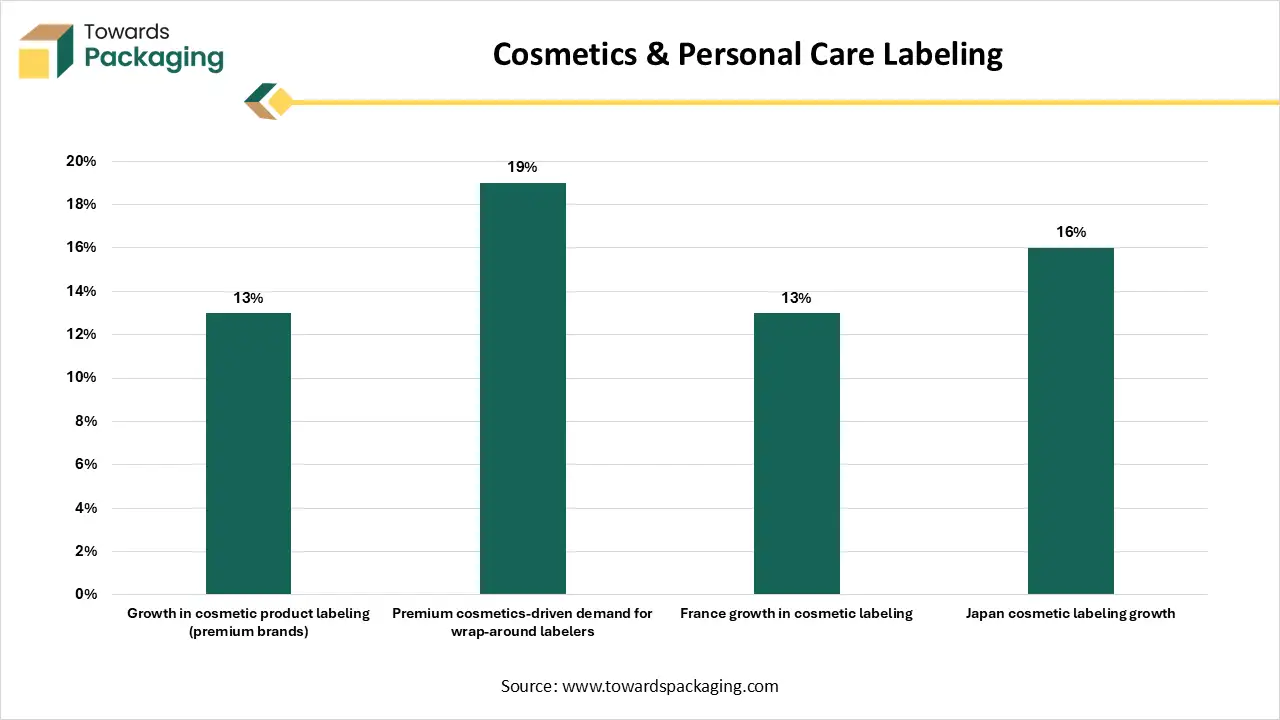

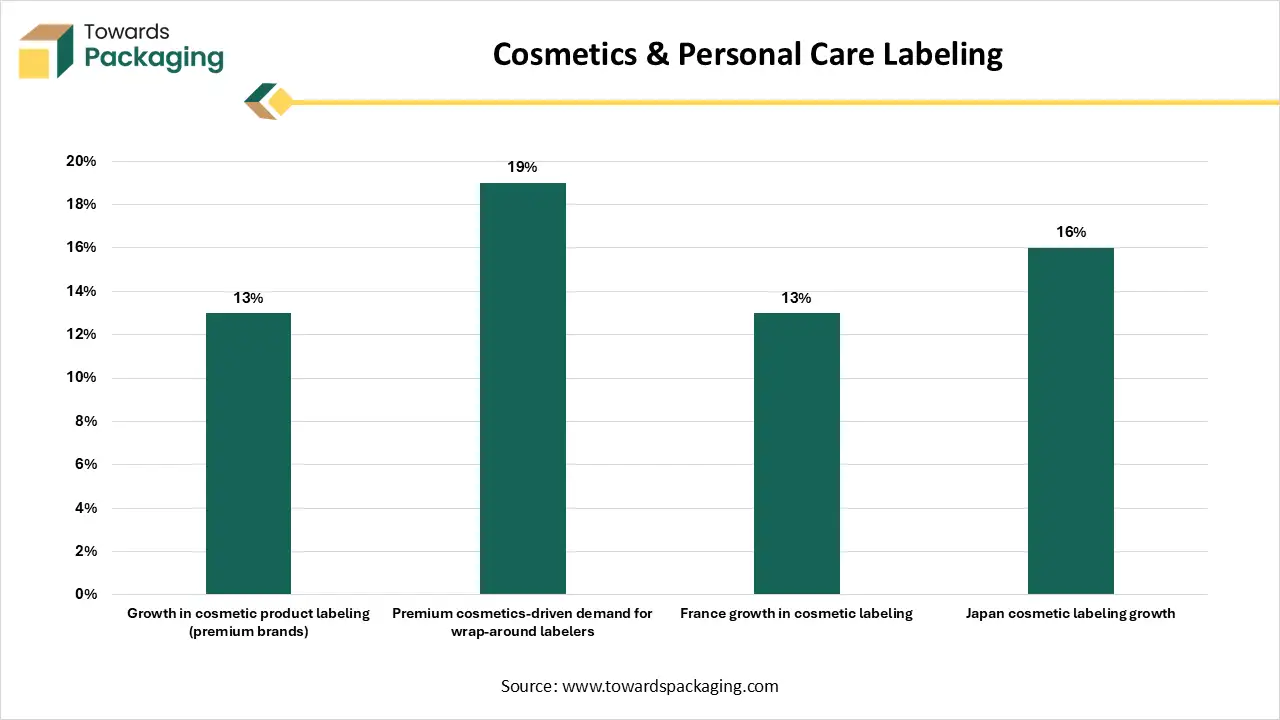

Cosmetics & Personal Care Labeling

| Indicator |

Value |

| Growth in cosmetic product labeling (premium brands) |

13% |

| Premium cosmetics-driven demand for wrap-around labelers |

19% |

| France growth in cosmetic labeling |

13% |

| Japan cosmetic labeling growth |

16% |

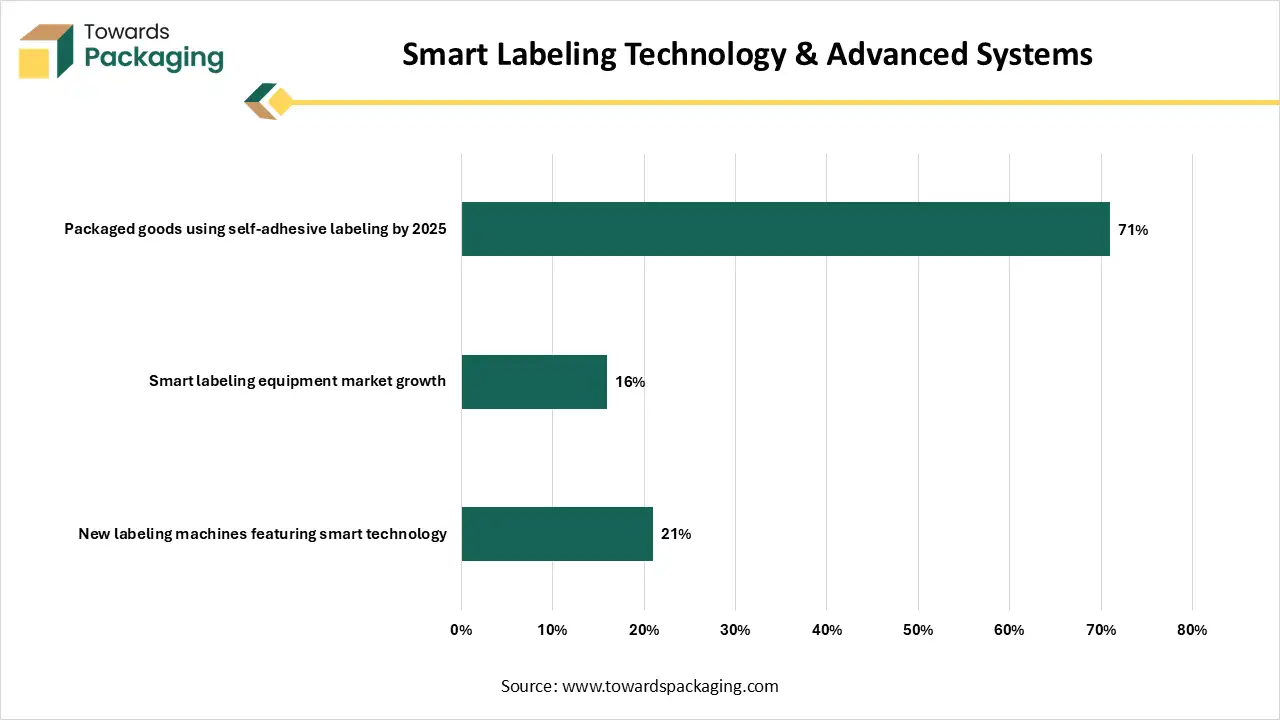

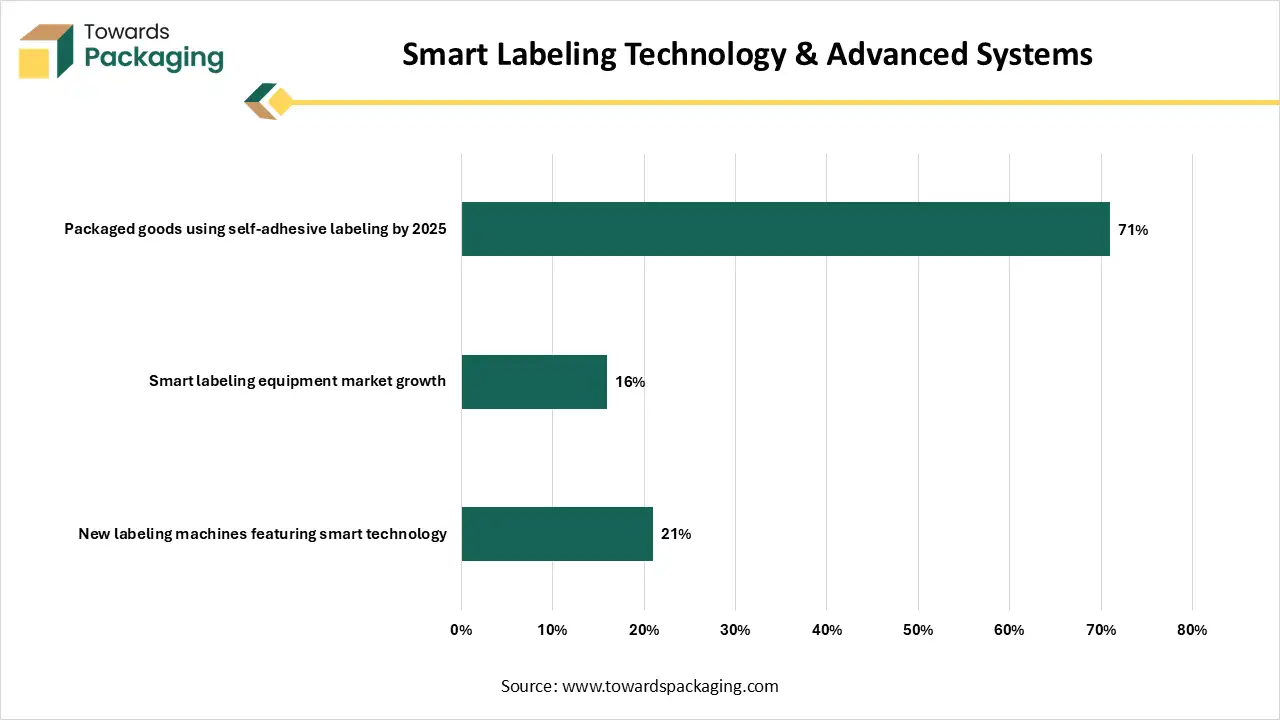

Smart Labeling Technology & Advanced Systems

| Indicator |

Revised Value |

| New labeling machines featuring smart technology |

21% |

| Smart labeling equipment market growth |

16% |

| Packaged goods using self-adhesive labeling by 2025 |

71% |

Labeling Type Insights

Why Self-Adhesive Labeling Machines Segment Dominated the Automatic Labeling Machine Market In 2024?

The self-adhesive labeling machines segment dominated the market with highest share in 2024 due to its ese-of-handling, cost-effectiveness, and versatility. These labels can be used in a wide variety of goods and container types, like boxes, bottles, and jars. They are a more reasonable choice for many usages compared to additional labelling procedures. These machineries are operator-friendly and can function at high speeds which made them suitable for both large and small-scale construction lines. It provides excellent performance and can be utilized on goods that are unprotected to severe situations.

The shrink-sleeve labeling machines segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its visual appeal and smart technology. It offers a unified, full-body embellishment that improves brand recognition and shelf appeal. The subsequent labels are unaffected to abrasion and moisture which made them suitable for contemporary packing lines.

The glue-based labeling machines are the fastest-growing in the packaging nets market, as it comprises efficiency and versatility. These are utilized on an extensive variety of goods and container types, comprising bottles, jars, and several sizes and shapes. The increasing demand for product traceability, automation, and high-speed packing are key factors influencing the acceptance of self-adhesive resolutions. These are widely used in industries like food, beverage, pharmaceuticals, and cosmetics.

Automation Level Insights

Why Fully Automatic Labeling Machines Segment Dominated the Automatic Labeling Machine Market In 2024?

The fully automatic labeling machines segment dominated the market with highest share in 2024 due to its traceability and compliance. Companies are progressively accepting automation to enhance efficacy, decrease errors, and fulfil supervisory necessities. There is a rising demand for accurate and high-speed labeling resolutions, mainly in high-volume construction surroundings. The requirement for machineries that can handle varied container variety and labeling submissions across several businesses is a major influencer. It is because of its capacity to generate full-body, high-influence designs on goods.

The semi-automatic labeling machines segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to changing business need and flexibility. The demand for excellent-speed, superior-quality labeling choices is growing, particularly in regions with huge population density and customer consciousness. Sustainability is becoming a key influencer, boosting demand for machineries that can accommodate environment-friendly packing and recyclable labeling.

End Use Insights

Why Food & Beverage Segment Dominated the Automatic Labeling Machine Market In 2024?

The food & beverage segment dominated the market with highest share in 2024 due to increasing safety standards and strict guidelines. Strict guidelines about product security, component lists, allergy cautions, and expiration dates require exact labelling which has made automatic machines vital for acquiescence. Rising consumer consciousness means corporations required to offer detailed data on labels, which upsurges the demand for superior-quality, precise labeling resolutions.

The pharmaceuticals segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to the presence of strict regulatory requirements. Stricter guidelines for tamper-evident seals, serialization, and traceability demand highly precise and automated labeling arrangements to prevent penalties for faults. The growing utilization of smart labeling skills, comprising RFID and vision-permitted systems, supports improve exactness and permits for real-time verification and tracking.

The personal care & cosmetics are the fastest-growing in the packaging nets market, as it is due to increasing concern towards ingredients list. The cosmetics & personal care sector is flourishing, with customers representing a robust preference for packed, ready-to-utilize products, which influences the requirement for labeling equipment. The rapid development of organic and natural cosmetic products is maintained by authorizations and transparency needs, which requires exact and authentic labeling. Customers are progressively attentive on exact ingredients and product qualities, resulting in more varied product outlines that need flexible and adjustable labeling resolutions.

Control Technology Insights

Why Servo-driven / Electronic Systems Segment Dominated the Automatic Labeling Machine Market In 2024?

The servo-driven / electronic systems segment dominated the market with highest share in 2024 due to enhanced precision and speed. It offers excellent control over site, speed, and torque, which is important for precise label assignment, particularly on high-speed manufacture lines and for multifaceted container forms. These structures permit for quick switches between diverse label patterns and product sizes, supporting the necessity for production customization and scalability in several sectors like cosmetics, food & beverage, pharmaceuticals. The increasing demand for mechanization and technological progressions in labeling solutions places the servo-driven/ electronic systems segments for sustained rapid development.

The Electromechanical Systems segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing demand for tamper-evident packaging. This segment is influenced by growing demand for complete-body, high-influence branding and tamper-obvious packing, mainly in the food & beverage and personal care sectors. This segment is boosted by strict guidelines for anti-counterfeiting measures, serialization, and traceability.

Regional Insights

How Asia Pacific is Dominating in the Automatic Labeling Machine Market?

Asia Pacific held the largest share in the automatic labeling machine market in 2024, due to rapid industrialization. It has a huge manufacturing unit that is quickly accepting automation to enhance efficiency, which comprises the usage of automatic labeling machines. The extension of logistics and e-commerce sectors needs effectual labeling for goods compliance and traceability, fuelling the market. Growing regulatory necessities for labeling in industries such as pharmaceuticals and food & beverage also subsidize to demand for automated arrangements.

Why Automatic Labeling Machine Market is Dominating in China?

Rising government support towards technological advancement has evolved the demand for automatic labeling machine in China. It is a worldwide engineering hub with a huge and rising consumer market. This generates a huge demand for packed products, from food & beverages to pharmaceuticals as well as cosmetics, all of which need labeling. To fulfil customer potentials and brand requirements, industries are accepting automatic labeling machines for their enhanced-quality output, speed, and precision.

Why Automatic Labeling Machine Market is Growing Fastest in Latin America?

Rapid expansion of the e-commerce sector has raised the demand for the automatic labeling machine market. Several sectors, particularly food & beverage, are accepting automation to improve productivity and exactness, decrease human error, and minimalize labor charges. Rising consumer consciousness and demand for a broader diversity of packed products are encouraging companies to utilize effective and smart labeling to preserve product significance and appeal. Growing production efficacy, while the upsurge of e-commerce sector has boosted the necessity for quick and precise package labeling for transportation.

How Automatic Labeling Machine Market is Expanding in Brazil?

Increasing popularity for high-quality labelling has boosted the development process in the market in Brazil. The incorporation of AI and data-influenced automation is a noteworthy trend, enhancing efficacy and generating chances for smart labeling resolutions. A strong presence of food & beverage industry influences demand, with suppliers providing aesthetically attractive and compliant resolutions.

Which Factor is Responsible for Notable Growth of Automatic Labeling Machine Market in North America?

The major factors influencing the growth of market are increasing demand for automation, strict supervisory guidelines, expansion of e-commerce sector, and rapid advancement in labelling technology. Strict government guidelines concerning product labeling for security, traceability, and customer data are convincing producers to invest in precise and dependable automatic labeling arrangements. Shifting customer preferences and a rising demand for an extensive range of packed and ready-to-utilize items, comprising tailored and environment-friendly choices, are influencing the requirement for excellent-quality and flexible labeling solutions.

Why the U.S. is Utilizing these Machines Significantly?

There is a strong adoption of automation in the U.S. which fuelled the development of the market. The quick development of the e-commerce sector needs high-speed, detailed, and trackable labeling resolutions for effectual logistics and inventory organization. Automatic arrangements, often incorporated with RFID technology and barcode, are crucial for managing the huge volume and intricacy of e-commerce shipments. These inventions enable services such as real-time display, predictive maintenance, and the capacity to handle various packaging types and label pattern.

The automatic labeling machine market in Europe is experiencing steady growth. This expansion is driven by strict labeling regulations in the pharmaceutical and food & beverage sectors, technological advancements, and the adoption of Industry 4.0 automation. European manufacturers are increasingly upgrading existing systems to enhance speed, precision, and sustainability, including handling eco-friendly materials. While Western Europe leads due to its mature industrial base, Eastern Europe is gradually catching up. Overall, growth is largely fueled by replacement demand and modernization, reflecting Europe’s focus on efficiency and regulatory compliance in packaging operations.

UK Automatic Labeling Machine Market Trends

In the UK, the automatic labeling machine market is advancing steadily. Growth is largely driven by strong demand in the food-&-beverage and pharmaceutical sectors, where regulatory compliance and packaging efficiency are key. Manufacturers and packagers increasingly invest in high-speed, flexible labeling systems that integrate with digital production controls and adapt to varied packaging formats. The UK’s emphasis on sustainable practices, automation and adaptability supports this trend.

In the Middle East & Africa region, the automatic labeling machine market is steadily expanding. Adoption of automatic labeling solutions is driven by rising consumer-packaged goods demand, growth in food & beverage and pharmaceutical manufacturing, and industrial automation initiatives in countries like the United Arab Emirates, Saudi Arabia and South Africa.

South Africa Automatic Labeling Machine Market Trends

In South Africa, the market is witnessing steady growth, driven by the country’s push toward industrial automation and modernization in packaging operations. Demand is particularly strong in the food & beverage, pharmaceutical, and consumer goods sectors, where efficiency, accuracy, and compliance with labeling standards are increasingly important.

Recent Developments

- In April 2025, LemuGroup has announced the launch of the Ultra Compact 3 which is a reasonable end of line mechanization device setup that influences efficacy and productivity when working with fewer accessible resources.

- In July 2024, Domino Printing Science declared the introduction of its new automated items printing and label verification solutions to support producers decrease the risk of product labeling faults.

Top Companies in the Automatic Labeling Machine Market

Krones AG

Corporate Information

- Name: Krones AG.

- Headquarters: Neutraubling (near Regensburg), Bavaria, Germany.

- Industry: Machinery / systems engineering for beverage and liquidfood production, filling, packaging, intralogistics, recycling.

- Employees: Around 20,000 globally (for example ~20,379 cited)

- Revenue: In 2024, ~ €5.293 billion.

History and Background

Early years & growth

- Founded in 1951 by Hermann Kronseder, in Neutraubling manufacturing semiautomatic labellers.

- 19661979: Early growth with new machine types and international presence. For example in 1975, the “Krones Bloc” (filler, capper, labeller without conveyors) was introduced.

- 19801996: The company became a public limited company (AG) and entered the brewery business and full line manufacturing.

- 19972007: Expansion into PET bottle production, stretch blowmoulding machines, and bottletobottle recycling.

Key Developments and Strategic Initiatives

- Digitalisation: In recent years, Krones has been heavily investing in digital tools, cloud, AI, Big Data, connecting machines/lines across lifecycle.

- Service/business model shift: They emphasise lifecycle services (Modular Service Agreements), digital service centres, increasing share of services revenue.

- Sustainability: Krones set up a climate strategy (via Science Based Targets initiative) to achieve netzero by 2040, cutting 90% of emissions in value chain.

Mergers & Acquisitions

- 2018: Acquired MHT Mold & Hotrunner Technology AG (injection moulding) for preform production.

- 2024: Acquired 100% of Netstal Maschinen AG (Swiss manufacturer of injection moulding machines for PET preforms & caps). This gives Krones full capability for closedloop PET solutions.

Partnerships & Collaborations

- Krones collaborates with major beverage producers, e.g., a recent case installing an aseptic line for Acqua Sant’Anna (Italy) that utilised the company’s labeller technology.

- The company is working with digital/IT vendors: e.g., introducing SAP S/4HANA beverage template to its customers.

Product Launches / Innovations

- Introduction of AIbased inspection machine “Linatronic AI” for emptybottle inspection (drops of water vs dirt) in 2020.

- Launch of the “Ergobloc L” highcapacity production line capable of 100,000 containers/hour and requiring significantly less space.

Key Technology Focus Areas

- Fullline systems: From preform production, bottle/container production, filling, packaging, labelling, palletising, intralogistics.

- Digitalisation / Industry 4.0: Machine connectivity, IoT, cloud services, AI/DeepLearning (e.g., Linatronic AI), analytics.

- Sustainability & circular economy: Bottletobottle PET recycling, lowenergy machines, analytics for energy/media optimisation, “enviro” programme.

R&D Organisation & Investment

According to Krones’ 2024 Strategy & Management System document: around 1,500 people are dedicated to digitalisation initiatives within the group; about 600 software & IT engineers work exclusively at “Krones.digital” (a specialised unit) with plans to add ~100 specialists per year.

The company emphasises “digitalisation moves to the centre of development”.

SWOT Analysis

Strengths:

- Strong global brand and leadership position in beverage/packaging machinery.

- Broad, endtoend portfolio (preform to filling to packaging to recycling) offers “onestop shop” advantage.

- High innovation capabilities (digital, AI, highspeed lines) and strong R&D backing.

- Established service/business model shifts (modular service agreements) enhance recurring revenue and customer lockin.

- Sustainability commitment and circular economy capabilities strengthen positioning with customers and regulators.

Weaknesses:

- High capital intensity and complexity of equipment may limit agility in some market segments.

- Being a large, global operation means exposure to supplychain risks, material cost inflation, currency/geopolitical risks.

- Heavy reliance on beverage sector (though diversified) means vulnerability if that market slows.

Opportunities:

- Growing demand for automation, digitalisation and sustainability in beverage/liquid food industry globally, especially in emerging markets (Asia, India).

- Growth in circular economy/regulations (e.g., PET recycling mandates) favours companies with closedloop solutions like Krones.

- Expansion into adjacent industries (pharma, personal care, cosmetics) leveraging existing machinery portfolio.

- Service/digital solutions growth (lifecycle services, remote monitoring) offer steady recurring revenue.

- Growth in India and Asia: new manufacturing footprint means cost benefits, localisation and faster delivery.

Threats:

- Macroeconomic downturns can delay large capitalequipment orders. For example, global uncertainties may impact beverage producers’ capex.

- Intense competition from other machinery suppliers (including regional/local players) may compress margins.

- Rapid technological change means constant R&D investment; risk of being outinnovated in some areas.

- Sustainability/regulation: while opportunity, it also implies heavy compliance costs and need for constant improvement.

- Supplychain disruptions (e.g., materials, semiconductors), labour costs, energy costs affecting margins.

Recent News & Strategic Updates

- In October 2024, SATO launched its new printing and apply labeling machine series LR4NX in Europe, offering a compact design, easy installation, and compatibility with multiple printer languages.

- In November 2024, Logopak Systeme Gmbh & Co. KG introduced the “Logomatic 850 PSC” cord labelling system. Debuted at the trade fair BrauBeviale, the system enables residue-free pallet labeling of returnable beverage crates using a reusable cord made of recycled textile fibers.

- Q1 2025: Krones reported order intake of €1,435.9 million (+6.8% vs Q4 2024) and revenue of €1,410 million (+13.1% y/y). EBITDA margin improved to 10.6%. Order backlog as of 31 March 2025: €4,315.4 million.

- H1 2025: Revenue increased +6.7% to €2,726.5 million. EBITDA +12.6% to €288.5 million. Order backlog as of 30 June 2025: €4,293.4 million. Krones confirmed fullyear 2025 guidance: revenue growth 79%, EBITDA margin 10.210.8%.

Other Top Companies

- KHS GmbH: It offers solutions for self-adhesive, cold glue, and roll-fed labeling approaches, known for excellent quantity and high uptime.

- Sacmi Imola S.C.: It offers an extensive variety of solutions for several label types and container forms, with an emphasis on application quality and high productivity.

- HERMA GmbH: It is known for progressive pressure-sensitive labeling apparatus, rapid switch mechanisms, and sectional architecture.

- Avery Dennison Corporation: They provide solutions that associate label resources, printers, and applicators to enhance labor and supply chain efficacy across several industries.

- Others: Fuji Seal International, Inc., IMA Group S.p.A., ProMach Inc., SATO Holdings Corporation, Weber Packaging Solutions, Markem-Imaje, Domino Printing Sciences PLC, Videojet Technologies Inc., Syntegon Technology GmbH, Accutek Packaging Equipment Companies, Inc.

Regulations are forcing Automation: Why Compliance is driving the Labeling Market

Regulatory pressure across pharmaceuticals, food and beverage, cosmetics, and chemicals is accelerating the adoption of automatic labeling machines. Manual labeling is dangerous and non-compliant with laws like DSCSA, EU-FMD, FDA labeling regulations, GHS, and allergen disclosure standards that demand accuracy, traceability, serialization, and tamper-proof packaging.

Automated systems help manufacturers meet these rules by enabling precise label placement, real-time inspection of digital tracking, and standardized templates across high-speed production lines.

Eco-friendly labels for recyclable materials and digital identifiers like QR/RFID for traceability are all being pushed by new sustainability regulations.

As a result, compliance is no longer a cost center; it has become a strategic driver of automation investment, reducing recall risk and ensuring product safety and market access.

Automatic Labeling Machine Market Segments Covered

By Labeling Type

- Self-Adhesive Labeling Machines

- Pressure-sensitive label applicators

- Wrap-around and front-back labelers

- Shrink-Sleeve Labeling Machines

- Steam and hot-air tunnel applicators

- Full-body and partial-sleeve configurations

- Glue-Based Labeling Machines

- Cold-glue rotary labeling systems

- Hot-melt glue labeling units

- In-Mould Labeling Machines

- Injection and blow molding integrated labelers

- Roll-fed or pre-cut label systems Shape

By Automation Level

- Semi-Automatic Labeling Machines

- Operator-assisted tabletop labelers

- Semi-auto flat-surface and wrap models

- Fully Automatic Labeling Machines

- High-speed in-line and rotary systems

- Sensor-based auto correction and rejection

By End-Use Industry

- Food & Beverage

- Bottled water, sauces, and ready-to-drink beverages

- Dairy, condiments, and spirits labeling

- Pharmaceuticals

- Vials, ampoules, and blister packs

- Track-and-trace serialization compliance

- Personal Care & Cosmetics

- Tubes, jars, and fragrance bottles

- Tamper-evident and premium labeling

- Chemicals & Specialty Products

- Household and industrial containers

- Hazard and barcode labeling

By Control Technology

- Electromechanical Systems

- Stepper motor drive with PLC feedback

- Optical label detection and feed control

- Servo-driven / Electronic Systems

- High-speed precision placement

- Vision-assisted rejection and correction

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

-

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA