Bagging Machines Market Growth, Innovations and Market Size Forecast

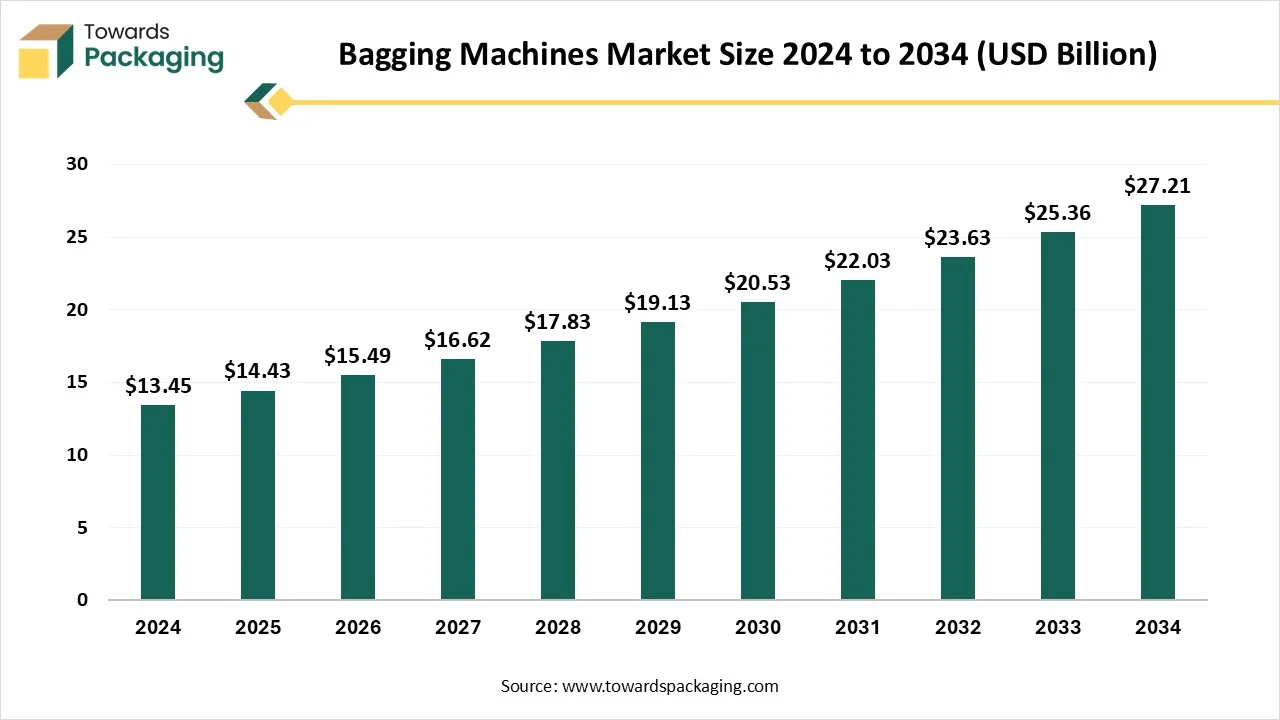

The bagging machines market is forecast to grow from USD 15.49 billion in 2026 to USD 29.2 billion by 2035, driven by a CAGR of 7.3% from 2026 to 2035. Growth is driven by rising demand for packaged food, e-commerce expansion, stricter hygiene & safety regulations, increasing adoption of automation in manufacturing, and sustainability initiatives encouraging eco-friendly packaging solutions.

Key Highlights

- In terms of revenue, the market is valued at a USD14.43 Billion in 2025.

- The market is expected to reach USD 29.2 Billion by the year 2035.

- Rapid growth at a CAGR of 7.3% will be officially witnessed between 2025 and 2034.

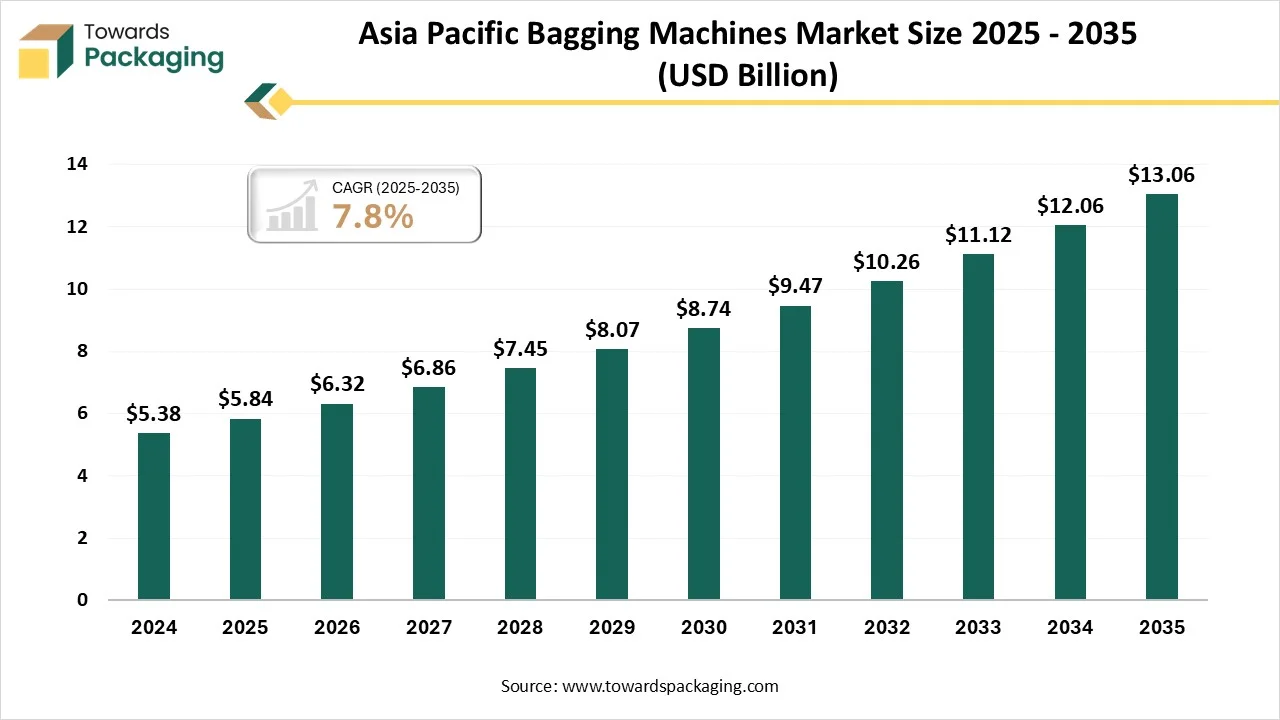

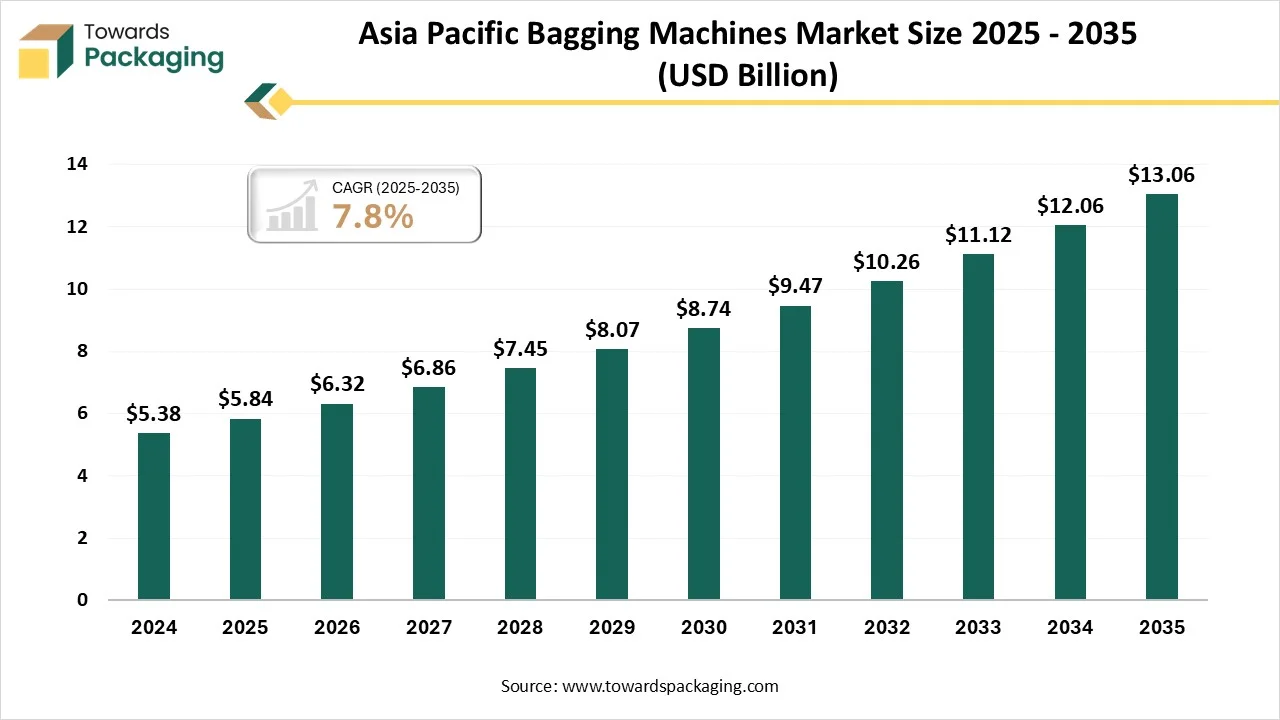

- By region, Asia Pacific dominated with the largest share of approximately 40% in 2024.

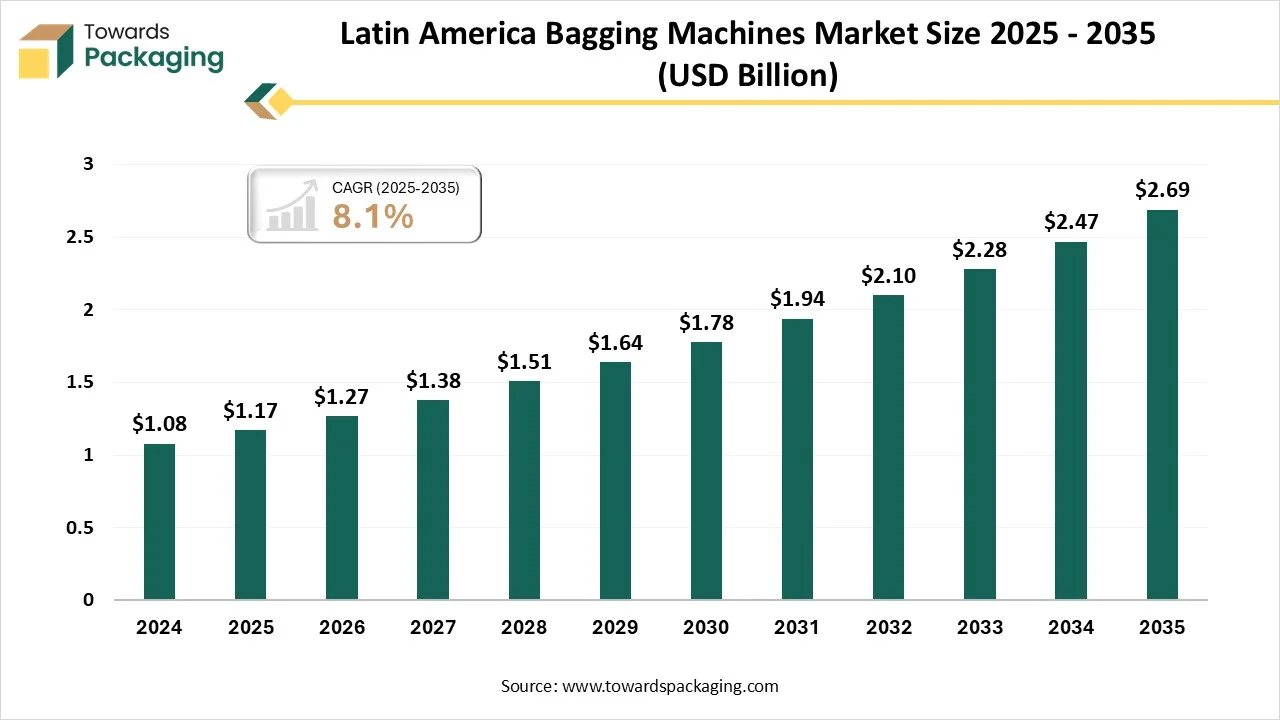

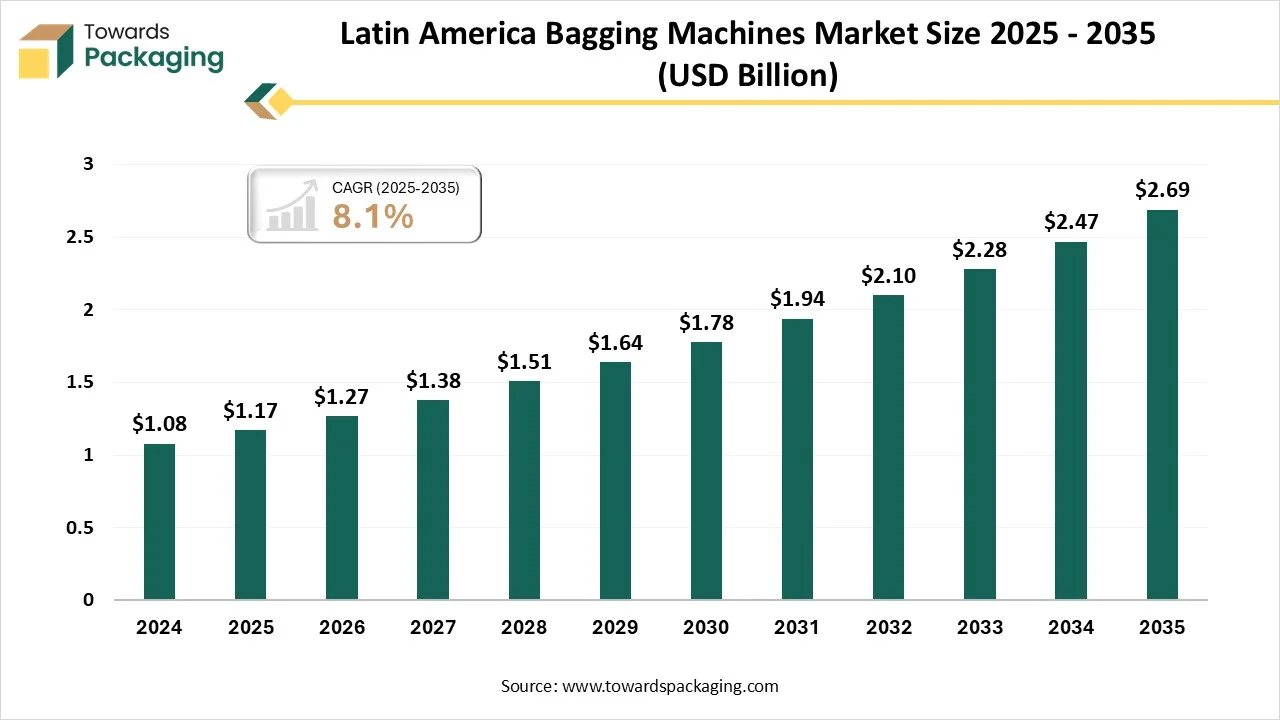

- By region, Latin America is expected to grow at a notable CAGR between 2025 and 2034.

- By machine type, vertical-form-fill-seal machines segment contributed to the largest share of approximately 30% in 2024.

- By machine type, bulk bagging machines segment will expand at a significant CAGR between 2025 and 2034.

- By automation level, fully automatic bagging machines segment contributed to the largest share of approximately 65% in 2024.

- By automation level, fully automatic (AI and robotics integration) segment will expand at a significant CAGR between 2025 and 2034.

- By bag type, plastic bags segment contributed to the largest share of approximately 40% in 2024.

- By bag type, biodegradable and paper bags segment will expand at a significant CAGR between 2025 and 2034.

- By application, food and beverages segment contributed to the largest share of approximately 35% in 2024.

- By application, healthcare and pharmaceuticals segment will expand at a significant CAGR between 2025 and 2034.

- By business model, OEM installations segment contributed to the largest share of approximately 55% in 2024.

- By business model, aftermarket services segment will expand at a significant CAGR between 2025 and 2034.

Market Overview

The global bagging machines market refers to automated equipment used for filling, sealing, and packaging products into bags across industries such as food & beverages, chemicals, pharmaceuticals, agriculture, and construction materials. These machines enhance packaging speed, accuracy, hygiene, and cost-efficiency, while reducing labor dependency. Bagging machines are available in automatic, semi-automatic, and fully integrated solutions, compatible with different bag types (plastic, paper, woven, bulk, etc).

Emerging Trends in Bagging Machines Market

- Advancements in High-speed bagging Technology: Pace is important in bulk packaging. The current growth in high-speed bagging technology has led to the development of a bag packaging machine that achieves extraordinary throughput prices. The latest machine can pack and seal 2,400 bags per hour, which has not been done before.

- Smart Technology and IoT integration: Combining smart Technology with Internet of Things (IoT) changes the bag packaging machine into smart systems that have potential for real-time tracking and enhancement. An enabled automated bagging procedure can gather data on product quality, product performance, and operational efficiency, enabling businesses to create data-driven decisions.

- Flexible Packaging Automation with Versatility: Current bag packing machines distinguish themselves because of their capability to adapt to different packaging demands. Flexible packaging automation makes it feasible for these machines to run on different bags in various shapes, sizes, and materials for various sectors. This development advantages fields like pharmaceuticals and FMCG because the packaging demands are specific and different for various sectors.

- Sustainability and Eco-friendly Features: The adventure of sustainability in the packaging industry is growing, so eco-friendly solutions are being made available in bag-packing machine designs. Automated bagging systems with energy-saving motors and waste-lowering systems, and offer the option to utilize non-plastic or recyclable bags.

Market Dynamics

Market Driver

Automation Leads The Bagging Machines Market

The bagging machine is initially driven by the growing demand for smooth and automated packaging solutions across sectors such as pharmaceuticals, food and beverages, chemicals, and agriculture. The growing importance of lowering labor costs, developing productivity, and ensuring constant packaging quality has increased the acceptance of high-level bagging machines. In addition, the surge in e-commerce, demand for sustainable packaging, and technological advancements like smart sensors and robotics further fuel market growth.

Market Restraint

Heavy Investment Lacks The Market

The bagging machines market experiences certain limitations, such as high initial investment and maintenance costs, which can restrict acceptance by small and medium enterprises. Limited flexibility in carrying various bag types and sizes, along with the demand for skilled operators, also poses challenges. Additionally, frequent mechanical issues, downtime, and energy consumption can affect operational efficiency. Compliance with strict packaging regulations and accepting machines for sustainable packaging materials further add to the disadvantages.

Market Opportunity

Technological Advancements Win The Bagging Machines Market

The future of the bagging machine industry holds strong possibilities with advancements in AI, automation, and IoT integration, allowing real-time tracking and predictive maintenance. Development of energy-efficient and eco-friendly machines will assist the growing demand for sustainable packaging. Customizable and highly flexible machines capable of handling various bag sizes and biodegradable materials are expected to gain attention. Moreover, the rise of e-commerce, small factories, and Industry 4.0 will drive inventions in accuracy, speed, and connectivity, which makes bagging machines more efficient, reliable, and adaptable to different industry demands.

Machine Type Insights

How Did The Vertical Form-Fill-Seal Machines (VFFS) Segment Dominate The Bagging Machines Market?

The Vertical Form-Fill-Seal Machines (VFFS) segment dominated the bagging machines market in 2024, as they are widely used in this sector due to their high efficiency and versatility. These machines form bags from a flat roll of film, fill them with the product, and seal them all in a vertical process. They are perfect for packaging food products, granules, powders, and liquids with constant accuracy and speed. VFFS machines are valued for lowering labor costs, making sure different bag styles, making them a selected choice in industries like food and beverage, chemicals, and pharmaceuticals.

The bulk bagging machines segment is predicted to be the fastest in the market during the forecast period. These are specialized packaging equipment designed to efficiently fill and seal large bags, typically used for bulk materials such as fertilisers, grains, cement, chemicals, and minerals. These machines help improve productivity by automating the weighing, filling, and packaging procedure, ensuring constant accuracy and lowering material wastage. Bulk bagging machines are especially beneficial for industries handling high-volume products, as they enhance operational efficiency, reduce labor costs, and track product quality during storage and transport.

Automation Level Insights

How Did The Fully Automatic Bagging Machine Segment Dominate The Bagging Machines Market In 2024?

The fully automatic bagging machine segment dominated the market in 2024 as they are advanced packaging systems designed to handle the overall procedure of filling, sealing, labelling, and palletizing bags with less human intervention. They are widely used in industries like agriculture, food, chemicals, and pharmaceuticals for their ability to deliver high-speed, precise, and constant packaging. These machines develop efficiency, reduce labor costs, and minimize errors while supporting different bag types and sizes. With features like touch-screen controls, weighing systems, and integration with smart technologies, fully automatic bagging machines are a main solution for modern, large-scale packaging operations.

The Fully Automatic (AI and Robotics Integration) segment is predicted to be the fastest in the market during the forecast period. This kind of machine serves the next generation of packaging technology. These machines not only handle filling, sealing, and labelling but also use AI-driven systems for real-time monitoring, predictive maintenance, and error detection. Robotics arms enable faster, more accurate bag handling, stacking, and palletizing, lowering human intervention and downtime. Such smart systems can adapt to different bag sizes, materials, and product types with fewer adjustments, making them highly flexible.

Bag Type Insights

How Did The Plastic Bags (PP, PE) Segment Dominate The Bagging Machines Market?

The plastic bags (PE, PP) segment dominated the bagging machines market in 2024 as they are hugely used in bagging machines due to their flexibility, durability, and cost-effectiveness. PE bags are selected for their strength, moisture resistance, and suitability for heavy or bulk products, while PP bags offer higher clarity, stiffness, and resistance to wear and tear, making them perfect for retail and consumer packaging. Both materials are compatible with automatic and semi-automatic bagging machines, ensuring efficient sealing, printing, and handling. Their versatility across industries like agriculture, food, chemicals, and construction makes PE and PP bags a perfect choice in modern packaging solutions.

The biodegradable and paper bags segment is expected to be the fastest in the market during the forecast period. They are increasingly being used in bagging machines as sustainable alternatives to plastic packaging. Biodegradable bags, made from plant-based or compostable materials. Help reduce environmental impact while maintaining durability and flexibility. Paper bags, on the other hand, are recyclable, eco-friendly, and suitable for dry goods, powders, and user products. Modern bagging machines are being adapted to handle these materials efficiently, making sure of the global shift towards green packaging solutions. The growing acceptance reflects growing demand and regulatory pressure for eco-friendly packaging solutions.

Application Insights

How Did The Food And Beverage Segment Dominate The Bagging Machines Market?

The food and beverage segment dominated the market in 2024 as they play an important role in ensuring safe, hygienic, and smooth packaging of products like grains, snacks, powders, dairy, frozen foods, and beverages. They help track product freshness, expand the shelf life, and provide tamper-proof sealing, which is important for user safety. With growing demand for convenience foods and ready-to-eat products, automated bagging machines allow high-speed production, constant portioning, and reduced labor costs. The shift toward sustainable packaging has also driven the use of paper, biodegradable films, and recyclable plastics in bagging, making these machines vital for aligning both industry standards and user expectations.

The healthcare and pharmaceutical segment is predicted to be the fastest in the market during the forecast period. These machines are important for accurate, sterile, and contamination-free packaging of products such as medicines, powders, tablets, medical devices, and diagnostic kits. These machines ensure compliance with strict regulatory standards by serving accurate dosing, secure sealing, and tamper-evident packaging. Automation in pharmaceutical bagging enhances efficiency, reduces human error, and tracks product integrity throughout the supply chain.

Business Model Insights

How Did The OEM Installations Segment Dominate The Bagging Machines Market?

The OEM installations segment dominated the market in 2024, as it refers to the setup and integration of machines directly by the manufacturers to ensure optimal performance, reliability, and compliance with industry standards. OEM installation provides end-users with benefits such as proper calibration, customised configurations, and seamless integration with current production lines. It also makes sure the use of genuine parts, except for technical support and warranty coverage.

The aftermarket services segment is predicted to be the fastest in the market during the forecast period. They include a wide range of support solutions provided after the sale and installation of equipment. These services typically cover spare parts supply, maintenance, repair, and upgrades. By ensuring timely servicing and availability of genuine parts, aftermarket services help reduce machine downtime, extend equipment life, and maintain constant productivity. Many servers also offer remote monitoring, software updates, and performance optimization to keep machines running smoothly.

Regional Insights

How Did The Asia Pacific Dominate The Bagging Machines Market?

Asia Pacific dominated the market in 2024, and it was growing rapidly, driven by industrial expansion, rising food and beverage consumption, and the boom in e-commerce. Countries like China, India, and Japan are leading due to strong manufacturing bases and increasing automation in packaging. Adoption of smart technologies such as AI, IoT, and robotics, along with a move toward sustainable packaging solutions, is further boosting market growth. With Asia-Pacific holding a major share of global revenue, the region is expected to remain a major hub for bagging machine demand in the coming years.

Latin America predicted to be the fastest-growing in the market during the forecast period. The demand for bagging machines in this region is steadily growing, supported by the expansion of food processing, agriculture, and packaging industries in countries like Brazil, Mexico, and Argentina. Rising urbanization, increasing consumption of packaged foods, and modernization of manufacturing facilities are the main drivers. While the region carries a smaller share of the global market, steady investments in automation and the adoption of Form-Fill-Seal technologies are boosting efficiency and productivity, making Latin America an emerging market for bagging machines.

Bagging Machines Market - Value Chain Analysis

- Material Processing and Conversion: Material processing and conversion in bagging machines count on preparing raw packaging materials, such as plastic films, biodegradable films, or paper rolls, and converting them into finished bags for filling. The machine unwinds the material, cuts or forms it into the desired bag shape, seals the edges, and prepares it for product filling.

Bagging Machines Market Top Companies

- Cemen Tech, Inc

- BEUMER GROUP, GmbH and Co

- CFT s.p.a

- Duravant LLC

- Mayer Industries, LLC

- Haver & Boecker OHG

- Niverplast B.V

- Pakona Engineers Pvt Ltd

- Robatech AG

- Tetra Pak International S.A

Recent Developments

- In December 2024, CMC Packaging Automation disclosed its current Genesys Compact packaging solution that packs and scans products without the demand for void fillers at up to 500 units per hour.

Segmentation of the Global Bagging Machines Market

By Machine Type

- Vertical Form-Fill-Seal (VFFS) Machines

- Horizontal Form-Fill-Seal (HFFS) Machines

- Open-Mouth Bagging Machines

- Valve Bagging Machines

- FFS Tubular Bagging Machines

- Bulk Bagging Machines (FIBC, Big Bags)

By Automation Level

- Semi-Automatic Bagging Machines

- Fully Automatic Bagging Machines

By Bag Type

- Plastic Bags (PE, PP)

- Paper Bags

- Woven Bags

- Jute & Biodegradable Bags

- Bulk/FIBC Bags

By Application/End-Use Industry

- Food & Beverages (grains, flour, snacks, frozen food, pet food)

- Chemicals (fertilizers, polymers, resins, detergents)

- Pharmaceuticals & Healthcare (powders, medicines, supplements)

- Agriculture (seeds, animal feed)

- Construction & Building Materials (cement, sand, minerals)

- Others (Retail, E-commerce, Consumer Goods)

By Distribution / Business Model

- OEM Installations (Direct machine sales by manufacturers)

- Aftermarket Sales (spares, upgrades, retrofits)

- Service Contracts & Maintenance Solutions

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (4)