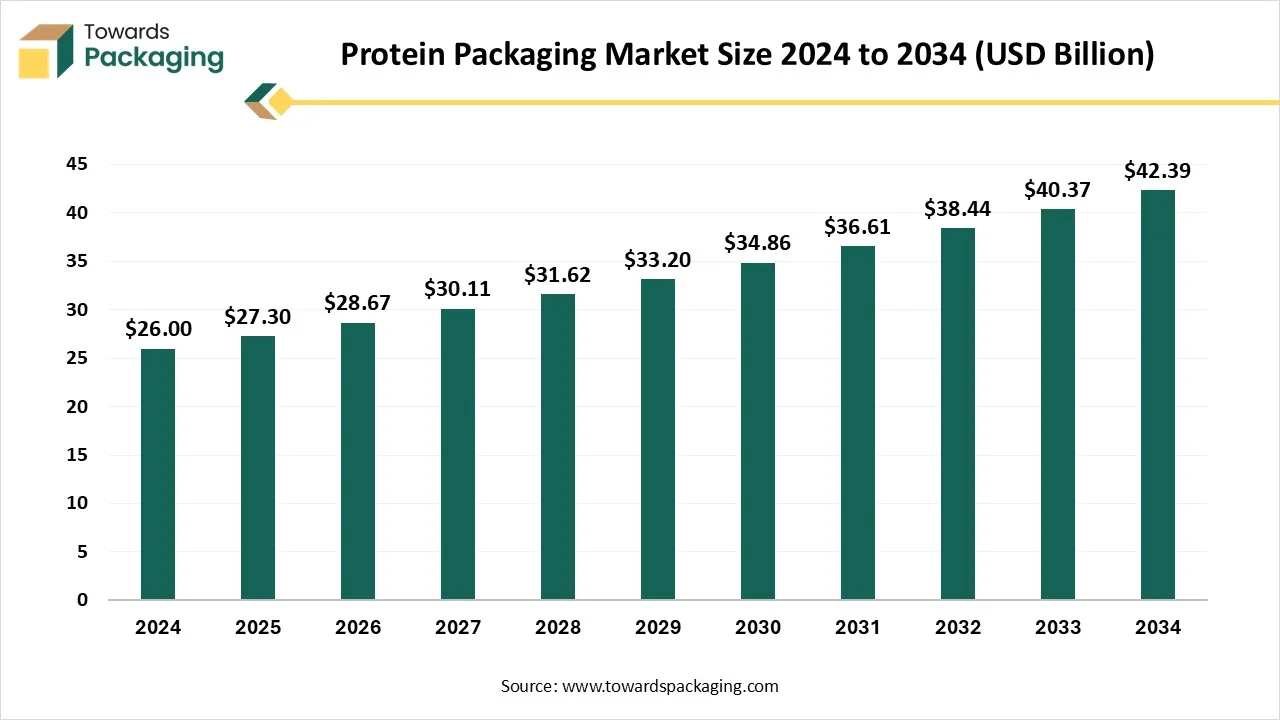

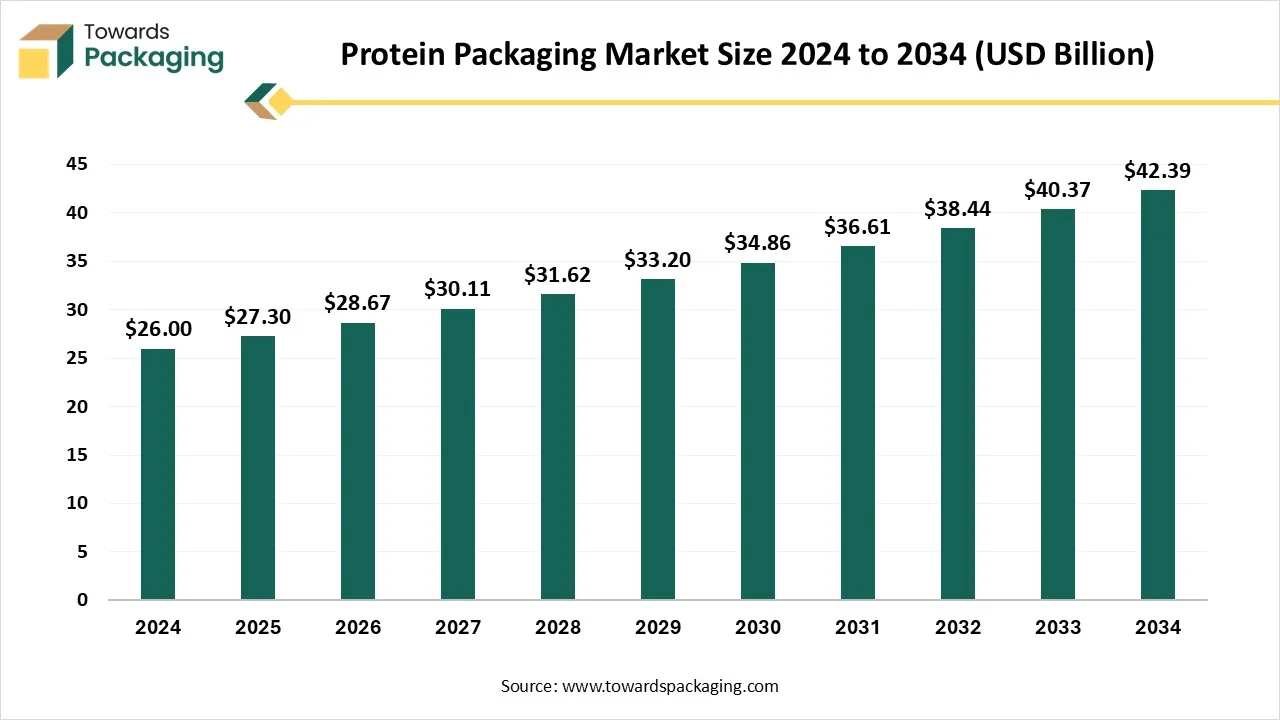

The protein packaging market is forecasted to expand from USD 28.67 billion in 2026 to USD 44.52 billion by 2035, growing at a CAGR of 5.01% from 2026 to 2035. This report covers market size, historical data, future forecasts, evolving consumer trends, and detailed segmentation, including packaging materials (plastics 55% share in 2024, compostables growing fastest), packaging types (flexible 60% share), distribution channels (direct sales 62% share), and end-use industries (sports nutrition leading with 45% share)

The protein packaging market covers the design, development, and commercialization of packaging solutions specifically tailored for protein-based products such as protein powders, ready-to-drink (RTD) shakes, protein bars, dairy proteins, plant-based proteins, and functional snacks.

Packaging solutions ensure product protection, shelf-life extension, convenience, brand positioning, and regulatory compliance, while preserving the integrity of sensitive protein ingredients. Formats include flexible and rigid packaging, across a range of materials including plastics, paperboard, Aluminium, glass, and emerging eco-friendly solutions.

AI's aim in protein research is rapidly developing, with an initial focus on predicting protein patterns and structures, understanding how proteins communicate with other biomolecules, and growing protein design and proteomics analysis. Considerably, the integration of AI and protein packaging design is at the top in industrial uses, making significant strides in developing drug development and protein engineering procedures. These high-level prediction techniques are heavily mixed with current workflows, growing inventions, and research in the field. As AI continues to change how one understands and simplifies proteins, its effect on biotechnology and medicine is poised to grow even further.

With the growth of artificial intelligence technology that is driven by deep learning, it serves as another way of deciding for protein research, bringing invention in the technique, procedure, and thinking.

Plant -Based Protein Drives The Protein Packaging Market Smoothly

Before the current protein trend, the masses depended on various protein sources. Regularly, users rely on plant-based proteins. Soy protein was a famous vegetarian option because of its affordability and overall amino acid profile. Casein, which comes from milk, serves sustained protein release. Egg whites were popular among fitness enthusiasts. The industry is experiencing a development in plant-based alternative seasoning from soy and peas to hemp and rice. While serving as a sustainable and comprehensive protein source, the challenge lies in duplicating the sensory pattern of regular protein products.

Other elements that drive the market are :

Livestock Farming Is The Main Issue

Livestock farming in protein packaging counts inefficient transformation of feed protein to animal protein, the main surrounding negative impact, and high resource usage like land, water, and feed, which is greenhouse gas emissions and land degradation, like public health risks like antibiotic resistance and zoonotic disease, and other market factors like unorganized market products matters a lot. Apart from these, the production of feed, specifically soy, has a totally negative environmental impact, such as land degradation and increased chemical usage.

Edible Packaging Has Taken Over the Protein Packaging Game

Edible packaging thin layers can be utilised to cover food. These substances are made from materials like seaweed, cellulose, starch, and lipids, which provide a protective barricade for food products. They can assist in expanding shelf life by preventing moisture loss and lowering the oxygen concentration. Edible coating can also behave like a carrier for colors, flavors, and nutrients, developing the sensory experience of the food. They can make sure that the usage of plastics for food packaging can be drastically reduced, if not eliminated.

How Did The Plastics Segment Dominate The Protein Packaging Market?

Plastics segment dominated the market in 2024 is very prevalent, lightweight, inexpensive, and convenient to transport. Prevalent plastic materials like PET, LLDPE, PP, and Nylon. Some of these materials are more commonly utilised as a space for composite materials in protein powder packaging. LLDPE has perfect tensile strength and is convenient to heat-seal, so it packs perfectly. It is highly flexible and can be adapted to different sizes and shapes. It also has good moisture opposition. One of the best examples of the plastic segment is a plastic jar, which has perfect resistance and can smoothly protect our protein powder during transportation and loading. They are very reliable. Wrap-around labels are being applied to plastic jars.

Compostable /Biodegradable materials segment predicted to be the fastest-growing segment in the market during the forecast period. Biodegradable materials decompose with the help of microbial action into natural components in the surrounding environment without leaving toxic residues. Nevertheless, the deterioration time changes considerably across procedures of different materials. The decomposition procedure of biodegradable packaging is managed by microorganisms such as fungi and bacteria, which digest the material, cutting it down into basic natural substances. The procedure starts with fragmentation, cutting down the material into smaller particles. Subsequently, microorganisms innovate the molecular relation and change the material into natural elements. The enzymes created by microorganisms promote the procedure, which leads to the fast disintegration of complicated polymers.

How Did Flexible Packaging Segment Dominate The Protein Packaging Market?

Flexible packaging segment dominated the protein packaging market in 2024, Flexible packaging is a perfect option for products that need high levels of protection from external factors like oxygen, UV light, and moisture. Sports nutrition bags and pouches are created using laminates. These patterns can be updated to receive levels of protection for the product that is packed. Materials like metalized polymers and aluminum serve as a perfect all-around barricade to protect powders like chocolate, powders, and capsules. , while the use of resealable zippers means that bulk powders and supplements remain fresh throughout the usage.

Rigid packaging segment is expected to be the fastest-growing segment in the market during the forecast period. They play an important role in protein packaging, specifically for poultry, meat, seafood, plant-based, and dairy products, in which product safety, freshness, and shelf life extension are critical. Rigid patterns not only protect proteins during storage and transportation but also support modified atmosphere packaging (MAP) and vacuum-sealing, which help preserve texture, flavor, and nutritional value. With growing demand for ready-to-eat meals, protein supplements, and plant-based alternatives, rigid packaging is gaining more attention, supported by innovations in recyclable and lightweight rigid containers to meet sustainability goals.

How Did Sports Nutrition And Dietary Supplements Segment Dominate The Protein Packaging Market?

Sports nutrition and dietary supplements segment dominated the protein packaging market in 2024, as it is all about making a diet or eating plan to assist in increasing athletic performance. It is prevalent in endurance and expanding sports, but can be used by anyone seeking to develop their performance. Accurate nutrition is the perfect foundation for perfect physical and mental health. While everybody demands to concentrate on tracking a healthy and balanced diet, sportspeople and athletes demand a highly specialised strategy to nutrition. Accurate nutrition, aligning with their highly tailored needs, could be the key to updating the performance and training of the sportsperson and athlete.

Dietary supplements are a kind of product that is added to the diet. It is generally consumed by mouth as a capsule, pill, or powder. Some people with cancer think about trying a dietary supplement to manage their symptoms or to diagnose their cancer.

Retail and E-commerce protein brands segment expects the fastest growth in the market during the forecast period. Seeking plant-based protein products has never been convenient, as users are actively finding them out. In fact, there are 451K online searches for “Plant-Based” protein items. This is leveraged by the growing usage of plant-based product elements that are searchable through online stores. By updating our listed elements to align with user choice, we can get the biggest return from e-commerce shoppers. Also, retail and e-commerce packaging makes a positive impression as products arrive safely, lowering shipping costs and having a positive impact on customers. One can use cushioning material like bubble wrap or foam for packing protein-rich bars, which assists in preventing the product from being damaged during travel.

How Did Direct Sales Segment Dominate The Protein Packaging Market?

Direct sales segment dominated the market in 2024 because protein packaging has been gaining attention as brands increasingly seek to build closer connections with consumers while limiting traditional retail intermediaries. In this model, protein product manufacturers -series from meat and dairy producers to plant-based and whey protein brands-sell packaged products directly through online platforms, subscription models, and brand-owned outlets. This strategy enables companies to manage packaging design, sustainability messaging, and portioning more effectively, while also collecting valuable consumer insights. Direct sales also encourage innovation in packaging formats, such as single-serve sachets for fitness users or family-sized bulk needs for households, meeting diverse customer demands.

Indirect sales ( distributors/B2B) segment predicted the fastest growth in the market during the forecast period. Protein powder through party production invests in eco-friendly and tamper-proof packaging. Organizations integrate unique formulations depending on user demands. It could be a mixture of plant proteins or whey isolate. Furthermore, it is so simple to tailor. We can even update the flavour, nutritional goals, and sweetness in any pattern one wants. Producers coordinate testing, production, labelling, packaging, and sourcing too. Moreover, the outcome product is served to users, which is ready to sell. The system lowers the main time and cost. From export documentation to formulation guidance, help is provided. Technical specialists make the product smoother. Furthermore, accurate paperwork ensures compliance with the function of exporting or auditing abroad.

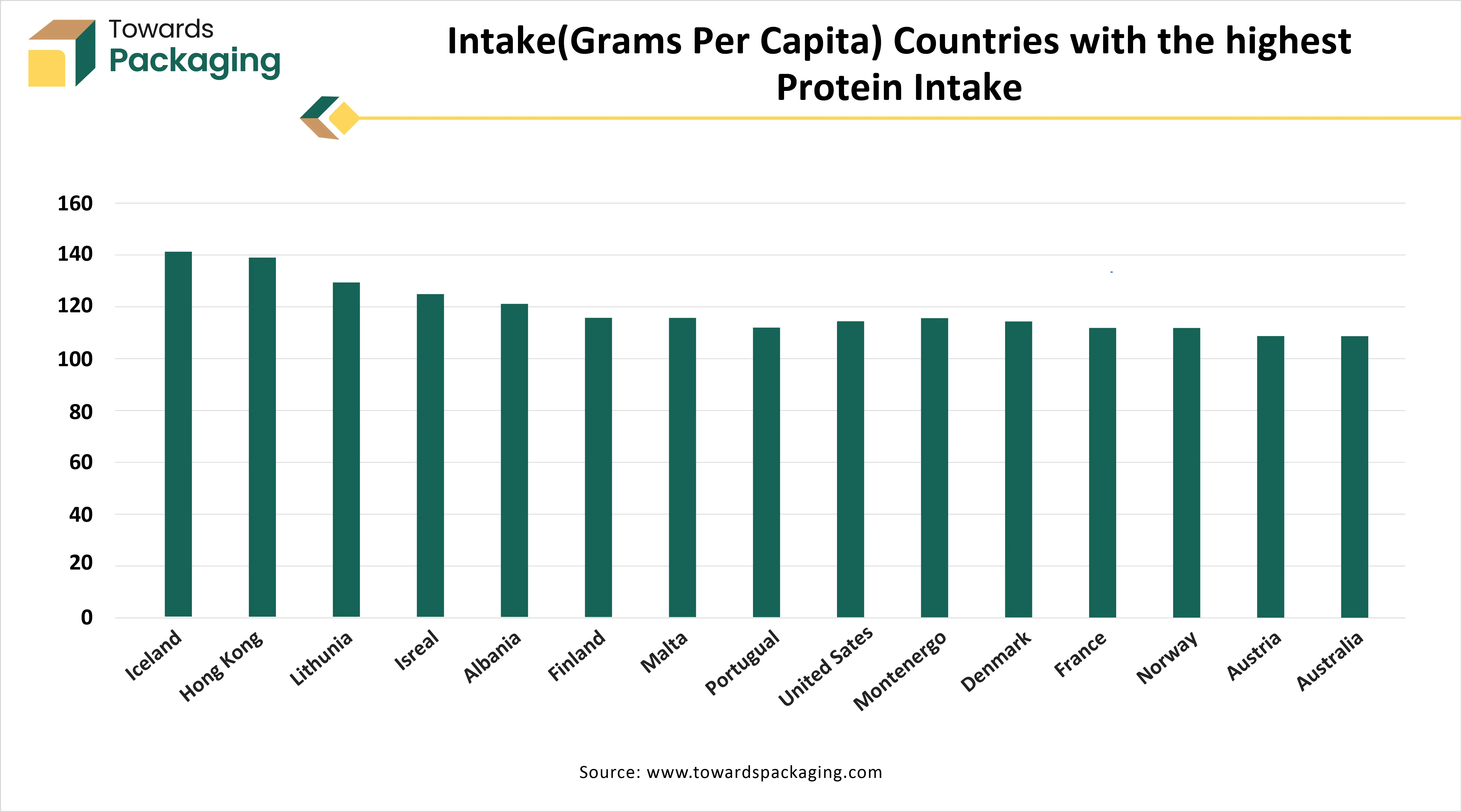

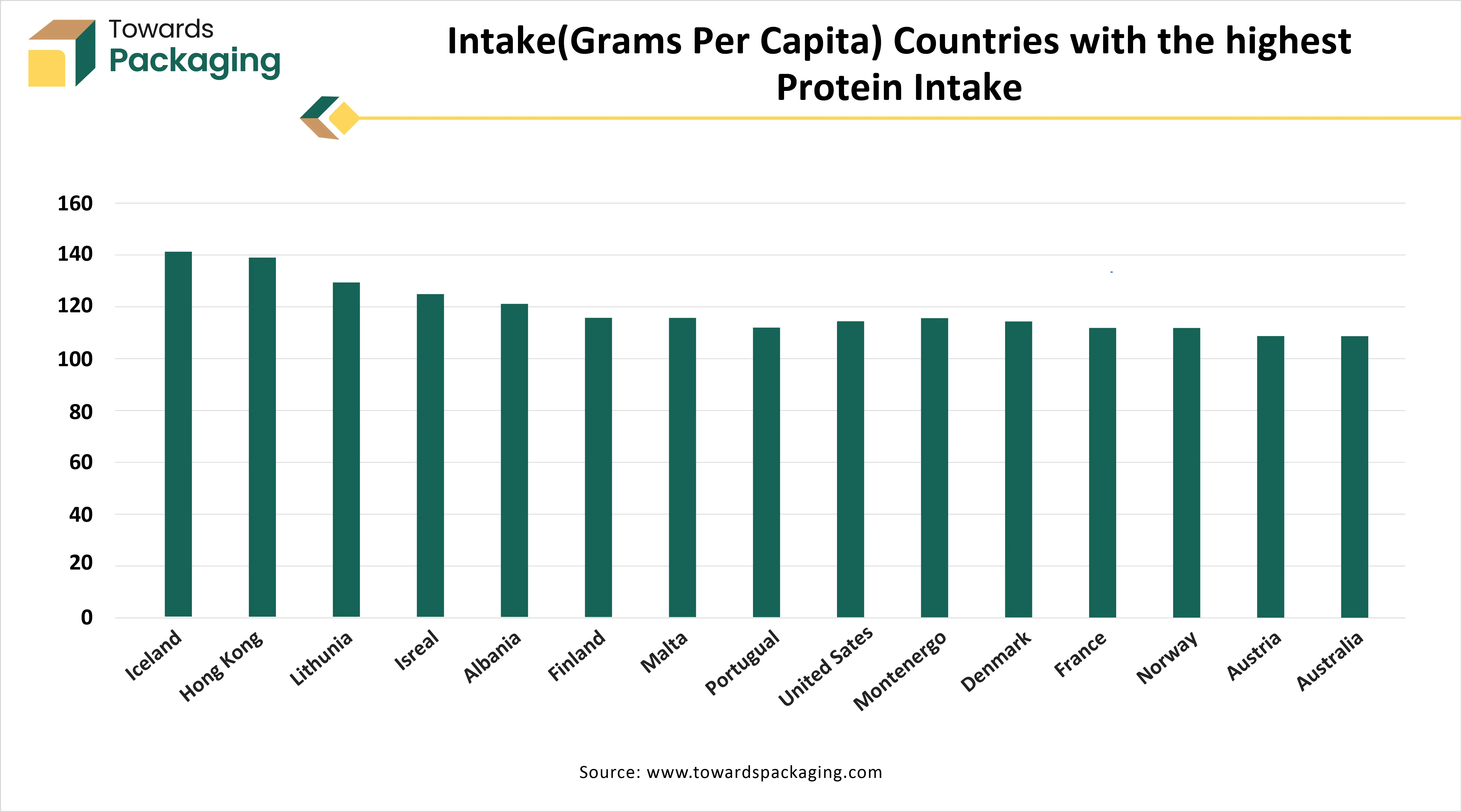

North America has dominated the protein packaging market in 2024 as US users consume protein in several forms, from regular staples like fish and meat to innovative plant-based alternatives. Many users engage with different protein designs, ranging from frozen or raw to ready-to-eat and prepared options that align with current demands for convenience. Approximately 90% of singles consume animal-based proteins on a regular basis, while over 40% count plant-based proteins in their diet. These segmentation points present possibilities for retailers and brands to change and develop their share in the upcoming years. , driven by animal-alternative protein trends.

Asia Pacific predicted the fastest growth in the market during the forecast period. The demand and production of protein packaging in the Asia Pacific are witnessing rapid growth, driven by growing health consciousness, urbanisation, and the booming fitness and sports nutrition sector. Countries like India, China, and Japan are seeking a surge in consumption of protein-rich products such as dairy proteins, plant-based proteins, and supplements, which are directly fueled by the demand for innovative and safe packaging. Flexible packaging formats like sachets, stand-up pouches, and resealable bags dominate due to their cost-effectiveness, lightweight, and convenience, while rigid containers, tubs, and bottles are selected for premium and bulk protein powders.

Material Processing and Conversion: The path transformation from milk to marketable whey protein powder includes several sophisticated procedures, including classification from cheese, filtration with the assistance of high-level membrane technologies, drying, and concentration. Every step is accurately managed to protect the nutritional integrity of the protein while ensuring product quality and safety.

Package Design and Prototyping: The current and modern food packaging designs, as we keep transforming, which have worked over a decade or two back, may not be used accurately. Packaging design trends keep growing and developing, and are encouraged by changing user tastes, technological excellence, etc. They are, therefore, one of the important factors that we must consider for your design procedure.

Logistics and Distribution: Third-party distribution and logistics play an important role in the protein product by tracking warehousing, distribution, and fulfillment. For protein bar producers and retailers, this points to official permission to climate-controlled storage, expertise in managing sensitive and high-demand products. By collaborating with third-party logistics, one must concentrate on product invention and marketing while making sure protein bars are shipped and stored under optimal conditions.

By Packaging Material

By Packaging Type

By End-Use Industry

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026