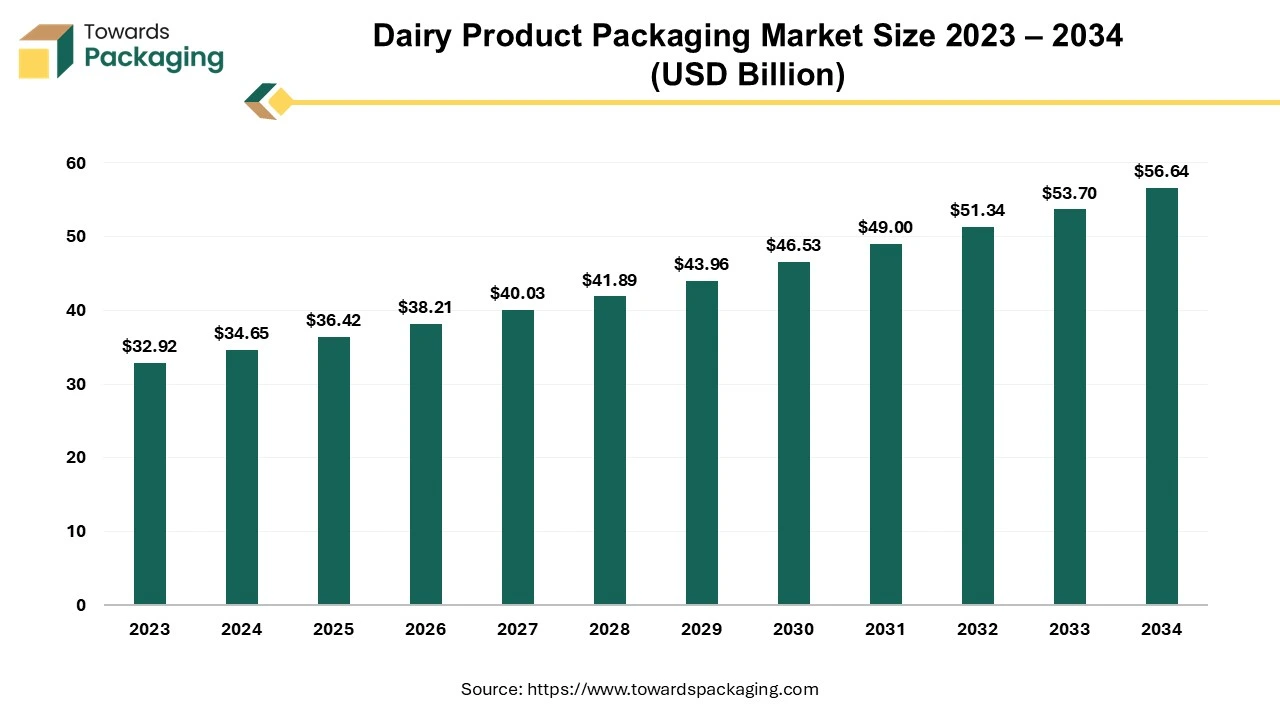

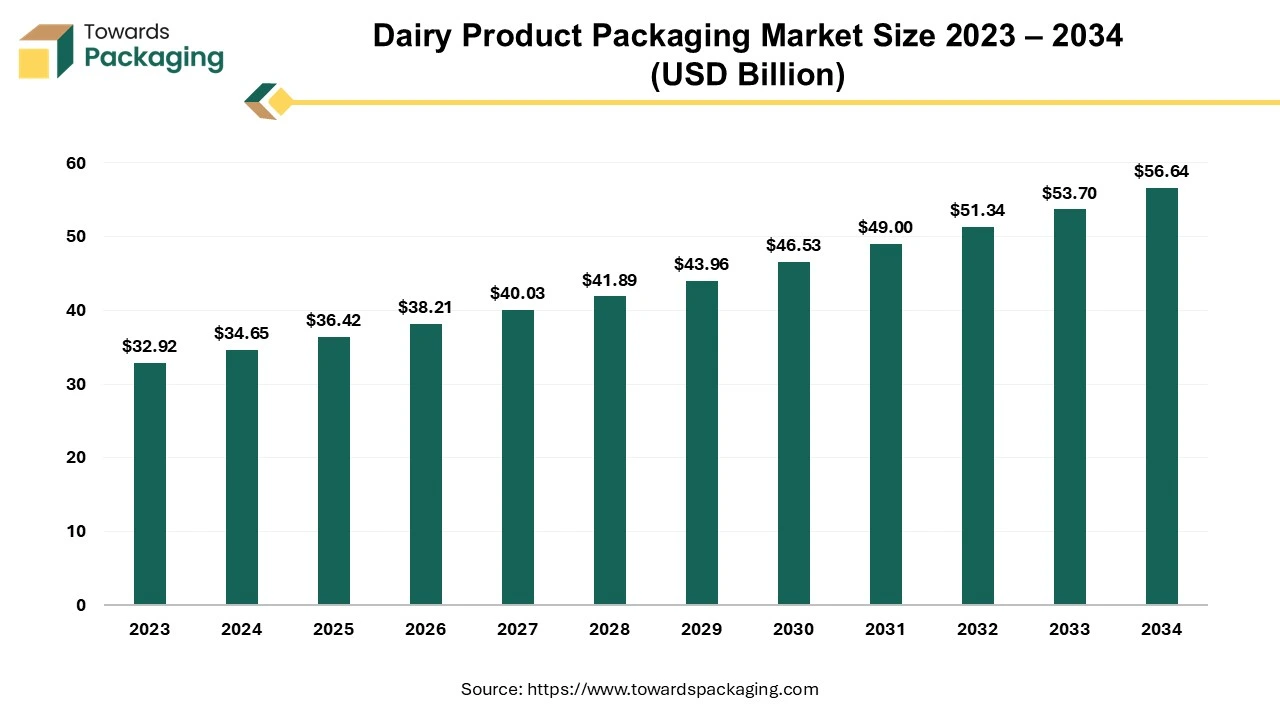

The dairy product packaging market is forecasted to expand from USD 38.35 billion in 2026 to USD 60.52 billion by 2035, growing at a CAGR of 5.2% from 2026 to 2035. The Dairy Product Packaging Market market provides a complete overview of global growth trends supported by statistical data, including forecasts up to 2035 and a steady 5.2% annual growth rate. The study analyzes packaging materials such as plastic, glass, paperboard, and biodegradable options, along with product categories like milk, cheese, yogurt, and butter. It highlights regional demand patterns, key companies, trade flow information, and supply chain analysis to help businesses understand both production and consumption dynamics.

The dairy product packaging market defines the industry that creates, manufactures, and distributes packaging materials specifically designed for dairy products. This market includes diverse packaging solutions designed to maintain the freshness, quality, and safety of dairy products such as milk, cheese, yoghurt, and butter throughout the supply chain.

Dairy product packaging serves several purposes: contamination prevention, shelf-life extension, product quality preservation, and consumer convenience. Dairy product packaging commonly used includes cartons, bottles, pouches, tubs, and wrappers, each designed to satisfy the specific needs of different dairy products. Furthermore, advances in packaging technology frequently contribute to sustainability initiatives by emphasising eco-friendly materials and innovative designs that lessen environmental effects.

| Trends | |

| Convenience-Oriented Packaging | Dairy product packaging sales are still largely driven by convenience. Consumers want packaging that is easy to handle, has portion control, and can be resealed. As consumers seek efficient and time-saving solutions, single-serve packaging, on-the-go choices, and user-friendly designs are gaining appeal. |

| Smart Packaging Technologies | Innovative dairy product packaging solutions are making their way into the market. These technologies include QR codes, RFID tags, and sensors that educate consumers about the origin, freshness, and safety of a product. Furthermore, creative packaging can help dairy producers with inventory management and supply chain optimisation. |

| Customization and Personalization | Consumer tastes differ, and the dairy industry is reacting by providing more customisable and personalised packaging alternatives. Personalised labels, packaging sizes, and product compositions that cater to specific dietary demands are all examples of this trend. Technology is being used by brands to offer a more personalised and engaging consumer experience. |

| Extended Shelf-Life Packaging | Extending the shelf life of dairy products is crucial for both farmers and consumers. Packaging methods that improve the retention of freshness and avoid rotting are gaining popularity. Modified Atmosphere Packaging (MAP) and vacuum packing, among other innovative techniques, improve the shelf life of dairy products and reduce food waste. |

Artificial Intelligence (AI) is transforming the landscape and changing the way businesses run in almost every industry. This can be witnessed in the dairy industry too; where they are finding different applications of AI in their infrastructure. For example, AI based model based advanced control, quality inferential, real-time optimization, predictive maintenance and insights etc., have proven useful for the dairy industry. The steady advancement of integration of AI into the diary product packaging solutions is helping in strengthening the products shelf life, quality maintenance and enhancing the convenience for consumers.

AI technology can help in optimization of the packaging design, increase efficiency through advanced analytics and predict consumer behavior. The AI-based design optimization could help with finding solutions that are sustainable and recyclable with less time-consuming process. Automation and AI together can help increase operational efficiency and reduce labor costs. The benefits of integration of AI into the dairy product packaging will help surge market growth during the forecast period.

Growing Focus on Preserving Functional Nutrients

The growing focus on preserving functional nutrients is a key driver of growth in the dairy product packaging market. As consumer demand shifts toward functional dairy products enriched with health-boosting elements like prebiotic fibers, omega-3 fatty acids, and bioactive peptides, packaging plays a critical role in maintaining the stability, efficacy, and shelf life of these sensitive nutrients. Traditional processes like pasteurization can degrade natural antioxidants and polyphenolic compounds in milk, making advanced, protective packaging essential for nutrient retention.

Moreover, innovations in packaging are enabling lactose-intolerant consumers to access nutrient-fortified alternatives without compromising on quality. This trend toward nutrient-preserving, functional dairy is pushing manufacturers to invest in high-barrier, intelligent packaging solutions that align with the evolving health and wellness preferences of global consumers.

Environmental Concerns Around Plastic Use

Environmental concerns around plastic use significantly restrain the growth of the dairy product packaging market by pressuring manufacturers to move away from conventional plastic materials, which have long been favored for their cost-efficiency, durability, and barrier properties. With rising consumer awareness and stricter environmental regulations, there is growing demand for sustainable and biodegradable alternatives, many of which are either cost-prohibitive or lack the technical performance required for preserving perishable dairy products. This creates a dilemma for producers: balancing environmental responsibility with the need for product safety, shelf life, and affordability. As a result, packaging innovation is slowed by regulatory uncertainty, limited material availability, and the technical challenges of replacing plastic without compromising product integrity.

Demand for Recyclable Packaging

Producers are increasingly developing packaging made from a single type of plastic, such as polyethylene or recycled polyethylene terephthalate (rPET), which simplifies the recycling process. Some companies are also introducing paper-based wraps and barrier packaging that are grease-resistant and easier to recycle than traditional multi-material laminates. In parallel, researchers are creating edible films and coatings from biopolymers like starch, chitosan, and milk proteins. For example, casein-based coatings can serve as effective oxygen barriers for cheese, while moisture-resistant edible glazes are being used on butter and other high-fat dairy products.

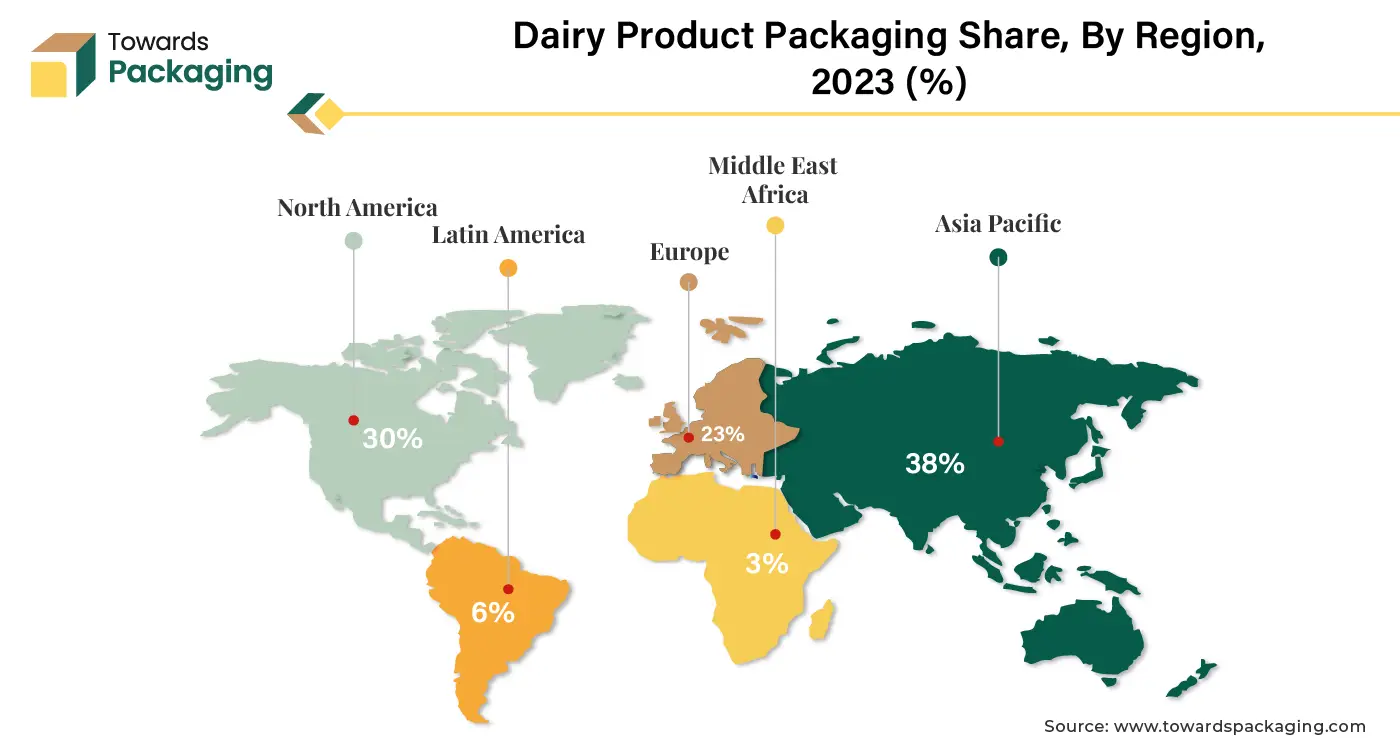

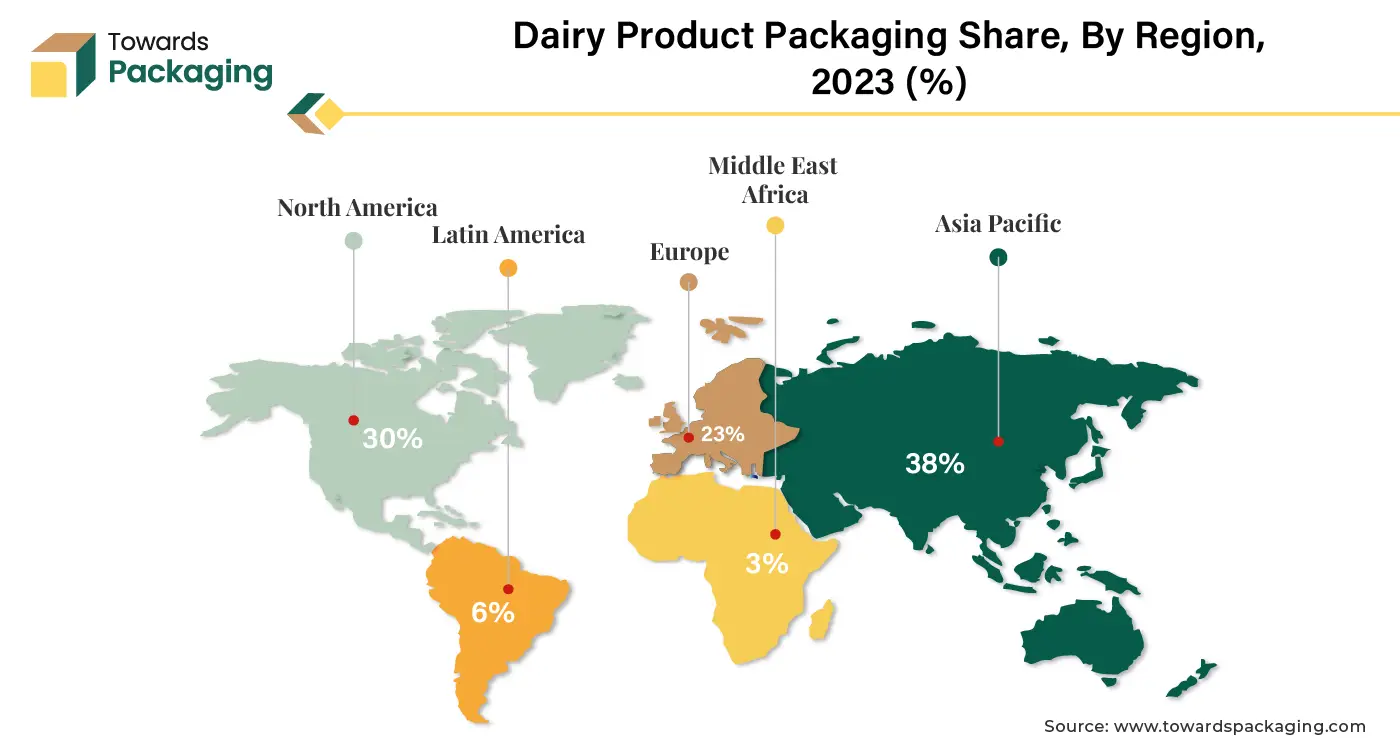

The Asia Pacific region has emerged as a dominant force in the dairy product packaging market, enjoying rapid growth and contributing significantly to the total expansion of the sector. The region's importance in the dairy product packaging market is due to several factors. Asia is the top milk-producing region in the globe. In 2022, it is predicted to increase by 2.1% annually to around 419 million tonnes, with a large portion of this rise forecast in India, China, Japan, Pakistan, Uzbekistan, and Kazakhstan are a few of the nations.

The growing population and increased disposable incomes in many Asia Pacific countries have increased dairy consumption. As demand for dairy goods, such as milk and various cheese varieties, grows, so does the need for effective and efficient packaging solutions. Second, urbanisation and changing lifestyles in the Asia Pacific region have resulted in a trend towards convenience-oriented packaged dairy products. This shift has compelled dairy product packaging makers to develop and adjust their offers to satisfy changing consumer tastes for on-the-go and ready-to-eat dairy products.

The Asia Pacific area has seen tremendous developments in packaging technologies and materials. To address global environmental concerns, manufacturers invest in cutting-edge facilities and use sustainable packaging procedures. The varied range of dairy products eaten in the region, from traditional milk to dairy-based snacks, has created a desire for adaptable and customised packaging options. This variety of product options needs an adaptable and responsive dairy product packaging market.

The Asia Pacific region's dairy product packaging market leadership can be ascribed to several factors, including population growth, rising disposable incomes, changing lifestyles, technical improvements, and various dairy product preferences. As the region's economy and culture evolve, the Asia Pacific dairy product packaging market is expected to remain a dynamic and influential participant in the global landscape.

North America is the second-largest market for dairy product packaging, with a vibrant business environment and numerous factors that have fueled its rise to prominence. The region's sophisticated customer base, which prefers various dairy products, propels the region's significant market share. North American consumer preferences change due to several variables, including sustainability, convenience, and health concerns. The market for creative and helpful dairy product packaging solutions has increased due to this change. Because of the region's technological and manufacturing expertise, innovative packaging techniques have been developed to meet these shifting needs.

For Instance,

The North American dairy industry has witnessed a surge in premium and speciality dairy product consumption. This trend has heightened the need for packaging that preserves product freshness and enhances the brand experience. As a result, packaging manufacturers in the region are investing in research and development to create solutions that align with the premiumization trend in the dairy sector. North America's position as the second leading region in the dairy product packaging market is underpinned by a combination of consumer-driven trends, technological innovation, and a responsive packaging industry that caters to the evolving demands of the dynamic North American market.

Cheese is the dominating category in the speciality foods sector in the United States, with sustained market growth year after year. The country has approximately 600 cheese kinds, with over 1,000 licenced artisan, speciality, and farmstead cheesemakers contributing to producing handmade, naturally flavoured, and farm-fresh cheeses. This diversification of cheese offers is gaining appeal among Americans, showing a preference for artisanal and unusual dairy products. When assessing the current market conditions for both traditional and speciality types of cheese, it is worth noting that cheese ranks 112th among all traded items globally. Despite its low ranking, the cheese sector has risen significantly, and packaging innovations have played a critical role in meeting customer needs.

One notable example of packaging innovation is Sargento's successful launch of Balanced Breaks, on-the-go cheese nibbles. This creative packaging approach connects with changing customer lifestyles, offering handy, portable solutions that increase sales. The success of such goods emphasises the significance of adjusting packaging tactics to accommodate changing customer demands. Insights indicate fascinating patterns when diving into consumer preferences for package size and kind. Respondents preferences vary, with a clear preference for containers for shredded (34%), sliced (35%), and cottage/ricotta (36%). Block (36%) and spread (41%) cheeses are preferred; nevertheless, containers are preferred.

For Instance,

Those who buy shredded cheese (47%) prefer plastic bags, while those who purchase cottage/ricotta (50%) prefer white plastic containers. Furthermore, a sizable minority of respondents (39%) do not prefer the packaging of block cheeses, indicating a potential for novel packaging solutions that meet consumer expectations. The cheese market in the United States is dynamic, driven by a diverse offering and a growing desire for speciality and artisanal goods. Packaging plays an essential influence in customer decisions. Therefore, continual innovation is required to accommodate changing preferences and lifestyle trends.

The market for dairy product packaging is supported by government initiatives that strengthen waste reduction policies, sustainability objectives, and food safety regulations. While EPR frameworks and plastic reduction regulations are pushing dairy brands toward more sustainable packaging designs, authorities like the European Commission and FSSAI are promoting the use of recyclable and food-grade packaging materials.

Sustainability is changing the packaging of dairy products by increasing the use of lightweight, recyclable, and reusable materials. Dairy companies are implementing eco-friendly substitutes, cutting back on plastic use, and making their packaging more recyclable to meet changing consumer demands and environmental goals. Manufacturers are also investing in recycled content, biobased materials, and mono-material packaging design to improve circularity. In addition, sustainability-focused labeling and carbon footprint reduction initiatives strengthen brand compliance and consumer trust.

Packaging is crucial in the entire food and beverage value chain from production to consumption; packaging is essential to developing and maintaining strong food supply networks. This information sheet highlights the importance of packaging in the dairy supply chain and consumers' daily lives to promote sustainability and robustness. Its compatibility with a circular economy model and environmental effect are essential factors. The goal is to create packaging that minimises environmental impact while enhancing the whole food supply network's ability to function effectively. Instead of using a one-size-fits-all approach, the emphasis is on comprehending the factors influencing the dairy industry's decision to choose specific packaging solutions, especially when selecting packaging materials.

The main focus is finding the best possible balance between the essential purposes of packaging and its environmental impact. No one packaging material is right or wrong in general since choosing one requires striking a careful balance between meeting basic packaging needs and reducing environmental effects. Dairy products must be packaged with inert materials to avoid interactions with the contents inside. However, new developments in container design are showing a move towards adding customised interactions to increase dairy products' shelf life. This development is captured in "smart, active, or intelligent packaging" where creative methods improve packaging's usefulness beyond simple containment.

For Instance

Plastics combine strength, lightweight, stability, ease of sterilisation, and flexibility (from film to rigid applications) in packaging products. For example, dairy product packaging made of plastic does not affect the product's flavour or quality. Currently, plastic makes up more than 75% of dairy product packaging. Food is shielded from outside contamination and retains its natural flavour thanks to the barrier qualities of plastics. Additionally, plastic packaging offers practical options for distribution and storage and is highly resistant to heat, cold, and moisture. Perishable food has an extended shelf life due to multi-layered plastic films. Packaging made of plastic can be recycled, repurposed, or utilised to recover energy.

For Instance,

The finest containers for pasteurised milk storage are made of high-density polyethene (HDPE). For milk packaging, another plastic substance utilised is polyethene terephthalate or PET. Pigmented polymer-emulsion (PET) coating shields food taste from light-induced lipid oxidation. Products for drinking yoghurt are packaged in HDPE bottles and sealed with PE-LD caps or aluminium foil laminate heat-seal closures. Other types of plastic bottles, such as PET ones, can also be utilised.

The biodegradable milk packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. This biodegradable milk packaging market is increasingly driven by environmental sustainability goals, regulatory mandates to reduce plastic waste, and shifting consumer preferences toward eco-friendly, non-toxic, and compostable packaging. It is also influenced by advancements in barrier technologies, allowing biodegradable packaging to preserve milk shelf life comparably to traditional plastic or multilayered cartons.

Despite higher production costs compared to conventional plastic, the market is experiencing rapid growth due to the ESG commitments of major dairy brands, innovation in material science, and pressure from retailers and regulatory bodies. Additionally, the market is expanding rapidly in Europe, fuelled by increasing environmental awareness, stringent government initiatives, rising focus on adopting biodegradable packaging, and aligning with the principles of the circular economy.

Dairy packaging relies on materials such as paperboard, plastics (HDPE, PET), aluminum, and glass, selected for barrier properties, durability, and sustainability. Sourcing focuses on high-quality, food-grade, and recyclable materials to ensure safety and freshness.

Key Players: Major suppliers include Tetra Pak, Amcor plc, SIG Combibloc, Elopak, Huhtamaki Oyj, and Berry Global Inc., offering cartons, bottles, and multilayer materials tailored for dairy packaging.

Efficient logistics are critical to maintain cold-chain integrity and timely delivery to retailers. Packaging must be compatible with automated handling and bulk transportation.

Key Players: Companies providing logistics solutions include Tetra Pak, Amcor, DHL, UPS, FedEx, and specialized cold-chain distributors that support safe dairy product movement.

Dairy packaging recycling focuses on paperboard cartons, plastics, and aluminum. Programs aim to recover materials for reuse and reduce landfill waste.

Key Players: Leaders include Veolia, SUEZ, Paprec, Waste Management (WM), and initiatives like TerraCycle, which process and recycle dairy packaging streams.

The competitive landscape of the dairy product packaging market is characterized by established industry leaders such as Mondi Group, Sealed Air Corporation, WestRock Company, ELOPAK, Nampak Ltd., Bemis Company Inc., Airlite Plastics, Ahlstrom, Huhtamaki Group and Tetra Pak. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions, and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

By Material

By Type

By Product

By Region

February 2026

February 2026

February 2026

February 2026