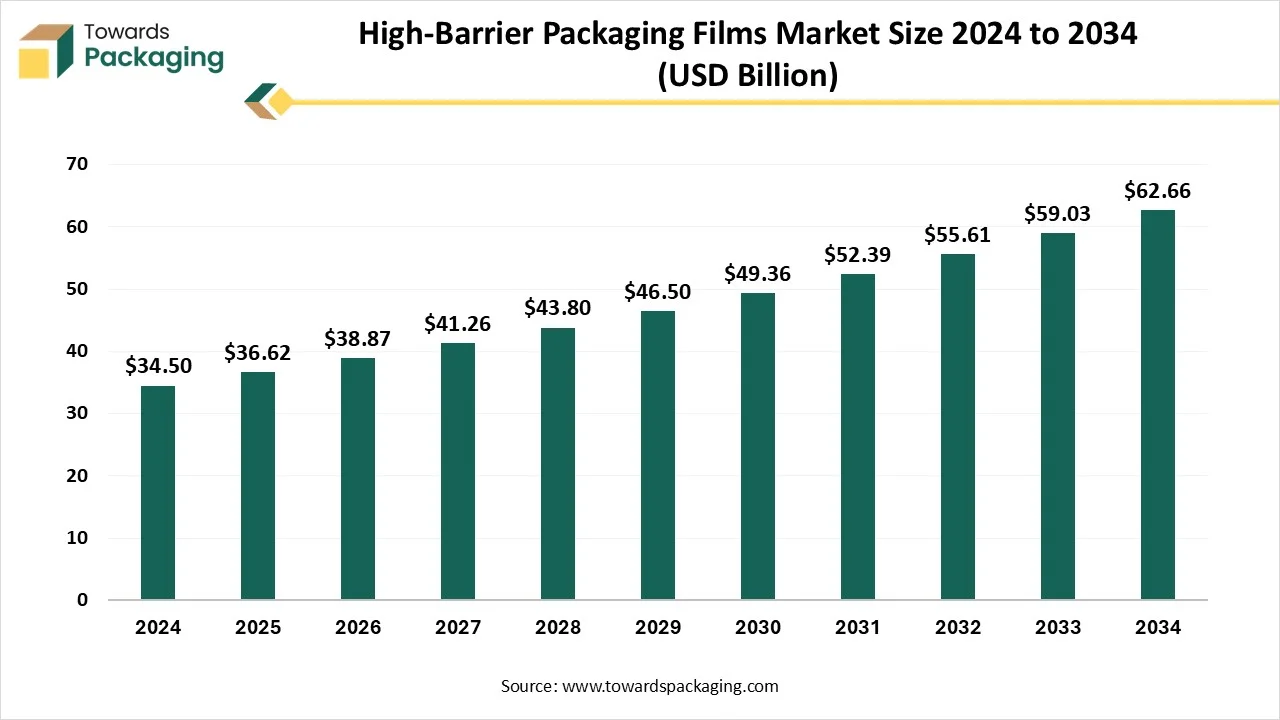

The high-barrier packaging films market is projected to reach USD 66.51 billion by 2035, expanding from USD 38.87 billion in 2026, at an annual growth rate of 6.15% during the forecast period from 2026 to 2035. The rising demand for enhanced protection of the perishable products from ecological adversities such as light, moisture, and oxygen has evolved the demand for market.

These are widely used in the food & beverages industry where there is high responsibility for the protection of products and maintaining its quality and integrity. Pharmaceutical industries are also highly using to protect the integrity of the drugs. This market is dominating in the Asia Pacific region due to continuous advancement in the packaging technology.

| Metric | Value |

| Global Installed Capacity | 12.3 million tons |

| Actual Annual Production | 10.7 million tons |

| Capacity Utilization | 86.90% |

| Multilayer Film Output | 7.12 million tons |

| Metallized Film Output | 2.06 million tons |

| Coextruded Barrier Film Output | 1.52 million tons |

| EVOH-Based Film Production | 0.98 million tons |

| PVdC-Based Film Production | 0.41 million tons |

| Nylon/PA Barrier Film Output | 0.63 million tons |

| Average Plant Production | 19,300 tons/year |

| Number of Production Lines | 5,460 |

| New Lines Installed in 2025 | 182 |

| Plant Automation Level (Avg.) | 64% |

| Energy Use per Ton of Film | 2.84 MWh |

| Average Production Scrap Rate | 6.90% |

| Inline Inspection Adoption | 72% of plants |

The high-barrier packaging films market refers to advanced multilayer films designed to provide superior protection against moisture, oxygen, light, and other external contaminants that can compromise product quality and shelf life. These films are widely used in food and beverages, pharmaceuticals, electronics, and industrial packaging, where product integrity and extended freshness are critical. Materials include plastic polymers, aluminum, and bio-based layers, often combined through co-extrusion, lamination, or metallization processes. Growth is driven by rising demand for packaged and convenience foods, stricter regulations on product safety, and consumer preference for longer shelf-life goods. Innovations such as recyclable high-barrier films, bio-based materials, and smart barrier technologies are reshaping the market, with Asia Pacific and North America emerging as key demand centers.

As part of the 2024/2025 EU regulation, high-barrier films and flexible packaging are now required to minimize harmful substances, such as per- and polyfluoroalkyl substances (PFAS), to ensure food and environmental safety. The regulation’s push to make all packaging recyclable encourages film producers to develop barrier films that are compatible with recycling streams or compostable/recyclable alternatives. With a 2030 recyclability deadline for all packaging, demand is likely to grow for high-performance films that balance barrier properties for food or pharmaceutical protection with recyclability and compliance, driving innovation in film materials and technologies.

Manufacturers are making significant changes to high-barrier packaging films in an effort to strike a balance between sustainability requirements and performance. Mono-material barrier solutions that are simpler to process in recycling streams are becoming more popular as complex non-recyclable multilayer films are discouraged by regulatory frameworks in North America and Europe. Restrictions on chemicals and solvent-based coatings also affect compliance, promoting the use of safer water-based and bio-based technologies. Manufacturers of food packaging must adhere to stringent migration and safety regulations, which leads to the creation of inks, adhesives, and antimicrobial additives that are compliant. In order to show their commitment to the environment and comply with eco-labeling and certification initiatives, brands are progressively implementing life cycle assessment techniques.

| Company | 2022 | 2023 | 2024 | 2025 |

| Amcor Plc | 7.20% | 7.30% | 7.40% | 7.60% |

| Sealed Air | 5.60% | 5.70% | 5.80% | 5.90% |

| Berry Global | 4.90% | 5.00% | 5.10% | 5.20% |

| Mondi Group | 4.40% | 4.50% | 4.60% | 4.70% |

| Huhtamaki | 3.20% | 3.30% | 3.40% | 3.40% |

| Winpak | 1.90% | 2.00% | 2.00% | 2.10% |

| Uflex | 1.70% | 1.80% | 1.80% | 1.90% |

| Metric | Value |

| Global Consumption | 10.3 million tons |

| Food Industry Consumption | 6.24 million tons |

| Meat & Protein Packaging | 1.48 million tons |

| Dairy & Cheese Packaging | 0.97 million tons |

| Snacks & Dry Foods | 1.71 million tons |

| Pharma & Medical Consumption | 1.76 million tons |

| Industrial & Chemical Consumption | 1.29 million tons |

| Household & Personal Care | 0.91 million tons |

| Average Consumption per Capita (Global) | 1.29 kg |

| Country With Highest Consumption | China — 2.14 million tons |

| Country With Fastest YoY Growth | India — 6.2% |

| Avg. Customer Order Size | 14.8 tons |

| Average Film Thickness Used | 38.4 microns |

| Shelf-Life Enhancement (Avg.) | 29% |

The addition of AI technology in the high-barrier packaging films market plays an important role in the innovation of the packaging films quality. AI is widely utilized for the selection of materials that help in enhancing barrier performance. The advanced technology support in designing high-barrier packaging films and sustainable structures. It helps in detecting errors in microscopic level which enhance the reliability of the market. AI help in predicting the maintenance required to the machines which prevent sudden shut down and disturbance in supply process.

"Units: cm³·mm/m²·day·bar - Values not explicitly provided in the text are marked N/A."

| Film Type | PO₂ at 10% RH | PO₂ at 50% RH | PO₂ at 85% RH | Notes |

| Biofilm/m-PVOH (10 µm layer) | ~0.10–0.17* | ~0.10–0.17* | 3.94 | PO₂ reduced 42–66% vs. 5 µm coating; stable up to 50% RH |

| Biofilm/m-PVOH/PLA | ~0.10–0.17* | ~0.10–0.17* | 4.02 | PLA becomes saturated at 85% RH |

| Biofilm/m-PVOH/PLA + 5% wax | N/A | N/A | 3.42 (15% lower than 4.02) | Wax reduces oxygen permeation |

| Biofilm/m-PVOH/PLA + 10% wax | N/A | N/A | 3.14 (22% lower than 4.02) | Higher wax = stronger barrier |

| Reference (Apicella et al. 2022, 5 µm coating) | 0.22–0.30 | 0.22–0.30 | N/A | Baseline for comparison |

The table compares the oxygen permeability (PO2) of different biofilm structures under varying humidity levels. m-PVOH-based biofilms show very low PO₂ at 10–50% RH, indicating strong oxygen barrier performance, but permeability increases sharply at 85% RH due to moisture sensitivity. Adding PLA layers maintains low PO₂ at lower RH, though PLA becomes saturated at high humidity. Incorporation of wax significantly improves oxygen barrier performance, reducing PO₂ by 15–22% at 85% RH, with higher wax content delivering stronger protection compared to the reference coating.

| Film Type | UVC Transmittance (200–280 nm) | UVB Transmittance (280–320 nm) | UVA Transmittance (320–400 nm) | TR% at 800 nm | Notes |

| Neat Biofilm | 0% | 0% | Low (<10%) | 9.60% | Baseline substrate |

| Biofilm/m-PVOH | 0% | 0% | Low (<10%) | 17.00% | Transparency increases with m-PVOH layer |

| Biofilm/m-PVOH/PLA (0% wax) | 0% | 0% | Low (<10%) | 17.10% | Similar to m-PVOH-only; PLA transparent |

| Biofilm/m-PVOH/PLA + 5% wax | 0% | 0% | Low (<10%) | <17% (reduced) | Wax lowers transparency |

| Biofilm/m-PVOH/PLA + 10% wax | 0% | 0% | Low (<10%) | <<17% (strong reduction) | Higher wax = lower transparency |

The results show that all film structures provide complete blocking of UVC and UVB radiation (0% transmittance), ensuring strong protection against harmful UV light. UVA transmittance remains very low (<10%) across all samples, supporting effective light-barrier performance. Adding m-PVOH and PLA layers increases transparency in the visible range, with TR% rising to about 17% at 800 nm. However, wax incorporation reduces transparency, and higher wax content leads to a stronger reduction in light transmission while maintaining UV protection.

Rising Technological Advancement

The rising technological advancement has driven the high-barrier packaging films market to develop sustainable films. The mechanical strong point and barrier properties of the packaging films that have been significantly boosted by resource inventions, comprising the expansion of multilayer packaging films and the utilization of nanotechnology for high quality films productions. They are therefore occupied in a diversity of businesses, comprising food packing and industrial & packing technologies.

Rising ecological problems have also encouraged the formation of biodegradable and recyclable barrier packaging films and are more famous among consumers and corporations who care regarding the environments. Therefore, the rising technical progressions and goods invention influence the high-barrier packaging films industry in the predicted period.

Presence of Several Alternatives

The presence of various substitutes has hindered the expansion of the market. Metals and glass are alternatives in some states, mainly when it about longer period storage. The progressive resources and measures needed to achieve enhanced barrier potentials normally result in amplified production charges, making these packaging less reasonable for charge-sensitive submissions.

Continuous Product Launch Raised the Opportunities of the High-Barrier Packaging Films Market

The continuous products launch has raised the opportunities for growth of the market. The rising demand for the high-barrier packaging films influences from their capability to offer long-lasting, lightweight resolutions which defend product quality and endure the severities of delivery, hence influencing market extension. Ecological worries and sustainable packing trends will drive the high-barrier packaging films industry. The rising demand to restrict plastic usage is influencing research in bio-based and recyclable films that offer sustainable substitutes. High-barrier packaging films deliver this shift by permitting for lighter and thinner packaging that results in less need for total resource consumption.

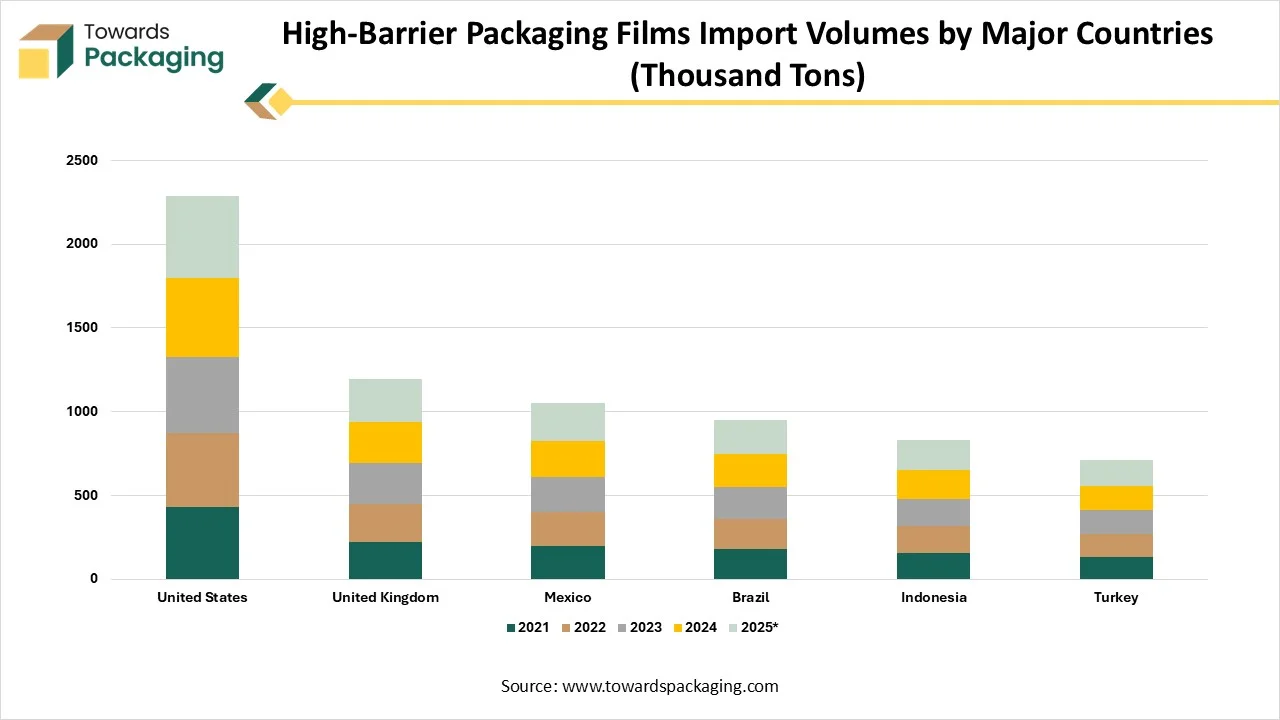

| Country | 2021 | 2022 | 2023 | 2024 | 2025 |

| United States | 428 | 443 | 457 | 472 | 488 |

| United Kingdom | 221 | 230 | 239 | 247 | 256 |

| Mexico | 196 | 203 | 210 | 218 | 225 |

| Brazil | 178 | 183 | 190 | 197 | 204 |

| Indonesia | 154 | 160 | 166 | 172 | 178 |

| Turkey | 132 | 137 | 142 | 147 | 152 |

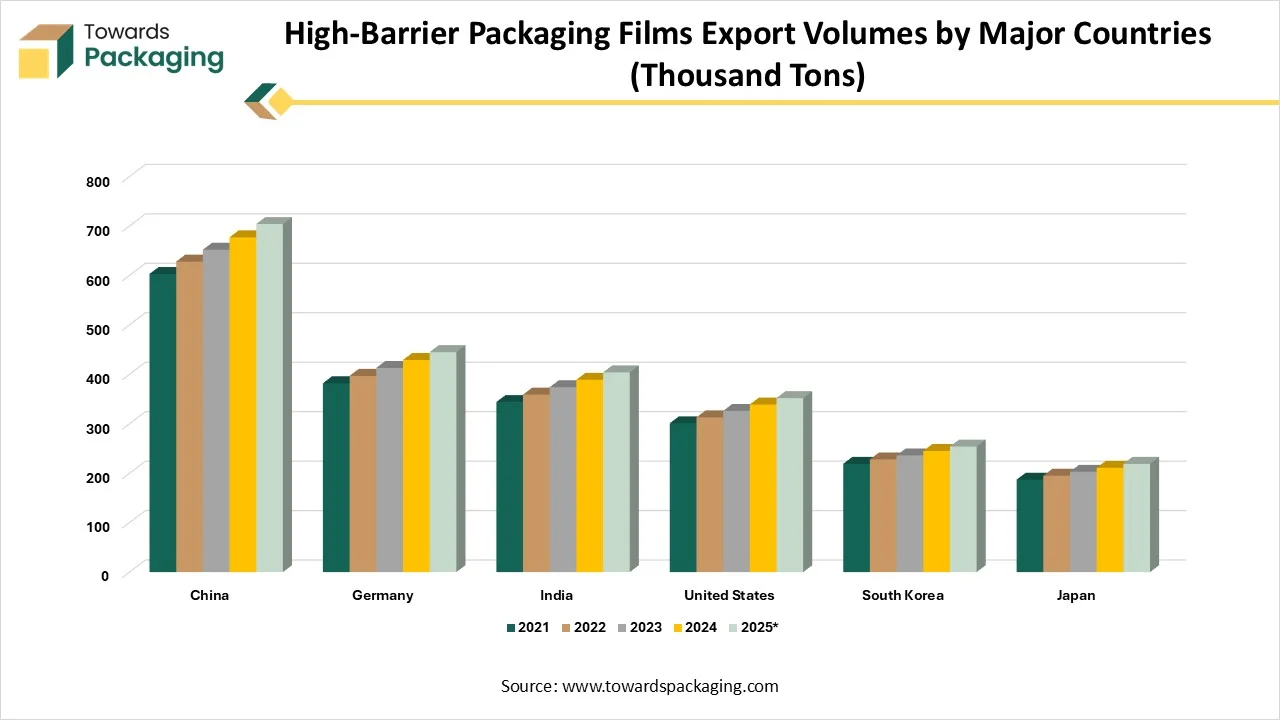

| Country | 2021 | 2022 | 2023 | 2024 | 2025 |

| China | 603 | 628 | 652 | 677 | 704 |

| Germany | 382 | 397 | 413 | 429 | 445 |

| India | 344 | 359 | 374 | 389 | 404 |

| United States | 301 | 313 | 326 | 339 | 352 |

| South Korea | 219 | 228 | 236 | 245 | 254 |

| Japan | 187 | 195 | 203 | 211 | 219 |

The plastics (PET) segment dominated the high-barrier packaging films market in 2024 due to its excellent clarity, chemical resistance, and barrier properties. These are widely used in the food and pharmaceutical sectors, with the development of investment towards healthcare sector there is a huge demand for enhanced quality packaging. The rising focus towards usage of recyclable films has influenced the demand of this sector.

The bio-based films segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The rising concern for ecological issues has influenced the demand for the usage of eco-friendly packaging films and boost the growth of this segment. The continuous research for blending polymers with PLA and PBAF materials to get mechanical strength and required barrier properties has also enhanced the adoption of this segment. Extensive usage for films for manufacturing sachets, pouches, and blister packs in the pharmaceutical industry has raised the demand for bio-based films.

The co-extrusion segment dominated the market in 2024 due to the capacity to provide enhanced barrier resistance from air, light, and moisture. It offers huge protection and protects products by enhancing shelf-life. The rising demand for sustainable and innovative packages has increased the demand for this segment. The growing e-commerce sector boosts the demand for packaging which is strong to resist adverse effect of ecology.

The metallization & SiOx/AlOx coating segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to its enhanced barrier properties and high recyclability. It provides transparency and microwave safe which enhance its demand in food & pharmacy industry. The capacity to provide exceptional protection from UV rays, oxygen, and moisture has raised the adoption of such technology.

The pouches segment held the largest share of the market in 2024 due to its high flexibility. Flexible packing, like pouches, is becoming popular as it is space-efficient, affordable, and lightweight. Both laminated and stand-up pouches are examples of high barrier packaging films which are becoming highly popular for protecting consumer goods, food & beverages, and medicines. These packing choices are highly attractive to a series of industries since these are flexible, controllable, and tailored.

The lidding films segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to the huge demand for high-protection packaging films which is used in tubs, trays, and cups. The major benefits of this segment it helps in the extension of shelf life of the products, and it is highly portable. Rising food safety guidelines has pushed the growth of this segment.

| Barrier sheet for dry fruits packaging | Protect nuts and dried fruits from moisture and oxidation. |

| Sweets & Desserts | Ensure freshness and maintain the texture of items. |

| Fruits & Vegetables | Prevent spoilage and extend shelf life. |

| Dairy (Flavored Milk/Cheese) | Maintain freshness and nutritional value. |

| Bakery & Snacks | Preserve crispness and prevent contamination. |

| Confectionery (Jelly) | Maintain texture and prevent degradation. |

| Meat & Seafood | Ensure hygiene and prevent bacterial growth. |

| Nutritional Products/Baby Food | Ensure safety and nutrient retention |

| Sauces & Soups | Preventing spillage and contamination. |

| Ready-to-Eat Food | Ideal for pre-packaged meals requiring long shelf life. |

| Beverages | Prevent leakage and maintain beverage quality. |

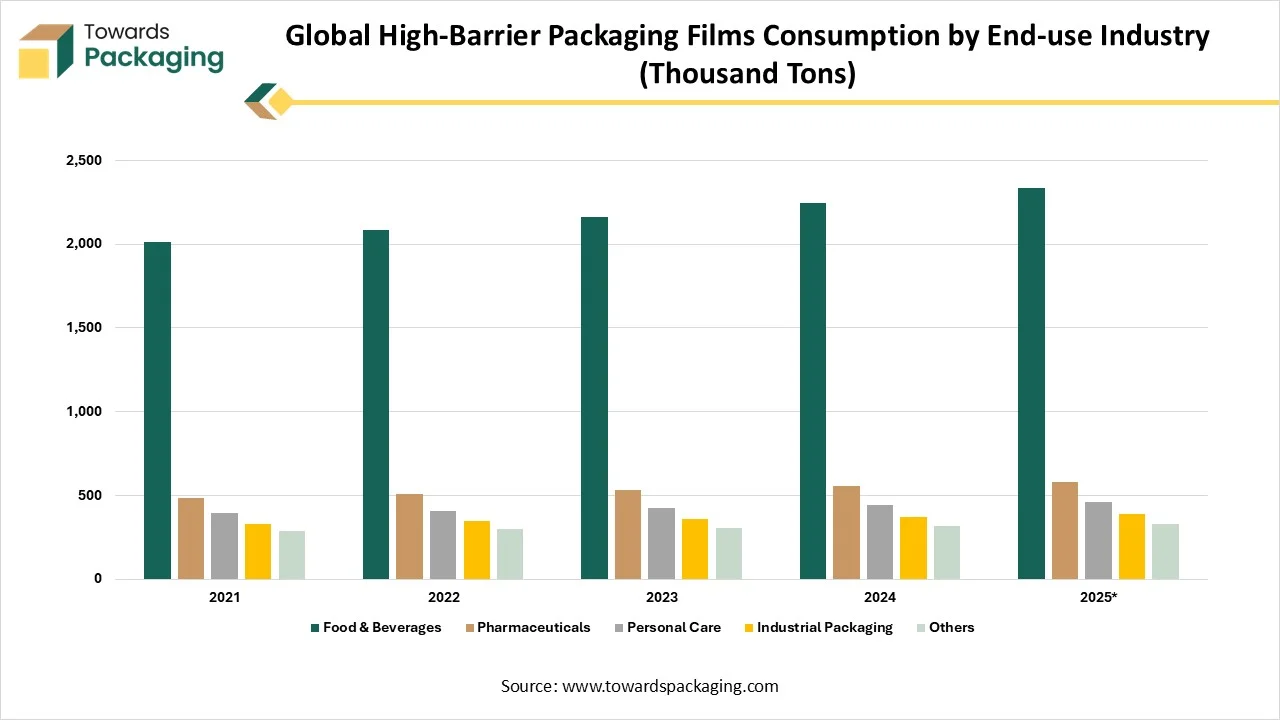

The food & beverages (snacks & confectionery) segment held the largest share of the market in 2024 due to rising demand for maintaining freshness of food products. The increasing focus of the industries to enhance the convenience of the consumers and decrease food waste has improved the demand for this segment. The rising worldwide demand for confectionery products and ready-to-eat food has boost the development of the market.

The pharmaceutical & medical segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to increasing demand for convenience, safety, and freshness. High barrier packaging films defend therapeutic medicines from light, moisture, and oxygen, safeguarding their efficacy and freshness. These packaging films deliver simplicity with services such as tamper-evident closures and easy-to-open pouches, refining consumers experience and security. As the growing demand for reliable and user-friendly packing resolutions in pharmaceutical sectors, high barrier packaging films will play an important role in attaining those demands, enhancing the growth of the market.

The food manufacturers segment held the largest share of the market in 2024 due to the rising pressure to maintain the freshness of the food products. The rising demand for sustainable and recyclable packaging has pushed this segment to utilize such films. Food products such as meat, fish, dairy products, beverages, and various others have influenced the demand for high-barrier packaging films. Continuous enhancement with new innovations in this market has meet the shifting demand of the consumers.

The pharmaceutical companies segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to rising concern for drug protection and maintaining the quality of the medicines. These barrier films provide protection to the drugs against various factors such as moisture, light, and oxygen which plays a crucial role to enhance the storage period of the medicines. The presence of sensitive antibiotics and biologics need high protection from external environment which enhance the usage of these films in this segment.

| Sector | 2021 | 2022 | 2023 | 2024 | 2025 |

| Food & Beverages | 2,012 | 2,083 | 2,165 | 2,248 | 2,338 |

| Pharmaceuticals | 486 | 508 | 529 | 553 | 577 |

| Personal Care | 394 | 409 | 426 | 444 | 461 |

| Industrial Packaging | 331 | 344 | 357 | 371 | 386 |

| Others | 284 | 298 | 306 | 317 | 329 |

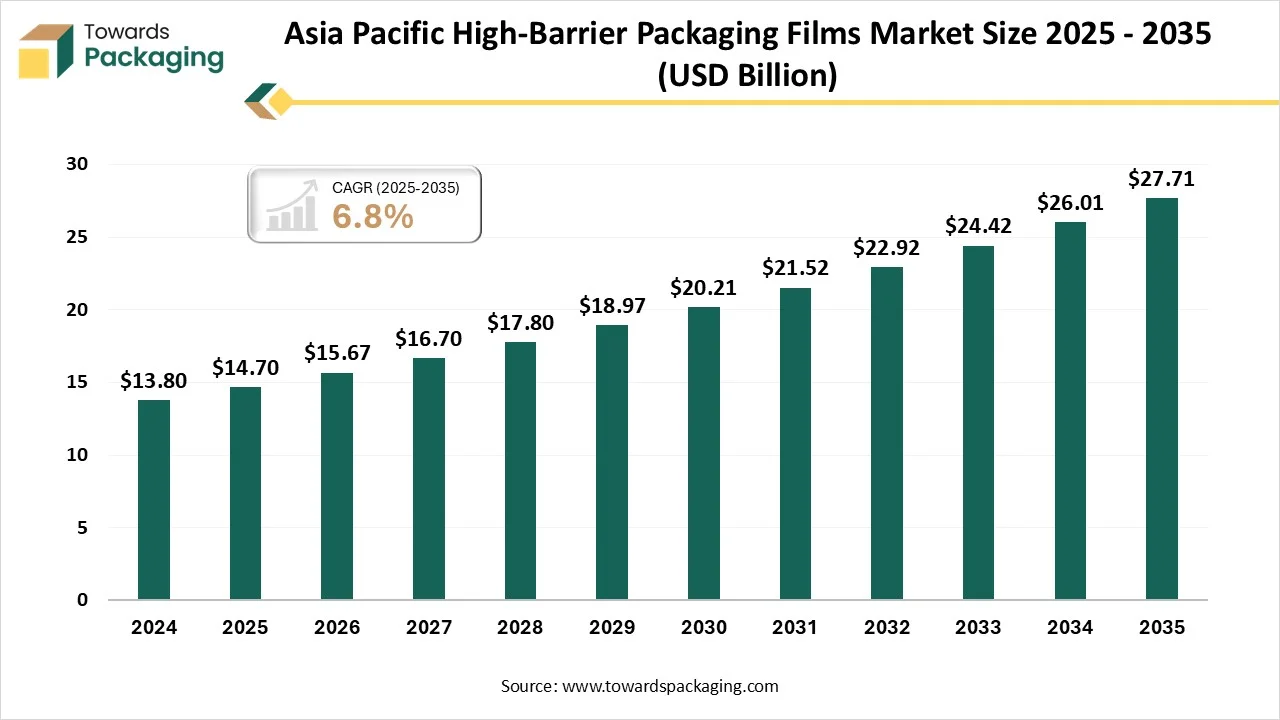

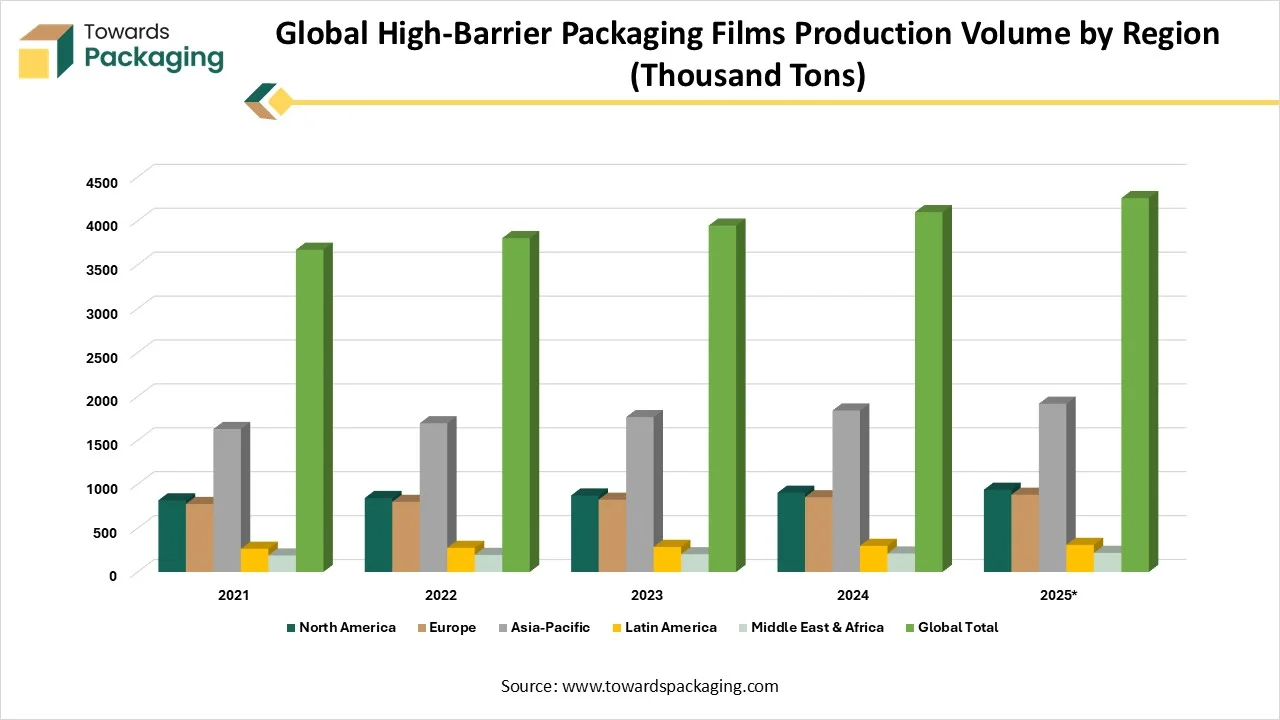

Asia Pacific held the largest share of the high-barrier packaging films market in 2024, due to its strong economic development. This growth has boosted customer expenditure and upsurges demand for barrier packaged films goods. This economic development is escorted by rising urbanization, along with the urban people projected to develop. The growing demand for packaging resolutions which are sustainable and developments in packing technologies are influencing the market growth. This region is undergoing rapid development because of the expansion of food & beverage sector, increasing urbanization, and growing disposable earnings.

The trend for High-barrier packaging films in India is classified by fast growth, driven by the user demand for packaged goods, a developing pharmaceutical industry, and a strong encouragement towards sustainable solutions. The industry is developing in order to serve a longer shelf life, good product protection across the main sectors, and convenience, too.

With India’s pharmaceutical sector rising rapidly, the high-barrier packaging is important for protecting the drugs, fragile products, and the medical devices from factors like oxygen, moisture, and pollutants too.

Continuously growing packaging industries has influenced the development of the market in China. Presence of well-developed food & beverages industry, pharmaceutical sector, e-commerce industries, and various others has influenced the demand for such packaging films. The major market players are focusing on the development of this sector in this region which raise its acceptance in multiple industries.

North America expects the significant growth in the market during the forecast period. This rapid growth is due to the presence of well-established industries for manufacturing films. The advancement of packaging industry in this region, which is notable by progressive technology and effective supply chains, boosts the robust requirement for high-barrier packaging films. Moreover, strict guidelines regarding food protection and pharmaceutical packing values improve the demand of the high-barrier packaging films.

| Region | 2021 | 2022 | 2023 | 2024 | 2025 |

| North America | 816 | 842 | 871 | 902 | 936 |

| Europe | 774 | 798 | 823 | 851 | 879 |

| Asia-Pacific | 1,628 | 1,694 | 1,764 | 1,839 | 1,916 |

| Latin America | 264 | 274 | 285 | 297 | 309 |

| Middle East & Africa | 188 | 195 | 202 | 210 | 218 |

| Global Total | 3,670 | 3,803 | 3,945 | 4,099 | 4,258 |

The raw materials majorly utilized in this market are ethylene vinyl alcohol (EVOH), polyethylene (PE), and polypropylene.

The components manufacturing to produce efficient barrier are metallized films, and plastics laminates.

It is managed by combining partnership with third-party logistics (3PL) provider and in-house capabilities.

The United States is one of the biggest users of high-barrier films worldwide. The urge is initially being driven by the food and beverage industry, which needs reliable packaging solutions in order to grow shelf life and maintain product integrity. High barrier packaging films are specifically famous for packaging frozen foods, snacks, and ready-to-eat meals. The developing trend towards easy foods and developing consumer alertness about food safety are the main elements that highlight this requirement.

By Material

By Technology

By Product Type

By Application

By End User

By Region

January 2026

January 2026

January 2026

January 2026