Europe Plastic Packaging Market Size, Share, Trends and Forecast Analysis

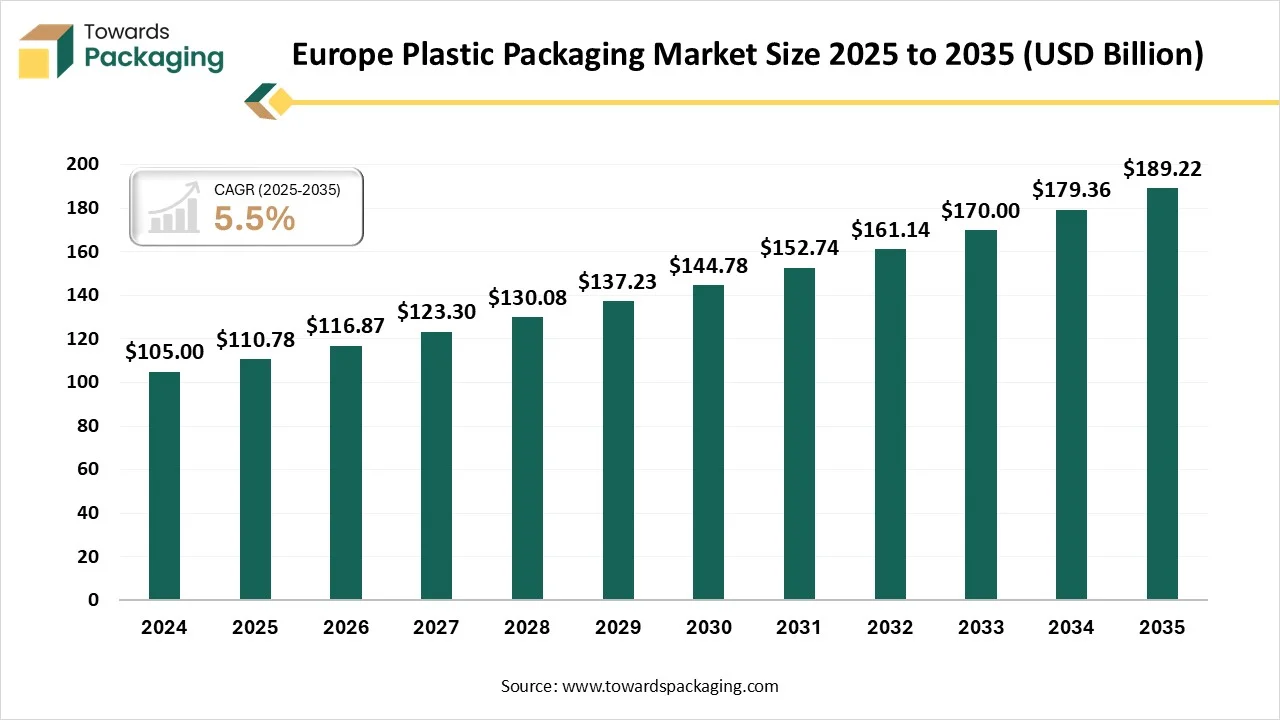

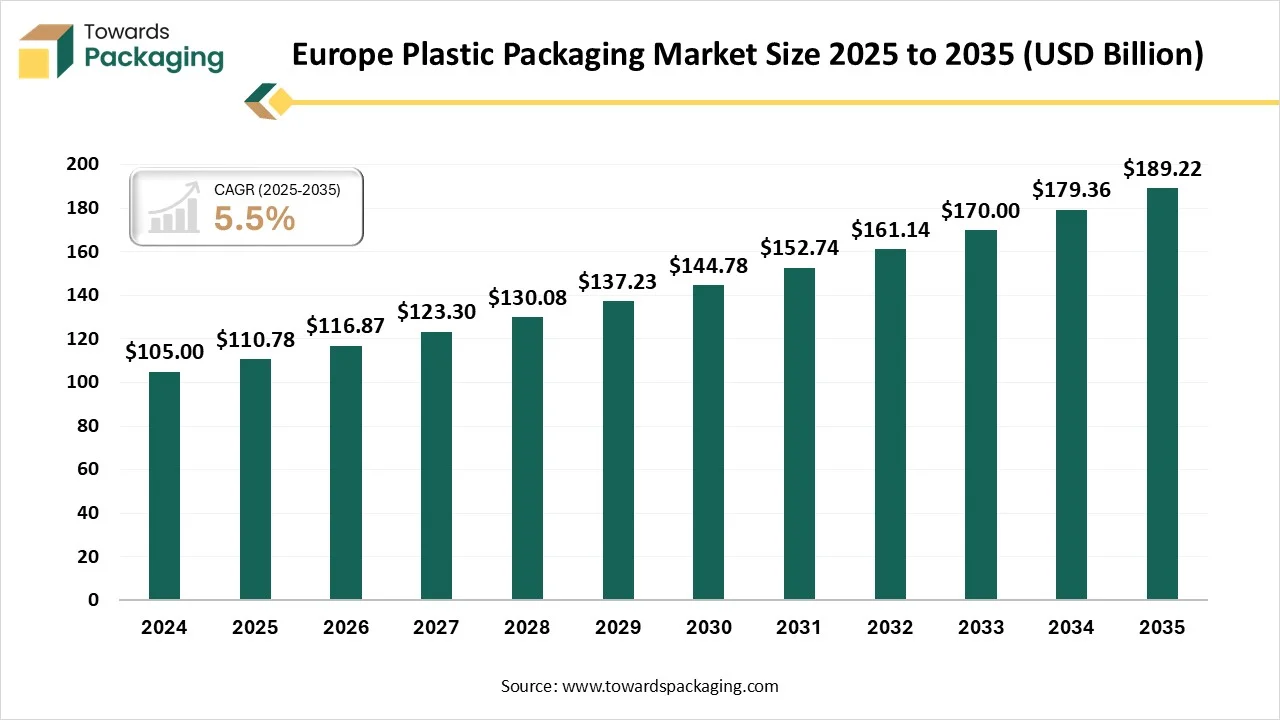

The Europe plastic packaging market is forecasted to expand from USD 116.87 billion in 2026 to USD 189.22 billion by 2035, growing at a CAGR of 5.5% from 2026 to 2035. The growth is driven because plastic is prevalently used in different industries due to its low cost, long durability, and high performance. It is specifically perfectly suited for the packaging, as several forms of plastic can endure high surrounding conditions.

Major Key Insights of the Europe Plastic Packaging Market

- In terms of revenue, the market is valued at USD 116.87 billion in 2026.

- The market is projected to reach USD 189.22 billion by 2035.

- Rapid growth at a CAGR of 5.5% will be observed in the period between 2026 to 2035.

- By material type, the polyethylene (PE) segment contributed the biggest market share in 2024.

- By material type, the polyethylene terephthalate (PET) segment will be expanding at a significant CAGR between 2026 to 2035.

- By product type, the bottles and jars segment has the largest market share in 2024.

- By product type, the pouches segment will be growing at a significant CAGR between 2026 to 2035.

- By application, the food and beverage segment contributed with the largest market share in 2024.

- By application, the pharmaceuticals segment will be expanding at a significant CAGR between 2026 to 2035.

What is the Plastic Packaging Market?

The Europe plastic packaging industry revolves around the production, design, and sale of plastic-based containers for products, which include both flexible and rigid designs, which are used across different industries such as healthcare, food, and automotive too. The market's expansion is experienced along with the regulatory changes in the region, mandates created by regulatory bodies, and demand for product innovation in multiple sectors.

Europe Plastic Packaging Market Trends

- Market Growth Overview: The European plastic packaging is expanding due to integration of elements such as fast demand from main fields like e-commerce, food, and healthcare, along with the invention of sustainable and circular packaging solutions.

- Global Expansion: Europe is diligently shifting towards a circular economy that gives importance to refill, reuse, and high-quality recycling. Several brands are moving towards mono-material structures (eg, mono-PE and mono-PP) and the recyclable alterations to match the latest standards.

- Major Market Players: The market includes main market players in the European Plastic Packaging sector, including Mondi Group, Sealed Air Corporation, and ALPLA Werke GmbH. Germany is the top plastic manufacturer and the producer in Europe, and the region is addressed to major raw material suppliers such as BASF and LyondellBasell.

- Startup Ecosystem: The European plastic packaging startup ecosystem is concentrated on making sustainable alterations and the solutions to solve the plastic waste, which is being driven by the Stringent European Union regulations and developing user demand for eco-friendly products.

Chemical recycling is developing as an innovative approach in the context of plastic recycling that serves as an updated solution for solving plastic waste. Like regular mechanical recycling, which is restricted to particular types of plastics, chemical recycling occurs at the molecular level, which allows the processing of contaminated and mixed materials. This cutting-edge strategy aligns with the sustainability goals by avoiding plastic waste and making a circular economy for plastics.

Sustainability Trends in Europe Plastic Packaging Market

- Advanced Recycling Technologies: Recycling is developing beyond mechanical strategies. Chemical recycling has broken plastics down to their molecular level, which enables a quality resume. Enzymatic procedures are also developing, which serve quicker and smoother plastic degradation.

- Integration of Anti-Microbial Plastics: Plastics with anti-microbial characteristics are transforming hygiene-sensitive sectors while encouraging sustainability. By preventing bacterial growth, such materials expand the lifespan of products, which lowers the demand for frequent substitutions and lessens complete plastic consumption. In fields like food and healthcare packaging, anti-microbial plastics also mitigate contamination risks that decrease the dependency on toxic chemical cleaners.

- Acceptance of the Plant-Based Packaging Materials: the move away from the petroleum-derived plastics is developing, with plant-based packaging rising as a main solution. It is made from renewable resources such as cornstarch, sugarcane, and algae, as these materials serve a low carbon footprint and reduce the reliance on non-renewable resources.

- Smart Manufacturing and Industry 4.0: AI, automation, and data-driven production are making plastic manufacturing more sustainable and smarter. The industry 4.0 technologies update resource usage, enhance energy efficiency, and reduce waste too.

For instance, to this

- In September 2025, Be-Up to boost the industrial uptake of biodegradable polymers across Europe. The be-Up project was being officially revealed to develop the industrial uptake of biodegradable polymers for packaging applications. The project will further concentrate on making cutting-edge aliphatic-aromatic biopolyesters which will then grow renewable raw material ingredients.

- HEINZ and TESCO have partnered up with the expertise in recycling technology and the packaging sector leaders in plastic energy, with Berry Global and SABIC, too.

- In October 2024, A leading waste management and circular solutions company situated in Finland, named Fortum Recycling & waste, successfully producing biodegradable plastic from the carbon dioxide emissions (C02) from the waste at its official plant.

Trade Analysis of Europe Plastic Packaging Market

Worldwide, the leading three importers of Europe Plastic Packaging are Ukraine, Uzbekistan, and Colombia. Uzbekistan has topped the globe in Europe Plastic Packaging, importing 271 shipments, which is being followed by Ukraine with 152 shipments, and Colombia, which takes the third position with 125 shipments.

The Globe has Imported its European plastic Packaging from Germany, China, and the European Union.

As per the global data, the world has officially imported 113 shipments of European plastic packaging during the period June 2024 to May 2025. These imports were being supplied by 52 exporters to 41 buyers, which marks a growth rate of -67% as compared to the previous twelve months.

Europe Plastic Packaging Market - Value Chain Analysis

Raw Material Sourcing

In Europe, the plastic packaging raw materials are being sourced from three main fields, such as recycled materials, fossil-based polymers, and bio-based plastics. It is driven by the strict regulations like the Packaging and Packaging Waste Regulation 9PPWR), which is a main move apart from the virgin fossil fuels towards renewable sources.

- Key Players: Amcor Group, Alpla -Werke. Coveris Holdings S.A

Component Manufacturing

In Europe, the plastic packaging elements are produced by a huge network of tailored molders, converters, and extruders, too, with Germany having the biggest market share. Strict EU regulations and a rising urge for sustainable materials such as recycled plastics and bioplastics mainly encourage manufacturing trends.

- Key Players: Sealed Air Corporation, Mondi Group UK, Flexible PE Film Extrusion, and RPC Group.

Logistics and Distribution

The latest EU Packaging and Packaging Waste Regulation has wide-reaching effects. The transport and distribution logistics, and the last mile in particular, are significantly affected as packaging plays a crucial role in this sector. By using the standard-sized cartons for every product, and hence due to shipping products in oversized cartons and /or having extra void filling, is no longer an accurate method under the PPWR.

- Key Players: Constantia Flexible Holding, Aptar Group, Papier Mettler

Material Type Insights

Why the Polyethylene Segment Dominated the Europe Plastic Packaging Market In 2024?

The polyethylene segment has dominated the market in 2024 as polyethylene is one of the most widely utilised plastic materials in the world and is made through the polymerization of ethylene monomers. It is a valuable material that has a huge range of applications in different sectors. The production of polyethylene is done by integrating ethylene monomers produced under conditions, which are generally achieved using a catalyst. The monomers of the outcome polymers create long chains that are linked in a continuous fashion due to the characteristics of polyethylene.

The polyethylene terephthalate segment is expected to experience the fastest CAGR during the forecast period. PET is a kind of plastic that is widely used in the packaging sector because of its strong, transparent, and lightweight properties. PET has a perfect effect on opposition, which makes it perfect for beverage bottles and food packaging. Furthermore, this material has good barrier characteristics against carbon dioxide and oxygen, which maintains the quality of the products inside. Several users are worried about toxic chemicals in plastic packaging, particularly for the Bisphenol A (BPA. Hence, PET plastic does not have BPA, which makes it a safer choice compared to some other kinds of plastic.

Product Type Insights

Why did The Bottles & Jars Segment Held The Largest Share In The Europe Plastic Packaging Market In 2024?

The Bottles & Jars segment has dominated the market in 2024 as plastic resin serves as a perfect power while staying lightweight and shatter-resistant, too, which makes it an actual alternative to glass bottles. This reliability assists in protecting against breakage at the time of daily use and shipping too. PET bottles also help in high-level decoration procedures like paint coating, logo engraving, and hot stamping, too. These potentially make PET packaging perfectly-suited for products by using the good-quality pump bottles, cream jars, and the airless pump, working too.

The pouches segment predicts the fastest CAGR during the forecast period. Pouch packaging is a kind of flexible packaging created from laminated films such as PE, PET, or PP crafted to protect products while having a lower weight and material usage. It counts designs like flat pouches, stand-up pouches, sachets, and the spouted versions as each one can be sealed, filled, and tailored to align with different products. It can even be printed directly, designated as recyclable mono-material patterns, as the UK and EU reveal curbside recycling for flexible plastics.

Application Insights

Why Has The Food & Beverages Segment Held The Largest Share In The Europe Plastic Packaging Market In 2024

The food and beverages segment dominated the market in 2024, as plastic is conveniently found in different household items such as snacks, instant noodles, beverage bottles, and frozen food. Its practicality creates plastic packaging as the initial choice in different industrial sectors. The benefit of plastic packaging is that it prevents the product from air and contamination, which then extends the shelf life of the food and beverages. This is important for the food industry, which gives importance to both product safety and quality. It excels in being strong, lightweight, reliable, and flexible too, which makes it a top choice across various sectors.

The pharmaceutical segment expects the fastest CAGR during the forecast period. The crucial function of pharmaceutical packaging is to protect medicines from the surrounding elements like oxygen, moisture, light, and contamination. The plastics have updated packaging with their originality. Their unbreakable and lightweight nature and the potential to be moulded into different shapes make them perfect for a series of products. These products include blister packs, bottles, and dropper bottles, too. Developments in plastic technology also include biodegradable plastics that match environmental sustainability goals.

Country Insights

How is Germany Dominating the Europe Plastic Packaging Market?

Germany held the largest share in the market in 2024, as it is one of the biggest and high-level plastics markets and is developing as a complicated frontier in the transformation to more sustainable materials. This region is very huge and encouraging too, as it features the demand for materials, which lowers the emissions and assists circular design. At the same time, the urge for PLA -specifically in packaging, automated, and medical uses is developing in response to strict sustainability aims and rising consumer expectations.

Why is the Europe Plastic Packaging Market Growing Rapidly in Eastern Europe?

The Eastern European plastics industry is predicted to have the fastest compound annual growth rate in Europe, as this region has a stretching food processing sector and developing retail sales of packaged food, which are the main consumers of plastic packaging. Poland, for instance, is witnessing fast growth in this segment. For several Eastern European countries, the plastic packaging is still in a development phase. Penetration into the European Union has also developed packaging and economic market capability for several nations. The demand for flexible plastic packaging, such as film and pouches, is developing due to its material efficiency and cost-effectiveness. The urge for recycled PET is developing, which is driven by both developing environmental awareness and the EU regulations, which are compulsory for recycled content. Countries with rising recycling design, like Poland, are experiencing funds in the rPET capacity.

How is the Europe Plastic Packaging Market expanding in the UK?

The UK has the highest e-commerce acceptance rate in Europe, which drives the urge for lightweight, rigid, and protective packaging to ensure safe delivery of products. As the biggest end-user, the food and beverage sector has a constant demand for plastic packaging because of its potential to protect the products and extend the shelf life. The choice for ease among the users, particularly in the food and beverage sector, is driving the urge for flexible packaging designs such as pouches, which serve portable, lightweight, and resealable characteristics.

Recent Developments

- In June 2025, INEOS Olefins & Polymers in Lavera, Southern France, officially received the primary deliveries of an inventive feedstock created from recycled plastic waste. This product, named pyrolysis oil, can be made to produce recycled polymers that assist its users in aligning with the EU needs for food contact, sensitive, and food plastic packaging to have a minimum of 105 recycled content by 2030.

- In December 2025, Henkel launched Pritt stick packaging to develop the point of sale user experience at home and across Europe. The latest cardboard blister packaging has a modern design with the latest digital learning and makes the content on the Prittworld available via QR codes.

Top Companies in the Europe Plastic Packaging Market

- XIFA Group ( Europe Focused): It is headquartered in Wenzhou, China, but the XIFA Group is a loyal B2B packaging factory that has mature export experience in Europe, with 25+ years of experience in packaging production.

- Smurfit Kappa Group: Smurfit Kappa, which is headquartered in Dublin, is currently the biggest packaging company in Europe by revenue. It is tailored in corrugated packaging and the containerboard solutions that have become a top choice in sustainable packaging.

- Mondi Group: Mondi is a vertically integrated packaging producer based in Weybridge, UK. It manufactures paper, flexible plastics, and containerboard, too. Its currency has confirmed a USD 5 billion partnership with DS Smith.

- Amcor Plc: Amcor is a Zurich-dependent global leader in the flexible and rigid packaging for the beverage, food, healthcare, and personal care industries. It concentrates extremely on recyclable and lightweight packaging solutions and delivers to over 100 countries.

- Stora Enso Oyj: Stora Enso is one of Europe’s oldest companies in the packaging sector, with its roots in the 1200s. It is located in Helsinki, as it tops the manufacturing of renewable materials, bioplastics, paperboard, and wood-based packaging solutions.

- ALPLA Group: ALPLA is dependent in Hard, Austria, which is a global plastic packaging organization that focuses on PET and HDPE solutions for household, personal care, and the food sectors. It is one of he biggest packaging producers for plastic containers in Europe.

- Ardagh Group: Ardagh Group is headquartered in Luxembourg, which is a main player in the rigid packaging production that supplies glass and metal packaging for the main food and beverage brands.

- DS Smith Plc: DS Smith, a top UK-based company for packaging, is well-known for its corrugated packaging and the recycling-led supply chain models.

- Constantia Flexibles: Constantia Flexibles, which is officially located in Vienna, is among the leading players in the packaging sector as organisations generate flexible films and high-barrier films for the pharmaceutical and food industries. It is packed in mono-material packaging with perfect recyclability.

- Huhtamaki Oyj: Huhtamaki, which is headquartered in Espoo, Finland, is a main player in fiber-based and food service packaging. By the year 2030, its goal is to create all its packaging compostable, reusable, or recyclable.

Europe Plastic Packaging Market Segments Covered

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Bioplastics / Bio-based plastics

- Others (EVOH, EPS, etc.)

By Product Type

- Bottles & Jars

- Trays & Containers

- Cups & Tubs

- Pouches

- Films & Wraps

- Bags

- Clamshells & Blister Packs

- Caps & Closures

By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Household Products

- Industrial Goods

- Chemicals

- Agriculture