High-Barrier Materials for Pharmaceutical Packaging Market Size, Trends, Share and Growth Analysis

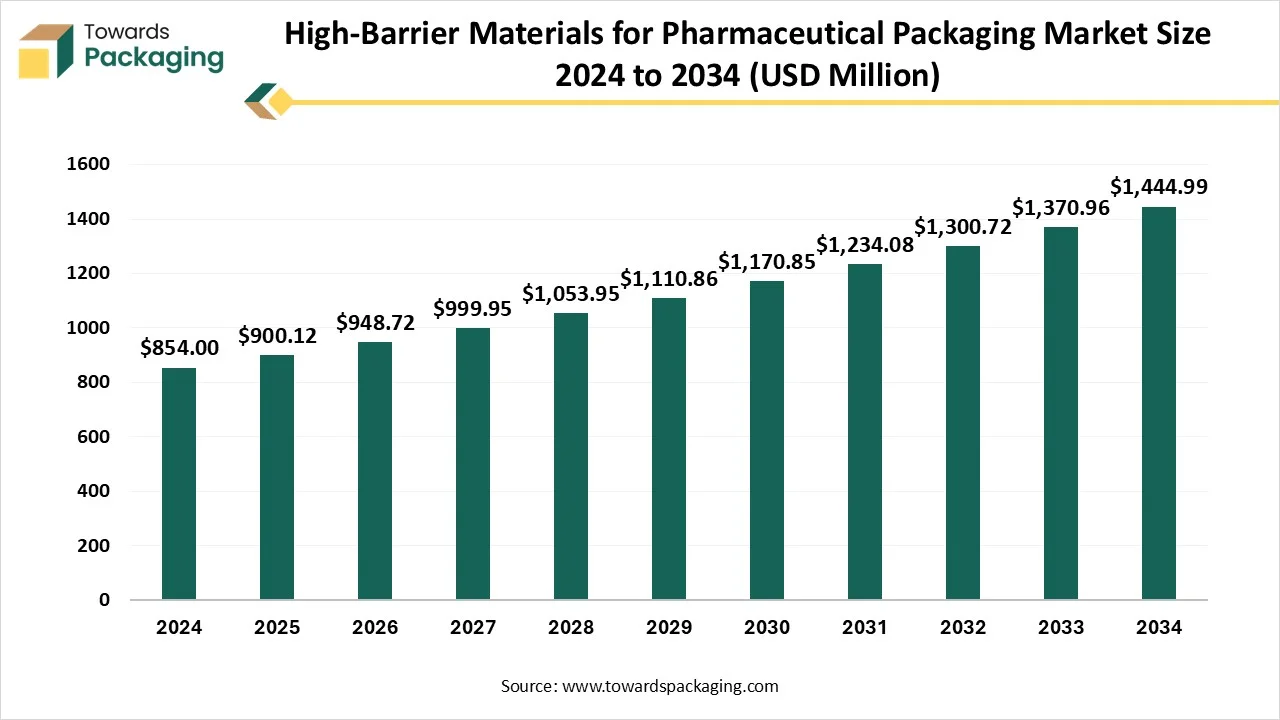

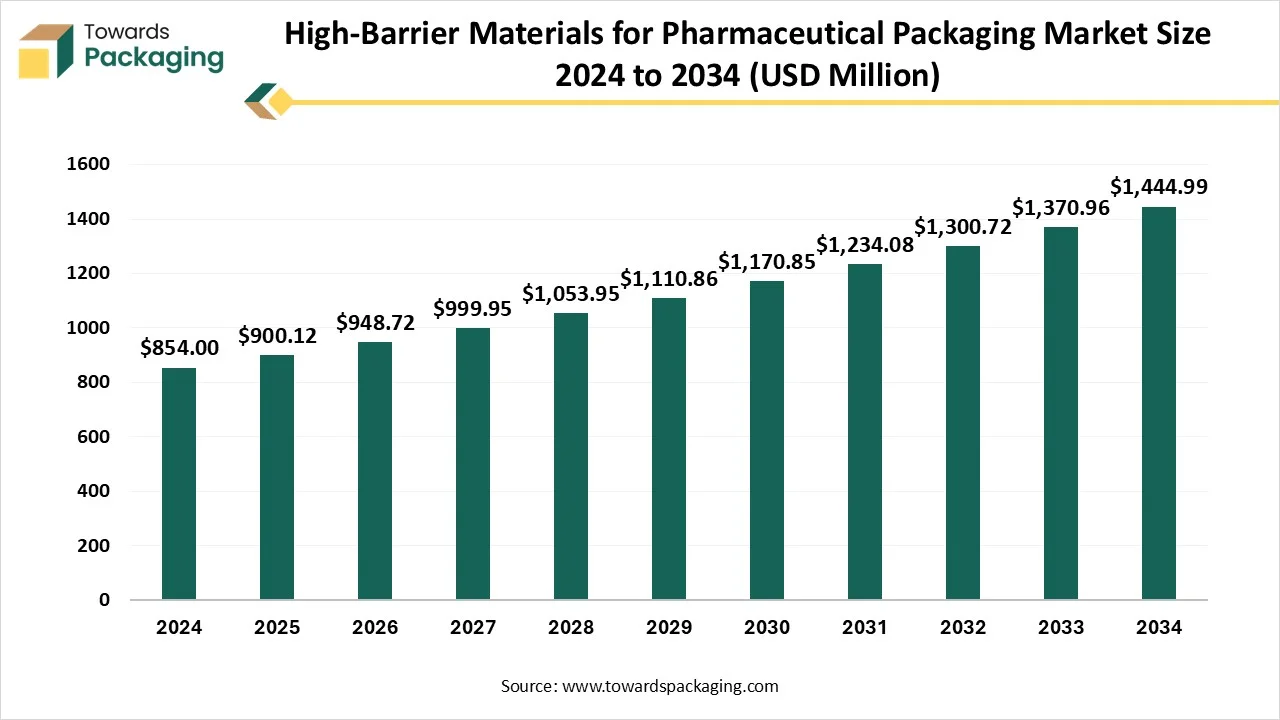

The high-barrier materials for pharmaceutical packaging market is set to grow from USD 948.72 million in 2026 to USD 1,523.02 million by 2035, with an expected CAGR of 5.4% over the forecast period from 2026 to 2035. The demand for this is being driven by a huge urge for longer shelf life, safety, and convenience, specifically in the pharmaceutical and food sectors. This type of packaging prevents moisture, oxygen, and light from penetrating into the product.

Key Highlights

- In terms of revenue, the market is valued at USD 900.12 Million in 2025.

- The market is predicted to reach USD 1,523.02 Million by the year 2035.

- Rapid growth at a CAGR of 5.4% will be officially experienced between 2025 and 2034.

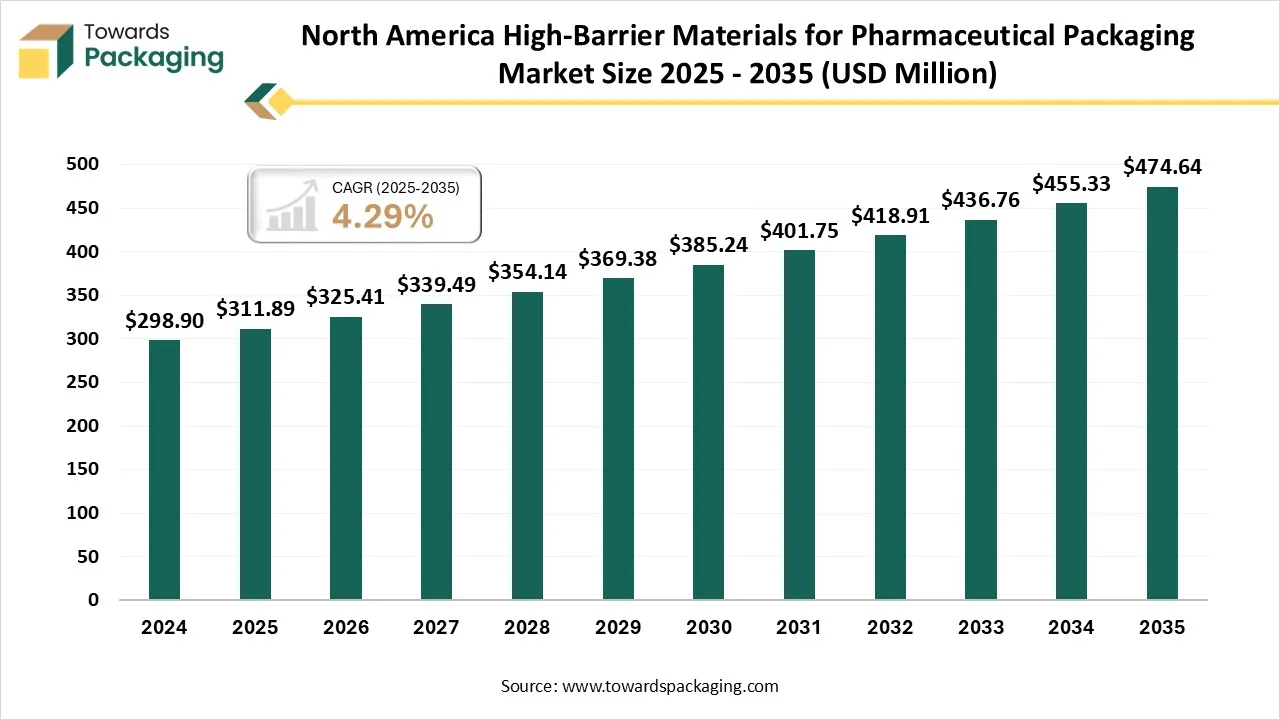

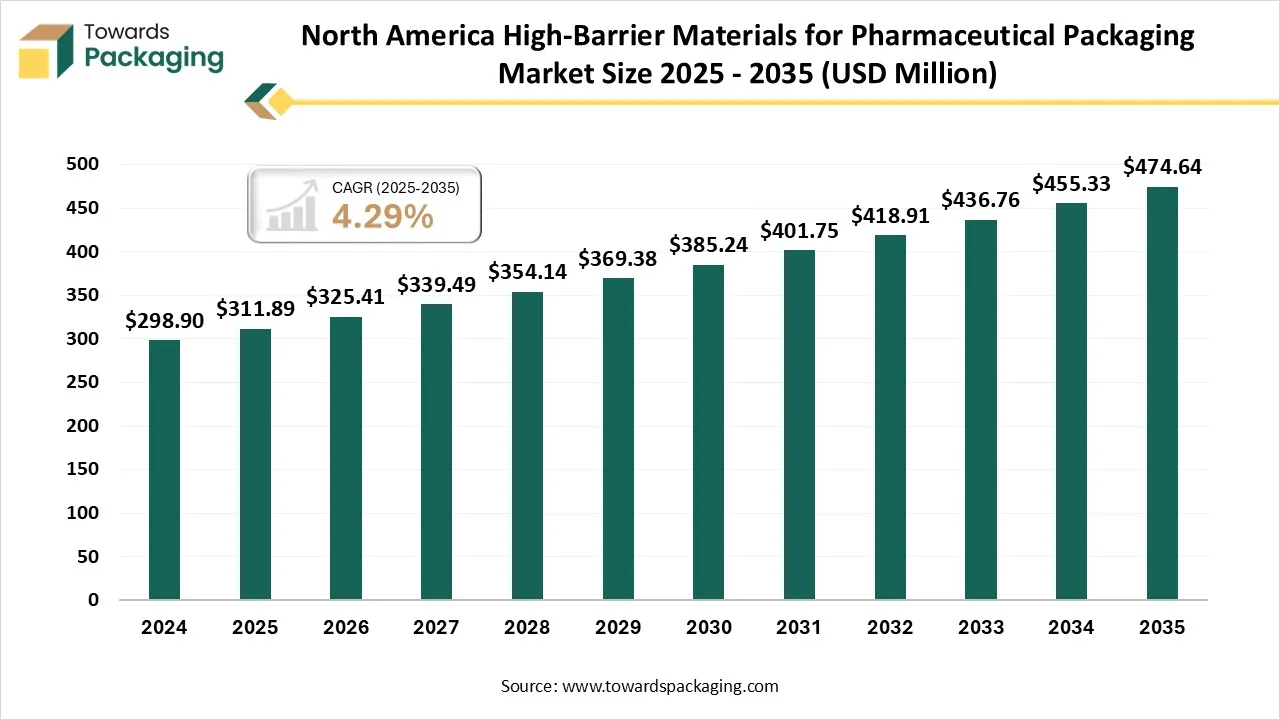

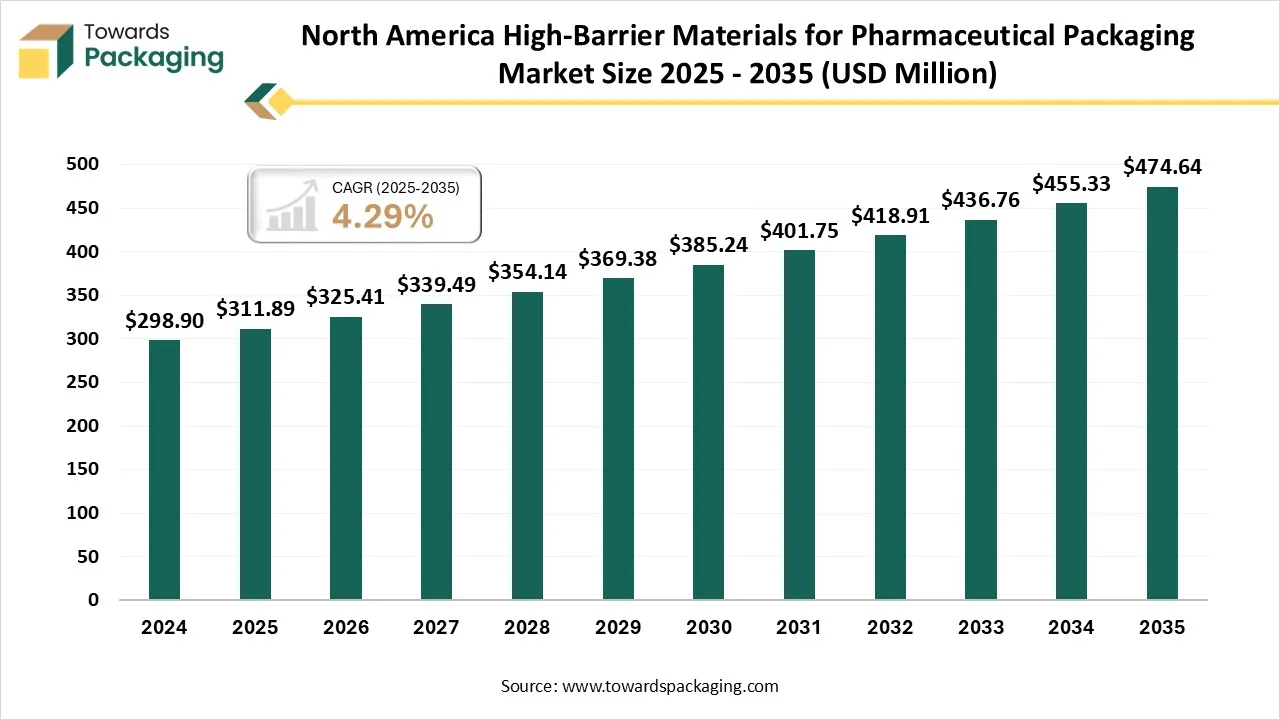

- By region, North America dominated the region, having the biggest share of approximately 35 % in 2024.

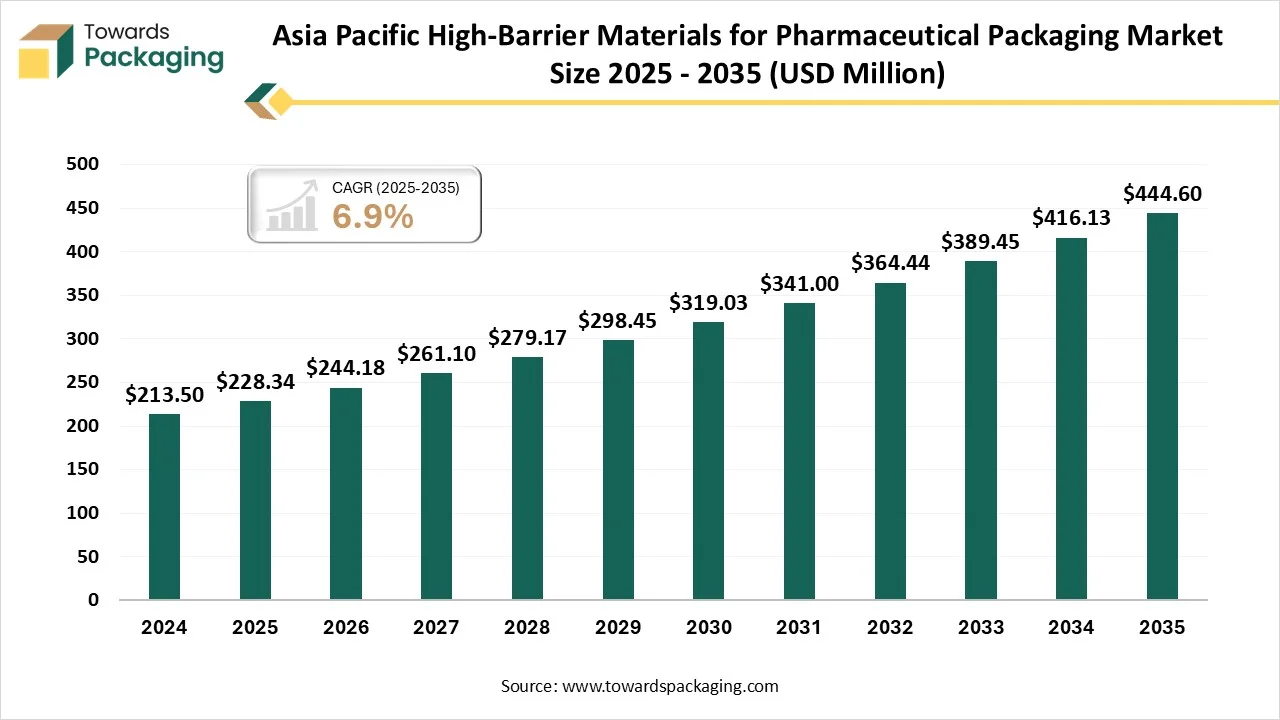

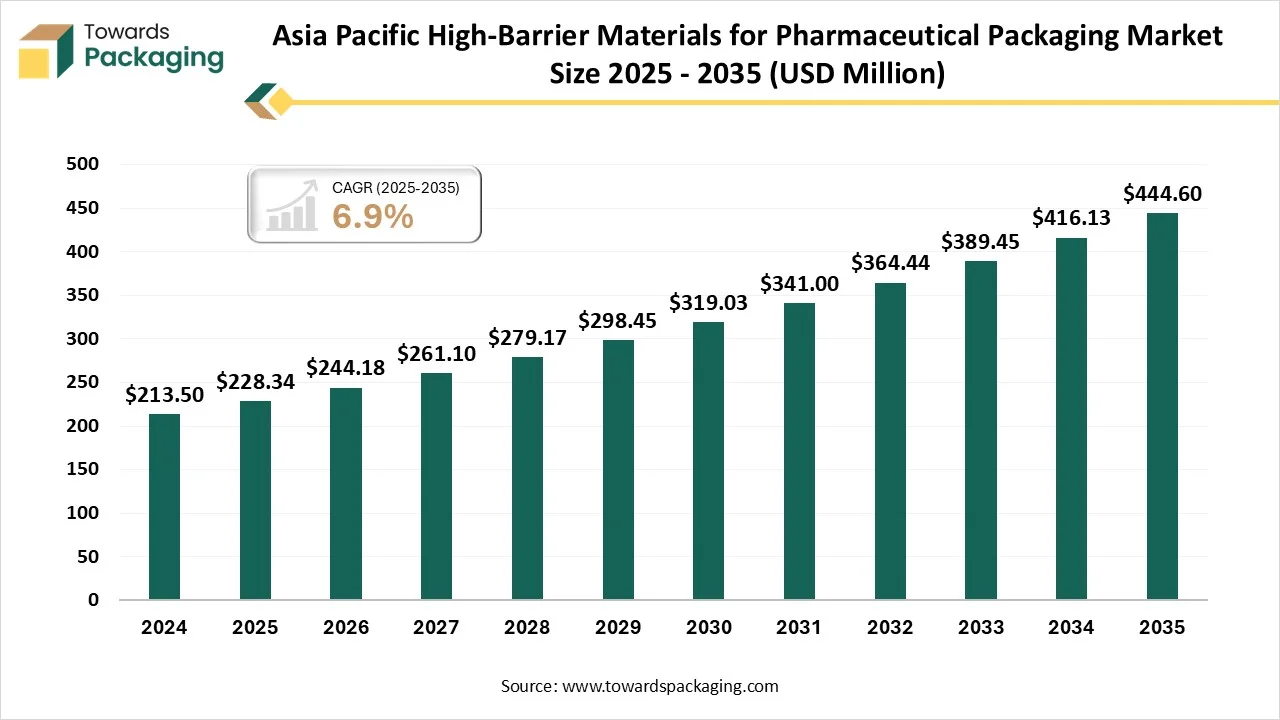

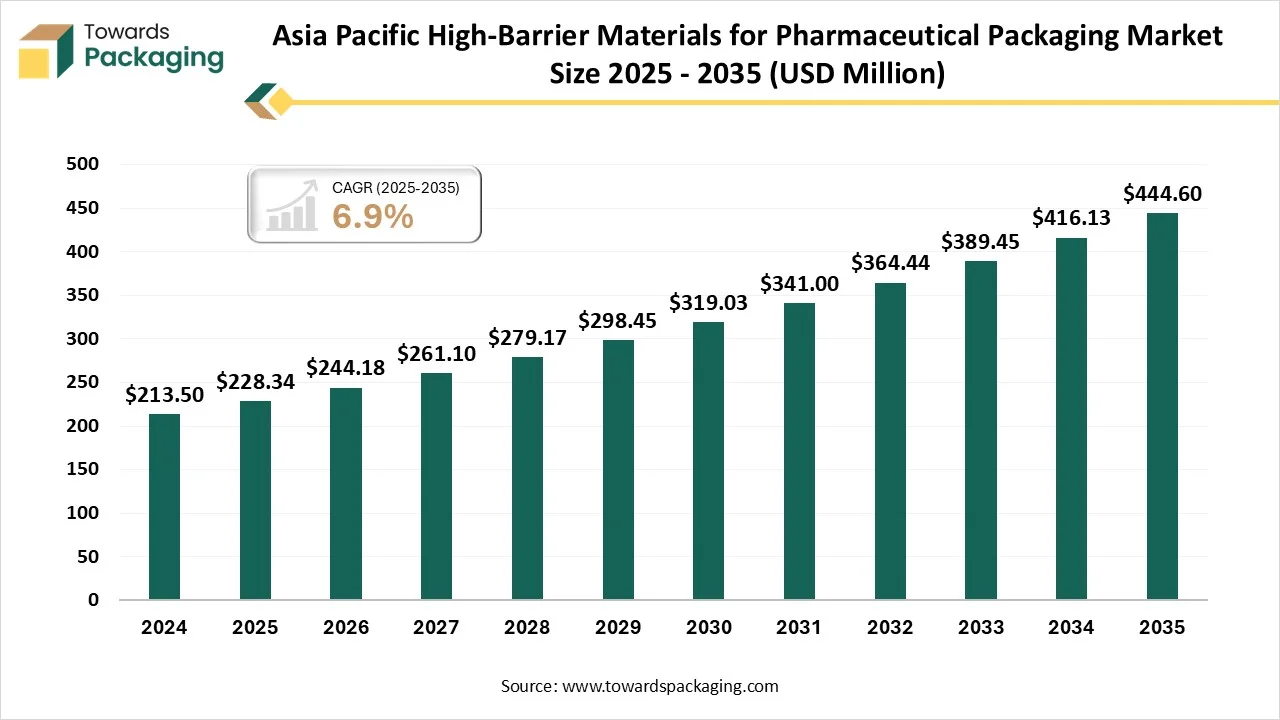

- By region, Asia Pacific is expected to rise at a notable CAGR between 2025 and 2034.

- By material type, the aluminium foil segment contributed to the biggest share of approximately 35% in 2024.

- By material type, advanced barrier materials segment will rise at a notable CAGR between 2025 and 2034.

- By product type, blister packs segment invested the biggest share of approximately 40% in 2024.

- By product type, unit-dose packaging segment will grow at a notable CAGR between 2025 and 2034.

- By application, solid dosage forms segment invested the largest share of approximately 50% in 2024.

- By application, liquid dosage forms segment will grow at a notable CAGR between 2025 and 2034.

- By end-user industry, pharmaceuticals segment invested the biggest share of approximately 60% in 2024.

- By end-user industry, biopharmaceuticals segment will rise at a notable CAGR between 2025 and 2034.

What Do You Mean By High-Barrier Materials For Pharmaceutical Packaging?

High barrier packaging points to materials that are crafted to serve superior protection against external elements like moisture, oxygen, and light. By making a more rigid barrier, the kind of packaging ensures product integrity, preserving quality, and extending the shelf life.

Industries like pharmaceuticals and food depend heavily on high-barrier packaging to track the freshness of food and the smoothness of pharmaceuticals. This packaging solution is growing to align with sustainability urges, which combines high-level protection with eco-friendly innovations.

By restricting external pollutants such as micro-organisms and dust, high-barrier packaging assists in tracking safety and cleanliness, which reduces the dependency on chemical preservatives and extends the product’s natural shelf life.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 900.12 Million |

| Projected Market Size in 2035 |

USD 1,523.02 Million |

| CAGR (2026 - 2035) |

5.4% |

| Leading Region |

North America |

| Market Segmentation |

By Material Type, By Product Type, By Application, By End-Use Industry and By Region |

| Top Key Players |

Amcor plc, West Pharmaceutical Services, Inc., Schott AG, Gerresheimer AG, Winpak Ltd., Taghleef Industries, Cosmo Films Ltd., Constantia Flexibles, Sappi Lanaken Mill. |

High-Barrier Materials for Pharmaceutical Packaging Market Outlook

- Industry Growth Overview: Between 2025 and 2034, the industry is witnessing huge development, which is being driven by factors like growing demand for stringent regulations, product protection, and a move towards sustainable packaging.

- Sustainability Trends: Sustainability is updating the scenario in high barrier films, specifically across the mature packaging industry. The European Union is encouraging change in every packaging with its Packaging and Packaging Waste Regulation, which will come into effect from 1st January 2030. The regulation will have a long-term effect on the field, not only in Europe but also a tremendous effect across the Globe. Several multinational brands are ready to use these regulations as a worldwide standard, and big barrier packaging as well as packaging designs that demand to be recyclable in the industry.

- Global Expansion: The global expansion for high-barrier material is on an advanced stage, which is being driven by different factors, including urbanisation, updated consumer choice, and the rising importance of product safety. Countries like Germany, China, the United States, and India are at the frontline of this urge, each with different market needs and dynamics.

- Major Investors: Major investors in high-barrier material for pharmaceutical packaging are initially big organizations and specialized packaging companies, which assign capital to research and development. While venture capital invests in the huge packaging sector, many direct investment in high-barrier pharmaceutical materials comes from the main producers, finding competitive benefits and sustainability inventions.

Key Technological Shifts in the High-Barrier Materials For Pharmaceutical Packaging Market

Pharmaceutical packaging is developing with laser and digital printing, AI-powered inspection systems, and current, eco-friendly machinery. These inventions develop traceability, accuracy, and flexibility while solvent-free adhesives, carbon-effective blister, and heat-recovery systems lines push sustainability forward. Single-use packaging is also being updated with halogen-free, lighter, compostable, or recyclable options.

Furthermore, current users expect packaging to do more than protect the product, as it should talk, develop, and communicate the user experience. Smart Packaging technologies, like QR codes and time-temperature indicators, have made this possible. Artificial Intelligence and Automation have transformed how high-barrier materials are inspected and manufactured. From high-speed manufacturing lines to error analysis systems, technology ensures scalability and accuracy.

- In June 2025, Honeywell, which is headquartered in Charlotte, North Carolina, disclosed that Evertis, a Portuguese generator of film for packaging, has chosen Honeywell Aclar Films to be utilized by its Evercare pharmaceutical company.

Trade Analysis Of High-Barrier Materials For Pharmaceutical Packaging Market: Import & Export Statistics:

- As per the world data, it has exported 61,124 shipments of Packaging Film from November 2023 to October 2024. These exports were created by 6,175 Exporters as compared to 6,456 customers, which marks a development rate of 24% as compared to the starting twelve months.

- During this time, in October 2024 alone, 3,316 shipments of Packaging Film were exported Worldwide. This marks a year-on-year development as compared to October 2023.

- The World has imported a total of 2,307 shipments of Barrier Films during the period from November 2023 to October 2024. These imports were being supplied by 168 exports to 201 overall buyers, which marks a development rate of 158% as compared to the previous 12 months.

Emerging Trends In High-Barrier Materials For Pharmaceutical Packaging Market

- Protection and Safety: Pharmaceutical packaging must prevent the drug from chemical, physical, and biological hazards throughout its shelf life. Packaging should be crafted in order to prevent tampering and serve as accurate proof if tampering occurs. Tamper-evident seals, shrink bands, and induction seals are prevalent procedures to ensure product integrity.

- Stability and Preservation: Accurate packaging expands the shelf life of pharmaceutical items by tracking optimal storage conditions. Constant studies, which are frequently directed by the International Conference on Harmonisation (ICH) guidelines, check the accurate packaging materials for every drug formulation.

- Regulatory Frameworks: Packaging lines should be crafted and operated as per the GMP standards to lower pollutant risk. Rules from agencies as the U.S Food and Drug Administration (FDA) and the European Medicines Agency (EMA) serve as frameworks for perfect assurance. In regions like the US and EU, serialization of pharmaceutical packaging is compulsory to combat counterfeit drugs and ensure traceability through the supply chain.

- Traceability and Serialization: Traceability is complicated in the pharmaceutical supply chain, making sure that each unit of a product can be maintained from the producer to the end-user. High-level pharmaceutical packaging solutions include digital systems that mix with enterprise resource planning (ERP) and track and trace systems, too.

- Functionality and user-friendliness: Beyond preserving and protecting the drug, pharmaceutical packaging must be user-friendly and practical. Precise labelling is important for transmitting dosage instructions, regulatory information, and expiration dates, too. The packaging must be crafted to accommodate this information in a legible design.

Value Chain Analysis Of High-Barrier Materials For Pharmaceutical Packaging Market

- Material Processing and Conversion: High barrier packaging is produced and transformed using tailored processes that integrate several materials, including aluminum, plastics, and high-level coatings, to serve perfect security against moisture, oxygen, and light. It initially includes transforming raw plastic resin into films and strong structures with the assistance of procedures like coextrusion and extrusion to make multilayer films.

- Package Design and Prototyping: Cyclic olefin copolymer materials have been developed as luxury solutions for high-value, sensitive pharmaceutical products. COC serves unique chemical opposition, perfect barrier characteristics, and excellent clarity while tracking significantly less weight as compared to glass alternatives. These materials show specific performance in parenteral drug packaging, in which transparency and chemical inertness are a must.

- Logistics and Distribution: Logistics and distribution for high-barrier pharmaceutical packaging must align with strict needs for sterility, temperature control, and security, with the assistance of the supply chain. Pharmaceuticals, specifically vaccines and biologics, often need temperature ranges, such as 2-8 degrees Celsius or below 20 degrees Celsius.

Market Dynamics

Market Opportunity

Nanotechnology Is The Future Of High-Barrier Materials For Pharmaceutical Industry

Nanotechnology’s role in terms of packaging is securely grounded in practicality. When used in barrier materials, nanomaterials such as nano-silica, nanoclays, or graphene derivatives are utilised in ultra-thin layers to drastically reduce permeability. These invisible developments result in packages that are more compact yet more reliable, at the same time aligning logistical professionals, sustainability officers, and procurement heads too. This science-backed transformation serves actual-world solutions without adjusting to cost or compliance, too.

Barrier packaging has always been a foundation of product protection in the packaging sector. As sectors move from pharmaceuticals to food and beverages, so does the demand for more high-level metareils, which not only protect product integrity but also match with moving environmental expectations.

Market Restraint

Basic Limitations Adheres

The major limitation or issue is creating packaging more patient-centric, which is accessible, convenient, and supportive of adherence. Pharmaceutical packaging has regularly been crafted with the initial goal of compliance and safety, sometimes at the expense of user-friendliness. Bad packaging design can lead to patients skipping doses or creating errors during administration. Thus, organisations must develop the packaging design in order to develop the patient experience while complying with all child-proofing, safety, and informational regulations.

The importance of this issue is high. Non-adherence to medication is calculated to cost healthcare systems several times and is linked with many preventable hospitalizations annually.

Material Type Insights

How Did The Aluminium Foil Segment Dominate The High-Barrier Materials For Pharmaceutical Packaging Market?

The aluminium foil segment has dominated the high-barrier materials for pharmaceutical packaging market with approximately 35% share in 2024, as it blocks moisture, air, bacteria, and light from penetrating it. This is very crucial for medicines, which can get damaged or lose power when exposed to the surroundings. The foil behaves like a rigid protection and stores every tablet or capsule safely. They are light and thin, which assists in lowering storage and shipping costs. At the same time, it serves as a strong prevention that lowers the chances of product loss.

As medicines are sensitive products, if they are not stored accurately, they can become less harmful or effective. Aluminum foil secures the product, which maintains the chemical stability of the medicine, keeping it just as smooth as the day it was packed.

The Advanced barrier materials segment is expected to be the fastest-growing in the market during the forecast period. The usage of advanced barrier materials and cutting-edge technologies, hence lowering the amount of material that is later discarded. Lowering the amount of both primary and secondary packaging is at the top of the list for updating to reduce fuel needs and transport, further reducing the C02 emissions. This kind of packaging includes advanced multi-layer materials, such as EVOH, metallised PET and compostable polymer, that provide an impenetrable protection against oxygen, light and moisture. These solutions are ready for industry standards for protecting freshness and quality, assisting sustainable brand goals, and extending shelf life.

Product Type Insights

How Did Blister Packs Segment Dominate The High-Barrier Materials For Pharmaceutical Packaging Market?

The blister packs segment has dominated the market with approximately 40% share in 2024 as blister packs play a crucial role in developing patient compliance with medication regimens in three different ways, like ease of use, medication intake, and precise labelling. The pattern of blister packs also includes the ease of use. They are generally convenient to open, which makes medication accessible even for those with restricted dexterity. At the same time, child-resistant characteristics can be included to protect accidental ingestion by children, which strikes the balance between safety and accessibility.

The transformation of blister packs from simple protective casings to standard machines for medication managers that encapsulate a deeper recognition of healthcare dynamics and patient needs.

The unit dose packaging segment is predicted to be the fastest-growing during the forecast period. Unit dose packaging has updated the way medications are tracked in healthcare settings. In the past, healthcare professionals had to manually calculate and release medications, which was an error-prone and time-consuming process. With unit dose packaging, medications are highly measured and packed in particular doses, which makes it convenient for healthcare providers to administer the correct medication to the right patient at the correct time. One of the main advantages of unit dose packaging is its potential to improve patient safety. By avoiding the demand for manual sorting and counting of medication, the risk of medication issues is reduced.

Application Insights

The solid dosage form segment has dominated the market with approximately 50% share in 2024 as a method to protect and expand the shelf life of solid dosage forms, which fall into two main categories: active packaging and passive barrier materials. The first one protects the transportation of shelf life-sapping encouragement, such as water vapour and oxygen. The latter diligently captures or scavenges sensitive substances. Pack integrity plays an important role as well.

The arrival of new drug delivery systems, changes in solid-dose products, and the increase in generic drug production are developing interest in passive and active shelf life protection technologies.

The liquid dosage form segment is predicted to be the fastest in the market during the forecast period. Barrier protection of liquid dosage forms in the medical sector is complicated for tracking the product’s stability, safety, and efficacy throughout the shelf life. Just like solid dodge forms, liquids are heavily sensitive to degradation from surrounding factors, so rigid barrier systems must be used. Oxygen permeating into the container can lead to oxidation degradation of the drug by lowering its capability. Also, sensitive elements in the formulation, such as flavours or excipients, can avoid the container so as to change the product's quality.

End-User Industry Insights

How Did The Pharmaceuticals Segment Dominate The High-Barrier Materials For Pharmaceutical Packaging Market?

The pharmaceutical segment has dominated the high-barrier materials for pharmaceutical packaging market with approximately 60% share in 2024, as pharmaceutical packaging plays an important role in ensuring the stability, safety, and efficacy of drug products from patient administration to manufacturing. It includes a perfectly designed process of elements that have, protect, store, and lastly serve a drug in its planned form. The primary objective of pharmaceutical packaging is to track the integrity of the product through the shelf life by protecting it from environmental elements like light, moisture, oxygen,, and temperature variations.

Beyond physical protection, pharmaceutical packaging must also complete the main regulatory and functional needs, including tamper resistance, sterility, and patient safety. A perfect packaging material should prevent pollutants, serve as a secure and airtight barrier, and provide ease of usage and handling.

The biopharmaceutical segment is expected to be the fastest in the market during the forecast period. In this field, there is no margin for error when it comes to procedure operator safety and integrity too. Among the several variables that must be tightly managed, pressure ranks high on the list. Vacuum or lever pressure can adjust not only the machine but also batch production timelines, sterility, and lastly patient safety too.

As pressure control needs include alongside the acceptance of single-use systems, a latest generation of integrated solutions is gaining attention, which serves embedded safety without sacrificing sterility, speed, or scalability too.

Regional Insights

How Did The North America Dominate The High-Barrier Materials For Pharmaceutical Packaging Market?

North America dominated the high-barrier materials for pharmaceutical packaging market with approximately 35% share in 2024, as this region is one of the biggest users of high-barrier films worldwide. The urge is initially driven by the food and beverage industry, which needs reliable packaging solutions to expand the shelf life and track product integrity. VFFS firms are specifically famous for packaging frozen foods, snacks, and ready-to-eat meals. The rising trend towards easy foods and growing consumer awareness about food safety are the main factors that urge this demand. High barrier pharmaceutical packaging in Canada is developing, which is being driven by strong Health Canada regulations, growing demand for sensitive and sterile product protection, and a concentration on sustainable and recyclable materials.

Main materials count plastic films like EVOH, polyamide, and metallized films, which frequently include a multi-layer structure to receive high opposition to oxygen, light, and moisture too.

- In February 2025, Production investments have taken the main stage in current years, from some pharma companies growing in GLP-1 manufacturing potential to align with growing demand to other organisations concentrating on high-level capabilities which could ensure a perfect supply of vaccines.

Asia Pacific is predicted to be the fastest-growing market during the forecast period. The fast expansion of the pharmaceutical sector in countries like India, China, and Japan has led to a growing demand for high-barrier packaging materials to assist the growing manufacturing of vaccines, medicines, and biologics. In China, one of the biggest pharmaceutical industries in the world, the urge for good quality packaging material has grown, particularly due to growth in over-the-counter and biologics drugs.

The country is focusing on developing its overall production potential, which places an emphasis on the growth of high-level packaging solutions that align with international standards. On the other hand, India’s packaging sector is experiencing fast development with high barrier materials that play an important role in aligning with the demand of different sectors like pharmaceuticals, food, and beverages too.

- In June 2025, Oliver Healthcare Packaging, a top healthcare organization, is driving the top invention and quality in terms of medical packaging, has disclosed the latest manufacturing facility in Johor, Malaysia, which is the biggest of Oliver’s sites in the Asia Pacific region.

- In April 2025, Amcor, which is a top leader in terms of producing and developing responsible packaging solutions, announced that it has officially completed construction of its high-level coating facility for healthcare packaging in Selangor, Malaysia.

Country-Level Investments & Funding Trends For High-Barrier Materials for Pharmaceutical Packaging Market

- In October 2025, LOG Pharma's primary Packaging has collaborated with Dow, which is one of the world’s top materials science organisations, in order to showcase LOG’s inventive barrier eco line at CPH Frankfurt 2025, which took place on October 28-30.

- In September 2025, CelluForce, which is the top leader in terms of cellulose nanocrystals, recently disclosed the launch of CelluShield™, which is a high-performance, bio-sourced barrier coating that is crafted to assist the packaging product to align with rising demand for recyclable flexible packaging without adjusting shelf life or product protection.

- In May 2025, Colorcon, which is a top leader in film coating systems, controlled release formulations, specialty excipients, and controlled atmosphere packaging for the healthcare sector, announced an exclusive collaboration with ASHA Cellulose, a frontline of organo-soluble Ethyl cellulose polymers that is greatly utilised in the dietary and pharmaceutical sector.

Recent Developments

- In December 2024, LOG Pharma Primary Packaging, which is at the top server with respect to inventive packaging solutions for the pharmaceutical sector, will display its cutting-edge barrier eco line for innovative and genetic drug organisations at Pharmapack Europe 2025, that takes place on January 22-23,2025, in Paris, France.

- In March 2025, JPFL Films Private Limited, which is a subsidiary of India’s huge flexible packaging company, Jindal Poly Films Ltd, has become the primary player to reveal Biaxially Oriented Polyamide Nylon Films in India.

- In January 2025, Akums Drugs and Pharmaceuticals Ltd, which is India’s contract manufacturing and development organization (CDMO), revealed its latest state-of-the-art sterile production facility, which is dedicated to generating lyophilized products. Furthermore, to lyophilized injectables, the availability is filled to produce ampoules, vials, eye and ear drops too.

- In September 2025, Alvogen Pharma US, which is a privately US-dependent pharmaceutical organisation, announced a definitive agreement by its shareholders to sell its parent company to Lotus Pharmaceutical Co, Ltd.

Top Vendors In High-Barrier Materials For Pharmaceutical Packaging Market And Their Offerings

- Amcor plc: Amcor plc is a top leader in packaging solutions for user and healthcare products, as industry-leading invention potential, technical expertise, and global scale assist every customer to develop and align with the demand of millions of users each day.

- Sealed Air Corporation: Sealed Air is in business in order to protect, solve complicated packaging challenges, and make our world better than we search for it. Our automated packaging solutions market a resilient, safer, and less wasteful global food, liquid, and fluids supply chain that protects goods in transit from damage.

- Uflex Ltd.: Uflex is India’s biggest multinational flexible packaging and solutions organisation, as it is perfect for global brands globally. Over the last three decades, they have gained a near reputation by defining the contours of the packaging sector in India and Overseas.

- Mondi Group: Mondi Group is a top leader in paper and packaging, that contributes to a perfect world through inventive solutions that are sustainable by design.

- Toray Industries, Inc.: Toray Industries is an MNC that is headquartered in Japan and specializes in industrial items centered on technologies in organic synthetic chemistry, such as polymers and biochemistry polymers.

High-Barrier Materials for Pharmaceutical Packaging Market Key Players

Tier 1

- Amcor plc

- West Pharmaceutical Services, Inc.

- Schott AG

- Gerresheimer AG

- Winpak Ltd.

- Jindal Poly Films Ltd.

- Kuraray Co., Ltd.

- Toray Industries, Inc.

- Klöckner Pentaplast

- Berry Global Group, Inc.

- Uflex Ltd.

- Mitsubishi Chemical Corporation

- DuPont de Nemours, Inc.

Tier 2

Tier 3

Segmentation of the High-Barrier Materials for Pharmaceutical Packaging Market

By Material Type

- Aluminum Foil

- Polymer Films

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Polyvinylidene Chloride (PVDC)

- Multilayer Films

- Co-extruded Films

- Laminated Films

- Advanced Barrier Materials

- Inorganic Oxide Coated Films

- Metalized Films

- Nanocomposite Films

- Biodegradable Barrier Films

By Product Type

- Blister Packs

- Pouches

- Unit-Dose Packaging

- Rollstock Films

- Other Formats (Transdermal Patches, IV Bags, Medical Device Packaging)

By Application

- Solid Dosage Forms (Tablets, Capsules, Powders)

- Liquid Dosage Forms (Injectables, Oral Liquids, Topical Solutions)

- Medical Devices (Syringes, Infusion Bags, Diagnostic Kits)

- Nutraceuticals (Dietary Supplements, Herbal Products)

- Cosmetics & Personal Care (Creams, Serums, Face Masks)

By End-Use Industry

- Pharmaceuticals (Prescription Drugs, OTC Drugs)

- Biopharmaceuticals (Biologics, Biosimilars)

- Nutraceuticals

- Medical Devices

- Cosmetics & Personal Care

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait