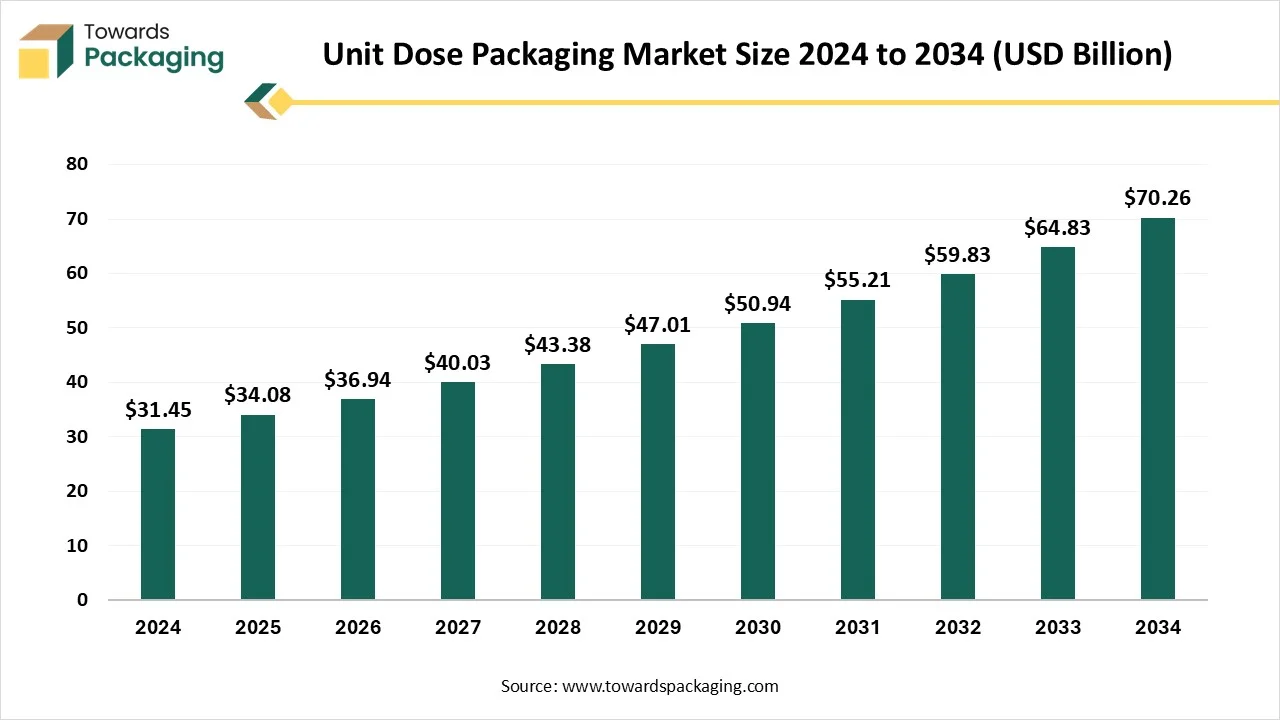

The unit dose packaging market is forecasted to expand from USD 36.94 billion in 2026 to USD 76.14 billion by 2035, growing at a CAGR of 8.37% from 2026 to 2035. This report includes full competitive analysis of companies such as Amcor, AptarGroup, Gerresheimer, and West Pharmaceutical Services, along with value chain mapping, trade flows, manufacturer capacity insights, and supplier ecosystem intelligence, ensuring every statistical and market-driven metric is fully documented.

The unit dose packaging market refers to the market for packaging solutions that contain a single, precise dose of a product, commonly used in pharmaceuticals, over-the-counter (OTC) drugs, and nutraceuticals. The main goal of unit dose packaging is to provide an accurate and convenient dosage for end-users, ensuring compliance, reducing medication errors, and improving patient safety. This type of packaging is typically used for single-use applications, such as blister packs, ampoules, vials, and sachets, catering to sectors like healthcare, personal care, and home care.

In the era of a rapidly evolving technological landscape, the integration of Artificial Intelligence in the unit dose packaging market emerges as a game-changer and holds significant potential to revolutionize various industries, particularly the pharmaceutical and nutraceutical industries. AI-driven solutions assist in streamlining processes, enhancing accuracy, improving patient safety, and driving efficiency in unit dose packaging operations. Machine learning can optimize various process parameters, including pressure, temperature, and mixing duration, to boost efficiency and minimize expenses. AI-powered computer vision systems can effectively detect even minute defects in packaging and labelling with greater accuracy and higher speed as compared to human inspection methods.

How is the Rising Demand for Precision Dosing Solutions Impacting the Unit dose Packaging Market’s Growth?

The increasing need for precision dosing solutions is expected to boost the growth of the unit dose packaging market during the forecast period. The rising prevalence of chronic diseases such as diabetes, high blood pressure, heart disease, and others has led to an increasing need for effective disease management solutions. Unit-dose packaging can play a crucial role in facilitating the delivery of treatments for chronic diseases, especially when precise dosing is paramount. These packaging solutions can enhance medication adherence, minimize the chances of errors, and simplify the administration of drugs for patients. Pre-measured doses can simplify the complex medication schedules, which assist patients in effectively following their prescribed treatment plans for better outcomes. Unit-dose packaging is packaged in compact and lightweight formats and can reduce medication waste, as patients only need to open and use the required dose.

High Initial Investment

The high costs associated with unit-dose packaging technologies are anticipated to hamper the market's growth. The implementation of these technologies requires substantial capital investment, which often poses a significant barrier for small and medium-sized enterprises (SMEs) and healthcare facilities operating within budget constraints. In addition, the rising environmental concerns with the use of single-use plastic in unit dose packaging solutions are likely to limit the expansion of the global unit dose packaging market.

Stringent Regulatory Environment and Increasing Focus on Sustainability

The stringent regulatory environment and increasing focus on sustainability are projected to offer lucrative growth opportunities to the unit dose packaging market during the forecast period. Regulations from authorized health regulatory bodies such as the FDA (Food and Drug Administration) and the EMA (European Medicines Agency) highly focus on the importance of accurate dosing and secure packaging, compelling pharmaceutical and biotechnology companies to embrace unit dose solutions. The stringent compliance ensures product integrity & efficacy, sterile packaging, and secure sealing, which ultimately enhances the overall patient safety. Moreover, the rising sustainability concerns are anticipated to propel the growth of the unit dose packaging market. By combining sustainability with unit-dose packaging material, several businesses across various industries can explore and adopt biodegradable and recyclable materials to align with environmental goals while enhancing brand loyalty among consumers.

The pharmaceuticals segment held the majority of the market share in 2024, owing to the rapid expansion of the pharmaceutical industry, along with the increasing demand for precise and accurate dosing solutions for treating various chronic diseases such as diabetes, high blood pressure, heart disease, and others. The pharmaceutical industry's unit dose packaging solutions are intended to enhance compliance and improve safety. Unit-dose packaging offers features like child-resistant and tamper-evident designs, promoting both security and safety. Unit-dose packaging assists in maintaining the integrity and stability of these sensitive drugs by offering a controlled and single-dose environment. In addition, the pharmaceutical industry is experiencing a rising shift towards the adoption of eco-friendly materials for green packaging solutions, bolstering the segment’s growth.

On the other hand, the nutraceuticals segment is projected to grow at a CAGR of between 2025 and 2034, owing to the growing demand for unit-dose packaging solutions in nutraceuticals and dietary supplement products. Unit dose packaging plays a crucial role in vitamins & supplements, probiotics, and herbal products, as it offers easy and precise dosing. The segment’s growth is driven by the increasing trend of preventive healthcare and personalized nutrition.

The blister packs segment held the largest share of the unit dose packaging market in 2024, owing to the increasing demand for blister packaging solutions. Unit dose packaging ensures pre-measured and accurate doses, which reduces the risk of medication errors and promotes patient safety. Blisters are tamper-evident and offer a robust barrier against oxygen, moisture, contamination, and light, extending the shelf life of drugs and ensuring medication integrity. Their lightweight and compact attributes provide convenience for patients to use on the go.

On the other hand, the vials & ampoules segment is expected to grow significantly during the forecast period, owing to the improving patient safety and rising need for convenience. The rapid growth of the segment is also driven by the rising demand for biologics, vaccines, and other injectable drugs, which further increases the need for vials and ampoules. The demand for vials and ampoules continues to rise, as the pharmaceutical industry is increasingly prioritizing patient-centred care, safety, and efficient medication delivery.

The plastic segment registered its dominance over the global unit dose packaging market in 2024. Plastics offer various benefits, such as lightweight, shatter-resistant, cost-effective, durable, versatile, and flexible packaging solutions. Plastic production reached nearly 413.8 million metric tons, nearly 40% of which was used in packaging applications in 2023. Plastics are less expensive than glass, lightweight, and longer life cycle, as well as offering lower transportation costs and reduced breakage risks as compared to glass. Plastic-based unit dose packaging solutions are gaining rapid traction across various industries such as food & beverage, nutraceuticals, pharmaceuticals, personal care, cosmetics, and home care & cleaning products due to their versatility, protective properties, cost-effectiveness, and enhanced customization.

On the other hand, the glass is expected to witness remarkable growth during the forecast period, owing to its rising adoption across various industries, such as food & beverages, cosmetics & personal care, and pharmaceuticals industries. Glass plays a significant role as a packaging material in the unit dose packaging market. Glass vials and ampoules are a common form of unit dose packaging for liquids to be protected from contamination and degradation, including vaccines, toxoids, and injections. They come in different sizes, ranging from small single-dose to larger ones for multiple doses. Glass is recyclable and is reused without losing quality, making it the most preferable eco-friendly option.

The single-dose packaging segment held a dominant presence in the unit-dose packaging market in 2024, owing to the increasing need for dosage accuracy, evolving consumer preferences, and rising adoption across various industries such as nutraceuticals, the food industry, cosmetics, the chemical industry, and the pharmaceutical industry. Single-dose assists patients adhere to medication schedules, particularly with complex regimens, by providing accurate and pre-measured doses as well as improving the overall patient safety. Moreover, innovations like smart packaging technologies, like RFID and QR codes, are significantly enhancing the functionality and traceability of the single-dose packages, providing healthcare professionals and patients with more interactive and informative options.

On the other hand, the multi-dose packaging segment is expected to grow at a notable rate. The segment's fastest growth is mainly driven by the rising adoption and innovation of multi-dose packaging systems in the pharmaceutical and nutraceutical sectors. Multi-dose packaging solutions are designed to store and dispense multiple doses of pharmaceuticals, nutraceuticals, and others. Multi-dose packaging improves the delivery of regenerative medicine and numerous dermatological treatments. In addition, the rising prevalence of chronic conditions necessitates long-term medication management, making organized multi-dose packaging essential for improving treatment outcomes is expected to fuel the segment’s growth during the forecast period.

The retail segment is expected to dominate the market in 2024 and is expected to further grow at the fastest CAGR, owing to the increasing consumer demand for convenience, safety, and personalized solutions, particularly within the nutraceutical, pharmaceutical, personal care, and cosmetics industries. Retail is a significant distribution channel that includes pharmacies, online stores, and grocery & supermarkets that offer unit dose packaging to meet the rising consumer need for convenience, portability, and reduced waste. Unit dose packaging solutions offer pre-measured and accurate portions that are easy to use, transportable, and store. The rapid expansion of online pharmacies necessitates unit-dose packaging solutions that provide efficient product delivery to consumers at home. These factors are supporting the segment’s growth during the forecast period.

The urge for unit dose packaging in the Asia Pacific region is due to growing industrialization and growing demand from countries such as China, Japan, and South Korea are driving the main technological shifts in the Asia Pacific unit dose packaging systems industry. Organizations are investing in intelligent technologies, cost-efficient manufacturing, and localized manufacturing to align with regional demands and develop competitiveness.

Asia Pacific is the second-largest unit-dose packaging area. The importance of rising economies such as China and India, with their disposable income and growing population, is driving the region’s growth.

North America held the dominant share of the unit dose packaging market in 2024. North America, especially the U.S., has a presence of well-established presence of pharmaceuticals, nutraceuticals, personal care & cosmetics, food & beverages, and homecare & cleaning products, which spurs the demand for unit dose packaging solutions. The growth of the region is driven by the presence of safety government standards, high consumer spending rising focus on patient safety, and reduced medication errors, the increasing need for improved supply chain transparency, the surge in healthcare expenditure, growing popularity of personalized medicine, the rise of home healthcare & self-administration, and the increasing need to comply with safety regulations. Additionally, the increasing population and rising prevalence of chronic diseases such as diabetes, hypertension, cardiovascular disease, and respiratory diseases necessitate unit dose packaging solutions that assist in accurate and consistent medication adherence.

Regulations from bodies like the FDA and EMA mandate features such as tamper-evident seals and child-resistant packaging, as well as continuously updating their standards, encouraging manufacturers to invest in compliance and quality assurance measures. The incorporation of advanced delivery systems is often associated with complex drug formulations, including biologics and specialty drugs, driving the demand for unit-dose packaging solutions. Several companies in the market across various industries are aggressively adopting digital technologies near-field communication (NFC) tags, QR codes, and Radio Frequency Identification (RFID), to improve visibility throughout the supply chain, improve consumer interactive experiences, and strengthen the connection between brands and end customers. Moreover, the rising shift towards online pharmacies and e-prescriptions, coupled with the increasing focus on sustainability to align with the circular economy principle, is driving the regional markets' growth. Such a combination of these factors is expected to accelerate the revenue of the unit dose packaging market during the forecast period.

On the other hand, the Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. The fastest growth of the region is mainly fuelled by the increasing consumer demand for accurate and consistent dosing, rising population, increasing healthcare expenditure, rising focus on maintaining drug integrity, growing need to optimize supply chain management, surging need to comply with safety standards, rising use of unit dose packaging in nutraceuticals and surging demand from multiple industries.

The rising incidence of chronic diseases and the surge in the aging population significantly fuel the market’s growth in the region, as the aging population is more susceptible to chronic diseases, which increases the demand for convenient and accurate pre-measured doses for managing chronic diseases, where unit dose medication intake is crucial for treatment efficacy and preventing any complications. This also simplifies adherence for patients on multiple medications. Several pharmaceutical manufacturing companies operating in the region are focusing on creating patient-friendly designs and increasingly investing in advanced delivery systems, bolstering the region’s growth during the forecast period Additionally, the expansion of pharmacies, online stores, and grocery & supermarkets, particularly in developing nations, and the increasing adoption of sustainable alternatives are expected to propel the market’s expansion in the region during the forecast period.

The Latin America region will experience average development. The growing health awareness among the people is driving the development of this area. On the other hand, the Middle East and Africa region is expected to rise steadily. The development of non-communicable diseases in this region is driving the growth of the market.

The industry in the Middle East and Africa is heavily leading the healthcare sector by developing the urge for accurate and easy drug delivery. The development of chronic disease, integrated with the demand for exact dosage and user-friendly drug designs, is driving healthcare practitioners and patients to favour unit dose packaging. Strict legal constraints pertaining to medication compliance and patient safety are also pushing the packaging solution.

The area’s development in the pharmaceutical sector, combined with developments in packaging technology, is driving the market growth. Trends towards personalised treatment, as well as effective inventory management in clinics and hospitals, are boosting demand for unit dose packaging in the Middle East and Africa.

By Product Type

By Material

By End-User Industry

By Application

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026