Pharmaceutical Plastic Packaging Market: Size, Share, Key Players, and Growth Opportunities

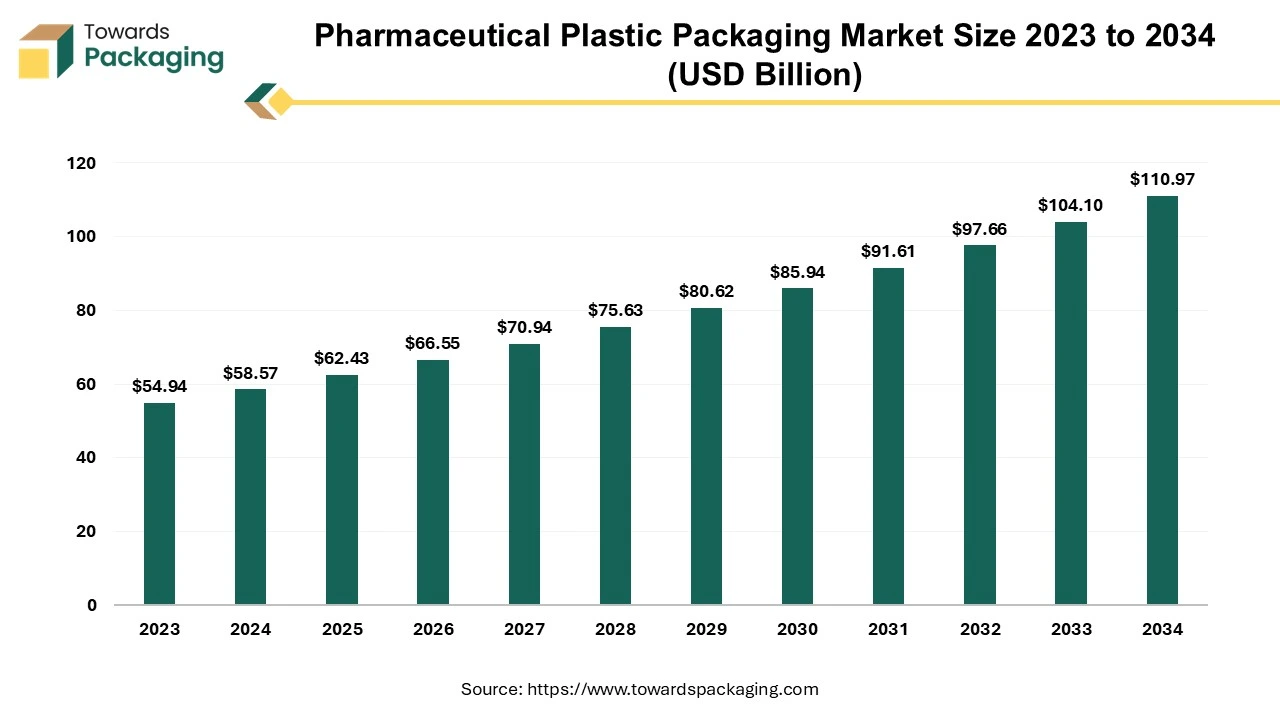

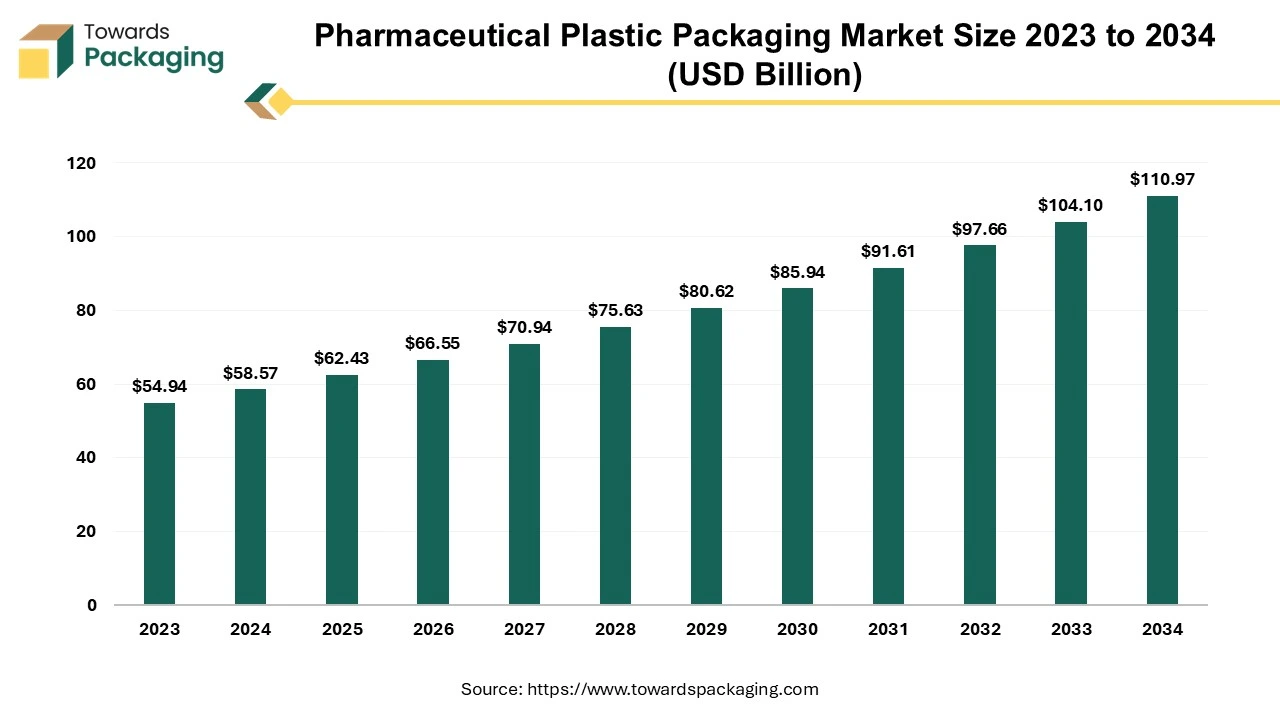

The pharmaceutical plastic packaging market is forecasted to expand from USD 66.56 billion in 2026 to USD 118.31 billion by 2035, growing at a CAGR of 6.6% from 2026 to 2035. This market analysis covers key segments such as plastic bottles, blister packs, pouches, and ampoules & vials, along with a deep dive into material types including polyethylene (HDPE/LDPE), polypropylene (PP), and polyethylene terephthalate (PET). We examine the market dynamics in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, highlighting growth opportunities in emerging economies like India and China.

Key Insights and Critical Revelations in the Pharmaceutical Plastic Packaging Market

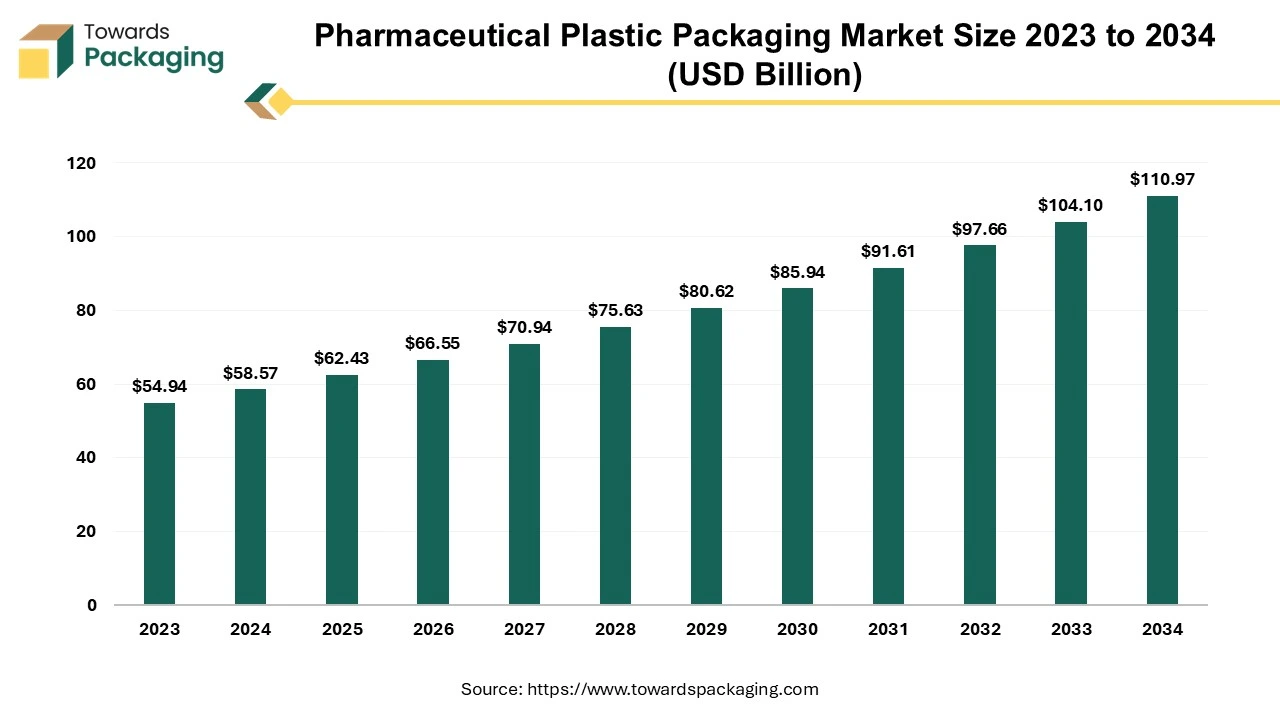

- Market Growth: The pharmaceutical plastic packaging market is expected to grow from USD 62.43 billion in 2025 to USD 110.97 billion by 2034, with a CAGR of 6.6%.

- Protection and Shelf Life: Pharmaceutical plastic packaging is essential in protecting drugs from contamination, damage, and counterfeiting, while also extending their shelf life.

- Regulatory Compliance: Packaging must adhere to strict international regulations, making it a critical part of the pharmaceutical supply chain.

- Oral and Parenteral Administration: Oral drug consumption (51%) is common, but parenteral (29%), inhalation (17%), and transdermal (3%) methods are on the rise.

- North America's Dominance: North America leads the market due to innovation in drug delivery and increasing specialized packaging demands.

- Asia Pacific Growth: The pharmaceutical packaging industry in Asia Pacific, especially in China and India, is experiencing rapid expansion, with India expected to grow significantly.

- Packaging Material Innovation: The pharmaceutical industry is transitioning to new materials, with polyethylene (HDPE) and composite materials accounting for significant market share.

- Recycling Challenges: The pharmaceutical packaging industry faces challenges in transitioning to recyclable materials while ensuring patient safety and regulatory compliance.

- Plastic Bottles Popularity: Plastic bottles are in high demand due to their affordability, versatility, and resistance to environmental factors, although they have some limitations in storing certain drugs.

- Key Players: Leading companies like SCHOTT AG, Gerresheimer AG, Amcor PLC, and West Pharmaceutical Services dominate the market, with frequent acquisitions and collaborations enhancing their market share.

Pharmaceutical plastic packaging plays an essential function in protecting pharmaceutical items from different hazards such as contamination, damage, deterioration and counterfeiting. Its relevance goes beyond conventional protection to include the prolonging of a product's shelf life. In the complex world of pharmaceuticals, producers must follow tight international laws, making packaging an essential component of the entire medication supply chain. The pharmaceutical plastic packaging market has grown significantly, incorporating plastic bottles, parenteral containers and blister packaging. This rise is driven by several causes, including increased research and development efforts, the proliferation of generic pharmaceuticals, and the discovery of novel packaging materials. Notably, the change in packaging extends to specialty bags, closures, labels, and associated things. Furthermore, a distinct trend of growing outsourcing to contract packagers contributes to the industry's rapid expansion.

Drugs have traditionally been taken orally as tablets or capsules, accounting for 51% of the total. This delivery is frequently aided by blister packs, a common technique in Europe and Asia or plastic pharmaceutical bottles, particularly in the United States. Oral drug intake also includes powders, pastels, and liquids. However, alternate administration approaches are gaining popularity. Notably, parenteral or intravenous procedures account for 29%, inhalation for 17%, and transdermal methods for 3% of medication consumption.

Despite the thriving industry, obstacles remain, particularly in increased packaging prices. Strict regulatory rules and persistent anti-counterfeiting efforts have increased compliance costs, limiting the market's potential expansion. These limitations highlight the delicate balance pharmaceutical firms must strike between guaranteeing product safety and complying with changing regulatory environments.

Pharmaceutical plastic packaging is a multidimensional industry in which compliance with international standards is critical, innovation drives diversity, and cost constraints dictate strategic solutions. The market's trajectory is intimately intertwined into the fabric of pharmaceutical breakthroughs, and its continued expansion is dependent on negotiating the complexity of regulatory landscapes while embracing innovations that improve both efficacy and safety in drug delivery.

What are the Major Trends in the Pharmaceutical Plastic Packaging Market?

- Sustainable Packaging Solutions: With growing global environmental concerns, sustainable packaging is gaining significant traction in the pharmaceutical sector. Consumers are increasingly aware of the environmental impact of packaging waste and are actively seeking products that align with their eco-conscious values. By adopting sustainable packaging practices, pharmaceutical companies can reduce their carbon footprint while enhancing brand reputation.

- Child-Resistant Packaging Innovations: Child-resistant packaging remains a critical concern for pharmaceutical companies, especially for medications that pose serious risks if accidentally ingested by children. Ongoing advancements in packaging solutions that integrate both safety and user convenience are helping to better protect vulnerable populations.

- Smart Packaging and Serialization: As the pharmaceutical industry becomes more digitized, smart packaging is transforming how products are delivered and managed. This includes the integration of technologies such as Near-Field Communication (NFC), RFID tags, and QR codes, enabling enhanced functionality, product traceability, and improved patient engagement.

- Personalized Packaging Experiences: In an era of increasing personalization, pharmaceutical companies are leveraging customized packaging to boost brand loyalty, improve patient adherence, and enhance overall customer satisfaction. Tailored packaging solutions can cater to individual needs and improve the user experience.

- Enhanced Labelling and Information Accessibility: Clear, comprehensive labeling is essential for ensuring patient safety and regulatory compliance. Labels should present key information, such as dosage, drug name, and side effects, clearly and concisely. Incorporating multilingual instructions and universal symbols further improves accessibility for diverse populations.

Pharmaceutical Plastic Packaging Market: Leading Manufacturers' Market Shares (2024)

| Manufacturer |

Estimated Market Share (%) |

| Amcor Plc |

22.0% |

| Gerresheimer AG |

18.0% |

| Berry Global Inc. |

16.5% |

| West Pharmaceutical Services |

12.0% |

| Alpla Group |

9.5% |

| Becton Dickinson |

8.0% |

| AptarGroup |

6.0% |

| Huhtamaki Oyj |

4.0% |

| Mondi Group |

2.0% |

| Essel Propack |

2.0% |

Manufacturer Profiles and Market Share Insights:

- Amcor Plc: As a global leader in packaging, Amcor's extensive portfolio and recent merger with Berry Global have solidified its dominant position in the pharmaceutical plastic packaging market.

- Gerresheimer AG: Specializing in glass and plastic packaging for the pharmaceutical industry, Gerresheimer has a strong presence in Europe and North America.

- Berry Global Inc.: Before its merger with Amcor, Berry Global was a significant player in the plastic packaging sector, known for its diverse product offerings.

- West Pharmaceutical Services: Focused on injectable drug delivery systems, West Pharmaceutical Services holds a substantial share in the parenteral packaging segment.

- Alpla Group: An Austrian company specializing in plastic packaging solutions, Alpla has a significant footprint in Europe and emerging markets.

- Becton Dickinson: Known for its medical devices, Becton Dickinson also plays a crucial role in pharmaceutical packaging, particularly in syringes and vials.

- AptarGroup: AptarGroup specializes in dispensing systems and has a notable presence in the pharmaceutical packaging market.

- Huhtamaki Oyj: A Finnish company providing sustainable packaging solutions, Huhtamaki has a growing presence in the pharmaceutical sector.

- Mondi Group: While primarily known for paper packaging, Mondi has ventured into plastic packaging solutions, contributing to its market share.

- Essel Propack: An Indian multinational, Essel Propack is a leading manufacturer of laminated plastic tubes, serving the pharmaceutical industry.

Leading Pharmaceutical Plastic Packaging Suppliers EBITDA Percentages (2024)

| Supplier |

Estimated EBITDA Margin (%) |

| Amcor Plc |

18.0% |

| Gerresheimer AG |

20.0% |

| Berry Global Inc. |

16.5% |

| West Pharmaceutical Services |

22.0% |

| Alpla Group |

15.0% |

| Becton Dickinson |

17.0% |

| AptarGroup |

14.0% |

| Huhtamaki Oyj |

13.0% |

| Mondi Group |

12.0% |

| Essel Propack |

10.0% |

Supplier Profiles and EBITDA Insights:

- Amcor Plc: Amcor's strong EBITDA margin reflects its operational efficiency and the value derived from its extensive product portfolio and recent mergers.

- Gerresheimer AG: With a focus on high-quality packaging solutions, Gerresheimer maintains a robust EBITDA margin, indicating effective cost management and premium product offerings.

- Berry Global Inc.: Prior to its merger with Amcor, Berry Global showcased a healthy EBITDA margin, driven by its diverse product range and global presence.

- West Pharmaceutical Services: West's specialized focus on injectable drug delivery systems contributes to its high EBITDA margin, reflecting the premium nature of its products.

- Alpla Group: Alpla's EBITDA margin is indicative of its efficient production processes and strong position in the European market.

- Becton Dickinson: Becton Dickinson's diversified portfolio in medical devices and pharmaceutical packaging supports its solid EBITDA margin.

- AptarGroup: AptarGroup's focus on dispensing systems contributes to its EBITDA margin, reflecting its niche market positioning.

- Huhtamaki Oyj: Huhtamaki's emphasis on sustainable packaging solutions aligns with its EBITDA margin, showcasing its commitment to innovation and cost efficiency.

- Mondi Group: Mondi's foray into plastic packaging solutions is reflected in its EBITDA margin, indicating its strategic expansion into new markets.

- Essel Propack: Essel Propack's EBITDA margin reflects its specialization in laminated plastic tubes, catering to the pharmaceutical industry's specific needs.

Decoding North America's Dominance in Specialized Pharmaceutical Plastic Packaging Solutions

North America dominated the pharmaceutical plastic packaging market in 2024. The market growth in the region is driven by increasing safety regulations, a rise in pharmaceutical production and increasing demand for lightweight and flexible packaging. The U.S. and Canada are dominating countries driving the market growth. Selecting the right packaging solution is critical in the complex world of pharmaceuticals. To meet certain guidelines, such as remaining legible in a large font and staying firmly on packaging, US pharma packaging regulations require all labels.

North America dominates the pharmaceutical plastic packaging industry, owing to an increase in new product releases that necessitate specialized packaging solutions. This region's dominance is bolstered by the growing tendency to outsource pharmaceutical manufacturing activities to emerging economies, creating new market growth opportunities. The United States has consistently maintained its position as the global leader in drug delivery innovation in North America. With an excellent 8.26, the United States continues to set the standard for pioneering advances in medication delivery systems. This unwavering leadership position demonstrates the country's dedication to innovation and its critical role in influencing the global trajectory of the pharmaceutical industry.

One of the critical elements determining North America's continued market share is the frequency of specialized packaging requirements for recently launched items. This pattern reflects how the pharmaceutical industry is changing and how special packaging is needed to meet the various needs of new drug formulations. Because of this, the area has drawn the attention of pharmaceutical companies looking for innovative packaging options that improve medication delivery's overall efficacy and safety while meeting regulatory requirements. the North American pharmaceutical plastic packaging market is promising, given the strategic shift towards outsourcing pharmaceutical manufacturing to emerging nations. As businesses take advantage of manufacturing facilities' capabilities and cost advantages in these developing areas, this movement creates new growth opportunities.

- In August 2022, The Tufpak® high-temperature polypropylene films and bags, which offer global sterilizability qualities and are primarily intended for medical and biopharmaceutical applications, were made available by Spartech, a prominent developer of engineered thermoplastics and customized packaging solutions, in October 2023.

The pharmaceutical plastic packaging industry in North America is resilient and growing overall because of the cooperative dynamics between established pharmaceutical markets and developing manufacturing centres. Several factors, including a rise in specialized packaging requirements brought on by introducing new products and the deliberate outsourcing of manufacturing processes, contribute to North America's continued dominance in the pharmaceutical plastic packaging business. The United States' ongoing capacity for innovation reinforces the country's position as a leader in developing new drug delivery methods on the global stage.

Asia Pacific is expected to grow fastest during the forecast period. The market growth in the region is driven by factors such as the increasing pharmaceutical production, growing healthcare access, and growing urbanization. China, India, Japan and South Korea are the largest countries propelling the market growth.

Charting the Rapid Growth of Pharmaceutical Plastic Packaging in Asia-Pacific Markets

The Asia Pacific pharmaceutical plastic packaging industry is expanding rapidly, with a particular emphasis on developing nations such as China and India. The strong growth in these economies has played a significant role in raising revenue forecasts in the pharmaceutical plastic packaging industry. According to projections, the packaging business in India is expected to experience substantial expansion in the following years. An increase in demand, especially from sectors like pharmaceutical plastic packaging, is driving this expansion. The predicted worldwide market recovery will likely further strengthen the region's economic prospects, raising demand for packing machinery. Rising growth rates are expected in emerging economies, particularly in China and India, mainly because of these nations' increasing trends in generics production and contract manufacturing activities.

Prefillable syringes and parenteral vials are the segments of the pharmaceutical plastic packaging industry that are expected to experience the most significant growth. This increase is anticipated to continue as novel medicines requiring injection administration are introduced due to biotechnology developments. In particular, India's pharmaceutical industry has experienced a phenomenal upswing, with a 25% gain that has propelled the nation ahead of China and into the third rank among the most innovative countries.

The expansion of China and India has made the Asia Pacific region a significant player in the pharmaceutical plastic packaging market. The demand boom, technological developments and the recovery of the worldwide market pave the way for a vibrant and growing industry landscape in the years to come.

- In July 2021, Sanner introduced Sanner BioBase®, the industry's first bio-based effervescent tablet packaging of renewable raw materials.

North America

Canada Market Trends

The pharmaceutical plastic packaging market in Canada is being driven by advancements in packaging technologies, enhancing product safety, and the rising need for specialty drugs and injectables. Increasing consumer pressure and regulatory mandates are pushing the industry toward adopting sustainable materials. Strict regulations have also made child-resistant and tamper-evident packaging mandatory to prevent accidental ingestion and combat counterfeiting. Additionally, Canada’s aging population is creating demand for easy-to-open, user-friendly medication packaging. The growth in the manufacturing and adoption of generic drugs is further fueling the overall demand for advanced and efficient packaging solutions.

Revolutionizing Pharmaceutical Industry Growth: How Plastic Packaging Solutions Are Redefining Possibilities

The plastic bottle market is expanding rapidly thanks to its affordability, broad use in the pharmaceutical industry, and resistance to numerous environmental variables. Plastic bottles have become indispensable and widely regarded as the most cost-effective and lightweight pharmaceutical plastic packaging material. However, it is vital to remember that plastic, as a material prone to interacting with and permeating gases and liquids, has limitations in the types of medications it can store. The primary pharmaceutical plastic packaging market is seeing tremendous growth, fuelled by the introduction of novel and complicated biologics, showing ample room for expansion. Plastic Packaging emerges as an expert in a wide range of pharmaceutical plastic packaging solutions, including liquid, solid, and ophthalmic applications and plastic vials and bottles used for personal hygiene.

- In October 2023, a Leading producer of medical equipment and pharmaceutical plastic packaging, Bormioli Pharma, introduced the Plastic Academy as a training initiative to introduce young people to the field of plastics processing technicians.

There has been a significant transition in pharmaceutical plastic packaging materials, with composite and plastic materials accounting for 24% and 43% of the industry's overall value, respectively. Plastic, particularly Cyclic Olefin Polymer (COP), has emerged as a viable replacement, driven by durability and cost-effectiveness. Concurrently, composite materials, which account for 24% of the market, provide a unique combination of plastic strength and desirable properties such as transparency and barrier protection. This transition in packaging materials expands pharmaceutical businesses' options, encouraging innovation in response to changing client preferences for sustainability and product integrity. The variety of packaging materials encourages the business to respond to shifting demands. The pharmaceutical plastic packaging market in China is significant, totalling 106.8 billion yuan, demonstrating the enormous scale and potential of the country's pharmaceutical plastic packaging landscape.

- In May 2022, The debut of EcoPositive, a brand for all of its sustainable packaging products, is Bormioli Pharma, a producer of plastic and glass primary packaging for pharmaceutical applications.

Medicine Packaging: Striking the Balance Between Protection and Recycling Challenges

Medicine packaging plays a crucial role in safeguarding the effectiveness and safety of pharmaceutical products during transport, storage, and throughout their shelf-life. Designed to shield contents from heat, light, temperature changes, and moisture, pharmaceutical packaging adheres to stringent regulatory requirements to maintain product integrity.

Recycling Challenges

While the importance of eco-friendly packaging is recognized, transitioning existing medicine packaging to be more recyclable poses significant regulatory and safety hurdles:

- Patient Safety Priority: Any changes must prioritize patient safety, ensuring no risk of contamination or compromise to product efficacy due to recycled materials.

- Regulatory Compliance: Adherence to strict regulations by health authorities like MHRA, FDA, and EMA, alongside international standards, is crucial.

- Collection Costs: The expenses associated with collecting and sorting used packaging for recycling purposes add to the complexity.

- Recycling Costs: The financial implications of the recycling process itself, including sorting, processing, and reprocessing materials.

- Manufacturing Capacity: Evaluating technological capabilities to efficiently recycle pharmaceutical packaging materials without compromising quality or safety.

- Environmental Impact: Assessing whether the environmental benefits of recycling outweigh the energy expended in the recycling process.

While recycling medicine packaging is essential for sustainability, navigating these multifaceted challenges requires a delicate balance between environmental responsibility and maintaining pharmaceutical safety standards. Addressing these challenges involves collaboration across regulatory bodies, pharmaceutical companies, and recycling industries to ensure advancements in eco-friendly packaging without compromising patient health or product integrity.

Dominance and Versatility of PE in Pharmaceutical Plastic Packaging Solutions

Polyethylene (PE) is the most popular material, accounting for 34% of the plastics market. Polyethylene polymer strands in this category pack densely to create high-density polyethylene (HDPE). HDPE is the most common plastic used for solid pharmaceutical products and is known for its moisture resistance and structural strength. Its inherent properties make it an appropriate material for creating containers that protect medications from environmental hazards.

Polyethylene (PE) is an essential material in the pharmaceutical plastic packaging industry. PE provides increased stability due to increased interactions between its polymers related to its peculiar form. Increased polymer interactions lead to a more muscular and stable material. One notable advantage of PE plastics is their ability to withstand autoclaving, a sterilization process. This sterilization capacity makes PE a good alternative for producing sterile drug containers that meet the pharmaceutical industry's demanding hygiene and safety criteria.

Polyethylene makes up a significant amount of the plastics market and is most common in the form of HDPE. Because of its qualities, including structural stiffness and moisture resistance, it is the best option for solid medicinal goods. Conversely, Polyethylene (PE) is a crucial material for making sterile medicinal product containers that adhere to the strict hygienic requirements of the pharmaceutical sector because of its improved stability and autoclaving capacity.

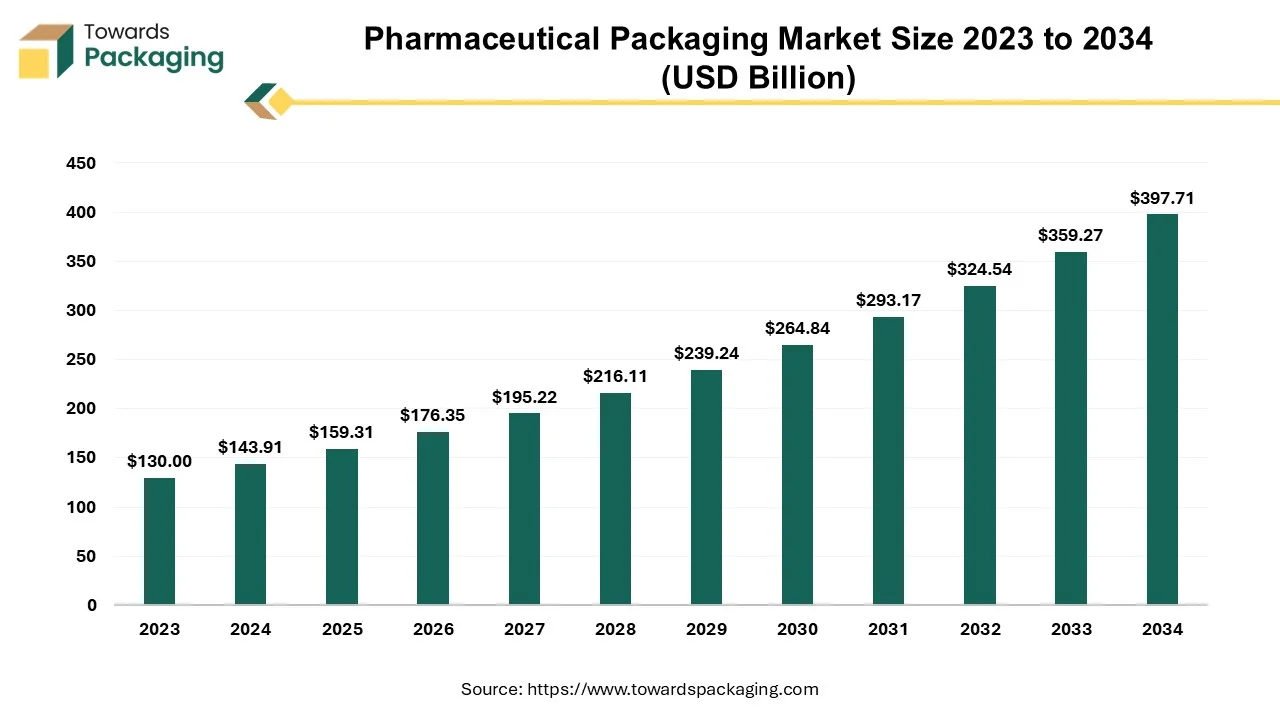

Future of Pharmaceutical Packaging Market

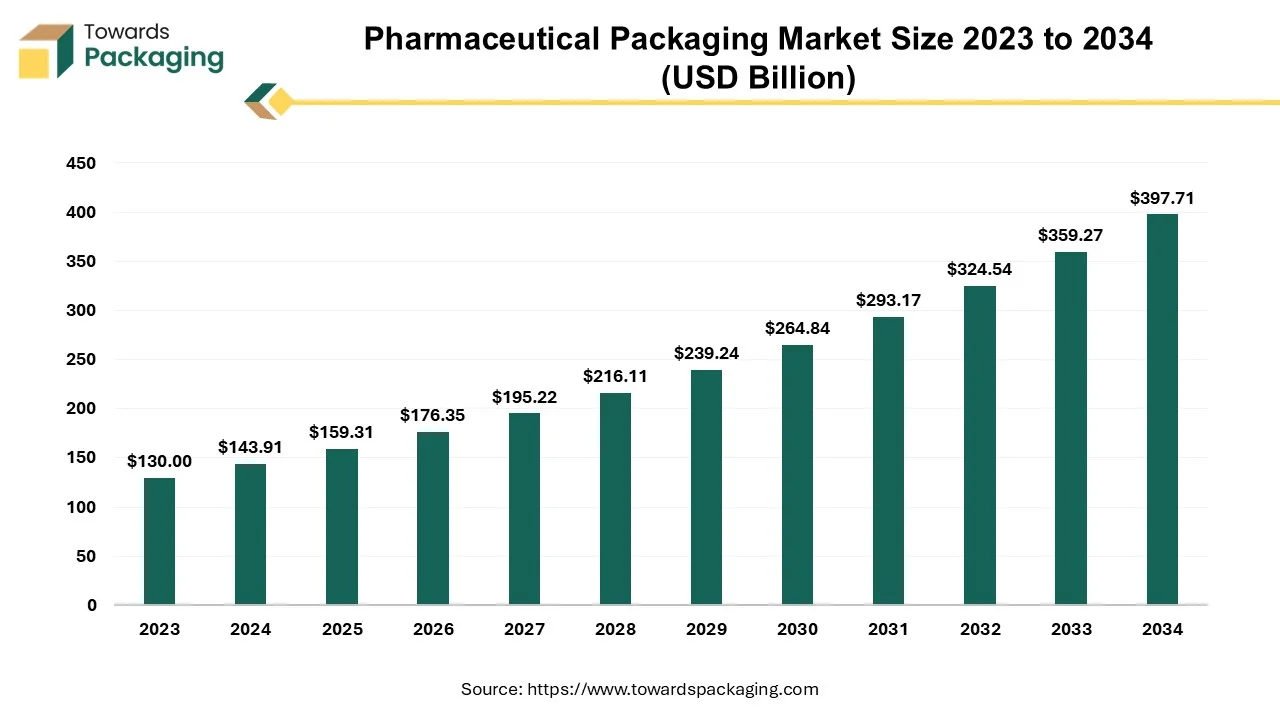

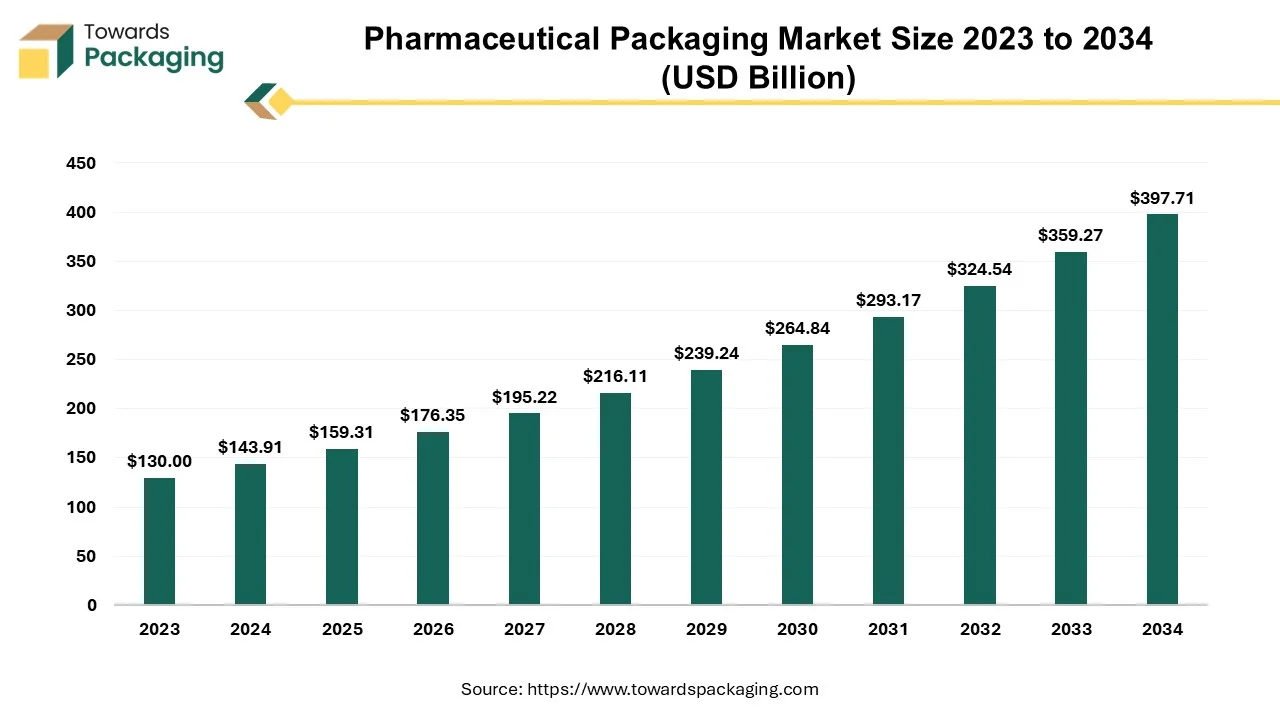

The global pharmaceutical packaging market is forecasted to expand from USD 159.31 billion in 2025 to USD 397.71 billion by 2034, growing at a CAGR of 10.7% from 2025 to 2034. The growth is mainly driven by the increasing need for safe and effective drug packaging due to rising demand for medicines worldwide. This is supported by advances in technology and stricter regulations ensuring product quality and patient safety.

A vital part of medicine delivery, pharmaceutical packaging guarantees the efficacy, safety, and integrity of pharmaceutical products for the course of their lifetime. Pharma packaging shields goods against deterioration, contamination, and other outside influences that could jeopardize patient safety and product quality by using specific materials and technology. Packaging acts as a protective barrier against temperature changes, moisture, light, and physical harm.

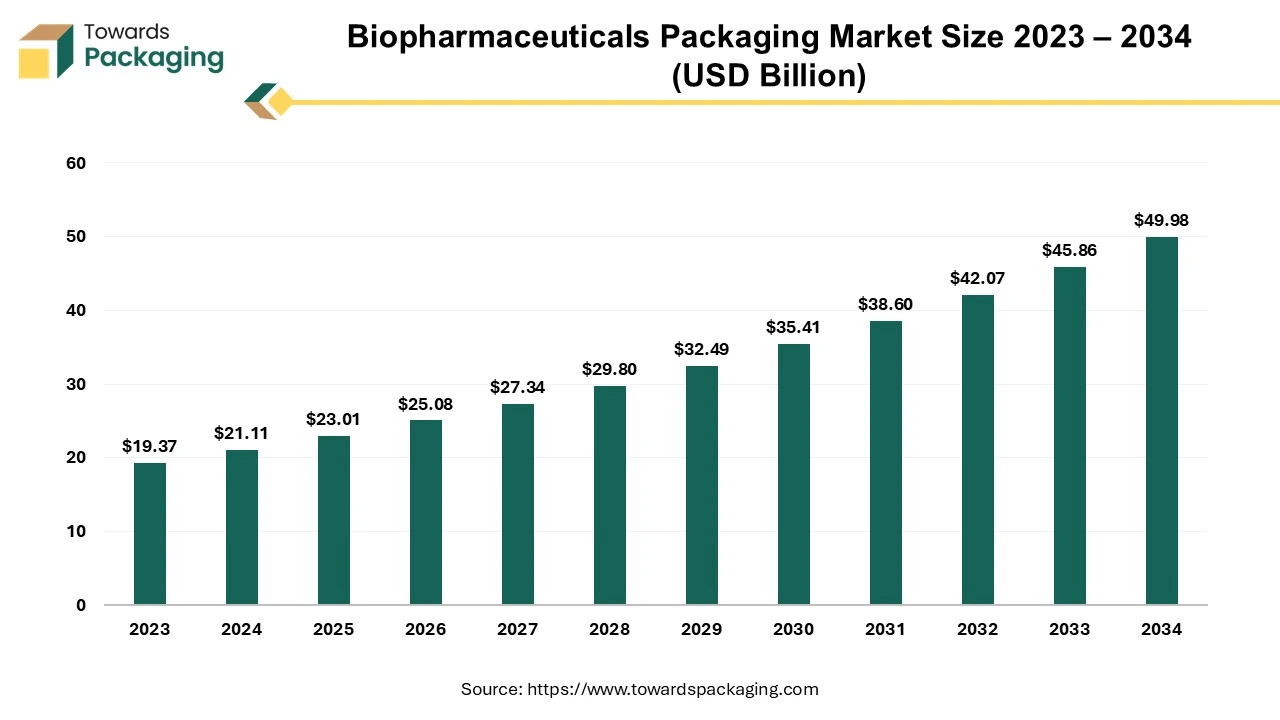

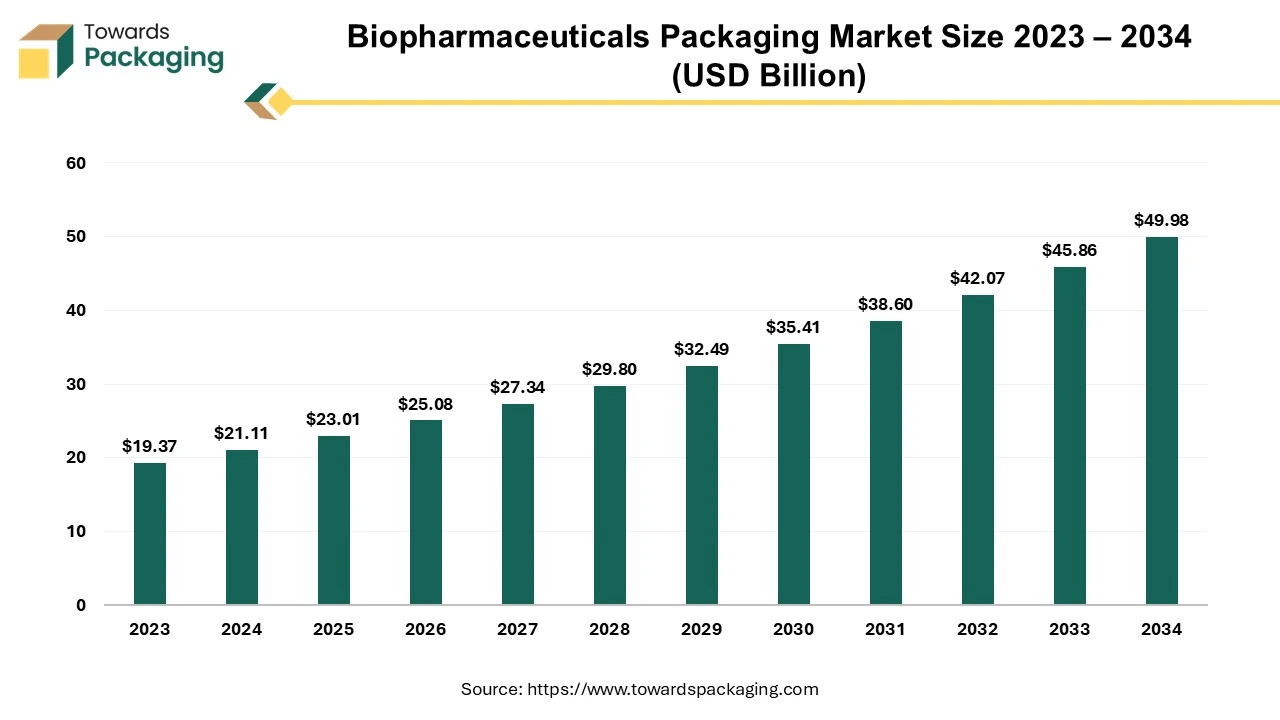

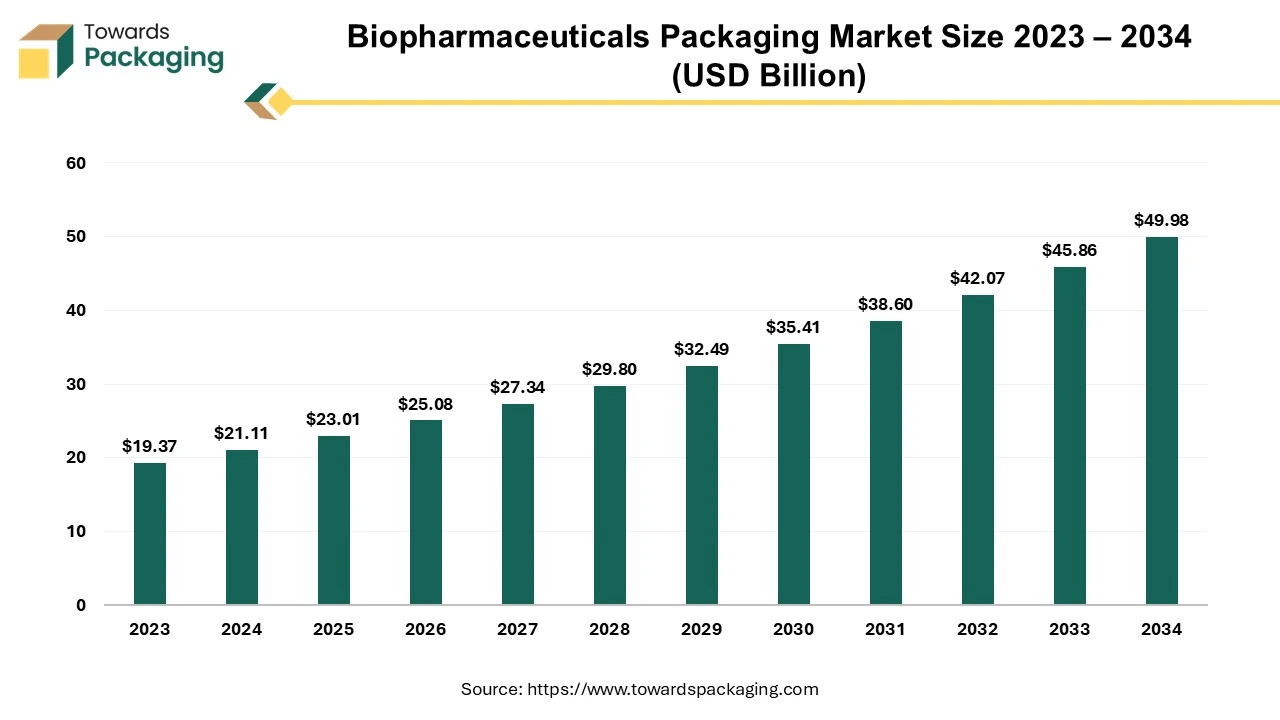

Future of Biopharmaceuticals Packaging Market

The biopharmaceuticals packaging market is set to grow from USD 23.01 billion in 2025 to USD 49.98 billion by 2034, at a 9% CAGR. This growth is driven by the rise in pharmaceutical outsourcing and a growing focus on sustainable, recyclable packaging.

The biopharmaceuticals packaging market deals with the process of enclosing medications and other pharmaceutical products in packaging materials that guarantee their information dissemination, identification, and protection. These materials include cardboard, paper, aluminum, glass, and plastics. These materials are carefully selected based on their ability to protect against regulatory requirements and external factors and compatibility with the pharmaceutical product.

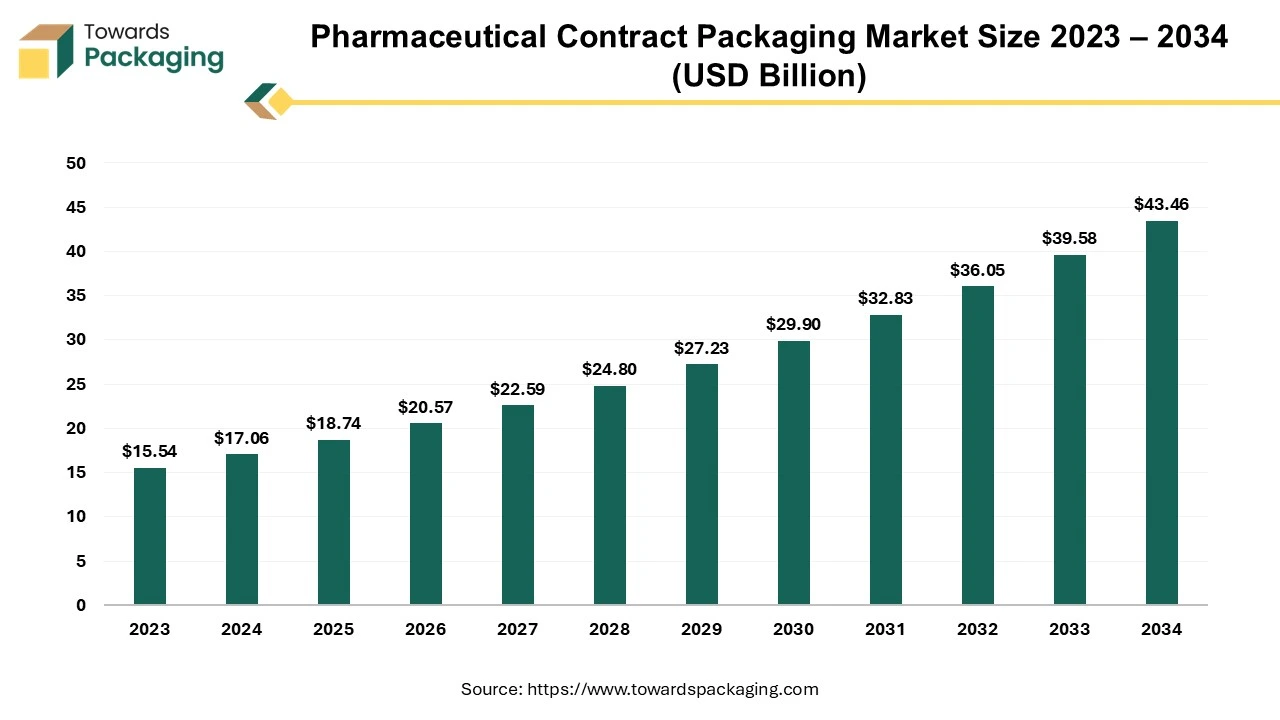

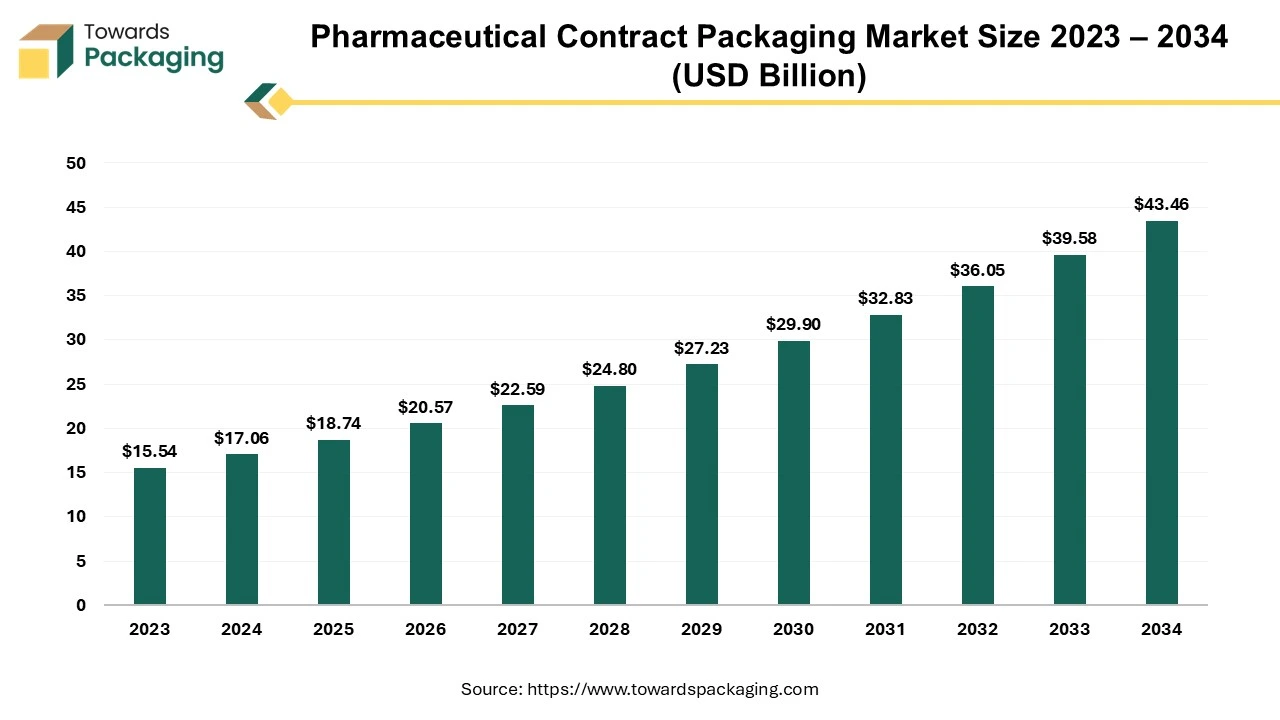

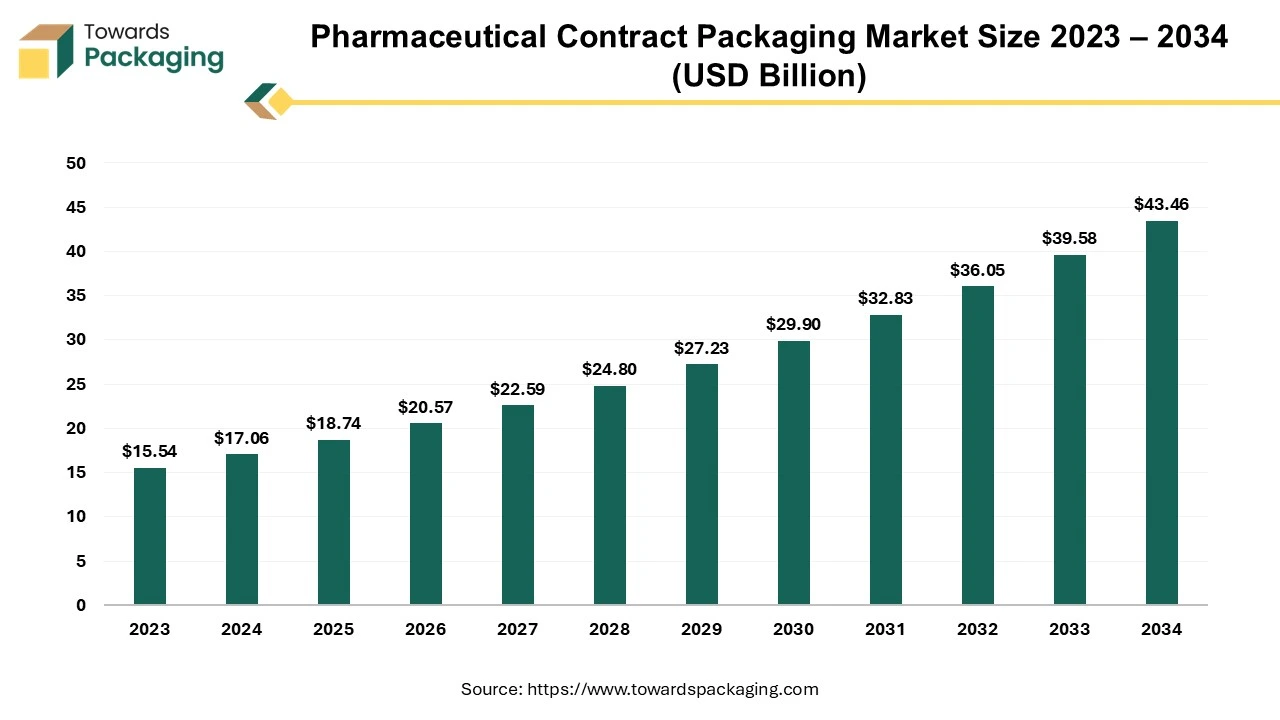

Future of Pharmaceutical Contract Packaging Market

The global pharmaceutical contract packaging market is projected to increase from USD 17.06 billion in 2024 to approximately USD 43.46 billion by 2034, expanding at a CAGR of 9.8% between 2024 and 2034.

Contract packaging is the utilisation of a contracted business to package products for shipment and sale. Contract packaging firms, known as co-packers or co-packagers, are hired to package, store, and distribute another company's products, such as pharmaceutical units. Within the pharmaceutical sector, contract packaging companies offer diverse services tailored to pharmaceutical packaging needs, including high-volume commercial solutions for primary and secondary packaging. Additionally, they provide ongoing support services throughout the life cycle of drug products. The global pharmaceutical packaging market, estimated at USD 117.23 billion in 2022, is expected to witness further growth.

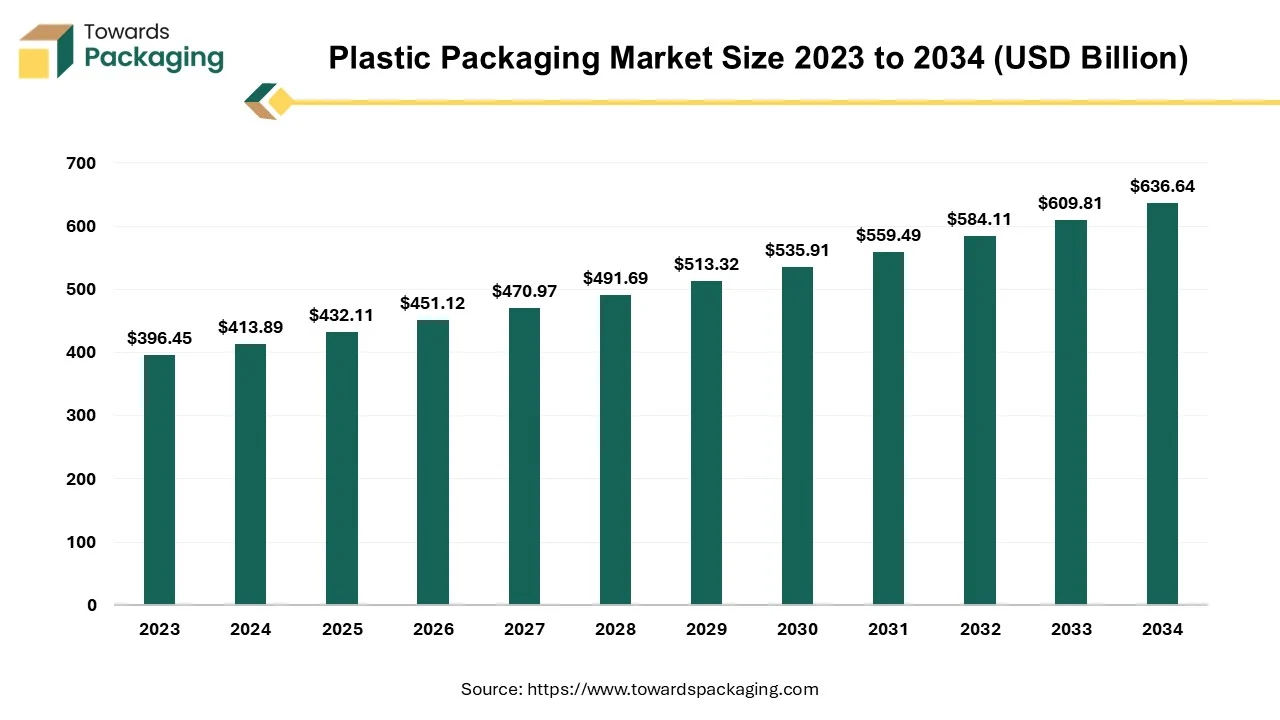

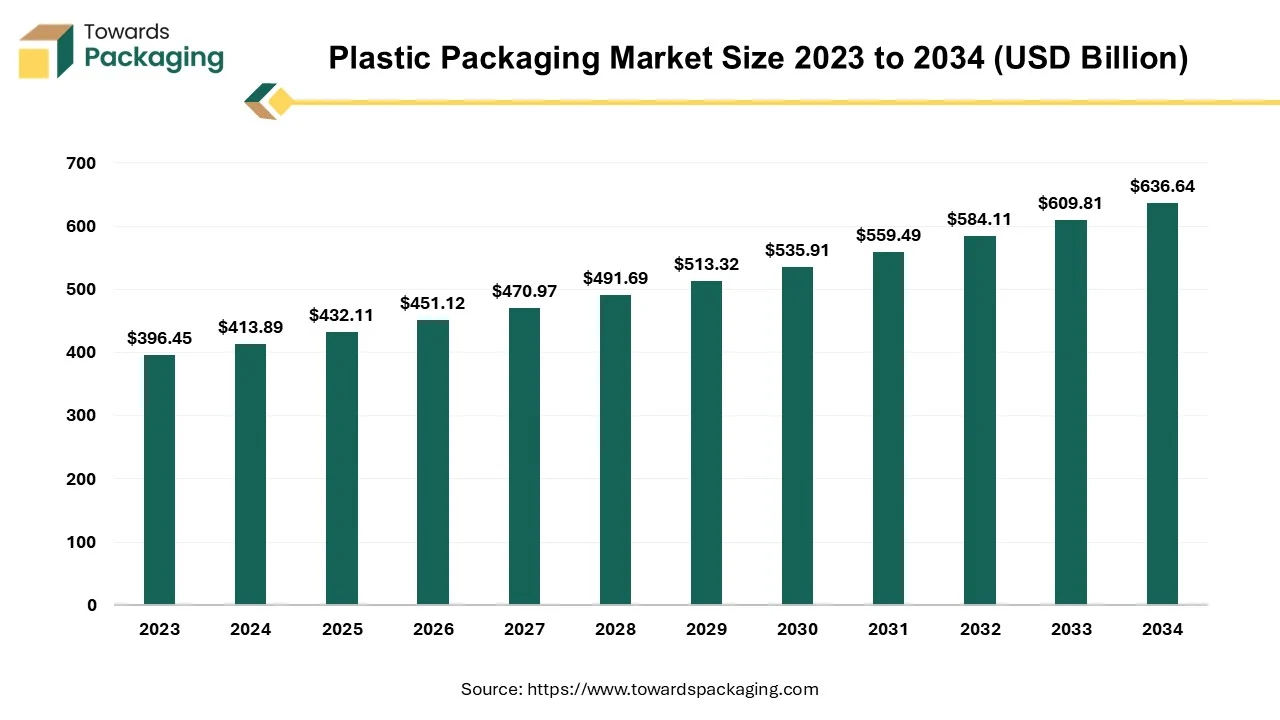

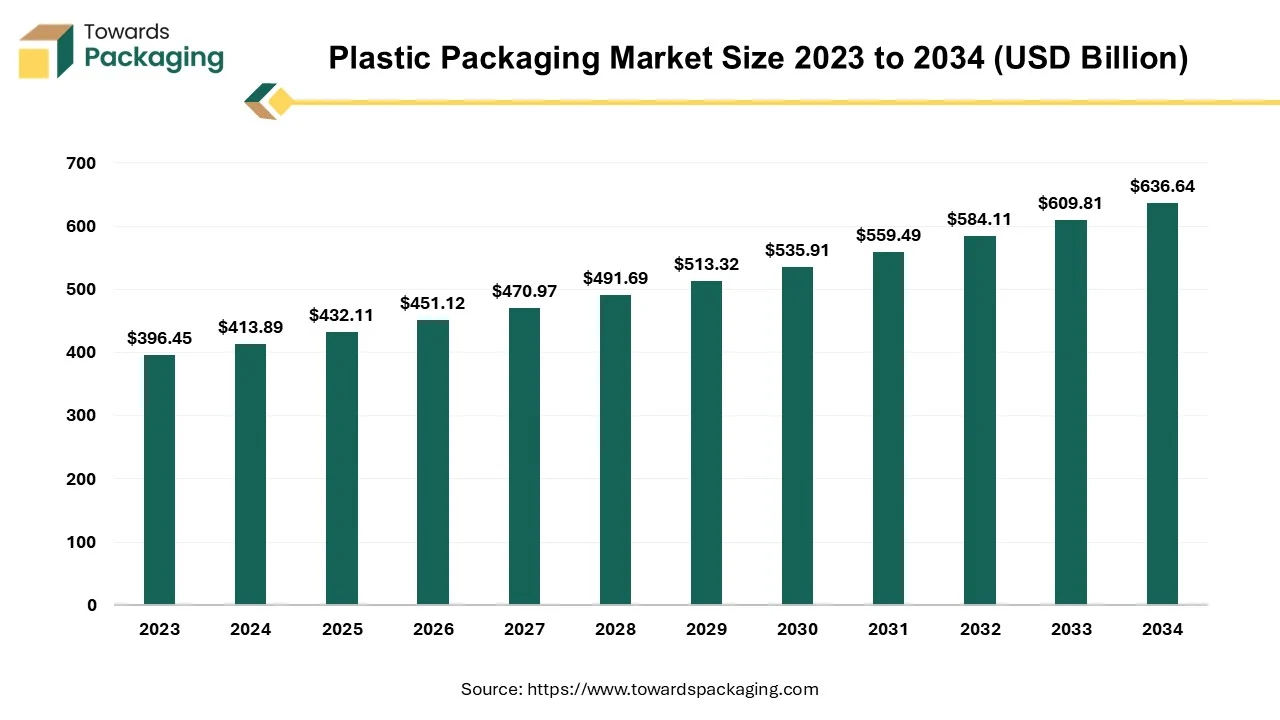

Future of Plastic Packaging Market

The plastic packaging market is projected to reach USD 636.64 billion by 2034, growing from USD 432.11 billion in 2025, at a CAGR of 4.4% during the forecast period from 2025 to 2034. The surge in online shopping, urbanization, and demand for convenient, safe, and long-shelf-life products has significantly increased the need for efficient and protective packaging solutions. The rising adoption of sustainable practices, technological innovations, and expanding food and beverage consumption globally are further fueling this market expansion.

The utilization of various semi-synthetic or synthetic materials to enclose, protect, transport, and display products is known as plastic packaging. The plastic packaging is extensively utilized for packaging materials worldwide, due to its versatility, durability, and cost-effectiveness. The common plastics utilized in packaging have been mentioned here as follows: polyethylene, polyethylene terephthalate, polystyrene, polyvinyl chloride, and bioplastics among others.

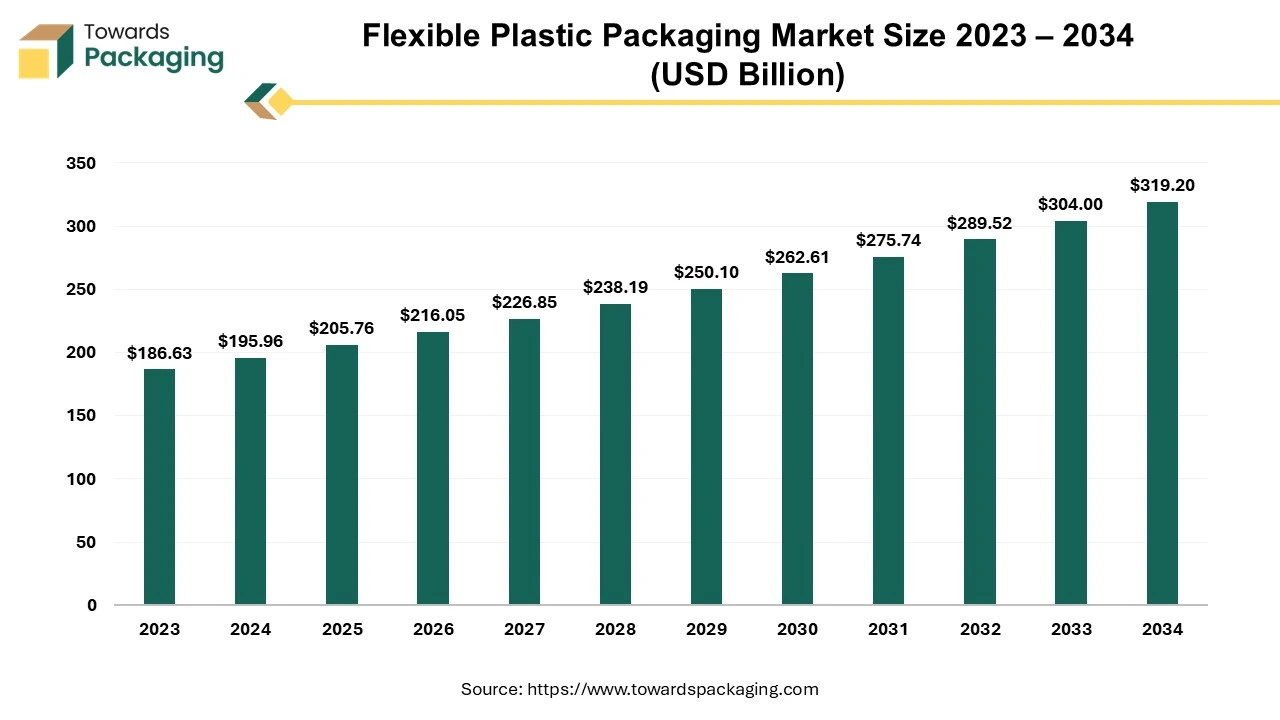

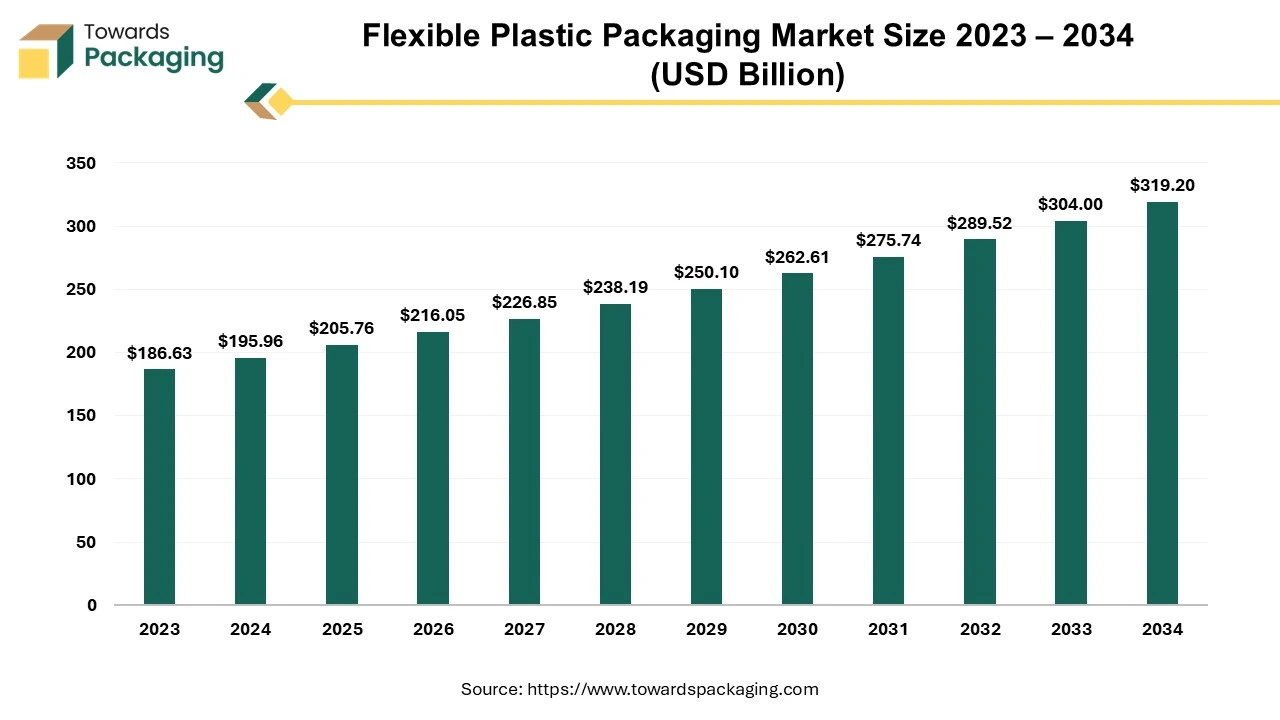

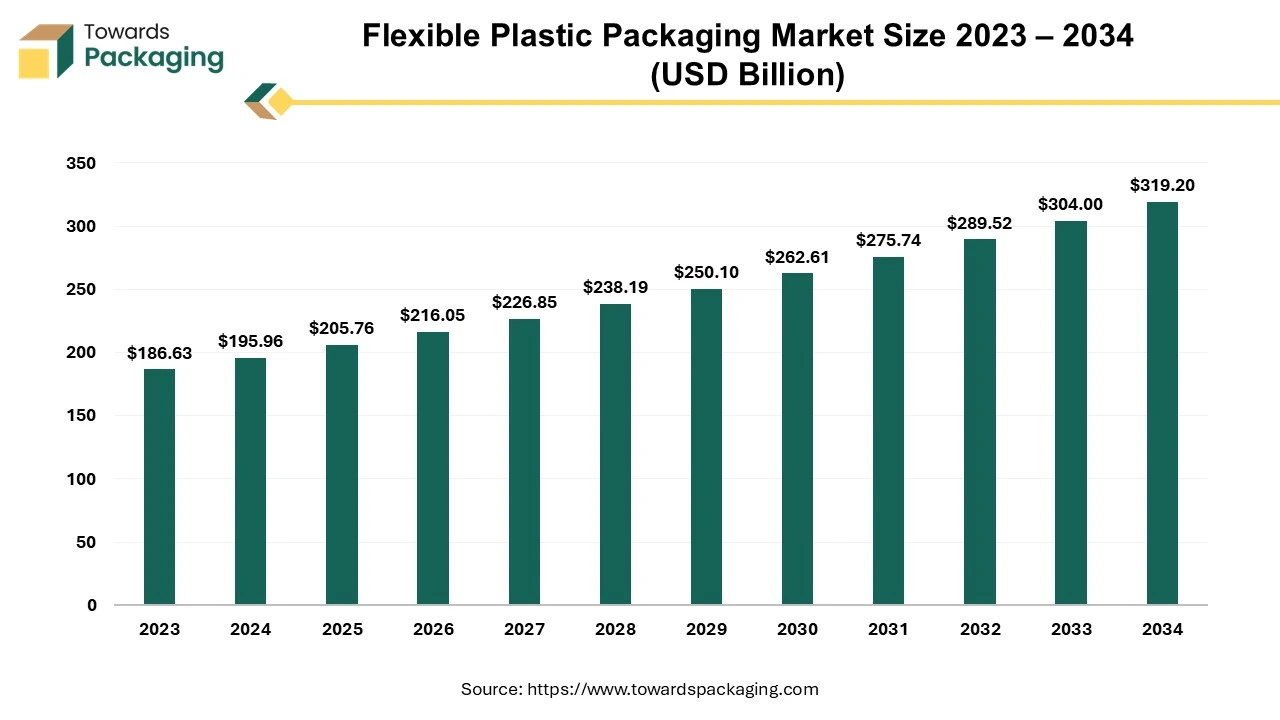

Future of Flexible Plastic Packaging Market

The flexible plastic packaging market is projected to reach USD 319.20 billion by 2034, growing from USD 205.76 billion in 2025, at a CAGR of 5.0% during the forecast period from 2025 to 2034.

Packaging materials composed of various flexible plastic materials that may conform to the shape of the item being packaged are referred to as flexible plastic packaging. It consists of a variety of plastic packaging shapes, mostly meant for home use, that are flexible or semi-flexible, like bags, films, pouches, and tubes. Because of their cost-effectiveness and versatility in the supply chain, plastic polymers generated from fossil hydrocarbons are commonly used to create these packaging solutions.

Future of Clear Plastic Film Market

The global clear plastic film market is set for substantial growth, with forecasts projecting revenue expansion into the hundreds of millions between 2025 and 2034. As companies shift towards eco-friendly and high-barrier packaging materials, clear plastic films are playing a crucial role in enhancing product safety, shelf life, and supply chain efficiency, ultimately supporting the development of sustainable infrastructure worldwide.

The clear plastic film market is anticipated to grow at a substantial rate during the forecast period. Plastic film is available in a range of shades, textures, and transparency levels. Transparent or opaque film is needed for many applications, but clear plastic film is specifically useful for many uses. Clear plastic film usually provides a distinctive finish or protective layer that doesn't physically hamper the material underlying. Clear film is available in a wide variety of alternatives to suit different organizational requirements, aesthetic preferences, and strength as well as durability levels. It is frequently utilized to provide defense against chemicals, impact, and wear and moisture exposure because of its optical clarity. Additionally, clear plastic film is widely used in the packaging sector.

The rising demand for flexible and transparent packaging in industries like food and beverages, cosmetics and pharmaceuticals coupled with the technological advancements in the film production such as multi-layer co-extrusion and bi-axially oriented films is expected to augment the growth of the clear plastic film market during the forecast period. Furthermore, the surge in the e-commerce coupled with the growing healthcare sector is also anticipated to augment the growth of the market. Additionally, the increased consumer preference for transparency, convenience foods and ready-to-eat meals as well as the rising disposable incomes and urbanization and adoption of the bio-based polymers and green manufacturing practices is also projected to contribute to the growth of the market in the near future.

Competitive Landscape: Key Players and Market Dynamics in Pharmaceutical Plastic Packaging

The competitive landscape of the pharmaceutical plastic packaging market is characterized by established industry leaders such as SCHOTT AG, Gerresheimer AG, Amcor PLC, West Pharmaceutical Services, In, Aptar Group Inc., Comar LLC, Klöckner Pentaplast Group, Pretium Packaging, Parekhplast India Ltd and Mondi Plc. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions, and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

Pharmaceutical Plastic Packaging Market Players

Recent Developments

- In December 2024, a leading global provider of innovative packaging solutions for the pharmaceutical industry, LOG Pharma Primary launched a new barrier eco line which optimizes oxygen scavenging for eco-friendly barrier bottles.

- In October 2024, Berry Globa, packaging solutions provider launched a range of clarified polypropylene (PP) bottles for healthcare applications, which offer enhanced product protection and offer superior sustainability compared to traditional coloured PET pill bottles.

- In October 2024, polyethylene terephthalate (PET) blister packaging, a first-of-its-kind in the healthcare industry was launched by Bayer on its renowned brand, Aleve. This innovative solution marks a stride in environmental stewardship and reduces the carbon footprint of this packaging by 38%.

- In January 2023, TricorBraun acquired Plas-Pak WA, a distributor and maker of plastic packaging situated in Perth, Australia. Plas-Pak WA staff will remain with TricorBraun.

- In March 2023, The ALPLA Group strengthened its position in the global pharmaceutical plastic packaging business by forming a joint venture with Indian Pharma. ALPLA, an international plastic and recycling specialist, and Spanish pharmaceutical plastic packaging manufacturer Inden Pharma are forming a long-term relationship to produce bottles, containers, and closures in clean rooms beginning in March.

- In August 2023, DuPont declared the completion of its acquisition of Spectrum Plastics Group (Spectrum), a reputable world leader in specialist medical devices and componentry.

- In October 2023, Asahi Kasei Pax's film division was split into a new company. Sumitomo Bakelite, a Japanese chemical manufacturing company, has agreed to buy 90% of the shares. To ensure a consistent supply and service of pharmaceutical plastic packaging films, Sumitomo will integrate Asahi's processing technology.

- In December 2022, Shriji Polymers (India) Limited, a manufacturer of rigid plastic packaging solutions for the pharmaceutical industry, acquired a controlling stake in Parekhplast India Limited.

Pharmaceutical Plastic Packaging Market Segments

By Product Type

- Plastic Bottles

- Blister Packs

- Pouches

- Ampoules & Vials

- Others

By Material

- Polyethylene (HDPE/LDPE)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

By Region

- North America

- Europe

- Asia Pacific

- LA

- MEA