Plastic Blister Packs Market Size, Share, Trends and Forecast Analysis

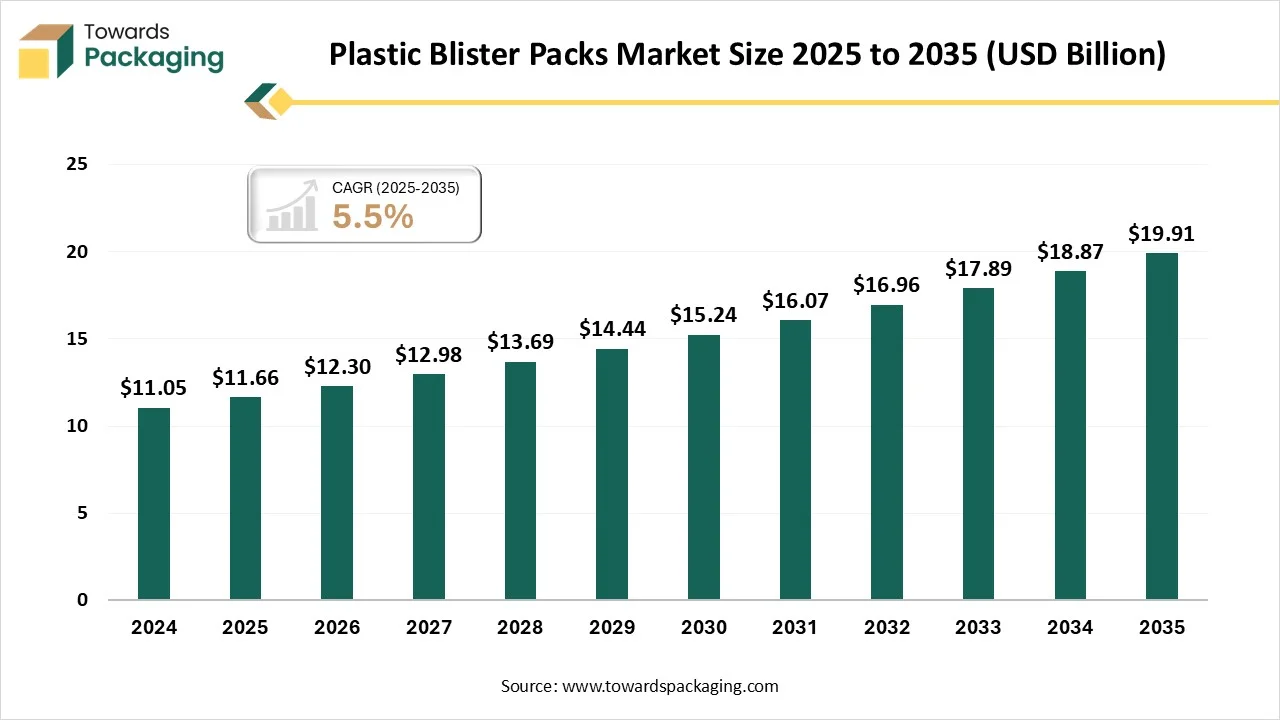

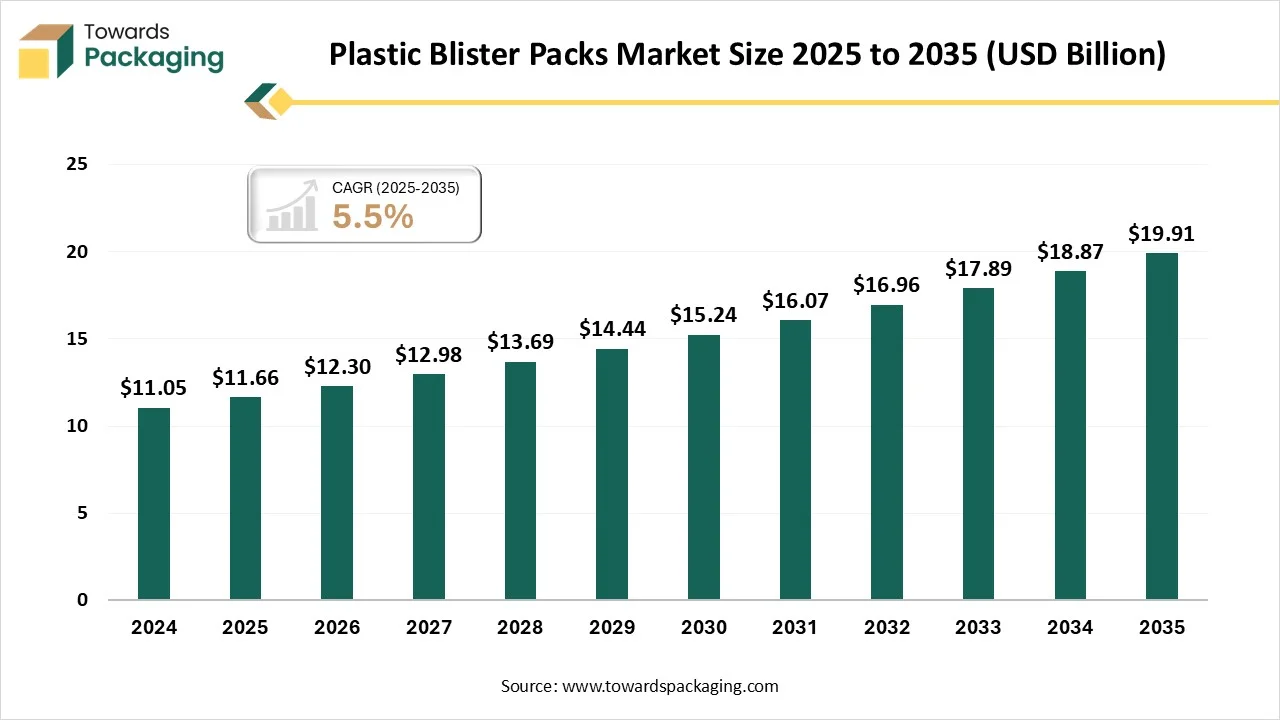

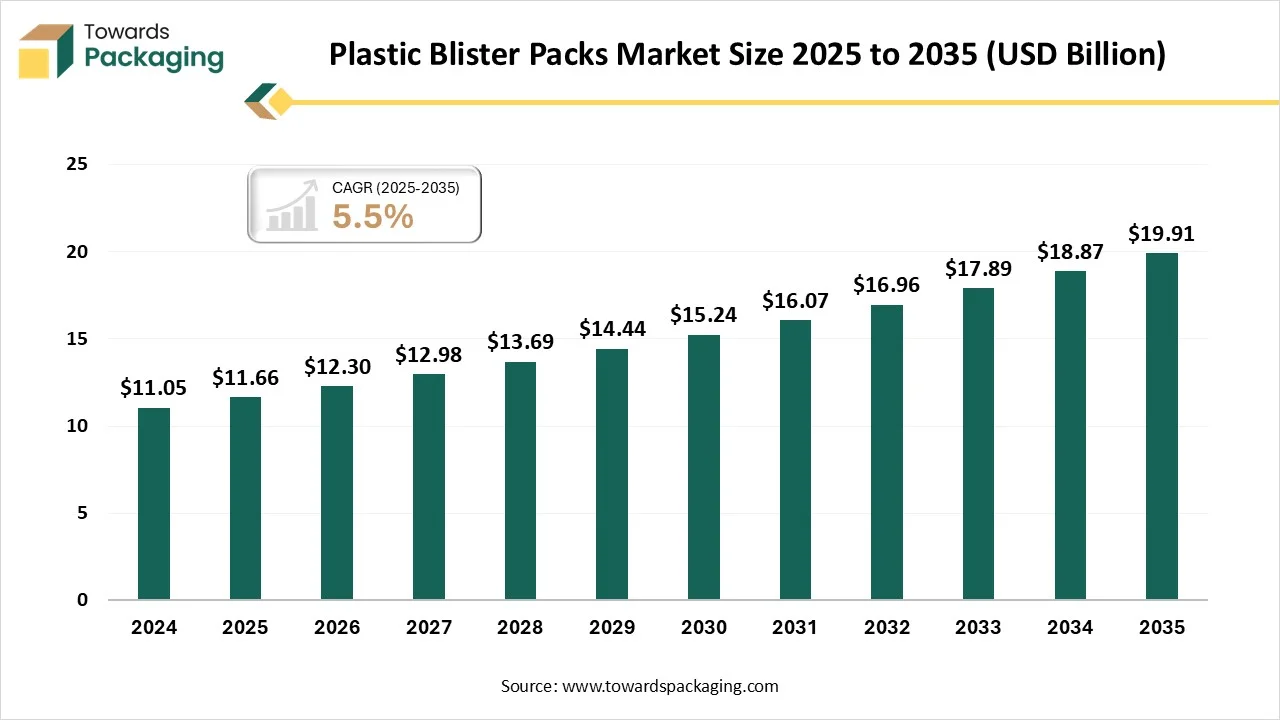

The plastic blister packs market is projected to reach USD 19.91 billion by 2035, growing from USD 12.30 billion in 2026, at a CAGR of 5.5% during the forecast period from 2026 to 2035. This market is influenced by the requirement for cost-efficient, tamper-evident, and suitable packaging choices. The healthcare industry is the primary end user. The need for tamper-evident, single-dose packaging that protects medical and pharmaceutical equipment from contamination, moisture, and gas is a major factor. The rapid growth of e-commerce requires durable packaging that can withstand the rigors of transportation while safeguarding product quality, which is driving demand for a strong plastic blister pack design.

Major Key Insights of the Plastic Blister Packs Market

- By region, Asia Pacific dominated the global market with the largest share in 2024.

- By region, North America is expected to grow at a notable CAGR from 2026 to 2035.

- By product/format, the carded blister packs (blister + card) segment contributed the biggest market share in 2024.

- By product/format, the strip/cavity blister packs segment will be expanding at a significant CAGR between 2026 to 2035.

- By end-use industry, the pharmaceuticals & healthcare segment contributed the biggest market share in 2024.

- By end-use industry, the consumer electronics & household goods segment will be expanding at a significant CAGR between 2026 to 2035.

Packaging Innovation: Materials, Sustainability, and Product Protection

Plastic blister packs are a type of pre-formed packaging that consists of a plastic cavity, or "blister," sealed to a helpful resource such as aluminum foil or cardboard. It is widely used to protect and package small goods, such as pharmaceuticals (capsules and tablets) and consumer products (toys, batteries, and electronics). The plastic hollow is naturally twisted over thermoforming, and the sealed pack shields the goods from tampering, moisture, and contamination.

Plastic Blister Packs Market Outlook

- Market Growth Overview: The plastic blister packs market is expanding due to the rising pharmaceutical industry, the extension of the e-commerce industry, protection of products, enhanced visibility, and cost-efficiency. The rising pharmaceutical sector has increased demand for tamper-evident, cost-effective packaging and the expansion of e-commerce.

- Global Expansion: Regions such as Latin America, North America, Asia Pacific, Europe, South America, the Middle East & Africa are witnessing rising demand from consumer goods and electronics, the pharmaceutical industry, packaging expansion, and the growth of the e-commerce sector.

- Major Market Players: Plastic blister packs market includes WestRock Company, Sonoco Products Company, Constantia Flexibles, Amcor Plc, Huhtamaki Oyj, and Honeywell International Inc.

- Startup Ecosystem: The startup industries play an important role in developing recyclable content, mono-materials packaging, and automated and technologically advanced packaging.

Advanced Materials and Automation Reshaping Manufacturing

Technological transformation in plastic blister packs includes smarter, more customer-friendly designs, the integration of smart technology, improved sustainability, and more efficient production processes. Inventions focus on services like peel-off and easy-open patterns for approachability, smart packaging with QR codes or NFC for patient and tracking data, and the growth of recyclable mono-material packs to decrease ecological impact. Advanced equipment utilizes a precise heat switch to avoid inferior-quality and ensure superior-quality packing.

Trade Analysis: Plastic Blister Packs Market: Import & Export Statistics

Market Context (Recent Years): Why Cross-Border Trade Matters

- Blister packs remain the dominant primary packaging format for tablets, capsules, and many OTC/OTC+prescription products because they combine dose-level protection, tamper evidence, and ease of serialization. This concentrates trade in pharma-grade blister board, films, and converted blisters to countries with large pharmaceutical manufacturing or strong retail/consumer markets. Market trackers consistently show the pharmaceutical segment as the largest single end-use for blister packaging.

- Cross-border trade is driven by (a) where converters and contract-packers are located, (b) regulatory requirements (child-resistance, serialization), and (c) growing sustainability and recyclability rules that are shifting material choice and origin decisions. Global customs data for HS 392690 and related codes shows many countries both exporting and importing blister-related items, reflecting that some regions specialize in converted blisters while others import finished blisters or raw sheet/film for local converting.

What’s Actually Traded

- Raw thermoforming sheet/film (rolls/reels) for blister forming (often reported under coated/printed plastic sheet HS lines).

- Converted plastic blisters & trays (finished blisters, pre-formed packs) that go directly into filling lines. These commonly map to “other articles of plastics”.

Top Exporters: Who Supply Global Blister Demand

Across HS-proxy data and trade dashboards, the most visible exporter origins for plastic blister items and related converted packaging are:

- China and Vietnam: large-volume, cost-competitive converters supplying consumer goods and some pharma blister demand and acting as OEM/ODM hubs. Several shipment-count aggregators list Vietnam and China among the top exporters of blister packaging by shipment count.

- Netherlands / Belgium / Germany (EU converting & re-export hubs): high-value converted blister shipments and specialty pharma blister formats are commonly routed through EU packaging hubs (Netherlands/Belgium) that consolidate and re-export across Europe. National HS splits show the Netherlands and Belgium featuring prominently in several blister-related HS lines.

- United States: exports specialty pharmaceutical blistering materials, high-barrier films and some converted packs (especially for regulated drug exports). U.S. firms are visible among the top suppliers in HS trade dashboards for blister-pack proxies.

Top importers/demand centres

- Germany, UK, Italy, and other EU markets: great pharmaceutical manufacturing and packaging demand; EU import data for blister-related HS codes show these countries among the top buyers.

- United States: imports specialty films, converted blisters, and serialized packaging lines, particularly for pharma and OTC markets.

- Fast-growth markets in APAC & Latin America (India, Mexico, Brazil, Southeast Asia) import both raw sheets and converted blisters to feed expanding pharmaceutical and FMCG production. National market reports highlight India as a growing importer and domestic market for blister conversion.

Key Trade Flows & Transaction Patterns

- Rolls (sheet/film): Local converters: Many markets import rollstock and perform local thermoforming & lidding to meet local regulations and reduce freight of bulky finished packs.

- Finished converted blisters: Pharma contract-packers or OEM supply chains: High-value, small-batch blister formats (child-resistant, cold-form alu-alu blisters) are often imported into regulated markets as finished packs.

- Re-export hubs: The Netherlands / Belgium act as consolidation points for European distribution; Asian OEM hubs (Vietnam, China) supply consumer-goods blister volumes globally. COMTRADE HS-6 flow tables show multi-directional trade consistent with these patterns.

Drivers Shaping Export/Import Decisions

- Pharmaceutical demand (unit-dose protection, serialization, tamper-evidence): Pharma remains the single biggest end-user, driving demand for pharmaceutical-grade blister materials and regulated converting services.

- Cost & packaging labour economics: Buyers balance importing low-cost converted blisters (from Asia) versus importing rollstock and forming locally to avoid freight and to meet local labelling/serialization needs.

- Sustainability & regulation: New regulations (EU Packaging & Packaging Waste Regulation (PPWR) and national EPR schemes) are changing material choice (moving away from PVC to recyclable mono-materials) and creating economic incentives to source recyclable or recycled-content packaging.

- Safety & child-resistance requirements: US Poison Prevention Packaging Act (PPPA) / CPSC and FDA guidance impose child-resistant or tamper-evident requirements that affect blister design and, in turn, the set of eligible exporters.

Regulatory & Quality Constraints Affecting Trade

- Food/drug-contact certifications and COAs for migration, extractables, and leachables are commonly required for pharma blisters; failure to provide these documents can delay customs clearance. Pharma converters usually insist on certified film suppliers and documented lot traceability.

- Child-resistant / tamper-evident testing and adult-use ergonomics (PPPA/16 CFR rules in the U.S.) affect which blister designs are acceptable in markets such as the U.S. and Canada.

- Extended Producer Responsibility (EPR) & recycled-content requirements (EU PPWR, national EPR schemes in India/US states) are increasing compliance costs and shifting sourcing toward suppliers who can document recycled content and take back/charge fees.

Top Countries Importing Plastic Blister Packs

- Vietnam: It is the top exporter of Blister Packaging with 31,225 shipments in the world.

- China: It stands in second position as the Blister Packaging exporter with 8,251 shipments in the world.

- United States: It stands in the third position as an exporter of Blister Packaging with 576 shipments in the world.

Plastic Blister Packs Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are polyvinylidene chloride (PVDC), cyclic olefin polymers (COP), and polyester (PET).

- Key Players: Technoform Packaging, Vinayaka Poly Products

Component Manufacturing

The component manufacturing in this market comprises forming film, lidding, printing, and heat-seal coating.

- Key Players: Winkel Packaging, Amcor

Logistics and Distribution

This segment is growing focus on direct sales to end-user industries and specialized transport.

- Key Players: Berry Global Group, Inc., Amcor Plc.

Material Type Insights

Why Did the Carded Blister Packs (Blister + Card) Segment Dominate the Plastic Blister Packs Market in 2024?

The carded blister packs (blister + card) segment dominated the market with the highest share in 2024, driven by its branding opportunities, suitability, and cost-effectiveness. This type of packaging is favoured for its ability to shield goods, clearly display branding, and improve shelf management, which has led to its robust market presence in sectors such as pharmaceuticals and consumer goods. This packaging arrangement is an inexpensive option for producers, with broad applicability across many product types. The cardboard back offers ample space for printing branding, supervisory information, and marketing messages, making it effective for customer engagement. Carded blister packs (blister + card) can be arranged in several sizes and shapes to accommodate various goods, from small pharmaceutical to electronics products.

The strip/cavity blister pack segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to better protection and ecological factors. These are mainly for smaller products; cavity packs are highly popular for their ability to provide better protection against environmental factors such as light and moisture, which is important for enhancing shelf life and ensuring patient safety. These are used for single-dose capsules, tablets, and suppositories, offering a protective, tamper-resistant, and often child-resistant container.

The wallet blister packs are the fastest-growing in the plastic blister packs market, as they offer convenience and portability. An increasing demand for patient-safety packaging, which wallet blister packs offer by being tamper-resistant and protecting against contamination. The design emphasizes the portability and convenience of use for over-the-counter supplements and drugs. This segment is observing progress in technology, with new biodegradable resources and incorporated processes being developed. The increase in specialty drugs and biologics, which require high-perceptibility and tamper-proof packaging, is influencing development.

End-Use / Industry Insights

Why Did the Pharmaceuticals & Healthcare Segment Dominate the Plastic Blister Packs Market in 2024?

The pharmaceuticals & healthcare segment dominated the market in 2024, with the highest share, driven by tamper-evident, safe, and hygienic packaging. These packs protect medications from environmental factors such as oxygen and moisture, helping maintain their efficiency and shelf life. The pre-portioned properties of blister packs help ensure precise dosing and can enhance patient adherence to handling plans. These packages are a cost-effective option for huge-volume goods, making them a prevalent choice for several pharmaceutical industries. The pharmaceutical sector needs packaging that meets stringent regulatory requirements. These packs are designed to be chemically compliant and inert with these requirements.

The consumer electronics & household goods segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. This segment is growing due to tamper-evident, visibility, and product protection. These packs and clamshells are widely used for a range of electronic products, including smaller gadgets, headphones, and cables. The segment is influenced by the need for durable, tamper-proof packaging to protect fragile or high-value products during transportation and storage, particularly with the growth of the e-commerce sector. These packages also provide excellent product visibility, which improves customer appeal in the retail sector.

The food & beverages (portion packs, snacks, etc) are the fastest-growing in the plastic blister packs market, as they comprise hygienic, convenient, and portion-controlled products. Busy customer lifestyles enhance the demand for one-time serve, easy-to-manage snacks & portion-controlled food products, which plastic blister packs enable. These packs provide superior barrier protection against oxygen, moisture, and pollution, enhancing shelf life and confirming food security. Plastic blister packs are a cost-effective alternative to other arrangements, requiring fewer materials and freeing up shelf space.

Regional Insights

How is Asia-Pacific Dominating the Plastic Blister Packs Market?

Asia-Pacific held the largest share of the plastic blister packs market in 2024, driven by strong manufacturing capacity. Major factors include rising healthcare needs, the expansion of e-commerce, and demand for cost-effective, robust, and versatile packaging options, particularly from countries such as Japan, China, South Korea, and India. The noteworthy growth of the e-commerce sector in the region underscores the need for safe, effective packaging that withstands transit. These packs are cost-effective, versatile, and lightweight compared to other packing types, making them an ideal option across several industries.

Why are Plastic Blister Packs Dominating in China?

The huge manufacturing base and the growing e-commerce sector have driven demand for plastic blister packs in China. The growing e-commerce industry and strong regulatory support for product security, particularly in the pharmaceutical sector, also drive demand for plastic blister packs, which offer a user-friendly, tamper-evident solution. The focus on product safety and integrity in China's packaging laws, particularly in the food and pharmaceutical sectors, makes plastic blister packs a favored option, given their tamper-evident features that help confirm compliance.

Why Plastic Blister Packs Market Growing Rapidly in North America?

The expansion of the pharmaceutical sector has raised the demand for plastic blister packs. The robust development is also influenced by the region's progressive healthcare organizations, which drive demand for tamper-evident packaging that confirms patient safety and dose accuracy. Severe guidelines in the region require safe, tamper-evident packaging to verify drug authenticity and patient safety, further driving demand for plastic blister packs. Industries are capitalizing in advanced and sustainable packing solutions, comprising environment-friendly resources and high-tech structures like series for anti-fabricating. Advances in resource science and robotic engineering procedures are also contributing to market development.

Why Plastic Blister Packs Market Expanding in the U.S.?

Continuous changes in consumer habits have accelerated development in the U.S. plastic blister packs market. There is a growing shift from blister packs to bottles for solid oral medications, driven by suitability and enhanced patient adherence. The extension of the customer products and electronics industry in the U.S. is driving the demand for plastic blister packs to protect goods and display them efficiently on retail shelves. Strict guidelines in the pharmaceutical sector drive the use of plastic blister packs that offer features such as extended shelf life and single-dose safety.

Which Factor is Responsible for the Notable Growth of the Plastic Blister Packs Market in Europe?

The major factors influencing the growth of plastic blister packs market are improved product protection, security and tamper-evidence, single-dose format, versatility, and cost-effectiveness. Plastic blister packs offer excellent protection against exterior factors such as contamination, moisture, oxygen, and light, which is important for preserving the efficiency and shelf life of sensitive medicines. Plastic blister packs are a cost-effective option compared to some substitute formats, providing versatility in pattern and attractive goods visibility for retail presentation. The integration of automation, digital technologies, and advanced thermoforming capabilities into engineering processes is improving efficiency, quality control, and the overall appeal of plastic blister packs.

Why Is Germany Using These Packs So Extensively?

The rising demand for durable, shelf-appealing, and cost-effective packs has fuelled growth in the plastic blister pack market. These packs are increasingly used in e-commerce due to their durability and resistance to spills and breakage, which are important for transportation. They are frequently less costly than substitutes such as hard bottles and the use of some resources, which makes them inexpensive. These packaging options offer an excellent demonstration for retail, with choices for hang-hook displays and modified branding to stand out on shelves.

Top Companies in the Plastic Blister Packs Market

- Amcor plc: It is a worldwide leader in developing and producing responsible packaging for consumer, medical, and industrial products.

- Klöckner Pentaplast: It is known for its rigid and flexible films, used for a variety of applications, including blister packaging.

- Constantia Flexibles: It provides flexible packaging solutions for the food, pet food, pharmaceutical, and medical industries.

- WestRock Company: It provides flexible packaging solutions for the food, pet food, pharmaceutical, and medical industries.

- Sonoco Products Company: It is a global provider of industrial and consumer packaging products and services.

- Others: Honeywell International Inc., TekniPlex, Inc., Blisterpak, Inc., Blissteck, Ecobliss Group

Recent Developments

- In November 2024, Bayer announced the launch of polyethylene terephthalate (PET) blister packing in its healthcare industry, Aleve, profession it a first-of-its-kind product in the healthcare sector. It focuses on swapping all its blister packaging for more sustainable alternatives.

- In October 2024, Liveo Research and Bayer have grown a ‘first-of-its-kind’ PET blister pack for its over-the-counter Aleve drug brand and report a 38% decrease in carbon footprint over its removal of PVC.

Plastic Blister Packs Market Segments

By Product / Format

- Carded blister packs (blister + card)- Dominated

- Clamshell blister packs

- Strip / cavity blister packs- Fastest

- Wallet blister packs

- Multi-cavity blister packs

By End-Use / Industry

- Pharmaceuticals & healthcare- Dominated

- Food & beverages (portion packs, snacks, etc)

- Consumer electronics & household goods - Fastest

- Industrial / automotive / other specialty uses

- Personal care / cosmetics

By Geography / Region

- North America- Fastest

- Europe

- Asia-Pacific- Dominated

- Latin America

- Middle East & Africa