Clear Plastic Film Market Outlook Scenario Planning & Strategic Insights for 2034

The global clear plastic film market is set for substantial growth, with forecasts projecting revenue expansion into the hundreds of millions between 2025 and 2034. As companies shift towards eco-friendly and high-barrier packaging materials, clear plastic films are playing a crucial role in enhancing product safety, shelf life, and supply chain efficiency, ultimately supporting the development of sustainable infrastructure worldwide.

Estimated by dividing the total market value (USD) for clear plastic film by an average global selling price per kg (approx. $1.5 - $2.0/kg based on supplier listings) and converting to tonnes.

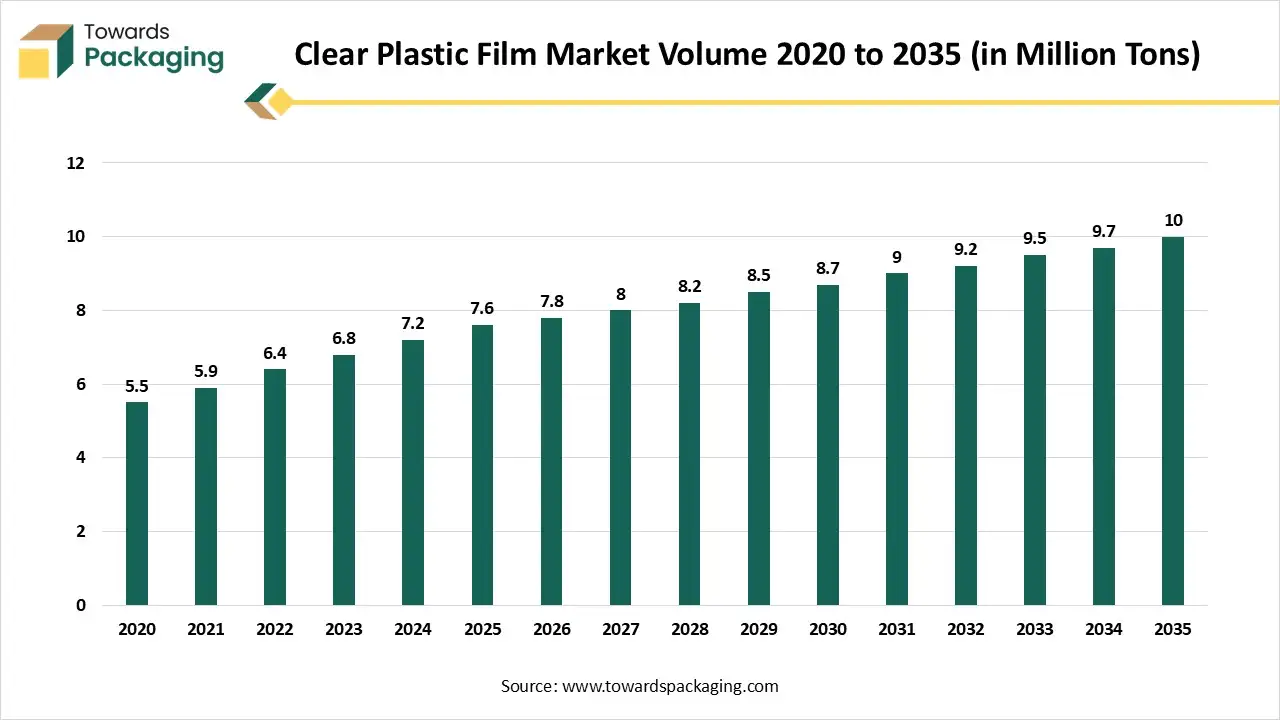

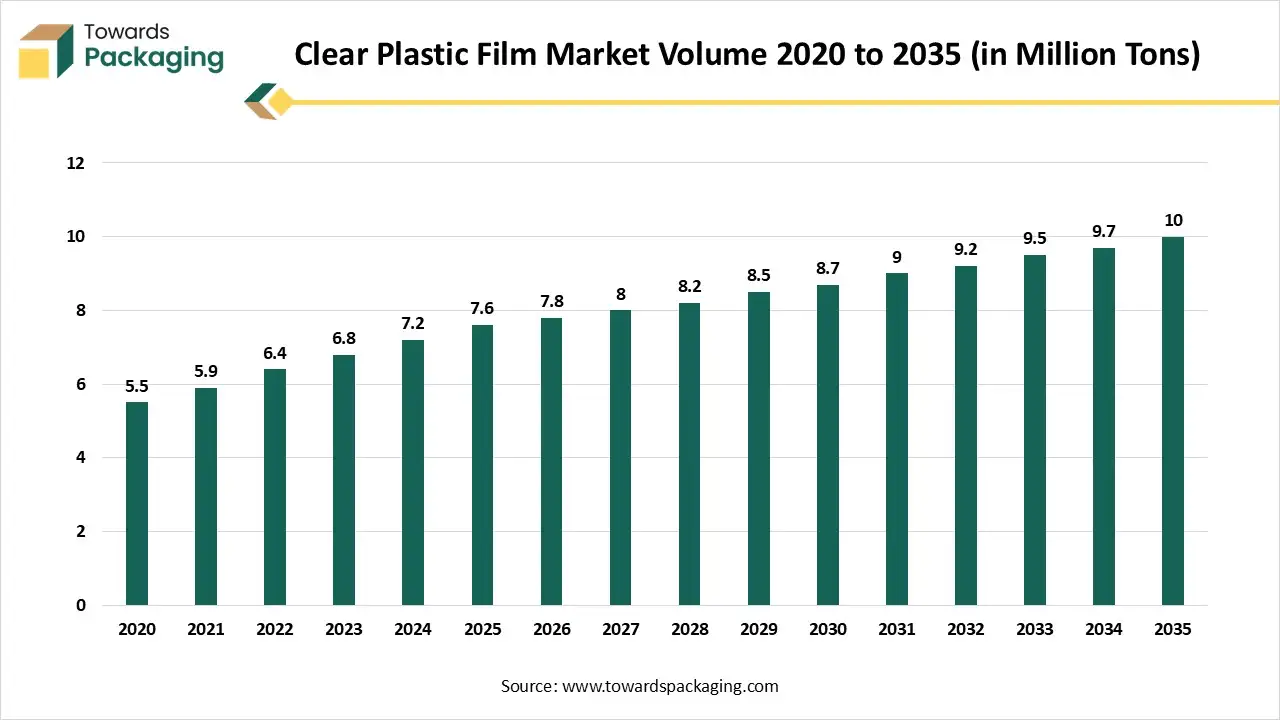

- Clear plastic film volume is projected to grow from 5.5 million tons in 2020 to 10.0 million tons by 2035, driven by packaging demand.

- Steady increase in film usage driven by packaging demand.

- CAGR applied 2.7%.

The clear plastic film market is anticipated to grow at a substantial rate during the forecast period. Plastic film is available in a range of shades, textures, and transparency levels. Transparent or opaque film is needed for many applications, but clear plastic film is specifically useful for many uses. Clear plastic film usually provides a distinctive finish or protective layer that doesn't physically hamper the material underlying. Clear film is available in a wide variety of alternatives to suit different organizational requirements, aesthetic preferences, and strength as well as durability levels. It is frequently utilized to provide defense against chemicals, impact, and wear and moisture exposure because of its optical clarity. Additionally, clear plastic film is widely used in the packaging sector.

The rising demand for flexible and transparent packaging in industries like food and beverages, cosmetics and pharmaceuticals coupled with the technological advancements in the film production such as multi-layer co-extrusion and bi-axially oriented films is expected to augment the growth of the clear plastic film market during the forecast period. Furthermore, the surge in the e-commerce coupled with the growing healthcare sector is also anticipated to augment the growth of the market. Additionally, the increased consumer preference for transparency, convenience foods and ready-to-eat meals as well as the rising disposable incomes and urbanization and adoption of the bio-based polymers and green manufacturing practices is also projected to contribute to the growth of the market in the near future.

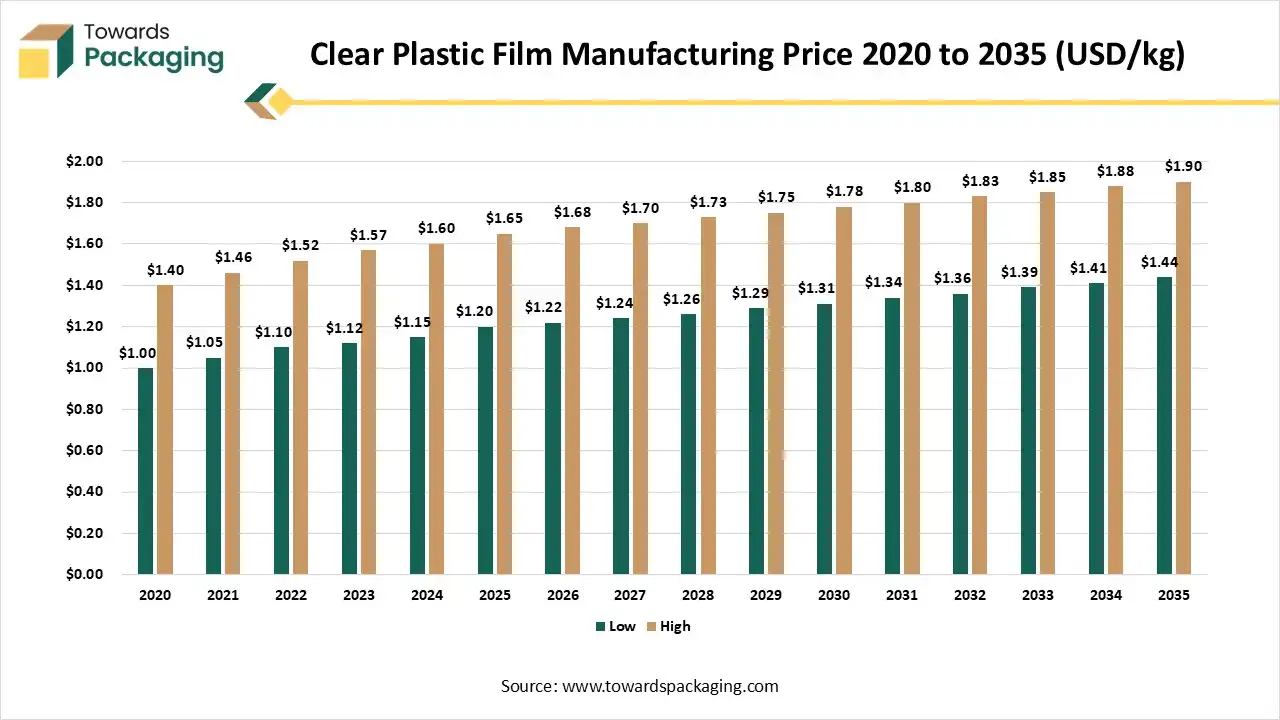

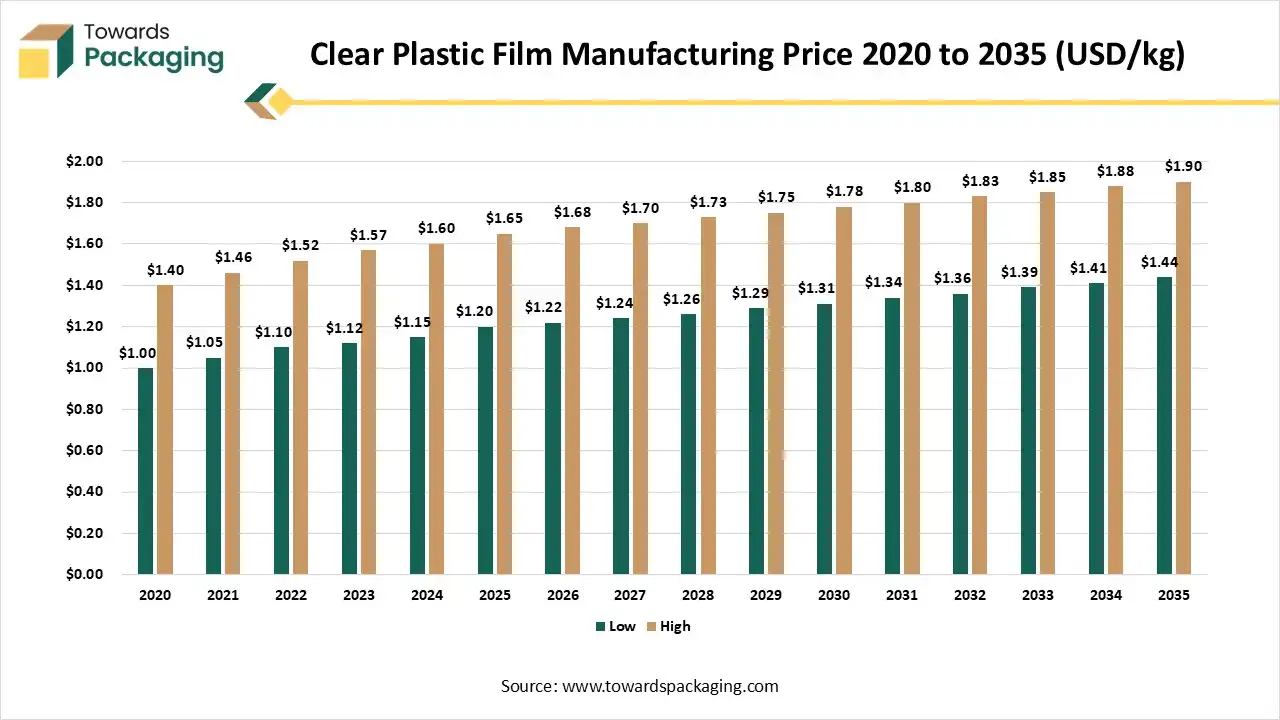

Clear Plastic Film Manufacturing Price 2020 to 2035 (USD/kg)

The manufacturing price range represents the likely cost per kg for producers to make clear plastic film (e.g., raw resin, processing, labor, overhead).

- Supplier average spot prices US$1.25 - 1.90/kg seen in global offers on Alibaba and trade listings.

- Forecast assumes moderately rising production costs (materials, energy, labor).

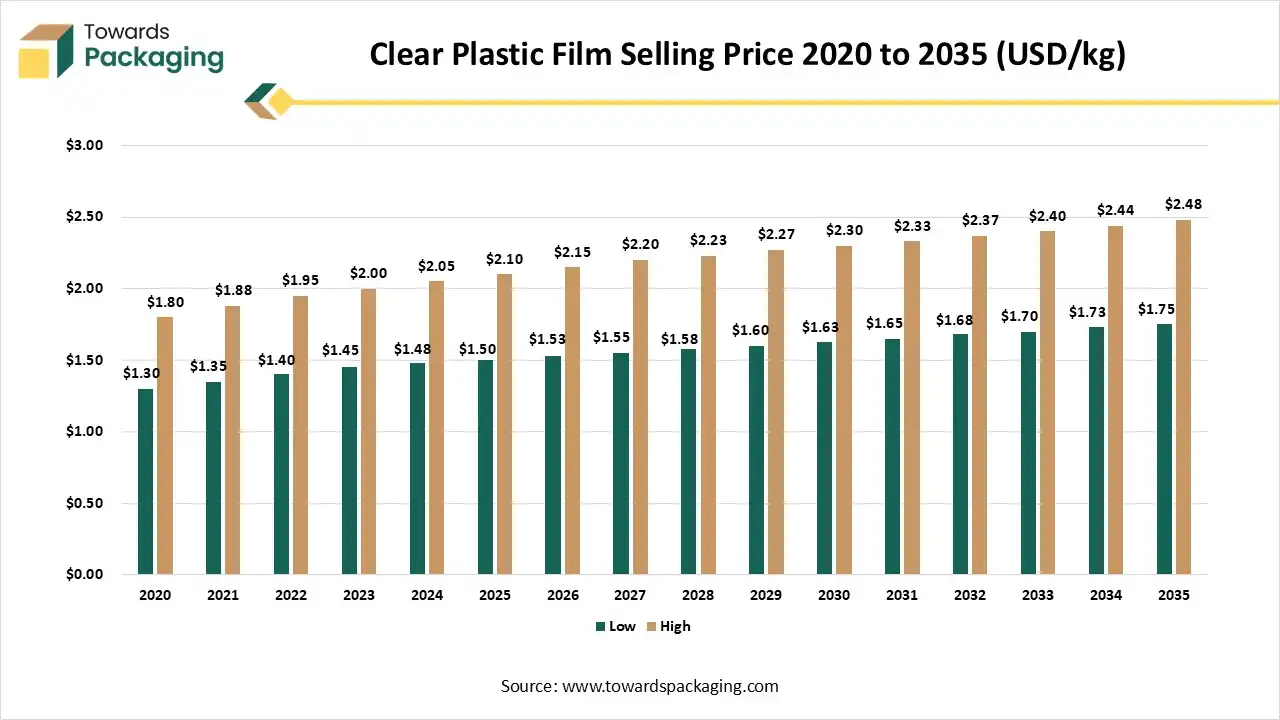

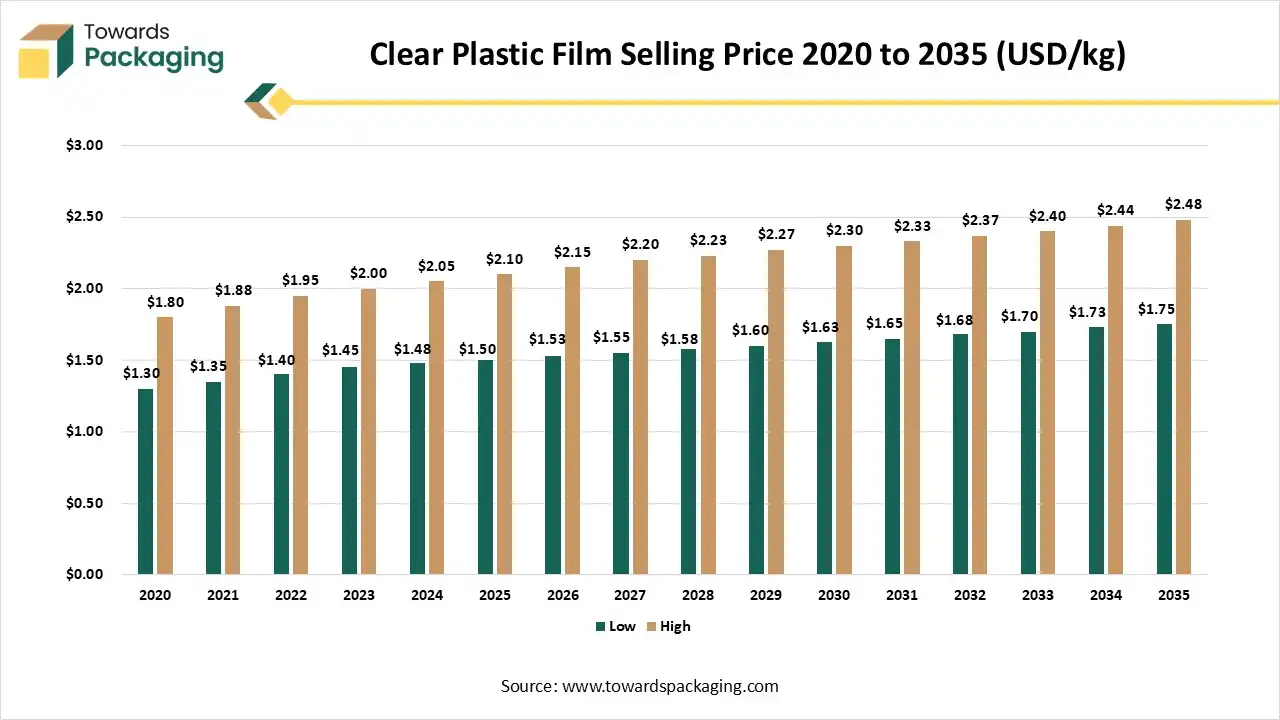

Clear Plastic Film Manufacturing Selling Price 2020 to 2035 (USD/kg)

- Addresses typical list prices and market quotations from transparent film producers and exchangable product pricing ($1.2 - $5/kg for various clear films) seen in online marketplaces.

- Selling often higher than manufacturing by about 15%‑25% to account for margin, distribution, and quality grades.

Key Takeaways

- Steady Volume Growth: Clear plastic film volume is projected to grow from 5.5 million tons in 2020 to 10.0 million tons by 2035, driven by packaging demand.

- Moderate Manufacturing Price Increase: Manufacturing prices are expected to rise at a 2.5% CAGR, from $1.00 - $1.40/kg in 2020 to $1.44 - $1.90/kg in 2035.

- Consistent Selling Price Growth: Selling prices will increase at 2.6% CAGR, moving from $1.30–$1.80/kg in 2020 to $1.75 - $2.48/kg by 2035."

Key Trends and Findings

- Future packaging design and text will continue to draw attention to transparency and clarity on food ingredients and the incorporation of transparent or see-through materials will increase. Clear packaging that eliminates uncertainty about what's inside will become a trend as organizations respond to consumer demands for transparency about their operations and manufacturing processes. Therefore, it should come as no surprise that studies reveal that customers prefer transparent packaging to opaque packaging when given the option.

- The industry of packaging is experiencing revolution as a result of Industry 4.0, as producers look to benefit from new developments through modern automation. Manufacturing processes are being transformed by machine learning, cloud computing, big data as well as machine vision. The shift to Industry 4.0 gives the chance to digitize procedures that can increase the output, eliminate waste, elevate product quality, increase industrial flexibility and save operating expenses. There is also a chance to solve persistent labor scarcity issues through bringing a digitalization strategy into action.

- Virtualism is another trend that is becoming popular. It is likely to improve the consumer experience by seamlessly merging physical products with digital interactivity. Augmented reality (AR) features integrated into the packaging that is clear can provide interactive product information or behind-the-scenes content, enriching the decision-making process. Virtualism also helps consumers to visualize products in their intended use environments via VR, guaranteeing better alignment with the personal preferences before purchase.

- A QR code can unlock anything. When iPhones were able to scan QR codes during the pandemic, their utilization became widespread; today, QR codes are found in everything. Additionally, organizations can utilize QR codes to affix them to the rear of packaging, giving customers access to their world, involving social media networks and information on how to make use of the product efficiently.

- North America held substantial market share in 2024. This is due to the advanced packaging solutions in the industries such as food and beverage, healthcare, and electronics as well as the adoption of recyclable and biodegradable films.

- Asia-Pacific is expected to grow at a fastest CAGR due to the rapid industrialization, urbanization, and increasing demand for flexible packaging in food, pharmaceuticals, and personal care sectors.

2024 EBITDA % Clear Plastic Film Suppliers

| Rank |

Supplier (HQ) |

FY period used |

2024 EBITDA % |

| 1 |

SRF Ltd. (India) |

FY2023–24 (year ended Mar 31, 2024) |

~21.0% |

| 2 |

Berry Global (USA) |

FY2024 (year ended Sep 28, 2024) |

~16.6% |

| 3 |

Amcor (Switzerland/Australia) |

FY2024 (year ended Jun 30, 2024) |

~13.3% |

| 4 |

Polyplex Corporation (India/Global) |

FY2023–24 (year ended Mar 31, 2024) |

~6.75% |

| 5 |

UFlex (India/Global) |

FY2023–24 (year ended Mar 31, 2024) |

~4.81% |

- SRF (~21.0%) – Strongest performer among peers. Its packaging films business benefited from stable demand and product diversification, while chemical intermediates added resilience, supporting high consolidated margins.

- Berry Global (~16.6%) – Solid EBITDA margin driven by disciplined cost control and product mix improvements in consumer packaging and flexible films, despite a softer volume environment in North America and Europe.

- Amcor (~13.3%) – Maintained double-digit margins through efficiency programs and steady demand in healthcare and food packaging. Scale advantages and global reach cushioned the impact of raw material volatility.

- Polyplex (~6.75%) – Margins weakened due to global BOPET film oversupply and price pressures. However, strategic global presence and backward integration in resin supported positive though compressed profitability.

- UFlex (~4.81%) – Lowest among leading peers, reflecting heavy pricing pressure in commodity film segments during FY2024. The company has begun shifting toward specialty films and value-added packaging solutions to restore profitability.

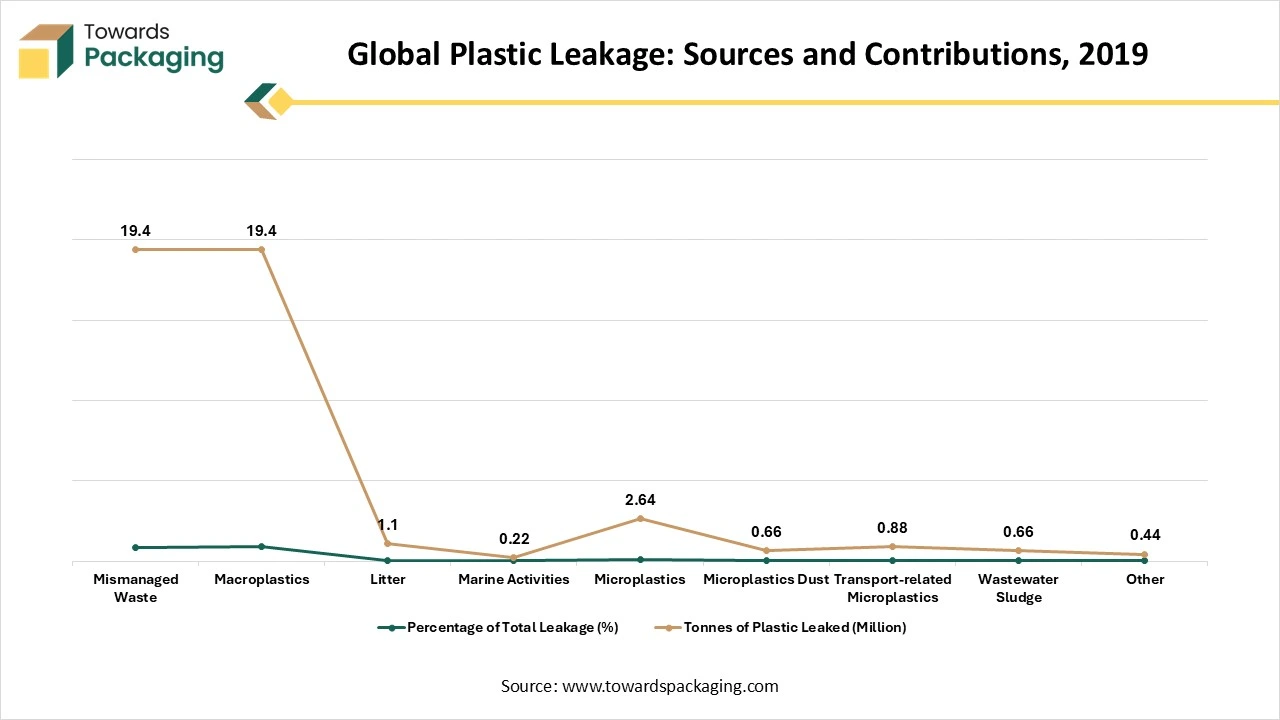

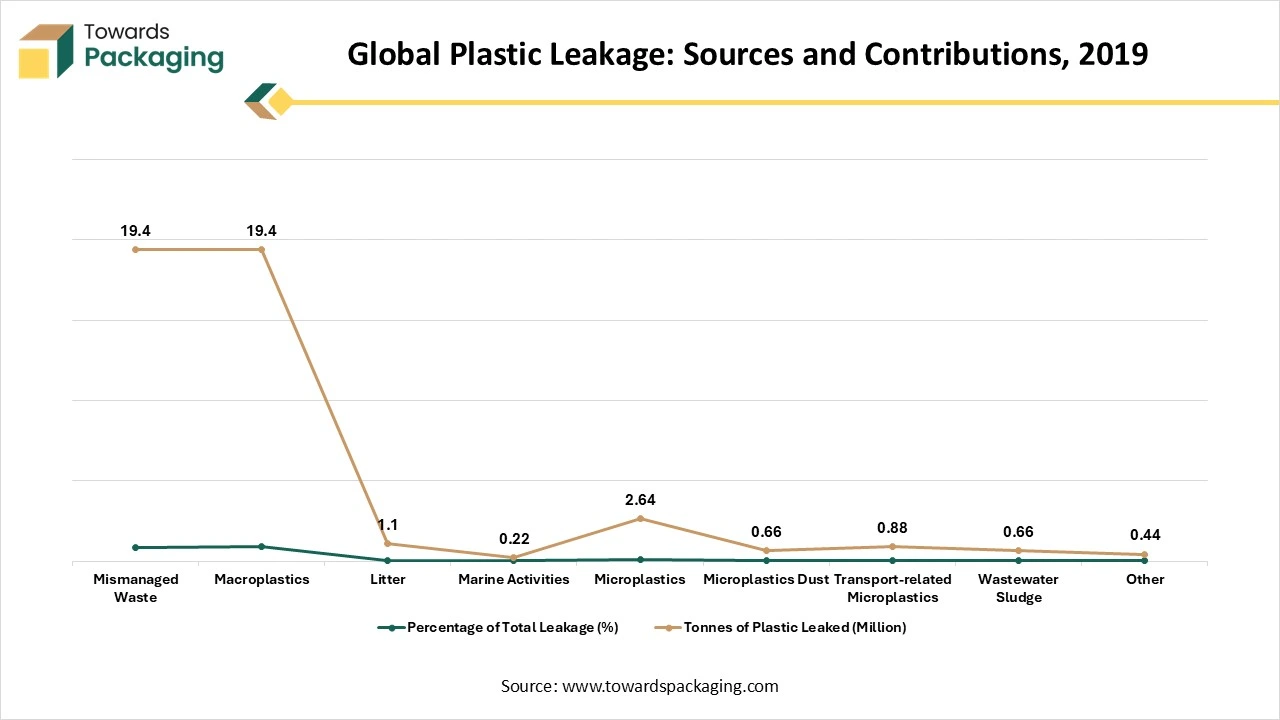

Global Plastic Leakage: Sources and Contributions, 2019

In 2019, approximately 22 million tonnes of plastics leaked into the environment, a significant portion of which was due to mismanaged waste. The majority of this leakage (82%) resulted from inadequate waste collection and disposal practices, contributing largely to macroplastic pollution (19.4 million tonnes). Other major sources of leakage included littering (5%), marine activities (1%), and microplastics (12%). Microplastics are primarily generated through the wear of tyres, road markings, and the washing of synthetic textiles, further compounding the global plastic pollution issue. The urgency of addressing these waste management and disposal practices is clear, particularly in the face of growing microplastic leakage.

Market Drivers

Growth in E-commerce

The exponential growth of the e-commerce sector is likely to augment the growth of the clear plastic film market during the estimated timeframe. This is owing to the widespread penetration of smartphones and high-speed internet, the rise of the secure digital payment platforms, the convenience of home delivery coupled with an extensive range of products as well as competitive pricing. All regions are expected to see an increase in the e-commerce penetration rates by 2029.

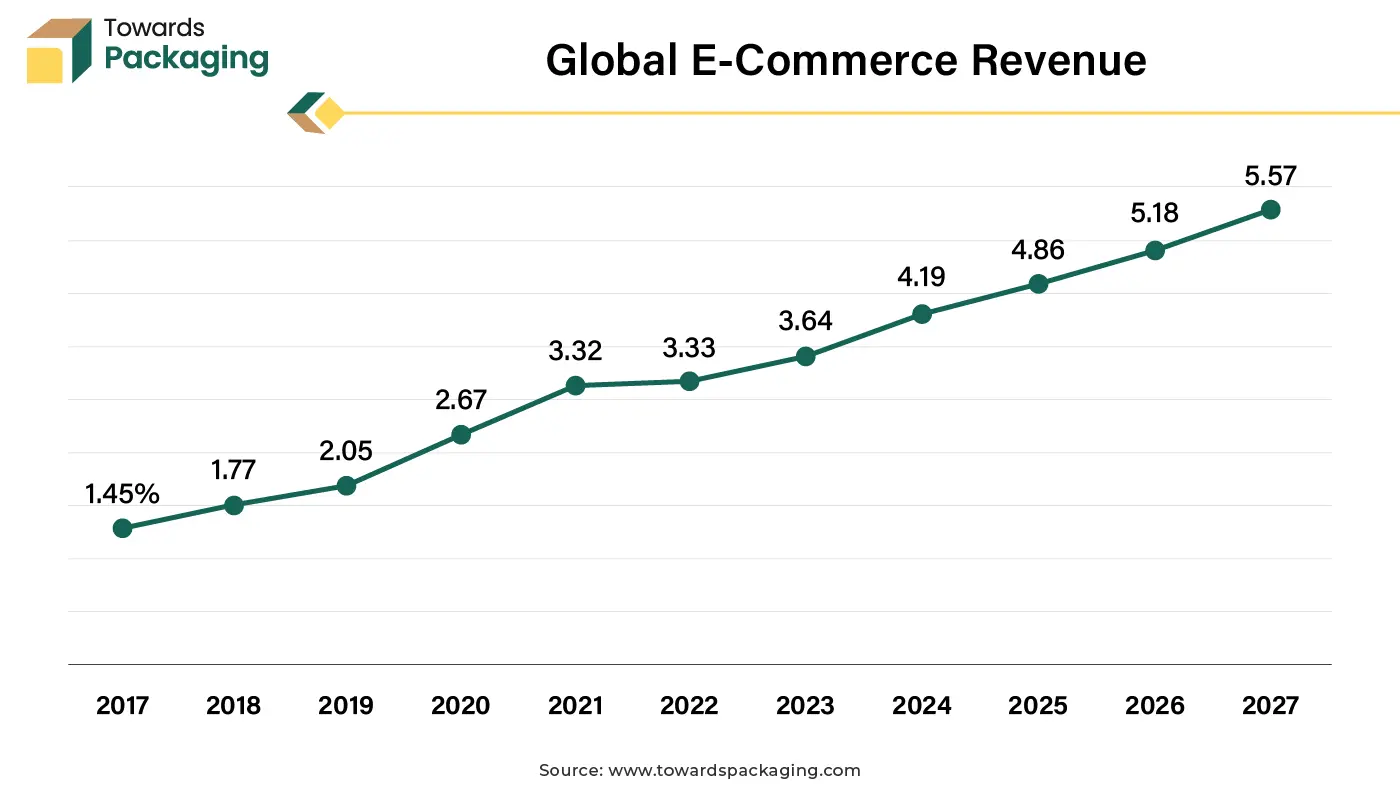

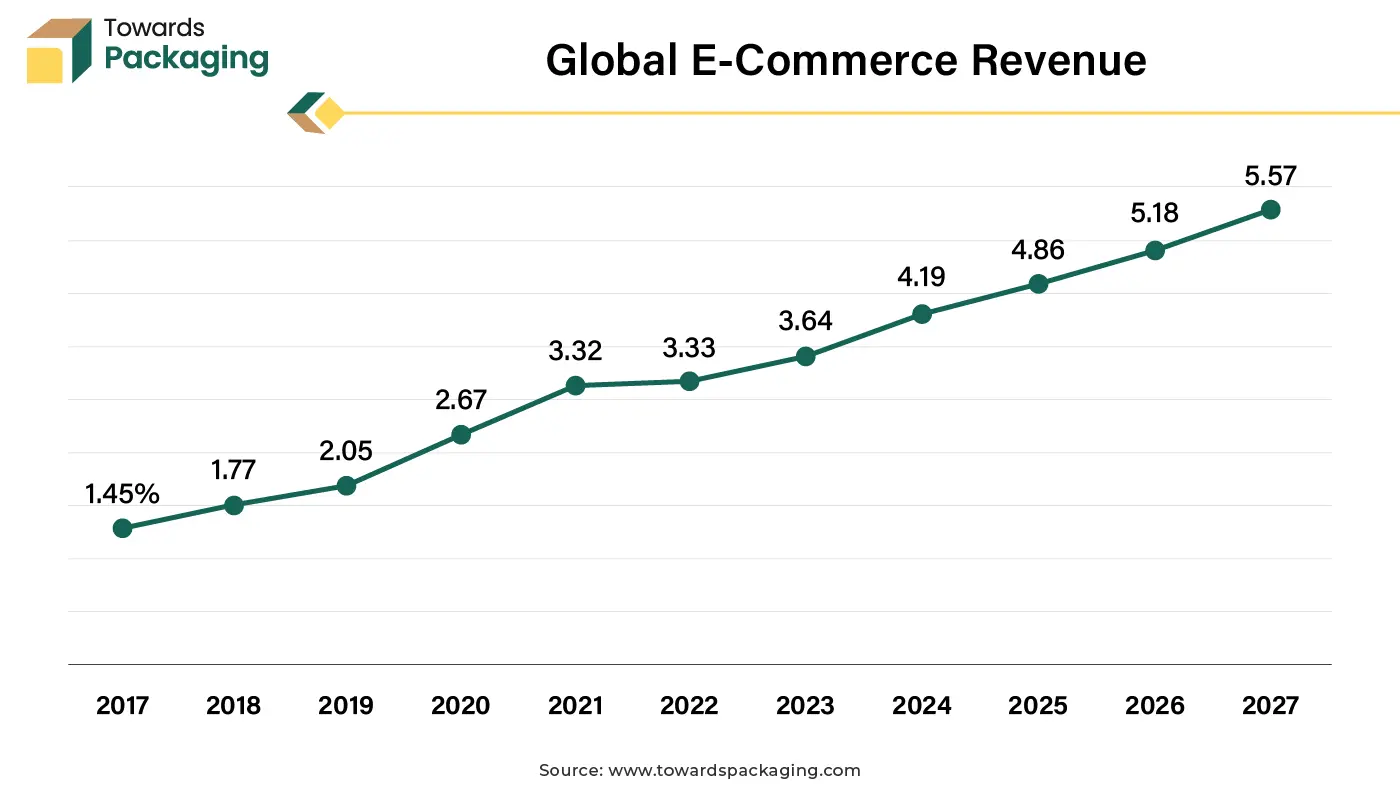

As per the International Trade Administration, U.S. Department of Commerce, by 2027, the worldwide business to consumer e-commerce market is predicted to reach USD$5.5 trillion at a consistent compound annual growth rate of 14.4%. Over the same time frame, globally retail e-commerce CAGR was projected to be 11.16 %. In 2023, the retail e-commerce market in Europe was estimated to be worth US$631.9 billion. By 2027, revenues are projected to have climbed by 9.31% annually, reaching an overall value of US$902.3 billion.

Furthermore, there has been a 1,300 percent surge in traffic to retail websites as a result of consumers utilizing chatbots based on generative AI as shopping assistants to identify products or bargains rapidly, according to the data by Adobe. Despite setting records for online spending, many consumers are granting themselves more budgetary freedom. The popularity of "Buy Now, Pay Later" (BNPL) has increased to an all-time high, and customers who can take advantage of this flexible payment option preferred smartphones. As online shopping becomes the primary mode of retail, guaranteeing the secure delivery of products to consumers becomes an important responsibility. Clear plastic films provide lightweight, strong and protective packaging options customized to the specific needs of the e-commerce operations. These films protect products from external influences assuring that they reach customers in their original condition. As the online retail market evolves, clear plastic films will become increasingly important in modern logistics and packaging.

Market Restraints

Growing Awareness of Environmental Issues

The growing awareness of the environmental issues associated with the plastic waste is likely to restraint the growth of the clear plastic film market during the forecast period. Plastics are mostly derived from non-renewable fossil fuels and have long degradation periods, contributing to the pollution in landfills, oceans as well as other ecosystems. Nearly 400 million tonnes of the plastic waste is produced annually worldwide in response to demand due to the irresponsible use and consumption of plastic, with 60% of this waste ending up in landfills or the environment.

According to a US congressional report from 2021, the US is the largest source of plastic pollution in the world. The nation produces over 42 million metric tons of plastic waste annually and is already one of the leading emitters of greenhouse gases in the world. Currently, the production of the plastic in the US contributes 232 million metric tons of atmospheric greenhouse gases annually, or 116.5 gigawatts of greenhouse gas emissions from coal plants.

Furthermore, governments are implementing regulations on single-use plastics and non-recyclable materials to reduce the environmental damage. Policies such as plastic bans, tariffs as well as extended producer responsibility (EPR) initiatives are prompting companies to reconsider their material selection and manufacturing practices. For instance, in an effort to preserve its natural resources, Thailand has prohibited single-use plastics in 155 national parks since 2019. It is not permitted to bring as well as use single-use plastic or foam containers such as plastic bags that are less than 36 microns thick, cups, food containers, straws or utensils. While these policies seek to minimize the environmental effect, they also limit the growth of the clear plastic film industry through increasing the costs and constraining material possibilities.

Market Opportunities

Next-Generation Recycling Facilities for a Sustainable Future

The establishment of the next-generation recycling facilities due to the growing focus on sustainability and circular economy is expected to create substantial growth opportunity for the clear plastic film market in the near future. These advanced facilities incorporate modern technologies supporting the efficient recycling of the complex plastic waste streams. For instance:

- In September 2024, Indorama Ventures Public Company Limited and Varun Beverages Limited announced a collaboration to build a number of advanced greenfield PET recycling facilities in India. This strategic partnership demonstrates the firms' shared commitment to sustainability and represents a major step towards satisfying India's growing need for recycled content. One facility is located in Kathua, which is part of the Indian Union's Jammu Division, and the other is located in Khurdha, which is part of the State of Odisha. The goal is for all of the plants together to have an annual capacity of 100 kilotons of recycled PET (rPET).

- In February 2024, Source One Plastics reported that its plant for sorting and recycling plastic waste in Eicklingen, Germany, was inaugurated successfully. According to the company, the new facility handles post-consumer plastic waste that is hard to recycle, like flexible polyolefins and mixed plastic packaging, which would otherwise be burned. 70,000 metric tons, or roughly the amount of plastic garbage generated by 1.5 million Germans each year, may be processed at the facility.

- In June 2024, CompuCycle further processed e-scrap plastics by expanding its plastics recycling capabilities. This action aims to draw clients from a broader range of plastic end markets, especially original equipment manufacturers. To better isolate plastic waste from end-of-life devices, the business recently expanded its recycling plant in Houston by 10,000 square feet. In addition to acrylonitrile butadiene styrene, or ABS, it can now split its mixed plastic stream into streams of PP, PE, and PS.

These facilities are helping to bridge the waste-to-resources gap through processing formerly difficult-to-recycle commodities such as multi-layer films, mixed plastics and flexible packaging. Additionally, having access to the recycled materials minimizes the need for virgin plastics, reducing production costs and increasing the marketability of the clear plastic films as a sustainable packaging option in a variety of industries.

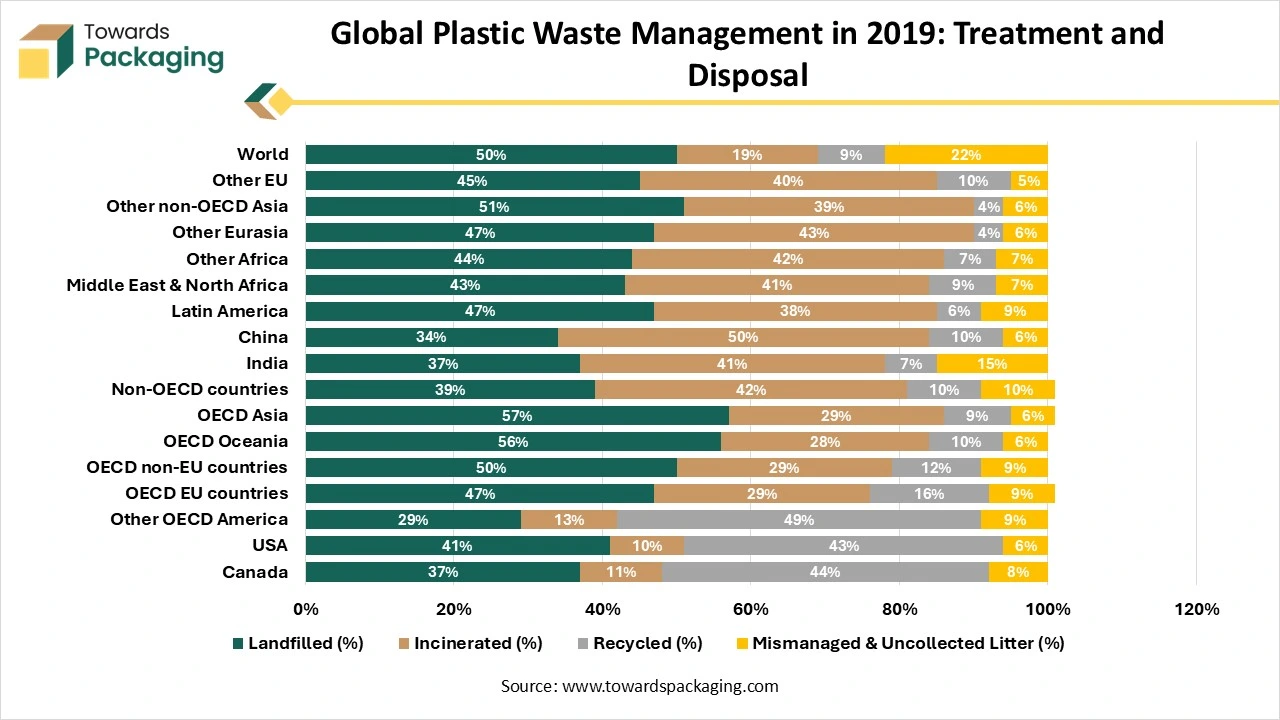

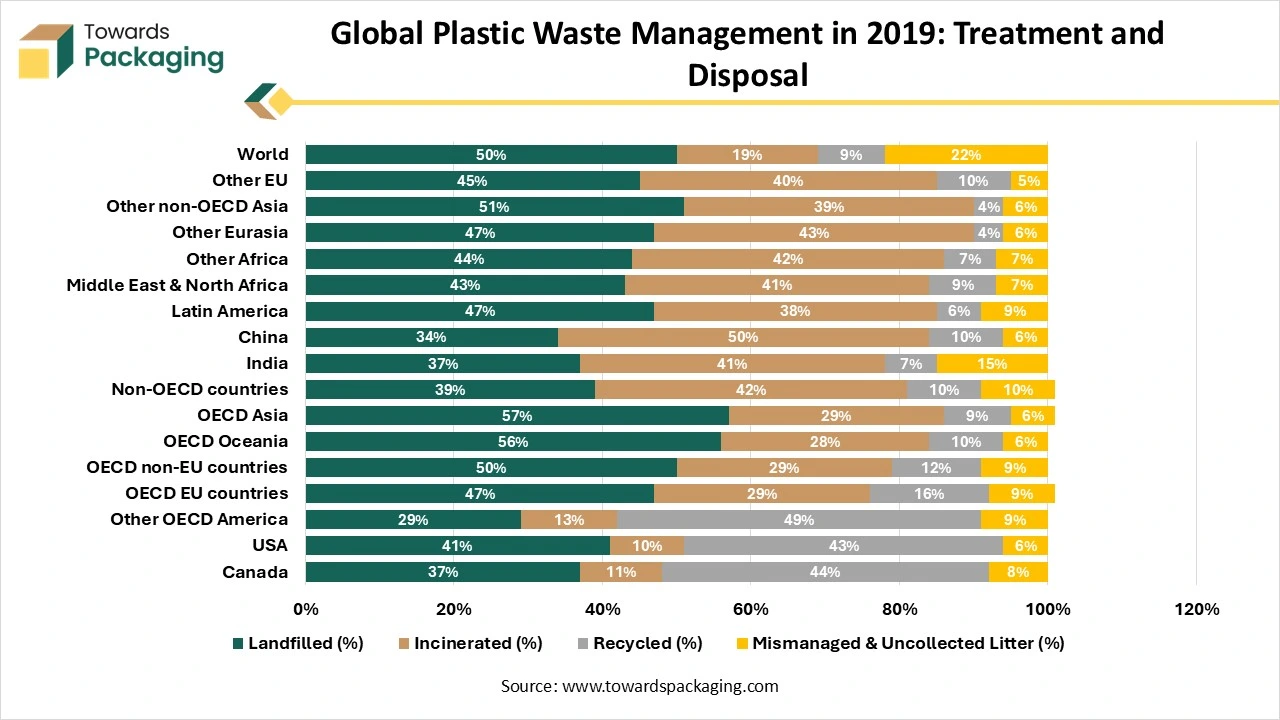

Global Plastic Waste Management in 2019: Treatment and Disposal

In 2019, global plastic waste reached 353 million tonnes, more than double the 156 million tonnes produced in 2000. A significant portion of this waste came from short-lifetime applications like packaging, consumer products, and textiles. However, only 15% (55 million tonnes) of this waste was collected for recycling, while 22 million tonnes became recycling residue, requiring additional disposal. Of the total plastic waste, 9% was recycled, 19% was incinerated, and nearly 50% was sent to sanitary landfills. Unfortunately, the remaining 22% was mismanaged, either dumped in uncontrolled sites, burned in open pits, or leaked into the environment.

Artificial Intelligence (AI) Impact on the Market

Artificial Intelligence (AI) is expected to reshape the clear plastic films market in unprecedented ways, merging cutting-edge technology with the demands of modern industries. The potential of machines to automate operations without the need for human interaction comes at a time when finding, training, and retaining personnel is difficult, machine uptime and optimization are more important than ever, and product quality and consistency are essential. AI may be implemented to decrease the waste and energy use while optimizing the production operations.

AI can further support in developing novel materials as well as compositions by identifying ideal material qualities through the analysis of the huge amounts of data and application of the simulation-based design techniques. It can help with the supply chain optimization, inventory control and forecasting demand with respect to the production planning and management. This improves the production efficiency of the process and helps in eliminating the barriers.

Furthermore, the processing of plastics continues to be influenced by artificial intelligence. The use of artificial intelligence into recycling procedures presents a viable way to address their drawbacks. AI has significantly improved the accuracy and effectiveness of the characterization phase by utilizing sophisticated machine learning (ML) techniques. For instance, 99.4% accuracy can be achieved when using the machine learning algorithm logistic regression (LR) to detect plastic waste made up of polypropylene (PP), polyethylene (PE), polystyrene (PS), polyethylene terephthalate (PET), and polyvinyl chloride (PVC).

The sorting process has been completely transformed by AI-driven technologies (such as infrared spectroscopy and optical sensors) that improve the identification as well as separation of different types of plastics, substantially decrease contamination rates and process a greater volume of plastics. This integration guarantees the industry’s adaptability to the evolving demands while unlocking unprecedented growth opportunities.

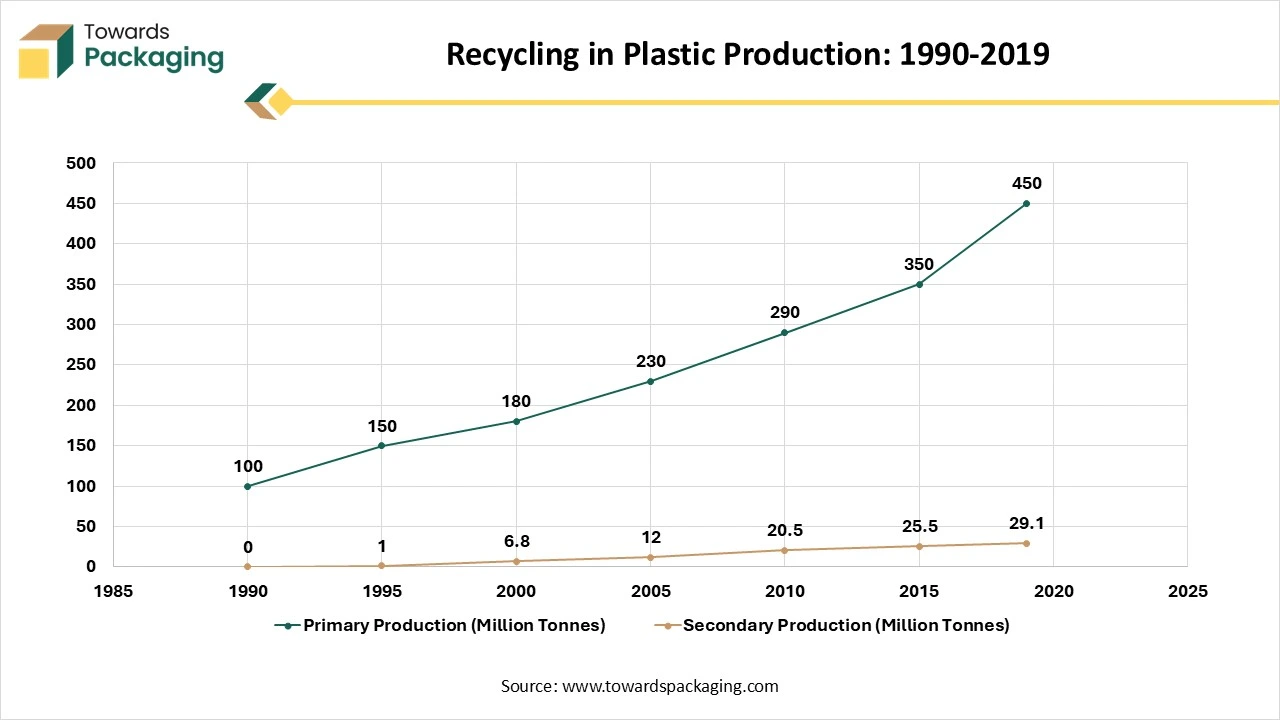

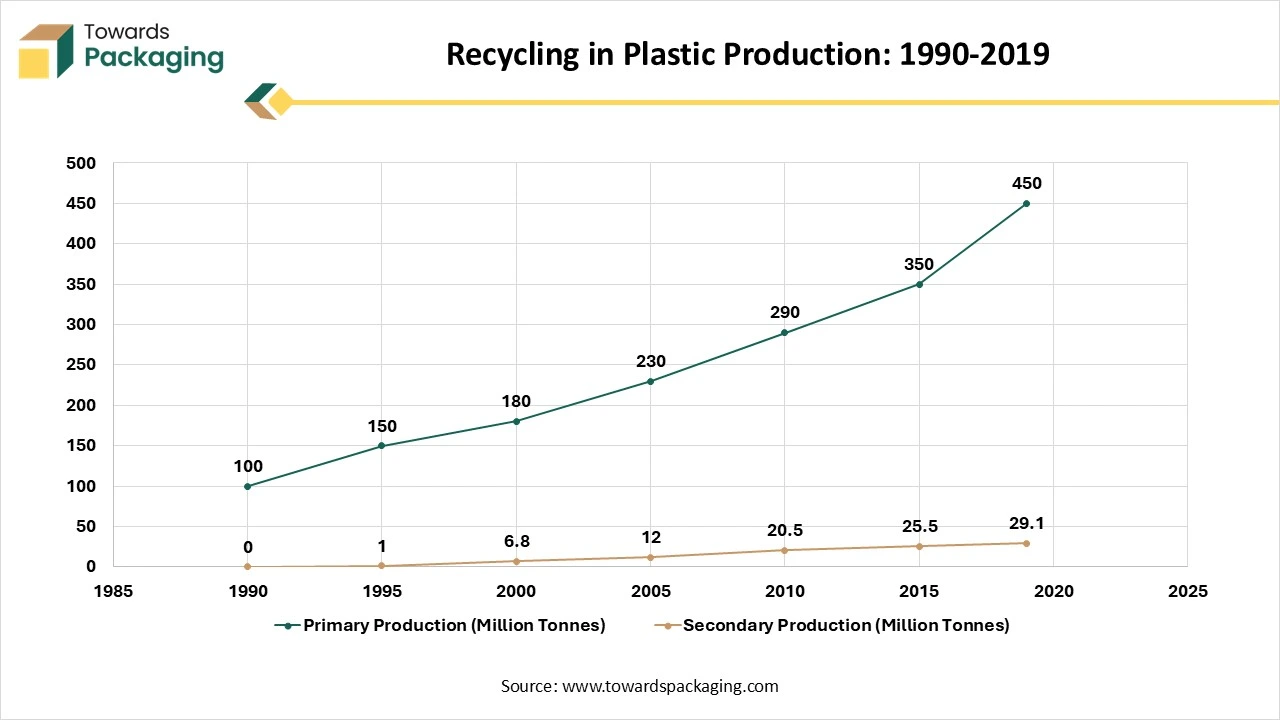

The Role of Recycling in Plastic Production: 1990-2019

Despite recycling efforts growing from 6.8 million tonnes (Mt) in 2000 to 29.1 Mt in 2019, secondary plastics only make up 6% of the overall feedstock for new plastics globally. While recycling plays a vital role in reducing environmental impact by diverting plastics from harmful waste management practices, the amount recycled is still a small fraction compared to primary plastic production.

Key Segment Analysis

Material Segment Analysis Preview

The polyethylene segment held largest share in the year 2024. Polyethylene is a versatile and frequently utilized material due to its unique combination of properties. It is appropriate for various applications due to its lightweight, flexibility, durability and great ability to resist impact, chemicals and moisture. Its transparency improves the product visibility that is important for the packaging in industries such as food, beverages, medicines and retail.

Furthermore, polyethylene is not costly and easy to manufacture, promoting large-scale production at competitive pricing. The material's versatility is further demonstrated by its various types like low-density polyethylene (LDPE) and linear low-density polyethylene (LLDPE), which provide to a number of functional requirements ranging from stretch films to the heavy-duty industrial packaging. Additionally, polyethylene has already been authorized as a food packaging material by the FDA, the international regulatory agency for the safe production as well as storage of foods and medications. The above mentioned factors are likely to support the segmental growth of the market during the forecast period.

End-Use Industry Segment Analysis Preview

The food & beverage segment held largest share in the year 2024. This is owing to the rise in the demand for packaged and processed foods across the globe. Furthermore, the growing preference for convenience and the rise of food delivery industries along with the increasing urbanization are also likely to contribute to the growth of the segment within the estimated timeframe. Additionally, the growing popularity of snacks and junk food as well as increasing percentage of ordering groceries and meals online and the accessibility to various payment options and coupled with the rise of the food franchises are further expected to support the segmental growth of the market in the near future.

Regional Insights

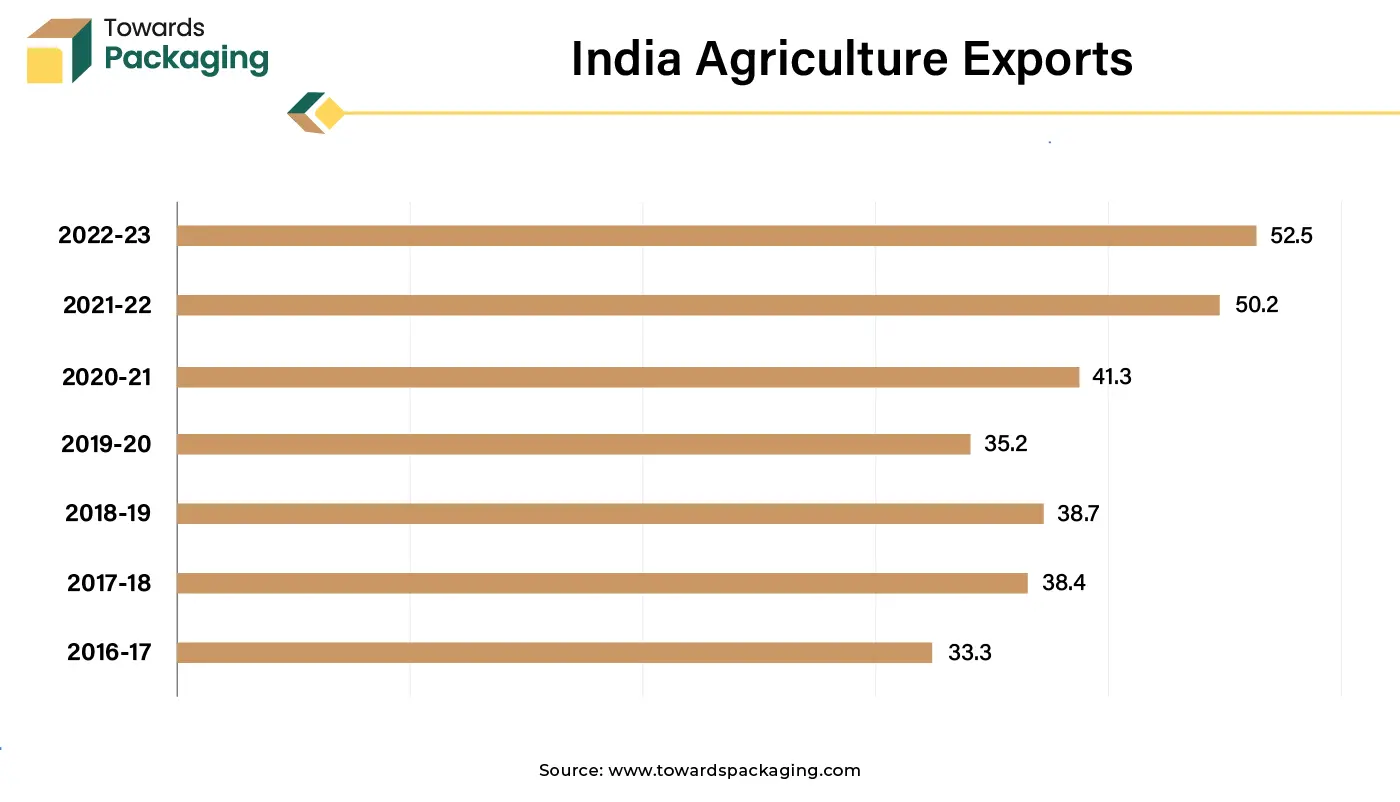

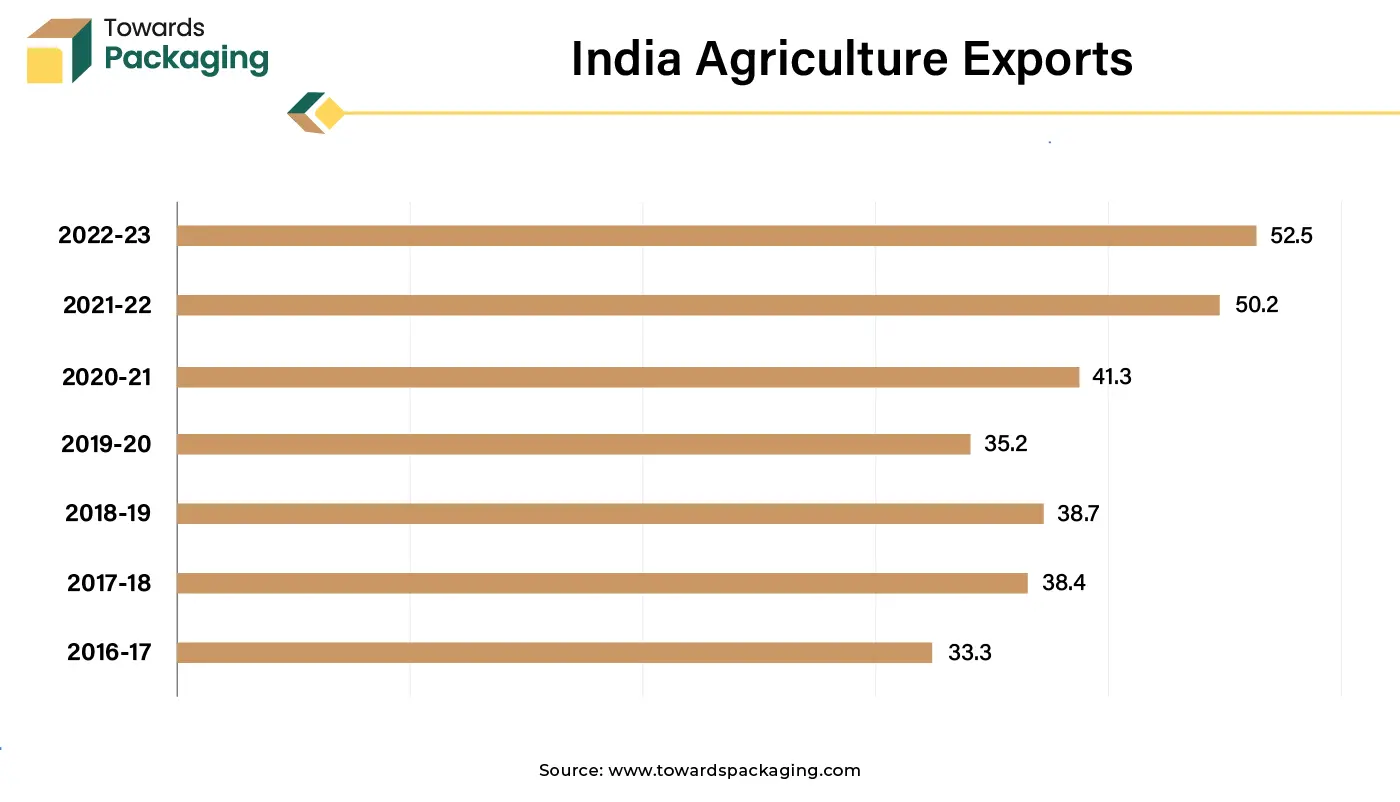

Asia Pacific is likely to grow at the fastest CAGR during the forecast period. This is due to the proliferation of local consumer goods and packaged food brands across the economies like China and India. Also, the rising agricultural sector and its export as well as the growing number of quick-service restaurants (QSRs) and meal kit delivery services is likely to contribute to the regional growth of the market.

According to the India Brand Equity Foundation data, due to shifting consumption patterns and urbanization, food consumption is predicted to reach approximately US$1.2 trillion by 2025–2026. In 2019, the processed fruit and vegetable market was estimated to be worth $15.4 billion USD. Furthermore, the increasing disposable incomes and changing consumer preferences are also expected to contribute to the regional growth of the market.

North America held substantial market share in the year 2024. This is owing to the rapid growth of e-commerce platforms and online grocery shopping across the region. The online grocery sales in the US increased by 55% to reach $96 billion in 2020 from $62 billion in 2019, as per the Food and Drug Administration (FDA). Additionally, the presence of major manufacturers and advanced production facilities as well as consumption and demand for convenience foods along with the escalating takeaway services is also expected to contribute to the regional growth of the market. Furthermore, the high purchasing power as well as higher consumption of premium packaged goods is also expected to contribute to the regional growth of the market.

Recent Developments by Key Market Players

- In March 2024, Jindal Films declared that it is creating PP and PE mono-material alternatives to assist the industry in adopting packaging that complies with the new, impending European mechanical recycling regulations. The Bicor 25 and 30 MBH568 films were introduced by Jindal Films at the CFIA exposition in Rennes, France. These are clear barrier films that combine the well-known VLTS seal technology from Jindal Films with a novel barrier coating technology to operate as single webs at rapid speeds on HFFS packaging machines.

- In April 2023, Nosco, Inc. introduced their proprietary EcoClear Film for StretchPak and other carded applications in packaging. This PVC-free film was purposefully created to satisfy big retailers' sustainability requirements while providing a clear presentation for improved product appearance. EcoClear Film, the company's first PVC substitute that conforms to global regulatory standards, was created with Nosco's Design for Environment (DfE) concept in mind.

- In January 2023, Cosmo Films launched its first BOPET line into production to create specialty PET films for window films, shrink labels, and other niche uses. Additionally, the organization revealed that a new BOPP line and a new CPP line will be put into service in FY 25 and FY 24, respectively. The most recent advancements relate to the growing need for inventive and sustainable technology.

Clear Plastic Film Market Players

Clear Plastic Film Market Segments

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Biaxially Oriented Polypropylene (BOPP)

- Others

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Others

By Region

- North America

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa