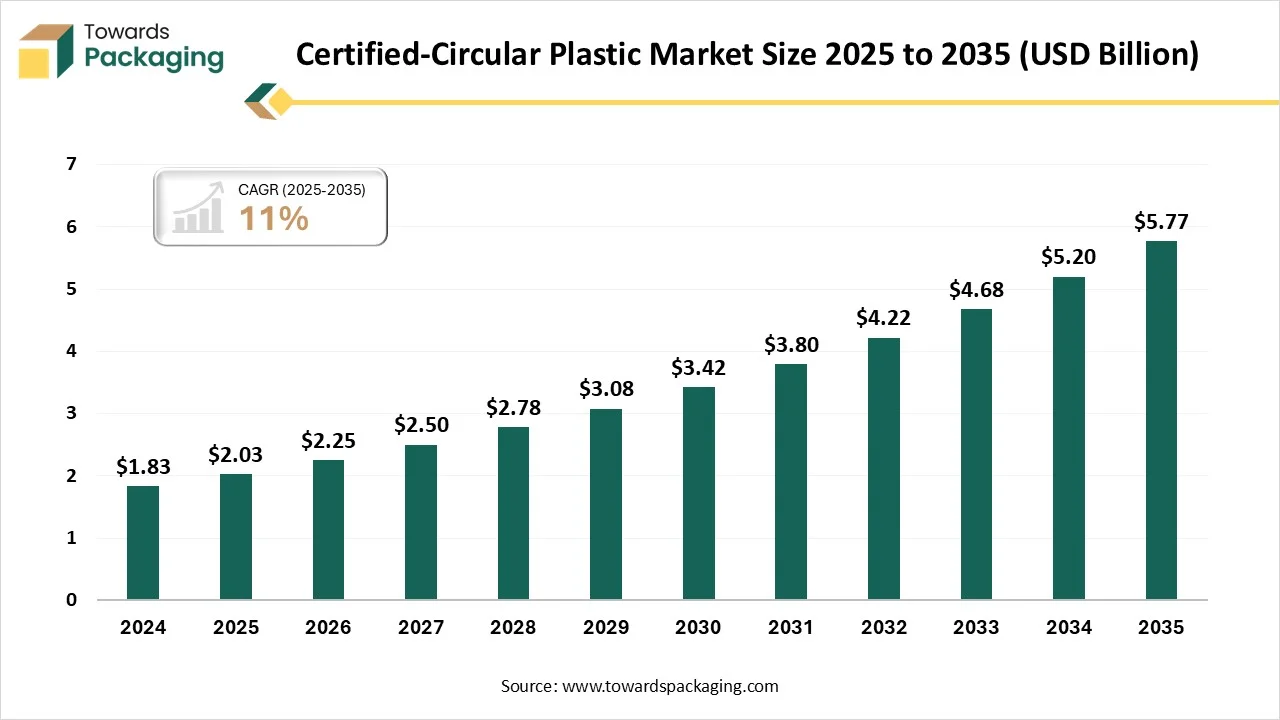

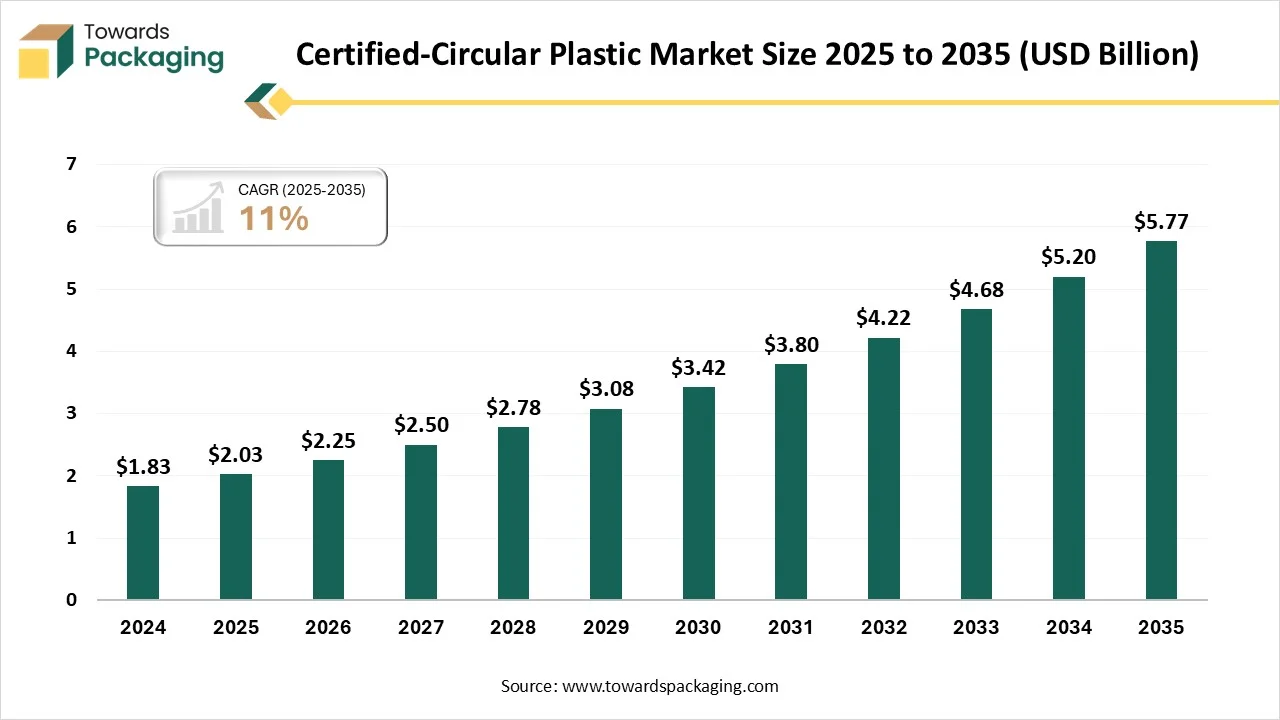

The certified-circular plastic market is forecasted to expand from USD 2.25 billion in 2026 to USD 5.77 billion by 2035, growing at a CAGR of 11% from 2026 to 2035. The rising ecological concern, increasing consumers demand, and strict guidelines of the government has boosted the development of this market. There is a huge demand for sustainable packaging among consumers across the globe which enhance the production process of the market.

Certified-Circular Plastic include plastics that are certified as circular-meaning they originate from recycled content, recycled feedstocks, chemical recycling processes, or other sustainable circular pathways and are audited/verified under recognized certification schemes (e.g., ISCC+, EuCertPlast, Recycled Content Certifications). These materials are used in flexible and rigid packaging, consumer goods, automotive parts, electronics housings, construction materials, textiles, and other applications requiring compliance with sustainability commitments.

Certified-circular plastics support waste reduction, improved material reuse, lower carbon footprints, and regulatory compliance with extended producer responsibility (EPR) and recycled content mandates. Growth is driven by policy pressures on virgin plastic reduction, brand commitments to sustainable packaging, consumer demand for recycled materials, and industrial partnerships aimed at closing the plastic loop.

Technological transformation in the certified-circular plastic market plays a major role in the advancement of recycling technology, enhancement in sorting and separation technology, and digital transparency and traceability. The integration of digital technologies is enhancing supply chain transparency and accountability. There is a rising emphasis on designing plastic packages for durability, reusability, and calmer recycling. It is important for confirming sustainability claims and confirming the quality of the mass balance ascription methods.

The raw materials sourcing includes usage of independent verified suppliers of recycled materials which adhere to identify international standards such as ISSCC. Major raw materials utilized are rPET, rPP, and rPE.

The component manufacturing in this market comprises material types such as polycarbonate (PC) and polyethylene (PE) and polypropylene (PP). The major manufacturing process such as injection molding and blown film extrusion.

This segment comprises advanced reverse logistics, mass balance attribution, and supply chain collaboration process.

The certified circular polyethylene (PE) segment dominated the market with highest share of approximately 40% in 2025 due to strong corporate commitments and huge usage. There is a huge demand for both rigid and flexible packaging with huge feedstock for circular processes. Major packaging market players have strict sustainability commitments which has led in huge demand for these plastic packaging. There is huge investment towards recycling technology has also evolved the demand for this segment.

The certified circular polypropylene (PP) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to advanced recyclability and shift in the preference of the consumers. It is highly versatile, durable, and a cost-effective solution for the packaging process. Enhanced ecological conce4rn among consumers has also shifted major focus towards this segment.

Recycled content certified segment in the market with highest share of approximately 50% in 2025 are its certification and transparency, economic and supply chain shifts, brand image and corporate commitments. Inventions in the recycling procedures improve the quality of the recycled plastics which is making them feasible substitutes to virgin resources. A wider shift in the direction of circular economy values, focusing on material reusage and waste decrease, helps the demand for this segment. Rising ecological concern boosts the preferences of the consumers for using sustainable, circular goods, pressuring brands to utilize the recycled content.

The carbon / environmental impact certified segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to bans on single-use plastics. Inventions in the recycling procedure are enhancing the quality, security, and accessibility of certified-circular plastics. Brands that clearly connect their sustainability standards and utilize certified resources can enhance brand loyalty and expand a competitive control.

The flexible & rigid packaging segment dominated the market with highest share of approximately 55% in 2025. It offers exceptional protection and durability against physical harm as it is important for fragile or heavy products in the distribution chain. A rising number of customers are eager to pay higher for items in recycled or sustainable packaging which is boosting brands to emphasize these choices in their leading packaging outlines. Developments in resource science and recycling skills have allowed the growth of high-presentation, recyclable mono-resources and operative chemical recycling procedures.

The automotive components segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to vehicle lightweight, technological advancement, and design flexibility. The increasing demand for lightweight resources to balance the weight of battery packs which are heavy in electric vehicles has been a major catalyst for development. The design flexibility of such plastics permits for advanced, aerodynamic patterns and the incorporation of advanced structures without compromising safety standards or quality.

Food & beverages segment in the market with highest share of approximately 38% in 2025 are strict regulation, increasing consumer consciousness, technological innovation, and corporate commitments. Customers, mainly ecologically aware demographics, are progressively inducing brand choices by demanding environment-friendly goods and packaging. Developments in recycling and resource science are manufacturing certified-circular plastics that are more viable, inexpensive, and practical for food-grade usages.

The automotive & transportation segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to enhanced supply chain collaboration, brand image, and increasing adoption of electric vehicles. Rising customer consciousness of ecological matters and preference for environment-friendly goods. The growth of planned collaborations and partnerships between automakers, resource suppliers, and recyclers is supporting to generate practical closed-loop distribution chains.

| Region | Market Share (%) |

| Europe | 35-38% |

| Asia Pacific | 24.1% |

| North America | 18.9% |

| South America | 7.5% |

| MEA (Middle East & Africa) | 5.4% |

Europe held the largest share in the market share of approximately 35-38% in 2025, due to strict regulatory framework and advanced infrastructure. Certifications offer traceability and confirm the quality of recycled content which is building trust among consumers and industries. Continuous advancement of the infrastructures for recycling has enhanced the adoption of such packaging. The packaging industry has strict guidelines for the usage of plastics which make it an affordable and suitable option for packaging of a wide range of products.

Why Certified-Circular Plastic Market is Dominating in Germany?

Rising industrial and market demand has raised the demand for market in Germany. Several sectors such as construction, automotive, and packaging are the primary consumers of these types of packaging. Major brands are committed towards sustainable packaging which has enhanced their inclination for this market. It has orders for least recycled content in goods, boosting industries to accept circular solutions. These plastics packaging ensures low contamination for definite waste streams, these are afterwards proficiently recycled.

Strict corporate commitments have influenced the demand for the market. It creates huge quantity of plastic waste, offering plenty raw resource for recycling which is making it economically feasible. Multinational brands are promising to circular distribution chains, necessitating certified-circular recycled content to fulfil ecological targets. Customers progressively prefer sustainable items, boosting brands to accept circular options. Rising infrastructure, EPR mandates, and informal recycling are fast-tracking its recycled plastics industry.

How Certified-Circular Plastic Market is Expanding in China?

Enhanced government policies have driven the demand of the market in China. Strict guidelines towards packaging industry have influenced the demand for certified-circular plastic industry. Invention in sorting process and chemical recycling has fuelled the demand for this sector in China. Rising ecological concern among people in this region has promoted the adoption of certified-circular plastics. Continuous collaboration among major market players has raised the advancement in this sector.

The primary factors influencing the growth of market are strict corporate sustainability goals, rising consumer awareness, and continuous advancement in packaging industry. Government is implementing strict guidelines to decrease the generation of plastic wastes. Increasing commitments among corporates for sustainable packaging has enhanced the adoption of this market. Production of high-quality recycled plastics has raised the acceptance for this market.

Why the U.S. is Utilizing Certified-Circular Plastic Market Significantly?

Increasing investment in recycling infrastructure has fuelled the development of the certified-circular plastic market. Rising ecological consciousness boosts the customers to favor brands utilizing recycled or sustainable resources. Utilizing certified circular plastics supports companies mark differently in an over-crowded market and fulfil sustainability goals. Government as well as private investment help the growth of better recycling process, fuelling the distribution of recycled resources.

Middle East & Africa expects the substantial growth in the market. Rising apprehension over plastic pollution influences customers and brand demand for the usage of recycled plastics. Increasing fundings for recycling services and waste management promotes the shift towards recycled plastics adoption. These plastics provide cost-effective solutions, while increasing e-commerce sector and urbanization enhanced demand for consistent packaging.

Why Certified-Circular Plastic Market is Growing Rapidly in Saudi Arabia?

Increasing industrial demand and strategic partnership among major companies are the primary reasons behind the growth of market in Saudi Arabia. There is a huge concern among people and businesses about increasing plastic pollution and its ecological impact have fuelled the adoption of this packaging. Increasing construction, textile, and various other industries has boosted this market to grow significantly. Rapid inventions make recycled resources more suitable and competitive in comparison to virgin plastics.

What Enhance the Adoption of Certified-Circular Plastic Market in South America?

Huge promotion of eco-labs has influenced the growth of the market in South America. Huge investment for the development of recycling infrastructure has fuelled the development of this market. Increasing awareness towards packaging industry has boost the production process of this market. Advanced technology for production of certified-circular plastics has fuelled the adoption of this market. Rising automotive, construction, and packaging sector has raised advancement in this sector.

Why Colombia is Highly Promoting Certified-Circular Plastic Market?

Increasing economic opportunities has enhanced the demand for the certified-circular plastic market in Colombia. The government in this region has targeted for sustainable packaging which influence the adoption of this type of packaging. Strict guidelines of the government also pushed industries to use these types of packages. Increasing commitment for zero plastic waste generation has boosted the demand of this market advancement.

By Plastic Type

By Certification Type

By Application

By End-Use Industry

By Region

February 2026

February 2026

February 2026

February 2026