Pharmaceutical Contract Packaging Market Size and Volume Worldwide

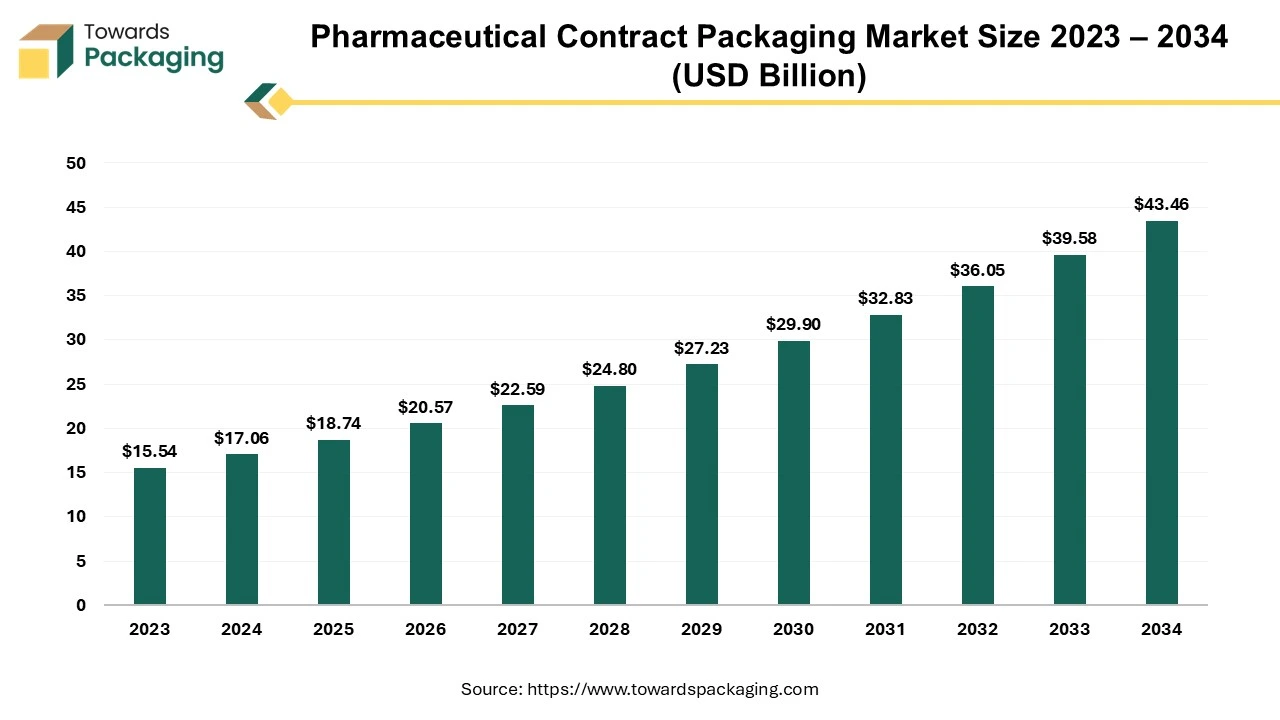

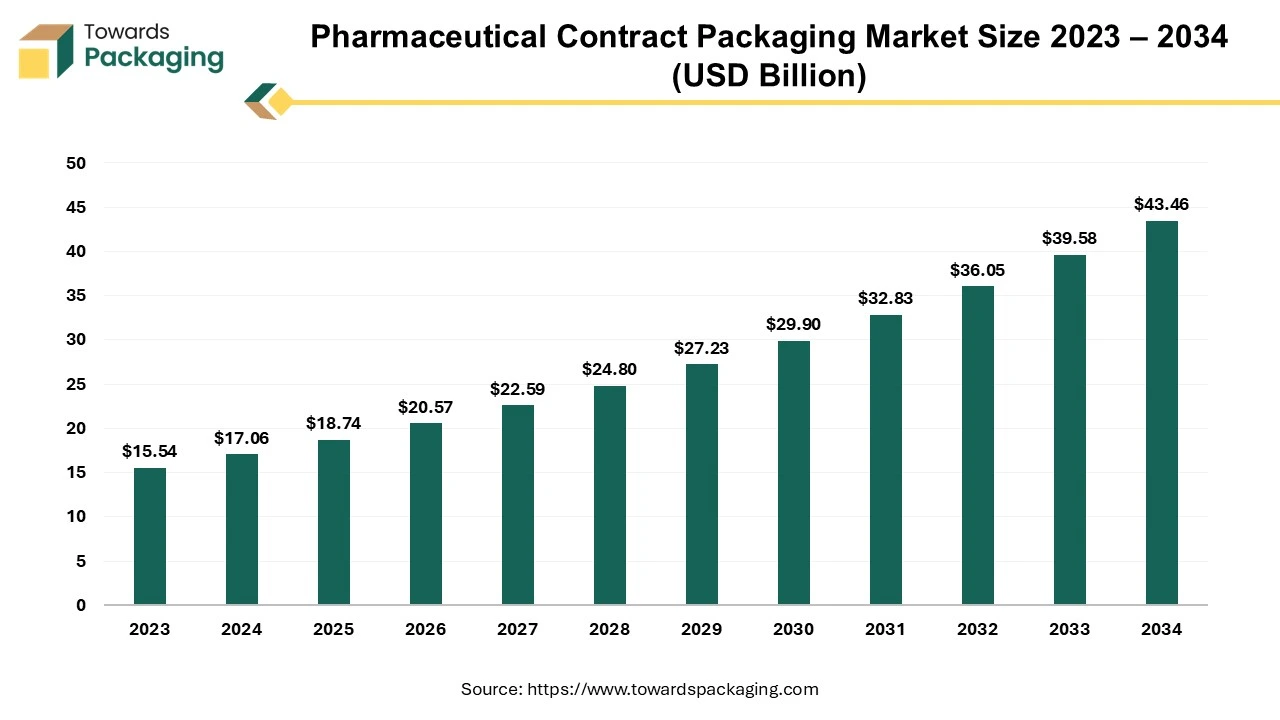

The pharmaceutical contract packaging market is forecasted to expand from USD 20.57 billion in 2026 to USD 47.71 billion by 2035, growing at a CAGR of 9.8% from 2026 to 2035. This report provides an in-depth view of market segmentation by material (plastic, glass, paper & paperboard, aluminum), product type (bottles, blister packs, vials, ampoules, caps, prefilled syringes), and form (oral and injectable).

It analyzes regional dynamics across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, highlighting the rapid expansion in Asia Pacific driven by generic drug production and healthcare investments. The report also includes trade data, value chain analysis, and profiles of key manufacturers such as Gerresheimer AG, AptarGroup, Catalent, Amcor, and West Pharmaceutical Services, offering insights into their market share, product innovations, and sustainability initiatives.

Report Highlights: Important Revelations

- Factors influencing the evolution of the North American pharmaceutical contract packaging market.

- Exploring Asia Pacific’s role in pharmaceutical contract packaging opportunities.

- Cost-efficiency of plastic in pharmaceutical packaging solutions.

- Determinants impacting bottle selection in pharmaceutical contract packaging.

- Key components of oral pharmaceutical contract packaging: from pills to powders.

Contract packaging is the utilisation of a contracted business to package products for shipment and sale. Contract packaging firms, known as co-packers or co-packagers, are hired to package, store, and distribute another company's products, such as pharmaceutical units. Within the pharmaceutical sector, contract packaging companies offer diverse services tailored to pharmaceutical packaging needs, including high-volume commercial solutions for primary and secondary packaging. Additionally, they provide ongoing support services throughout the life cycle of drug products. The global pharmaceutical packaging market, estimated at USD 117.23 billion in 2022, is expected to witness further growth.

Packaging holds a pivotal role in the pharmaceutical supply chain by serving multiple functions such as presentation, promotion, identification, information dissemination, compliance, and stability maintenance of drug products. It also ensures protection during distribution, storage, sale, and consumption. While customized packaging services may vary across companies and countries, they share common objectives of ensuring patient safety and drug efficacy throughout the intended shelf life. This includes maintaining uniformity across different production lots, meticulous documentation of materials and processes, control of potential migration of packaging components into the drug, prevention of drug degradation, and ensuring sterility.

Traditionally, the pharmaceutical packaging industry is categorized into three segments: primary, secondary, and tertiary packaging. Primary packaging, also known as sales or consumer packaging, directly interacts with drug products. Therefore, understanding the potential interactions between primary pharmaceutical packaging containers and their contents is crucial. During the primary research and development stage, efforts are made to confirm drug product stability and compatibility to ensure that custom pharmaceutical packaging remains inert and does not alter the chemical composition of the drug.

Secondary pharmaceutical contract packaging services involve packaging that consolidates individual units of primary packaged goods, often assembling them into multipacket units. Unlike primary packaging, secondary packaging is not intended to hold the drugs but to facilitate their delivery in mass quantities to the point of sale or end user.

For Instance,

- In February 2021, the big pharmaceutical outsourcing service provider Central Pharma takes over Biotechnica, the biggest seaweed extract manufacturer of UK.

Pharmaceutical Contract Packaging Market Trends

Increasing Demand for Eco-Friendly & Sustainable Products

There is a growing emphasis on eco-friendly and sustainable packaging solutions. The use of recyclable materials and green technologies aligns with global environmental goals and consumer preferences.

Increasing Demand for Outsourcing

More pharmaceutical companies are outsourcing packaging due to cost efficiencies, focus on core competencies, and the need for specialized packaging solutions.

Increasing Popularity of Biopharmaceuticals

As the demand for biopharmaceuticals increases, there is a rising need for specialized packaging solutions to handle biologics, such as temperature-sensitive packaging and unique delivery systems.

Market Consolidation

There is consolidation in the contract packaging industry as larger players seek to broaden their portfolios and capabilities, often acquiring smaller companies to expand globally.

Personalization and Customization

Pharmaceutical companies are seeking more tailored packaging solutions to cater to specific brand identities and consumer demands, leading to innovation in packaging designs and materials.

Trends Shaping the North American Pharmaceutical Contract Packaging Market

The North American pharma contract packaging market is forecasted to undergo consistent growth from 2024 until 2032. This growth is propelled by multiple factors such as an increase in the new product development with complex packaging requirements in this region. The scenario of outsourcing of pharmaceutical manufacturing to emerging markets offers new opportunities to grow.

The pharmaceutical industry in North America is undergoing drastic changes as many new business opportunities are growing across different sectors. The biotech industry stands as an example of the dramatic growth which is now witnessed, discussions about near-shore manufacturing do not exclude the pharmaceutical boardrooms or halls of governments. Also, packaging and medication delivery breakthroughs have made a comeback, which indicates an insurmountable growth in these areas during the last twelve months.

Strategic alliances are considered as the possible answers to deal with the hardships and to make the most of the opportunities. The rest of the companies may prefer to keep their contracts and develop them by themselves. Another challenge that arises is in the ownership of liabilities in case of problems, as this increases the complexity of the decision-making process.

The trend in the pharmaceutical contract packaging market may involve slow and gradual transformations with the possibility that smaller medium-sized groups, created by mergers and acquisitions, may take over more market share. Investors are supposed to contribute much towards the development of such companies by providing capital as an expansion asset and acquisition of complementary assets.

An organization like CPHI North America are key platforms for U.S. contract packagers that are looking at leveraging their networks and seizing growth opportunities. As the business is on the verge of transformation, the events offer vital lessons and connections for the companies expecting to flourish in the dynamic pharmaceutical contract packaging market ecosystem.

For Instance,

- In October 2021, Tjoapack, a Dutch contract packaging organisation that serves the pharmaceutical industry, acquired US-based PPS, a healthcare packaging services company based out of Clinton, TN.

Asia Pacific’s Expanding Healthcare Market to Support Growth

Asia Pacific region is anticipated to grow at the fastest rate in the pharmaceutical contract packaging market during the forecast period. The Asia-Pacific region has experienced significant growth in pharmaceutical production due to rising healthcare demands, increasing investments, and expanding generic drug markets. Countries like India and China are major hubs for pharmaceutical manufacturing, driving the need for packaging services. Contract packaging is often more cost-efficient for pharmaceutical companies, especially for small and mid-sized firms, as it eliminates the need to invest in in-house packaging infrastructure. Pharmaceutical companies increasingly outsource packaging to focus on their core competencies like drug development and marketing. Outsourcing allows scalability, flexibility, and access to advanced packaging technologies. The rise of biopharmaceuticals and personalized medicine is driving demand for specialized and innovative packaging solutions. Rising expansion of the pharmaceutical industry in the Asia Pacific region has increased the demand for the pharmaceutical contract packaging, which is estimated to drive the growth of the pharmaceutical contract packaging market in the Asia Pacific region.

For instance, in November, 2024, On the grounds of its Matsushige Factory (Situated in Matsushige-cho, Itano, Tokushima), Otsuka Pharmaceutical Factory, Inc. (Head Office: Naruto, Tokushima, Japan; President and Representative Director: Shuichi Takagi; henceforth, Otsuka Pharmaceutical Factory) will construct a new factory "MP-PS" (henceforth, the New Factory) to manufacture prefilled syringes (syringes already filled with injectable drug solution) (henceforth, the Product). Prefilled syringes are ready-to-use kits that come with a plastic syringe injector filled with medication solution. It has the medicine name on the label and doesn't need any pharmacological preparation. It lowers the danger of bacterial and foreign matter contamination, avoids drug mix-ups and misadministration, and improves clinical and operational efficiency. In recent years, there has been a rise in demand for this helpful product due to the prevention of medical mishaps and patient safety in medical services.

J. O. Pharma Co., Ltd. (Head Office: Izumo, Shimane; President and Representative Director: Yoshifumi Fujimoto; henceforth referred to as J. O. Pharma), a subsidiary of Otsuka Pharmaceutical Factory, is currently producing the product. In order to streamline manufacturing operations using high performance equipment, the New Factory will integrate the most recent technology from Otsuka Pharmaceutical Factory with the manufacturing technique that J. O. Pharma has developed over the years. Stable supply will be guaranteed by the New Factory, and disaster risk reduction will be aided by decentralized manufacturing.

For Instance,

- In January 2024, Alcami Corporation (Alcami), a top CDMO (contract development and manufacturing organization), announced today that it has finalized the acquisition of PPS Inc. (PPS), a renowned supplier of cGMP pharmaceutical storage and services.

Market Driver

Technological Advancements

Innovations in packaging technologies, such as child-resistant packaging, tamper-evident designs, and smart packaging (e.g., RFID tags, QR codes), drive the pharmaceutical contract packaging market.

- For instance, in June 2024, Amor, a company in packaging solutions, announced the release of the "AirGuard Rx," a new child-resistant closure, in June 2024. The push-and-turn mechanism of its closure makes it simple for adults to open but challenging for kids.

- Moreover, in April 2024, SnapSlide, LLC, a company focused on providing packaging technology, has launched the first adaptive packaging solution on the market with a range of child-resistant, no-torque lids. Single-handed opening and closing are made possible by SnapSlide's proprietary, two-step, sliding opening process, which also keeps it child-resistant. Utilizing a slide-to-open/close capability that takes less force and dexterity to operate than the present push-and-turn technology, the user-friendly cap closing technology was specifically designed to assist millions of consumers with physical disabilities and restrictions. In addition to providing convenient, timed dosing, the cap itself remains securely attached to the vials, delivering an extra layer of security and convenience.

Market Opportunity

Expanding Generic and OTC Markets

The increasing production of over-the-counter (OTC) and generic drugs medications boosts the demand for contract packaging services. Growth in global pharmaceutical production, especially in developing markets, fuels the demand for outsourced packaging solutions.

Plastic's Contribution to Cost-Effective Pharmaceutical Packaging Solutions

Plastic is a versatile substance which is being widely used for manufacturing bottles and many different packaging solutions in the pharmaceutical industry due to it being flexible, lightweight and most important of all cost-effective. Although plastic bottles have the benefit of being durable and resistant to damage, they do not behave chemically in the same manner as glass containers, which are not only inert but also impermeable to gases and fumes. PET (Polyethylene terephthalate) is a popular worldwide used plastic known for its ability of resisting to oxygen permeation, which guarantees the originality of medicine.

Plastic has a wide range of applications for the secondary packaging of goods in the pharmaceutical contract packaging sector. Contract packaging in essence entails the production of goods employing various methods such as blister packaging and flow wrapping. The blister package involves cardboard printing and heat-sealing the plastic blisters, while flow wrapping necessitates packaging products with a protective film.

Bottles of plastic are a major ingredient in pharmaceutical contract packaging which can be analogized to face-seal blisters. Meanwhile, on plastic bottles, paper may be added to the blister shape in order to protect and package it better. The employments of plastic in pharmaceutical contract packaging are still increasing as it is useful, tough, and could be customized to meet packaging needs.

For Instance,

- In February 2022, Comar, an established custom medical devices, assemblies and specialty packaging solution provider, is pleased to announce that it has acquired Automatic Plastics Ltd. (APL), a contract manufacturer of injection moulded components mainly for the medical device and pharmaceutical sectors.

Factors Influencing Bottle Selection in Pharmaceutical Contract Packaging

Bottles are the main packaging systems in pharmaceutical contract packaging market and play a critical role for many types of medicine and pharmaceutical products. These bottles are invented to be completely sealed and protected against damage, making their condition intact from manufacturing to consumption. In the field of pharmaceutical contract packaging, plastic bottles are employed for a broad spectrum of items, like liquid medications, tablets, capsules and power. The decision on the type of material to use goes with account of some factors which are about compatibility, stability and regulations.

For liquids in a bottle polyethylene terephthalate (PET) and glass are the most frequently used because they help preserve product quality and prevent contamination. Unlike glass, plastic bottles are light in weight but offer durability at the same time. This enables them to be used for a range of medication for liquid purposes.

The second packaging solution is yet the bottles which sometimes used in secondary packaging to group and arrange them for distribution or retail display. Contract packaging firms, on the other hand, take care of sourcing containers, bottles filling, labeling and packing assemblies according to their customer’s specification and needs; they must make sure that they uphold the industry standard and regulations. bottles in pharmaceutical contract packaging are vital for the effective packaging of numerous pharmaceuticals as they adequately control of different pharmaceutical products types and hence offer quality, safety and efficacy in medicine delivery to consumers.

For Instance,

- In February 2023, Berry Global Healthcare launches a holistic package solution to assist customers in leveraging the growing requirements for CRC and TE packaging for the pharmaceutical and herbal market of syrup and liquid medicines.

Essentials of Oral Pharmaceutical Contract Packaging from Pills to Powders

Oral forms of medication account for a considerable segment of the pharmaceutical contract packaging industry due to their popularity and variety of applications. Oral pharmaceuticals include pills, capsules, liquids, powders, and other forms that are taken by mouth. Tablets and capsules are among the most frequent types of oral drugs. These solid dose forms are frequently packaged in blister packs or bottles for easy storage, delivery, and use. Blister packs include discrete unit dosages, which improves drug adherence and makes dosing more accurate. Contract packaging firms conduct blister pack filling, sealing, and labelling to ensure product quality and regulatory compliance.

Liquid pharmaceuticals, which include syrups, suspensions, and solutions, are another important category in oral pharmaceutical packaging. To safely hold and dispense the liquid medication, these formulations require appropriate containers such as bottles or vials. Contract packagers specialise in filling and capping liquid prescription bottles to ensure accurate volume measurement and leak-proof closure. Powdered drugs, whether for reconstitution or direct intake, require specialised packaging. Contract packagers may use pouches, sachets, or bottles with measuring devices for safely distributing powdered pharmaceuticals.

Oral pharmaceutical packaging is essential for assuring the safe, efficient, and compliant distribution of pharmaceuticals to patients, with contract packagers providing experience in packaging design, material selection, filling, labelling, and quality assurance.

For Instance,

- Catalent has finalized its acquisition of Bristol-Myers Squibb’s 305,000 square feet biologics, sterile and oral solids manufacturing and packaging facility in Anagni, Italy. The facility complements the European network and will provide clients with additional capacities to accelerate their biologics and oral drug product introductions into the market.

Key Players and Competitive Dynamics in the Pharmaceutical Contract Packaging Market

The competitive landscape of the pharmaceutical contract packaging market is dominated by established industry giants such as Baxter BioPharma Solutions, AptarGroup Inc., Gerresheimer AG, Pfizer Centre Source, CCL Industries Inc., Becton Dickinson & Company, MeadWestvaco Corporation, Vetter Pharma International, COMAR LLC, Schott AG, International Paper Company, Adelphi Healthcare Packaging, Catalent Pharma Solutions, Graphic Packaging International Inc., WestRock Company SGD S.A., Drug Plastics Group, Berry Plastics Corporation, Patheon, Amcor Limited, Sharp Corporation, Owens Illinois Inc., RPC Group Plc, Owens-Illinois Inc., West Pharmaceuticals Services Inc., Schott Pharmaceuticals Services Inc., AbbVie Contract Manufacturing, Daito Pharmaceutical, Nipro Corporation, Graphic Packaging International Inc. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

The main angle of Baxter is the delivery of all round contract packaging services that are specially made to address the needs of the pharmaceutical industry. Their strategies will have aspects as different ways to pack, being really strict with regulations, investing money in technology and methods to achieve efficiency, and developing personalized solutions suitable for all their clients.

For Instance,

- At the facility, the department will perform contract services such as making and packaging drugs for biopharma companies which will mainly be for infused or injected products. The Baxter CMO branch has joined hands in the development of the Novavax and Moderna vaccines.

AptarGroup delivers tailor-made packaging solutions for the generic and branded pharmaceutical markets. They might carry out strategies of designing the package more fashionable that makes it safe for use, easily usable, and helps to patient compliance. They may as well unlikely focus on sustainability programs, spend on new packaging materials research and development, and be closer as partners to pharmaceutical companies to come up with packaging custom solutions.

For Instance,

- In March 2024, Aptar Pharma, a division of AptarGroup, announced the expansion of its capacity at Congers facility in New York, US.

Gerresheimer is primarily engaged in the development and provision of excellent packaging solutions that are applicable in the pharmaceutical and healthcare industries. Their strategies can include providing a wide range of packaging solutions, taking advantage of their knowledge in glass and plastic packaging materials, industries adhering to regulatory requirements, and providing tailor made packaging solutions to meet with specific demands of their customers.

For Instance,

- In October 2022, The German packaging provider Gerresheimer and the drug company Merck have teamed up to develop a digital twin solution that will help to ‘transform’ the pharmaceutical supply chain.

Pfizer Centre Source offers clients customized contract packaging for all kinds of pharmaceutical products. Their strategies could be designed along the lines of utilizing their good reputation and substantial experience in the pharmaceutical industry, delivering high end packaging solutions from primary to secondary packing, undertaking quality assurance and compliance efforts as well as offering additional services.

For Instance,

- In October 2022, Pfizer Inc made the announcement of the closure of its acquisition deal with Biohaven Pharmaceutical Holding Company Ltd., the maker of NURTEC® ODT (rimegepant), an innovative approved therapy for both acute and preventative treatment of migraines in adults.

Top Companies in the Pharmaceutical Contract Packaging Market

Latest Announcements by Industry Leaders

- Stevanato Group S.p.A. (NYSE: STVN), SCHOTT Pharma AG & Co. KGaA (MDAX: 1SXP), and Gerresheimer AG, a cutting-edge system and solution provider and a global partner for the pharmaceutical, biotech, and cosmetic industries, announced today that they have formed a strategic industry alliance ("Alliance for RTU") to promote the market adoption of Ready-to-Use (RT) vials and cartridges. By emphasizing the benefits of RT designs over traditional bulk packaging, the Alliance for RTU seeks to impart technical knowledge and skills in high-quality sterile primary packaging, particularly ready-to-fill vials and cartridges, to pharmaceutical companies, CMOs, and CDMOs.

- Lukas Burkhardt, a member of Gerresheimer AG's (Gerresheimer AG -primary packaging products for medication and drug delivery devices company) management board, stated that as an industry, the company is fully prepared for the transition to RT vials and cartridges. With recent advancements, RT processing is a mature technology which will improve our customers’ operations in terms of efficiency, cost and time to market. Franco Stevanato, CEO of Stevanato Group stated that the quality of products has significantly improved due to RT vials and cartridges, which provide increased dependability and efficiency in pharmaceutical procedures. This partnership enables the company to further emphasize how RT solutions raise industry standards, guaranteeing patients throughout the world receive their prescriptions in a safer and more efficient manner.

- Andreas Reisse, CEO of SCHOTT Pharma stated that the shift towards ready-to-use cartridges and vials reflects a collective industry shift to advance efficiency and quality in aseptic filling processes and this alliance shows readiness by increasing capacity and thereby supporting the market trend. Ready-to-use solutions can reduce complexities and better meet the stringent requirements of modern pharmaceutical production. At a special event held at the exposition fairground on October 8, 2024, the Alliance for RT will be formally introduced at the PHI in Milan.

Recent Developments in the Pharmaceutical Contract Packaging Market

- In March 2024, Adare Pharma Solutions, a technology driven Contract Development and Manufacturing Organization (CDMO) focused on oral dosage forms, revealed that the company expanded its warehousing and packaging capabilities in Milan, Italy, Europe. The site's two-story, 2,800-square-meter addition will house a new packaging plant in a specially designed packing hall. Tablets and capsules will be packaged into Aclar, Triplex, PVC, PVDC, and ALU/ALU blisters using the Marchesini Integra 220S MA260 packaging process. The device can package over 50 million blisters a year and has built-in Robocombi "pick and place" and serialization capabilities. By Q4 2024, the new packaging line should be operational. A second packing line for future requirements and an extra 1,000 square meter storage with 900 pallet capacity are also included in the expansion of the Pessano location.

Market Segments

By Material

- Plastic

- Glass

- Paper & Paperboard

- Aluminium

By Product Type

- Bottles

- Blister Packs

- Vials

- Ampoules

- Caps

- Closure

- Prefilled Syringe

By Form

By Region

- North America

- Asia Pacific

- Europe

- LA

- MEA