Semi-Automatic Stretch Wrappers Market Analysis, Demand and Growth Rate Forecast

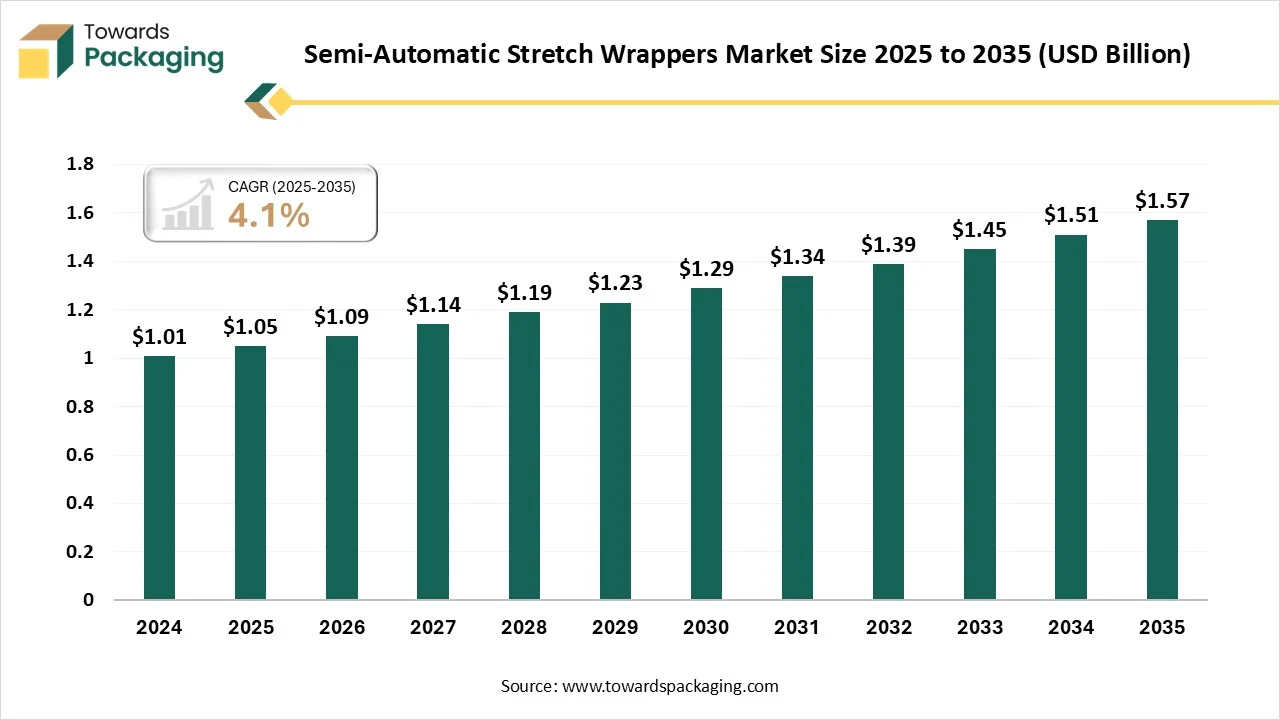

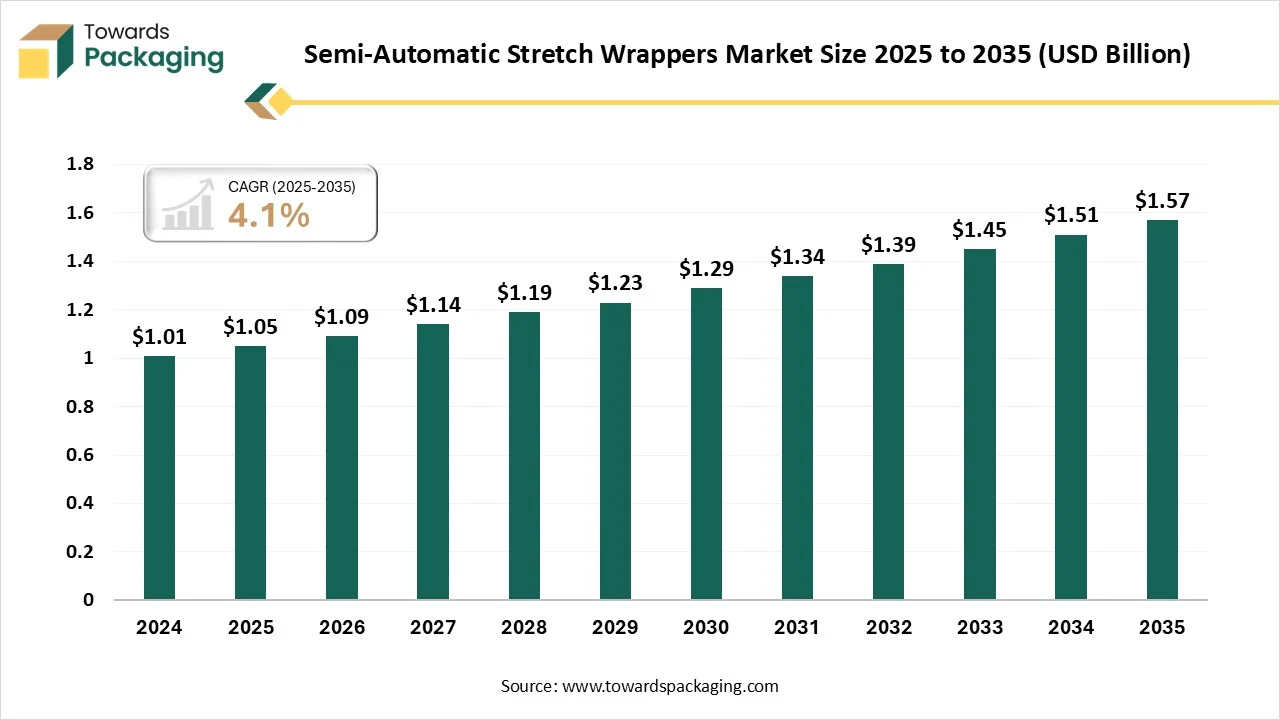

The semi-automatic stretch wrappers market is forecasted to expand from USD 1.09 billion in 2026 to USD 1.57 billion by 2035, growing at a CAGR of 4.1% from 2026 to 2035. The market is growing steadily as manufacturers and logistics firms adopt cost-effective, flexible pallet wrapping solutions to improve load stability, efficiency, and reduce labor costs. It’s driven by e-commerce, industrial automation, and sustainability trends, with strong demand in SMEs and expanding regions.

Major Key Insights of the Semi-Automatic Stretch Wrappers Market

- In terms of revenue, the market is valued at USD 1.09 billion in 2026.

- The market is projected to reach USD 1.57 billion by 2035.

- Rapid growth at a CAGR of 4.1% will be observed in the period between 2026 and 2035.

- By region, North America dominated the market with the largest revenue share of 43.4% in 2025.

- By region, Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By type, the turntable semi-automatic stretch wrappers segment held the largest market share of in 62.2% in 2025.

- By type, the rotary arm semi-automatic stretch wrappers segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By load handling orientation, the standard height load wrappers segment led the market with a revenue share of 72.3% in 2025.

- By load handling orientation, the high-stack/tall load wrappers segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By wrapping technology, the pre-stretch film systems segment held the highest market share of 64.4% in 2025, and is expected to grow at the fastest CAGR from 2026 to 2035.

- By film type, the LLDPE segment has contributed to the biggest market share of 56.8% in 2025.

- By film type, the recycled/sustainable stretch film segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By application/end use, the food & beverage segment dominated the market with a revenue share of 38.8% in 2025.

- By application/end use, the E-commerce & retail segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By end user industry, the warehousing & distribution segment held the major market share of 54.4% in 2025.

- By end-user industry, the 3LP segment is expected to grow at the fastest CAGR from 2026 to 2035.

What are Semi-Automatic Stretch Wrappers?

Semi-automatic stretch wrappers are packaging machines that wrap pallets with stretch film using partial automation, requiring manual loading while ensuring consistent, secure, and efficient load wrapping. The semi-automatic stretch wrappers market is growing due to rising demand for cost-effective packaging automation, increasing warehouse and logistics activities, expanding e-commerce, and SMEs seeking efficient pallet wrapping solutions that improve load stability, reduce labor effort, and minimize material waste.

Emerging Trends in the Semi-Automatic Stretch Wrappers Market

- Smart Monitoring Capabilities

Semi-automatic stretch wrappers are increasingly equipped with smart sensors and connectivity features that help operators track machine performance, identify maintenance needs early, and reduce downtime while improving overall packaging efficiency.

- Focus on Sustainable Packaging

Manufacturers are designing machines that use stretch film more efficiently and support recyclable or eco-friendly materials, helping companies lower material waste, cut packaging costs, and meet growing sustainability and environmental compliance goals.

- Flexible and Modular Machine Designs

New models offer adjustable settings and modular components, allowing businesses to easily handle different pallet sizes, load weights, and packaging requirements without investing in multiple machines or extensive system upgrades.

- Compact and Space-Efficient Equipment

Demand is rising for smaller, space-saving stretch wrappers that fit into warehouses with limited floor space, especially in urban logistics centers and small manufacturing units seeking efficient packaging without layout expansion.

- Improved Film Pre-Stretch Technology

Advanced pre-stretch mechanisms are being adopted to maximize film usage, ensuring better load containment while significantly reducing film consumption, material costs, and long-term operational expenses.

- Operator-Friendly Controls

Manufacturers are prioritizing simple interfaces, touch-screen panels, and easy setup processes, enabling faster training, minimizing operator errors, and improving productivity even with less-skilled labor.

- Better Warehouse System Compatibility

Semi-automatic stretch wrappers are increasingly designed to integrate smoothly with warehouse management and production systems, enabling improved workflow coordination, data tracking, and packaging process optimization.

Technological Developments in the Semi-Automatic Stretch Wrappers Market

Technological developments in the market include advanced film pre-stretch systems that reduce material use and improve load stability, smart sensors with IoT connectivity for real-time monitoring, and user-friendly touchscreen controls. Enhanced modular designs allow flexible adaptation to diverse pallet sizes, while integration with warehouse systems boosts automation. Safety features and energy-efficient drives further improve performance, reliability, and operational productivity.

Trade Analysis of Semi-Automatic Stretch Wrappers Market: Import & Export Statistics:

- European Union was the largest exporter of packing/wrapping machinery (HS 842240) with exports valued at about $4.67 billion in 2024.

- Italy exported around $3.15 billion, while Germany and China also had significant export values, with China exporting $804.6 million and over 7.2 million units globally.

Semi-Automatic Stretch Wrappers Market - Value Chain Analysis

Raw Material Sourcing

Raw materials for semi-automatic stretch wrappers come from two sources: machine components like steel, motors, PLCs, and sensors supplied by industrial manufacturers, and stretch film materials made from LLDPE/LDPE resins sourced from petrochemical firms and converters.

- Key Players: LG Chem, SABIC, Berry Global, Amcor.

Material Processing and Conversion

The production of semi-automatic stretch wrappers relies on specialized plastic films, mainly LLDPE, which are processed and converted into rolls of suitable size for wrapping operations.

- Key Players: Berry Global, Amcor, Sealed Air, and LINPAC, providing high-quality films optimized for machine efficiency and load stability.

Package Design and Prototyping

Package design for semi-automatic stretch wrappers aims to secure and stabilize products during transport using stretch film. The process includes prototyping and testing to ensure optimal film use and load integrity.

- Key Players: Robopac, Lantech, Wulftec, and ITW Mima, which provide both machinery and guidance for effective load unitization.

Role of Semi-Automatic Stretch Wrappers in Warehouse Operations

| Warehouse Aspect |

Role of Semi-Automatic Stretch Wrappers |

Key Benefit |

| Pallet Wrapping |

Wraps palletized goods with consistent film tension |

Improves load stability |

| Loading Area |

Require manual pallet placement |

Low equipment complexity |

| Packaging Speed |

Faster than manual wrapping |

Higher throughput |

| Labor Efficiency |

Reduces physical effort for workers |

Lower labor fatigue |

| Film Usage |

Controlled film application |

Reduced material waste |

| Space Utilization |

Compact machine footprint |

Fits small warehouses |

| Damage Prevention |

Secure wrapping during transit |

Lower product loss |

| Cost Efficiency |

Lower investment than automatic systems |

High ROI for SMEs |

Segmental Insights

Type Insights

Why Did the Turntable Semi-automatic Stretch Wrappers Segment Dominate in the Semi-Automatic Stretch Wrappers Market in 2025?

The turntable semi-automatic stretch wrappers segment holds the largest market share of 62.2% in 2025, because it offers a balance between cost and efficiency, making it ideal for small to medium-sized businesses. These machines require minimal manual effort while ensuring consistent load stability and reduced film usage. Their versatility, ease of integration into existing production lines, and lower investment compared to fully automated systems drive widespread adoption across logistics, manufacturing, and e-commerce sectors.

The rotary arm semi-automatic stretch wrappers segment is expected to grow at the fastest CAGR, due to its ability to efficiently wrap unstable or tall loads with minimal floor space. Its high-speed operation, consistent film tension, and ease of use make it ideal for industries like food & beverage, pharmaceuticals, and e-commerce. Growing demand for faster, space-efficient packaging solutions is driving adoption in both emerging and developed markets.

Load Handling Orientation Insights

What Made the Standard Height Load Wrappers Segment Dominant in the Semi-Automatic Stretch Wrappers Market in 2025?

The standard height load wrappers segment led the market with a 72.3% share in 2025, because they efficiently handle the most common pallet sizes used across industries. Their versatility, cost-effectiveness, and ease of operation make them suitable for various sectors, including logistics, FMCG, and manufacturing. Additionally, these wrappers provide consistent load stability, reduce film waste, and integrate smoothly into existing packaging lines, driving their widespread adoption globally.

The high-stack/ tall load wrappers segment is expected to grow at the fastest CAGR during the forecast period, due to increasing demand for efficient packaging of taller and unstable loads in industries like e-commerce, food & beverages, and pharmaceuticals. These wrappers provide enhanced load stability, uniform film tension, and space-saving benefits, making them ideal for maximizing warehouse storage and transport efficiency. Rising adoption in emerging markets and growing industrial automation further accelerate their market growth.

Wrapping Technology Insights

How will the Pre-stretch Film Systems Segment dominate the Semi-Automatic Stretch Wrappers Market in 2025?

The pre-stretch film system segment held the highest market share of 64.4% in 2025 and is expected to grow at the fastest CAGR due to its superior material efficiency and cost savings. Pre-stretching film before application, it reduces film consumption while improving load stability and consistency. Industries such as logistics, manufacturing, and e-commerce increasingly prefer this technology for its ability to lower packaging costs, enhance productivity, and support sustainable packaging practices, driving strong adoption during the forecast period.

Film Type Insights

How Does the LLDPE Segment Dominate the Semi-Automatic Stretch Wrappers Market in 2025?

The LLDPE film segment contributed the largest market share of 56.8% in 2025, due to its superior stretchability, puncture resistance, and load-holding strength compared to other film types. LLDPE provides consistent wrapping performance while reducing material usage, making it highly cost-effective. Its compatibility with semi-automatic stretch wrappers, along with wide availability and recyclability, has driven strong adoption across logistics, manufacturing, and e-commerce industries.

The recycled/sustainable stretch film segment is expected to grow the fastest CAGR from 2026 to 2035, due to increasing environmental regulations and corporate sustainability goals. Companies are adopting eco-friendly packaging to reduce plastic waste and carbon footprints. Advancements in recycled resin quality and compatibility with semi-automatic stretch wrappers further support performance, cost efficiency, and broader acceptance across logistics, retail, and manufacturing sectors.

Application/end use Insights

Why the Food & Beverage Segment Dominated the Semi-Automatic Stretch Wrappers Market In 2025?

The food & beverage segment dominated the market share of 38.8% in 2025, due to high packaging volumes and the need for secure palletization during storage and transportation. Semi-automatic stretch wrappers ensure product safety, hygiene, and load stability while handling diverse package sizes. Rapid growth in packaged foods, beverages, cold-chain logistics, and distribution networks further increased demand, driving higher revenue contribution from this segment compared to other end-use industries.

The e-commerce and retail segment is expected to grow at the fastest CAGR during the forecast period due to rising online shopping, increasing parcel volumes, and expanding fulfillment centers. Semi-automatic stretch wrappers support faster palletization, improved load stability, and cost-efficient packaging. Their flexibility and ease of use make them ideal for high-throughput, space-constrained warehouse operations, driving strong adoption across global e-commerce and organized retail supply chains.

End-User Insights

Why the Warehousing & Distribution Segment Dominated the Semi-Automatic Stretch Wrappers Market In 2025?

The warehousing and distribution segment held the major market share of 54.4% in 2025 due to the growing need for efficient pallet handling and load protection across supply chains. Semi-automatic stretch wrappers help warehouses improve packaging speed, ensure load stability, and reduce labor dependency. Rising inventory movement driven by e-commerce, retail, and third-party logistics providers increased demand for reliable, cost-effective wrapping solutions, supporting strong adoption in warehousing and distribution facilities worldwide.

The third-party logistics (3PL) segment is expected to grow at the fastest CAGR during the forecast period due to rising outsourcing of warehousing, transportation, and fulfillment services. 3PL providers handle high shipment volumes and require flexible, cost-efficient packaging solutions to meet diverse client needs. Semi-automatic stretch wrappers offer quick deployment, consistent load stability, and lower operating costs, making them ideal for dynamic logistics environments and driving rapid adoption across global 3PL operations.

Regional Insights

What’s Driving the North America’s Semi-Automatic Stretch Wrappers Market?

North America dominated the semi-automatic stretch wrappers market with 43.4% share in 2025 due to its well-established logistics and warehousing infrastructure, high adoption of packaging automation, and strong presence of manufacturing and e-commerce industries. The region benefits from early technology adoption, availability of skilled operators, and high focus on operational efficiency and workplace safety. Additionally, continuous investments in distribution centers and growing demand for cost-effective pallet wrapping solutions further supported market leadership in North America.

Why is the U.S. Accelerating Adoption of Semi-Automatic Stretch Wrappers Market?

The U.S. market is expanding due to rapid growth in e-commerce, large-scale warehousing, and advanced logistics operations. Companies are adopting semi-automatic systems to balance automation benefits with cost efficiency while addressing labor shortages. Rising demand for faster pallet handling, improved load stability, and reduced packaging waste, along with continuous investments in distribution centers and manufacturing facilities, is further driving market growth across the United States.

How is Asia Pacific Emerging as the Fastest-Growing Stretch Wrapping Hub?

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period due to rapid industrialization, expanding manufacturing bases, and strong growth in e-commerce and logistics sectors. Rising investments in warehouses and distribution centers, especially in China, India, and Southeast Asia, are boosting demand for cost-effective packaging automation. Additionally, increasing adoption by small and medium enterprises, improving infrastructure, and growing focus on export-oriented manufacturing are accelerating market expansion across the region.

Why India Becoming a Key Growth Engine for Semi-Automatic Stretch Wrappers Market?

India’s market is expanding as businesses shift toward standardized palletized transport to reduce product damage during long-distance movement. Increasing use of third-party logistics, growth of cold storage facilities, and rising exports are encouraging the adoption of reliable wrapping solutions. Additionally, improved access to affordable machinery, growing automation awareness among small manufacturers, and demand for consistent packaging quality across industries are supporting steady market growth in India.

What’s Fueling Europe’s Semi-Automatic Stretch Wrappers Market Growth?

Europe is anticipated to grow at a notable rate during the forecast period due to increasing automation across the manufacturing and logistics sectors. Strict regulations on packaging efficiency and sustainability are driving the adoption of advanced stretch wrapping solutions. Growth in cross-border trade, expansion of distribution centers, and rising demand for consistent load protection, particularly in food, pharmaceuticals, and industrial goods, are further supporting steady market expansion across European countries.

Why is the UK Leading in Advanced Stretch Wrapping Solutions?

The UK is anticipated to grow at a notable rate during the forecast period due to increasing investment in modern warehousing and fulfillment infrastructure. Rising adoption of automation to address labor shortages and improve operational efficiency is boosting demand. Additionally, strong growth in e-commerce, focus on load safety during domestic and cross-border shipments, and adoption of cost-efficient semi-automatic packaging solutions are supporting steady market expansion in the UK.

How is the Middle East & Africa Market Gaining Momentum in Stretch Wrapping?

The Middle East & Africa region is expected to grow at a significant rate due to rapid industrialization, expanding logistics and warehousing infrastructure, and increasing e-commerce activities. Growing investments in manufacturing, retail, and export-oriented operations are driving demand for efficient packaging solutions. Semi-automatic stretch wrappers help improve load stability, reduce labor costs, and ensure safer transportation, making them increasingly adopted across industries in the region.

Why is the UAE Emerging as a key Hub for Semi-Automatic Stretch Wrappers Market?

The UAE market is expected to grow significantly due to rising industrial and retail activities, expanding logistics networks, and growing demand for reliable palletization solutions. Businesses are adopting these machines to enhance load stability, reduce packaging time, and optimize operational efficiency, while the growth of e-commerce and distribution hubs further fuels the need for cost-effective and efficient semi-automatic wrapping solutions across the region.

What’s Driving the Surge of Stretch Wrappers in South America?

South America’s semi-automatic stretch wrappers market is projected to grow significantly as companies focus on improving export packaging standards and reducing product damage during transit. Rising demand in industries like beverages, processed foods, and consumer goods, along with the modernization of supply chains and distribution networks, is driving adoption. Semi-automatic solutions offer flexibility, faster pallet handling, and lower operational costs, making them increasingly preferred across emerging South American markets.

Why is Brazil Becoming a Fast-Growing Market for Semi-Automatic Stretch Wrappers Market?

Brazil’s market is poised for significant growth as manufacturers and logistics providers focus on optimizing packaging operations and minimizing material waste. Rising demand for faster pallet handling in sectors like food processing, beverages, and retail, combined with government initiatives supporting industrial automation, is driving adoption. The growing need for standardized, secure packaging for domestic distribution and export markets is further boosting market expansion in the country.

Recent Developments

- In April 2024, Cox & Co, a single-origin chocolate brand, launched a new paper flow wrap for its chocolates, fully eliminating plastic. The packaging is kerbside recyclable, has a minimum 12-month shelf life, and replaces the previous compostable plastic wraps, reducing landfill waste. This sustainable shift is also expected to cut packaging costs by 35%, responding to rising cocoa prices while meeting growing consumer demand for eco-friendly options.

- In 2025, Robopac introduced Robopac S7 Robot Wrapper an IoT-enabled semi-automatic stretch wrapping machine, allowing real-time monitoring, improved efficiency, and reduced operational downtime.

Top Companies in the Semi-Automatic Stretch Wrappers Market

- Dorado Packaging: Dorado Packaging provides semi-automatic and automatic stretch wrapping systems designed for efficient pallet load containment. Their machines ensure consistent load stability, reduce film waste, and support diverse industries, including logistics, manufacturing, and distribution centers.

- Salco Stretch Wrappers: Salco Stretch Wrappers specializes in durable semi-automatic and fully automatic pallet wrapping machines. Their solutions focus on reliability, ease of use, and operational efficiency, catering to warehouses, logistics providers, and industrial packaging operations.

- Arkpak Stretch Wrappers: Arkpak Stretch Wrappers offers cost-effective industrial stretch wrapping solutions. Their machines are designed for consistent film application, secure load handling, and ease of integration into existing packaging lines for small to medium enterpris

- Fesco Packaging Systems: Fesco Packaging Systems delivers customized packaging and stretch wrapping lines. Their solutions combine automation, flexibility, and efficiency, supporting high-volume production environments and ensuring load integrity for logistics and manufacturing industries.

- Aetna Group (ProMach): Aetna Group, part of ProMach, provides advanced semi-automatic and automatic stretch wrapping machines. Their products emphasize high-speed operation, precise film control, and seamless integration with production and distribution systems across multiple sectors.

- Packsize / Pregis: Packsize, in collaboration with Pregis, offers integrated packaging and protective film solutions. Their systems optimize material usage, improve load stability, and provide customizable options for e-commerce, retail, and industrial packaging applications.

- Champion Packaging Solutions: Champion Packaging Solutions provides robust stretch wrapping systems and end-to-end packaging services. Their offerings focus on reliable load containment, operational efficiency, and tailored solutions for warehousing, logistics, and manufacturing sectors.

Semi-Automatic Stretch Wrappers Market Segment Covered in the Report

By Type

- Turntable semi-automatic stretch wrappers

- Rotary arm semi-automatic stretch wrappers

By Load Handling Orientation

- Standard height load wrappers

- High-stack / tall load wrappers

By Wrapping Technology

- Pre-stretch film systems

- Non-pre-stretch film systems

By Film Type

- Linear low-density polyethylene (LLDPE)

- Blown stretch film

- Recycled/sustainable stretch film

By Application / End Use

- Food & Beverage

- E-commerce & Retail

- Pharmaceuticals & Healthcare

- Automotive & Industrial

- Consumer Goods

By End User Industry

- Warehousing & Distribution

- Manufacturing

- Third-party Logistics (3PL)

By Regions

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA