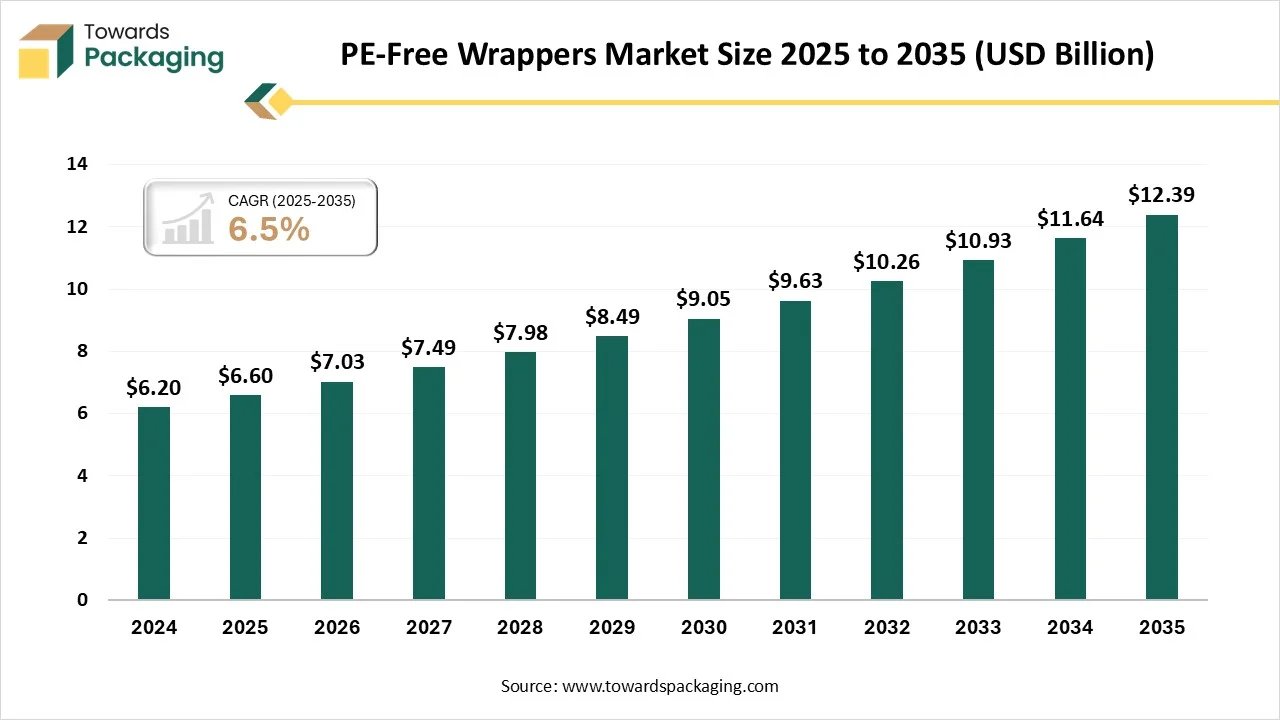

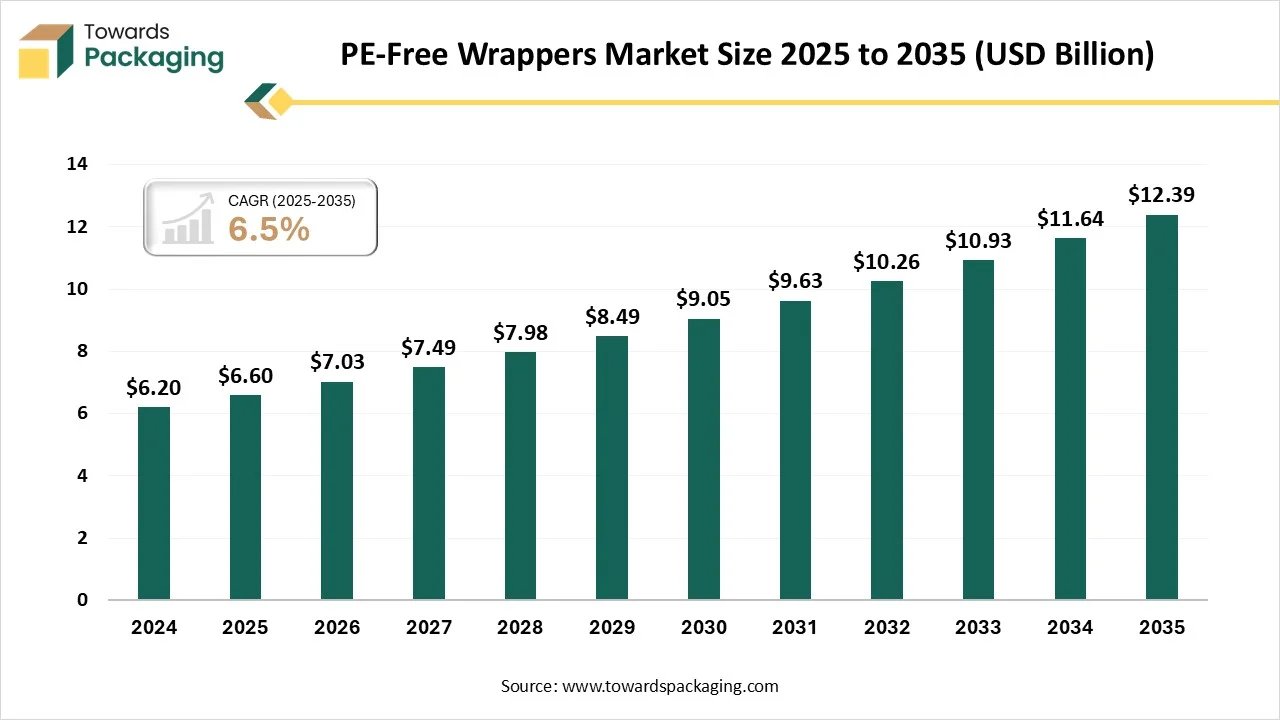

The PE-free wrappers market is forecasted to expand from USD 7.03 billion in 2026 to USD 12.39 billion by 2035, growing at a CAGR of 6.5% from 2026 to 2035. Market growth is driven by regulatory bans on single-use plastics, extended producer responsibility (EPR) mandates, rising consumer demand for sustainable packaging, and innovations in high-performance PE-free materials.

The PE-free wrappers comprises packaging wrappers made without polyethylene (PE) including materials such as paper, cellulose, polylactic acid (PLA), and other bio-based polymers. Aluminum-based laminates without PE layers, and certified compostable/biodegradable films used in food, confectionery, bakery, consumer goods, pharmaceuticals, and specialty applications. PE-free wrappers are designed for recyclability, compostability, and reduced environmental impact compared to traditional PE-containing films.

A creative growth in terms of sustainable packaging is the plantable packaging, in which packaging materials are filled with seeds. After suage, the packaging can be easily planted to grow flowers, herbs, or even trees that shift the waste into soil necessary for the surrounding. Furthermore, the on-demand and customized manufacturing are developing trends that enable organizations to make packaging only when needed. This lowers waste made from huge packaging and lessened the environmental impact of the manufacturing.

The growth of sustainability concentrates on the developed industry's urge for reusable food wrapping papers. The reliable design of the beeswax-coated cloth enables it to be washed for the same usage, due to which such wraps deliver as a perfect eco-friendly choice.

The zero-waste concept pushes the reuse and recycling of packaging. So, the returnable glass milk or glass bottles of soft drinks are the perfect examples of zero-waste packaging. A move to plastic packaging will enable users and producers to reuse the packaging, leaving behind no waste. In another scenario, the packaging can be overall recycled, or the packaging biodegrades without making any damage to the surroundings.

Compostable bioplastics created from natural materials, such as cornstarch, serve as an environmentally friendly alternative that breaks down into non-toxic elements. Hence, they frequently need industrial composting facilities, which cannot be permissible everywhere, which limits their fast advantages. Also, seaweed -based materials are biodegradable, and some are even edible too.

| Material Type | Market Share (%) |

| Paper & Paper-Based Films | 40% |

| Cellulose & Cellulose-Derived Films | 14.5% |

| Bio-Based Polymers | 12.6% |

| Aluminium Foil & PE-Free Laminates | 16.2% |

| Other PE-Free Specialty Materials | 16.7% |

The paper and paper-based films segment has dominated the market with approximately 40% share in 2025, as they are also known as paper laminates, these are coated or uncoated papers, depending on the kraft and sulfite pulp. They can be easily laminated with aluminum or plastic to develop different types of properties. Hence, lamination mostly increases the cost of the paper. Laminated paper is utilized to package dried items such as herbs, soups, spices, and pharmaceutical products, too.

The bio-based polymers segment is expected to witness the fastest CAGR during the forecast period. The bio-based polymers, such as PLA, which is a bioplastic generated from renewable crops such as sugarcane or cornstarch. PLA is used in food packaging, bags, and bottles, which biodegrade in the surrounding environment. The perfect thing about PLA is that it is generated from plants, which is greener than plastic generated from oil. Another is PBAT, which is a petroleum-based biodegradable plastic that works almost the same as traditional plastic.

The food and beverage wrappers segment has dominated the PE-Free wrappers market with approximately 55% share in 2025, as current research has thrown light on promising novel food packaging materials, which include plant-based, compostable, and edible selections. It's crucial to remember that such categories frequently repeat at times. For example, several plant-based materials are unavoidably compostable, and a large number of edible packaging selections are also plant-based. As the food packaging industry develops, it includes a high level of computational machines, which are becoming important.

The personal care and cosmetics segment is predicted to experience the fastest CAGR during the forecast period. Cornstarch is an ideal alternative to plastic for cosmetic brands that are looking for more eco-friendly and organic packaging options for their lotion bottles. As the name demands, it is created from the polylactic acid (PLA), which comes from renewable sources such as sugarcane or cornstarch. As an achievable substitute, cornstarch serves many of the same purposes when it comes to sustainable cosmetic packaging selection. It is both recyclable and biodegradable, which also makes it a great choice for the skincare cream jars and lotion bottles. It is also non-pollutant and does not generate large amounts of waste, which is why several cosmetic companies are now looking into cornstarch as a perfect alternative.

The flexible wrappers segment has dominated the market with approximately 50% share in 2025, as flexible packaging frequently uses less material than strong alternatives, which leads to lower material costs. They are lighter and more compact than the strong packaging as it lowers the transportation costs and completes usage, both are incoming to production facilities and outgoing to the distribution stores and centers. So, the flexible packaging has taken up less space in warehouses and is frequently found on the shelves.

The individual wraps and sachets segment is predicted to experience the fastest CAGR during the forecast period. In the food service, PE-free points to paper wraps, which do not have a polyethylene plastic lining, making them convenient or compostable to recycle. The Beeswax wraps are a famous single-use alternative to the PE-coated plastic wrap for home food storage. So, the greaseproof paper is being diagnosed with natural coverings instead of PE to serve as a barrier against the moisture and oil for the burgers and sandwiches.

Europe dominated the market with approximately 38% share in 2025, as European users are increasingly eco-conscious, with a perfect percentage that will select products with sustainable packaging. So, the recyclability and reusability are the main priorities, and users greatly prefer paper and cardboard as the most sustainable materials. There are also technological developments, such as inventions like seaweed-based barriers and water-based coatings, which allow paper-based packaging in order to receive the necessary moisture and grease resistance that regular plastics do not provide.

How is the PE-Free Wrappers Market Growing in Germany?

The usage of PE-free wrapper materials is becoming excessively common in the German packaging sector. Inventions in the biodegradable material, like plant-based packaging, are serving as viable alternatives to the regular plastics. Hence, growth in recycling technologies is developing the recyclability of the packaging materials, which further reduces the waste, as some of the main eco-friendly materials are gaining attention, such as bioplastics made from renewable biomass sources, mushroom-based packaging, and recycled cardboard, too.

Asia Pacific expects the fastest growth in the market during the forecast period, as it is being driven by the growing urge across various sectors, which include healthcare, food and beverages, e-commerce, and personal care, too. This has a huge market, which includes all the potential revenue from the acceptance of single-use plastic packaging solutions in the region that is responsible for both emerging and developed economies. Significantly, the food and beverage industry is responsible for approximately 50% of this demand for huge usage of PE-Free wrappers for the packaging of sensitive goods, which is linked with growing disposable urbanization and income.

Why is India using the PE-Free Wrappers Market Importantly?

The urge for the PE-Free wrappers is for the plastic-free packaging in India that witnesses fast development, which is being driven by the combination of strong regulatory compulsions, which drives the industry, which carries the biggest market for the plastic-free options, which is being filled by the growth of online food delivery and takeaway services. Famous alterations include sugarcane bagasse, paper-based solutions, and PLA.

The PE-Free Wrappers Market in the North America region is growing as this market has come up as a crucial segment in the huge sustainable packaging sector, which is driven by the developing environmental issues, strict regulatory frameworks, and shifting user choice too. As the awareness of plastic pollution on the ecosystems and human health grows, both organizations and users are actively finding PE-free wrappers. So, such a trajectory is filled by the inventions in terms of biodegradable materials, which develops the acceptance of reusable packaging solutions and a regulatory encouragement towards lowering the use of single-use plastics.

Canada PE-Free Wrappers Market Trend

Canada’s Greening Government Strategy is driving the action within the federal government and showing the direction for the practical steps in order to track the usage and disposal of plastics in its own operations. They are working towards avoiding the unwanted usage of single-use plastics in government operations, events, and meetings, too, while buying more sustainable plastic products that can be reused, repaired, and repurposed.

PE-Free Wrappers Market in the Middle East &Africa (MEA) region is growing quickly as these nations need to have huge access to plastic feedstocks. They create several such products and transport them globally. The circumstances point to having less plastic waste in order to recycle and a more processing-efficient design. So, MENA is rapidly urbanizing, which makes more waste as compared to developing highly consumptive waste-making behaviors.

UAE PE-Free Wrappers Market Trend

The development of the UAE PE-Free wrappers market, which is initially driven by developing eco-friendly awareness and the government initiatives whose goal is sustainability. Users are becoming more conscious of their ecological footprint, which leads to a higher urge for environmentally friendly packaging options. Furthermore, strong regulations and policies that promote waste reduction and have a ban on single-use plastics also demand that brands accept the sustainable packaging options.

In South America, the PE-Free Wrappers market is growing steadily as users are notably more shifted towards sustainable packaging instead of their counterparts in Europe or North America, with several recyclable and refillable selections. Also, governments across the region are using bans on single-use plastics and “Extended Producer Responsibility “ policies, which require that organizations track the lifecycle of their packaging waste.

Brazil PE-Free Wrappers Market Trend

Brazil's PE-free wrappers market is due to rapid development, which is driven by strong government policies, growing user choices, and corporate sustainability for environmentally friendly, responsible packaging. Organizations in Brazil are heavily investing in R&D to make alterations that align with the reliability and cost-effectiveness of the plastic. Development in the food and beverage, e-commerce, and personal care sectors is gaining huge acceptance.

By Material Type

By End-Use Application

By Wrapper Format

By Region

February 2026

February 2026

February 2026

January 2026