U.S. Pharmaceutical Packaging Services Market Size, Share, Trends and Growth Forecast

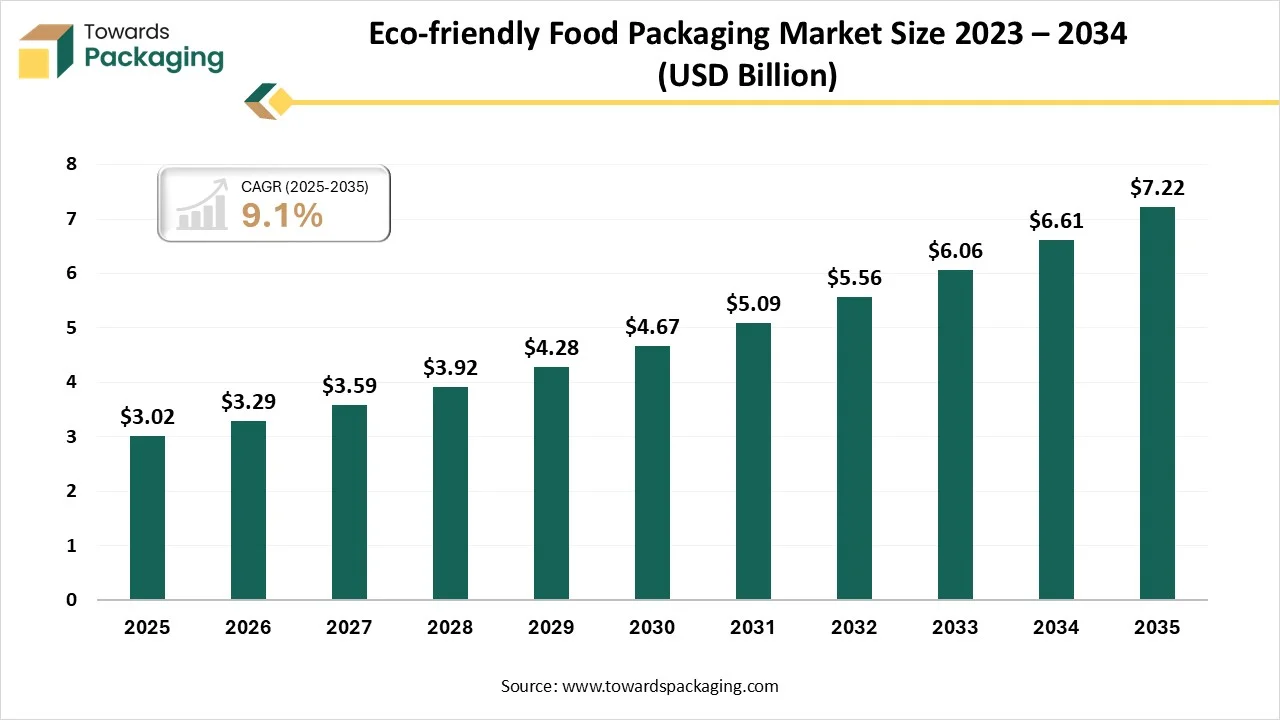

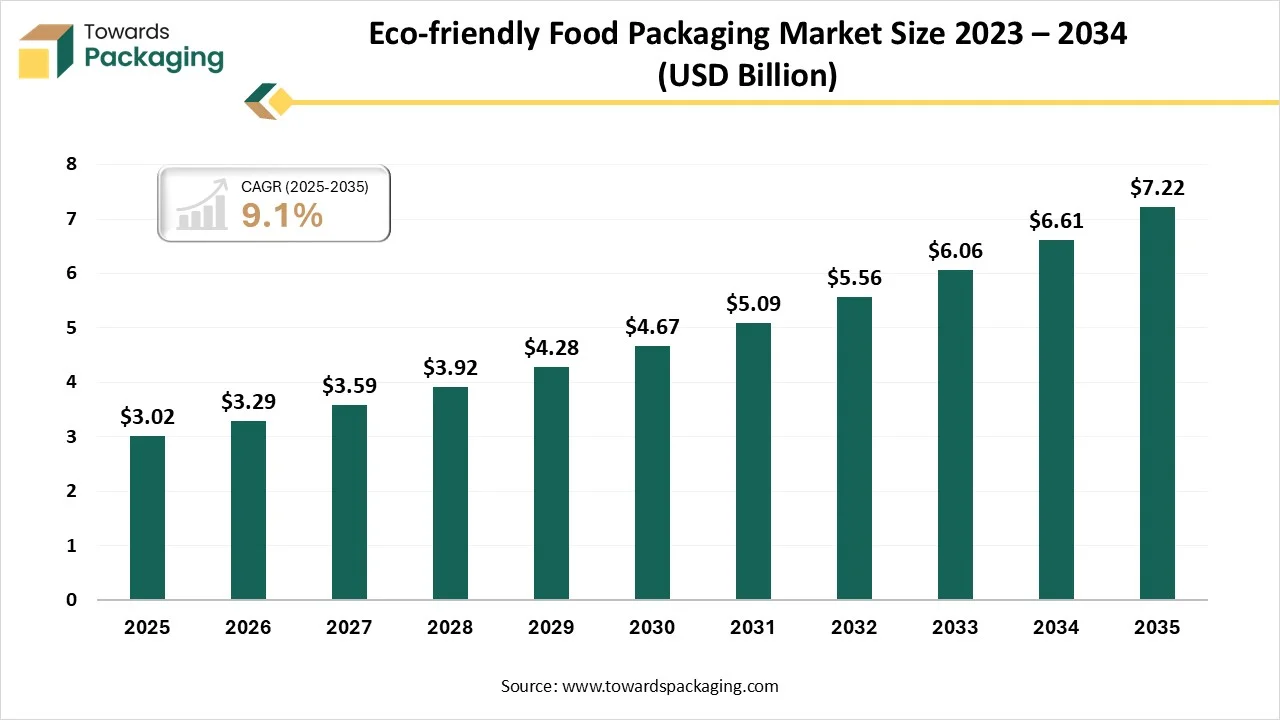

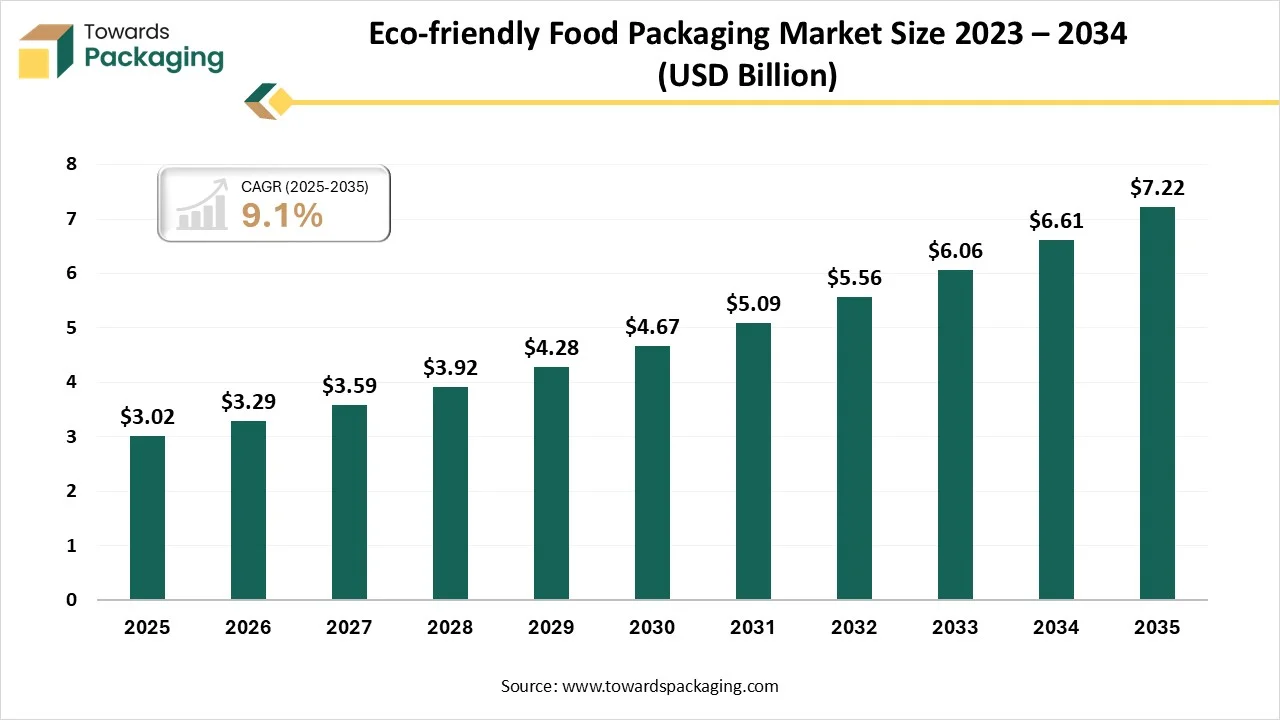

The U.S. pharmaceutical packaging services market is forecasted to expand from USD 3.29 billion in 2026 to USD 7.22 billion by 2035, growing at a CAGR of 9.1% from 2026 to 2035. Strict sterilization concern, rising outsourcing, and increasing biologics has fuelled the market to grow rapidly. Presence of small producers, rising focus towards child-resistant and tamper-evident packaging has fuelled the demand for development in this market.

Major Key Insights of the U.S. Pharmaceutical Packaging Services Market

- In terms of revenue, the market is valued at USD 3.02 billion in 2025.

- The market is projected to reach USD 7.22 billion by 2035.

- Rapid growth at a CAGR of 9.1% will be observed in the period between 2026 and 2035.

- By product, the branded product segment contributed the biggest market share in 2025.

- By product, the biosimilar packaging services segment will be expanding at a significant CAGR in between 2026 and 2035.

- By service line, the primary packaging segment contributed the biggest market share in 2025.

- By service line, the secondary packaging segment will be expanding at a significant CAGR in between 2026 and 2035.

- By manufacturer size, the small manufacturer segment contributed the biggest market share in 2025.

- By manufacturer size, the medium manufacturer segment will be expanding at a significant CAGR in between 2026 and 2035.

What is U.S. Pharmaceutical Packaging Services?

U.S. pharmaceutical packaging services include focused, cGMP-compliant and FDA-regulated procedures for firmly enclosing, labelling, and distributing medicines. They confirm drug constancy, prevent pollution/fabricating, and preserve sterility from production over to the patient. These facilities encompass primary, secondary, and tertiary packaging, comprising specialized facilities such as cold chain logistics and serialisation. It is influenced by growing specialized drug demand, rising necessity for advanced drug transport, and the need for safe, compliant packaging options to shift products from manufacture to patients.

U.S. Pharmaceutical Packaging Services Market Trends

- Market Growth Overview: The market is experiencing strict regulatory compliance, specialized drugs and biopharmaceuticals, sustainability focus, and rapid technology adoption.

- Major Market Players: The market comprises PCI Pharma Services, Catalent Inc., Berry Global Group Inc., Sharp Services LLC, Nelipak Healthcare Packaging, and many other.

- Startup Ecosystem: The startup industries are highly focusing on advanced cold-chain option, sustainability, and intelligent tracking. Increasing emphasis towards developing tracking and high security packaging.

Technological transformation in the U.S. pharmaceutical packaging services market plays a significant role in integration of smart technology such as QR codes, RFID tags, and sensors. Rising patient-centric packaging production required development of user-friendly packaging with smart adherence-tracking process. Rapid shift recyclable and biodegradable packaging have enhanced the adoption of advanced technology such as AI to predict the recyclability potential of the material. These advancements raised the adoption of such packaging by appealing a wide range of consumers.

Trade Analysis of U.S. Pharmaceutical Packaging Services Market: Import & Export Statistics

- United States is one of the leading exporters of pharmaceutical packaging with 3,016 shipments worldwide.

- While the United States imported 8,000 shipments of pharmaceutical packaging worldwide.

- Application U.S. Pharmaceutical Packaging Services Market

- Specialized & Sterile Packaging: Surgical tools and diagnostic components necessitating contamination-free, strict, and validated packaging.

- Smart & Connected Packaging: Use of sensors, IoT, and RFID in packing to monitor medicine observance for enduring diseases.

- Specialty Logistics & Temperature-Controlled: Focused packaging for delicate vaccines and biologics.

- Tamper-Evident & Child-Resistant Solutions: Obligatory in the U.S. for several oral medicines to avoid unintentional tampering and ingestion.

U.S. Pharmaceutical Packaging Services Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are aluminum, glass, paper, paperboard, and plastics such as (PE, PP, and PVC).

- Key Players: Contract Pharma, West Pharmaceutical Services

Component Manufacturing

The component manufacturing in this market comprises plastic/glass vials, drug delivery devices, and prefillable syringes (PFS). Advancement of smart and secure packaging has raised the demand for this market.

- Key Players: Dickinson and Company (BD), West Pharmaceutical Services

Logistics and Distribution

This segment ensures specialized, safe, and cold-chain distribution heavily to expand the market.

- Key Players: Cardinal Health, Cencora

Segmental Insights

Product Insights

Why Branded Product Segment Dominated the U.S. Pharmaceutical Packaging Services Market In 2025?

The branded product segment dominated the market with highest share in 2025 due to huge growth in speciality pharmaceutical sector. The continuous growth in complex drug-device, biologics, and injectables has pushed this segment to expand. Presence of strict FDA guidelines related to product safety and traceability has raised the demand for such branded products. It is enhancing brand value, product safety, and stability. This market is growing rapidly due to increasing concern for hygienic and long-lasting packaging of pharma products.

The biosimilar packaging services segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to enhanced focus for sustainable packaging. These are highly utilized for the packaging of sensitive, temperature-controlled, and sophisticated drugs packaging. Huge shift in the direction of eco-friendly, biodegradable, and recyclable packaging. These are cost-effective efficient solution for the packaging of sensitive drugs.

Service Line Insights

Why Primary Packaging Segment Dominated the U.S. Pharmaceutical Packaging Services Market In 2025?

The primary packaging segment dominated the market with highest share in 2025 due to its drugs sterility, stability, and safety. It is majorly influenced by injectable therapies, and upsurge in biologics. Presence of strict regulatory guidelines for temperature-evident and child-resistance packaging has fuelled the demand for this market. Enhanced glass and specialized plastic packaging has raised the demand for this segment.

The secondary packaging segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to high demand for smart and active packaging. Production of self-administered and high-value packaging demand to prevent counterfeiting has raised the demand for this segment. Constant growth in the direct-to-patient delivery facilities has fuelled the demand for this segment. There is a huge investment in the innovation of this segment which enhanced its adoption.

Manufacturer Size Insights

Why Small Manufacturer Size Segment Dominated the U.S. Pharmaceutical Packaging Services Market In 2025?

The small manufacturer size segment dominated the market with highest share in 2025 due to advanced outsourcing strategies to small producers and small pharmaceutical firms. These are the cost-effective solution with enhanced quality to build their image. High-quality packaging such as pouch, vial, and blister packaging has raised the demand for this segment. It is majorly influenced by specialized, efficient, and localized services. Growing demand for specialized and customized packaging has pushed this segment to grow efficiently.

The medium manufacturer size segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to rapid response options, tailored and cost-effective packaging solutions. Huge investment in this segment has enhanced the production quality and process. It offers responsive services and flexibility which has enhanced the need for this segment. These companies are considered as bridge between high-volume and less-flexible producers for the production of specialized pouches.

Country Insights

The U.S. witnessing rapid growth in the market, due to massive demand for advanced packaging of drugs. Presence of strict FDA guidelines comprises child-resistance and serialization packaging. Incorporation of patient-centric, sustainable, and smart packaging technology has influenced the growth of this market. This market includes packaging of special and biologics drugs with enhanced manufacturing and distribution process. Presence of major market players such as Aphena Pharma Solutions, PCI Pharma Services, Legacy Pharma Solutions, All Packaging Services, LLC, and several others pushed advancement in this industry.

Recent Developments

- In June 2025, Vetter Pharma International GmbH announced about the construction of new clinical site with advanced ceremony in Des Plaines. The company has invested nearly around $285 million starting to deliver enhanced-quality facilities and drug items.

- In January 2026, Sharp announced to invest around €20 million (US$21.6 million) in Belgian and Dutch facilities. This investment is to enhance the capacity of the packaging, assembly, labelling, and cold storage.

Top Companies in the U.S. Pharmaceutical Packaging Services Market

- U.S. Continental Packaging: It is a manufacturer and packaging distributor focusing on turnkey, high-quality, and innovative packaging solutions for various industries.

- SGS North America Inc.: It is a leading inspection, verification, testing, and certification company, ensuring pharmaceutical packaging meets regulatory standards.

- Crown Packaging Corp.: It is offering a wide range of packaging products, equipment, and services.

- All Packaging Services, LLC.: It is a company identified in the U.S. pharmaceutical packaging services market, focused on providing specialized packaging solutions.

- PakFactory: It is specialized in custom packaging solutions, providing folding cartons, rigid boxes, and inserts tailored for pharmaceutical and nutraceutical products.

- Others: Intertek Group plc, Sharp Services, LLC, PCI Pharma Services, Aphena Pharma Solutions, Legacy Pharma Solutions, Wasdell Packaging Group, West Pharmaceutical Services, Inc. and many others.

U.S. Pharmaceutical Packaging Services Market Segments Covered

By Product

- Branded

- Generic

- Biosimilar

- Vaccine

- Cell Therapy

- Gene Therapy

- Others

By Service Line

- Primary Packaging

- Secondary Packaging

- Repackaging

- Bulk-up

By Manufacturer Size