Single-Use Plastic Packaging Market Size, Share, Trends, and Forecast Analysis

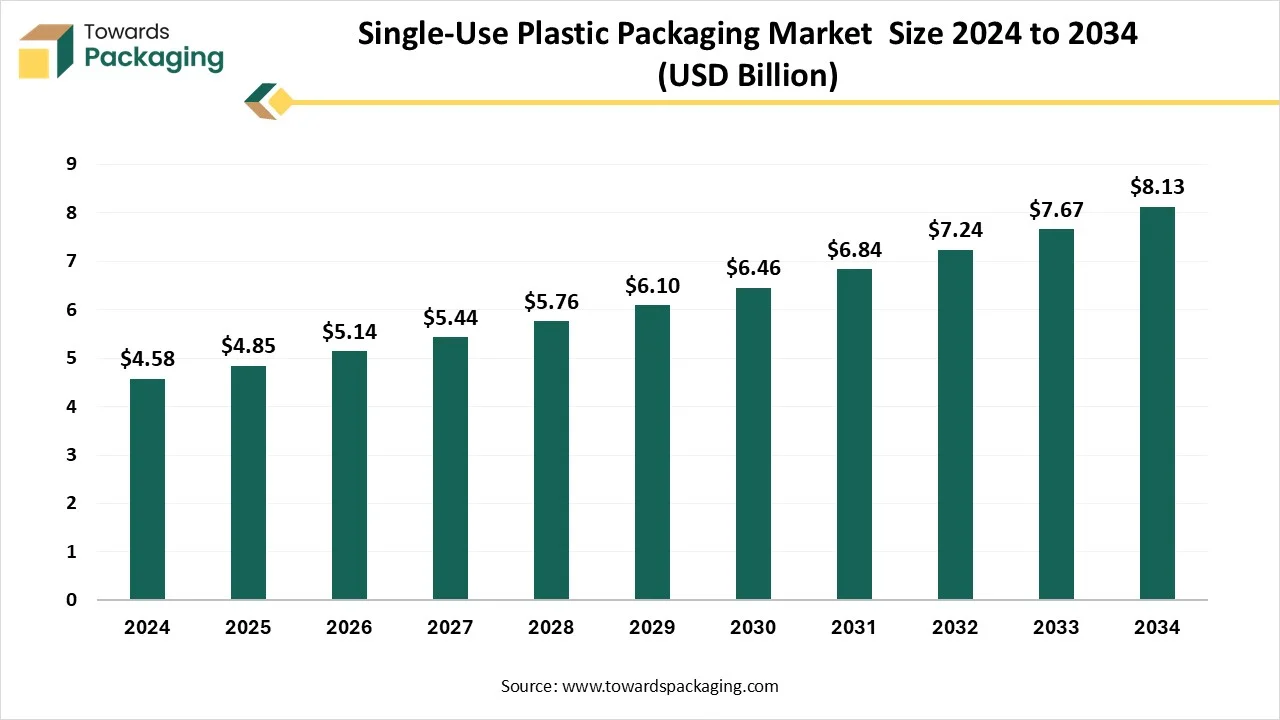

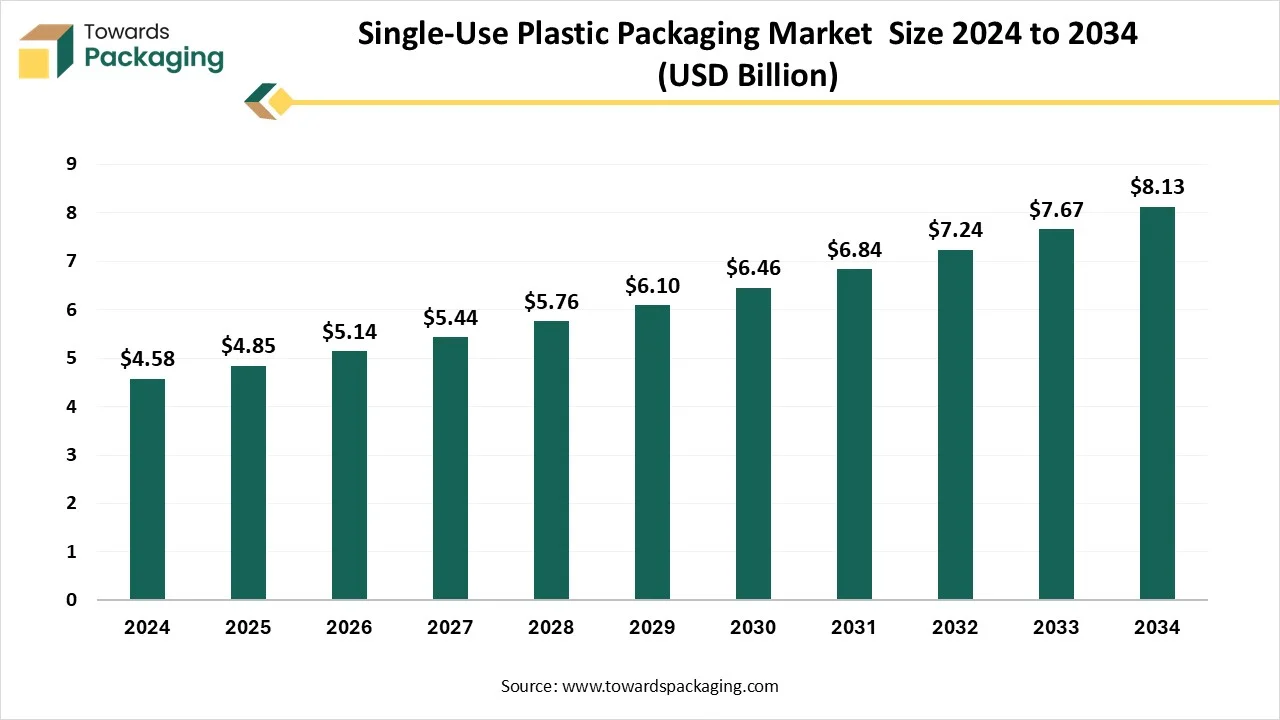

The single-use plastic packaging market is projected to reach USD 8.13 billion by 2034, expanding from USD 4.85 billion in 2025, at an annual growth rate of 5.90% during the forecast period from 2025 to 2034.

The rising demand for cost-effective, durable, and hygienic packaging has influenced the development of the single-use plastic packaging market. Continuous innovation in this sector to fulfil the shifting demand of the consumers has influenced the growth of this market. Due to the presence of major market players and investors, this industry is dominating in the Asia Pacific region.

Key Insights

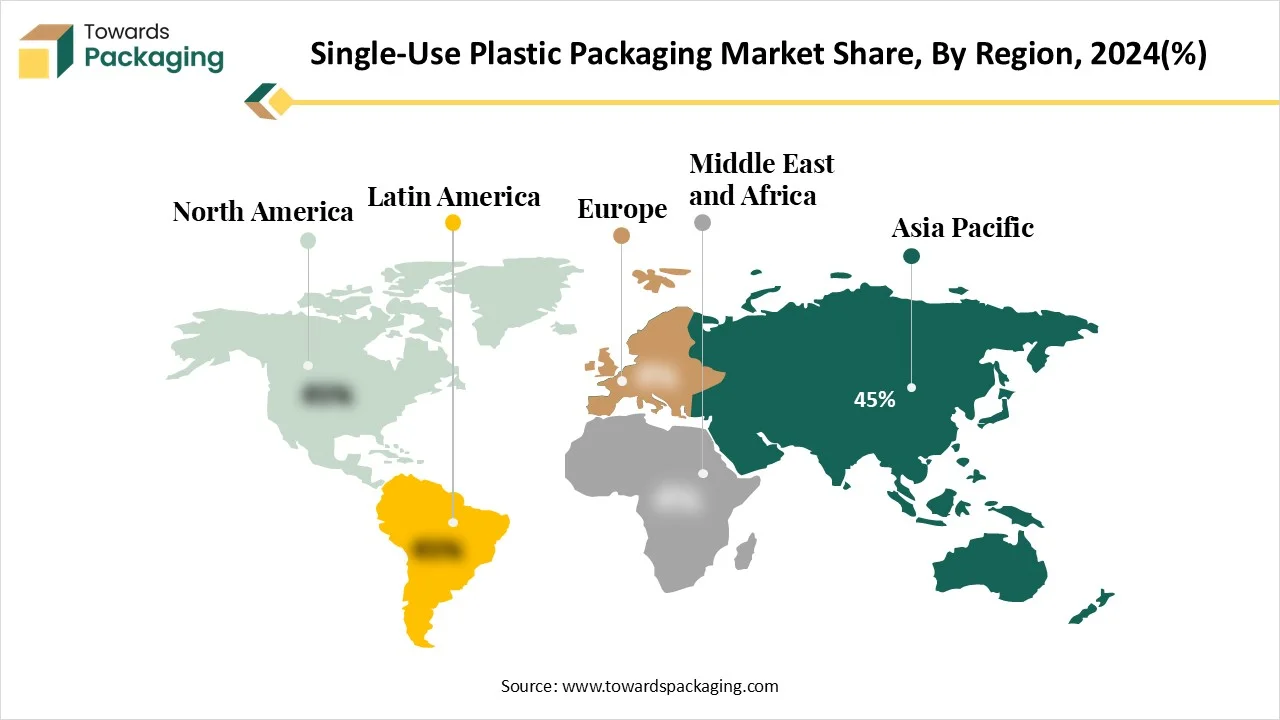

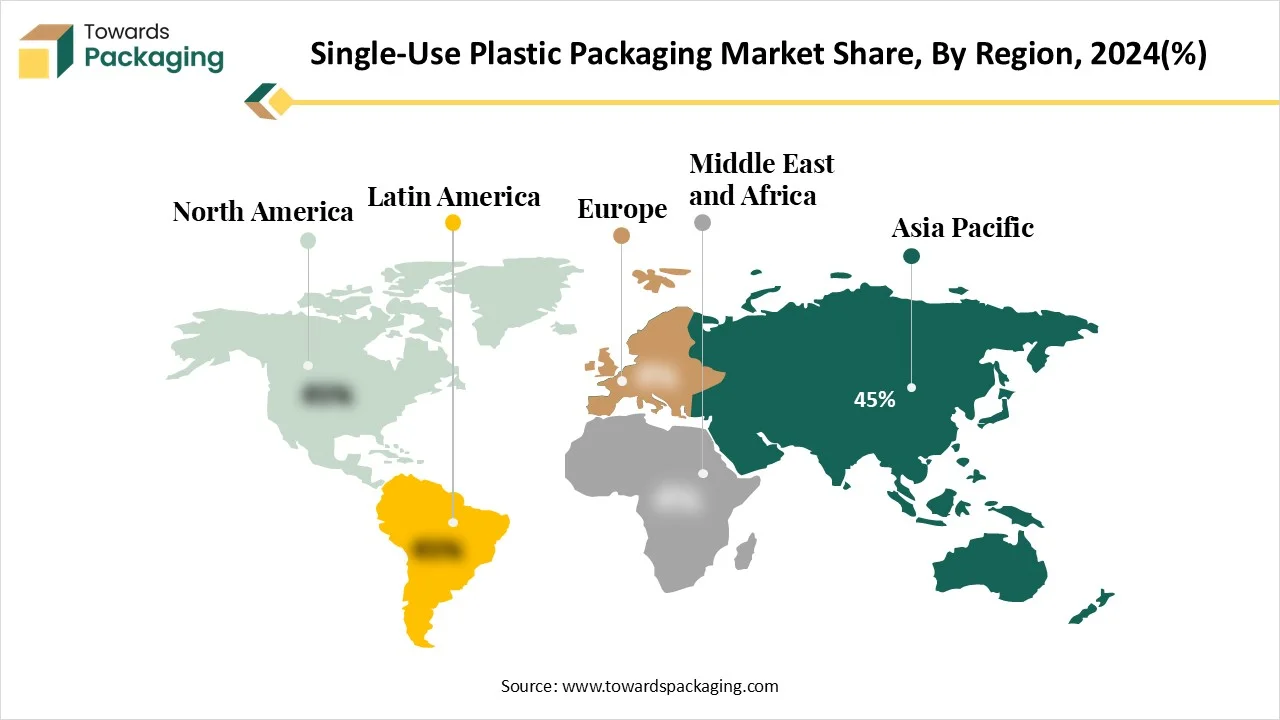

- Asia Pacific dominated the global market by holding more than 45% of the market share in 2024.

- Asia Pacific dominated the global market with the largest share in 2024.

- Europe is expected to grow at a notable CAGR from 2025 to 2034.

- By material, the polyethylene (PE) segment contributed the biggest market share of 42% in 2024.

- By material, the bio-based plastics segment is expected to expand at a significant CAGR between 2025 and 2034.

- By product type, the bags & pouches segment contributed the biggest market share of 38% in 2024.

- By product type, the bottles & jars segment will be expanding at a significant CAGR between 2025 and 2034.

- By end-use industry, the food & beverage segment held the major market share of 51% in 2024.

- By end-use industry, the pharmaceuticals & healthcare segment is projected to grow at a CAGR between 2025 and 2034.

Market Overview

The single-use plastic packaging market encompasses the global industry involved in the manufacturing, distribution, and sale of these disposable plastic packaging solutions across various end-use sectors. This market is shaped by factors such as consumer demand for convenience, hygiene requirements, and cost-effectiveness, while also being significantly influenced by growing environmental concerns, sustainability initiatives, and evolving government regulations aimed at reducing plastic waste. Single-use plastic holds a substantial segment within the packaging industry, driven by convenience and cost-effectiveness. However, it faces increasing pressure due to global environmental concerns and stringent regulations aimed at reducing plastic waste.

What are the New Trends in the Single-Use Plastic Packaging Market?

Rising Food Delivery Services

- Rising food delivery services have amplified the demand for this market due to hygienic packaging.

Expansion of Urban Population

- The increasing urban population influences the demand for equipped and ready-to-eat food goods, significantly manipulating food facility packaging tendencies.

Increasing Demand for Convenient Packaging

- The increasing demand for packaging that is convenient to carry and use.

How Can AI Improve the Single-Use Plastic Packaging Market?

The incorporation of AI in the single-use plastic packaging market plays an important role in producing high-quality packages. AI can create multiple pattern conceptions based on predefined restrictions and consumer preferences. Such apparatuses can quickly yield an extensive variety of ideas at a much earlier pace than human creators could automatically create, resultant in amplified efficacy. AI authorizes brands to reply fast to industry demands and consumer preferences. It is offering new opportunities for brand landlords to proficiently discover and improve their packing plans and fulfil developing customer demands.

Market Dynamics

Drivers

Rising Demand for Convenience and Food Delivery Trend

The continuous growing demand for convenience and the food delivery trend has driven the development of the single-use plastic packaging market. Single-use plastic packaging is an economically successful packing resource due to its impermeability, flexibility, strength, lightness, consistency, and ease of disinfection. In spite of all the ecological apprehensions linked with single-use plastic packing, it is unwavering. Metals, aluminum, and glass, which are more expected to be reused, can all be utilized instead of plastic, but they frequently cost a lot more and require more energy to produce. On the other hand, paper-based resources are igniter but may not be perfect for the multifaceted necessities of food & beverage packaging.

Challenges and Restraints

Strict Government Rules

Strict government regulation towards the packaging industry has hindered the extension of the single-use plastic packaging market. All governments are endorsing rules to decrease ecological waste and improve waste management processes in response to public apprehensions about packing waste, primarily single-use plastic packaging waste. Increasing demand for sustainable packaging has played a significant role in restricting the growth of this market.

Opportunity

Rapid Growth in the Pharmaceutical Industry

The rapid development in the pharmaceutical industry has influenced the demand for the single-use plastic packaging market. Single-use plastic packaging places a supreme position on patient security. Each product is independently wrapped and sterilized before utilizing, significantly decreasing the risk of contamination and microbial exposure. By choosing single-use plastic packaging for diagnostic kits, pre-fillable syringes, and medical devices, healthcare benefactors generate a safe patient situation. The healthcare segment faces several infection risks and many tangled with healthcare-associated infections (HAIs). These contaminations stem from exposure to fungi, bacteria, viruses, and other pathogens throughout a patient's break. Single-use plastic packaging efficiently moderates these risks, mitigating possibility difficulties before they emerge.

LPCB Consumption in the EU: Progress and Disparities in 2023

In 2023, the consumption of lightweight plastic carrier bags (LPCBs) in the European Union varied greatly. Belgium had the lowest consumption, with just 4 bags per person, while Latvia had the highest, with 209 bags per person. This significant difference reflects varying levels of progress toward sustainability targets across the region.

Several EU countries have made strong strides in reducing LPCB consumption. Nine countries, including Belgium, Poland, Portugal, Austria, Sweden, and Denmark, have successfully reduced their consumption to fewer than 40 bags per person. Belgium, for instance, reported just 4 LPCBs per person, setting an excellent example for others to follow. Ireland and France are also making good progress, with 45 and 46 bags per person, respectively, and are on track to meet the 2025 target.

However, some countries are still struggling with high consumption levels. Latvia, Lithuania, and Czechia had the highest LPCB consumption, with 209, 196, and 185 bags per person, respectively. Other countries, such as Estonia, Slovakia, and Poland, also showed higher consumption levels, ranging from 111 to 131 bags per person.

The EU tracks not only total LPCB consumption but also very lightweight plastic carrier bags (VLPCBs), which are less than 15 microns thick. In 2023, Ireland reported that 97.1% of its total plastic bag consumption was made up of these ultra-thin bags, followed by other countries like France, Czechia, and Croatia, where a significant portion of bags were VLPCBs.

Between 2018 and 2023, several countries made impressive reductions in LPCB consumption. Sweden led with a decrease of 131 bags per person, followed by Lithuania (-125) and Latvia (-118). However, some countries, like Romania, Italy, and Croatia, saw increases in LPCB consumption during the same period.

Belgium achieved the largest percentage reduction, cutting its LPCB consumption by 86%, followed by Sweden with a reduction of 85%, and Luxembourg at 76%. Other countries like Poland and Austria also made significant reductions, showing strong progress toward reducing single-use plastic consumption.

While the EU has made good progress, the disparities between countries like Belgium and Latvia highlight the challenges still faced in reaching sustainability targets across the region. Continued efforts will be needed to ensure all member states meet their goals for a more sustainable and circular economy.

Segmental Insights

Why Polyethylene (PE) Segment Dominated the Market in 2024?

The polyethylene (PE) segment contributed a considerable share of the single-use plastic packaging market in 2024 due to its lightweight and durability. Polyethylene is considered a lightweight, durable thermoplastic resin with an adjustable crystalline construction and is one of the most widely twisted plastics global. Polyethylene is utilized to make goods, from plastic sheet wraps and bags, for packaging solutions. The base resource of polyethylene packaging is ethylene, which is a derivative of petroleum or natural gas. These plastic resins undergo polymerization, which associates a sequence of monomers into a plastic or polymer.

The bio-based plastics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Fewer carbon emissions led to the rising demand for this segment. This is widely accepted by brands due to its biodegradability, which is an eco-friendly solution to the packaging industry. Increasing demand for food safety has influenced the formulation of the bio-based plastic packaging sector.

Why the Bags & Pouches Segment Dominated the market in 2024?

The bags & pouches segment is expected to have a considerable share of the single-use plastic packaging market in 2024 due to superior product protection, cost-effectiveness, and space-saving pattern. Pouches are considered a flexible and safe option for the packaging of products while transporting. These segments provide huge space for printing purposes, which also attracts brands towards this market for unique packaging. Airtight sealing facility enhances the longevity of the products and increases the demand for them. It also reduces carbon footprints, which boosts the production of such packaging.

The bottles & jars segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Single-use plastic beverage bottles are among the most widely used forms of beverage vessels. Some of the most widespread changes in beverage bottles are made from plastic. PET bottles are common in a variation of product sorts. PET bottles are becoming more well-adored by high-end customers due to their lightweight, low price, and frequent developments in printing technology.

Why the Food & Beverage Segment Dominated the Market in 2024?

The food & beverage segment is expected to have a considerable share of the single-use plastic packaging market in 2024 due to the increasing demand for spillage-proof, hygienic, and enhanced shelf-life. It protects product packaging against external factors like dust, pollution, moisture, and several others. The growing demand for enhanced shelf life of packaged food and beverages has raised the demand for such single-use plastic packaging. The growing food and beverages industry and the rapidly changing lifestyle of people have influenced the growth of the market.

The pharmaceuticals & healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The growing healthcare sector has influenced the demand for enhanced pharmaceutical packaging. There is a huge investment in this sector for the development of advanced diagnosis, treatment, and medication purposes, which increases the demand for such packaging.

Regional Insights

Rising Demand for Food Packaging in Asia Pacific Promotes Dominance

The Asia Pacific region held the largest share of the single-use plastic packaging market in 2024, due to the rising demand for food packaging services. In countries such as India, China, Japan, South Korea, Thailand, and several other there is a huge demand for food delivery services due to the changing lifestyle of a huge population. The necessity for single-use plastic packaging is growing and will undergo development throughout the forecast period. Plastic has been an important element of the packaging segment, which is essential to customer suitability culture. The durability and versatility of plastic make it a significant choice for several food packaging applications, from ready-made containers to packaged beverage bottles.

Trend of Single-use Plastic Packaging in India

The demand for single-use packaging in India is moving towards dramatic growth because of rigid government regulations, developing consumer awareness, and innovation in sustainable alterations. While ease, the urbanisation and a developing e-commerce market are primarily driving the developed demand for single-use packaging, a rigid encouragement towards a circular economy and the lesser plastic waste are now updating the industry.

The industry for single-use plastic is shifting away from the regular plastics and towards more eco-friendly options made from compostable, biodegradable, and plant-based materials, such as sugarcane pulp, bamboo, and cornstarch. The fast development of this industry continues to drive the urge for single-use packaging, but the companies are heavily discovering sustainable options to align with user demands for convenience and the latest regulations, too.

Trend of Single-use Plastic Packaging in Canada

Canada is finding a rigid trend away from the regular single-use plastic packaging, which is being driven by the federal ban, shifting user preferences, and technological innovations in sustainable alternatives. The shift aims to fight against Canada’s high per-person waste generation and very low plastic recycling costs.

Studies in Canada are being motivated to reduce the use of single-use plastic packaging and are heavily investigating sustainable alternatives. The development of online retail has increased the urge to ship packaging, which encourages the suggestion to seek durable yet environmentally friendly protective solutions.

Europe’s Sustainable Packaging Demand Supports Growth

The Europe region is estimated to grow at the fastest rate in the single-use plastic packaging market during the forecast period. The high utilization of single-use plastic bottles for bottling and packaged drinking water is under analysis. Numerous establishments are working to decrease marine clutter by disparate this training and assembling and eliminating these bottles from diverse water bodies. As a consequence of the extensive disgrace against the usage of single-use plastic packaging, numerous countries in this region have endorsed or planned legislation preventing its usage in several circumstances.

Trend of Single-Use Packaging In Germany

In Germany, the usage of single-use packaging is developing, which is being driven by factors such as e-commerce and a fast-paced lifestyle. Hence, strict German and EU regulations are growing a similar trend towards sustainable alternatives, which has increased the recycling and compulsory reuse options for particular products.

Global Plastics Production & Usage Overview

| Metric |

Value |

Unit |

Year |

| Global plastics production |

402.8 |

Million tonnes |

2022 |

| Share of Europe in global production |

13.6 |

% |

2022 |

| Circular / recycled plastics share in Europe |

20.3 |

% |

2022 |

| Share of recycled content in global plastics output |

9.2 |

% |

2022 |

| Global plastics consumption projection |

881 |

Million tonnes |

2050 |

| Global plastics accumulation expected by 2050 |

4,690 |

Million tonnes |

2050 |

| Global plastics production in 2015 |

379.5 |

Million tonnes |

2015 |

| Share of packaging in total plastics consumption |

41.3 |

% |

2022 |

| Plastics from fossil feedstock |

97.8 |

% |

2022 |

| Global plastics historic growth rate |

8.4 |

% CAGR |

1950-2015 |

This table captures global production and waste statistics for plastics, revealing strong growth over time and the relatively small recycling share. Packaging remains the largest application area, dominating one-third of global plastics usage.

European Single-Use Plastic & Packaging Waste Indicators

| Metric |

Value |

Unit |

Year |

| Plastic packaging waste generated in Europe |

16.38 |

Million tonnes |

2022 |

| Recycling rate of plastic packaging waste |

41.2 |

% |

2022 |

| Per-capita plastic packaging waste |

35.8 |

kg/person |

2022 |

| Total packaging waste generated (all materials) |

79.1 |

Million tonnes |

2023 |

| Per-capita packaging waste (all materials) |

176.5 |

kg/person |

2023 |

| Per-capita plastic packaging waste (updated EU avg) |

35.1 |

kg/person |

2023 |

| Share of plastics in total packaging waste |

20.1 |

% |

2023 |

| Energy recovery share in plastic packaging waste |

34.6 |

% |

2022 |

| Plastics industry turnover (Europe) |

€ 398 |

Billion |

2021 |

| Plastics production in Europe |

57.9 |

Million tonnes |

2022 |

This table summarizes key European packaging waste and circularity data, highlighting per-capita waste generation and recovery performance. It illustrates progress toward EU sustainability directives and remaining gaps in recycling and export dependency.

Trade, Import–Export & Environmental Impact Indicators

| Metric |

Value |

Unit |

Year |

| Export value of HS 3923 plastic packaging goods |

10.6 |

Billion USD |

2023 |

| Recycled material share in global plastic production |

9.2 |

% |

2022 |

| Mismanaged plastic waste globally |

108.3 |

Million tonnes |

2019 |

| Plastic entering oceans annually |

6.3 |

Million tonnes |

2019 |

| CO₂ emissions from plastics value chain (EU) |

189 |

Million tonnes CO₂-eq |

2022 |

| Share of plastics from fossil-based sources |

97.8 |

% |

2022 |

| Global plastics in use stock (to 2050) |

4,690 |

Million tonnes |

2050 |

| Global plastics demand projection |

881 |

Million tonnes |

2050 |

| Global plastic production |

402.8 |

Million tonnes |

2022 |

| China’s share in global plastic production |

31.6 |

% |

2022 |

This trade-focused table shows the commercial scale of packaging plastics, the dominance of virgin feedstock, and environmental leakage levels. It highlights international movement of waste and upcoming sustainability targets for circular content.

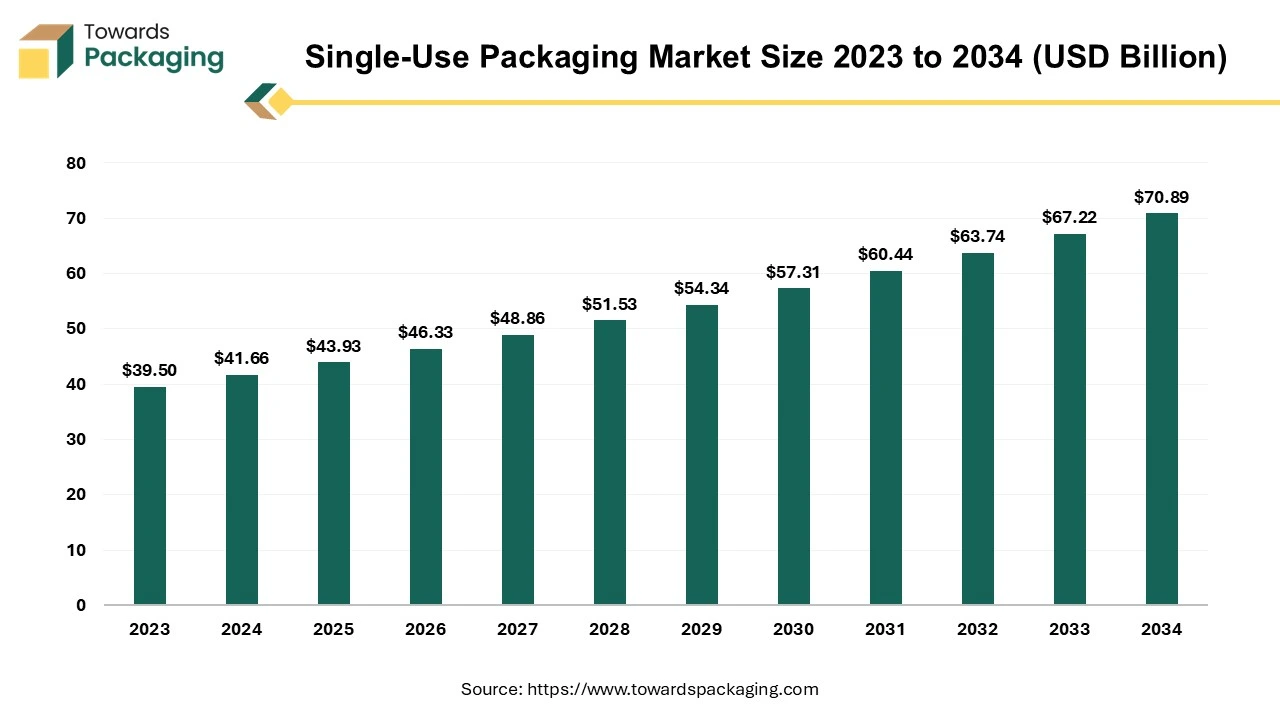

Single-Use Packaging Market Size, Segments and Regional Data (2025-2035)

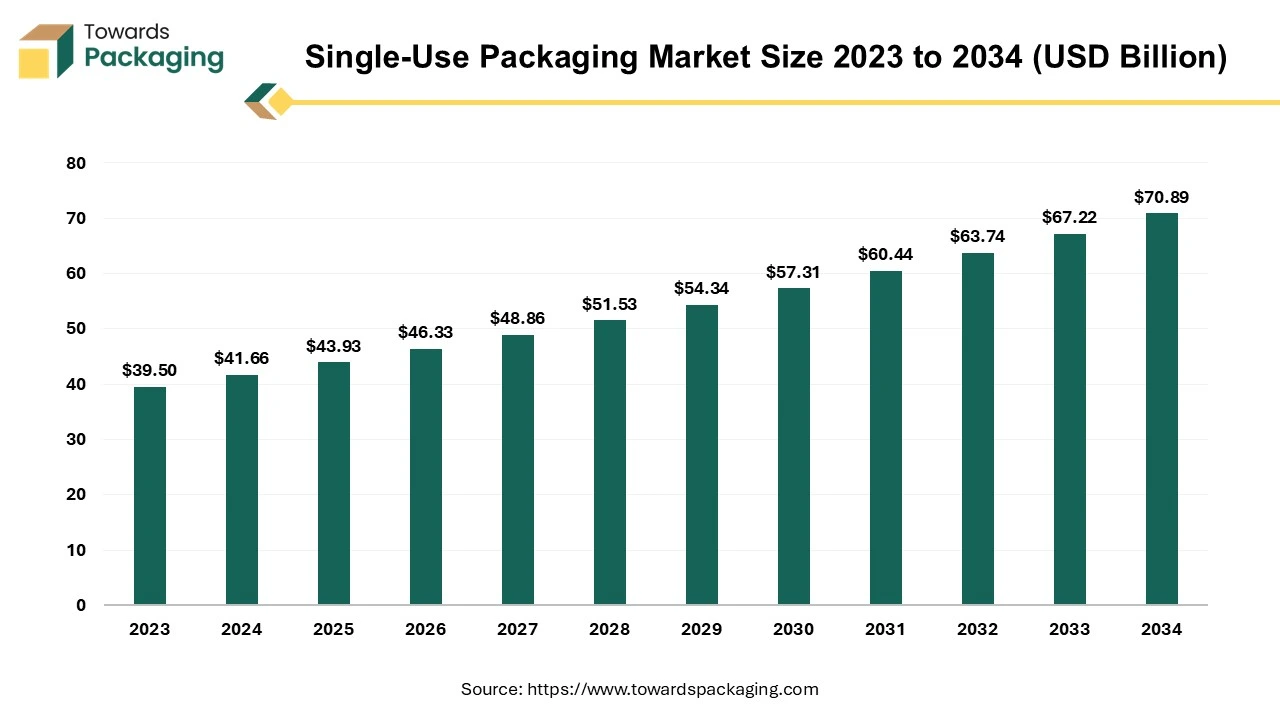

The https://www.towardspackaging.com/insights/single-use-packaging-market-sizing is projected to grow from USD 43.93 billion in 2025 to USD 70.89 billion by 2034, at a CAGR of 5.46%. The market is divided into key segments by material (Plastic, Paper, Glass, and others) and type (Food & Beverage, Pharmaceuticals, Personal Care). The Asia-Pacific region leads with the highest market share, while North America and Europe show steady growth, especially in the healthcare and beverage sectors. Key players include Pactiv LLC, Sealed Air Corporation, and Winpak Limited, with competitive analysis focusing on sustainable practices and packaging innovations.

Key Insights and Strategic Revelations in the Single-Use Packaging Market

- The single-use packaging market is projected to reach USD 70.89 billion by 2034, growing at a CAGR of 5.46% from 2025 to 2034.

- Single-use packaging plays a critical role in healthcare by ensuring product sterility and preventing cross-contamination.

- The environmental impact of single-use plastic packaging is a growing concern, with 90% of plastic waste going unrecycled.

- The demand for single-use packaging is increasing in Asia-Pacific, driven by the rise of e-commerce and fast-food services.

- North America’s single-use packaging market is expanding, especially in the pharmaceutical and beverage industries.

Single-use Pouches Market Insights, Forecast and Competitive Strategies

The single-use pouches market is experiencing rapid expansion, with revenue expected to reach hundreds of millions of dollars between 2025 and 2034. This growth is driven by the increasing demand for lightweight, convenient, and eco-friendly packaging solutions across industries such as food & beverages, pharmaceuticals, and personal care.

The single-use pouches market is expected to experience significant growth during the forecast period. The single-use pouches are designed for one-time use. These pouches are made-up of flexible materials like plastic, paper as well as combination of materials and come with features such as zippers, spouts or tear notches to improve its usability. They are commonly utilized across industries such as food and beverages, pharmaceuticals, cosmetics and household products, where convenience, portability and lightweight packaging are important. Single-use pouches can be utilized for products such as snack packs, sauces, personal care items and pharmaceutical doses. Due to their lightweight nature, they also reduce the transportation costs as well as environmental impact compared to the traditional rigid packaging.

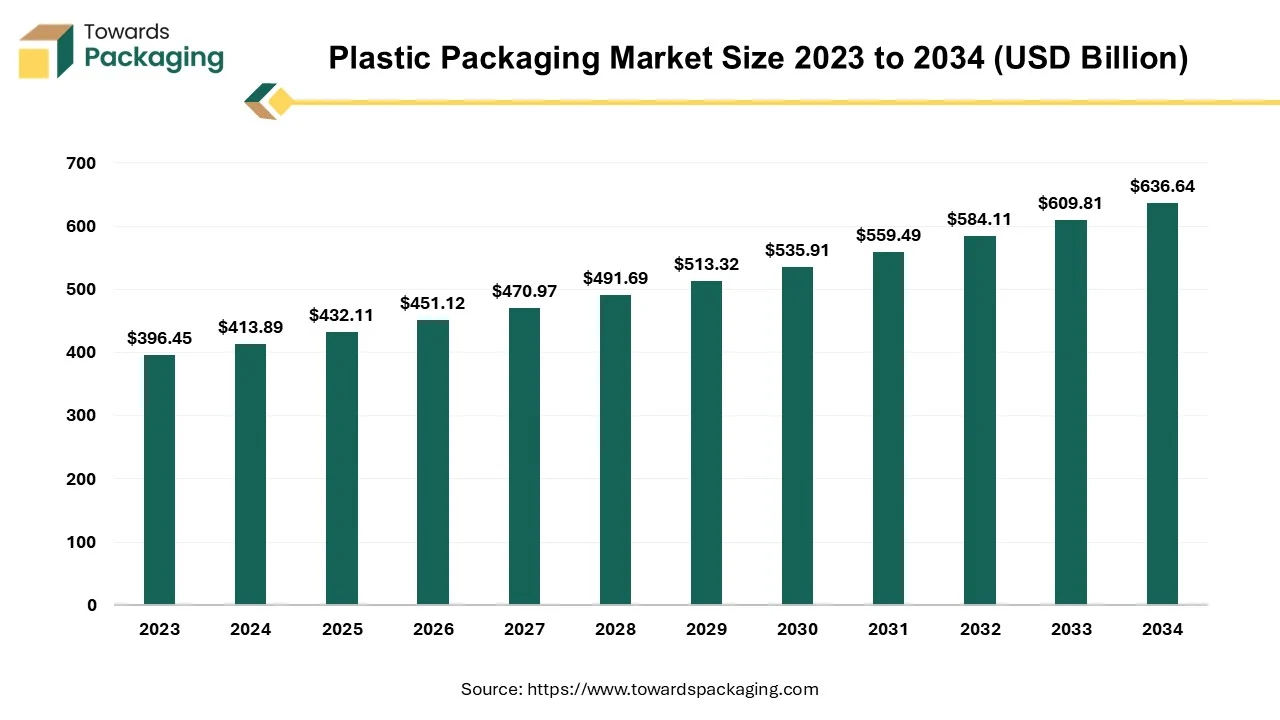

Plastic Packaging Market Size, Growth Drivers, Challenges and Opportunities

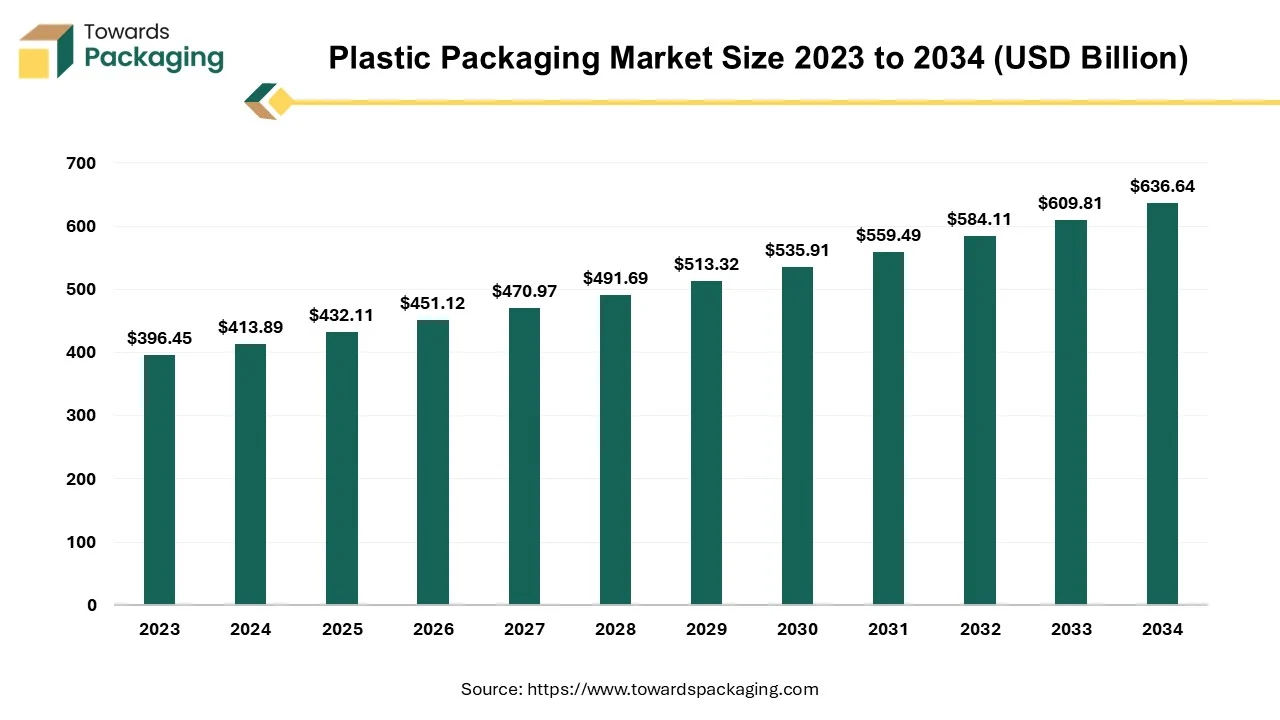

The plastic packaging market is projected to grow from USD 432.11 billion (2025) to USD 636.64 billion (2034) at 4.4% CAGR. Our report covers segment data (materials: PET leading in 2024; products: rigid leading; technologies: extrusion leading; applications: food & beverages leading), regional analysis across NA, EU, APAC, LA, MEA (with APAC dominating 2024 and North America set for strong growth), company profiles, competitive analysis, value chain mapping, trade statistics, and a manufacturers & suppliers database. We also quantify key adjacencies: Flexible Plastic Packaging (USD 205.76B 2025 to USD 319.20B 2034, 5.0% CAGR), Rigid Plastic Packaging (USD 351.69B 2025 to USD 614.65B 2034, 6.4% CAGR), Molded Plastic Packaging (USD 294.7B 2025 to USD 450.55B 2034, 4.83% CAGR), Pharmaceutical Plastic Packaging (USD 62.43B 2025 to USD 110.97B 2034, 6.6% CAGR), Single-Use Plastic Packaging (USD 4.85B 2025 to USD 8.13B 2034, 5.90% CAGR).

Major Key Insights of the Plastic Packaging Market

- Asia Pacific dominated the plastic packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By material, the polyethylene terephthalate (PET) material segment dominated the market with the largest share in 2024.

- By product, the rigid segment registered its dominance over the global plastic packaging market in 2024.

- By technology, the extrusion segment dominated the market with the largest share in 2024.

- By application, the food & beverages segment dominated the plastic packaging market in 2024.

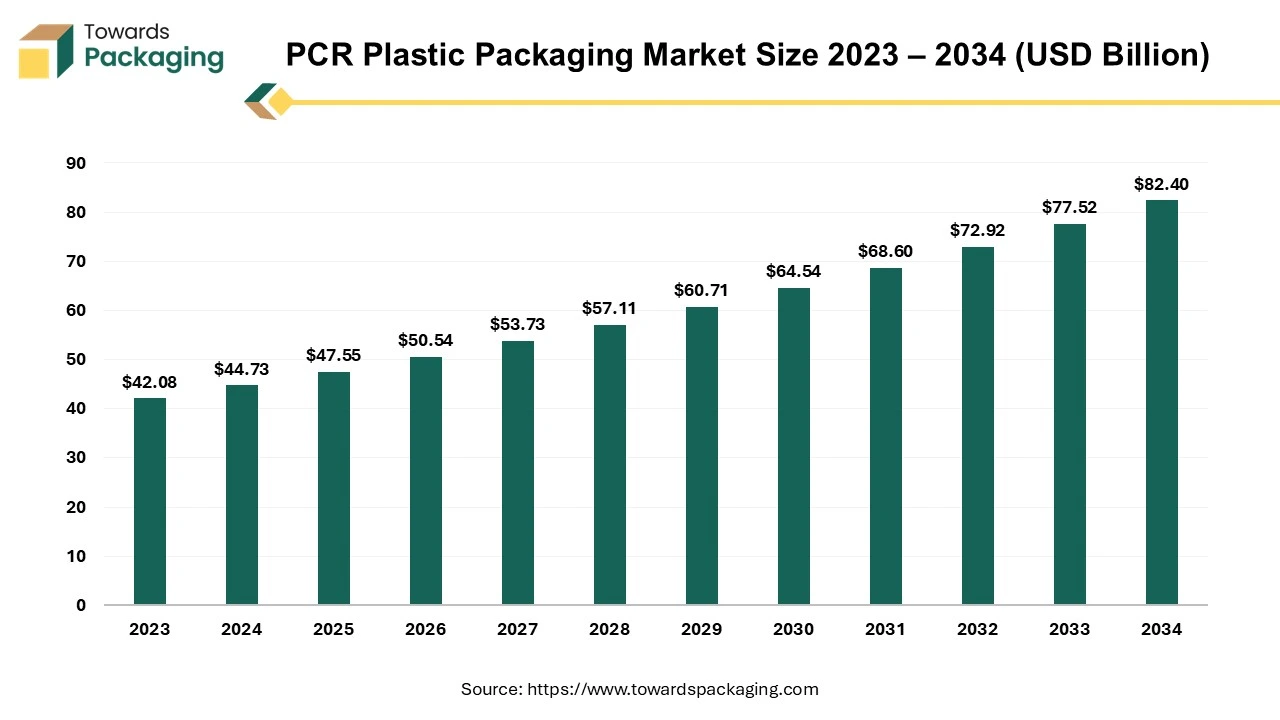

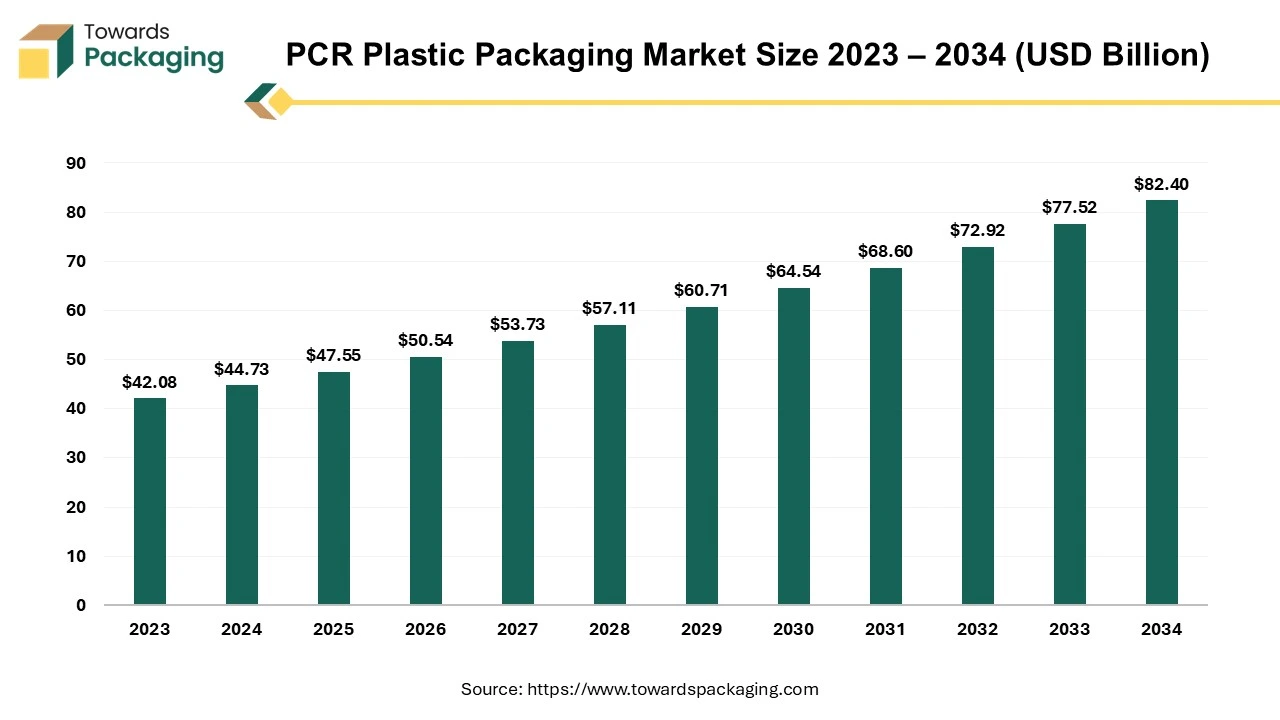

PCR Plastic Packaging Market Size, Share and Growth

The global PCR plastic packaging market is projected to grow from USD 42.08 billion in 2023 to USD 82.40 billion by 2034, expanding at a CAGR of 6.3% from 2024 to 2034. This report covers comprehensive market size data, segment-wise breakdown by material (PET, PE, PP, PVC), product type (bottles, pouches, trays, etc.), and end-use sectors (food & beverage, pharmaceuticals, cosmetics). The competitive analysis includes leading companies such as Transcontinental Inc., Amcor, and Mondi, and provides insights into global trade, supplier data, and market trends in regions like North America, Europe, Asia Pacific, LAMEA, and more.

Report Highlights: Important Revelations

- Essential contribution of PCR plastic packaging to plastic sustainability in Europe.

- North America's impact on PCR plastic packaging.

- Pet's significance in meeting growing demand and enhancing recycling capabilities.

- Leadership in PCR plastic bottles at the forefront of packaging.

- Rising PCR plastic packaging's influence in the food and beverage sector.

Top Companies in the Single-Use Plastic Packaging Market

Latest Announcements by Industry Leaders

Professor Linda Godfrey, CSIR principal researcher, expressed, “Skubu is a great demonstration initiative to show how circular economy principles can be implemented through collaboration. The intention is to focus on the national system of innovation, which looks at how a country creates and applies new ideas to improve technology and grow its economy. This includes bringing universities and science councils closer to the private sector to help de-risk and scale circular interventions.” (Source: CSIR)

New Advancements in the Market

- In November 2025, Zydus Lifesciences, a top invention-driven life science organization, and SIg, which is a forefront packaging solutions server, have entered into a partnership to crucially package the liquid cough and the cold medication in single-serve spouted pouches that have tethered spout solution SIg Strawcap 30 Linked and the SIG Motion Servo named the 3.2 filling technology.

- In June 2025, the launch of Skubu marks a significant step in integrating circular economy principles into retail, demonstrating how innovation and sustainable business practices can benefit communities. (Source: CSIR)

- In April 2024, Kao Accelerates Activities to Achieve Plastic Packaging Net Zero Waste by 2040 and Negative Waste by 2050. (Source: Kao Corporation)

Single-Use Plastic Packaging Market Segments

By Material

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Expanded Polystyrene (EPS)

- Polyvinyl Chloride (PVC)

- Bio-based plastics (e.g., PLA)

- Other Material Types

By Product Type

- Bags & Pouches

- Bottles & Jars

- Clamshells

- Trays, Cups, & Lids

- Films & Wraps

- Sachets

- Other Product Types

By End-Use Industry

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Consumer Goods

- Industrial Manufacturing

- Retail & E-commerce

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa