Snack Packaging Machine Market Size, Demand and Trends Analysis

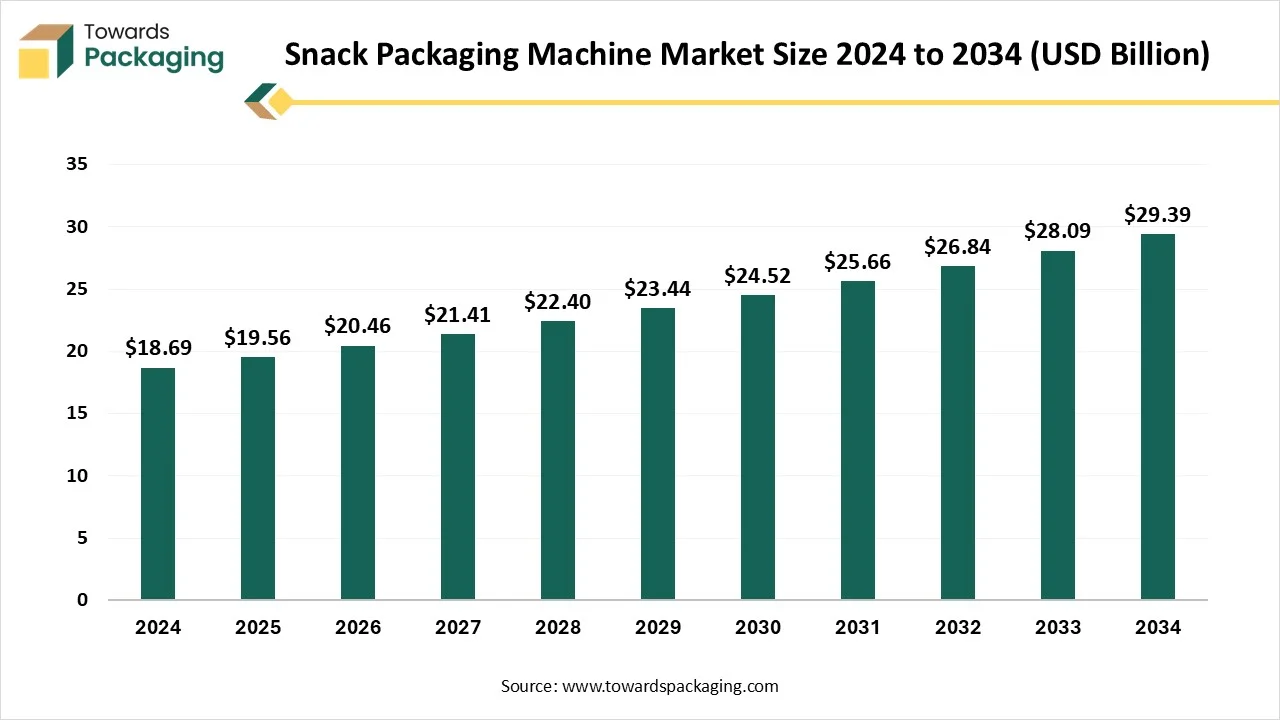

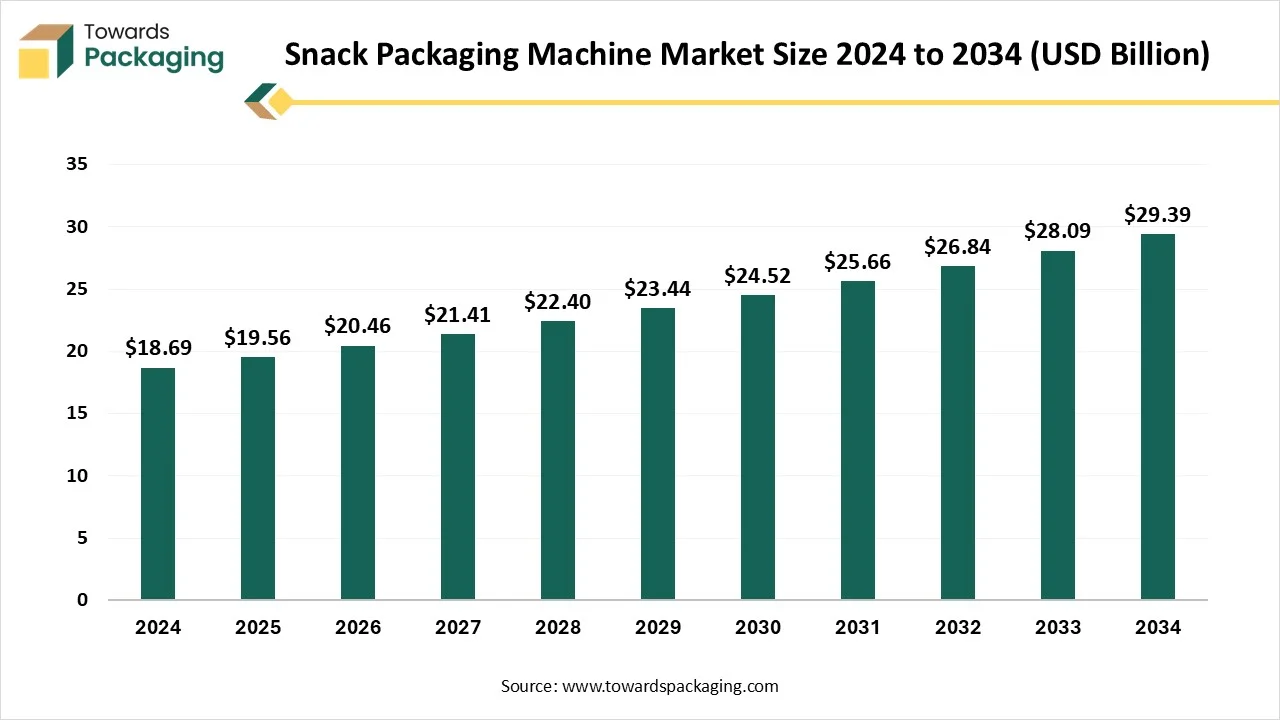

The snack packaging machine market is projected to grow from USD 20.46 billion in 2026 to USD 30.75 billion by 2035, registering a CAGR of 4.63%. Our report covers complete market size evaluation, segment-wise analysis (machine type, automation level, snack category, end-user industry), and regional breakdown across NA, EU, APAC, LA, and MEA. It also provides detailed insights into leading companies, competitive strategies, technological advancements, value chain structure, raw material sourcing, manufacturing hubs, and supplier networks, along with global trade data illustrating import–export movement of packaging machinery.

Key Takeaways

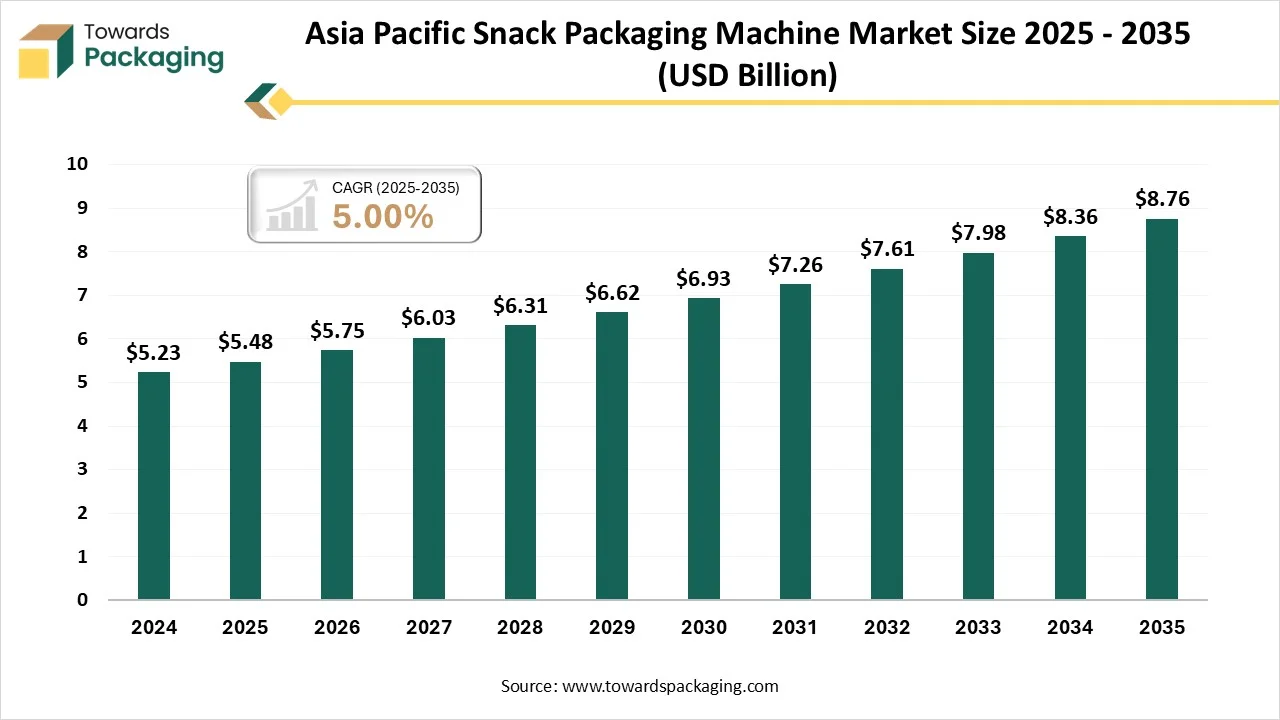

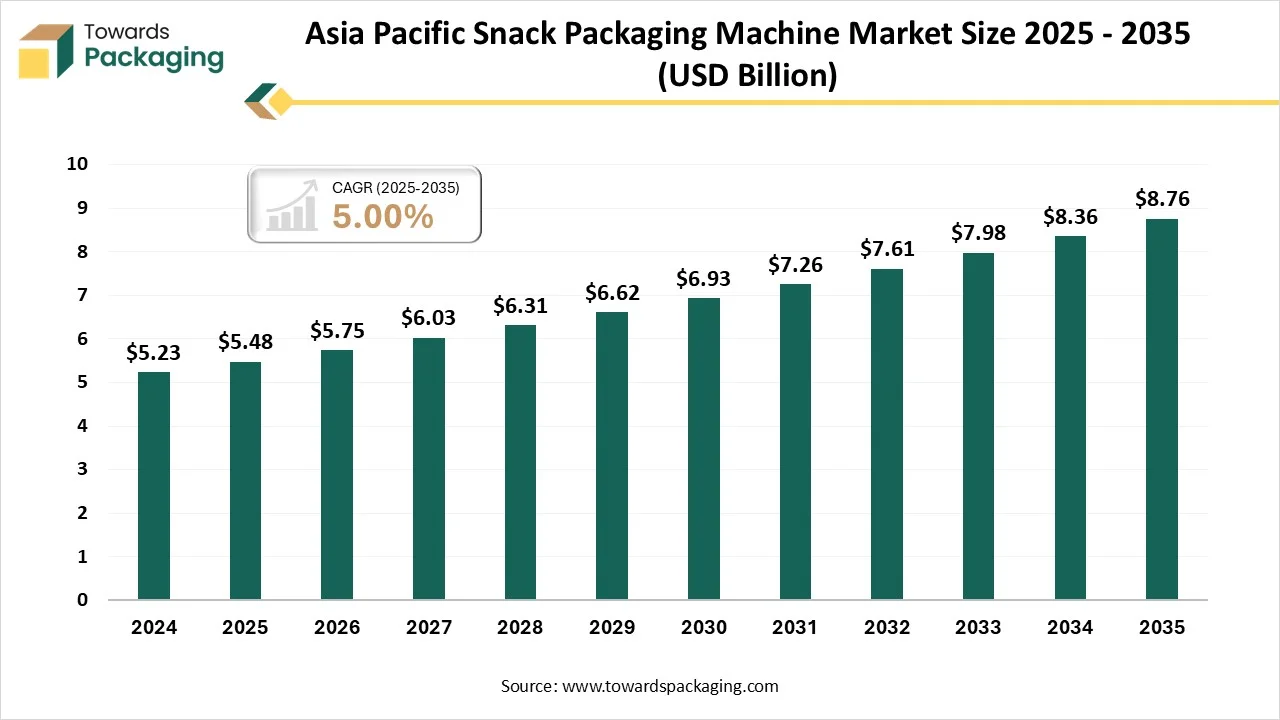

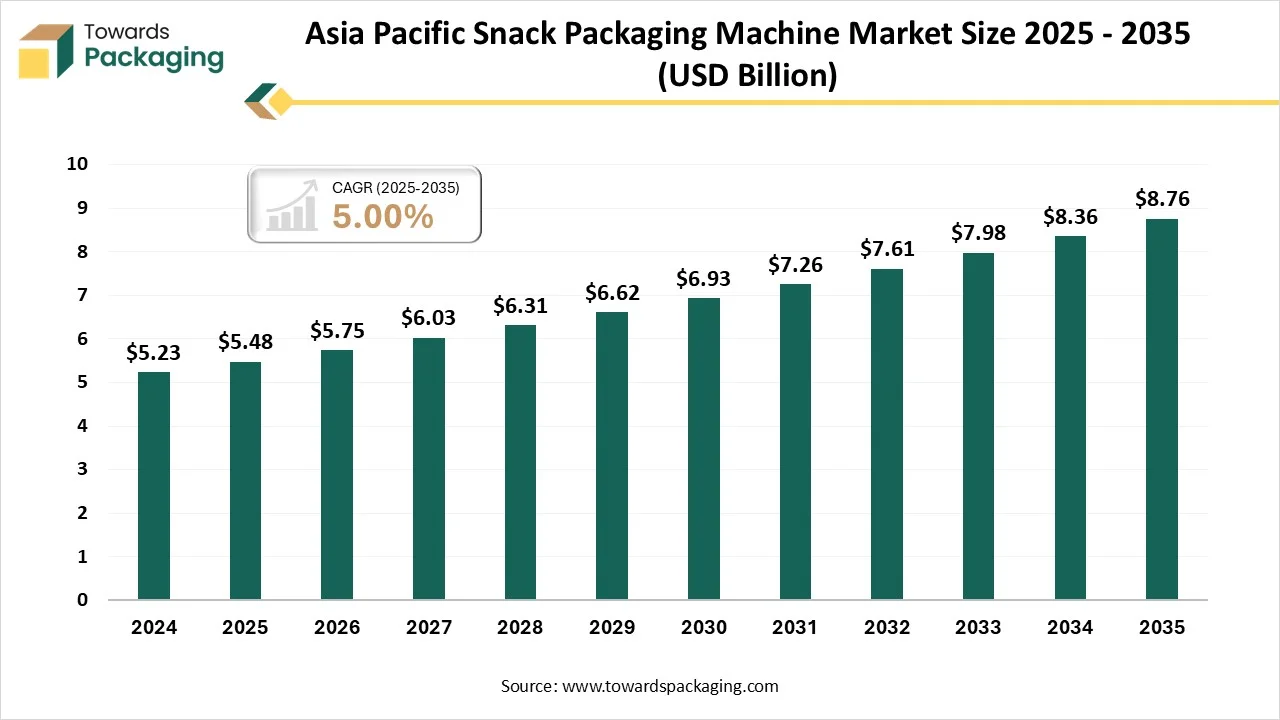

- Asia Pacific led the snack packaging machine market with the highest share in 2024.

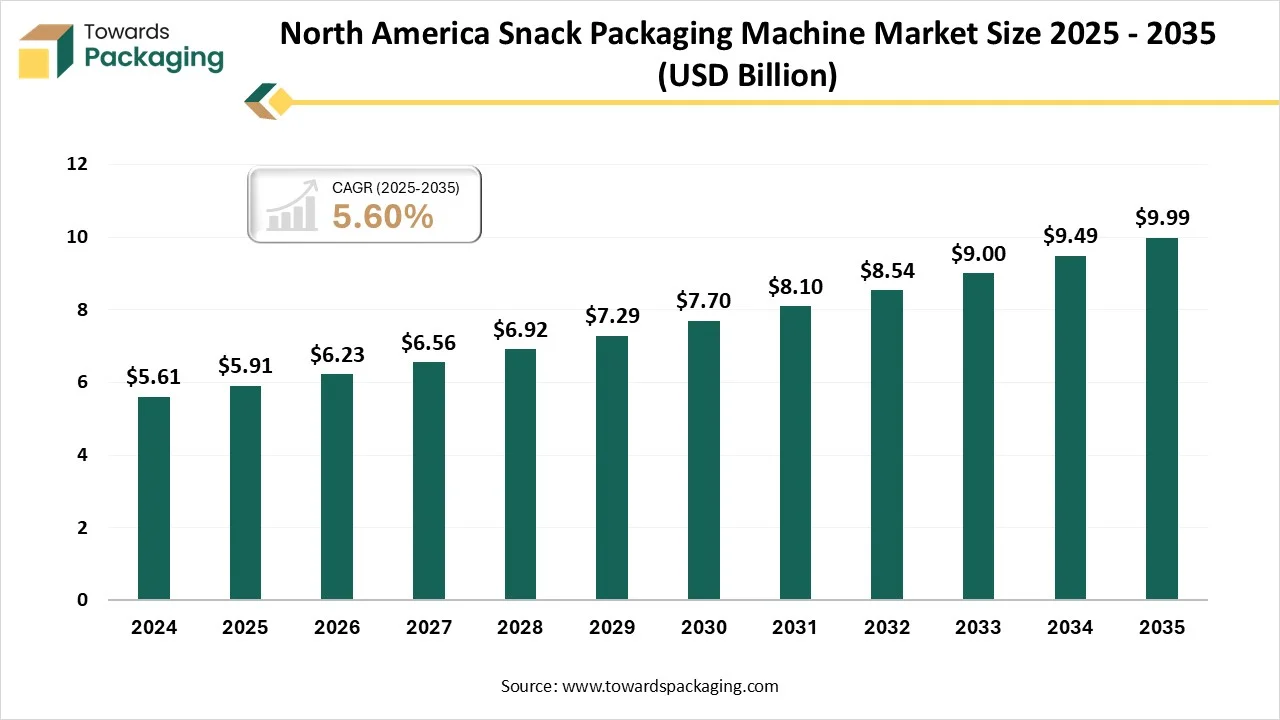

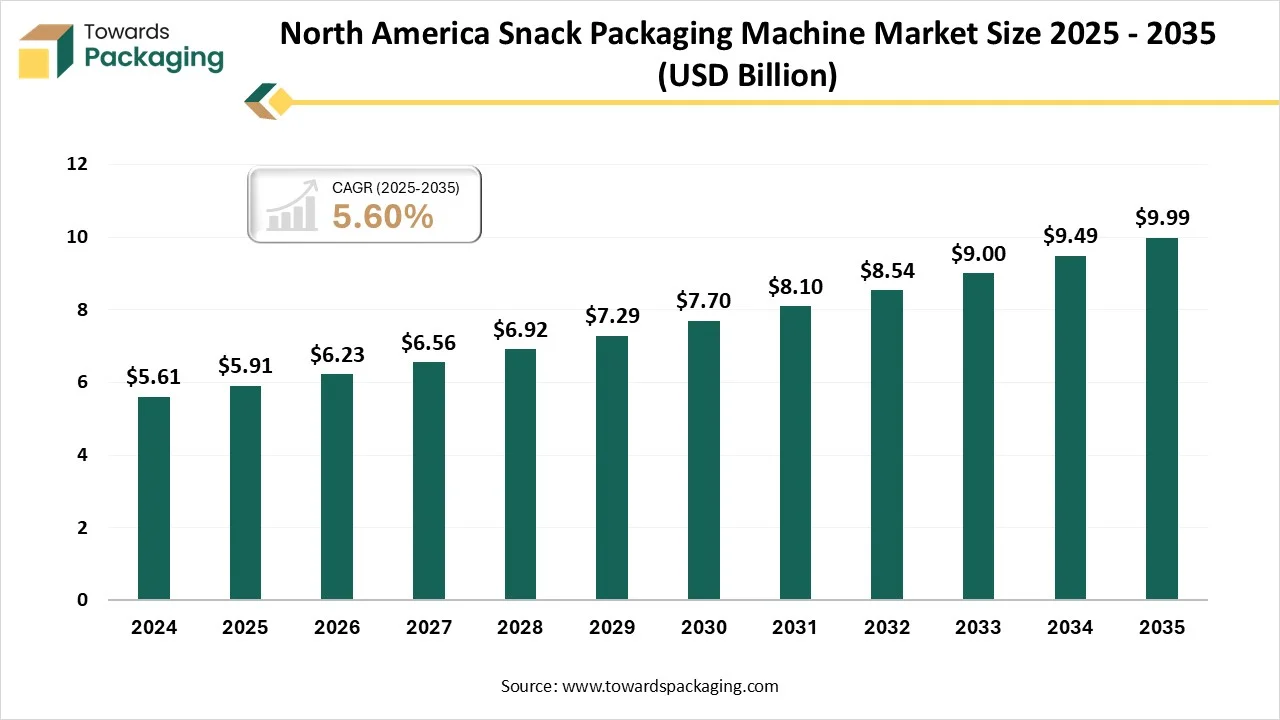

- By region, North America is expected to witness the highest CAGR during the forecast period.

- By material, plastic dominated the snack packaging machine market.

- By type, the form-fill-seal machine market share in 2024.

- By packaging type, flexible packaging dominated the snacks packaging machine market.

- By operations, the automatic segment dominated the snacks packaging machine

- By application, the Savory snacks segment dominated the market share in 2024.

Snack Packaging Machine Market Overview

The snacks packaging machine market is driven by the rising demand for packaged food items, the continuous technological improvements, and enhanced food preservation techniques. Increasing focus on hygienic food and healthy snacks is the key driving factor for the snacks market worldwide, which is creating demand for snacks packaging machines to fulfill the increasing demand for effective and high-quality packaging.

There are global market players in the snacks packaging industry as well as domestic players who are also playing a crucial role. they both have their own equipment requirements; high-end systems are prioritized by the big brands which has automation and AI-driven IoT integrated Systems. On the other side, domestic suppliers are preferring small-size, cost-effective, performance-centric, and low-cost machines, which might be automatic to semi semi-automatic, based on the cost and the requirement.

Snack Packaging Machine Market Trends

- Technological improvements have enabled advancements in automation, which is making the packaging machines more effective, increasing the accuracy in the product packaging, reducing the labor cost, and increasing the operation speed.

- Integration of smart packaging technologies is the snacks packaging is the essential

AI Integration in Snack Packaging Machine Market

Integration of artificial intelligence has completely transformed the packaging industry by increasing efficiency, accuracy, speed, and reducing labor costs. The defect detection systems developed using AI are so accurate that they have brought the defective pieces shipped to almost zero. Which is helping to create a better consumer experience and saving a huge cost of returned defective packages.

AI-driven optimized designs have saved a lot of material wastage, which also saves transportation costs by consuming less space. The AI synergy with smart packaging solutions, such as QR codes and RFID, is creating consumer interactivity and helping in the increase of brand loyalty among consumers.

Snack Packaging Machine Market Dynamics

Driver

Growing Demand for Packaged Snacks Globally

Globally, the demand for packaged food has increased a lot in recent times. people have developed an inclination towards packaged snacks and adopted them as a part of their lives. Packaged snacks are a very convenient option for on-the-go consumption. The fast-paced life has generated the requirement for packaged snack items. one of the key reasons behind the increasing preference for packaged snacks is the hygienic concerns. After COVID-19, global hygiene awareness has increased a lot. People have become more conscious about the hygienic concerns, and they are avoiding unhealthy and unhygienic open food. Instead of this, they are preferring healthy, hygienic options, which are snack packages. This factor has generated a huge demand in the snack packaging machine market for effective and reliable packaging solutions.

Restraint

Operational Complexity and Skilled Labor Shortage

Modern packaging machines often involve complex operations that necessitate skilled technicians for setup, maintenance, and troubleshooting. The scarcity of such skilled labor can hinder the effective utilization of advanced machinery.

Fluctuating Raw Material Prices

The packaging industry relies on various raw materials like plastics, metals, and films. Volatility in the prices of these materials can increase manufacturing costs for packaging machines, affecting profitability and investment decisions.

Opportunity

Industry 4.0 Systems with Integration of IoT and AI

Industry 4.0 has enabled highly advanced and technologically superior snack packaging machines with automated operations offering high precision and enhanced performance. The integrated intelligent systems are capable of monitoring the machine performance on a real-time basis and provide notifications regarding the timely maintenance to ensure smooth and uninterrupted operational availability of the machine.

Segmental Insights

Plastic Segment Led the Market in 2024

Plastics dominated the snacks packaging machine market because it is a highly available material with high durability, high strength, moisture resistance properties, lightweight, and cost effectiveness, which makes it one of the ideal materials for snacks packaging. Considering the trends of circular economy is promoting the usage of plastic material in overall food packaging.

Form Fill Seal (FFS) Dominated the Snack Packaging Machine Market

The form fill seal (FFS) segment accounted for a considerable share of the snack packaging machine market in 2024. By reducing labor requirements and minimizing packaging material waste, form fill seal (FFS) machines lower operational costs in the long run. FFS machines can handle various snack types (chips, puffs, nuts, etc.) and packaging styles (pillow pouches, gusseted bags, sachets), making them highly adaptable.

These machines typically use roll stock film, which is cheaper and generates less waste compared to pre-made bags, reducing packaging costs. FFS systems are generally compact and can be integrated into existing production lines, saving space in manufacturing facilities. The automated process minimizes human contact with food products, helping meet food safety and hygiene regulations more easily.

Regional Insights

North America’s Expansive Snack Food Industry to Promote Dominance

Changing lifestyle in the North American region has changed the eating habits of the general population. People are more inclined towards packaged snacks for on-the-go consumption. People have. One of the key reasons for packaged snacks is that they are more hygienic compared to any other street food item, and very convenient to carry while travelling. These are the primary driving factors for the snack packaging machine market in the North American region.

Various fast-food brands are also using the snacks packaging machines on a large scale to provide snack packs option in parallel with their main course, which is creating huge demand for the snack packaging machines in this particular segment. North America, particularly the U.S., boasts a strong food processing sector encompassing various snack categories such as chips, confectionery, and bakery products. This diversity fuels the demand for flexible and efficient packaging solutions.

U.S. Snack Packaging Market Trends

The U.S. is one of the largest consumers and producers of snack foods (chips, popcorn, protein bars, etc.), which creates consistent demand for advanced packaging machines. Major snack brands (like PepsiCo, Mondelez, and Kellogg’s) invest heavily in high-efficiency packaging technology. The U.S. leads in adopting automation, robotics, and Industry 4.0 technologies in packaging machinery. American companies invest in smart packaging systems (IoT-enabled machines, AI-driven operations) that increase productivity and reduce downtime.

U.S.-based machine manufacturers consistently invest in research and development, driving innovation in packaging speed, flexibility, and sustainability. This includes advancements in handling recyclable, compostable, and lightweight packaging materials. The U.S. also has specialized training institutions and technical workforce for operating and maintaining high-tech machinery. Strict U.S. FDA and USDA regulations drive the need for hygienic, reliable, and automated packaging systems that ensure food safety boosting demand for compliant machines.

Major global packaging machine manufacturers such as Barry-Wehmiller, ProMach, and Matrix Packaging are based in the U.S., enhancing its dominance and export capacity. The U.S. snack market demands custom packaging designs, single-serve sizes, and resealable features, which promotes the use of versatile, high-tech machinery.

Asia-Pacific’s Robust Manufacturing Facility to Support Fastest Growth

Asia Pacific market is having huge packaged food demands, particularly in packaged snacks due to a huge population and growing consumption of packaged foods in the urban areas and various other regions various other areas also particularly in the Indian market, various local snacks are highly demanded. In Indian market, there are all types of brands present in the snacks packaging. multinational companies with big brands and mega factories as well as there is a huge contribution of domestic snacks suppliers who require small-sized sophisticated automated systems for snacks packaging, which will provide a decent shelf life and protection at a reasonable cost. The rise of e-commerce and food delivery platforms has increased the need for efficient and reliable packaging solutions that ensure product integrity during transit. This trend is boosting the demand for advanced packaging machinery.

China Snack Packaging Machine Market Trends

China's expansive food and beverage industry, fuelled by a population exceeding 1.4 billion, drives significant demand for packaging machinery. The sector's growth necessitates high-quality, efficient packaging solutions. The Chinese government has implemented policies to reduce plastic waste and promote sustainable packaging practices. These regulations encourage manufacturers to adopt advanced machinery capable of producing eco-friendly packaging. China is investing heavily in smart manufacturing, integrating AI, IoT, and automation into packaging machinery.

The expansion of SMEs in China, supported by favourable government policies, contributes to increased demand for cost-effective and efficient packaging machinery. These enterprises seek modern solutions to scale their operations. East China, encompassing provinces such as Jiangsu, Zhejiang, and the municipality of Shanghai, serves as a manufacturing and innovation hub for packaging machinery. East China benefits from a well-educated workforce and proximity to research institutions, facilitating technological advancements in packaging solutions.

Europe’s Huge Consumer Base & Sustainability Initiatives to Project Steady Growth

Europe region is seen to grow at a notable rate in the foreseeable future. The European Union has implemented comprehensive policies aimed at reducing packaging waste and promoting recyclability. Initiatives such as the Packaging and Packaging Waste Regulation (PPWR) set ambitious targets, including a 15% per capita reduction in packaging waste by 2040 and a mandate for all packaging to be recyclable by 2030.

These regulations compel manufacturers to adopt advanced packaging machinery capable of handling sustainable materials. Europe, particularly countries like Germany, Italy, and France, is at the forefront of integrating advanced technologies into packaging machinery. The adoption of automation, robotics, and artificial intelligence enhances production efficiency, reduces labor costs, and ensures consistent product quality. These innovations are crucial for meeting the high standards of the European market.

Snack Packaging Machine Market Key Players

- Aetna Group

- CHLB Pack

- Coesia Group

- Fuji Machinery

- GEA Group

- IMA Group

- Ishida

- Krones

- Marchesini Group

- MULTIVAC Group

- Nichrome Packaging Solutions

- PAC Machinery Group

- Sidel

- Syntegon Technology

- Tetra Pak

Latest Announcements by Snack Packaging Machine Industry Leaders

- According to Dominik Eberhard, team leader for Multivac thermoforming packaging machines, the F 286 is specifically designed for smaller and medium-sized enterprises who wish to enter the thermoforming packaging market for the first time or, alternatively, to pack smaller batch sizes more flexibly. The machine is also made for processors, who now use revolving filling and sealing machines to package their goods in film pouches. They can increase staff productivity and save expensive pouch expenditures by switching to thermoformed packs.

New Advancements in Snack Packaging Machine Industry

- In May 2025, ULMA Packaging UK, leading packaging machinery manufacturer, revealed the launch of the FM 400 horizontal flow wrap packaging machine, which is designed to satisfy the requirements of high-speed Modified Atmosphere Packaging (MAP) applications in the fresh food industry. Setting a new industry standard for performance in perishable food packaging, the FM 400 was created with durability, efficiency, and hygiene in mind. Using a Long-Dwell sealing head, the FM 400 combines speed and accuracy to produce up to 150 packs each minute. The preservation of product integrity and the extension of shelf life through MAP depend on this cutting-edge orbital movement technology, which guarantees hermetically sealed packaging at high speed.

- In February 2025, TIPA, a world pioneer in the development of compostable packaging, is introducing a cutting-edge metallized high-barrier film for home composting. This solution offers improved performance and durability in a biodegradable form, addressing important issues in environmentally friendly packaging for chips and salty snacks. The global market for sustainable snack packaging is expected to expand at a rate of more than 5% over the next five years, so its introduction comes as demand for the product is rising.

Snack Packaging Machine Market Segments

By Material

- Plastic

- Paper & paperboard

- Metal

- Others

By Type

- Form-fill-seal (FFS) machines

- Flow wrapping machines

- Vacuum packaging machines

- Cartoning machines

- Others

By Packaging Type

By Operation

By Application

- Bakery products

- Confectionery

- Savory snacks

- Nuts & dried fruits

- Others

By Distribution Channel

By Region Covered

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- South Africa

- Middle East and Africa (MEA)