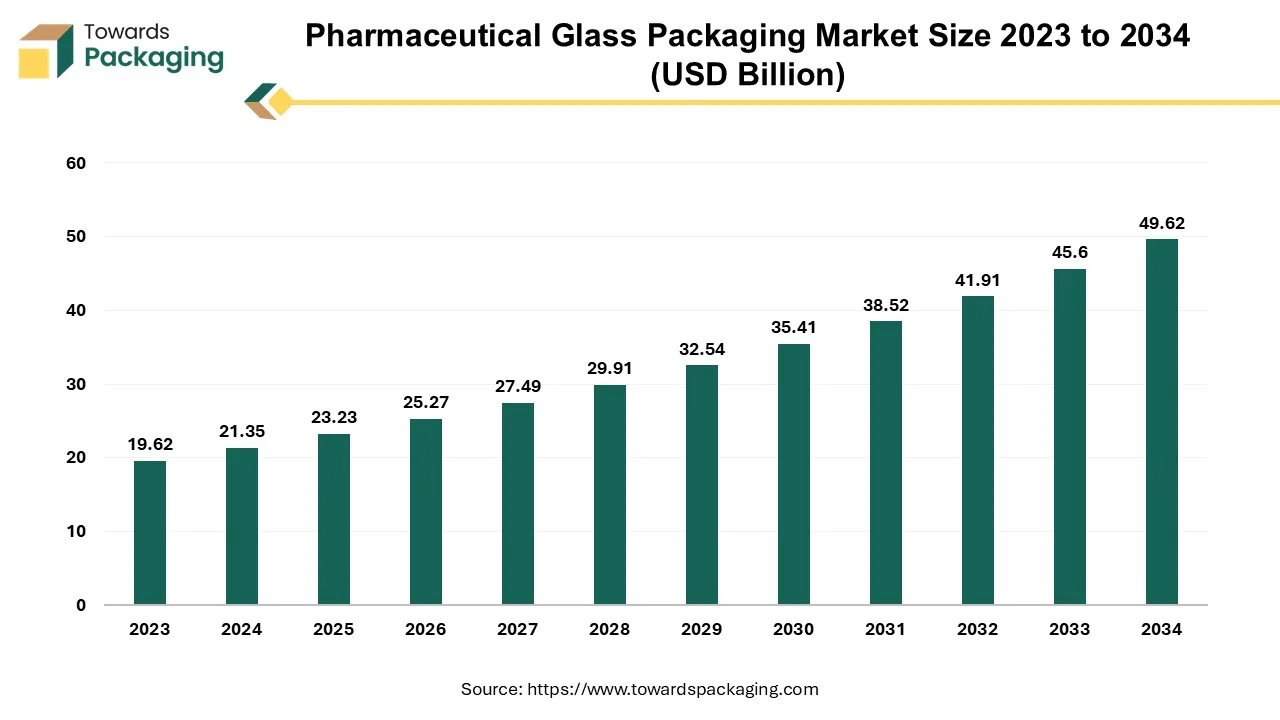

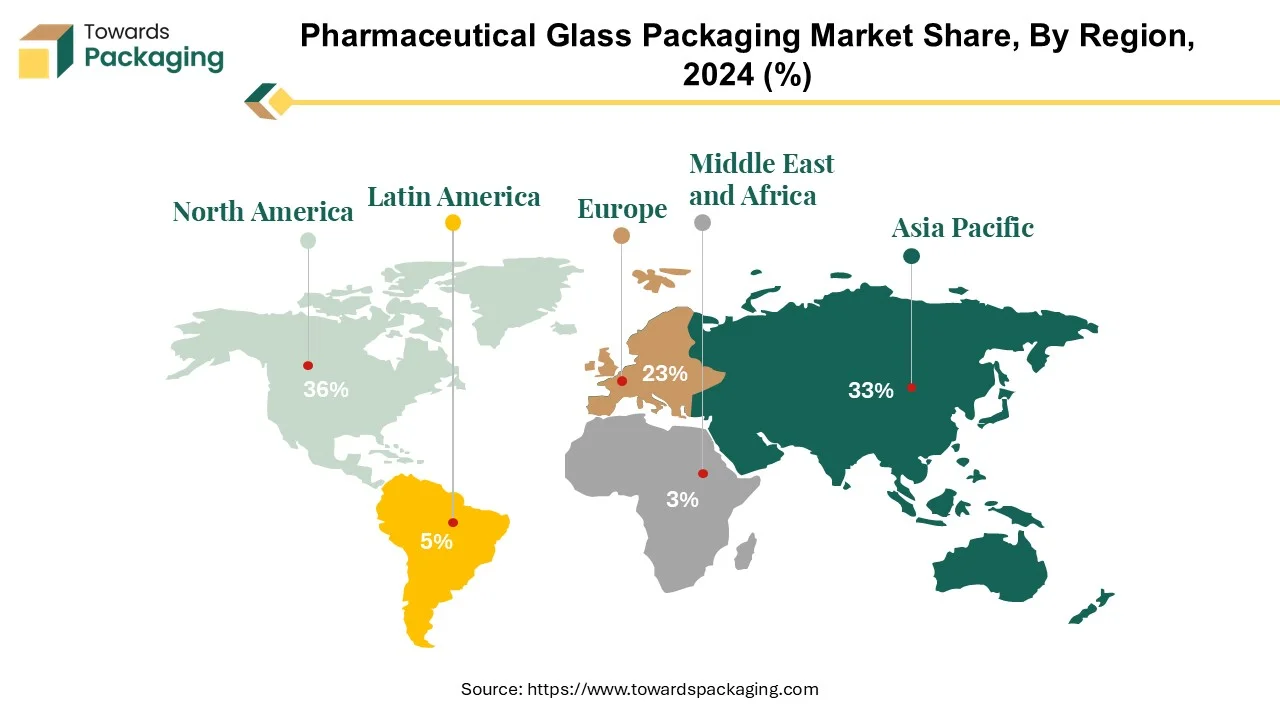

The pharmaceutical glass packaging market is forecasted to expand from USD 25.27 billion in 2026 to USD 53.99 billion by 2035, growing at a CAGR of 8.8% from 2026 to 2035. The report provides detailed segmentation by packaging type (vials, bottles, ampoules, syringes, cartridges), drug type (generic, biologic, branded), and distribution channels (pharmacies, hospitals, clinics, wholesalers, distributors). The regional analysis spans North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Glass has long been the main material used in the pharmaceutical packaging industry because of its remarkable qualities. Glass is a great material to store drugs in solid, liquid, injectable, or reconstitution form because of its chemical stability and inertness. The medications' purity and integrity are guaranteed to last due to its non-reactive nature, even in the presence of other compounds or chemicals. Glass also has a strong resilience to temperature changes, which is important in the pharmaceutical industry because pharmaceutical items frequently need certain storage conditions. This resilience is especially useful for preserving the integrity of the packaging during procedures like sterilisation, freezing, or freeze-drying.

Amber-coloured pharmaceutical glass can be developed to reduce light transmission, which makes it appropriate for pharmaceuticals that are sensitive to light. Packaging businesses usually buy glass tubes and use them to make the finished product. When it comes to make these tubes into vials, heat processing is applied, which entails heating, cutting, and shaping the vials' shoulders, mouths, and bases. The vials then go through an annealing furnace, which lowers the stress created during the moulding process.

Glass vials with tubular shapes that are thin, transparent, and have a consistent surface are especially well-suited for freeze-drying processes. A increasing trend in pharmaceutical packaging is also the use of recycled glass, with speciality goods meeting the needs of particular types of glass needed for pharmaceutical applications. To complete the material's lifecycle, recycling entails using chemical and mechanical procedures to recreate the glass powder. In parallel, efforts are being made to create low-emission furnaces with innovative technologies in an attempt to reduce the impact that glass manufacture has on the environment.

Glass is still widely used in pharmaceutical packaging because of its natural qualities of chemical stability, temperature resistance, and inertness. The glass sector is seeing improvements in environmental sustainability and recycling techniques, which ensures glass's continuous existence as the material of choice for pharmaceutical packaging.

For Instance,

The pharmaceutical glass packaging market in North America is expanding significantly due to a number of factors, including regulatory requirements, growing demand for pharmaceutical products, and technical improvements. The two main nations fostering this expansion in the area are the United States and Canada.

The United States' pharmaceutical glass packaging market is expanding due to a number of causes, including the ageing population, rising healthcare costs, and the incidence of chronic diseases. Pharmaceutical businesses package a wide range of pharmaceutical items in glass containers, such as injectable drugs, oral solid pills, liquid formulations, and biologics." Because of its chemical stability, inert qualities, and ability to maintain medication potency for extended periods of time, glass is preferred. This has caused pharmaceutical companies in the US to gradually switch to glass packaging, with a focus on patient safety and product integrity.

The Canadian pharmaceutical glass packaging sector is growing due to similar considerations. Strict regulatory requirements that guarantee the safety and quality of medicines define the nation's pharmaceutical sector. Because it can prevent contamination, preserve product sterility, and safeguard the effectiveness of medications, glass packaging is recommended. Moreover, the growing demand for biologics, customised drugs, and specialty pharmaceuticals is propelling the adoption of glass packaging solutions tailored to particular formulations and delivery modalities.

Pharmaceutical glass packaging finds application outside traditional medicine methods of distribution in North America, the pharmaceutical industry's top-performing region. The packaging of diagnostics, laboratory reagents, and biopharmaceuticals is also included in this industry. Developments in technology within the glass manufacturing industry have enabled the production of novel packaging solutions, such as ampoules, cartridges, vials, and prefillable syringes, which cater to the evolving needs of the pharmaceutical business.

Future growth in North America's pharmaceutical glass packaging market is anticipated due to factors like increased healthcare expenses, advancements in drug delivery technology, and a focus on patient-centred care. It is expected that the region would maintain its prominent position in the worldwide pharmaceutical glass packaging industry with additional improvements and expenditures in research and development.

For Instance,

The pharmaceutical glass packaging market in Asia Pacific is growing at a fast pace owing to some significant factors. In China, India, Japan, South Korea and Australia, the pharmaceutical industries are increasing which result into high demand of glass packaging solutions.

China being the biggest exporter of glasses and glassware’s has its application everywhere. China and India, two of the largest pharmaceutical markets in the region are experiencing rapid increase in both drug production and consumption. In 2022, India exported glass worth $329.68 million to US. Several forces drive the need for pharmaceuticals made from glass in these countries such as population growth, rising healthcare costs and government efforts to improve health facilities. Pharmaceutical products including injectables, vaccines biologics and oral drugs use glass packaging.

For Instance,

Japan’s high-end pharmaceutical packaging solutions are highly sought after due to its burgeoning medical industry as well as an aging citizenry. Combined with Japan’s $235.56 billion-worth drug markets is that of China. Glass packaging is better for preserving medication stability and integrity; this especially it applies to light-sensitive formulas that are delicate.

The rapid growth of the Asia-Pacific pharmaceutical glass packaging market is caused by factors such as pharmaceutical manufacturing operations, increasing demand for specialty pharmaceuticals and expanding healthcare infrastructure. The region is projected to be a significant development driver for the global pharmaceutical glass packaging market in light of continued expenditure on pharmaceuticals and healthcare.

For Instance,

Amber glass bottles serve as an eco-friendly alternative to plastic containers for cleaning products. Made by melting iron, sulfur, and carbon together, this process gives amber glass its distinctive dark color, which effectively shields its contents from light.

The concentration of leading biopharmaceutical companies in the US, including Johnson & Johnson, Pfizer, Merck & Co., and Eli Lilly and Company, has spurred a growing demand for amber glass. These companies use it to package medicines, providing crucial UV protection. Amber glass is also used in the production of injection vials, bottles, cartridges, and ampoules.

Pharmaceutical glass vials are available in different sizes and designs, suitable for different pharmaceutical uses including storing liquids, powders or capsules. These bottles can be made from either amber or clear glass. Clear glass vials perform well for many medications because they allow for high UV penetration; on the other hand, when it comes to light sensitive drugs such as those that undergo degradation by exposure, amber glass vial is the preferable choice. These glasses absorb the higher-energy region of the visible spectrum thereby minimizing damage from light which slows down the decomposition of drugs recommended.

Glass vials used in pharmaceuticals are very versatile with several compositions and storage requirements. These containers ensure secure packing of medicines whether they come in form of liquids, powders or pellets. Therefore, there is no need to worry about searching for the best option since these products have a wide range of sizes and shapes making them more efficient at utilizing space and less wasteful.

The choice between clear and amber glass vials has a bearing on the stability as well as efficacy of drugs throughout their shelf life. More security is provided by amber bottles.

For Instance,

Generic drugs are pharmaceuticals sold under their chemical or generic name even if they are bioequivalent to the brand name medication. Some of these pharmaceuticals can be manufactured and marketed at a lower cost by some pharmaceutical companies because they are produced after the patent exclusivity of the original brand-name medication has expired. Glass packaging is frequently utilized in the pharmaceutical industry for generic medications due to many reasons.

The glass packaging ensures generic drugs’ safety and integrity over their shelf life by acting as an excellent barrier against contamination and degradation. It prevents interactions between drugs with its inert nature hence, the potency of the medicine is preserved. The glass container as well protects against light, air and moisture that may ultimately damage some drugs.

A variety of therapeutic classes including cardiovascular, anti-infective, central nervous system, and respiratory treatments use glass vials, ampoules or bottles to package generics in. To this effect, oral medications, intravenous solutions among others have to rely on dependable and long-lasting containers that preserve effectiveness and purity over time.

For Instance,

The growth of distribution channels, particularly pharmacies, is the main factor driving the market for prescription glass packaging. Considering the goal to render it simpler for prescription medications packaged in glass containers to be distributed and dispensed, pharmacies are essential intermediary between end users and pharmaceutical manufacturers. Because more pharmacies—both conventional physical shops and internet merchants-are opening up, there is a growing need for pharmaceutical glass packaging.

As more pharmacies open, there is an increasing need for a trustworthy and efficient packaging solution for the safe storage and dispensing of medications. Glass containers ensure the long-term viability and quality of the pharmaceuticals by offering the best protection against light, moisture, and contamination. There is less potential for chemical reactions that might decrease the potency and efficacy of the medication since glass is inert and does not react with medications.

Glass packaging increases product visibility so that consumers and chemists may conveniently evaluate its contents. Pharmaceutical glass packaging is in higher demand as specialty pharmacies that fill costly and challenging prescriptions proliferate. For certain medications, glass containers are an excellent choice because their stability and efficacy often require special packing methods. Pharmacies are adopting sustainable methods and friendly materials for packaging like glass at an increasing pace. Glass is eco-friendly and reusable, which makes it consistent with the sustainability goals of many pharmaceutical companies and pharmacies. The rise of distribution channels, primarily pharmacies, favours the expansion of the pharmaceutical glass packaging market by creating a strong requirement for trustworthy and better packaging solutions to meet the demands of the developing healthcare industry.

For Instance,

The competitive landscape of the pharmaceutical glass packaging market is dominated by established industry giants such as Amcor plc, Bormioli Pharma, SGD Pharma, Gerresheimer AG, Becton, Dickinson, and Company, AptarGroup, Inc., Drug Plastics Group, Schott AG, Owens Illinois, Inc., West Pharmaceutical Services, Inc., Berry Global, Inc., WestRock Company, International Paper, Comar, LLC, CCL Industries, Inc., Vetter Pharma International, Corning Inc., Nipro Corporation, Stölzle-Oberglas GmbH, , Shandong Medicinal Glass Co., Ltd., Beatson Clark, and Şişecam Group. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Amcor is a pharmaceutical glass packaging company that prioritises sustainability and innovation. They make research and development investments to provide innovative packaging solutions that satisfy the changing demands of pharmaceutical firms. Sustainability is given top priority by using environmentally friendly raw materials and production techniques.

For Instance,

High-quality glass packaging solutions designed especially for the pharmaceutical industry are Bormioli Pharma's area of expertise. Offering a wide variety of cutting-edge, adaptable packaging alternatives that guarantee the security, integrity, and compliance of pharmaceutical products throughout their lifecycle is the core of their business approach.

For Instance,

SGD Pharma is committed to providing the pharmaceutical industry with high-end glass packaging solutions. Utilising state-of-the-art technology and strict quality control procedures, their approach creates pharmaceutical-grade glass containers that satisfy the most exacting requirements for dependability, purity, and durability.

For Instance,

Gerresheimer AG is dedicated to being the world's foremost supplier of glass packaging solutions for pharmaceuticals. Their approach consists of ongoing investments in innovative production facilities as well as substantial R&D activities.

For Instance,

By Packaging Type

By Drug Type

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026