Pouch Materials for Pharmaceutical Market Size, Share, Trends and Forecast Analysis

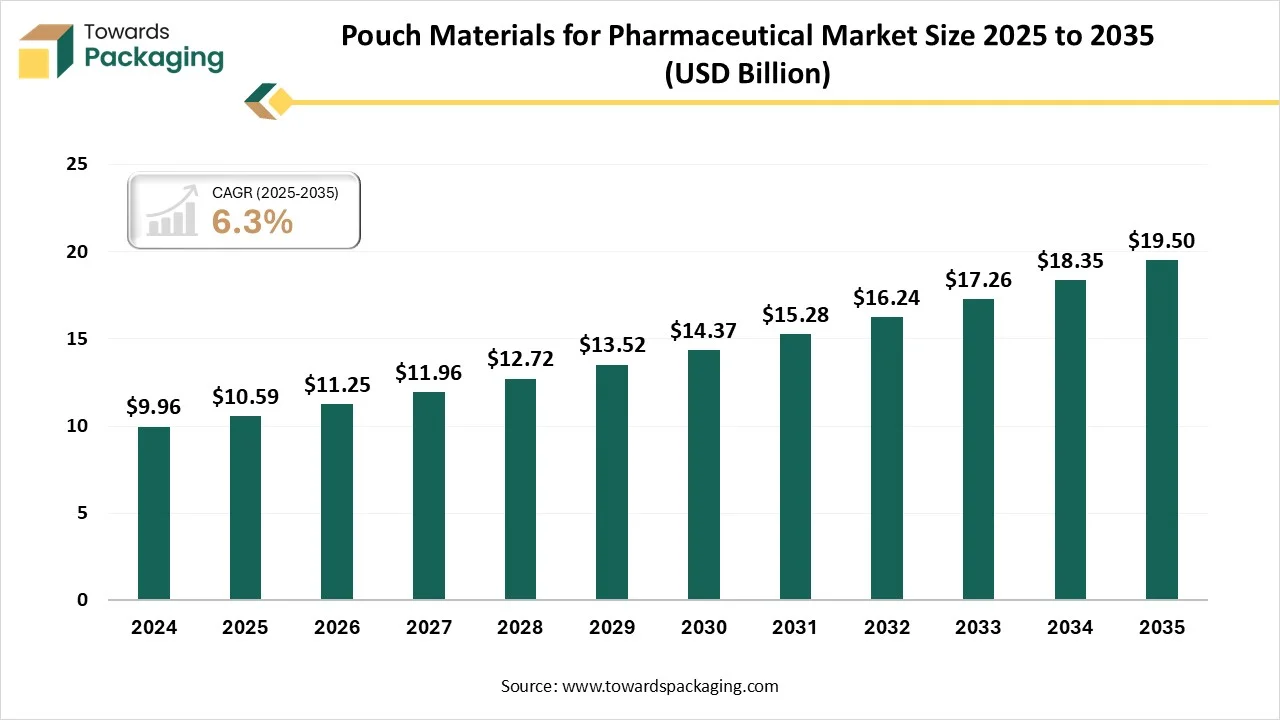

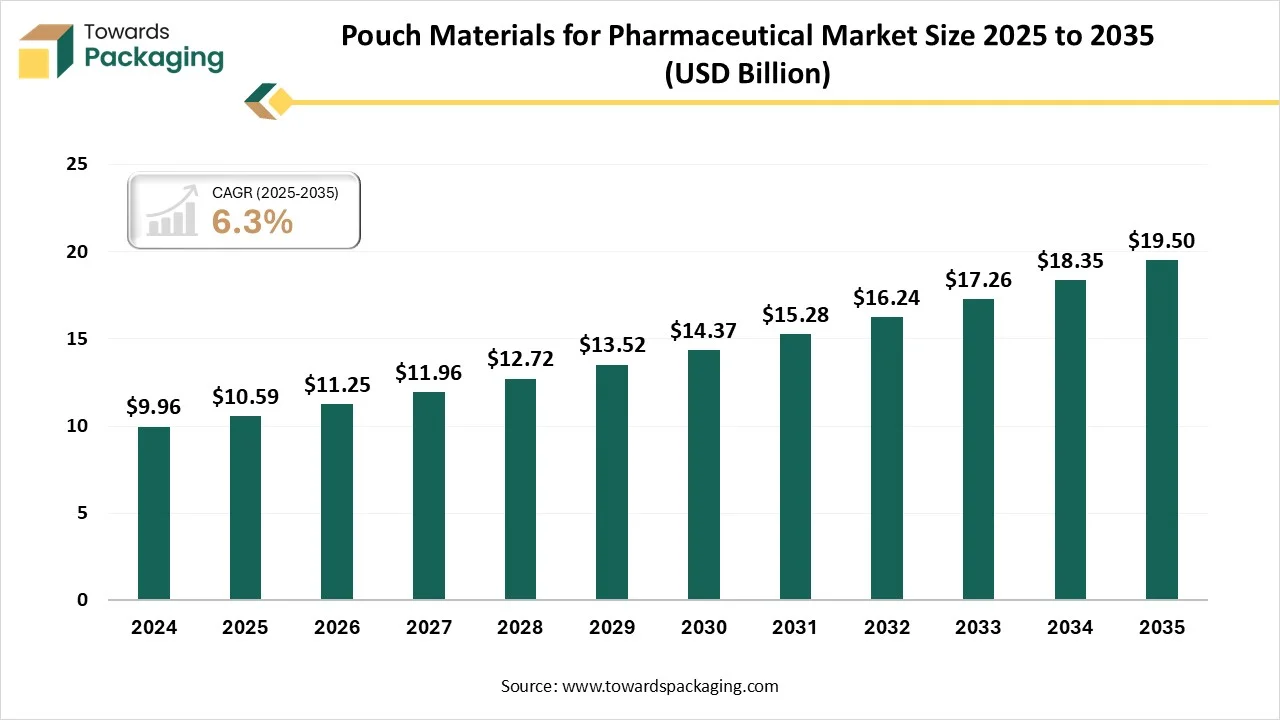

The pouch materials for pharmaceutical market is expected to increase from USD 11.25 billion in 2026 to USD 19.5 billion by 2035, growing at a CAGR of 6.3% throughout the forecast period from 2026 to 2035. The increasing demand for protection of drugs and its safety has influenced the demand for this market. Advancements in resource science and packing technology are allowing the manufacturing of pouch with improved resistance barrier properties, durability, and breathability, while preserving cost efficacy. The growing emphasis on patient suitability, easy storing, and acquiescence with ecological sustainability creativities is also determining market dynamics.

Major Key Insights of the Pouch Materials for Pharmaceutical Market:

- In terms of revenue, the market is valued at USD 11.25 billion in 2026.

- The market is projected to reach USD 19.5 billion by 2035.

- Rapid growth at a CAGR of 6.3% will be observed in the period between 2026 and 2035.

- By region, North America dominated the global market by holding highest market share of 35% in 2025.

- By region, Asia Pacific is expected to grow at a fastest CAGR from 2026 to 2035.

- By product type, the aluminum foil pouches segment contributed the biggest market share of 40% in 2025.

- By product type, the plastic film pouches segment will be expanding at a significant CAGR in between 2026 and 2035.

- By deployment type, the on-premise packaging units segment contributed the biggest market share of 55% in 2025.

- By deployment type, the cloud-based / digital monitoring systems segment will be expanding at a significant CAGR in between 2026 and 2035.

- By application, the oral solid dosage forms (tablets / capsules) segment contributed the biggest market share of 50% in 2025.

- By application, the powders & granules segment will be expanding at a significant CAGR in between 2026 and 2035.

- By end-use industry, the pharmaceutical & biotech companies segment contributed the biggest market share of 65% in 2025.

- By end-use industry, the contract packaging organizations (CPOs) segment will be expanding at a significant CAGR in between 2026 and 2035.

What are Pouch Materials for Pharmaceutical?

Pouch materials for pharmaceutical includes materials and packaging solutions designed specifically for the storage, protection, and transportation of pharmaceutical products. These materials include aluminum foils, plastic films, paper-based substrates, and multi-layer laminates that provide barrier protection against moisture, oxygen, light, and contaminants. The market is driven by the need for safe, tamper-evident, and patient-compliant packaging for oral solids, injectables, powders, and specialty pharmaceuticals. Innovations in barrier technologies, sustainable materials, and advanced sealing techniques are increasingly shaping the demand for these pouch materials across pharmaceutical manufacturers, contract packaging organizations, and healthcare providers worldwide.

Pouch Materials for Pharmaceutical Market Trends

- Market Growth Overview: The market is experiencing development in the food & beverages industry, retail & e-commerce sector, enhancement in product categories, and sustainable packaging.

- Global Expansion: Regions such as South America, North America, Asia Pacific, Europe, Middle East & Africa has enhanced the demand for this market due to huge customization option, rising disposal earning, and rapid technological advancement.

- Startup Ecosystem: The startup industries play an important role in developing digital printing solutions and sustainability recycling technology.

Technological transformation in the pouch materials for pharmaceutical market plays a significant role in its expansion. To defend delicate medications from light, moisture, and oxygen, inventions in high-resistance films are important. It is the top-most packaging enhanced resistance coatings that improved stability in fluctuating climates. Technology incorporation is a significant trend, converting pouches to a cooperative device for patient meeting and supply chain administration. These inventions target to fulfil severe supervisory necessities, combat fabricating, and expand patient security and suitability.

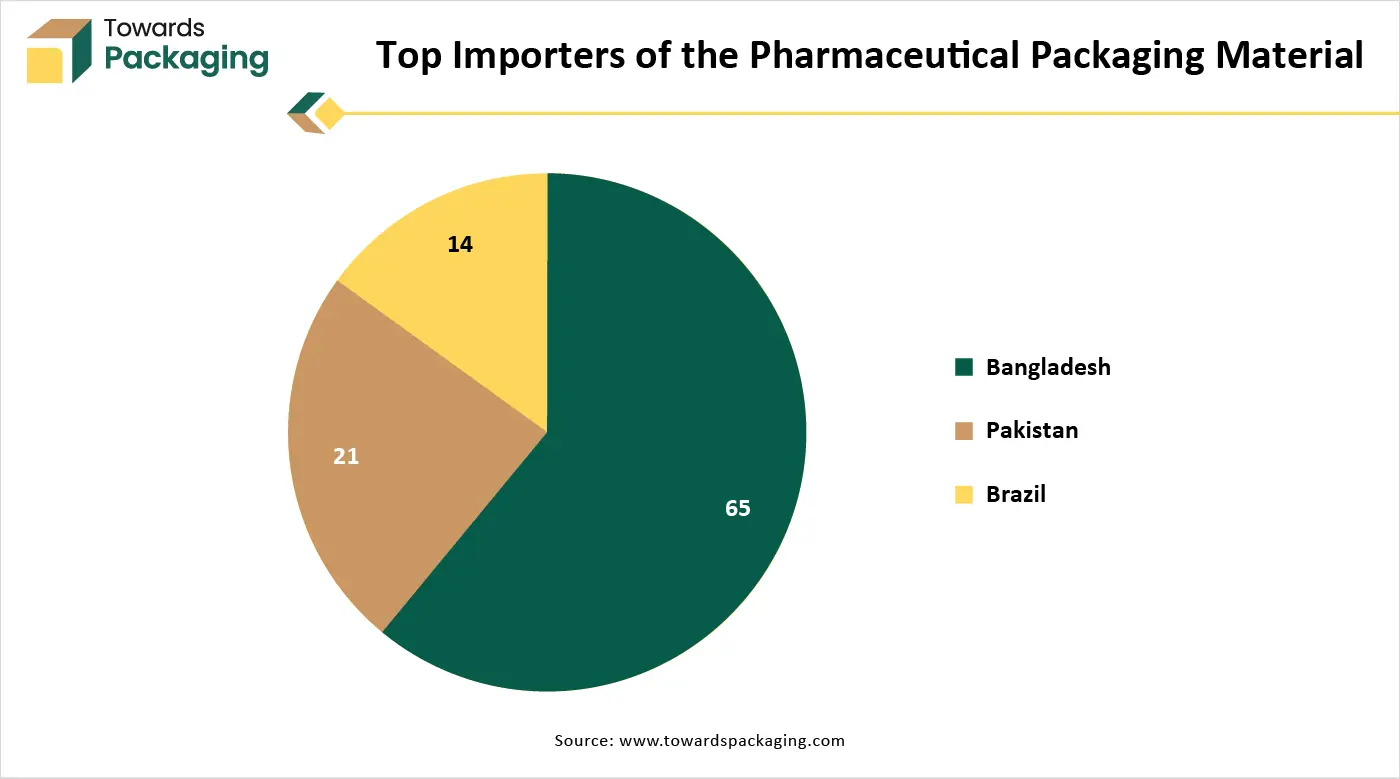

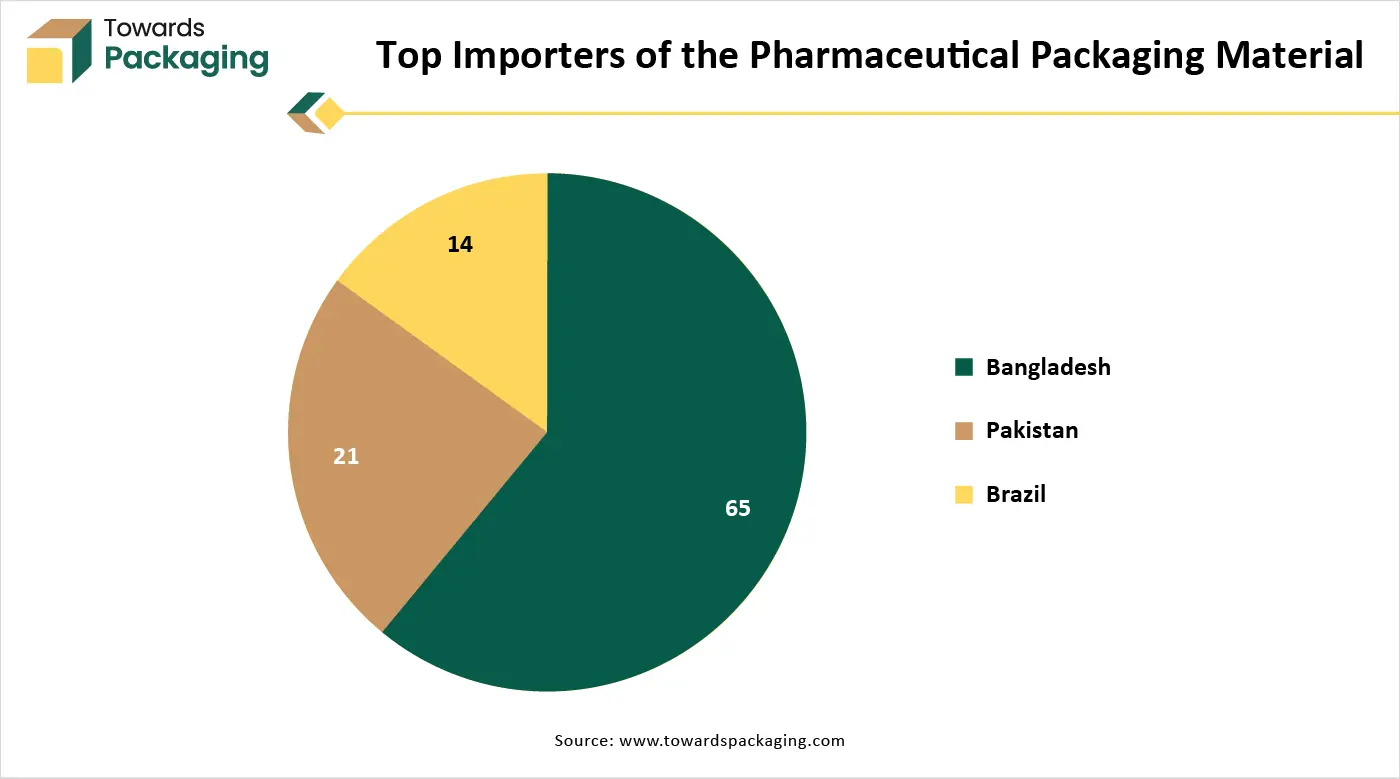

Trade Analysis of Pouch Materials for Pharmaceutical Market: Import & Export Statistics

- India: It is considered as top-most exporter of the pharmaceuticals packing material with 1,152 shipments.

- China: It is the second leading exporter of the pharmaceuticals packing material with 184 shipments.

- United States: It is the third leading exporter of the pharmaceuticals packing material with 165 shipments.

Pouch Materials for Pharmaceutical Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are aluminum foil, paperboards, plastics and polymers.

- Key Players: Gerresheimer AG, West Pharmaceutical Services

Component Manufacturing

The component manufacturing in this market comprises plastics (polymers), coated paper, aluminum foil, and specialty films. Producers depend on expert packing suppliers to confirm resources obey with standards from supervisory bodies.

- Key Players: Cosmo Films Limited, Polyplex

Logistics and Distribution

This segment comprises critical resistance properties, chemical lifelessness, durability, and obedience with strong regulations. It is high-presentation multi-coating laminates and plastics.

- Key Players: Origin Pharma Packaging, CPHI Online

Product Type Insights

Why Aluminum Foil Pouches Segment Dominated the Pouch Materials for Pharmaceutical Market In 2025?

The aluminum foil pouches segment dominated the market with highest share of 40% in 2025 due to protective and sterile packaging demand. It offers near-perfect shield, water vapor, blocking gases, and UV light is important for moisture-sensitive medicines. It confirms efficacy and strength by avoiding degradation, important for tablets, capsules, lozenges, and powders. This segment permits for incorporation of tamper-evident seals, serialization, and holograms, opposing counterfeiting.

The plastic film pouches segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its cost-effectiveness and barrier properties. It is essential for protecting medicines from oxygen, light, contaminants, and moisture. Increasing demand for unit-dose, child-barrier, and patient-friendly patterns that fuel compliance. Rising demand for recyclable numerous-layer films as well as biodegradable choices.

Deployment Type Insights

Why On-Premise Packaging Units Segment Dominated the Pouch Materials for Pharmaceutical Market In 2025?

The on-premise packaging units segment dominated the market with highest share of 55% in 2025 due to complete quality control. This is important for preserving drug efficiency and patient security, particularly for sensitive goods such as injectables and biologics that need, sterile packaging surroundings. This segment permits companies to straight implement and displays these complex supervisory needs, decreasing the danger of faults and authorized non-compliance.

The cloud-based / digital monitoring systems segment will be expanding at a significant CAGR in between 2026 and 2035. This segment is growing due to traceability and regulatory compliance. It safeguards consistent and consistent manufacturing, a major aspect in a sector with huge and continuous demand. The capability to rapidly regulate packaging patterns or labelling without coordinative with partner is boosting the growth of this segment. It is important for preserving drug effectiveness and patient security, particularly for sensitive goods.

Application Type Insights

The oral solid dosage forms (tablets / capsules) segment dominated the market with highest share of 50% in 2025 due to patient convenience and cost-effectiveness. These forms display excellent physical and chemical steadiness in comparison to liquid or semi-solid substitutes. These types of drugs are easily packed into several formats, comprising pouches, blister packs, and bottles, which offer superior shield from contamination, moisture, and light. Numerous coatings proficiently cover the unpleasant odor or taste of the active ingredients in pharmaceutical products.

The powders & granules segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to huge demand for enhanced shelf life and stability of the medicines. The rising demand for convenience and portability of single-dose packaging has raised the demand for medicine pouches. Several medicines are unstable in liquid forms which are essential to store in powder for in which pouches are considered as ideal format for packaging.

End-User Type Insights

Why Pharmaceutical & Biotech Companies Segment Dominated the Pouch Materials for Pharmaceutical Market In 2025?

The pharmaceutical & biotech companies segment dominated the market with highest share of 65% in 2025 due to strong requirement for advancement in packaging sector. Huge requirement for cost-efficient, high-resistance, and compliant packing choices has fuelled the demand for this segment. It is important to preserve drug steadiness, sterility, and efficiency of the good’s shelf life. It has influenced high demand for dedicated cold chain packing, comprising temperature-controlled and insulated pouches choices. Major companies are capitalizing in advanced, environment-friendly pouch resources to decrease carbon footprint and improve brand image.

The contract packaging organizations (CPOs) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to presence of strict packaging guidelines in the pharmaceutical industry. The enhancement of complex drug goods, like injectables, biologics, and customized drugs, requires particular packaging choices. These are progressively emphasized on lightweight, high-resistance aluminum foil and innovative laminate buildings that offer excellent protection against light, moisture, and oxygen, which is important for preserving drug steadiness and confirming an extended shelf life. This segment can hasten the introduction of new medicinal products with their ready-made experience and infrastructure.

Regional Insights

How North America is Dominating in the Pouch Materials for Pharmaceutical Market?

North America held the largest share in the market share of 35% in 2025, due to the presence of advanced healthcare infrastructure. Strict necessities for traceability, safety, and labeling, convincing producers to utilize superior-quality, compliant pouch resources and unconventional packaging choices. There is a noteworthy boost in the direction of sustainable and environment-friendly packaging choices, comprising the utilization of mono-materials, recyclable, and bio-based polymers to decrease ecological impact. The growth of online drugstores and direct-to-patient supply models has enhanced the demand for safe, durable, and trackable packing that can resist the severities of shipping.

Why Pouch Materials for Pharmaceutical Market is Dominating in the U.S.?

Rising focus on enhanced patient safety has raised the demand for market in the U.S. There is a huge demand for safe packaging of sensitive drugs to confirm the quality for longer period. Highly flexible pouches are often utilized for sterile medical equipment and device-drug groupings, shielding against microbial entrance. Pouches takes less space on pharmacy as well as in warehouses and enhance storage efficacy. These pouches also come with advancement such as QR codes which help consumers to gather details about medicines.

Why Pouch Materials for Pharmaceutical Market is Growing Rapidly in Asia Pacific?

Rising rate of chronic diseases have influenced the demand for the market. Increasing trend for at-home care services raised the demand for advancement in this packaging market. Continuous research and development to meet the demand of the consumers has raised the adoption of such packaging. These are considered as essential form of packaging to enhance the shelf life of the medicines. Increasing number of aged populations has also fuelled the expansion of this market.

How Pouch Materials for Pharmaceutical Market is Expanding in China?

Rising biologics and innovations have driven the development of the market in China. Increasing healthcare infrastructure has enhanced the demand for pharmaceutical products as well which has pushed this market to grow rapidly. Growth in paper-based packaging and mono-material plastics availability pushed companies to adopt such packaging. It helps in reducing the wastage of material which raised its adoption among a wide range of healthcare sectors.

Which Factor is Responsible for Notable Growth of Pouch Materials for Pharmaceutical Market in Europe?

The primary factors influencing the growth of market are strict safety and traceability standards, rising biopharmaceuticals, lightweight and cost-effectiveness, and circular economy mandates. Lightweight properties of these pouches have replaced glass and metal packaging in the pharmaceutical sector. Presence of aged people and busy lifestyle has pushed the usage of pouch packaging of the pharmaceutical products. Growing demand for convenience of the users has evolved this packaging industry. Huge investment for research and development has evolved this market demand tremendously. It reduces the risk of breakage as well as wastage of products which enhanced the usage of such packaging.

Why Germany is Utilizing Pouch Materials for Pharmaceutical Market Significantly?

Enhancing digitalization and demographic shifts has fuelled the development of the market. Pouches provide superior barriers against moisture, oxygen, and light, protecting medication efficiency. This type of packaging offer high value for money in comparison with rigid substitutes which is making them financially attractive. Inventiveness for circular economy inspire utilization of resources that help waste decrease, with specific pouch resources fitting these aims. High e-commerce growth in Germany fuels the demand for sturdy, breaking-resistant flexible pouches for packaging that shield products during transportation.

Why Adoption of Pouch Materials for Pharmaceutical Market is Growing in Middle East & Africa?

Middle East & Africa expects the notable growth in the market. Progressive barrier skills can encompass the shelf life of fragile pharmaceuticals. Such advancement helps to track the quality of the products. It is boosting the requirement for cost-operative packaging process. It utilized to check the temperature and sterility of biologics and vaccines. The flexible and lightweight properties of pouches provide noteworthy charge benefits.

Why Pouch Materials for Pharmaceutical Market is Growing Rapidly in Saudi Arabia?

Increasing focus towards the development of patient-centric pharmacy facilities are the major reason behind the rapid growth of market in Saudi Arabia. There is a huge demand for sachets and pouches in drugs packaging to protect it from moisture. Increasing inclination in the direction of environment-friendly and mono-resources pouches to bring into line with the ecological mandates. This type of packaging is suitable for sterile medical materials and single-dose therapies.

What Enhance the Adoption of Pouch Materials for Pharmaceutical Market in South America?

Technological advancement and advanced barrier properties has influenced the growth of the market in South America. Increasing shift in the direction of recyclable and biodegradable polymers to fulfil ecological mandates. It improves patient safety and drug traceability which raised the demand for this market. The increasing trend toward customized medicine is influencing demand for customized and single-dose pharmaceutical pouch. Its portability and easy-to-handle facilities boost the demand for this market.

Why Colombia is Highly Promoting Pouch Materials for Pharmaceutical Market?

Increasing concern for product protection and sterility has raised the demand for market in Colombia. It provides superior barriers against light, moisture, and pollution, and important for drug efficacy. Collaboration among major market players enhanced the quality of the packaging and fulfil the demand of the consumers. These are easy-to-use packaging for pharmaceutical products which is considered as suitable for medicines storage. Continuous economic growth has also influenced growth of this packaging market.

Recent Developments

- In November 2025, Zydus Lifesciences Ltd. collaborated with SIG to develop packaging for cold medication and liquid cough in one-time serve spouted pouches. This advancement has improved hygiene demand and deliver precise dose medicine.

- In July 2025, Sunshine Enclosures announced the launch of domestic Mylar pouch production potential. It offers exceptional service, innovations, and speed for its consumers.

Top Companies in the Pouch Materials for Pharmaceutical Market

- Amcor Plc: It is well-known for blister system designed for recyclability.

- Bemis Company, Inc. (now part of Amcor): It is sustainable sachet and stickpack materials introduced to replace traditional multi-material laminates.

- Winpak Ltd.: It focuses on technical flexible films for both trial and commercial pharmaceutical applications.

- Sealed Air Corporation: It is known for production of specialized films for intravenous (IV) fluids and injectable drugs.

- Constantia Flexibles Group GmbH: It uses validated methodology to reduce the carbon footprint of aluminum-based pharma foils and containers.

- Others: Uflex Ltd., Huhtamaki Oyj, Mondi Group, ProAmpac LLC, Sonoco Products Company, Berry Global, Inc., Interflex Group, Coveris Holdings S.A., CCL Industries Inc., Huhtamaki PPL Limited, Schur Flexibles Group, Printpack Inc., Cosmo Films Ltd., Laminazione Sottile S.p.A., and LINPAC Group

Pouch Materials for Pharmaceutical Market Segments

By Product Type

- Aluminum Foil Pouches

- Blister aluminum pouches

- Foil-laminated pouches

- Plastic Film Pouches

- Polyethylene (PE)

- Polypropylene (PP)

- Paper-Based Pouches

- Coated paper pouches

- Kraft paper pouches

- Laminated / Composite Pouches

- Multi-layer laminated pouches

- Barrier films

- Ancillary Tools & Accessories

- Sealing machines

- Storage trays

By Deployment Type

- On-Premise Packaging Units

- Cloud-Based / Digital Monitoring Systems

- Hybrid (On-Premise + Digital)

- Shape By Application

- Oral Solid Dosage Forms (Tablets / Capsules)

- Injectables / Parenteral Products

- Powders & Granules

- Topical / Semi-solid Forms

- Other Applications

By End-User

- Pharmaceutical & Biotech Companies

- Contract Packaging Organizations (CPOs)

- Hospitals & Clinics

- Other End-Users

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA