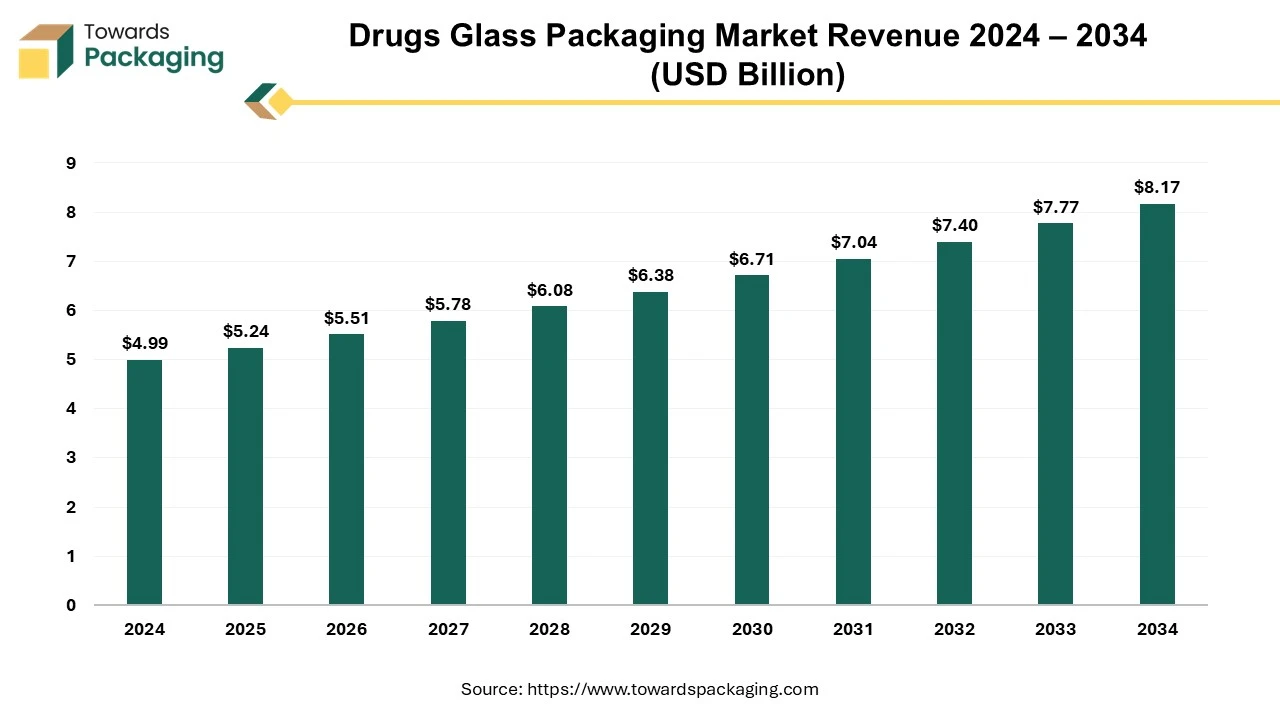

The drugs glass packaging market is forecasted to expand from USD 5.51 billion in 2026 to USD 8.58 billion by 2035, growing at a CAGR of 5.05% from 2026 to 2035. This report covers complete market size statistics, segmentation by type (cartridges, vials, ampoules) and application (injection, transfusion), along with deep regional analysis across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

It discusses leading companies such as SCHOTT AG, Gerresheimer, Nipro, SGD Pharma, Corning, PGP Glass, and others while presenting competitive benchmarking, manufacturing capabilities, value chain structure, global trade data, import–export flows, and supplier networks driving the industry.

The market is proliferating due to the increasing pharmaceutical industries due to continuous research and funding. These drugs need safe contamination-free packaging which can also enhance the shelf life of the products. This eco-friendly, safe and sustainable packaging demand in several industries significantly drives the drugs glass packaging market.

The drugs glass packaging market is an important industry in the healthcare packaging sector. This deals with sustainable packaging and transporting medicinal glass packaging to several areas. This market is generally driven by the rising trend of eco-friendly packaging and reliable glass packaging demand among consumers which should also be convenient. The drugs glass packaging industry manufactures different types of glass bottles with various requirements such as shapes, sizes, quality, locking systems, and many others.

This industry manufactures different quality glass with a variety of designs which create a difference from one brand to another. These packaging glasses are of different types according to their composition and medical demand. As there is a huge demand for eco-friendly drugs glass packaging the growth factor of this industry is exponential.

main developments in the drugs glass packaging market is the growing demand for medical products due to rising diseases globally. Drugs glass packaging has a longer shelf life that attracts consumers to use it for convenience storage. With the rise of chronic diseases resulting in the growth of drugs glass packaging is getting popular now with more chronic to various diseases at an early age. These are some of the most popularly prescribed drugs by healthcare experts due to the non-reactive properties of glass with chemicals globally, with a noteworthy upsurge in demand in developing markets such as India, Japan, Thailand, China, South Korea, and many others.

This rise in chronic diseases is causing a rising number of patients due to the changing lifestyle of youth and social norms with unhealthy habits resulting in using drugs glass packaging often. The development in the field of the healthcare sector led to rising demand for new medicines for various diseases which favour drugs glass packaging for their moisture-free packaging and capability to preserve the quality and worth of the medicine driving the demand in the industry.

Drugs glass packaging delivers high-quality barrier assets, shielding the product quality from outer impurities and conserving its quality which makes it easy to maintain brand status and customer fulfilment.

One of the important opportunities in the drugs glass packaging market is the rising patient belief in the medicine packaging industry. As customers become more perceptive and exploratory in their medical packaging options, there is a growing demand for exclusive and superior-quality glass packaging medicines. This factor is pushing the development of packaging and transportation businesses, which frequently prefer drugs glass packaging for the safety of the medicines and the capability to maintain the shelf-life of the medicinal products.

Moreover, the growing number of patients with several diseases such as heart attack, diabetes, cancer, and many other issues raise packaged medicine or vaccine delivery additional opportunities for modified and limited medicinal glass bottle packaging solutions. Another chance lies in the rising importance of sustainability and environment-friendly drugs glass packaging options. Patients are more ecologically conscious and are looking for products that line up with their ethics. Drugs glass packaging is highly recyclable and is well-placed to take advantage of this tendency.

There is a higher chance of leakage in such packaging which can cause damage to medicines, vaccines, and various healthcare products. Such issues hinder the growth of the drugs glass packaging market.

Asia Pacific witnessed the largest revenue share for the year 2024 this growth is because of the growing investment by the government sector and awareness among people towards various diseases. This development is mainly driven by the growing number of patients with chronic diseases such as heart attack, diabetes, high blood pressure, stroke and various others in countries such as Japan, China, South Korea, Thailand, and India.

The growing demand for high-quality drug packaging influences the drugs glass packaging industry. Moreover, favourable government guidelines and funds in the medicine industry provide additional support to market development. The Asia Pacific market delivers noteworthy opportunities for medical product glass packaging to tap into the increasing customer base and grow advanced packaging solutions personalized to the preferences of the region.

Some of the major market players contributing to the growth of the drugs glass packaging market are Ajanta Bottle Pvt. Ltd., PGP Glass, SCHOTT AG, SGD Pharma, Gerresheimer AG, NIPRO CORPORATION, AGI glaspac, Amazing Enterprises, and many others. These are well-known for producing drugs glass packaging solutions for the healthcare industry in India.

China Market Trends

China's drug glass packaging market is driven by the advanced manufacturing capabilities, export growth & global supply chain role in the country. China is becoming a major export hub for drug packaging materials. Competitive pricing, scaling capacity, and improving quality standards make Chinese firms attractive partners in global pharmaceutical supply chains. China is the second-largest pharmaceutical market in the world. As domestic and export-oriented drug production increases, the demand for high-quality drug packaging, including glass vials, ampoules, and syringes, rises. In China, heavy investments in automation and high-precision equipment for glass packaging production have fuel the growth of the drug glass packaging market.

North America is estimated to grow at the fastest rate over the forecast period. The drugs glass packaging market shows a changing demand for medicinal products across diverse regions, driven by several aspects such as growing diseases, changing lifestyles, consumption of fried oily food, excessive consumption of alcohol, and personalized medicinal product using trends. In countries such as the U.S. and Canada, the market is considered by a strong changing lifestyle which led to the demand for online medicines and a superior quality of packaging of drugs and vaccines. These countries have numerous major market players such as Gerresheimer AG, West Pharmaceutical Services Inc., Ardagh Group, Berry Global, Corning Incorporated, and many others which contribute significantly to the growth of this market.

U.S. Market Trends

The U.S. drug glass packaging market is driven by several factors. U.S. supports the growth of the drug glass packaging market through a combination of regulatory standards, technological innovations, and a robust pharmaceutical industry. The U.S. Food and Drug Administration (FDA) enforces strict guidelines that promote the utilization of high-quality, safe, and effective packaging materials, driving demand for premium glass products like Type I borosilicate glass. Significantly investment in Research & Development, automation, and cleanroom manufacturing enhances production capabilities and innovation in packaging solutions. The strong presence of leading pharmaceutical companies and biotech firms further stimulates market growth, as injectables and biologics require advanced glass containers. Additionally, public and private funding for healthcare and life sciences supports expansion in drug manufacturing, indirectly fueling sustained demand for reliable, sterile, and durable glass packaging.

By type, the cartridges segment led the drugs glass packaging market in 2024. The cartridge glass bottle packaging is widely used in the healthcare sector as these are capable of intact the quality of the vaccines. Such cartridge bottles are considered to be appropriate for patients.

By application, the injections segment led the drugs glass packaging market in 2024. These are highly preferred by healthcare experts for some chronic diseases to start the effect of the medicine quickly in the body and boost the demand in the drugs packaging market. Injection glass tubes help to maintain the quality of medicines which is preferred by brands as well as patients.

By Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026