Beer Glass Packaging Market Research, Consumer Behavior, Demand and Forecast

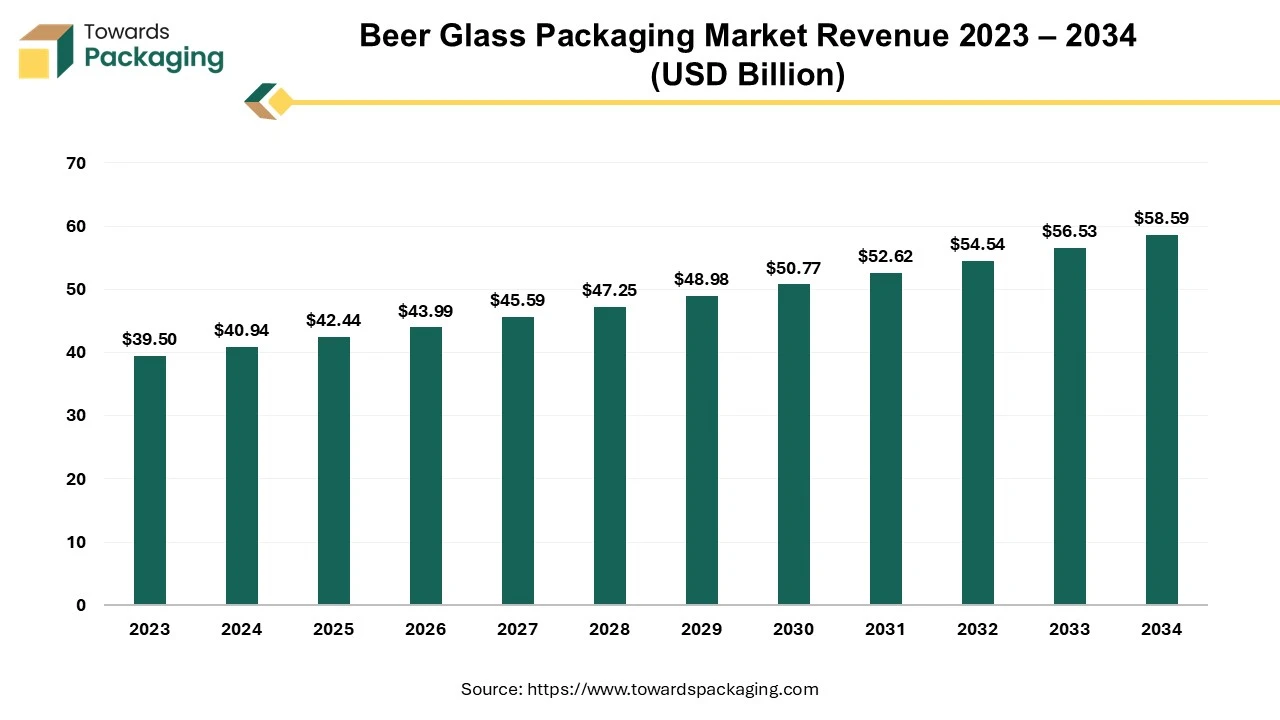

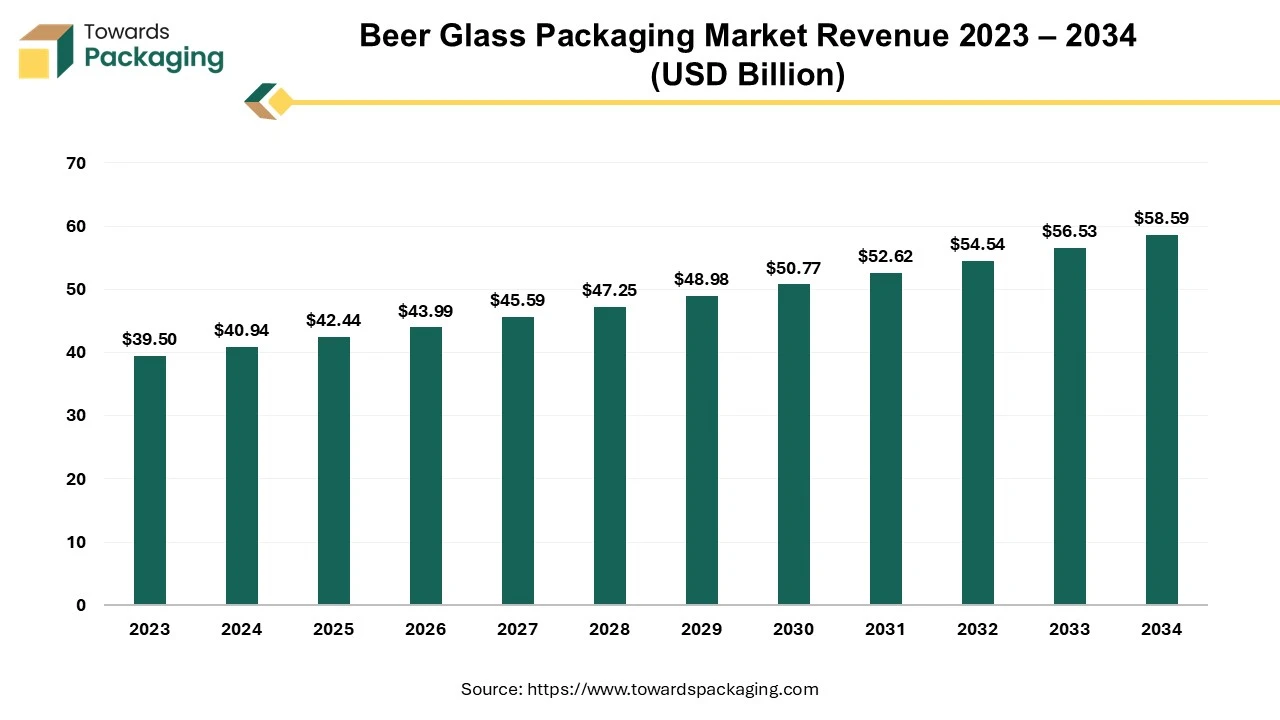

The beer glass packaging market is forecasted to expand from USD 43.98 billion in 2026 to USD 60.73 billion by 2035, growing at a CAGR of 3.65% from 2026 to 2035. This report provides detailed insights into market segmentation by type (500ml, 650ml) and application (alcoholic and non-alcoholic beer) across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It further covers company profiles, market shares, manufacturing value chain, supplier mapping, and trade flow analysis to present a holistic industry overview.

The market is proliferating due to the increasing demand for alcoholic beverages in celebrations. Consumers' demand for eco-friendly packaging is pushing the beer glass packaging market.

The beer glass packaging market is an important industry in the packaging sector. This deals with sustainable packaging and transporting beer bottles to several areas. This market is generally driven by the rising trend of premium-looking bottle demand among consumers which should also be convenient to use. The beer glass packaging industry deals with manufacturing different types of bottles with a variety of shapes, sizes, colors, locking systems, and many others. This industry manufactures different quality glass bottles with a variety of designs which makes it different from one brand to another. These bottles are of different types according to their weight as well. As there is a huge demand for lightweight glass bottles the growth factor of this industry is exponential.

Another critical component of beer glass packaging that often goes under the radar is the closure cap. Not only does it preserve the carbonation and flavor integrity of the beer, but innovations in closure design have also contributed to improved sustainability and branding opportunities. As the market evolves, manufacturers are exploring materials and features that enhance both function and appeal.

- In February 2024, Vetropack announced the launch of the 0.33-litre returnable bottle. It is developed as a sustainable solution in the Austrian brewing industry.

Drivers

Growing Consumers of Beer Globally Driving the Beer Glass Packaging Market

One of the main developments in the beer glass packaging market is the growing consumption of beer globally. Beer is considered one of the most popular alcoholic beverages globally, with a noteworthy upsurge in demand in developing markets such as India, Japan, China, and many others. This rise in consumption is pushed by a rising number of people with growing disposable earnings and a social modification in the direction of drinking on occasion. Moreover, the craft beer drive has expanded, increasing the spread of brewpubs and microbreweries. These launches frequently favor glass bottle packaging for its finest look and capability to reserve taste and worth, thus driving the demand in the industry.

One more development aspect is the fondness for beer glass bottles over any other packaging materials because of their eco-friendly nature and recyclability possibilities. As ecological apprehensions become more projecting, consumers and manufacturers both are inclined towards eco-friendly packaging solutions. Beer glass bottle packaging can be reutilized in various ways for endless time without compromising on quality or cleanliness which make them an ideal choice for ecologically sensible brands and consumers. Furthermore, beer glass bottle packaging delivers high-quality barrier assets, shielding the beer quality from outer impurities and conserving its taste which makes it difficult to maintain brand status and customer fulfilment. The global packaging industry size is growing at a 3.16% CAGR.

- In July 2024, Ardagh Group, announced the launch of a new series of craft beverage bottles. It is 100% recyclable glass with a unique design and quality.

Beer Glass Packaging Market Trends

Customization of Bottles

The availability of customization options for the beer glass bottles for different markets according to their requirement led to growth in the business of these glass packaging.

Sustainability and Safety

The capacity to withstand external conditions and transportation of these bottles from one place to another in an organized manner led to the growth of the market. These bottles help to transport beer without any contamination.

Demand for Eco-Friendly Packaging

The growing demand for eco-friendly packaging raised the beer glass packaging market. As it can be recycled and reused for several times which make it more preferrable by consumers.

Market Opportunity

Growing Preference of Premium Bottles Enhance the Beer Glass Packaging Market Opportunity

One of the important opportunities in the beer glass packaging market is the rising consumer fondness for finest and craft beers. As customers become more perceptive and exploratory in their beer packaging options, there is a growing demand for exclusive and superior-quality drinks. This tendency is pushing the development of craft breweries and microbreweries, which frequently prefer beer glass packaging for their finest look and capability to maintain the integrity of the beer.

This offers a chance for packaging industries to grow advanced and appealing glass packaging with patterns that supply the craft beer sector. Moreover, the growing fame of partial-version issues and seasonal brews delivers additional opportunities for modified and limited packaging solutions. Another chance lies in the rising importance of sustainability and environment-friendly packaging options. Customers are more ecologically conscious and are looking for products that line up with their ethics. Glass packaging is highly reusable and recyclable, and is well-placed to take advantage of this tendency.

Regional Insights

Rising Demand for Sustainable Packaging: Asia to Remain as a Leader

Asia Pacific witnessed the highest revenue share for the year 2024 this growth is because it is the sustainable solution for beer packaging in the market. This development is mainly driven by the growing urbanization, changing consumer preferences, and disposable incomes in countries such as Japan, China, South Korea, Thailand, and India. The growing popularity of beer and its packaging among the young population and the rising adoption of superior quality and craft beers are contributing to the request for beer glass packaging in these countries. Moreover, favorable government guidelines and funds in the brewery industry additional support to market development. The Asia Pacific market delivers noteworthy opportunities for beer packaging producers to tap into the increasing customer base and grow advanced packaging solutions personalized to the preferences of the region.

Some of the major market players contributing to the growth of the beer glass packaging market are Xuzhou Hualian Glass Bottle Factory Co., ltd, Anhui Creative Packing Technology Co. Ltd., SGS Bottle, CRYSTAL, Idea Technology Imp & Exp Co., Ltd., Unipack Glass, Xuzhou Shanli Artware, Foshan Shining glass, ShangHai Misa Glass Co., Ltd, and many others. These are well-known for producing bio-based packaging solutions for the beer industry.

- In July 2024, Asahi, announced the launch of the world’s first super dry beer. It is developed as the most premium and distinctive packaging.

Rising Economic Conditions: North America

North America is estimated to grow at the fastest rate over the forecast period. The beer glass packaging market shows changing development designs across diverse regions, driven by several aspects such as economic conditions, cultural preferences, and beer consumption trends. In countries such as the U.S. and Canada, the market is considered by a strong occurrence of craft breweries and a superior quality of beer consumption. These countries have numerous major market players such as Owens-Illinois, Kaufman Container, Verallia, O-I Glass, and many others which contribute significantly to the growth of this market.

The demand for beer glass packaging in North America is determined by the rising craft beer drive, which highlights quality, genuineness, and exclusive packaging. Moreover, the trend in the direction of premium packaging and the growing popularity of special beer brands further push the market to grow in this region.

- In September 2024, Ardagh Group (AGP-North America), announced the launch of a new 500 ml celebration bottles BOB's (BuyOurBottles) collection.

Segmental Insights

By type, the 500 ml segment led the beer glass packaging market in 2024. 500 ml bottle is widely used in the celebration in various sectors. As these are considered to be appropriate for the consumers.

By application, the alcohol beer segment led the beer glass packaging market in 2024. These are highly preferred by the commercial sector celebration which eventually enhances the demand in the market. As beer glass helps to maintain the quality of alcoholic beer these are preferred by brands as well as consumers.

Recent Developments

- In August 2024, Verallia Group, was announced as the world’s third-largest producer of glass packaging for Heineken, Pernod Ricard, Nestlé, and Danone.

- In May 2024, O-I Glass Inc., announced the launch of a lightweight glass wine bottle. It is developed with the intention to reduce carbon impact in the French market.

Beer Glass Packaging Market Companies

- AGI glaspac - AGI Greenpac Limited

- Ardagh Group

- Amcor

- Ball Corporation

- Orora Ltd

- MAHALAXMI PACKAGING INDUSTRIES

- SVM Enterprises

- Chaudhary Glasspack Private Limited

- Glassex (India) Private Limited

- HNG glass factory

- WestRock

Beer Glass Packaging Market Segments

By Type

- 500ml

- 650ml

By Application

- Alcohol Beer

- Non-alcoholic Beer

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (2)