Expanded Polystyrene for Packaging Market Size, Share and Competitive Landscape

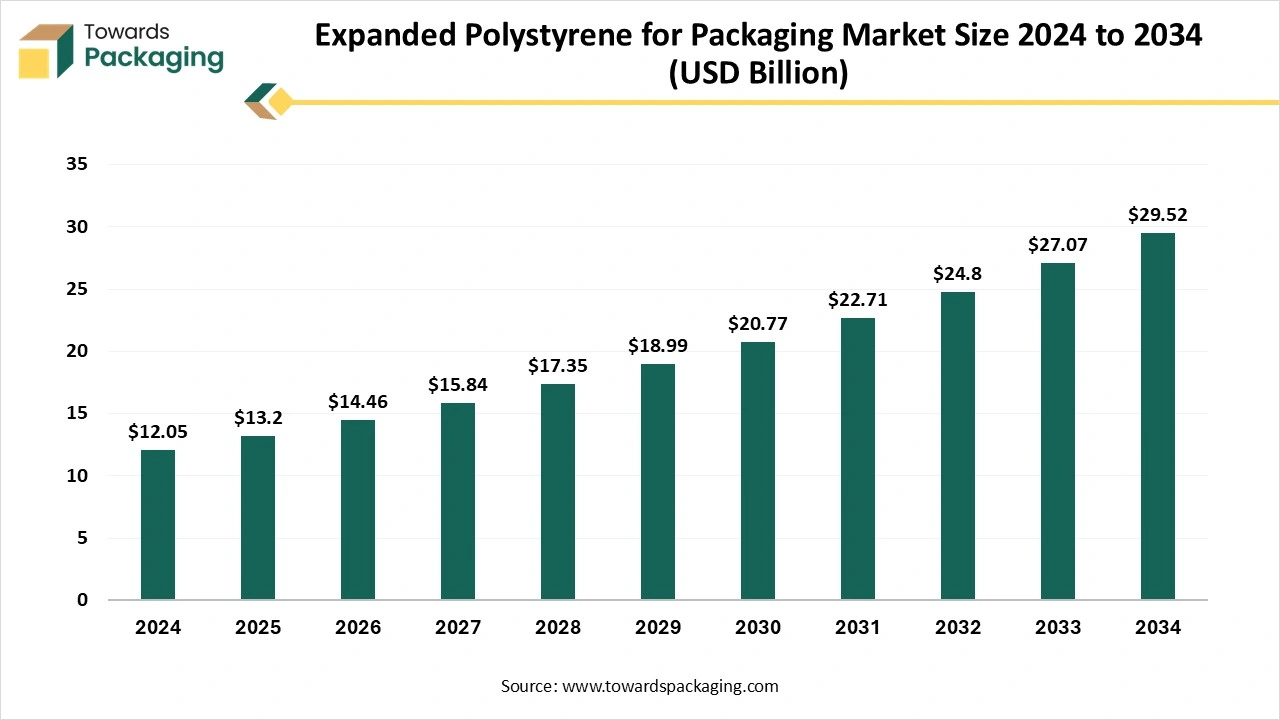

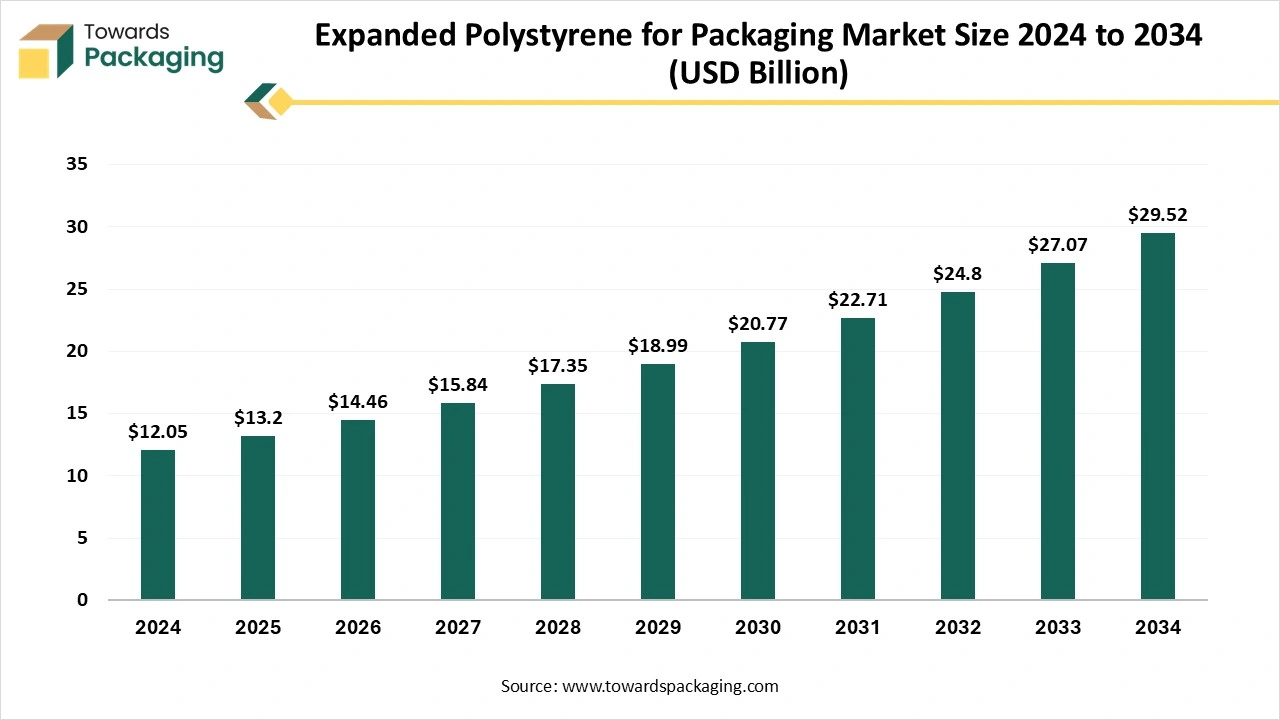

The expanded polystyrene for packaging market is forecasted to expand from USD 14.46 billion in 2026 to USD 32.80 billion by 2035, growing at a CAGR of 9.53% from 2026 to 2035.

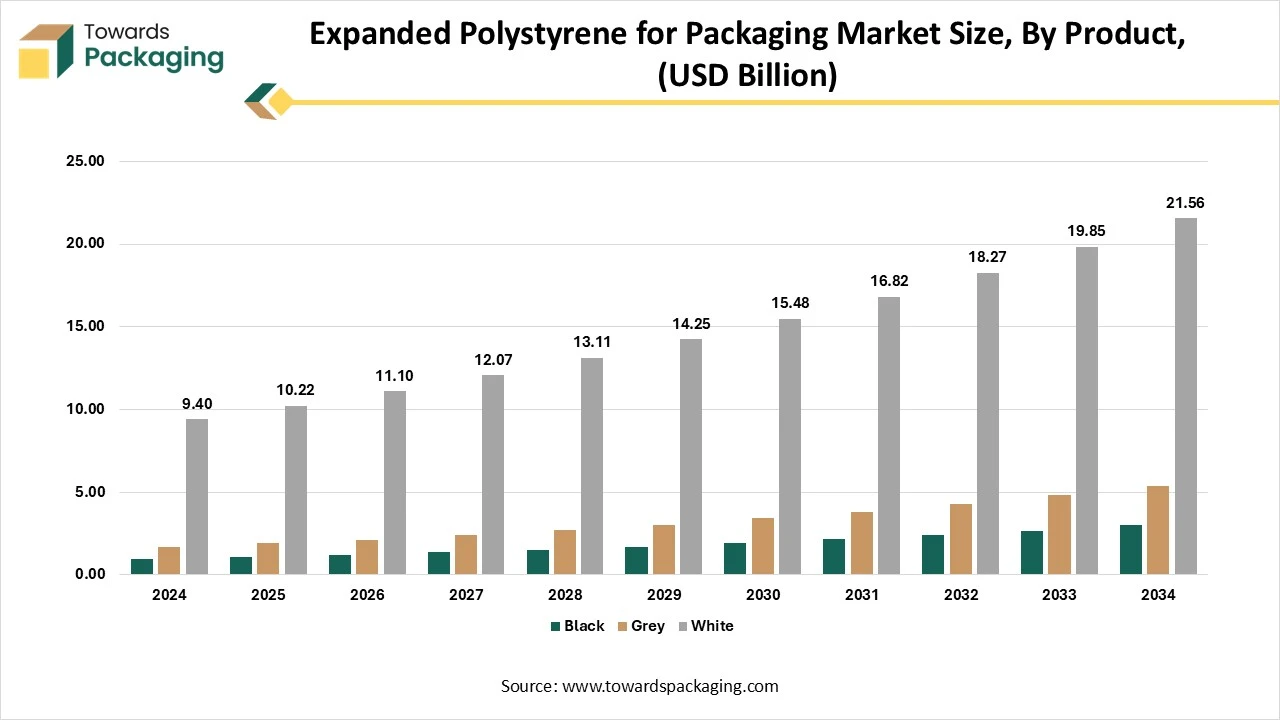

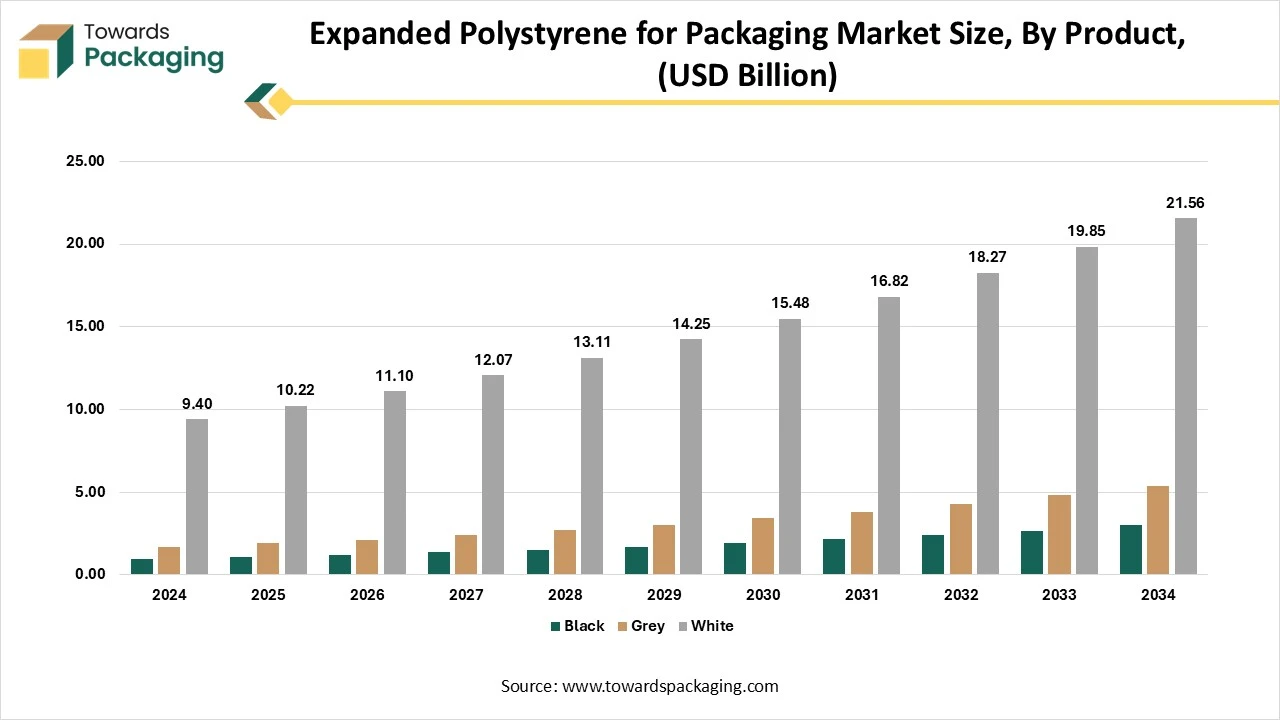

The market is segmented into white EPS (62% share in 2024) and grey EPS (38% share), with grey EPS growing fastest at 11.2% CAGR. In applications, foam coolers account for 34% of global volume, followed by trays & clamshells at 27%, and protective blocks at 22%. End-use shows food & beverages holding 41% share, and healthcare increasing from 13% in 2024 to 19% by 2034.

Key Insights

- In terms of revenue, the expanded polystyrene for packaging market is valued at USD 13.2 billion in 2025.

- The market is projected to reach USD 29.52 billion by 2034.

- Rapid growth at a CAGR will be observed in the period between 2025 and 2034.

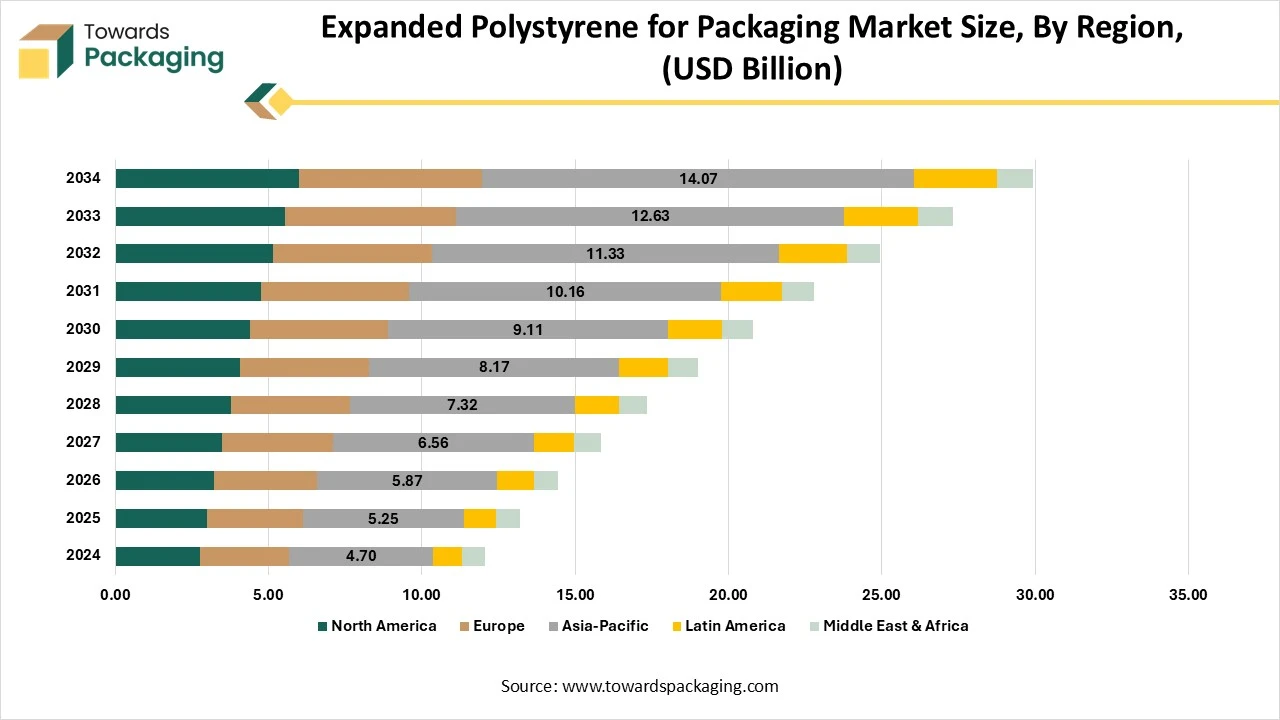

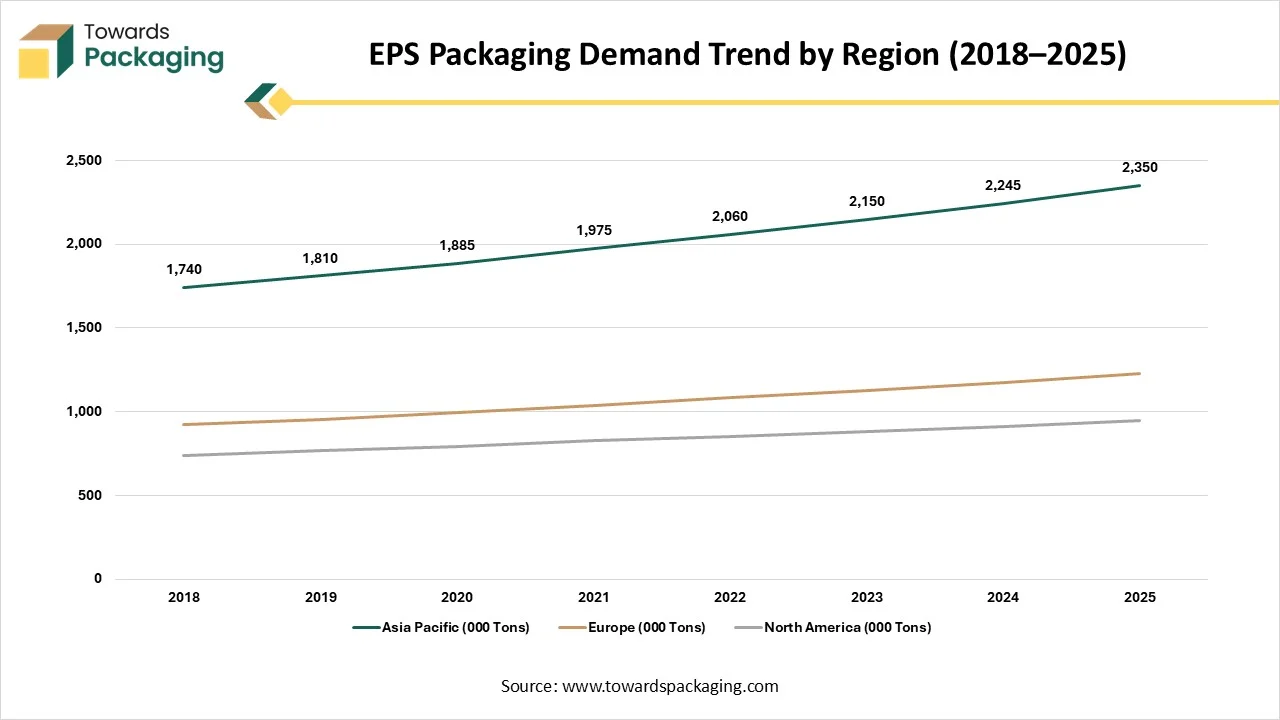

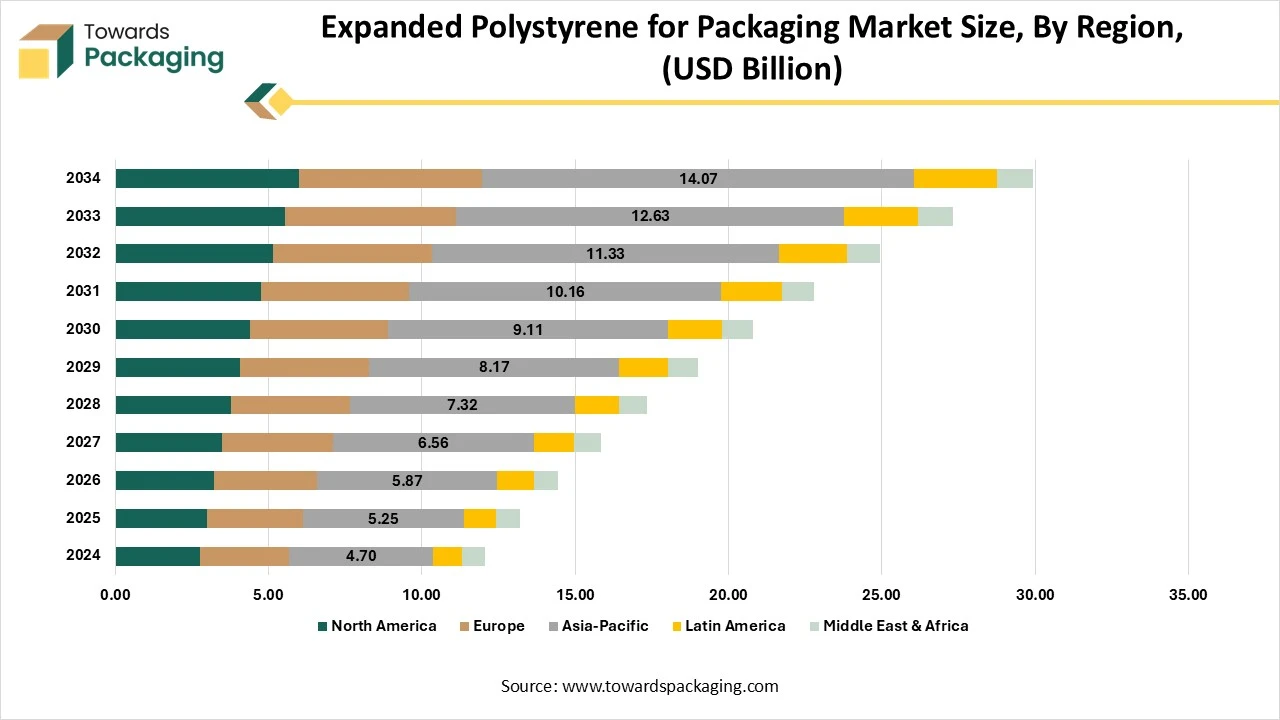

- Europe dominated the global market with the largest revenue share in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 20245 to 2034.

- By product type, the white segment held the largest revenue share in 2024.

- By product type, the grey segment is expected to grow at a significant CAGR between 2025 and 2034.

- By application, the foam coolers segment dominated the market in 2024.

- By application, the trays and clamshells segment is expected to grow at a significant CAGR in the studied period.

- By end use, the food and beverage segment led the global market in 2024.

- By end use, the healthcare segment is expected to grow at a significant CAGR over the projected period.

Middle East and Africa Expanded Polystyrene for Packaging Market Trends:

In the MEA region, future demand for EPS packaging is expected to rise with the growth of e-commerce, modern retail, and expanding cold chain logistics for food and pharmaceuticals. Because of EPS's lightweight insulating and protective qualities, which lessen damage during long-distance transportation, businesses will use it more frequently. Growing investments in industrial projects, logistics corridors, and infrastructure will encourage the use of EPS, and companies that care about the environment will pay more attention to sustainable and recyclable EPS grades

UAE Expanded Polystyrene for Packaging Market Trends:

In the UAE, demand for EPS packaging will grow strongly because of the nation's role as the Gulf region's center for trade and logistics. The use of insulated and shock-resistant EPS solutions will be fueled by the growing flow of perishable goods, electronics, and pharmaceuticals. Due to EPS's affordability and effectiveness in safeguarding goods during transportation, retailers and distributors will also favor it. In keeping with the UAE sustainability initiatives eco eco-friendly and recyclable EPS variants will be gradually adopted.

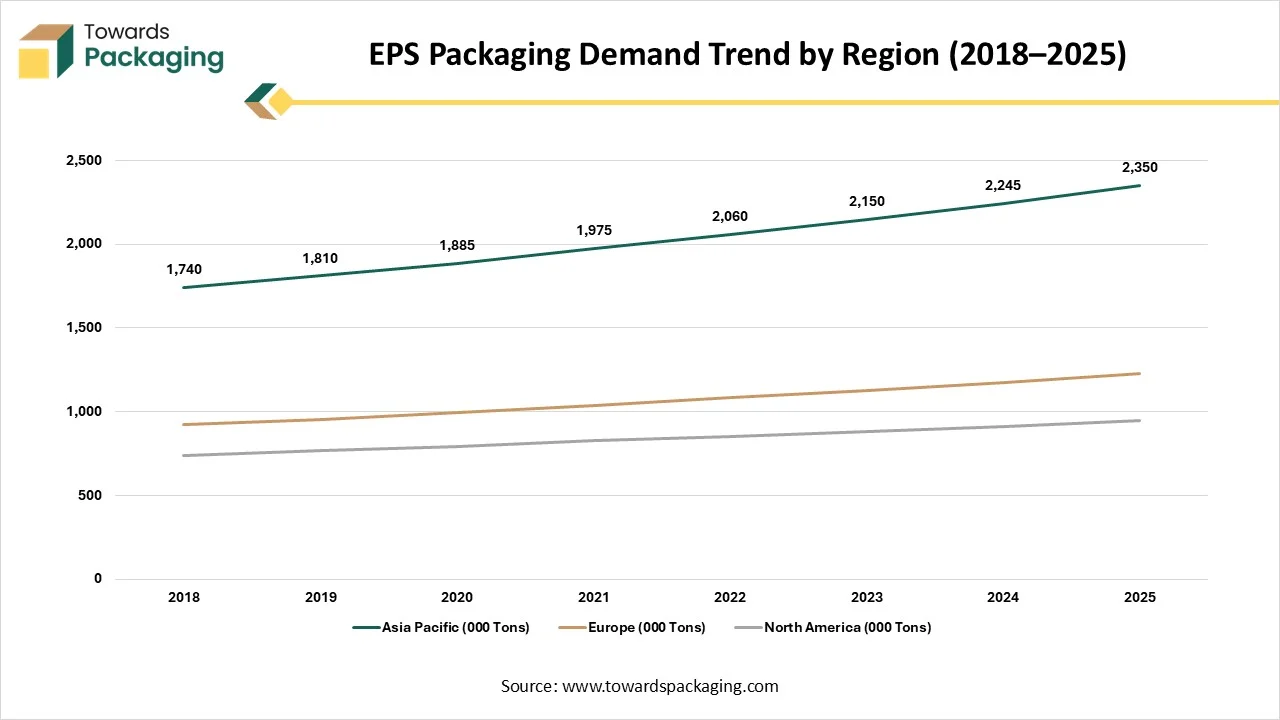

| Year |

Asia Pacific (000 Tons) |

Europe (000 Tons) |

North America (000 Tons) |

| 2018 |

1,740 |

920 |

740 |

| 2019 |

1,810 |

955 |

768 |

| 2020 |

1,885 |

995 |

792 |

| 2021 |

1,975 |

1,036 |

825 |

| 2022 |

2,060 |

1,083 |

854 |

| 2023 |

2,150 |

1,128 |

882 |

| 2024 |

2,245 |

1,173 |

910 |

| 2025 |

2,350 |

1,225 |

945 |

Expanded Polystyrene for Packaging Market: Cushioning Packaging Materials

Expanded polystyrene (EPS) is a rigid foam material that is widely adopted due to its lightweight nature. It is a material extensively used in the electronics packaging and construction sectors, as these are energy-efficient insulators as well as a cost-effective solution available in the packaging industry. Its cushioning nature provides extra protection during the transportation of shock-sensitive materials and ensures safe delivery of products without any damage.

Expanded polystyrene is made up of solid beads of polystyrene, and its compression resistance is suitable for the stackable packaging of goods. It helps to maintain the freshness of the products without causing any chemical damage, which attracts a wide number of pharmaceutical as well as chemical companies. These packages provide enhanced quality moisture protection as well as thermal protection, which makes it the most preferable option in the packaging industry.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 13.20 Billion |

| Projected Market Size in 2035 |

USD 32.80 Billion |

| CAGR (2025 - 2035) |

9.53% |

| Leading Region |

Europe |

| Market Segmentation |

By Product, By Application, By End-Use and By Region |

| Top Key Players |

Kaneka Corporation, Fortifori Plastics P Ltd., Infinite ProPack Pvt Ltd, NOVA Chemicals Corporation, B.M. Insulations Private Limited, BASF SE |

What are the New Trends in the Expanded Polystyrene for Packaging Market?

Growing Demand for Versatile and Sustainable Packaging

The growing demand for electronic equipment and continuous advancement in these devices has influenced the demand for packaging with enhanced safety, which helps in the transportation of the products and increases the accessibility of the products. Only 2% of polystyrene is used in the process of manufacturing process of these packaging has influenced the growth of sustainable packaging with a reduced carbon footprint.

Innovation in Safe Transportation of Products

The constant innovation in the packaging industry has influenced the ecommerce and packaging industry to raise the standard of the packaging of products and make it easy for brands to transport products. The growing demand for cost-effective packaging foams that provide enhanced protection to delicate electronics products, with the growing demand for miniature electronic devices, has influenced the development of this market.

Retail and Food Industry Adoption

FMCG companies, particularly in the food, beverage, and cosmetics sectors, are embracing upcycled packaging to meet ESG targets. Brands like Nestlé and L’Oréal are exploring upcycled inputs for secondary and primary packaging

Enhanced Recyclability Option and Government Regulations for the Packaging Industry

The rising recyclability options for packaging products have influenced this market as an eco-friendly solution with several other benefits has raised the demand for such expanded polystyrene packages.

Future Demands

- Growth in online shopping and direct-to-consumer brands will significantly increase the need for protective packaging materials like EPS.

- Increasing shipments of fragile products such as medical devices, glassware, and electronics will raise demand for shock-absorbing EPS.

- Expansion of cold chain logistics will boost EPS usage because of its excellent insulation for food, pharmaceuticals, and vaccines.

- Growth of organized retail and modern trade will increase demand for standardized, stackable EPS packaging formats.

- Companies focusing on product safety and damage reduction will adopt EPS for its high compression strength and cushioning performance.

- Increased production of home appliances and consumer electronics in emerging economies will continue to fuel EPS packaging needs.

- Rising demand for cost-effective packaging solutions will support EPS growth since it remains cheaper than many alternative materials.

- Development of recyclable and low-impact EPS grades will attract sustainability-focused brands and industries.

- Improved EPS recycling infrastructure in many countries will boost market confidence and reduce regulatory pressure.

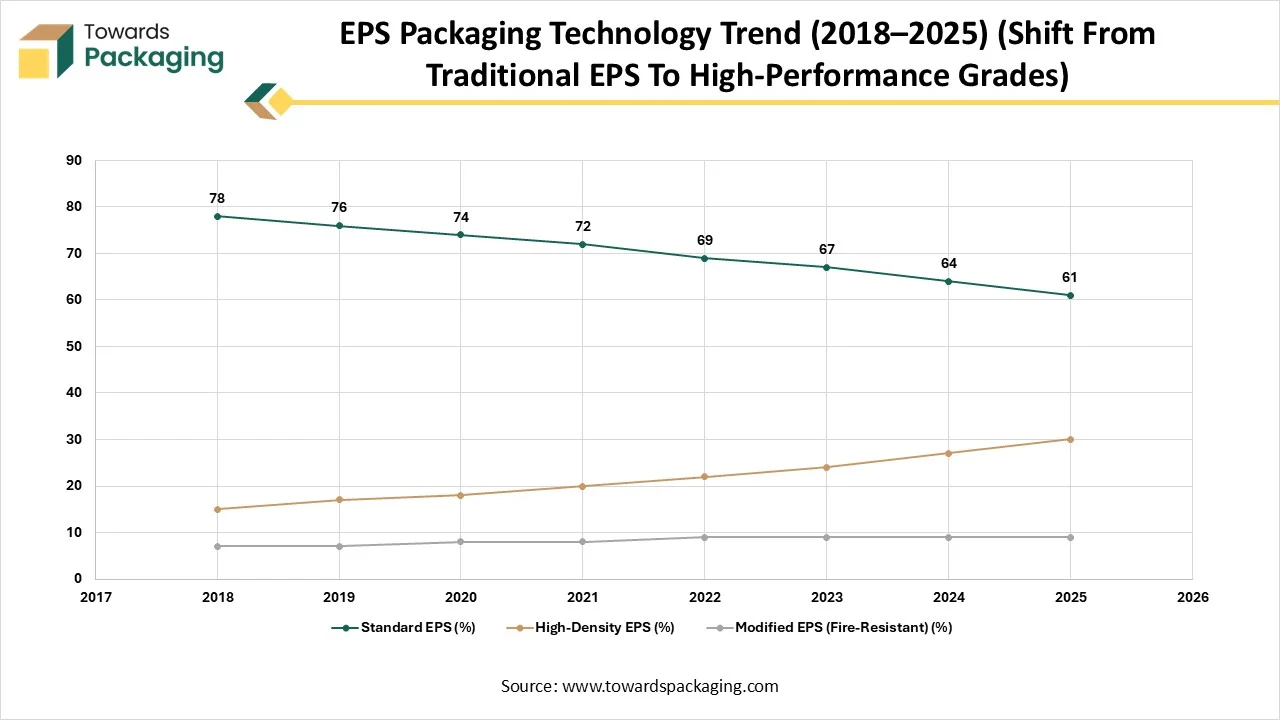

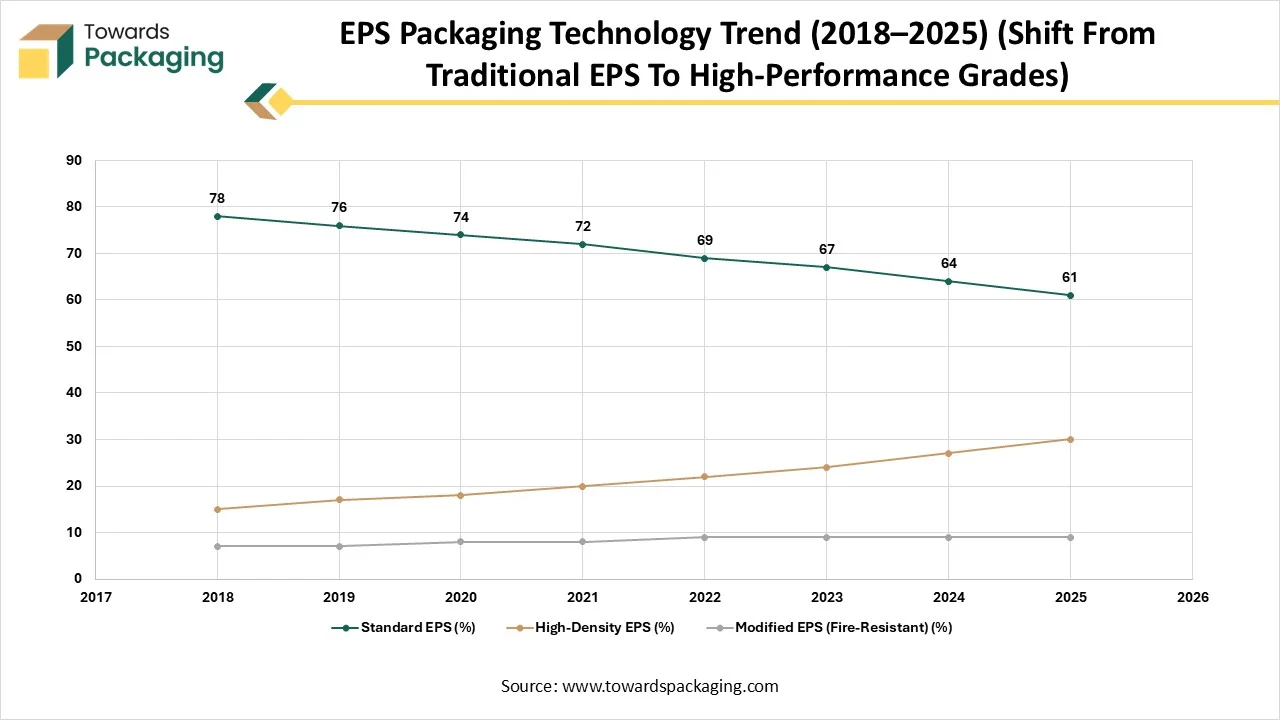

| Year |

Standard EPS (%) |

High-Density EPS (%) |

Modified EPS (Fire-Resistant) (%) |

| 2018 |

78 |

15 |

7 |

| 2019 |

76 |

17 |

7 |

| 2020 |

74 |

18 |

8 |

| 2021 |

72 |

20 |

8 |

| 2022 |

69 |

22 |

9 |

| 2023 |

67 |

24 |

9 |

| 2024 |

64 |

27 |

9 |

| 2025 |

61 |

30 |

9 |

How Can AI Improve the Expanded Polystyrene for Packaging Market?

AI has a significant role in the advancement of the expanded polystyrene for packaging market as it helps in the optimization process while manufacturing these packages to ensure the authenticity of the raw materials used, which enhances the reliability of the brands on this market. By using technologies such as machine learning and robotics, it has become easy for manufacturing companies to analyse the market demand and avoid the surplus production of packages. It helps to reduce the charges by reducing the man-power requirement for repetitive work. These advanced technologies are utilized for detecting errors during the production process. It is utilized to enhance the design of the packages as well as biodegradability due to growing ecological concerns among people.

- In January 2025, DGeo collaborated with Lifoam Industries LLC and announced the launch of a subsidiary of Altor Solutions Inc. to offer sustainable packaging solutions designed to store and move temperature-controlled goods safely and compliantly. (Source: PlasticsToday)

Future Demand Drivers Shaping the EPS Packaging Market Ahead

| Future Demand Factor |

Description |

Impact Ahead |

| Growth of E-commerce & Home Deliveries |

Rising shipments of electronics, fragile goods, and perishables increase the need for shock-proof, lightweight packaging. |

Higher EPS consumption for protective and insulated packaging. |

| Expansion of Cold-Chain & Pharma Logistics |

Vaccines, diagnostics, and temperature-sensitive goods rely heavily on EPS boxes and insulated containers. |

Strong demand for EPS-based thermal packaging solutions. |

| Rapid Rise in Consumer Electronics & Appliances |

More gadgets and appliances require strong cushioning and low-cost protection during transport. |

Steady growth in molded EPS packaging blocks and panels. |

| Shift Toward Cost-Efficient Packaging |

EPS remains cheaper and lighter than many alternatives, helping reduce freight costs. |

Increased adoption in price-sensitive and bulk shipment sectors. |

| Advancements in EPS Recycling |

Improved collection and recycling technologies make EPS more acceptable in sustainability-focused markets. |

Wider use of recyclable EPS in retail, FMCG, and electronics packaging. |

Market Outlook

- Industry Growth Overview: The market for EPS packaging is still expanding because of its superior insulation, lightweight, and cushioning qualities. Steady demand is supported by high usage in food delivery appliances and electronics. Innovations in protective foams and molded shapes are improving performance.

- Sustainability Trends: Enhancing EPS recyclability through mechanical densification and take-back programs is the main goal of sustainability initiatives. Reduce VOC formulations, and bio-based EPS substitutes are becoming more popular. To reduce material consumption, brands are investigating thinner, optimized EPS designs.

- Global Expansion: Global expansion is supported by strong industrial growth and expanded cold chain infrastructure in Asia, Europe, and the U.S. Major EPS manufacturers are increasingly developing regional molding capacities and partnering with recyclers. Growing shipments of appliances, electronics and perishables drive wider international adoption.

Key Technological Shifts

- Advanced EPS Molding Techniques: Adoption of precision molding and thermoforming for product-specific and complex shapes, improving cushioning and fit.

- Lightweight & High-Strength Designs: Development of EPS grades with improved compression strength while reducing material usage for sustainability and cost efficiency.

- Recyclable & Eco-Friendly EPS: Innovations in chemically recyclable and biodegradable EPS to meet stricter environmental regulations.

- Integration with Cold-Chain Technology: EPS containers are designed with enhanced insulation and temperature monitoring for perishable and pharmaceutical goods.

- Automation-Compatible Packaging: EPS packaging designed for high-speed automated packing lines and robotic handling systems.

- Smart Packaging Integration: Embedding IoT-enabled sensors into EPS for real-time condition monitoring, tracking, and anti-tampering.

- Improved Surface Finishes & Printing: Technological improvements enabling better branding, labeling, and customized printing directly on EPS surfaces.

- Energy-Efficient Production Processes: Adoption of new manufacturing techniques that reduce energy consumption and lower CO₂ emissions during EPS production.

- Multi-Layer & Composite EPS: Development of EPS combined with other materials to enhance barrier properties, moisture resistance, and durability

Market Dynamics

Driver

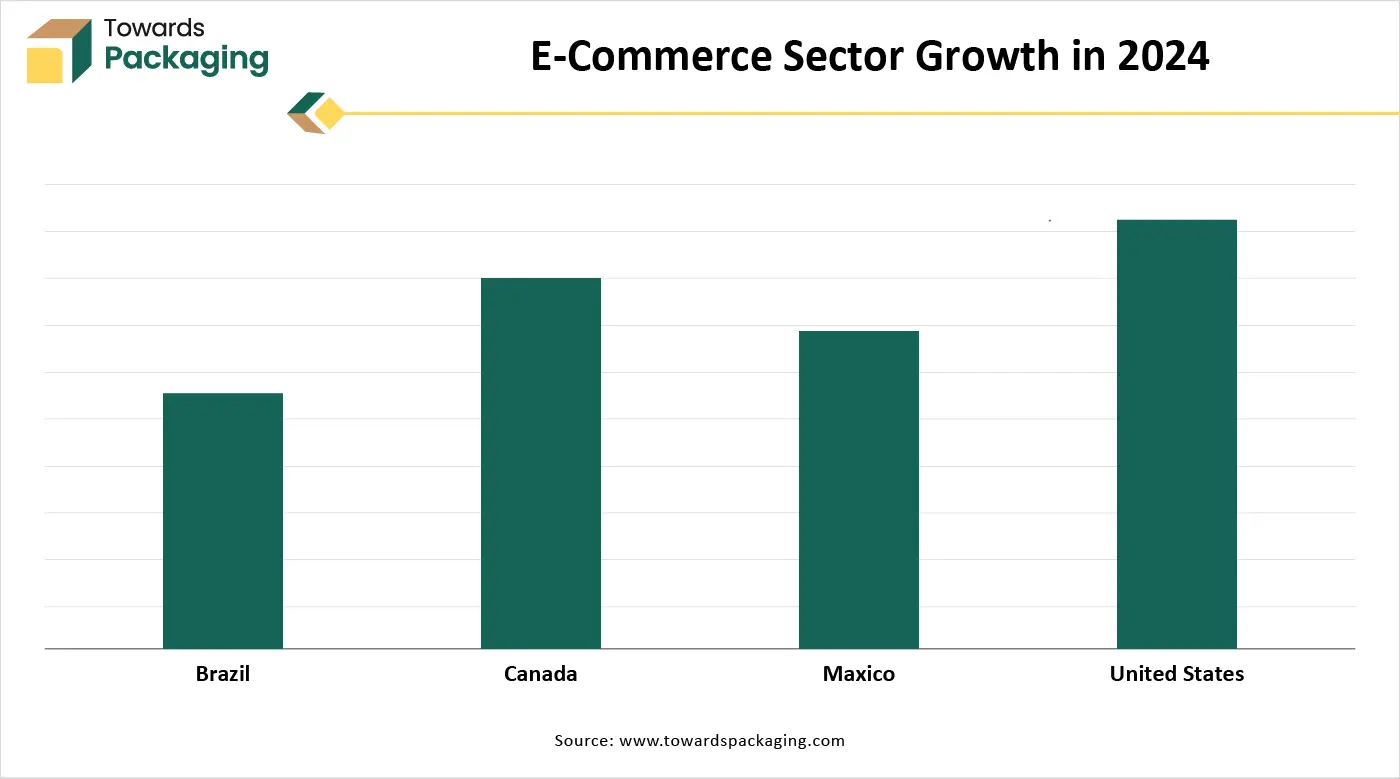

Rising Online Retailing and Cost-Effectiveness

The rising online retailing sector has significantly influenced the growth of the expanded polystyrene for packaging market, with the growing ecommerce platforms attracting online shopping, which raises the concern for effective packaging of the products. Expanded polystyrene is considered to be an effective solution as these is lightweight, capacity to withstand adverse conditions, has cushioning ability, and many such properties have increased the demand for this market.

Online suppliers highly rely on EPS for enhancement in the packaging quality of the products. The versatility of expanded polystyrene packaging permits the personalisation of packaging resolution to accommodate several product sizes and shapes, giving an affordable and effective means for the safety of products at the time of transportation. As the online shopping trend is rising worldwide, the demand for EPS packaging is also growing significantly.

The accessibility and convenience provided by e-commerce websites have reshaped the habits of customers, resulting in high online purchases in various product categories. Therefore, online retailers are looking for reliable packaging solutions that can fulfil the strict requirements of the distribution market. It maintains the products against stacking, temperature differences, and rough handling at the time of transportation.

(Source: JP Morgan)

Restraint

Limited Biodegradability and Raw Material Price Volatility

The limited biodegradability has hindered the growth of expanded polystyrene for the packaging market. It is generally known as Styrofoam, which is manufactured from petroleum-based resources, and it is well-known for its slow decomposition. The low decomposition rate has a negative effect on the packaging market. There is a constant search for an alternative option for packaging due to limited biodegradability options. The imperious to report the limited biodegradability of the expanded polystyrene for packaging continues, driving continuous efforts to revolutionize, implement, and educate sustainable packaging processes on a worldwide scale.

Opportunity

Growth of Bio-based Substitutes

The growth of bio-based substitutes for expanded polystyrene for the packaging market signifies an important step in the direction of addressing ecological apprehensions related to traditional EPS for packaging resources. Bio-based substitutes are derived from renewable materials such as biopolymers, agricultural waste, or plant-based materials, contributing a more environment-friendly and sustainable choice for the packaging process. This move in the direction of bio-based substitutes is driven by the rising consciousness of the ecological influence of traditional packaging resources and the necessity for more sustainable resolutions across trades.

Bio-based substitutes for these packaging are increasing traction because of their decreased carbon footprint and capacity for compostability or biodegradability. Unlike old-style expanded polystyrene, which is extracted from fossil fuels and other non-renewable materials, bio-based substitutes use renewable feedstocks, thus dropping dependency on limited resources and reducing greenhouse gas releases. Bio-based resources propose the possibility for end-of-life choices such as recycling or composting, further offering towards the circular economy and reducing waste generation.

The growth of bio-based substitutes for expanded polystyrene for packaging offers opportunities for collaborations and innovation across the distribution chain. Producers are capitalizing on research and development to generate bio-based resources with properties comparable to traditional expanded polystyrene, safeguarding compatibility with present packaging procedures and performance necessities. Moreover, association with raw resource suppliers, packaging messengers, and end-users is important to confirm the successful acceptance and execution of bio-based substitutes in the expanded polystyrene for packaging market.

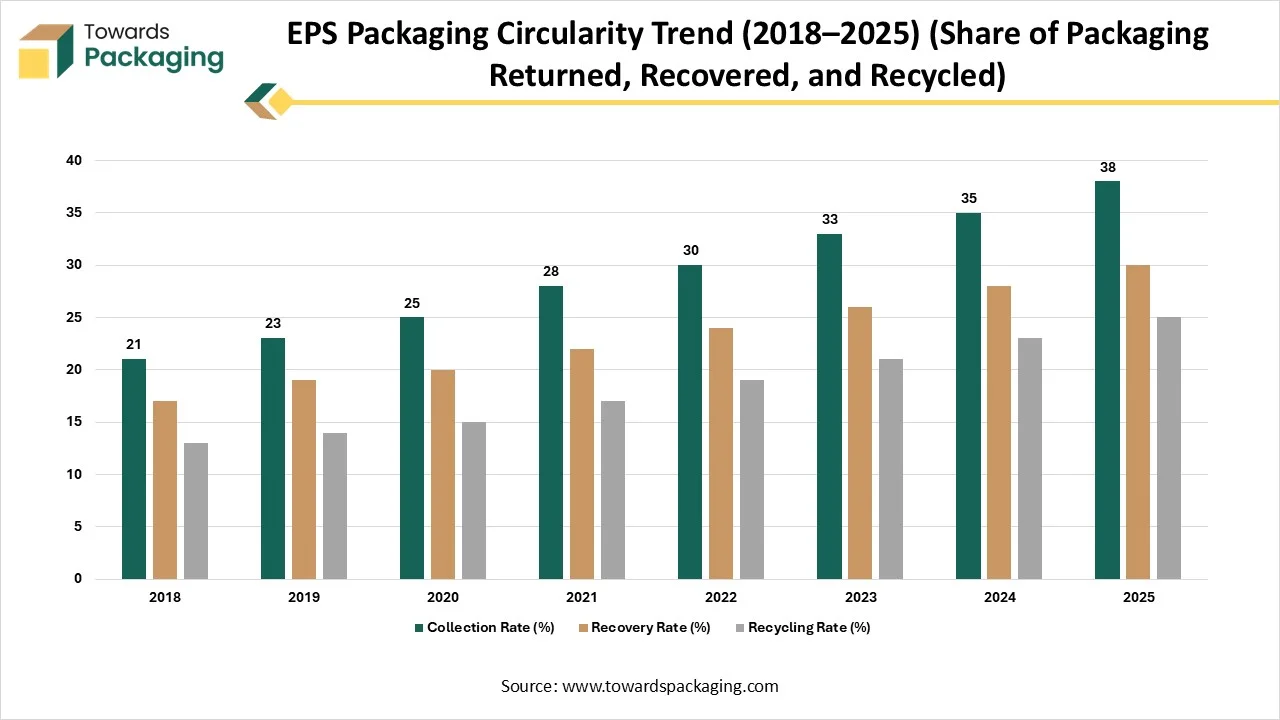

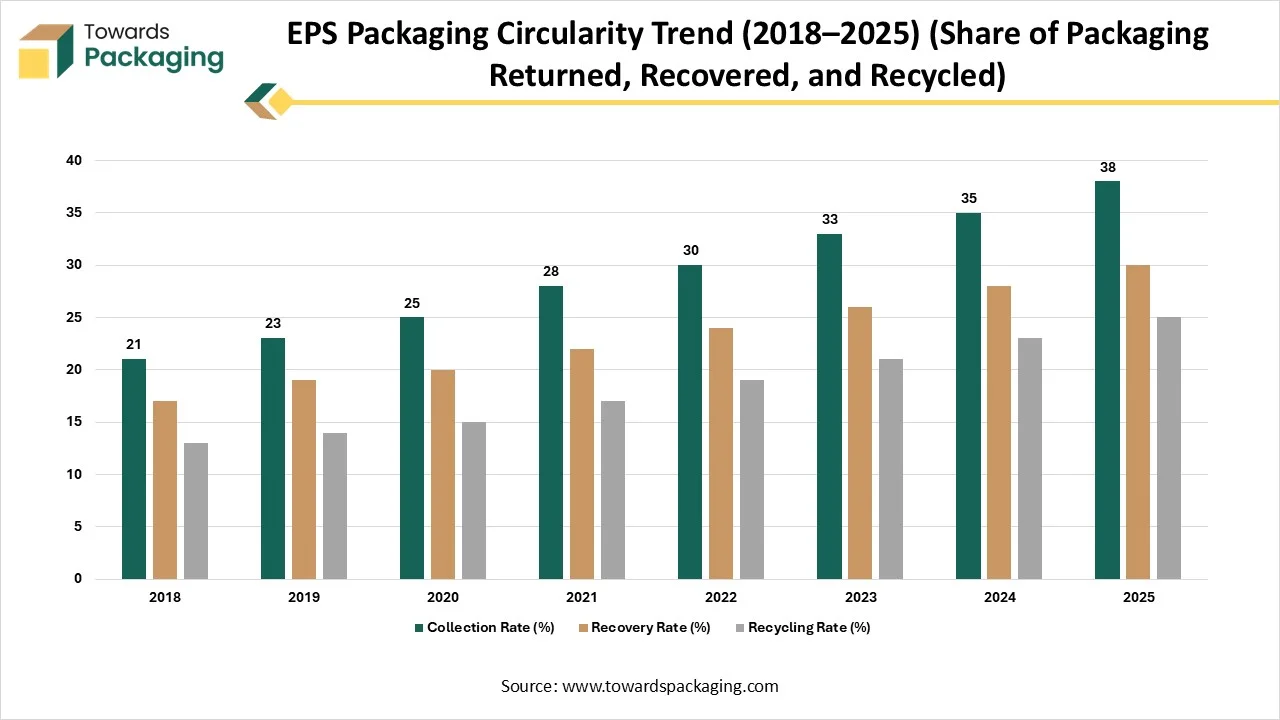

EPS Packaging Circularity Trend (2018-2025) (Share of Packaging Returned, Recovered, and Recycled)

| Year |

Collection Rate (%) |

Recovery Rate (%) |

Recycling Rate (%) |

| 2018 |

21 |

17 |

13 |

| 2019 |

23 |

19 |

14 |

| 2020 |

25 |

20 |

15 |

| 2021 |

28 |

22 |

17 |

| 2022 |

30 |

24 |

19 |

| 2023 |

33 |

26 |

21 |

| 2024 |

35 |

28 |

23 |

| 2025 |

38 |

30 |

25 |

Segmental Insights

White Segment Led the Market in 2024

White foam is considered a highly flexible material used for the packaging of products along Due to their insulating, shock-absorbing, and light nature, these materials are widely used in the market. This product type is highly used by the food and beverage industries as its thermal stability allows the transportation of perishable materials. On the other hand, the grey segment will grow rapidly in the market during the forecast period of 2024 to 2034. It is widely accepted due to the high insulation power of the packaging products. In grey expanded polystyrene, due to the presence of graphite, the insulation property is enhanced.

Foam Coolers Segment Holds Significant Revenue Share

Foam coolers are used in huge quantities to transport materials that require temperature controlling system, such as pharmaceutical products, frozen foods, dairy products, and seafood. Rising demand for ready-to-eat food products has influenced the demand for these packages. Similarly, the tray and clamshells segment is anticipated to grow with the highest CAGR in the market during the studied years. These are used to keep food products warm and ready to consume. Such containers prevent the leakage of food products and are used for quick service in restaurants.

Reduced Cost Influences the Food and Beverage Industry to Promote Dominance

The food and beverage segment registered its dominance over the expanded polystyrene for packaging market in 2024. Expanded polystyrene is widely used in this industry due to its insulation, packaging, lightweight, and reduced charges. For the storage of milk and other food and beverages, these packages are highly utilized as this type of package is considered to be safe and leak-proof, which prevents spilling of products. The continuous growth in the medical industry has influenced the demand for these packages for the safety of medical equipment. These packages are considered safe for the storage and transportation of the surgical devices.

Regional Insights

Presence of Market Leaders in Europe Promotes Dominance

Europe held the largest revenue share of the expanded polystyrene for packaging market in 2024, due to the presence of market leaders in countries such as the U.K., Germany, France, Italy, Spain, and several others. The transportation of fragile components has influenced the demand for such expanded polystyrene packaging. The presence of several market players such as Alpek SAB de CV, Versalis, SABIC, ACH Foam Technologies, Inc., Kaneka, NOVA Chemicals Corporation, and several others has contributed to the continuous innovation of this market.

U.K. Expanded Polystyrene for Packaging Market Trends

The U.K. EPS packaging market remains stable since industries depend on its lightweight stick absorbing and economical characteristics for cold chain goods, electronics, and appliances. Improvements in recyclability and collection initiatives are helping EPS stay relevant despite growing sustainability pressures. Consistent demand is sustained by expanding e-commerce and pharmaceutical logistics.

Asia’s Growing Pharma Industry and Expansion of Industrialization Support Growth

Asia Pacific will grow rapidly in the expanded polystyrene for packaging market during the forecast period. Countries such as India, China, Japan, South Korea, and others are considered as largest producers as well as consumers of the EPS, which makes it a rapidly growing region. The innovation in the pharmaceutical sector enhanced the requirement for safe transportation and storage of the products. The huge necessity of a temperature-controlled system for healthcare product storage has raised the demand for such packaging in this region.

India Expanded Polystyrene for Packaging Market Trends

In India, EPS packaging demand is growing rapidly because the FMCG, electronics appliances, and e-commerce industries are growing. It is a popular option for mass packaging requirements due to its cost-effectiveness, robustness, and durability. Strong market growth is being supported by investments in EPS recycling and improved production technologies despite regulatory concerns about plastics.

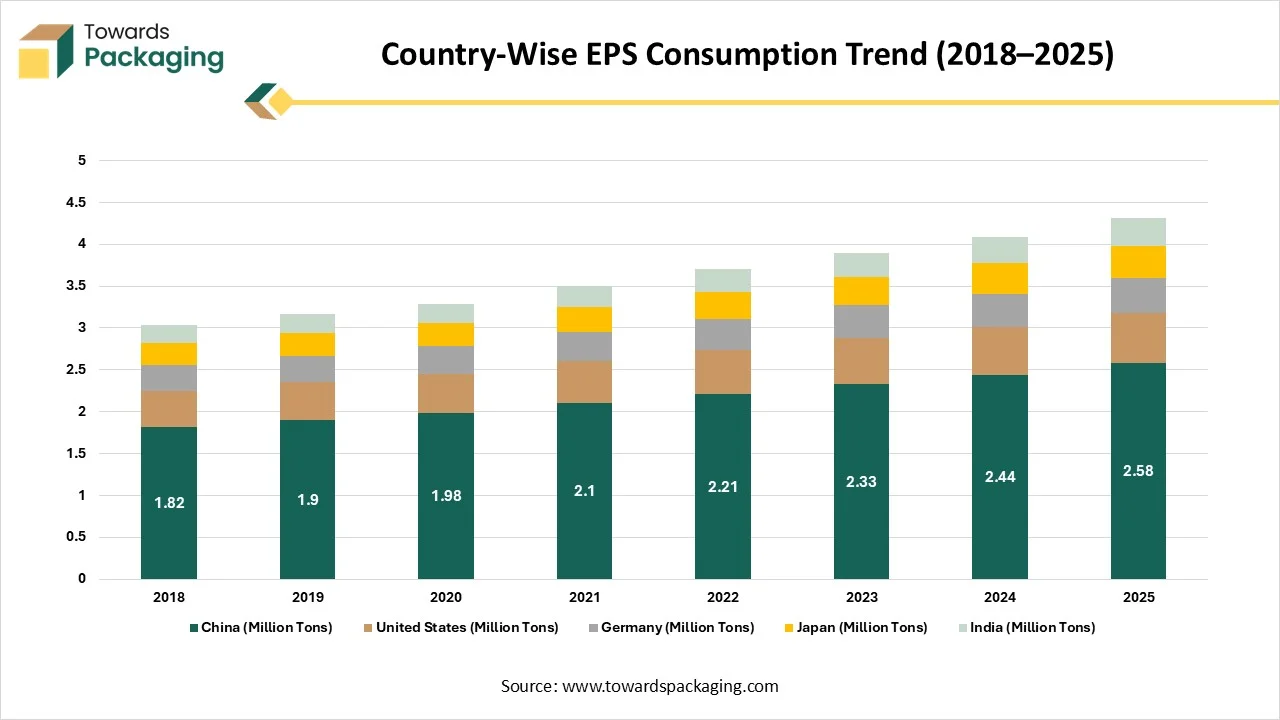

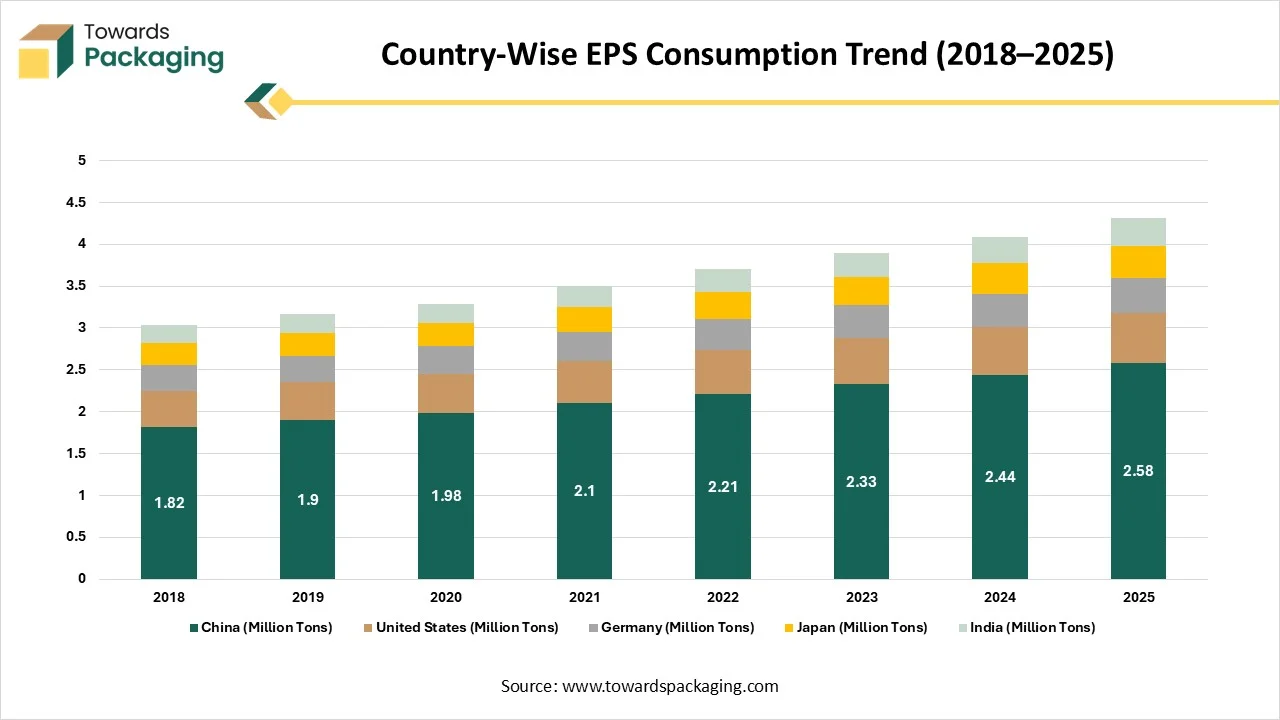

Country-Wise EPS Consumption Trend (2018-2025)

| Year |

China (Million Tons) |

United States (Million Tons) |

Germany (Million Tons) |

Japan (Million Tons) |

India (Million Tons) |

| 2018 |

1.82 |

0.43 |

0.31 |

0.26 |

0.21 |

| 2019 |

1.9 |

0.45 |

0.32 |

0.27 |

0.22 |

| 2020 |

1.98 |

0.47 |

0.33 |

0.28 |

0.23 |

| 2021 |

2.1 |

0.5 |

0.35 |

0.3 |

0.25 |

| 2022 |

2.21 |

0.53 |

0.37 |

0.32 |

0.27 |

| 2023 |

2.33 |

0.55 |

0.39 |

0.34 |

0.29 |

| 2024 |

2.44 |

0.57 |

0.4 |

0.36 |

0.31 |

| 2025 |

2.58 |

0.6 |

0.42 |

0.38 |

0.33 |

Value Chain Analysis

- Raw Materials Sourcing: EPS production uses polystyrene resin and blowing agents; resin quality affects expansion, density, and shock absorption properties. Long-term contracts stabilize supply and costs.

- Logistics and Distribution: Molded EPS packaging is shipped to electronics, appliances, and cold chain companies. Optimized stacking reduces transport volume and cost while protecting fragile products.

- Recycling and Waste Management: Optimizing transport and regional hubs to reduce costs, minimize damage, and support industrial and cold chain clients. They are adopting modular designs to improve shipping efficiency.

Manufacturer-Wise EPS Production Trend (2018-2025) (Top EPS Packaging Manufacturers)

| Year |

BASF Production (000 Tons) |

SABIC Production (000 Tons) |

SUNPOR (000 Tons) |

Kaneka (000 Tons) |

Synthos (000 Tons) |

| 2018 |

620 |

505 |

318 |

276 |

242 |

| 2019 |

643 |

524 |

331 |

285 |

254 |

| 2020 |

667 |

543 |

346 |

296 |

266 |

| 2021 |

705 |

568 |

362 |

309 |

279 |

| 2022 |

742 |

593 |

379 |

322 |

292 |

| 2023 |

778 |

618 |

398 |

337 |

306 |

| 2024 |

810 |

642 |

417 |

349 |

318 |

| 2025 |

842 |

668 |

438 |

363 |

332 |

Expanded Polystyrene for Packaging Market Key Players

Latest Announcements by Industry Leaders

- In February 2025, Christian Bekken, CEO of BEWI, expressed, “Through the collaboration with TRCG, we strengthen RAW’s position in the European EPS market. We maintain the operational benefits of being vertically integrated while at the same time facilitating growth in our downstream business. Here, we have higher margins and see a higher growth potential both organically and through acquisitions, supported by strong megatrends for the construction markets in Europe”. (Source: Cision)

New Advancements in Expanded Polystyrene for the Packaging Market

- In February 2025, BEWI collaborated with the Rock Capital Group (TRCG) to combine their respective raw material businesses to create a leading EPS producer in Europe. (Source: Cision)

- In November 2024, the Indian Institute of Science (IISc) announced the development of a biodegradable foam that could transform the packaging industry while addressing critical environmental concerns. (Source: Times of India)

Expanded Polystyrene for Packaging Market Segments

By Product

By Application

- Sheets

- Trays and Clamshells

- Foam coolers

- Cups and bowls

- Packaging peanuts

By End-Use

- Food and beverages

- Foodservice

- Healthcare

- Electronics and Electrical appliances

- Building and construction

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait