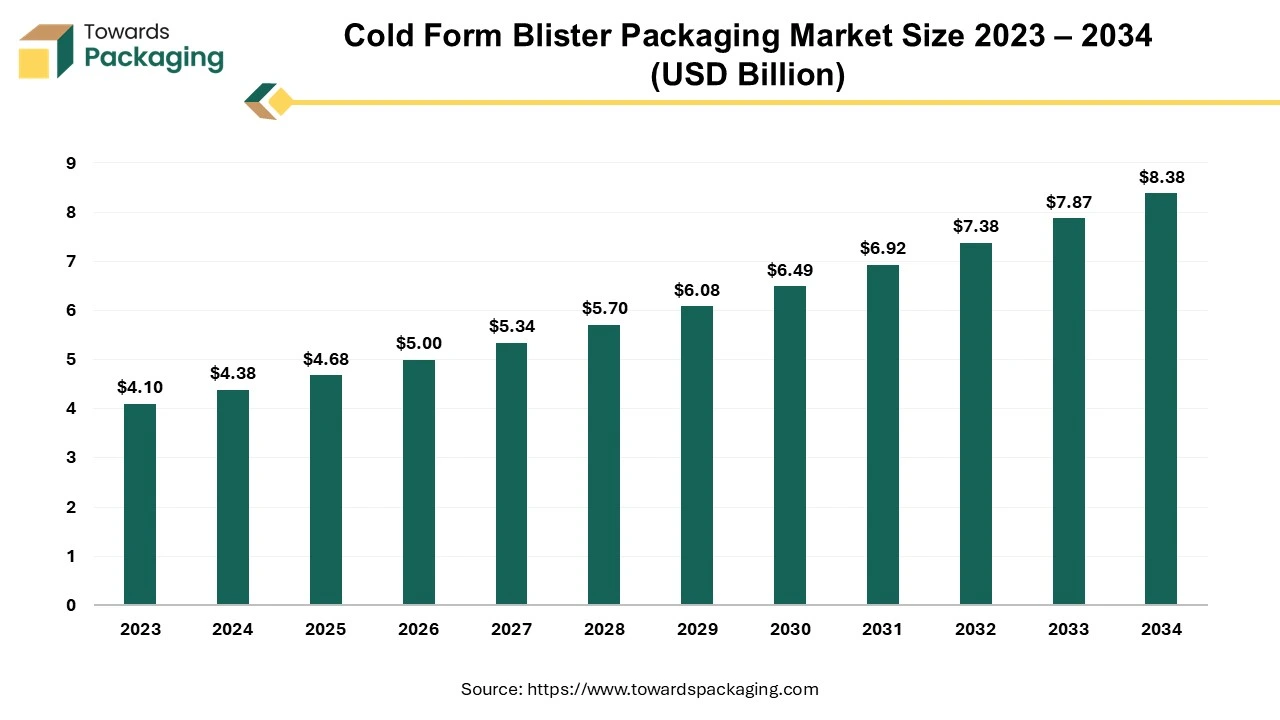

The cold form blister packaging market is forecasted to expand from USD 4.99 billion in 2026 to USD 8.99 billion by 2035, growing at a CAGR of 6.75% from 2026 to 2035. This report delivers detailed market size data, trend analysis, and segmentation by material (aluminum, PVC, polyamide, PP, PE, PET) and application (healthcare, electronics & semiconductors, food, consumer products).

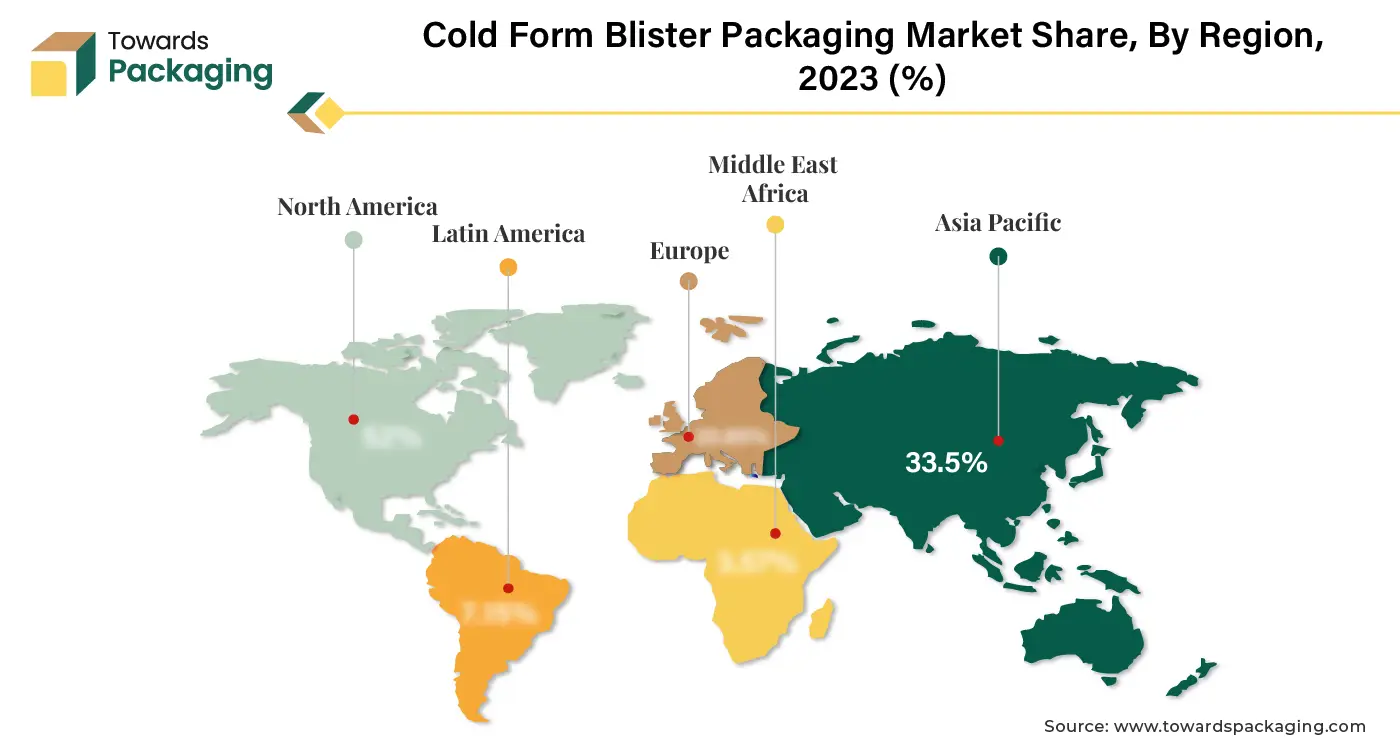

It provides comprehensive regional analysis across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with Asia Pacific leading market share and North America growing at the fastest rate. Coverage includes competitive benchmarking of Amcor, Constantia Flexibles, Sonoco, WINPAK, ACG, Bilcare, along with value chain analysis, manufacturer & supplier mapping, and global trade data, including USD 70.4 billion aluminum foil exports (HS 7607).

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing cold form blister packaging which is estimated to drive the global cold form blister packaging market over the forecast period.

Cold form blister packaging is a type of pharmaceutical and medical packaging used to protect products like tablets, capsules, or sensitive medical devices. It is made by pressing aluminum-based laminate sheets into the desired shape without the use of heat, hence the term "cold form." The components of cold form blister packaging have been mentioned here as follows: aluminum foil, polymer film (e.g., PVC or PVDC), and nylon film. The aluminium foil offers and impermeable barrier to moisture, light, oxygen and other environmental factors. The polymer film adds structural support and acts as a sealing layer. The nylon films provide extra durability and strength, making it resistant to punctures.

The cold form blister packaging provides excellent barrier properties which completely protects the contents from oxygen, UV, moisture, light, and contaminants, extending product shelf life. Unlike thermoforming, where heat is utilized to shape plastic, cold forming uses mechanical force, making it ideal for heat-sensitive products. Resistant to punctures and strong enough to withstand external pressures during transport and storage.

| Metric | Details |

| Market Size in 2025 | USD xx Billion |

| Projected Market Size in 2035 | USD xx Billion |

| CAGR (2026 - 2035) | 6.75% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Application and By Region |

| Top Key Players | Amcor plc, Constantia Flexibles, Sonoco Products Company, WINPAK LTD., SteriPack Group, Klöckner Pentaplast. |

The cold form blister packaging industry is experiencing significant growth, driven by advancements in packaging technology, sustainability demands, and the increasing demand for secure and tamper-evident packaging in healthcare and pharmaceuticals.

Aluminum remains the dominant material due to its superior barrier properties against moisture and oxygen. Innovations in recyclable and biodegradable materials are also gaining traction to meet sustainability goals.

Rising environmental awareness is pushing the industry towards sustainable solutions, such as recyclable and biodegradable materials, which appeal to eco-conscious consumers and comply with regulatory standards.

Incorporating technologies like RFID tags, QR codes, or sensors for product tracking and authentication can enhance market appeal.

| Company | Headquarters | Product |

| Amcor plc | Switzerland | Cold form blister foils and packaging systems |

| Constantia Flexibles | Austria | High barrier aluminum blister foils |

| Sonoco Products Company | USA | Barrier blister packaging solutions |

| WINPAK Ltd. | Canada | Sterile barrier & cold form systems |

| Klöckner Pentaplast | Germany | Pharma packaging solutions |

| SteriPack Group | UK | Contract packaging & blister production |

| ACG | India | Pharma packaging & blister foils |

| Bilcare Limited | India | Blister foil & pharmaceutical packaging |

AI integration can significantly enhance the growth of the cold form blister packaging industry by cutting-down costs, optimizing processes, improving quality, and driving innovation. AI-driven analytics can predict machinery breakdowns, minimizing downtime and ensuring continuous production. AI-powered systems can automate repetitive tasks, increasing efficiency and throughput. AI algorithms can optimize material usage, minimizing waste and costs.

AI-enabled computer vision systems can identify defects in real-time, such as uneven sealing or material inconsistencies, ensuring high-quality output. AI can analyze patterns in production and flag irregularities before they become significant issues. The integration of AI tools can create more efficient and eco-friendly packaging designs by simulating material stress and environmental impact. AI enables customized packaging designs tailored to specific product or customer demands, improving market differentiation.

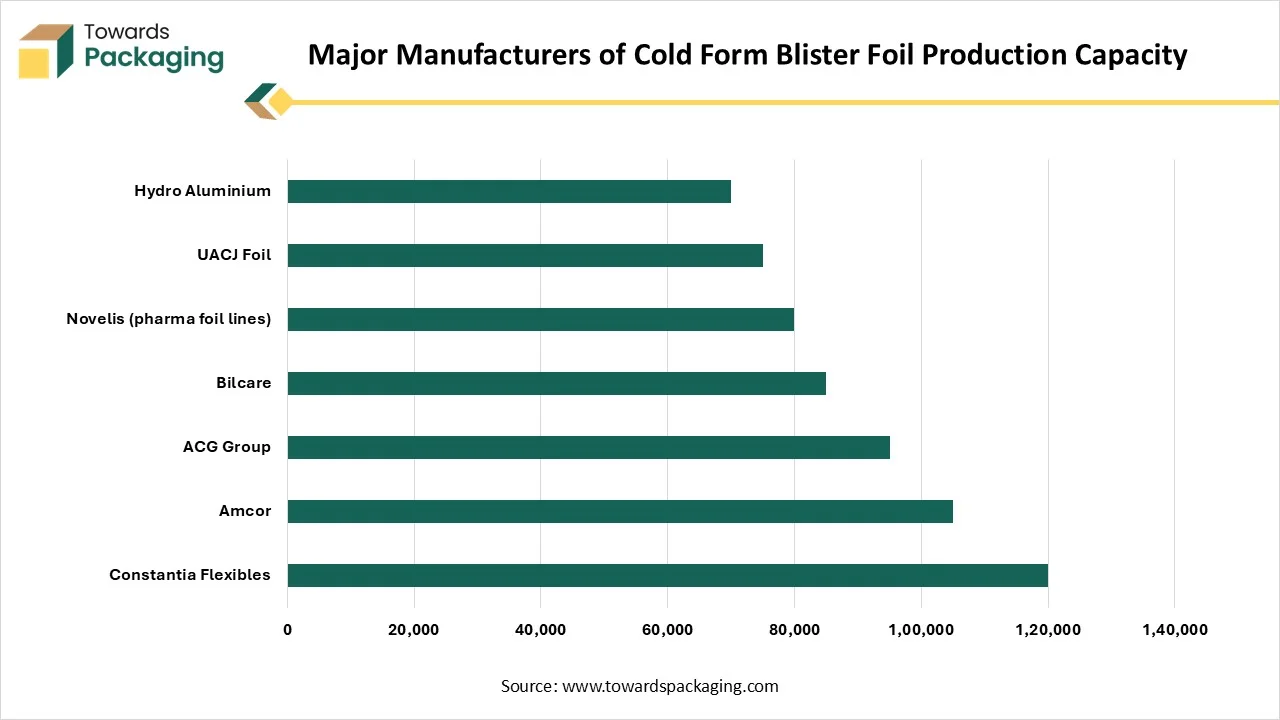

| Manufacturer | Country | Annual Production Capacity (Metric Tons) |

| Constantia Flexibles | Austria | 120,000 |

| Amcor | Switzerland | 105,000 |

| ACG Group | India | 95,000 |

| Bilcare | India | 85,000 |

| Novelis (pharma foil lines) | United States | 80,000 |

| UACJ Foil | Japan | 75,000 |

| Hydro Aluminium | Norway | 70,000 |

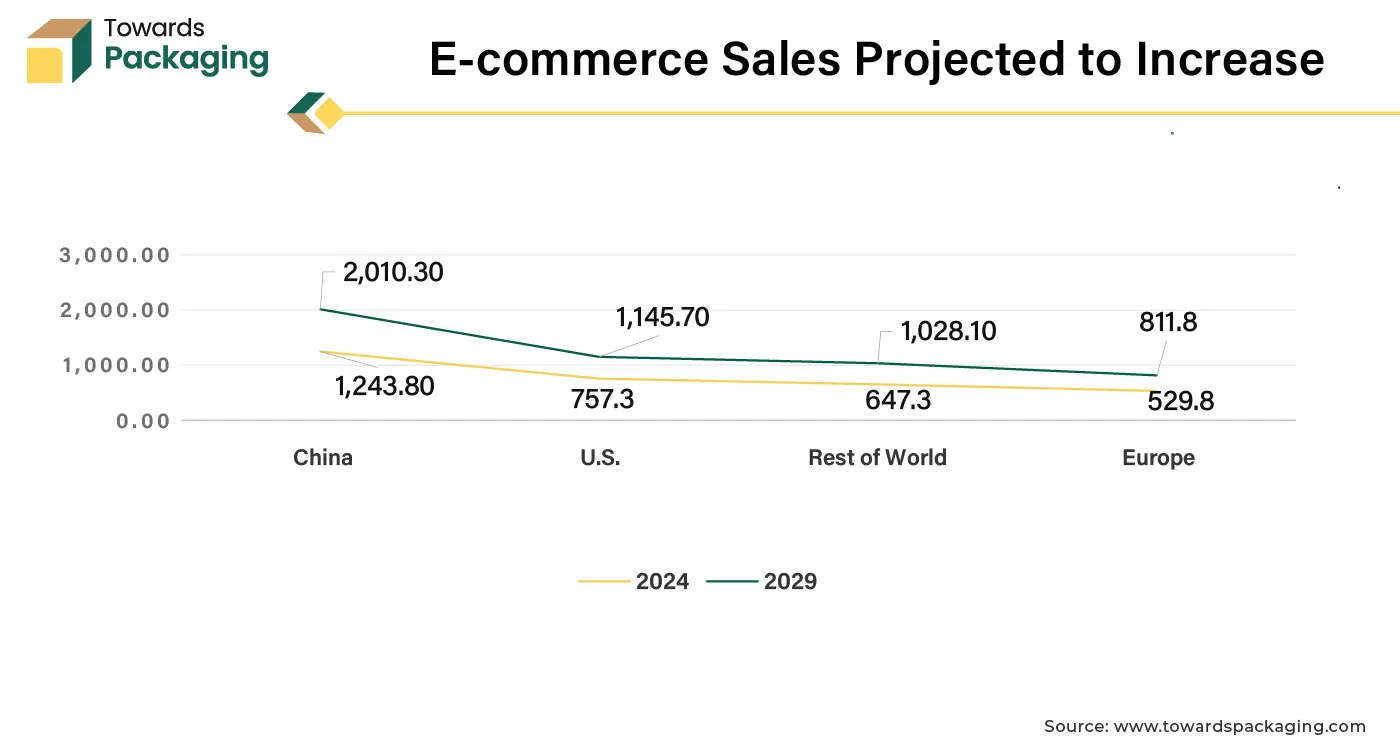

Rise in demand for secure packaging for shipping goods, which is estimated to drive the growth of the cold form blister packaging market over the forecast. Cold form blister packaging provides durability and protection, ideal for products sold and shipped through e-commerce platforms. Expanding online retail necessitates secure and tamper-proof packaging to ensure product safety during transit.

The key players operating in the cold form blister packaging market are facing challenges due to stringent regulatory norms as well as limited design flexibility. The high material costs and competition from alternative materials restrict the growth of the cold form blister packaging market. Thermoforming is a less expensive and more flexible alternative, making it a preferred choice for some manufacturers. Pouches and sachets provide lightweight and cost-effective solutions, posing competition to cold form blister packs. Cold form blister packaging processes are slower compared to thermoforming, which can limit scalability and increase production time. Cold form packaging is less flexible and provides limited customization compared to thermoformed plastic packaging. This can restrict its application in products requiring intricate shapes or branding.

Regulatory requirements for moisture-proof, tamper-evident, and safe packaging encourage the adoption of cold form blister packs. The need for secure, long-lasting packaging in the food industry presents growth potential. The increasing popularity of dietary supplements requires reliable, moisture-resistant packaging to preserve product efficacy.

Rising preference for convenient, unit-dose packaging in pharmaceuticals and nutraceuticals drives demand. Enhanced security against counterfeiting and tampering presents an opportunity to differentiate through innovation.

| Region | Annual Production Volume (Metric Tons) | Share (%) |

| Europe | 235,000 | 33 |

| Asia (China, India, Japan, Korea) | 295,000 | 41 |

| North America | 135,000 | 19 |

| Rest of World | 45,000 | 7 |

The aluminium segment held a dominant presence in the cold form blister packaging market in 2024. Aluminium is predominantly utilized in cold form blister packaging because of its unique properties that make it highly effective for protecting sensitive products. Aluminum offers a nearly impermeable barrier against moisture, protecting products that are sensitive to humidity.

The aluminium material blocks light and oxygen, preventing oxidation and degradation of sensitive items like pharmaceuticals and food products. Aluminum material provides strong mechanical protection, ensuring the integrity of products during transportation and storage. Aluminum is often laminated with plastic films and other materials to enhance its performance, combining the strengths of different layers (e.g., forming capability, sealing properties). Aluminum is ideal for deep drawing and forming without cracking, enabling the creation of secure cavities for various product shapes and sizes.

The Polyvinyl Chloride (PVC) segment is expected to grow at the fastest rate in the cold form blister packaging market during the forecast period of 2024 to 2034. PVC is a desirable substitute for cold-form blister packaging solutions when compared to other materials, particularly for less expensive products or when cost reduction is a key factor. The market expansion for this sector is further driven by the fact that these films have great visibility properties, which are crucial for items like oral medications where the visual appeal or identification of the contents is important.

The healthcare segment registered its dominance over the global cold form blister packaging market in 2024. The global increase in chronic illnesses and aging demographics drives higher consumption of medications that require moisture- and light-resistant packaging like cold form blister packs. The growth in biologics, specialty drugs, and highly sensitive formulations requires advanced packaging to maintain efficacy and stability.

The electronics & semiconductors segment is expected to grow at the fastest rate in the cold form blister packaging market during the forecast period of 2024 to 2034. Electronic components, such as capacitors, semiconductors, and resistors, are sensitive to moisture, which can cause corrosion or malfunction. Cold form blister packaging provides an effective moisture barrier. The packaging prevents oxidation and UV damage, extending the shelf life of delicate electronic parts.

Cold form blister packaging offers robust protection against punctures, ensuring electronic components remain intact during handling and transportation. It safeguards small, fragile components from mechanical shocks during storage and transit. Cold form packaging can be tailored to fit the exact dimensions of electronic components, minimizing movement and potential damage. Electronic components are often manufactured in one location and shipped globally.

Cold form blister packaging ensures product integrity during long-distance transport. The protective nature of cold form blister packaging reduces the risk of damage, minimizing financial losses and ensuring customer satisfaction. Its lightweight in nature and assists to minimize shipping costs, which is crucial for high-volume shipments of electronics. As sustainability becomes a priority, cold form blister packaging with recyclable materials aligns with eco-friendly practices in the electronics industry.

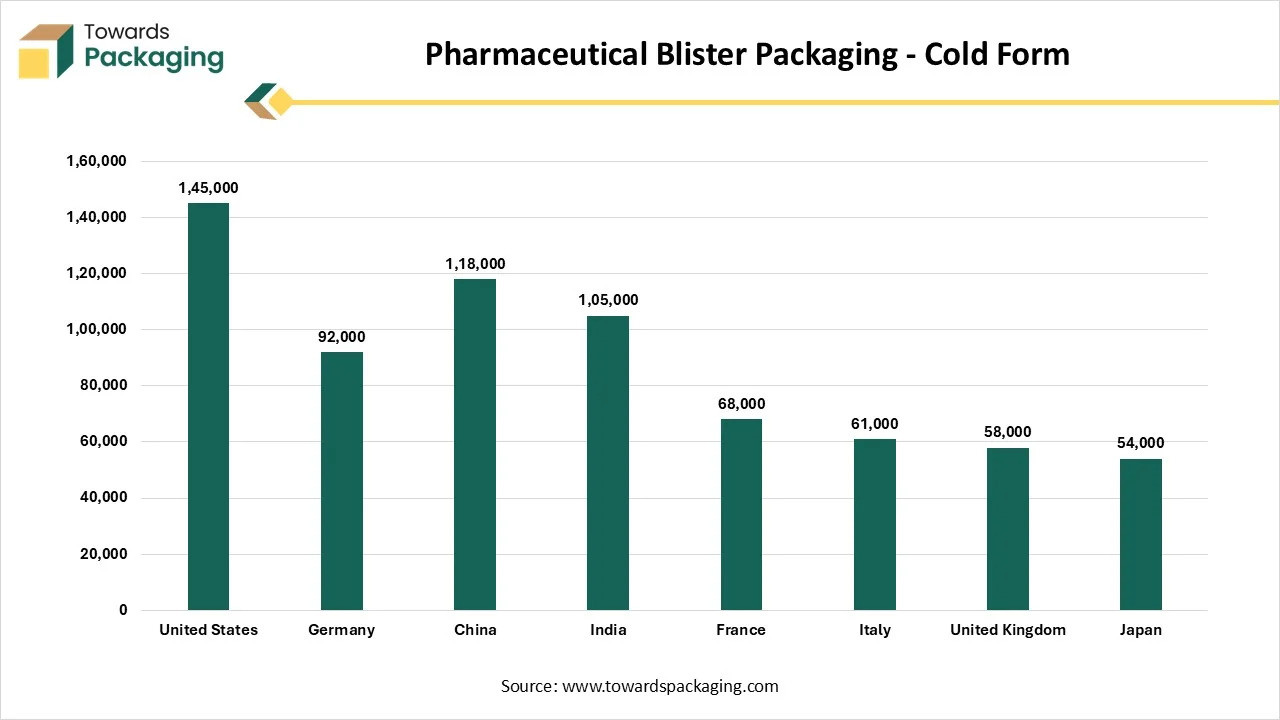

| Country | Annual Consumption (Metric Tons) |

| United States | 145,000 |

| Germany | 92,000 |

| China | 118,000 |

| India | 105,000 |

| France | 68,000 |

| Italy | 61,000 |

| United Kingdom | 58,000 |

| Japan | 54,000 |

Asia Pacific region held the largest share of the cold form blister packaging market in 2024. As Asian pharma companies expand their product portfolios, particularly in high-value drugs like biologics and generics, the demand for protective, long-shelf-life packaging like cold form blister packs will grow. Focus on sensitive drugs: Many pharmaceutical companies are developing moisture- and temperature-sensitive drugs that require superior barrier properties, directly benefiting cold form blister packaging.

To meet export demands, pharma companies often follow international packaging standards, which can increase the use of cold form blister packs due to their compliance with strict regulations for drug safety and quality. As sustainability becomes a focus, Asian pharma companies can push packaging firms to develop recyclable or eco-friendly cold form blister materials, contributing to the industry's growth. Asian pharma companies expanding into developing markets will increase the need for durable and affordable packaging, including cold form blisters, for safe drug transportation and storage in diverse climates.

China plays a distinctive role in the cold form blister packaging market. This is due to the large and growing pharmaceutical and healthcare industry in China, driving blister packaging demand. Additionally, its status is not only as a major API producer but also as a global manufacturing hub means blister packaging is crucial for protecting goods during transit and storage. Pharmaceutical companies in China often rely on blister packaging to protect and display their medications, which are then exported globally.

India also plays a significant role in the cold form blister packaging market. This is because the pharmaceutical industry is experiencing rapid growth in the region, leading to increased demand for cold form blister packaging. Indian pharmaceutical manufacturers leverage cold form blister packaging to protect and present their medications, highlighting the growth of the pharmaceutical industry in India.

North America region is anticipated to grow at the fastest rate in the cold form blister packaging market during the forecast period. eCommerce requires robust packaging to withstand handling, long shipping durations, and varied climatic conditions. Cold form blister packaging, with its superior barrier properties, ensures the safety of pharmaceutical and healthcare products during transit. Many eCommerce platforms cater to pharmaceuticals and OTC drugs that are highly sensitive to environmental factors. Cold form blister packs offer excellent protection against moisture, oxygen, and light, making them ideal for such products.

North America’s stringent regulations for pharmaceuticals emphasize serialization and anti-counterfeiting measures. Cold form blister packs, with their adaptability for unique codes and tamper-evidence features, align well with these needs, supporting eCommerce distribution's transparency. The eCommerce boom in North America acts as a catalyst for the cold form blister packaging industry by increasing demand for durable, secure, and innovative packaging solutions. The intersection of consumer expectations, eCommerce logistics, and regulatory requirements ensures that cold form blister packaging remains a critical component in the value chain of pharmaceutical and healthcare products sold online.

The U.S. plays a remarkable role in the North American cold form blister packaging market, . This dominance is spurred by the large consumer base, high demand across various industries, and strict regulations, especially in the pharmaceutical sector. The presence of major pharmaceutical companies in the U.S., like Merck, Pfizer, and Elli lilly, contributes to the demand for high-quality, reliable packaging, including blister packs. Also, strict regulations, including those from the Consumer Product Safety Commission and the FDA, mandate the use of child-resistant and tamper-evident packaging like cold-form blisters, heightening market growth.

Europe is expected to witness notable growth in the forecast period, driven by the presence of a robust pharmaceutical industry and regional emphasis on child-resistant and unit-dose packaging, and a focus on sustainable materials. Stringent regulation in Europe encourages the development of sustainable packaging solutions. Rich research sector of the region, enabling access to cutting-edge technologies to not only develop eco-friendly solutions but also to enhance sustainable properties of each product manufactured.

Germany leads the regional market, driven by the country's strong pharmaceutical manufacturing and innovation sector. Germany is a hub for major pharmaceutical companies and drives demand for packaging solutions like cold-form blisters. Germany has an increased need for reliable and effective packaging solutions, particularly in the healthcare sector.

The UK is the second largest country, leading the regional market with countries with well-established healthcare infrastructure, pharmaceutical & biotechnology manufacturing, and innovation sectors. The UK has established the blister pack recycling scheme for Boots Advantage Card members nationwide, who can earn 100 points (worth £1) for every five empty blister packs when they drop them off at a participating Boots store and spend £5 or more.

| Indicator | Value (USD) |

| Global exports in aluminium foil (HS 7607) | USD 70.4 billion |

| Global imports in aluminium foil (HS 7607) | USD 68.9 billion |

| Share used for pharma blister foil | 20 to 25% |

| Trade value attributable to blister foil | USD 14 to 17 billion |

According to Johannes Steurer, CEO of Aluflexpack, packaging company, stated that new regulations shaped the cold form blister packaging market and encouraged the company to try something no one had done before: form lacquered aluminum into a new, fully recyclable product for the pharmaceutical industry.

By Material

By Application

By Region

January 2026

January 2026

January 2026

January 2026