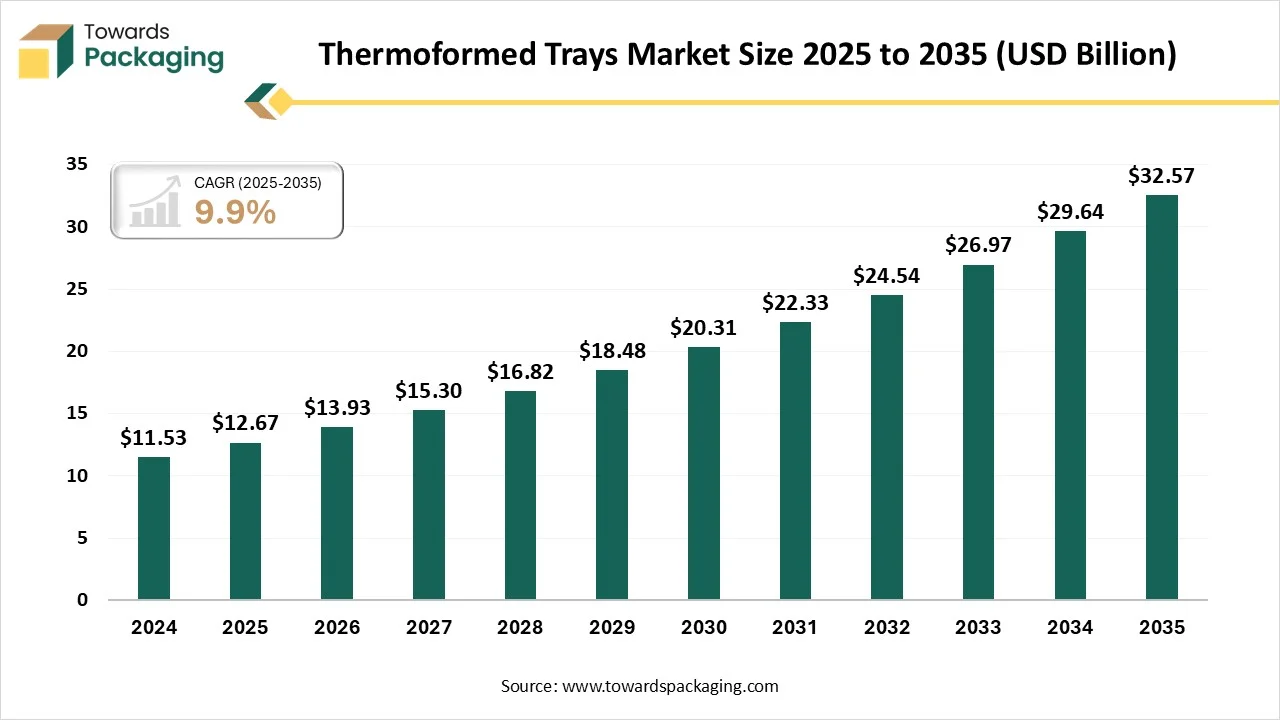

The thermoformed trays market is forecasted to expand from USD 13.93 billion in 2026 to USD 32.57 billion by 2035, growing at a CAGR of 9.9% from 2026 to 2035. The urge for thermoformed trays is developing because of developing food demands, healthcare and electronics sectors, and e-commerce growth, which is driven by their cost-effectiveness, durability, and customization too.

The thermoformed trays market comprises rigid or semi-rigid packaging trays produced by heating and molding plastic sheets into specific shapes. These trays are widely used in food packaging, pharmaceuticals, medical devices, electronics, and industrial components due to their lightweight structure, durability, cost-effectiveness, and high customization capabilities.

Thermoformed trays display a tailored packaging solution designed through the thermoforming procedure. This procedure includes heating a plastic sheet until it is pliable and then molding it into a particular shape by using a tailored mold. The outcome is a lightweight, durable tray that serves as perfect protection for different products. The thermoforming procedure enables accurate personalization, which ensures that every tray aligns with needs and demands.

Automatic thermoforming machines shape the plastic sheets into the packaging by using pressure and heat. The procedure begins when the machine heats a plastic sheet until it becomes soft. The sheet then shifts into a mold, in which the machine utilizes the vacuum or air to make a desired shape. This procedure makes packaging that matches food safety standards and serves better product protection. Thermoforming packaging machine technology assists organizations in receiving airtight seals, which leads to longer shelf life and improved safety for the food packaging.

Raw Material Sourcing: ABS is created with acrylonitrile, butadiene, and styrene, which is a very rigid material and has perfect flexibility and elasticity, which reacts well with paint and glues well. These characteristics have integrated with the lease cost and ease of production, which make it the most prevalently used plastic raw material in the thermoforming procedure. It is generally used in sectors like electrical enclosures, auto parts, and medical and health needs and requirements.

Component Manufacturing: Thermoforming plastic trays and bins have grown as productive and evergreen solutions. Bins and trays manufactured through the tailored thermoforming production procedure are well known to serve various advantages for different sectors. From medical device storage to food processing, the thermoformed plastic taurus and bins serve a cost-effective and tailored material handling selection that ensures product visibility, protection, and easy handling too.

Logistics and Distribution: The selection of packaging design and material plays a crucial role in reducing transportation costs, optimizing space, and ensuring product safety, too. Among different packaging solutions, thermoforming trays are differentiated as a practical option and are cost-effective too. Such trays deliver an accuracy, durability, and ease of handling which make them perfect for smooth storage and logistics.

The polyethylene terephthalate segment dominated the market in 2025 with 32.2% share as it maintains structural integrity from -40 degrees Fahrenheit to 180 degrees Fahrenheit, which makes it perfect for both hot food uses and frozen too. Styrofoam trays perform perfectly well in the cold but cannot be wrapped at temperatures above 100 degrees Fahrenheit. These trays serve as an effective barrier to puncture opposition that lowers the product loss from packaging failures. Independent testing displays PET trays that stand firmly with 40% more puncture force as compared to comparable Styrofoam alternatives.

The bio-based plastics segment is expected to experience the fastest CAGR during the forecast period. Bioplastics have various characteristics compared to regular plastics. Some of the bio-based plastics, such as polylactic acid (PLA) and the polyhydroxyalkanoates, are thermoplastics that can, theoretically, be utilised for thermoforming. Hence, because of their various pattern, bioplastics have special needs and demands in relation to processing and temperature that may change from those of regular plastics.

The standard thermoformed trays segment dominated the market in 2025 with a 72.3% share, as it became famous because of the combination of its intrinsic physical benefits and the growth of high-volume and cost-effective production procedures, which align with the developing demands of different sectors in the post-WWII space. These thermoformed trays can be personalized to meet product weights, shapes, and dimensions, too. This enabled organizations in various sectors like medical, food, and electronics to fit their exact demands.

The custom thermoformed trays segment is expected to experience the fastest CAGR during the forecast period. Custom thermoformed trays are updating the way organisations package their products, serving a combination of durability, flexibility, and aesthetic look that regular packaging procedures cannot align with. These taurus are designed by using high-level thermoforming machines, which design plastic sheets into high-quality and accurate packaging solutions. They deliver medical, food, or industrial uses and custom thermoformed taurus that enables products to serve products securely while maintaining a professional look.

The food packaging segment dominated the market with a 34.9% share in 2025, as one of the initial benefits of thermoformed taurus for food packaging is hygiene. Such trays are being manufactured in controlled surroundings, by adhering to rigid food safety regulations and lowering the contamination too. Their packed edges and constant structure make sure that food stays safe, fresh, and visually appealing throughout the supply chain. The usage of thermoformed plastic trays assists in protecting against bacterial development and protects the quality of sensitive products like dairy, fruits, meat, and ready meals.

The pharmaceutical and medical segment is expected to experience the fastest CAGR during the forecast period. Pharmaceutical organizations use thermoformed trays to keep and distribute medication. Thermoformed plastic trays serve accurate classification that protects the pollutant. Hence, custom trays crafted for the medication assist quality management system standard, as they implement compliance and safety with the pharmaceutical sector's strict regulations and standards. Whereas the healthcare sector relies on thermoformed plastic trays to track the integrity and sterility of implants, instruments, and diagnostic machines.

The vacuum forming segment has dominated the market with 54.8% because it is a tailored subset of thermoforming. It utilises vacuum pressure to push a plastic sheet tightly over a mold. This procedure is perfect for making in-depth shapes with smooth surfaces. Vacuum forming is specifically effective for the single-surface molds that solve manufacturing. Producers frequently select vacuum forming for projects that need uniformity and accuracy. Prevalent uses count taurus, signage, and protective covers.

The pressure forming segment is expected to experience the fastest CAGR during the forecast period. Pressure forming trays is a high-level thermoforming procedure that utilises both positive air pressure and vacuum to make highly detailed, exact plastic trays with factors that are also suitable for injection molding. This procedure is widely used for manufacturing high-quality medical, food, and retail packaging trays. A flat sheet of thermoplastic, such as PVC, PET, and HIPS, is being heated in an oven until it becomes flexible.

North America dominated the market with a 46.5% share in 2025, as the thermoformed trays industry is witnessing strong demand due to development in the healthcare and food delivery sectors. Rising usage of ready-to-eat meals and strict regulations on food safety drive the acceptance of high-barrier thermoformed solutions. With growing demand for medical trays and sensitive barrier machines, producers are moving towards sustainable alterations. Also, the industry’s growth is initially being driven by high user demand for packaged and convenient foods and the strong presence of the main production procedures that need protective and durable packaging solutions.

The growth is predicted to continue due to current product invention, technological advancements in material science and automation, and the developing demand for reliable and efficient packaging across different sectors. On the other hand, the demand for tamper-evident, sterile, and organized packaging for medical devices, unit-dose medications, and diagnostic kits is a main demand source. The U.S pharmaceutical industry is stretched, and big companies with an overall market share invest mainly in this area.

Asia Pacific expects the fastest growth in the market during the forecast period, as the demand for food and beverages is developing, which is driven by the rising popularity of microwavable meals, frozen and ready-to-eat, as well as the demand to stretch the shelf life and ensure hygiene too. Thermoformed trays are widely used in supermarkets for showcasing fresh produce, dairy products, and meat, too. Also, producers utilise thermoformed items like trays and clamshells for packaging sensitive electronic batteries, components, and accessories due to their protective qualities.

India‘s packaging sector is experiencing an update, which is driven by technological developments, automation, and sustainability urges. Thermoforming machines are playing an important role in shaping the future of medical supplies, food packaging, and industrial items, too. With the development of eco-friendly materials and fast-speed manufacturing, the future of thermoforming machines in India will emerge.

Europe's thermoformed trays industry is witnessing major development, which is driven by the developing demand across different sectors, including healthcare, consumer goods, and food packaging. The industry's expansion is driven by technological elevation, growing user choice, and sustainability initiatives for reliable packaging solutions. As organizations find inventive and environmentally friendly options, the industry is meant for constant growth, with main players that invest in research and development to develop product services and align with emerging regulatory standards.

Storing environmental regulations, such as the German Packaging Act (VerpackG) and the EU directives on plastic waste, depends on producers to utilise compostable, recyclable, and bio-based materials. The German companies are receiving big recycling rates of 68.9% for the plastic packaging in the year 2023, and the latest Plastic Fund Act (EWKFondsG) has revealed an imposition on single-use plastics that encourages the urge for more sustainable options like PLA and rPET.

The Thermoformed Trays Market in the Middle East & Africa (MEA) region is currently the most chosen material because of its availability and low cost, as there is growing demand for biodegradable, sustainable, and eco-friendly alternatives, such as moulded pulp, which is being driven by the growing surrounding awareness and the government regulations on single-use plastics. South Africa has a mature food-producing foundation that tops the food processing machine market in the region, as the UAE is quickly advancing, supported by urbanization and national food security measures.

The development of the e-commerce industry in the UAE needs reliable yet cost-effective packaging for the accessories, electronics, and consumer goods that frequently use thermoformed blisters, clamshells, and trays, too. There is a main market trend towards eco-friendly practices and the application of biodegradable or recyclable materials, which is driven by user demand and government regulations that concentrate on plastic waste management.

The development of the Brazilian thermoformed tray is initially being driven by the growing demand for packaged food and beverages, which has a compulsion for versatile and smooth packaging solutions. Growing urbanization and updated user lifestyles have led to a demand in the e-commerce and retail sectors. Furthermore, government regulations mandate food safety and packaging standards that assist market expansion by pushing producers to update their machinery.

By Material Type

By Product Type

By Application

By Forming Technology

By Region

January 2026

January 2026

January 2026

January 2026