The U.S. 503B Compounding Pharmacy Packaging market is expanding rapidly, driven by drug shortages, rising chronic disease cases, and strong uptake of sterile injectable therapies. The market is forecast to grow significantly through 2034, with prefilled syringes and hospital end-users dominating demand in 2024. Our report covers complete market size data, growth projections, segment-level analysis (packaging types and end-users), and detailed regional insights across North America, Europe, APAC, Latin America, and the Middle East & Africa.

It includes competitive benchmarking of key companies such as Walgreens, Wells Pharma of Houston, Albertsons Companies, Roseway Labs, and U.S. Compounding Inc., along with value chain mapping, packaging supply analysis, and U.S. trade data for sterile packaging materials.

| Metric | Details |

| Growth Drivers | Drug shortages of commercially available drugs Demand for personalized medicine Growth in chronic disease cases Advancements in packaging |

| Targeted Therapeutics | Sterile injectables, biologics, specialty meds, ENT, and animal health compounds |

| Market Segmentation | By Packaging Type and By End-User |

| Top Key Players | Walgreens Co, Albertsons Companies, Galenic Laboratories Ltd. (Roseway Labs), Wells Pharma of Houston, US Compounding Inc. |

503B pharmacies can provide practitioners and pharmacists with affordable solutions by acquiring materials in bulk and using effective compounding procedures. The knowledge of 503B pharmacies, which focus on repackaging and compounding pharmaceuticals, can be advantageous to licensed pharmacists and practitioners.

Compared to conventional pharmacies, a 503B compounding pharmacy, which is governed by FDA section 503B, produces more compounded drugs. These facilities guarantee the safety, purity, and potency of pharmaceuticals by adhering to strict quality standards such as Current Good Manufacturing Practice (cGMP). When commercial solutions aren't appropriate, they mainly provide consistent and compliant compounded medications to healthcare settings.

Strict regulatory requirements are followed by 503B compounding pharmacies, guaranteeing that drugs are precisely and accurately mixed. The safety and effectiveness of pharmaceuticals are preserved by 503B pharmacies through the use of appropriate packing materials and strict adherence to quality control procedures.

503B outsourcing facilities are under increasing scrutiny from the FDA, necessitating strict adherence to Current Good Manufacturing Practices (cGMP). This has led to a heightened focus on quality assurance measures, including rigorous visual inspections and compliance with Good Manufacturing Practices (GMP).

To improve efficiency and accuracy, 503B pharmacies are adopting advanced technologies such as automation, robotic systems, and digital platforms. These innovations streamline operations, reduce errors, and enhance overall productivity.

The demand for personalized medicine is growing, with 503B pharmacies well-positioned to meet this need by tailoring medications to individual patient requirements. This includes adjusting dosage forms, strengths, and combinations to optimize treatment outcomes.

For 503B compounding pharmacies, quality assurance will continue to be their first priority. The safety and effectiveness of compounded pharmaceuticals will continue to depend on putting strong quality control procedures into place, carrying out frequent testing and inspections, and abiding by stringent requirements.

Hospitals, clinics, and physicians are among the healthcare providers with whom compounding pharmacies are increasingly working. The goal of this partnership is to enhance communication amongst medical experts and guarantee the smooth incorporation of compounded pharmaceuticals into patient care programs. Larger hospitals and hospital systems either have contracts with outside compounders or have created in-house compounding tailored to their clinical demands and supply problems. The operational and compliance requirements of USP <797> or GMP rules caused some hospitals to stop in-house compounding.

Industry Growth Overview: Growth is supported by increased sterile compounding volumes in hospitals and specialty pharmacies, along with investment to comply. Over the medium term, automation, traceability, and consolidation services will further support demand.

Sustainability Trends: The industry is gradually adopting recycling and right-sized packaging to reduce material waste, while ensuring sterility and drug compatibility. Sustainability efforts remain secondary to safety and compliance but are gaining importance among hospital buyers.

Startup Economy: Startups are emerging in smart packaging, regulatory documentation software, and sustainable medical materials. Market entry is challenging due to high validation costs and conservative purchasing behavior, favoring startups with proven compliance credentials.

AI-powered computer vision systems can detect packaging defects (e.g., cracks, seal issues, labeling errors) with greater accuracy than manual inspections. The AI integration ensures compliance with FDA’s strict cGMP regulations, reducing the risk of recalls or violations. Machine learning algorithms monitor equipment performance and predict failures before they occur. The AI integration reduces downtime, enhances productivity, and extends equipment lifespan. AI can forecast demand for packaging materials based on usage trends, patient demand, and historical data. The AI integration optimizes material ordering, reduces waste, and prevents shortages.

Drug shortages can negatively impact patients by postponing or restricting access to care, which is a major public health issue. It was included to GAO's High-Risk List because to issues with the Food and Drug Administration's (FDA) supervision of pharmaceuticals, such as medication shortages. The FDA was tracking 102 medication shortages as of July 31, 2024. While medicine shortages are lasting longer, the number of new shortages reported annually has typically decreased since the COVID-19 pandemic began in 2020. In general, the kinds of medications that were in short supply maintained pre-pandemic patterns. For instance, sterile injectable medications that are essential to hospital care and cancer therapy are typically the ones that experience shortages. Moreover, the pandemic made the supply chain weaknesses that cause shortages worse.

According to the U.S. FDA, Congress, and others, drug shortages are a complex problem that calls for a coordinated government response. Nevertheless, HHS lacked a department-wide coordination framework to manage its tactics and reactions. According to HHS, this made it more difficult for the agency to prevent shortages, address them, and improve supply chain resilience. President Biden announced a coordinator job at HHS in November 2023 to improve supply chains for medical products and solve associated shortages. To create this job, HHS took action. For instance, it designated an acting coordinator who formed a task group with members from various HHS agencies.

The key players operating in the U.S. 503B compounding pharmacy packaging market are facing issue due to stringent regulatory compliance and limited standardization across states. 503B outsourcing facilities must comply with Current Good Manufacturing Practices (cGMP), enforced by the FDA. These regulations require sophisticated quality control systems, validated packaging processes, and thorough documentation. Non-compliance risks shutdowns, fines, or product recalls, making entry and growth difficult for smaller players.

While the FDA oversees 503B facilities, state-level licensing, inspection, and approval requirements vary. This fragmented regulatory landscape creates compliance challenges and slows market expansion. Some healthcare providers still prefer traditional pharmaceutical suppliers over 503B facilities due to concerns over product consistency, packaging reliability, and legal accountability. Lack of education on the benefits of outsourcing sterile compounding can limit market uptake.

An increasing emphasis on individualized patient care has led to a surge in demand for customized medications. 503B compounding pharmacies, capable of producing large batches of tailored medications, are well-positioned to meet this need, thereby boosting the packaging market associated with these products.

The growing geriatric population and the rising incidence of chronic diseases in the U.S. have escalated the demand for specialized medications. 503B compounding pharmacies cater to these needs by providing customized treatments, thereby driving the associated packaging market.

The U.S. 503B compounding pharmacy packaging market is rapidly evolving due to improvements in safety, efficiency, and regulatory compliance brought about by technological advancements. Nowadays, a lot of packaging lines use automation and robotics to handle sterile goods, lowering human errors and increasing production speed. AI and machine learning assist with inventory management, predictive maintenance, and quality inspection, guaranteeing that every batch satisfies stringent FDA and cGMP requirements. Prefilled syringes and unit-dose vials are examples of advanced packaging formats that are becoming more and more popular, reducing preparation errors in clinics and hospitals.

Systems for digital monitoring and traceability, which enable real-time tracking of environmental conditions, batch details, and shipment information, are also becoming indispensable to achieve environmental goals without sacrificing sterility. Sustainable packaging materials such as recycled and biodegradable plastics are being introduced. Better supply chain visibility and alignment with hospital inventory and patient safety requirements are further benefits of integration with healthcare IT systems. When combined, these advancements are promoting compounding pharmacy operations that are safer, more effective, and ecologically friendly.

Competition in the U.S. 503B compounding pharmacy packaging market is expected to grow stronger as the need for sterile products that are ready to use rises. Due to medication shortages and operational difficulties, hospitals and clinics are outsourcing more compounding services, which is encouraging both new and established businesses to enter the market. Smaller businesses will find it challenging to compete due to stringent FDA regulations and high compliance costs, which will result in market consolidation where well-capitalized providers dominate.

Automation, robotics, and digital quality systems are examples of technological innovations that will become important differentiators. Businesses that use these innovations will have an advantage over rivals by providing packaging that is quicker, safer, and more dependable. As healthcare providers place greater emphasis on environmental responsibility, and eco friendly packaging may also become a competitive advantage.

The prefilled syringes segment held a dominant presence in the U.S. 503B compounding pharmacy packaging market in 2024. Prefilled syringes are sterile and ready-to-use, which minimizes the risk of cross-contamination and dosing errors compared to traditional vial-and-syringe methods. This is particularly crucial in hospital settings where precision and sterility are paramount. Utilizing prefilled syringes streamlines the drug preparation process, reducing preparation time and labor costs. This efficiency is beneficial for 503B compounding pharmacies that supply large volumes of medications to healthcare facilities. Prefilled syringes adhere to stringent regulatory standards, ensuring consistent quality and dosage accuracy.

This compliance is essential for 503B pharmacies operating under the Drug Quality and Security Act (DQSA), which mandates high-quality manufacturing practices. The rise in chronic diseases has led to increased use of biologics, which often require precise dosing and are suited for self-administration. Prefilled syringes facilitate this by providing accurate, ready-to-use doses, enhancing patient compliance and convenience. During periods of drug shortages, prefilled syringes allow for efficient distribution and administration of medications, ensuring timely patient care. Their ease of use and storage makes them a practical solution in managing limited drug supplies.

The hospitals segment accounted for a significant share of the U.S. 503B compounding pharmacy packaging market in 2024. Hospitals require a consistent supply of sterile, ready-to-administer medications for various critical care scenarios, including surgeries, intensive care units, and emergency departments. 503B outsourcing facilities specialize in producing these medications in bulk, ensuring that hospitals have immediate access to essential drugs without the need for in-house compounding. 503B compounding pharmacies are mandated to comply with the U.S. FDA's Current Good Manufacturing Practice (cGMP) standards, which are more stringent than the requirements for traditional compounding pharmacies.

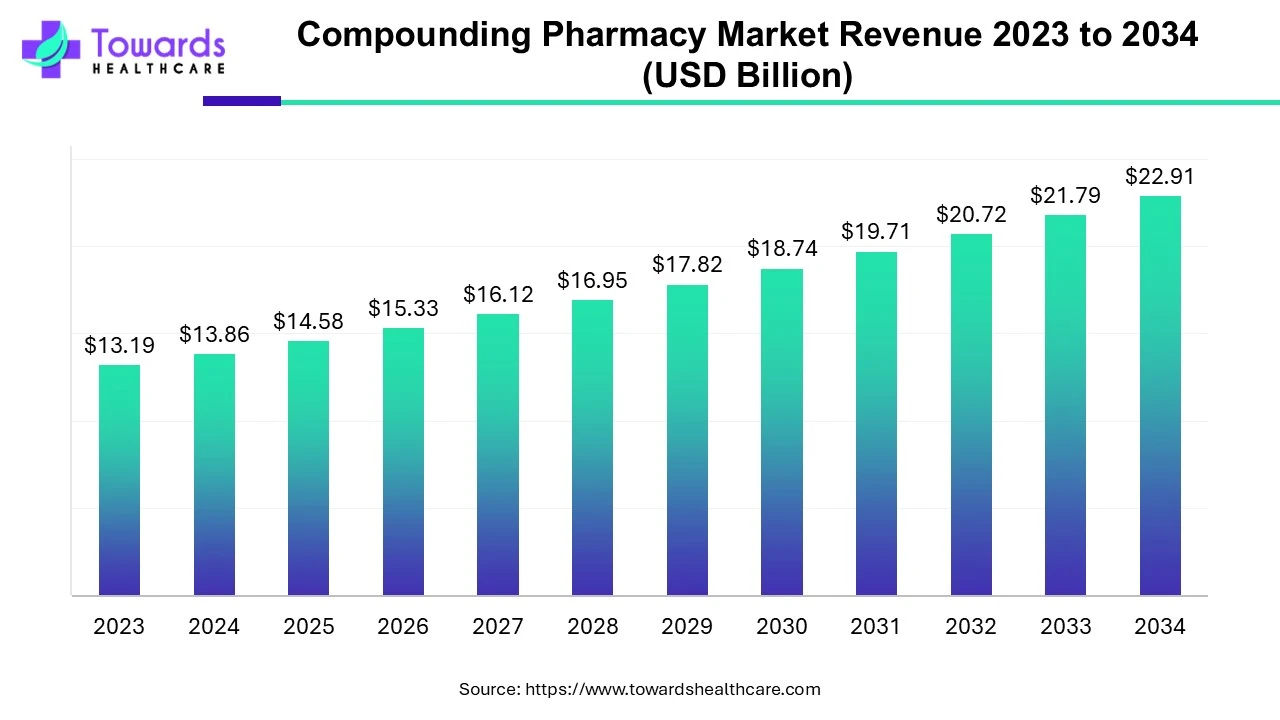

According to Towards Healthcare, the global compounding pharmacy market size was estimated at US$ 13.19 billion in 2023 and is projected to grow to US$ 22.91 billion by 2034, rising at a compound annual growth rate (CAGR) of 5.15% from 2024 to 2034. The growing demand for high-quality and highly-specified medicines is driving the growth of the market.

The production and distribution of compound medications to address the unique requirements of patients are the focus of the compound pharmacy industry. If a patient is unable to take an FDA-approved medication, such as a patient who has an allergy to a particular dye and requires a medication that doesn't contain it, or a child or elderly patient who can't swallow a tablet or capsule and requires medication in a liquid dosage form, a drug may be compounded for them. Patients may occasionally be prescribed compounded medications by medical professionals in clinics, hospitals, and other healthcare settings when an FDA-approved medication is not deemed medically necessary to treat them. Compounding may be able to meet a significant patient need in some circumstances.

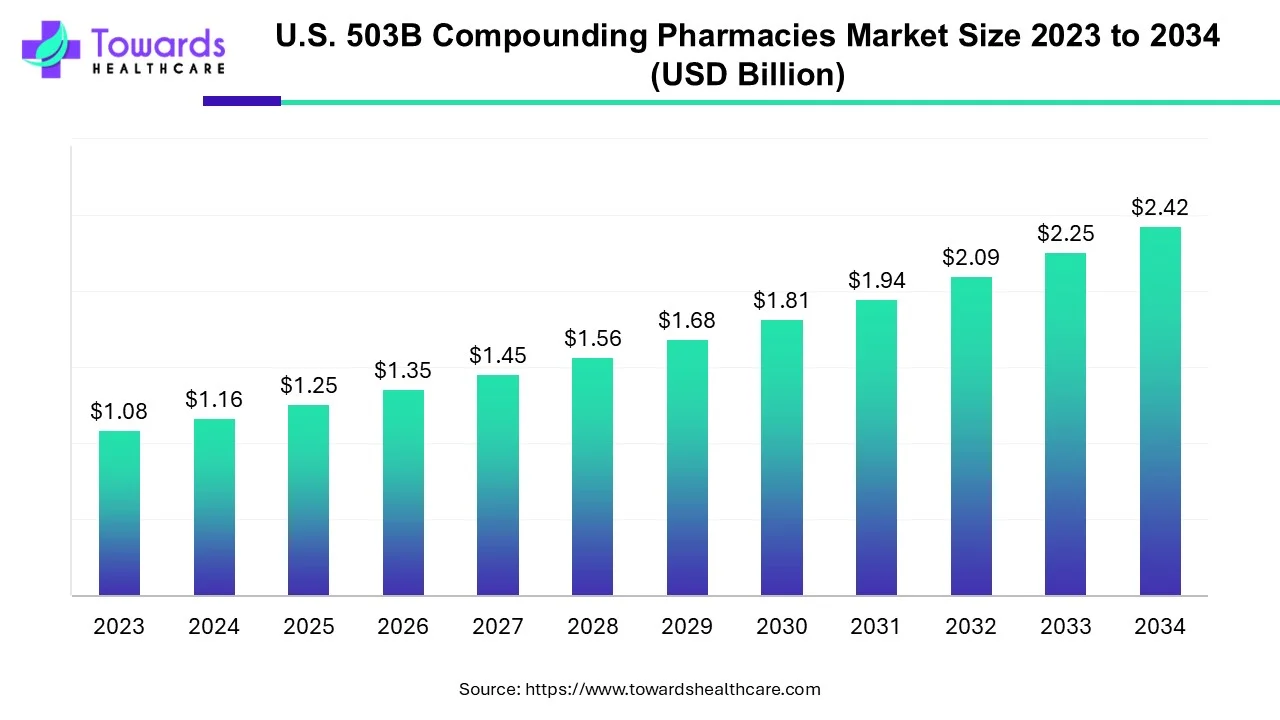

According to Towards Healthcare, the U.S. 503B compounding pharmacies market size is predicted to expand from USD 1.25 billion in 2025 to USD 2.42 billion by 2034, growing at a CAGR of 7.63% during the forecast period from 2025 to 2034.

The FDA directly regulates 503B pharmacies through the use of CGMP regulations, which are the subject of the 503B compounding pharmacies market. Pharmaceutical firms also adhere to the same set of CGMP rules. As a result, a 503B pharmacy is a compounding pharmacy that follows the strict CGMP regulations.

The only pharmacies authorized to provide compounded pharmaceuticals for use in doctor's offices, clinics, and hospitals are these 503B outsourcing facilities. In recent times, the 503B U.S. compounding pharmacy market has undergone significant changes due to a number of key developments that will likely affect 503B outsourcing facilities in 2024 and beyond.

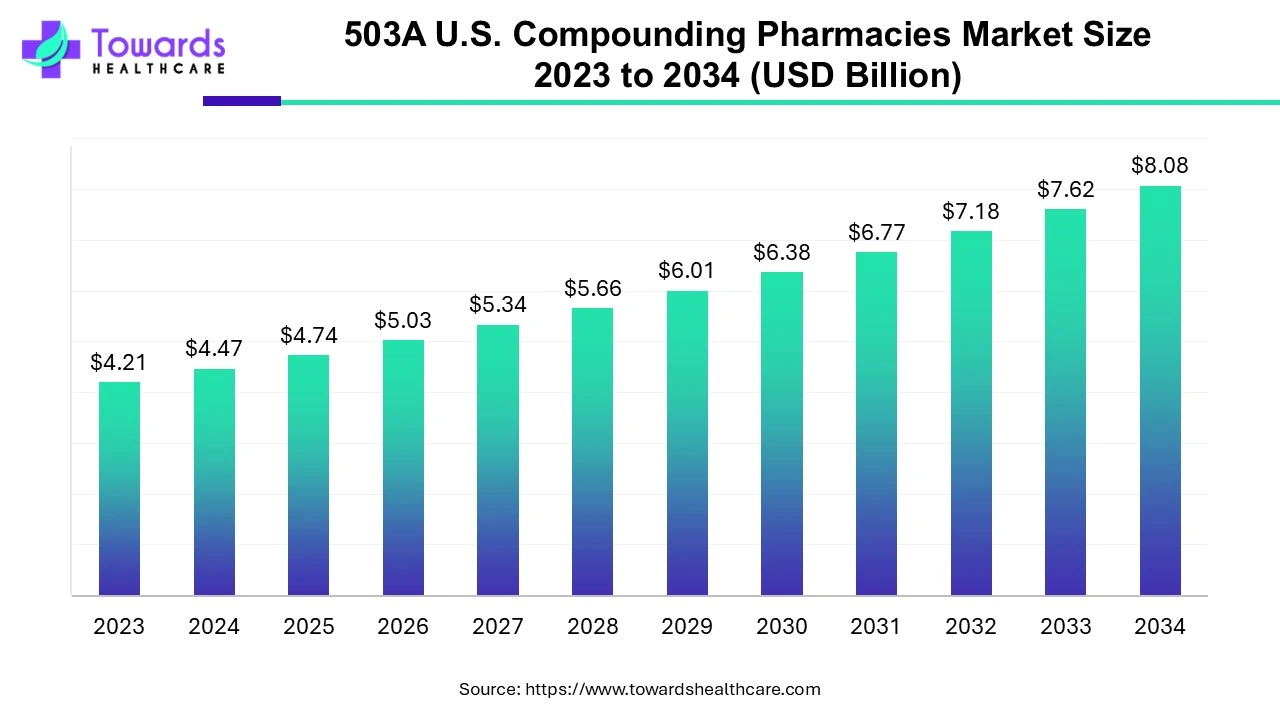

According to Towards Healthcare, the 503A U.S. compounding pharmacies market is projected to reach USD 8.08 billion by 2034, growing from USD 4.74 billion in 2025, at a CAGR of 6.11% during the forecast period from 2025 to 2034, increasing demand for personalized, convenient and accessible care.

The FDA has elected 503A compounding pharmacies as those pharmacies that compound medicines as per prescriptions particular to patients and must adhere to USP and other regulations as mandated by state boards of pharmacy. 503A facilities are not allowed to manufacture in large batches and they are meant to produce and dispense for home use only. The government has employed some regulations for compounders to strictly follow while compounding pharmacies. Regulations suggested for 503A include USP <795> and <797> along with state board of pharmacy regulations.

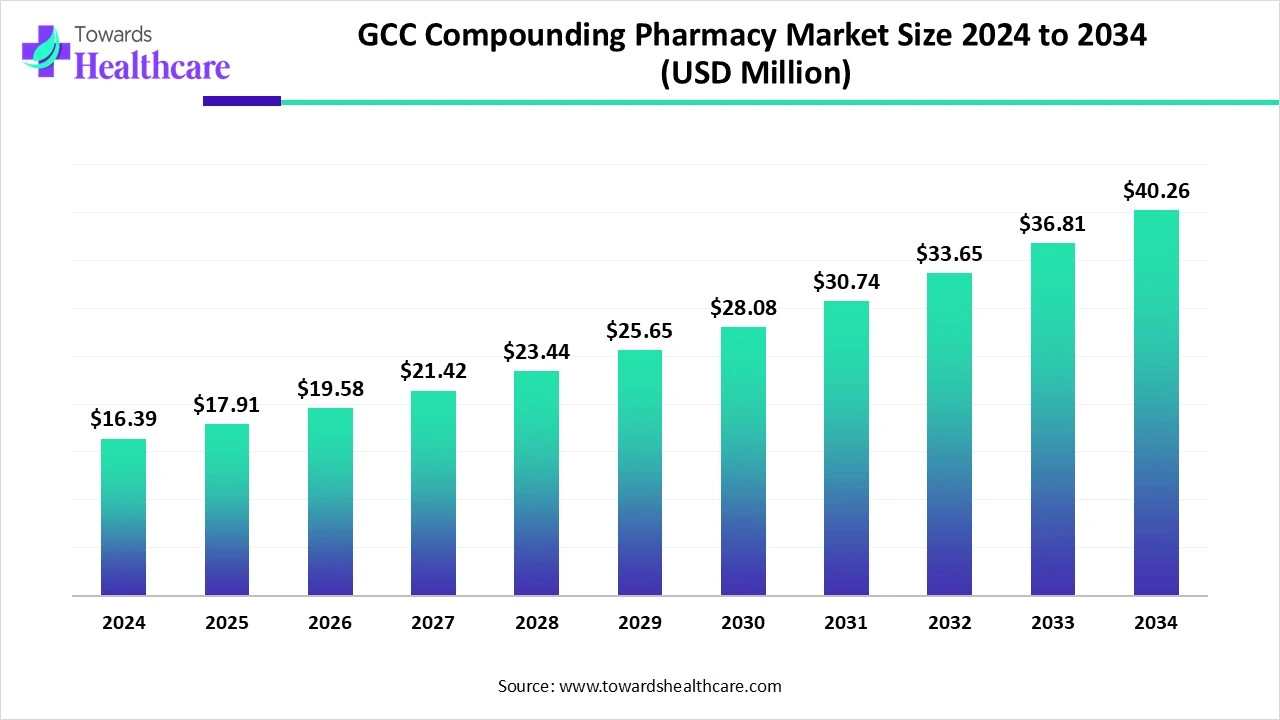

According to Towards Healthcare, the global GCC compounding pharmacy market size is calculated at USD 16.39 million in 2024, grew to USD 17.91 million in 2025, and is projected to reach around USD 40.26 million by 2034. The market is expanding at a CAGR of 9.27% between 2025 and 2034.

The GCC compounding pharmacy market is primarily driven by the growing demand for personalized medicines. Approved products or medications may cause severe allergies or infections, necessitating pharmacists to provide compounded medications. Government support and increasing investments in compounding pharmacies potentiate market growth. The future looks promising with favorable regulatory policies and the adoption of advanced technologies.

R&D: R&D focuses on material compatibility, sterility assurance, patient-friendly designs, and basic smart features like QR-based traceability. Regulatory validation remains the key factor influencing development timelines.

Distribution to Hospitals & Pharmacies: Products are supplied directly to hospital pharmacies, through medical distributors and GPOs, or via online platforms for independent pharmacies. Documentation, flexibility, and technical support are critical suppliers for differentiators.

Patient Support and Services: Packaging is increasingly designed to improve dosing accuracy, safety, and adherence through clear labeling, unit-use formats, and digital information access.

American initiatives for sustainability in the U.S. market for 503 compounding pharmacy packaging is growing slowly because patient safety and legal compliance continue to be the top concerns. Only in cases where sterility, chemical compatibility, and drug stability have been thoroughly verified are pharmacies and packaging suppliers investigating recyclable and reduced-material packaging. The most widely used sustainable practices are waste reduction in cleanroom operations and appropriately sized packaging.

From a compliance perspective, packaging must align and relevant state pharmacy regulations, ensuring aseptic handling, containment of hazardous drugs, and clear labeling. Suppliers are required to provide detailed validation of data, certificates of analysis, and change-control documentation. As a result, sustainable packaging solutions gain acceptance only when they demonstrate full regulatory compliance without compromising safety or quality.

By Packaging Type

By End-User

December 2025

December 2025

January 2026

December 2025