U.S. Sustainable MAP Trays Market Value, Growth Drivers, Material Segments, Global Regional Mapping, Manufacturers

The U.S. Sustainable MAP Trays Market provides complete coverage of market size projections, industry dynamics, and segment-level insights across material type, tray rigidity, applications, and end-use sectors. The study includes detailed data on regional demand patterns across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, reflecting global adoption trends for MAP packaging.

The U.S. sustainable MAP (Modified Atmosphere Packaging) trays market is driven by rising demand for eco-friendly food packaging, regulatory pressures to reduce single-use plastics, and growing consumer preference for recyclable or compostable solutions. Companies are increasingly adopting fiber-based, PLA-lined, and recyclable board trays that offer comparable barrier properties to plastic while minimizing environment impact. Innovations focus on compatibility with existing packaging machinery, ensuring seamless integration. Key players are developing dual-ovenable and freezer-safe trays that meet sustainability goals without compromising food safety or shelf life.

Key Insights

- By material type, the plastic segment dominated the market with the largest share in 2024.

- By material type, the biodegradable/compostable segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By tray structure/rigidity, the rigid trays segment dominated the market with the largest share in 2024.

- By tray structure/rigidity, the semi-rigid / flexible trays segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034.

- By application, the food packaging (meat, poultry, seafood, RTE meals) segment dominated the market in 2024.

- By application, the medical/pharmaceutical products segment is expected to grow at the fastest CAGR in the forecast period.

- By end-user, the food and beverage segment dominated the market in 2024.

- By end-user, the healthcare and pharmaceutical segment is expected to grow at the fastest CAGR in the forecast period.

Market Overview

Sustainable MAP trays refer to eco-friendly packaging trays used in modified atmosphere packaging (MAP) systems, designed to extend the shelf life of perishable food while reducing environmental impact. The sustainable MAP trays are made from renewable, recyclable, or compostable materials (e.g., paperboard, molded fiber, bagasse, or bioplastics). The sustainable MAP trays contain minimal plastic, often limited to a thin barrier layer that can be separated or is compostable. The sustainable MAP trays maintain necessary barrier properties (e.g., oxygen, moisture) to support MAP’s function of preserving freshness. The sustainable MAP trays are designed for recyclability or industrial composting, aligning with circular economy goals.

Key Metrics and Overview

| Metric |

Details |

| Key Market Drivers |

Rising demand for eco-friendly packaging, regulatory push on plastics, growing fresh food and RTE meal consumption |

| Market Segmentation |

By Material Type, By Tray Structure / Rigidity, By Application and By End-User Industry |

| Top Key Players |

Amcor, Sealed Air, Berry Global, Smurfit Kappa, Coveris, Solidus |

What are the New Trends in the Sustainable MAP Trays Market?

- Plant-based and compostable materials

MAP trays increasingly incorporate biopolymers like PLA, cornstarch, seaweed, and even mushroom mycelium, often paired with molded fibre or paperboard bases. These alternatives degrade much faster than conventional plastics.

- Smart Packaging Integration

MAP trays now embed QR codes, NFC tags, and even sensor systems to improve traceability, communicate sustainability credentials, and actively monitor freshness.

- Minimalist and Mono-Material Designs

Reducing inks, layers, and material types improves recyclability. Monomaterial trays made from a single recyclable substrate are gaining traction.

- Circular and Reusable Packaging Systems

The industry is experimenting with returnable or refillable tray systems, encouraging reuse within supply chains and reducing single-use waste.

- Advanced Recycling and AI Optimization

Chemical and enzymatic recycling are enabling new use-cases for mixed or bio-based trays. AI-driven design tools and sorting systems help boost material efficiency and enhance recyclability.

- Visual Transparency and Clean Design

Bold minimalist aesthetics and transparent sections communicate eco-friendliness effectively. Many trays also feature QR-enabled eco-labels that guide end-of-life disposal.

How Can AI Improve the Sustainable MAP Trays Industry?

AI integration is revolutionizing the sustainable MAP trays industry by enhancing efficiency, sustainability, and product performance. Through AI-powered design optimization, manufacturers can reduce material usage while maintaining barrier integrity, leading to lighter, eco-friendly trays. AI algorithms also support predictive shelf-life modelling, ensuring optimal gas mixtures and materials are used to extend food freshness. In production, AI enhances quality control by detecting defects, inconsistencies, or contamination in real-time, reducing waste and recalls.

Additionally, AI aids in supply chain transparency by tracking tray materials, carbon footprints, and end–of–life outcomes via smart labeling systems like QR codes or RFID. It also helps in consumer engagement by delivering interactive sustainability data and usage instructions. Furthermore, AI-driven sorting and recycling technologies improve post-consumer recovery of tray materials, supporting circular economy goals. Overall, AI fosters innovation and accountability across the MAP tray lifecycle, aligning with environmental regulations and evolving consumer expectations.

Market Dynamics

Driver

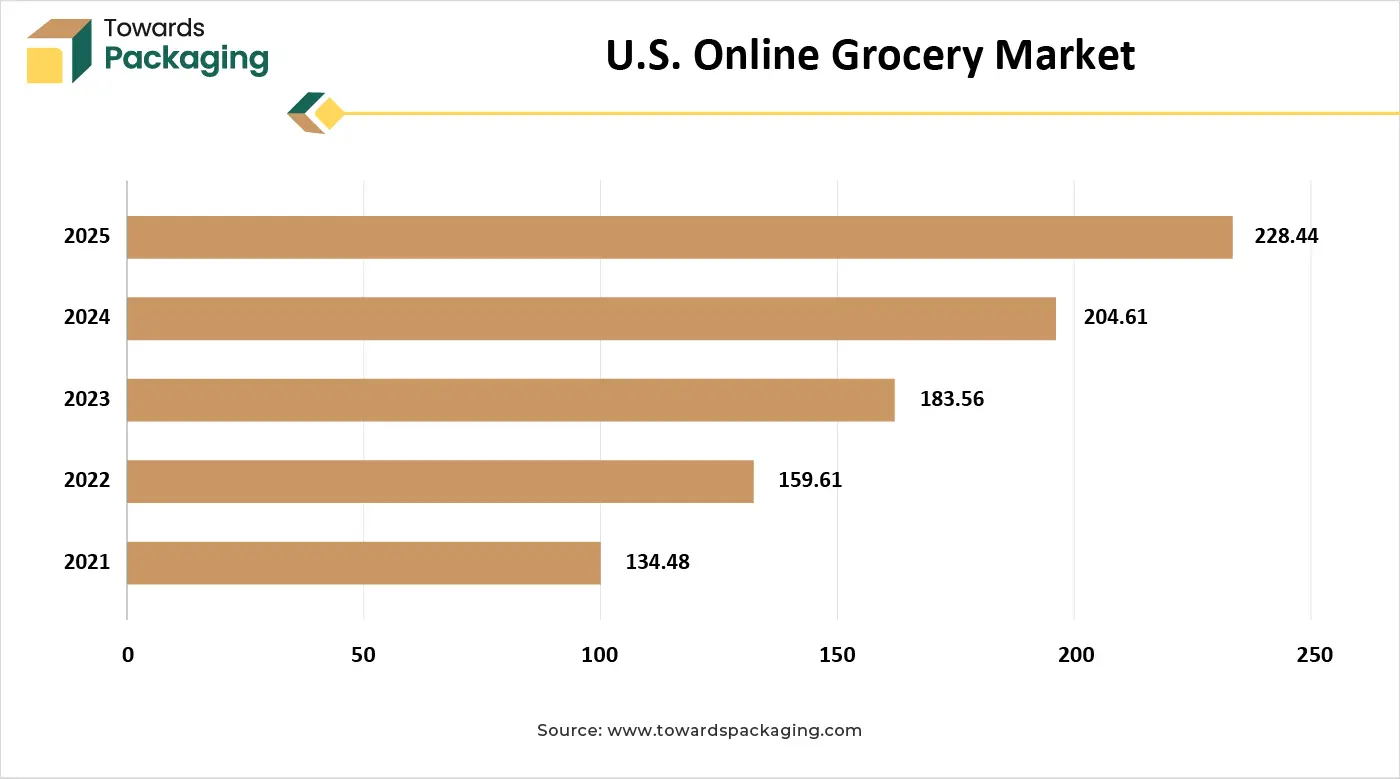

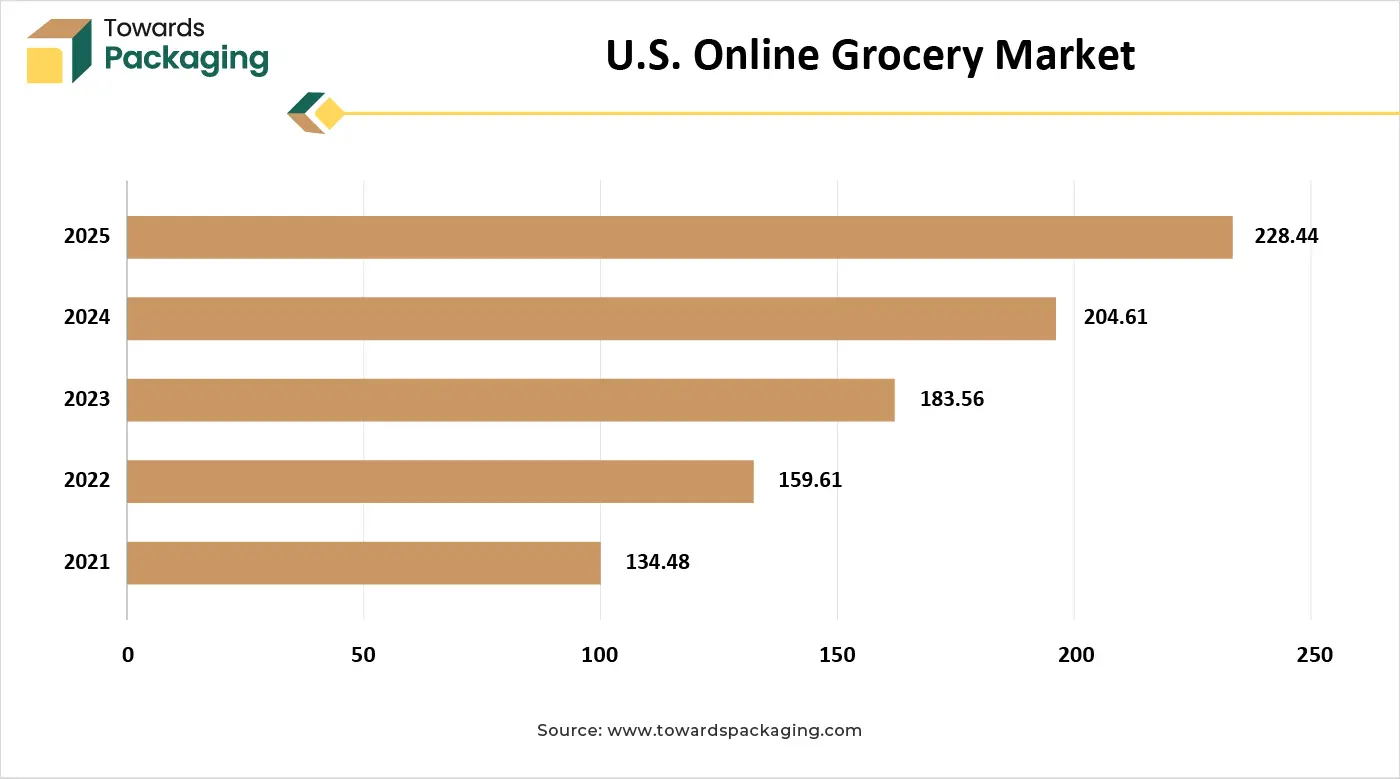

Growth in Online Food Ordering, Packaged and Fresh Food Consumption

The increased demand for fresh, minimally processed foods with extended shelf life, such as meats, fruits, and ready meals, boosts the need for sustainable MAP trays that preserve freshness while reducing environment impact. The rising consumption of packed and fresh food significantly drives the growth of the sustainable MAP trays market. Consumers increasingly prefer ready-to-eat meals, fresh-cut produce, meat, and dairy products that require longer shelf life without compromising quality.

Sustainable MAP trays, which modify the internal atmosphere to slow spoilage, are ideal for preserving freshness, flavor, and appearance. As demand for healthier and fresher food grows, particularly in urban areas and among health-conscious consumers, retailers and manufacturers are seeking packaging solutions that not only extend product life but also align with sustainability goals.

- In January 2025, according to the data published by the Foodservice Packaging Institute (FPI), it was estimated that packed foods make up a substantial portion of the American diet. Approximately 70% of the U.S. diet comprises processed foods, with 61-73% of daily calories coming from ultra-processed items. Per capita availability of fresh food (including meat, poultry, vegetables, dairy, and fruits) remains high, e.g., in 2024, ~ 378lb of vegetables and 185 lb of meat per person were available.

Restraint

Barrier Performance Limitations and Recycling Infrastructure Gaps

The key players operating in the U.S. sustainable MAP trays market are facing issues due to barrier performance limitations and recycling infrastructure gaps, which are estimated to restrict the growth of the market. Eco-friendly materials may struggle to match the gas and moisture barrier properties of conventional plastics, which can affect the shelf life and safety of perishable foods. Many regions lack the advanced recycling or composting infrastructure required to process sustainable trays effectively, reducing their environmental benefit and consumer adoption.

What are the Opportunities for the Growth of the U.S. Sustainable MAP Trays Market?

Branding and Consumer Influence

Eco-friendly aesthetics and on-pack eco-labeling or QR-enhanced data promote brand differentiation and appeal to sustainability-minded buyers.

Fresh and Convenience Food Trends

Growing consumer budgets on ready-to-eat, fresh, organic, and plant-based foods create new demand for trays that extend shelf life while aligning with eco-conscious values.

Segmental Insights

Why does the Plastic Segment Dominate the U.S. Sustainable MAP Trays Market?

The plastic segment held a dominant presence in the market in 2024, owing to the excellent barrier properties of plastic material. Plastics like PET, PP, and EVOH offer superior resistance to oxygen, moisture, and gas transfer, making them ideal for preserving food freshness and extending shelf life. Plastic trays are strong, impact-resistant, and maintain their structure under various temperatures, making them suitable for automated processing, refrigeration, and transport. Plastics are fully compatible with existing MAP sealing machines and thermoforming systems, enabling efficient, high-speed production without the need for equipment upgrades. Clear plastic trays allow product visibility, which enhances consumer trust and appeal, especially in retail environments.

The biodegradable/compostable segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Rising environmental awareness and preference for plastic-free lifestyles are pushing consumers to choose packaging made from biodegradable or compostable materials like PLA, bagasse, and molded fiber. These materials break down naturally in industrial composting conditions, helping reduce landfill waste and the environmental burden of single-use packaging. Policies in many U.S. states are phasing out non-recyclable plastics and encouraging compostable alternatives, accelerating the shift toward bio-based MAP tray formats. Biodegradable MAP trays resonate with the clean-label and organic food sectors, as they support the overall sustainability narrative that health-conscious consumers value.

Which Tray Structure/Rigidity Dominated the Sustainable MAP Trays Market in 2024?

The rigid trays segment registered its dominance over the global market in 2024. Rigid trays, especially those made of PET, PP, or other sturdy plastics, offer excellent resistance to oxygen, moisture, and physical impacts, keeping perishable foods fresh and safe throughout distribution. These trays work seamlessly with existing MAP machinery and high-speed thermoforming lines, avoiding costly equipment upgrades. Their structural rigidity allows for diverse shapes, compartments, transparent lids, and tamper-evident seals, all essential for convenience foods and strong branding. Rigid trays are lightweight yet strong, keeping material and shipping costs low. Many are made of recyclable plastics (e.g., PET, HDPE), making them both affordable and partially eco-friendly.

The semi-rigid/flexible tray segment is experiencing the fastest growth in the U.S. sustainable MAP trays market due to its cost-effectiveness, material efficiency, and adaptability to sustainability goals. These trays require significantly less material and energy to produce than rigid trays, resulting in lower production and transportation costs. Despite their lighter weight, advanced multi-layer films used in flexible trays provide strong barrier properties, preserving food freshness and extending shelf-life. Their lightweight nature also reduces carbon emissions across the supply chain.

In terms of design, flexible trays offer greater versatility, with options like resealable pouches and customizable shapes that enhance consumer convenience and visual appeal. Moreover, many of these trays are made from mono-materials for easier recycling or are compostable, aligning with growing regulatory and consumer demand for circular economy solutions. These combined benefits make semi-rigid and flexible trays a preferred choice for brands aiming to balance performance with sustainability.

Why does the Food Packaging (Meat, Poultry, Seafood, RTE meals) Segment Dominate the Sustainable MAP Trays Market?

The food packaging (meat, poultry, seafood, RTE meals) segment dominates the market due to the large consumption of packed food and the rise in environmental concerns. The food packaging segment holds a dominant position in the sustainable Modified Atmosphere Packaging (MAP) trays market due to several driving factors. Increasing consumer demand for fresh, minimally processed, and preservative-free food has boosted the use of MAP trays, which effectively extend shelf life by slowing microbial growth and oxidation. This is especially important for perishable items like fresh produce, meat, seafood, and ready-to-eat meals.

Additionally, the growth of chilled and frozen food categories, driven by urbanization and changing lifestyles, has further fuelled demand. Regulatory pressure for eco-friendly packaging and rising consumer awareness around sustainability have also led food producers and retailers to adopt biodegradable or recyclable MAP trays. Moreover, the foodservice and retail sectors, including supermarkets and delivery services, rely heavily on MAP technology to ensure freshness and reduce food waste. Altogether, these factors contribute to the food packaging segment’s leadership in the sustainable MAP trays market.

The medical/pharmaceutical products segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The medical and pharmaceutical products application segment is experiencing the fastest growth in the U.S. sustainable MAP trays market due to increasing demand for sterile, contamination-free packaging. Sustainable MAP trays help preserve the integrity of sensitive items such as medical devices, diagnostic kits, and pharmaceutical products by maintaining controlled atmospheric conditions. Stringent regulatory standards set by bodies like the FDA are pushing manufacturers to adopt packaging that meets high hygiene, safety, and environmental requirements.

Additionally, the growing use of biologics, vaccines, and temperature-sensitive drugs calls for advanced packaging solutions that ensure product stability and extended shelf life. Healthcare providers and pharmaceutical companies are also embracing sustainability initiatives, opting for recyclable or compostable MAP trays to reduce environmental impact. Technological advancements in barrier films, tray sealing, and eco-friendly materials further support the adoption of sustainable MAP trays in medical applications, making this segment the fastest growing in the market.

Which End-User Industry Dominated the U.S. Sustainable MAP Trays Market in 2024?

The Food and Beverage end-user segment holds a dominant position in the U.S. sustainable MAP trays market due to several contributing factors. There is a consistently high demand for packaging of perishable products such as fresh produce, meat, poultry, seafood, dairy, and ready-to-eat meals, all of which require extended shelf life and freshness, key benefits provided by MAP technology. Consumer preferences are shifting toward convenience and freshness, leading to greater consumption of packaged and on-the-go foods, which in turn increases the need for reliable and eco-friendly packaging solutions.

Additionally, efforts to reduce food waste are driving the adoption of MAP trays by producers and retailers to minimize spoilage while supporting sustainability goals. Stringent food safety regulations in the U.S. also favor MAP trays, as they ensure hygiene and product integrity. Moreover, food and beverage companies are increasingly turning to biodegradable or recyclable MAP trays to enhance their sustainability credentials and attract environmentally conscious consumers.

The Healthcare and Pharmaceutical end-user segment is the fastest-growing in the U.S. sustainable MAP trays market, propelled by several critical factors. First, strict regulatory requirements from the FDA and EPA demand sterile, tamper-evident, and high-barrier packaging for drugs, biologics, and medical devices requirements that MAP trays are uniquely suited to fulfill. Second, the rapid rise of biologics, vaccines, and temperature-sensitive pharmaceuticals necessitates advanced, controlled-atmosphere packaging to maintain stability and extend shelf life. Third, there is growing environmental pressure and policy support, such as Extended Producer Responsibility (EPR) laws in multiple U.S. states, pushing pharmaceutical companies toward recyclable and biodegradable solutions.

Fourth, technological innovation including high-barrier sustainable materials, smart traceability features like RFID and serialization, and AI-enhanced production efficiency has lowered barriers to adoption. Finally, healthcare institutions and pharmaceutical firms are embracing sustainability commitments, integrating eco-friendly MAP trays to reduce waste and strengthen corporate responsibility. Collectively, these drivers are fueling rapid growth in the segment.

U.S. Sustainable MAP Trays Market Players

Latest Announcements by Industry Leaders

- In January 2025, Glenn Divers, Vice-President of sales at Cirkla, Inc., stated that the company is expanding the potential of environmental friendly packaging with the introduction of fiber MAP trays. With the help of Cirkla Inc.’s owned technology, brands can easily switch from plastic to fiber while overcoming issues with scalability, affordability, and performance. (Source: Packaging Gateway)

New Advancements in the Market

- On January 16, 2025, Cirkla Inc., a supplier of eco-friendly packaging options, revealed the introduction of its moldable fiber modified atmosphere packaging (MAP) trays in the U.S.. The company stated that these trays, which have an 85% lower plastic content than conventional plastic MAP trays, were made with its in-house technology and are intended to be a sustainable substitute. MAP trays are frequently used to prolong the shelf life and maintain the freshness of perishable foods like meat and frozen goods. These trays have historically relied on polymers like Polypropylene (PP) and polyethylene terephthalate (PET). (Source: Packaging Gateway)

U.S. Sustainable MAP Trays Market Segments

By Material Type

- Plastic

- Paper-based

- Foam

- Biodegradable/Compostable

By Tray Structure / Rigidity

- Rigid Trays

- Semi-rigid / Flexible Trays

By Application

- Food Packaging (Meat, Poultry, Seafood, RTE meals)

- Medical/Pharmaceutical Products

- Electronics

- Cosmetics

- Industrial Goods

By End-User Industry

- Food and Beverage

- Healthcare and Pharmaceutical

- Electronics

- Retail

- E-commerce