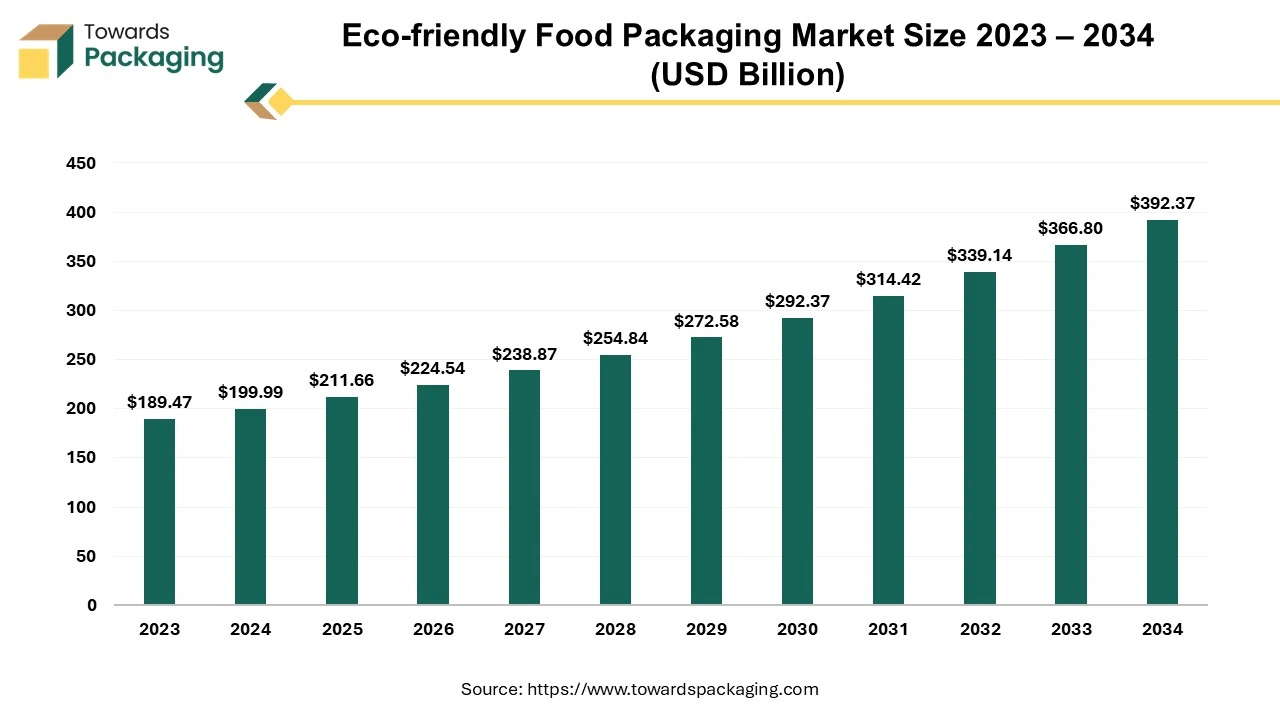

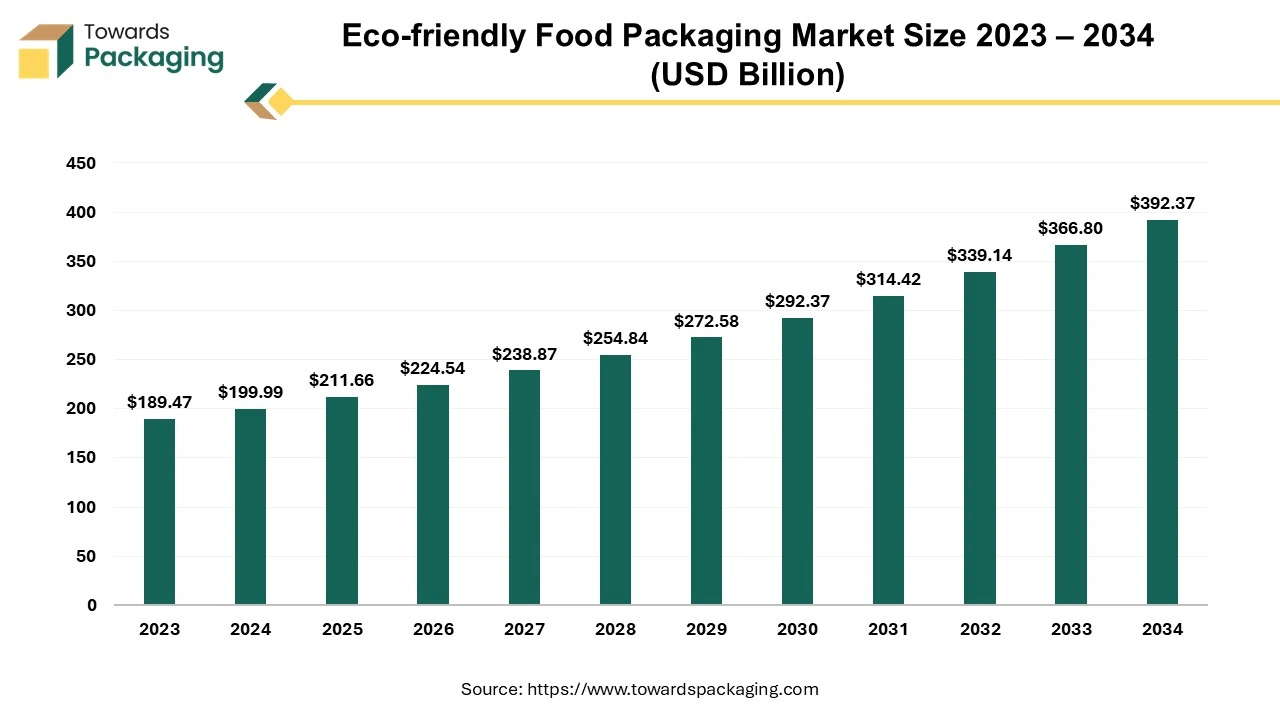

The eco-friendly food packaging market is forecasted to expand from USD 228.84 billion in 2026 to USD 419.65 billion by 2035, growing at a CAGR of 6.97% from 2026 to 2035. The competitive ecosystem includes Amcor, Tetra Pak, Mondi, Smurfit Kappa, WestRock, Huhtamaki, DS Smith, and Berry Global, each strengthening circular packaging portfolios. Value chain data shows rising adoption of PLA, PHA, bagasse, molded fiber, and recycled paper sourced from suppliers like NatureWorks, Novamont, BASF, UPM, and global trade data indicates that sustainable packaging imports into Europe rose 17% YoY in 2023 as brands shift away from plastics.

The eco-friendly food packaging market is predicted to witness strong growth in the years to come. Eco-friendly food packaging materials can be recycled, composted, biodegradable or used again. Plastic food packaging can cause endocrine system disruption and accumulate in the ocean, among other health and environmental hazards. Eco-friendly packaging, fortunately, has many advantages for consumers, companies, and the environment. Plant-based extracts such as wheat, bamboo and wood, as well as sustainable bioplastics are frequently utilized in sustainable packaging for food. According to the research, eco-friendly packaging has a much lower rate of chemicals and also non-intentionally added substances (NIAS) migrating into food and the body than plastics. Eco-friendly alternatives are therefore safer compared to plastic packaging.

The rising environmental awareness among organizations and consumers along with the stringent government regulations and bans on the single-use plastics in various countries is expected to augment the growth of the eco-friendly food packaging market during the forecast period. Furthermore, technological advancements in the material science such as the development of the bio-based plastics and recyclable paper-based materials are also anticipated to augment the growth of the market. Additionally, the growing consumer inclination towards the eco-friendly products as well as the expansion of the food and beverage industry coupled with the corporate sustainability initiatives and commitments by major brands to achieve the net-zero emissions is also projected to contribute to the growth of the market in the near future.

| Metric | Details |

| Market Size in 2025 | USD 213.93 Billion |

| Projected Market Size in 2035 | USD 419.65 Billion |

| CAGR (2026 - 2035) | 6.97% |

| Leading Region | Europe |

| Market Segmentation | By Type, By Product, By End-user and By Region |

| Top Key Players | Amcor Plc, Tetra Pak, Mondi Group, Sabert Corporation, Smurfit Kappa Group, WestRock Company. |

The growth of the quick-service restaurants (QSRs) and food delivery services is anticipated to support the growth of the eco-friendly food packaging market during the estimated timeframe. With approximately 70 percent of the adults in America already ordering takeaway and 60 percent doing so at least once a week, the pandemic considerably increased the popularity of the takeout and delivery. Emerging restaurant concepts with smaller footprints and fewer dining areas are appearing in response to this desire. Nowadays, delivery, drive-thru, and carry-out account for over 75% of restaurant traffic; QSRs see an even greater percentage. In addition to lowering development and operating costs, this move to more compact, effective designs also helps firms stay competitive through responding to consumer preferences. This has further prompted restaurants and food service providers to adopt biodegradable, compostable and recyclable alternatives. For instance

Some food delivery services are also piloting reusable packaging systems, in which customers return containers for cleaning and reuse. The usage of plant-based bioplastics, molded fiber trays and edible packaging are anticipated to increase, resulting in sustainable solutions for the food service industry over the long run.

| Future Demand Factor | Summary |

| Biodegradable & Compostable Materials | Strong growth in plant-based, biodegradable packaging due to bans on single-use plastics and eco-conscious consumers. |

| Growth in E-Commerce Food Delivery | Rising online grocery and food delivery will fuel demand for leak-proof, sustainable, lightweight packaging. |

| Recyclable Flexible Films | Demand for mono-material and easily recyclable films will expand as brands adopt circular packaging commitments. |

| Edible & Smart Packaging | Increasing interest in edible wrappers and smart freshness-indicating solutions will create new growth waves. |

| Bio-based Plastics Adoption | Demand for corn, sugarcane, and algae-based packaging will rise as brands aim for net-zero goals. |

The high production cost is anticipated to hamper the growth of the eco-friendly food packaging market during the estimated timeframe. Adopting the eco-friendly packaging might seem like the best option, but there are unstated expenses involved. These extend beyond the price tag of the material of the packing. It also covers the manufacturing, shipping as well as disposal of the packaging. Fillers made of shredded paper cost about $30, while packing peanuts cost about $20. However, packing peanuts are not recyclable and need to be disposed of properly, and additional shredded paper is required for keeping a product safe. Since eco-friendly packaging is a relatively young sector and its techniques are still being developed, it is generally more expensive to produce. It costs about one cent to make a plastic bag and about four cents to make a paper bag.

Similarly, as biodegradable polymers need advanced production techniques and natural raw materials, they are typically 20–30% more expensive compared to conventional plastics. It can be more challenging for corporations to acquire biodegradable plastic and eventually give clients this more sustainable option when they purchase because the average cost can range from $2 to $7 USD per kilogram. Furthermore, the survival of a small company may be greatly impacted by these expenses therefore mindful selection is important. Sustainable packaging is not always the most economical, even though it is environmentally good. The higher prices of eco-friendly packaging solutions are a big turnoff for customers, even if more than half of them say they would be willing to spend more on it. The cost of producing sustainable packaging is on the rise due to inflationary pressures, rising energy prices, as well as the shortage of resources. This has led to a gap in pricing, which frequently influences buyers to choose less expensive and less sustainable options.

The increasing focus on the corporate sustainability initiatives is expected to create substantial opportunity for the growth of the eco-friendly food packaging market in the near future. Leading food and beverage companies, like PepsiCo, Nestle, Coca-Cola, McDonald’s, Starbucks, and Unilever, have committed to moving toward 100 percent recyclable, biodegradable or compostable packaging in coming years. As a result, these global brands need to take proactive measures to reduce plastic waste and carbon emissions, as well as comply with environmental regulations which in turn increase the demand for sustainable packaging material.

The Coca-Cola Company recently revealed its latest sustainability targets that focus on the design of packaging and post-use collection, with the aim of achieving these targets by 2035. These take the place of earlier objectives pertaining to reusable packaging, recycled content as well as recyclability. One new objective is to increase the usage of recycled plastic to between 30% and 35% worldwide, as well as utilize 35% to 40% recycled content in primary packaging materials. The other new objective is to work with partners to collect used packaging; the corporation wants to make sure that 70% to 75% of the same number of bottles and cans that are placed into the market each year are collected.

Similarly, Nestle is making a greater effort to use packaging that is sustainable. The organization recently announced new initiatives and advancements in the direction of a waste-free future. By 2025, Nestle wants all of its packaging to be recyclable or reusable, setting high goals. During the same time frame, the corporation also wants to minimize its usage of virgin polymers by one-third. In keeping with its pledge, Nestlé has declared a $30 million investment to expand the supply of recycled plastics for utilization in food in the US.

Additionally, Starbucks and Unilever are also working on the returnable and reusable packaging models to reduce their dependency on waste materials. These sustainability promises not only help in managing the environmental concerns, but they also influence the consumer expectations and industry trends. As major organizations set the example, small and medium-sized enterprises are urged to use greener packaging, resulting in a general push toward sustainability in the food industry.

| Impact Metric | Units | Achieved to Date | Projected Impact (2025-2030) | Projects Delivering Impact to Date | Projects Expected (2025-2030) |

| GHG Emissions Reduction | tonnes CO₂e | 31,980 | 15,95,600 | 11 | 17 |

| Virgin Fossil-Based Plastic Packaging Avoided | tonnes | 17,955 | 2,23,650 | 6 | 13 |

| Non-Packaging Virgin Plastics Avoided | tonnes | 1,205 | 1,24,510 | 1 | 3 |

| Additional Plastic Packaging Recycled | tonnes | 21,355 | 6,02,320 | 7 | 10 |

| Waste Reduction | tonnes | 19 | 15,935 | 4 | 5 |

| Water Consumption | tonnes | 59,840 | 6,95,420 | 3 | 6 |

| Chemical Use | tonnes | 4,875 | 29,415 | 1 | 1 |

| Waste Generation | tonnes | 3,985 | 31,860 | 2 | 6 |

| Additional Land/Aquaculture Requirements | hectares | 0.58 | 741 | 1 | 4 |

| Revenue Generated | £ | 2,72,08,000 | 38,89,35,000 | 8 | 15 |

| Jobs Created | FTE | 258 | N/A | 24 | N/A |

| People Upskilled/Trained | FTE | 230 | N/A | 63 | N/A |

| Trained Through BPF Courses | FTE | 526 | N/A | 1 | N/A |

| UK Recycling Capacity Enabled | tonnes | 101,500 (by 2030) | +441,000 (future roll-out) | – | – |

The data shows that the projects are already helping the environment by reducing emissions, cutting plastic use, and increasing recycling. They also bring economic benefits like more revenue, new jobs, and better training for people. Even bigger results are expected in the coming years as more projects grow and reach the market. Overall, the programme is moving the UK toward cleaner, more sustainable plastic use.

The current landscape is being altered by emerging artificial intelligence (AI) technologies, which expedite the process of identifying alternatives without the excessive expenses and timeframes seen in conventional methods. Loving Earth, a company based in Australia that packages its vegan chocolate bars in a compostable film made from wood pulp and non-GMO corn, and No Evil Foods, which sells small batch plant-based meat substitutes that come in completely compostable materials printed using plant-based ink, are just two examples of companies that have invested time, money along with creativity into finding creative ideas for sustainable packaging.

The science-based artificial intelligence (AI) can help organizations do everything much more quickly and at scale. For data scientists, infusing AI into research provides a means to get to the lab-based experiments with the most promising materials quickly. By running thousands of experiments virtually for the most promising candidates, scientists can quickly identify potential compounds and speed the discovery of better performing, safer, and more environmentally sustainable packaging materials.

Waste management is another important aspect of sustainable packaging. The optimization of waste recycling procedures can be greatly improved with AI and ML. These tools can spot chances for better disposal of waste and higher recycling rates by examining trends in consumer behavior and recycling practices. This reduces the quantity of packaging waste that ends up in landfills and makes it possible to develop more environmentally friendly packaging materials, which involves compostable or bio-based substitutes.

New science-infused AI techniques may also prove important in reducing the plastic leaching and speeding up the development and commercialization of the sustainable materials and additives, which will result in better-performing, more eco-friendly packaging. These techniques involve improving the bio-content of formulations as well as discovering low-toxicity plasticizers. As artificial intelligence evolves, its integration into packaging material innovation along with smart packaging ideas will be a key in accelerating the adoption of eco-friendly food packaging while increasing cost efficiency and sustainability across industries.

Key Players: NatureWorks, Novamont, BASF, UPM.

Key Players: Huhtamaki, Tetra Pak, Amcor, WestRock.

Key Players: TerraCycle, Veolia, SUEZ, BioPak.

| Questions / Statements | 1 | 2 | 3 | 4 | 5 | Total |

| Have you encountered businesses using eco-friendly packaging? | 3 | 7 | 11 | 9 | 20 | 50 |

| Importance of using eco-friendly packaging in the F&B sector | 4 | 6 | 9 | 12 | 19 | 50 |

| Switching from plastic to eco-friendly packaging is helpful | 2 | 7 | 10 | 11 | 20 | 50 |

| Paper bags help maintain a cleaner environment | 3 | 8 | 9 | 23 | 7 | 50 |

| Paper bags are more suitable than plastic bags | 2 | 9 | 18 | 16 | 5 | 50 |

| Businesses can save more using eco-friendly materials | 4 | 12 | 14 | 11 | 9 | 50 |

| Businesses comply with environmental policies | 3 | 7 | 10 | 9 | 21 | 50 |

| TOTAL | 21 | 56 | 81 | 91 | 101 | 350 |

| PERCENTAGE | 6% | 16% | 23% | 26% | 29% | 100% |

The data shows that most respondents hold a positive view toward eco-friendly packaging in the food and beverage industry. A large portion of participants selected ratings 4 and 5, indicating strong support for the use of paper bags and other sustainable materials. Many believe that eco-friendly packaging is important, helps maintain environmental cleanliness, and is a practical alternative to plastic. Although fewer respondents selected the lowest ratings, a noticeable segment remains unsure about whether businesses truly save costs or fully comply with environmental policies. Overall, the findings reflect a strong preference toward greener packaging solutions.

The biodegradable segment dominated the eco-friendly food packaging market, motivated by growing regulatory restrictions on single-use plastics and growing concerns about plastic pollution. To improve their sustainability credentials, food manufacturers and brands are actively switching to biodegradable materials like paper molded fiber and bioplastics. The dominance of this market is further reinforced by growing consumer preferences for eco-friendly packaging and robust government support.

The recyclable segment is growing rapidly as companies look for affordable, scalable, environmentally friendly packaging options. Plastic, paper, and metal formats are becoming more recyclable thanks to developments in recycling infrastructure and mono-material packaging designs. The use of recyclable packaging is also being accelerated by extended producer responsibility regulations and corporate sustainability goals.

The bags & pouches segment dominated the eco-friendly food packaging market, driven by its extensive use in packaged food snacks and ready-to-eat items, as well as its lightweight design and material efficiency. Convenience, reduced transportation costs, and flexibility for sustainable material substitution are all provided by these formats. Further bolstering segment dominance is the growing use of recyclable and biodegradable films in pouches.

The container segment is witnessing a rapid growth driven by rising demand for sustainable packaging in food service, takeaways, and home delivery applications. Growth in ready meals and fresh food packaging is boosting the adoption of eco-friendly containers made from paperboard, molded pulp, and biobased. Plastic improved barrier properties and durability are also expanding their use across multiple food categories.

The food processing segment is dominating the market because processed, packaged, and frozen food products all use a lot of packaging. Regulations and consumers are putting a lot of pressure on large-scale food processors to use environmentally friendly packaging. This segment contributes significantly to overall market revenues due to long-term supply contracts and high volume demand.

Europe held largest market share of 36.45% in the year 2024. This is due to the well-increasing demand for sustainable products across the region. Statistics gathered by ITC from five EU nations (Germany, France, Italy, the Netherlands, and Spain) show that retailers in important EU markets now place a high priority on sustainable product sourcing. 92 percent of the merchants anticipate a rise in sales of sustainable items over the next five years, while 85 percent report an increase in sales of eco-friendly goods during the previous five years. Additionally, the European Union's ban on plastic straws, cutlery, and certain food containers are also further expected to contribute to the regional growth of the market. Also, the closed-loop recycling systems along with the well-established waste management and recycling system are also expected to support the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR of 9.22% during the forecast period. This is due to the government regulations and bans on the single-use plastics in countries like China, India, Japan and Australia. Additionally, the rapid growth of the food delivery as well as takeout sector by platforms like Zomato, Swiggy, Meituan and GrabFood are also expected to contribute to the regional growth of the market. Furthermore, the expansion of quick-service restaurants (QSRs) and the fast-food chains along with the strong growth of the retail and e-commerce industry is likely to contribute to the regional growth of the market.

China Market Trends

China eco-friendly food packaging market is driven by the strong industrial manufacturing power in the country. China has been aggressively implementing policies to reduce plastic pollution, including bans on single-use plastics and non-degradable packaging. The government includes green development and circular economy goals in national planning, encouraging industries to adopt sustainable practices. China has the largest population and a rapidly growing urban middle class, leading to high demand for packaged food, thus pushing for more sustainable packaging solutions. The food delivery and e-commerce sectors are booming, increasing the pressure to reduce the environmental footprint of packaging.

China has a strong manufacturing infrastructure that allows it to quickly scale up the production of biodegradable and recyclable packaging materials like PLA (polylactic acid), paper, and bamboo. The country also benefits from cost advantages in material production and labor. Chinese companies are under increasing pressure from the public and regulators, to meet sustainability goals. China is investing heavily in research and development for new sustainable materials, such as seaweed-based films, bagasse (sugarcane fiber), and mushroom packaging.

North America region is seen to grow at a notable rate in the foreseeable future. The U.S. and Canada have strict regulations and standards for environmental sustainability. Agencies like the U.S.FDA, EPA, and Environment Canada push industries to adopt sustainable packaging practices. Consumers in North America are highly aware of environmental issues and actively seek out eco-friendly products. There's a growing demand for sustainable and biodegradable packaging due to concerns about plastic pollution and climate change.

North America’s advanced manufacturing technologies and well-developed supply chains support the production and distribution of eco-friendly packaging. Major food and beverage companies (e.g., Coca-Cola, PepsiCo, McDonald's) based in or operating heavily in North America are committing to sustainability goals. These include reducing plastic usage and increasing the use of renewable or recyclable materials. Many states and cities in the U.S. and Canada have implemented plastic bans or incentives for green packaging. Examples include bans on Styrofoam, single-use plastics, and mandates for compostable materials in food services. The region sees significant investment in R&D for green materials like bioplastics, paper-based alternatives, and edible packaging. Startups and collaborations between academia and industry drive innovation in this space.

Latin America is expanding the eco-friendly food packaging market, motivated by growing pressure to reduce plastic waste, urbanization, and environmental awareness. To encourage food manufacturers and retailers to switch to paper-based, recyclable, and biodegradable packaging options, governments throughout the region are imposing restrictions on single-use plastics. The demand for sustainable packaging formats that satisfy both environmental objectives and food safety standards is further supported by the quick expansion of quick service restaurants, food delivery services, and packaged food.

Brazil represents one of the most important markets in the eco-friendly food packaging market, supported by strong consumer awareness and evolving regulatory frameworks targeting plastic reduction. The country's large food processing and agribusiness sectors are increasingly adopting compostable films, molded fiber trays, and recyclable cartons to align with sustainability commitments. Additionally, multinational food brands operating in Brazil are investing in eco-friendly packaging innovations to meet corporate ESG goals and respond to growing consumer preference for environmentally responsible products.

The Middle East & Africa are leading issues related to food security, waste management, and sustainability are prioritized. Demand for environmentally friendly packaging solutions is being driven by the expanding tourism, hospitality, and foodservice sectors, especially in urban areas. The adoption of recyclable and biodegradable food packaging materials is progressively accelerating throughout the region, even though cost sensitivity is still a problem in some African nations.

UAE is emerging in the market, motivated by ambitious national environmental goals zero zero-waste programs, and robust sustainability policies. Adoption of biodegradable plant-based and recyclable packaging solutions is being encouraged by regulations designed to replace single-use plastics and the high consumption of packaged and ready-to-eat foods. Global food brands, cutting-edge retail facilities, and an increasing number of environmentally conscious consumers all contribute to the nation's quick transition to sustainable food packaging.

By Type

By Product

By End-user

By Region

March 2026

March 2026

March 2026

March 2026