Compound Pharmacy Packaging Market Size, Share and Future Growth Projections

The compound pharmacy packaging market covers a complete analysis of global and regional market size, including North America’s dominance in 2024, strong growth expectations for Asia-Pacific, and emerging demand in Europe, Latin America, and the Middle East & Africa. The report evaluates trends such as sustainable packaging, smart packaging, and AI-driven automation, while providing segmentation insights by packaging type (vials, bottles, syringes, blister packs), material (plastic, glass, biodegradable), and end-use (sterile and non-sterile compounding). It includes statistical forecasts up to 2034, profiles leading companies like West Pharmaceutical Services, Amcor, Berry Global, and Fagron, and offers competitive benchmarking, value chain mapping, and trade flow data for manufacturers and suppliers.

Major Key Insights of the Compound Pharmacy Packaging Market

- North America dominated the compound pharmacy packaging market in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By packaging type, the vials and bottles segment dominated the market with the largest share in 2024.

- By material, the plastic segment registered its dominance over the global compound pharmacy packaging market in 2024.

- By end-use, the sterile compounding segment dominated the compound pharmacy packaging market in 2024.

Compound Pharmacy Packaging Market

Compound pharmacy packaging refers to the specialized packaging of medications that are custom-prepared (compounded) by pharmacists for individual patients, rather than being mass-produced by pharmaceutical manufacturers. This packaging must ensure safety, accuracy, stability, and compliance for personalized medicines. Compounding is the process of creating a custom medication for a patient by: Altering dosage forms (e.g., turning a pill into a liquid), Removing allergens (like lactose or dyes), Combining multiple medications into one dose, Creating unique strengths not commercially available.

Compound pharmacy packaging is often used for children or elderly who need specific forms, patients with allergies or sensitivities, veterinary medicine, hormone replacement therapy (HRT) and dermatological or topical preparations. Key Features of compound pharmacy packaging are tamper-evident seals, child-resistant closures, light-resistant (amber or opaque containers), moisture-barrier materials. The compound pharmacy packaging contains custom labels with patient name, ingredients, expiration date, compounding pharmacy info, and dosage instructions.

Key Metrics and Overview

| Metric |

Details |

| Leading Region |

North America |

| Market Segmentation |

By Packaging Type, By Material, By End-Use and By Region |

| Top Key Players |

Companies in North America and globally like West Pharmaceutical Services, Berry Global, Amcor US are major contributors to packaging innovation. |

| Growth Opportunities |

Personalized Medicine: Rising demand for customized dosages and formulations. E-commerce: Growth of home delivery driving the need for secure and compliant packaging. |

Market Trends

Quality Assurance and Enhanced Regulatory Oversight

Compounding pharmacies, especially 503B outsourcing facilities, are experiencing increased scrutiny from regulatory bodies like the FDA. This has led to a heightened focus on quality assurance measures, including rigorous visual inspections and compliance with Good Manufacturing Practices (GMP).

Integration of Advanced Technologies

The adoption of automation, robotics, and digital platforms is streamlining compounding processes. Technologies such as Restricted Access Barrier Systems (RABS) and robotic compounding equipment are enhancing efficiency, reducing errors, and improving productivity in sterile compounding environments.

Eco-Friendly and Sustainable Packaging Solutions

There's a growing emphasis on sustainability in pharmaceutical packaging. Innovations include the use of biodegradable and compostable materials, as well as reusable containers. For instance, some companies are introducing plant-based plastics and glass containers to reduce environmental impact. All industries continue to place a high priority on sustainability, and pharmaceutical packaging is no exception. Lightweighting, creating packaging from biodegradable materials, and/or using post-consumer recycled (PCR) materials are some examples of how this manifests itself.

Connected and Smart Packaging

The implementation of smart packaging technologies is on the rise. Features such as tamper-evident seals, temperature indicators, and QR codes for tracking are being integrated to enhance drug safety, ensure proper storage conditions, and improve patient compliance. Smart packaging technologies are another emerging trend that aims to improve drug adherence and patient involvement, both of which are critical components of successful therapy. Smartphone apps can now track dose and send reminders for smart blisters and bottles with embedded sensors.

Additionally, by communicating adherence data to healthcare practitioners, these packaging solutions enable real-time modifications to treatment plans. The concept of intelligent packaging technologies that improve patient adherence, safety, and traceability is based on smart packaging. Packaging that incorporates loT (Internet of Things) devices can offer a fresh approach to patient interaction and data collection. Additionally, it provides real-time temperature, humidity, and other vital parameter monitoring, guaranteeing the integrity of pharmaceutical products while they are being transported and stored.

Customization and Personalized Medicine

The demand for personalized medications is increasing, leading to a need for packaging solutions that can accommodate customized dosages and formulations. This includes flexible packaging options that can be tailored to individual patient requirements.

How Can AI Improve the Compound Pharmacy Packaging Processes?

AI (Artificial Intelligence) has the potential to significantly improve the compound pharmacy packaging industry by enhancing accuracy, efficiency, quality control, compliance, and customization. AI-powered vision systems can detect labelling errors, dosage inconsistencies, or packaging defects (e.g., cracks, incorrect seals, color deviations). The integration of the artificial intelligence in the compound pharmacy packaging industry reduces human error in highly sensitive and regulated compounding environments.

AI can monitor whether each batch meets documentation and quality requirements (e.g., batch tracking, expiration management, temperature logs). AI can analyze machine data to predict wear and tear, schedule proactive maintenance, and avoid costly downtime. AI can work with IoT-enabled smart packaging to: track temperature/humidity during transport, alert patients to take medication and confirm tamper-evidence or seal integrity.

AI enhances every stage of the compound pharmacy packaging lifecycle from planning and production to inspection and patient delivery. The integration of AI results in higher efficiency, better compliance, and more personalized care, which are all crucial in modern pharmaceutical practices.

Market Dynamics

Driver

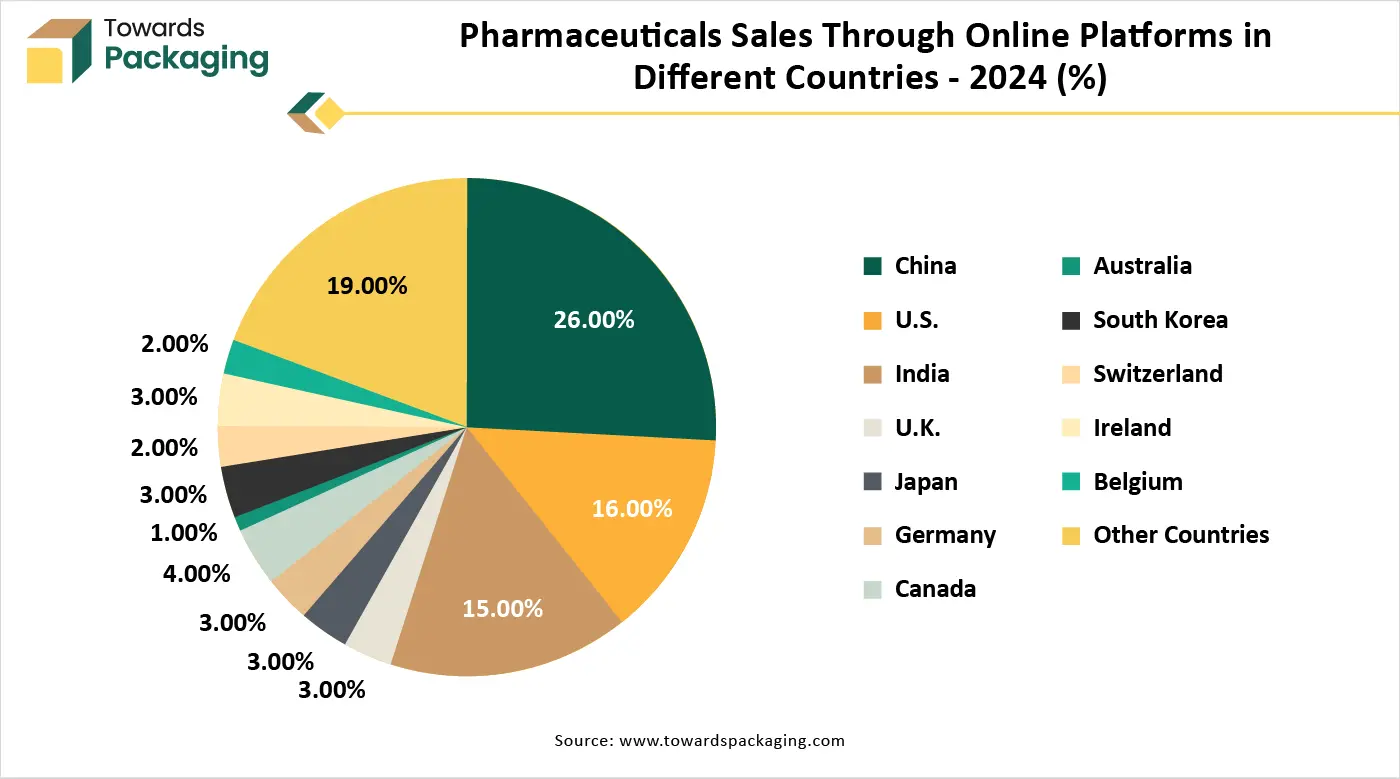

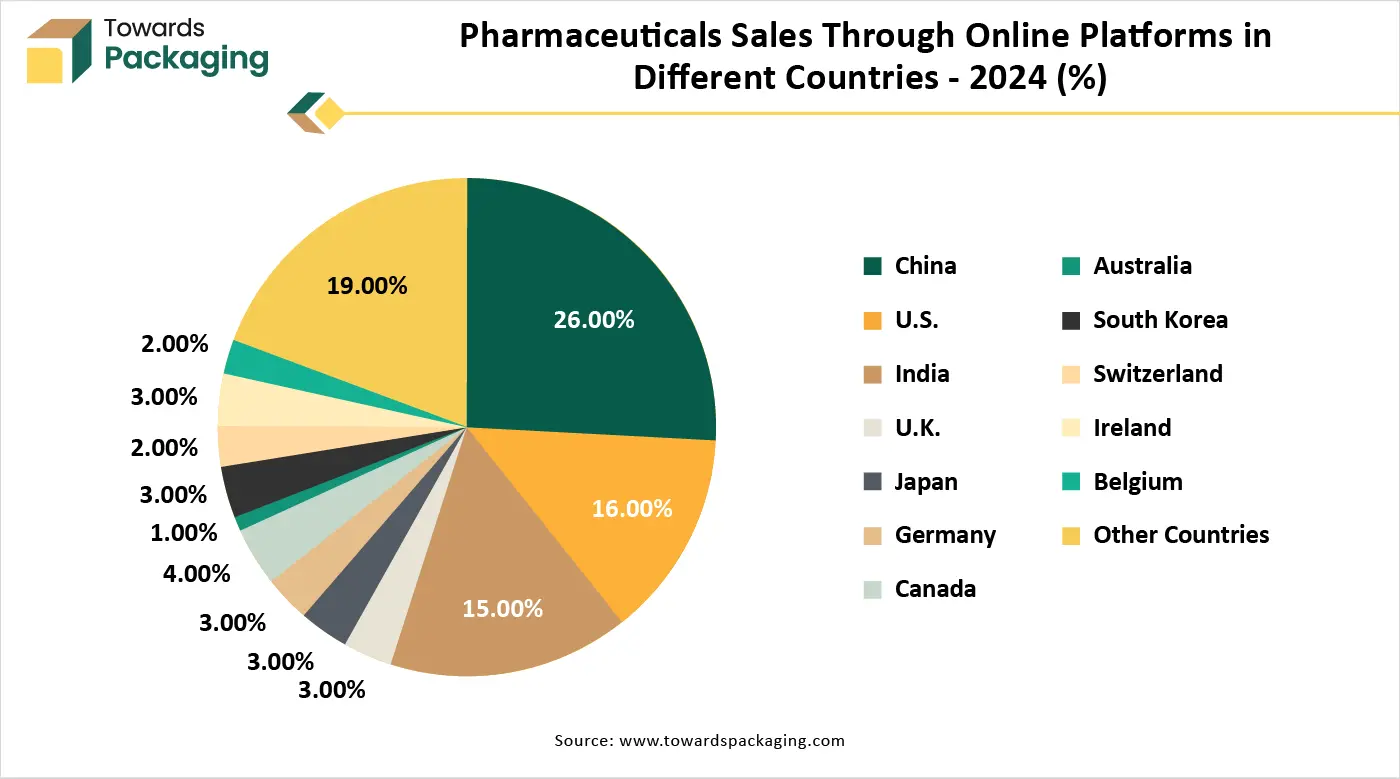

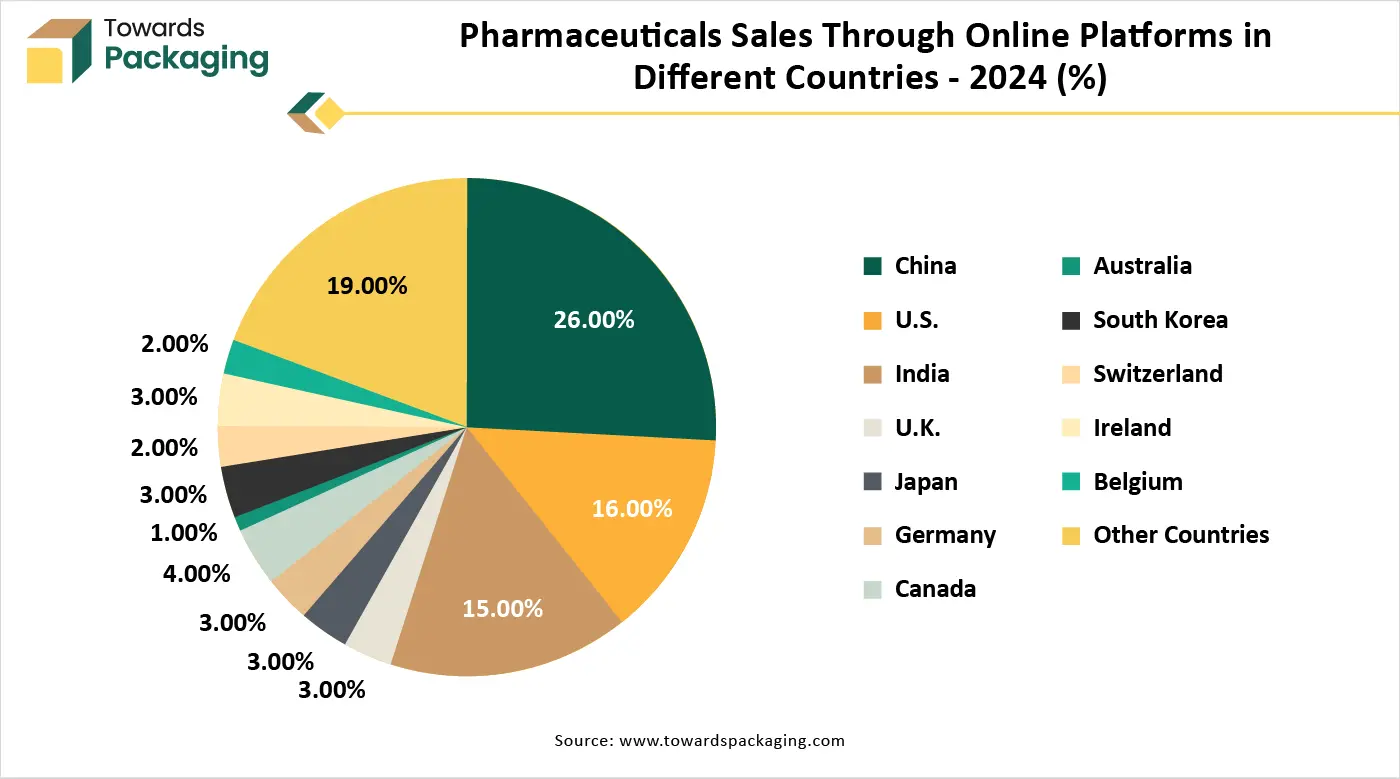

Expansion of E-commerce Platform & Pharmaceutical Industry

The expansion of e-commerce platforms & pharmaceutical industry has significantly driven the growth of the compound pharmacy packaging market in the near future. Increased demand for home delivery of medications has increased the demand for the compound pharmacy packaging. As patient order customized medications online, there’s a higher need for secure, durable, and tamper-proof packaging that can protect compounded drugs during shipping and handling. E-commerce requires packaging that complies with regulatory standards for pharmaceuticals and ensures product integrity during transit particularly critical for sensitive compounded formulations. Compounding pharmacies leveraging e-commerce often bypass traditional pharmacies. This trend boosts demand for retail-ready, informative, and patient-friendly packaging that enhances user experience.

In January 2025, according to the data published by the National Community Pharmacists Association, the pharmaceutical industry's worldwide data and analytics market was estimated to be worth US$1.1 billion in 2022 and is expected to reach US$2.1 billion by 2028. Furthermore, the Indian Economic Survey 2021 projects that the home market will triple in size during the next ten years. The domestic pharmaceutical market in India was valued at US$42 billion in 2021 and is projected to grow to US$65 billion by 2024 and US$120–130 billion by 2030.

Biopharmaceuticals, bioservices, bioagriculture, bioindustry, and bioinformatics are all part of India's biotechnology sector. By 2025, the biotechnology sector in India is projected to have grown from its 2020 valuation of $70.2 billion to $150 billion. In FY20, the medical devices market in India was valued at US$10.36 billion. From 2020 to 2025, the market is anticipated to grow at a CAGR of 37% to reach US$50 billion.

Restraint

Limited Automation and Technology Adoption & Strict Regulatory Requirements

The key players operating in the compound pharmacy packaging market are facing issue due to strict regulatory laws and limited technology adoption. USP <795>, <797>, and <800>** standards for non-sterile, sterile, and hazardous compounding are complex and costly to comply with. Frequent regulatory updates create uncertainty and require continuous investment in facility upgrades and staff training. Non-compliance can result in fines, shutdowns, or loss of licensure. Specialized packaging (e.g., tamper-evident, temperature-sensitive, smart packaging) increases production costs. Small and independent compounding pharmacies may struggle to afford modern packaging machinery or high-quality materials. Many compounding pharmacies still use manual or semi-automated processes, increasing labor costs and chances of human error. Lack of investment in AI, robotics, or digital systems delays packaging innovation.

Market Opportunities

Rising Demand for Personalized Medicine

Patients increasingly need customized dosages, allergy-friendly formulations, or alternative delivery forms. This drives demand for flexible, custom-fit packaging solutions tailored to individual prescriptions. When mass-produced drugs are out of stock, discontinued, or unavailable in specific forms, compounding pharmacies fill the gap. This creates demand for packaging tailored to rare or non-standard medication formats (like oral suspensions, troches, or topical creams).

Innovations in smart packaging, biodegradable materials, and tamper-evident designs are becoming more accessible. Pharmacies can now offer safer, longer-lasting packaging even for sensitive compounded medications.

Segmental Insights

Vials and Bottles Led the Market in 2024

The vials and bottles segment held a dominant presence in the compound pharmacy packaging market in 2024. Vials are ideal for injectable, sterile, or lyophilized medications. Bottles suit liquid suspensions, syrups, and oral solutions. This variety allows compounders to package medications in forms best suited to their therapeutic use. These containers provide excellent barriers against light, moisture, and air, preserving the stability and potency of sensitive compounded drugs. Vials and bottles are often used because they meet USP and FDA requirements for sterile and non-sterile packaging, especially for parental and oral drugs. Bottles and vials allow for clear, customizable labelling, essential for individualized prescriptions.

The blister packs segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. Blister packs support unit-dose packaging, making it easier for patients to follow complex or customized medication regimens especially important in compounding where doses vary per patient. Blister packs offer superior protection against moisture, oxygen, and light, extending shelf life for sensitive compounded formulations, especially capsules, tablets, and troches. They provide clear tamper-evident seals, which are critical for patient safety and required by regulatory bodies for both sterile and non-sterile compounded drugs.

Plastics Segment Witnessed Significant Share in 2024

The plastic segment segment accounted for a significant share of the compound pharmacy packaging market in 2024. Plastic is used to manufacture a wide range of packaging types bottles, vials, syringe, jars, and tubes suiting liquids, creams, gels, capsules, and more, which are common in compounding pharmacies. Plastic packaging is lightweight yet durable, making it ideal for transport and shipping, especially with the growth of home delivery and e-commerce in the pharmacy sector. Plastic is more economical to produce than glass or metal, allowing compound pharmacies to keep packaging costs low while maintaining compliance and safety.

The biodegradable materials segment is anticipated to grow with the highest CAGR in the market during the studied years. Biodegradable materials (like PLA, PHA, or starch-based polymers) are typically more expensive to produce than traditional plastics like HDPE or PET. The raw materials and manufacturing processes are less mature and less scalable. Biodegradable packaging can degrade over time or under certain storage conditions, making them less suitable for long-term storage of compounded medications unless specially engineered, which increases cost.

Sterile Compounding Led the Market in 2024

The sterile compounding segment registered its dominance over the global compound pharmacy packaging market in 2024. Sterile compounded medications such as injectables, IV solutions, ophthalmic drops, and infusions are widely used in critical care, oncology, surgery, and emergency settings, driving significant packaging needs. Innovations like tamper-evident seals, dual-chamber syringes, and barrier films are being rapidly adopted to meet the high standards of sterile compounding pushing the segment forward.

The non-sterile compounding segment is projected to expand rapidly in the market in the coming years. Non-sterile compounding covers a broad variety of dosage forms creams, ointments, capsules, suspensions, suppositories, lozenges, and troches used for dermatology, hormone therapy, paediatrics, and veterinary medicine. Non-sterile compounding follows USP <797>. This makes it more accessible for many pharmacies and leads to higher packaging demand. Non-sterile packaging tends to less expensive and easier to source than sterile packaging (which needs tamper-proof and contamination-resistant formats), supporting wider market penetration.

Regional Insights

North America’s Strong Infrastructure to Promote Dominance

North America region held the largest share of the compound pharmacy packaging market in 2024, owing to strong presence of pharmaceutical companies and advanced infrastructure in the region. The U.S. has a well-developed compounding sector, with over 7,500 compounding pharmacies, including: 503A pharmacies (patient-specific), 503B outsourcing facilities (bulk sterile compounding for hospitals and clinics). This large base generates high demand for advanced packaging solutions. U.S. follows strict standards from: U.S. Pharmacopeia (USP <795>, <797>, <800>), U.S.FDA oversight (especially for 503B outsourcing facilities). These regulations mandate high-quality, tamper-evident, sterile, and traceable packaging, stimulating demand for premium packaging technologies.

North America has the highest per capita healthcare expenditure in the world. This supports investment in cutting-edge packaging equipment, materials, and compliance systems. Strong infrastructure for automation, robotics, AI, and smart packaging integration. Leading companies in North America develop and deploy: temperature-controlled packaging, child-resistant and senior-friendly packaging and track-and-trace systems using QR/barcodes. North America has a mature e-pharmacy market (e.g., Amazon Pharmacy, Capsule).

This fuels demand for durable, secure, and compliant packaging that supports shipping and home delivery. Presence of global packaging leaders (e.g., West Pharmaceutical Services, Berry Global, Amcor US) enables fast access to innovative materials and technology.

Canada Compound Pharmacy Packaging Market Trends

Canada compound pharmacy packaging market is driven by the regulatory modernization and alignment. Streamline Health Canada regulations to mirror the FDA's 503A/503B system. The government of Canada encourage opening of sterile and non-sterile compounding pharmacies, especially in underserved provinces. Use Canada’s proximity to the U.S. market to become a compounding packaging hub for North America. Partner with U.S.-based 503B facilities to supply packaging materials or contract packaging services. Canada’s environmental policies can position it as a leader in eco-friendly packaging (e.g., recyclable, compostable, or biodegradable materials). Canada’s proximity to the U.S. market and string trade infrastructure allows it to become a packaging and compounding hub for North America.

Asia’s Growing Personalized Medicine Industry to Support Growth

Asia Pacific region is anticipated to grow at the fastest rate in the compound pharmacy packaging market during the forecast period. Countries like Japan, China, and South Korea have rapidly aging populations. Older adults often require personalized or compounded medications, boosting demand for specialized packaging. Governments across Asia-Pacific are increasing investment in healthcare infrastructure. Greater access to healthcare drives demand for compounded pharmaceuticals and their packaging. Rapid urbanization and a growing middle-class population, especially in India and China, increase awareness and consumption of healthcare products. Higher incidence of conditions like diabetes, cancer, and cardiovascular diseases leads to a need for customized medications, hence growth in compounding and related packaging.

A growing number of pharmacies in the region are adding compounding services to cater to specific patient needs, which directly increases demand for customized packaging solutions. Adoption of innovative packaging technologies (e.g., tamper-evident, child-resistant, and sustainable packaging) is becoming more common. Expansion of the pharmaceutical companies in the Asia Pacific region has estimated to drive the growth of the compound pharmacy packaging market in the region.

For instance, In April 2025, Nelipak Corporation, a prominent worldwide producer of packaging solutions for demanding applications such as pharmaceutical drug delivery, medical devices, and diagnostics, announced that it is strengthening its dedication to providing direct customer service as well as through preferred partners to customers in the Asia-Pacific region. There is a wide variety of specially made sterile-barrier packaging options in the Nelipak medical packaging product line.

The flexible packaging product line from Nelipak consists of bags, pouches, die-cut sheets and lids, and coated roll-stock. Nelipak heat-seal coating technology (Nelipak CR27 and Nelipak SBP2000 coatings; Nelipak PS-series coated papers) and a variety of material substrates (Tyvek, medical papers, films, and foil-laminates) are found in these goods.

China Compound Pharmacy Packaging Market Trends

China compound pharmacy packaging market is driven by the massive pharmaceutical base. China is one of the world’s largest producers of active pharmaceutical ingredients (APIs) and finished drugs. This drives demand for a wide variety of pharmaceutical packaging solutions, including those used for compounded medications. China offers low-cost, large-scale manufacturing of packaging materials such as plastics, glass, blister films, and labels. This cost advantage makes it a global hub for pharmaceutical packaging exports. Chinese manufacturers are rapidly adopting automated, high-precision packaging equipment and technologies, including tamper-evident features, smart labels, and barrier materials, aligning with global quality standards. Chinese government has made healthcare and pharmaceutical innovation a strategic priority, with policies supporting local production, R&D, and GMP compliance benefiting the packaging sector as well.

Europe’s Government Initiatives to Project Notable Growth

Europe region is seen to grow at a notable rate in the foreseeable future. Europe has a strong focus on patient-centered care, leading to increasing use of compounded medicationsm, especially for pediatrics, geriatrics, and rare diseases driving demand for customized packaging solutions. The European Medicines Agency (EMA) and national health authorities enforce strict packaging and labeling regulations. This drives adoption of advanced, compliant packaging for compounded drugs, including tamper-evident and child-resistant formats. Europe is seeing a rise in home-based treatments and specialty care (e.g., for cancer, autoimmune disorders), increasing the need for secure, portable, and patient-friendly packaging for compounded injectables and oral medications. European countries are aggressively pursuing eco-friendly pharmaceutical packaging in line with the EU Green Deal.

This pushes innovation in biodegradable and recyclable materials for compounding pharmacies. Europe region is at the forefront of smart packaging, using RFID, QR codes, and tracking systems to improve patient safety, dosing accuracy, and drug traceability, particularly important for personalized medications. Regulatory support for hospital and community compounding pharmacies (especially in Germany, France, the Netherlands, and Nordic countries) is expanding market size and packaging demand.

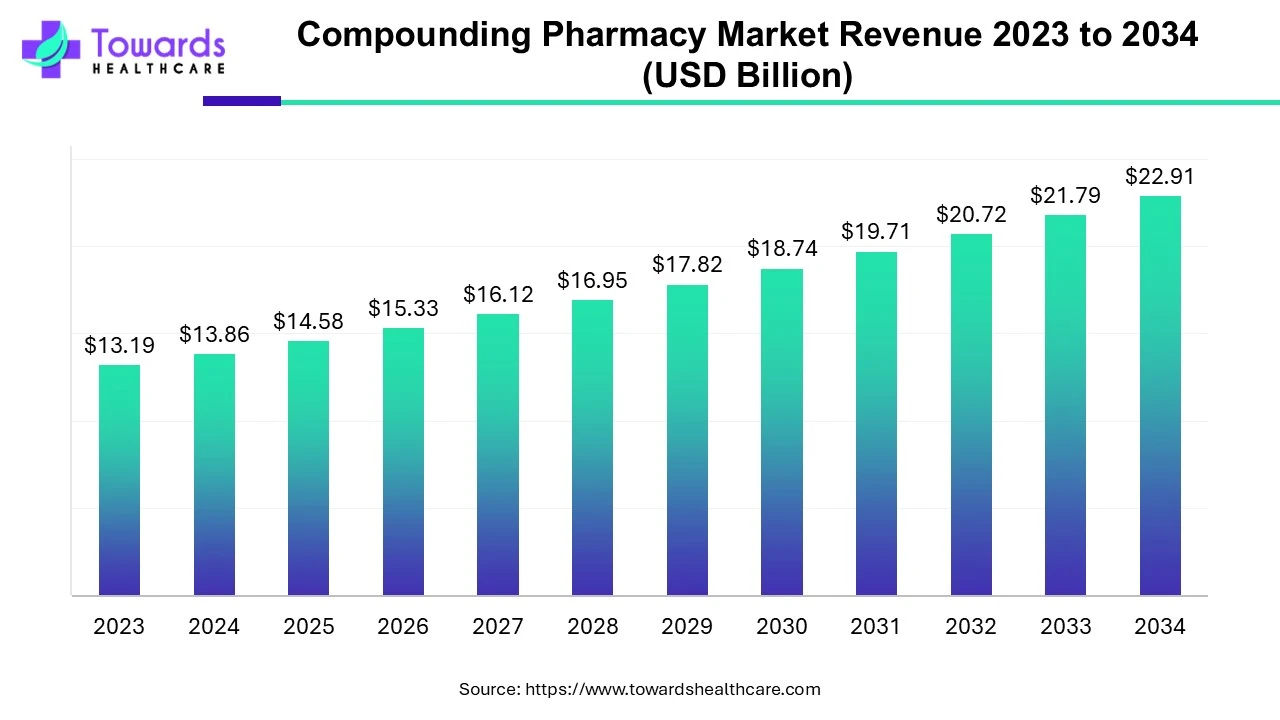

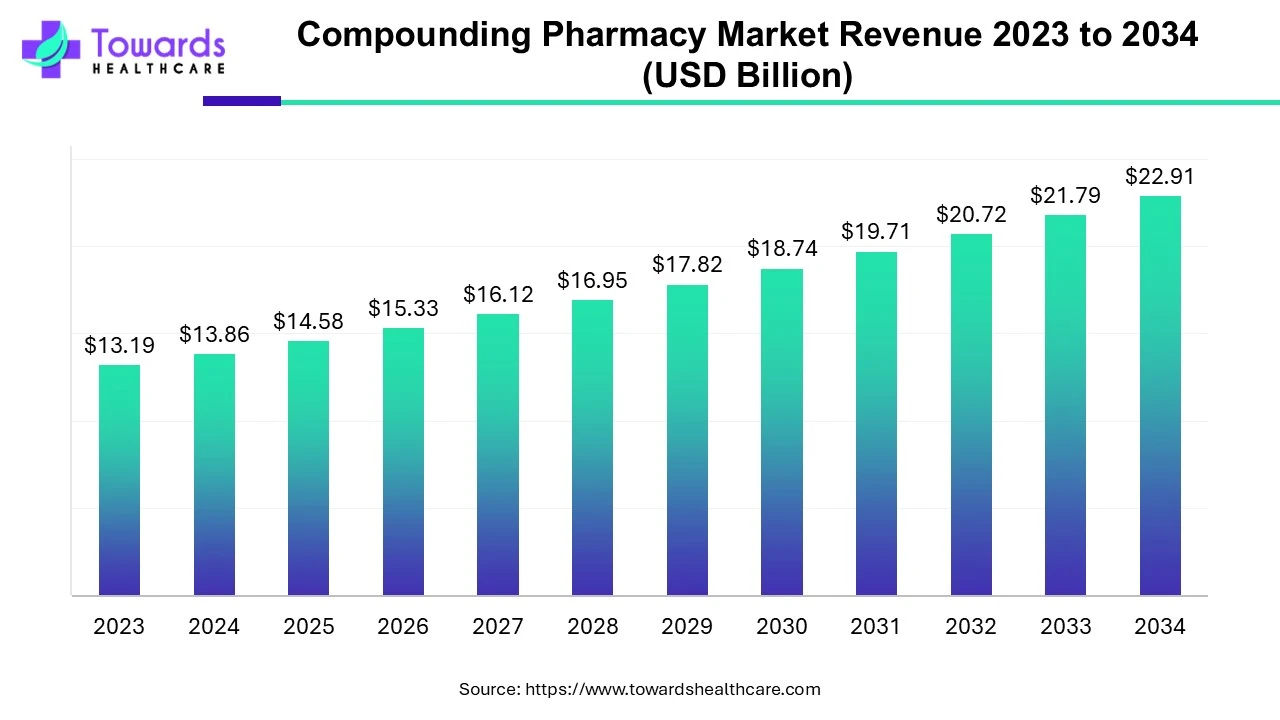

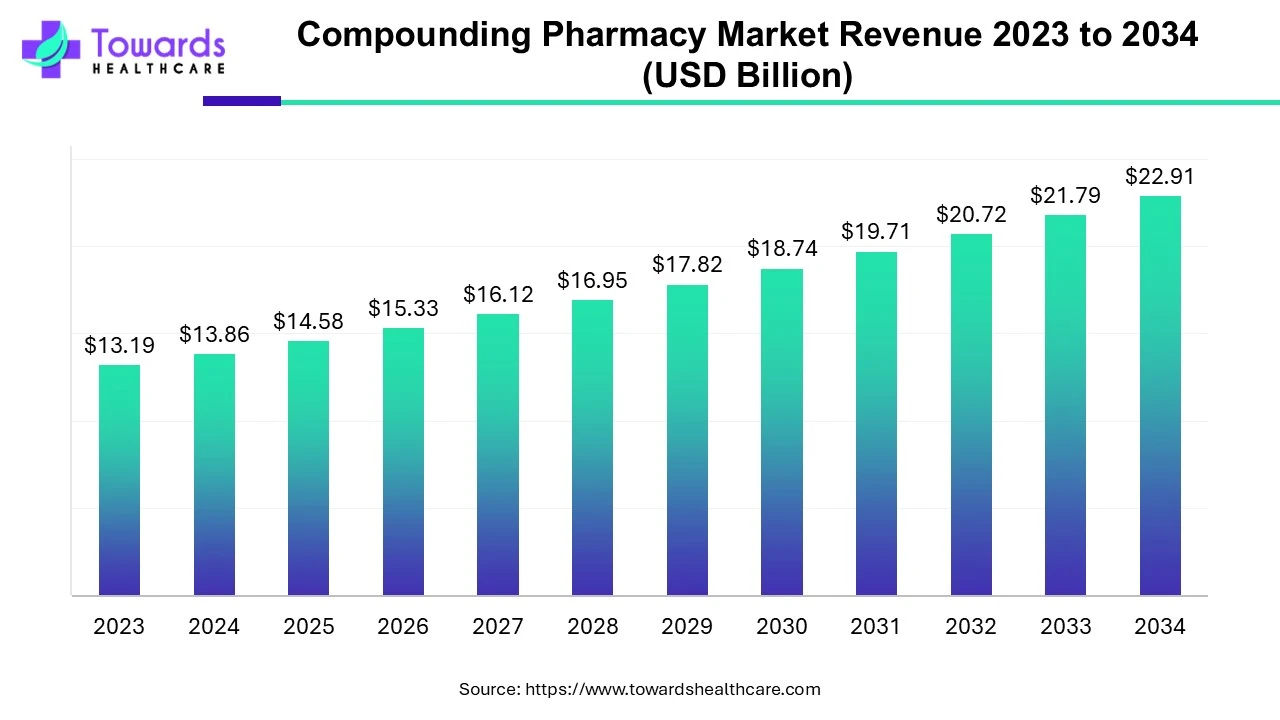

Future of Compounding Pharmacy Market

According to Towards Healthcare, the global compounding pharmacy market size was estimated at US$ 13.19 billion in 2023 and is projected to grow to US$ 22.91 billion by 2034, rising at a compound annual growth rate (CAGR) of 5.15% from 2024 to 2034. The growing demand for high-quality and highly-specified medicines is driving the growth of the market.

The production and distribution of compound medications to address the unique requirements of patients are the focus of the compound pharmacy industry. If a patient is unable to take an FDA-approved medication, such as a patient who has an allergy to a particular dye and requires a medication that doesn't contain it, or a child or elderly patient who can't swallow a tablet or capsule and requires medication in a liquid dosage form, a drug may be compounded for them. Patients may occasionally be prescribed compounded medications by medical professionals in clinics, hospitals, and other healthcare settings when an FDA-approved medication is not deemed medically necessary to treat them. Compounding may be able to meet a significant patient need in some circumstances.

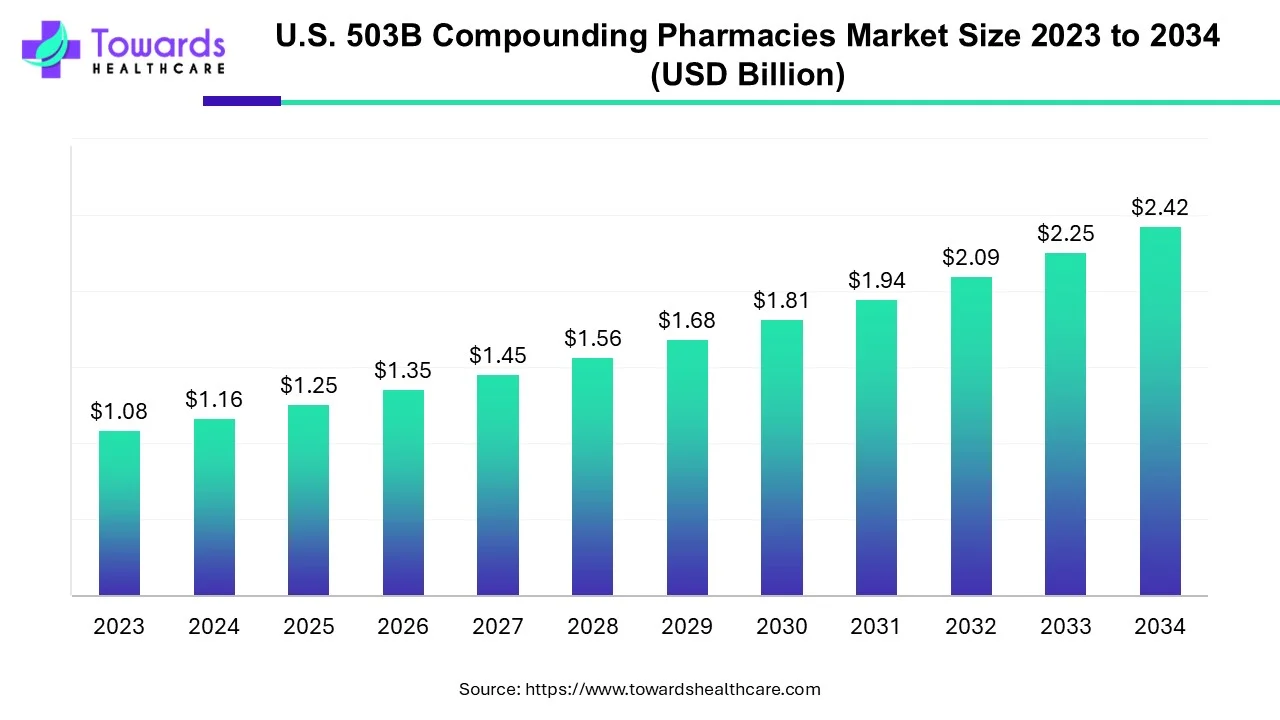

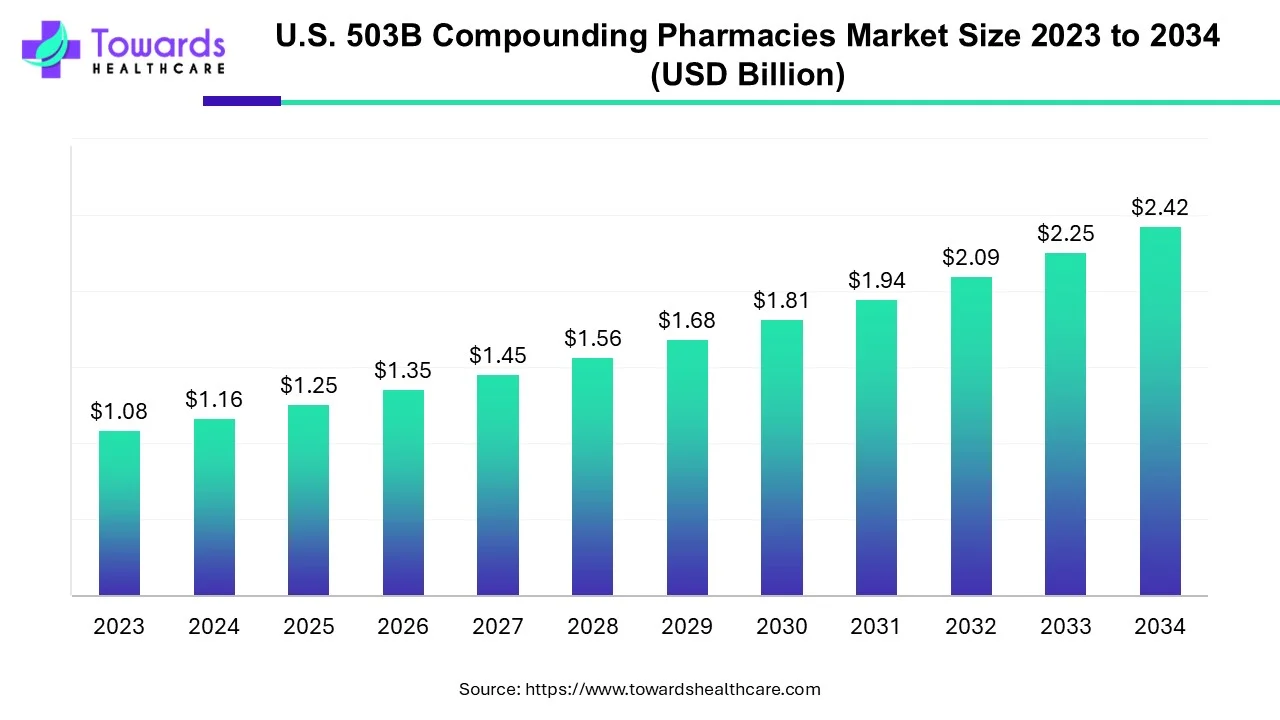

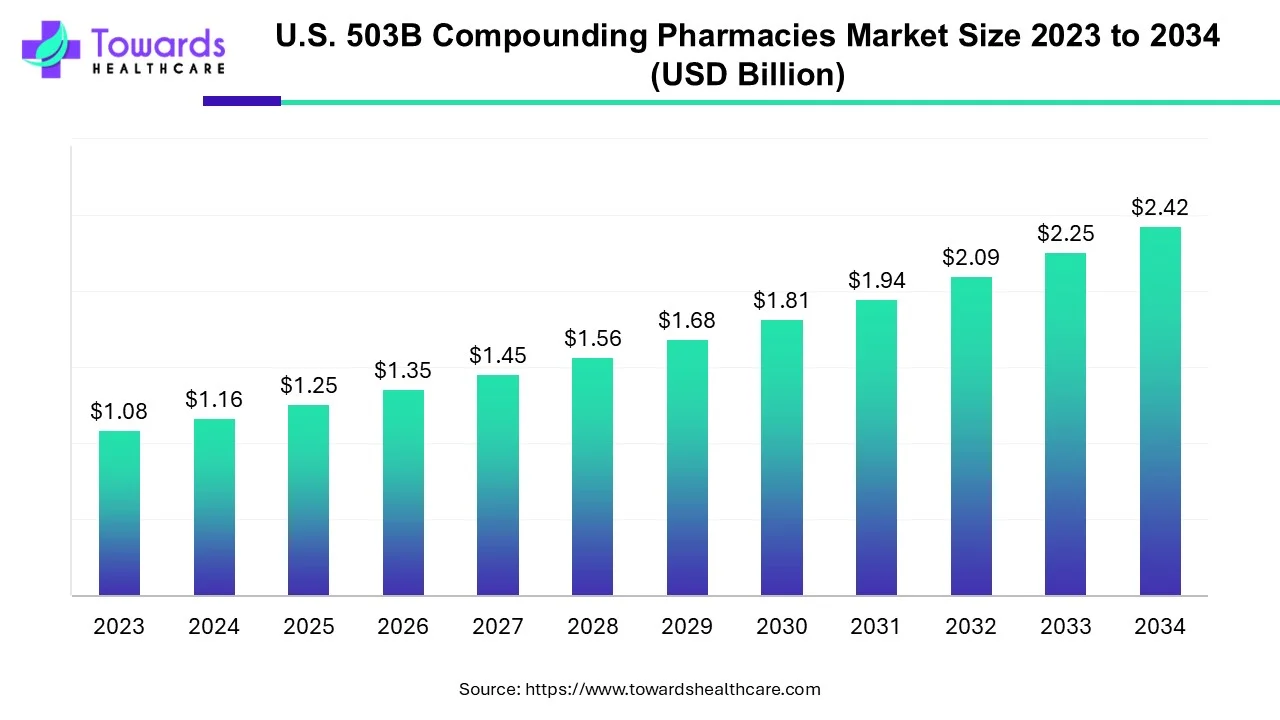

Future of U.S. 503B Compounding Pharmacies Market

According to Towards Healthcare, the U.S. 503B compounding pharmacies market size is predicted to expand from USD 1.25 billion in 2025 to USD 2.42 billion by 2034, growing at a CAGR of 7.63% during the forecast period from 2025 to 2034.

The FDA directly regulates 503B pharmacies through the use of CGMP regulations, which are the subject of the 503B compounding pharmacies market. Pharmaceutical firms also adhere to the same set of CGMP rules. As a result, a 503B pharmacy is a compounding pharmacy that follows the strict CGMP regulations.

The only pharmacies authorized to provide compounded pharmaceuticals for use in doctor's offices, clinics, and hospitals are these 503B outsourcing facilities. In recent times, the 503B U.S. compounding pharmacy market has undergone significant changes due to a number of key developments that will likely affect 503B outsourcing facilities in 2024 and beyond.

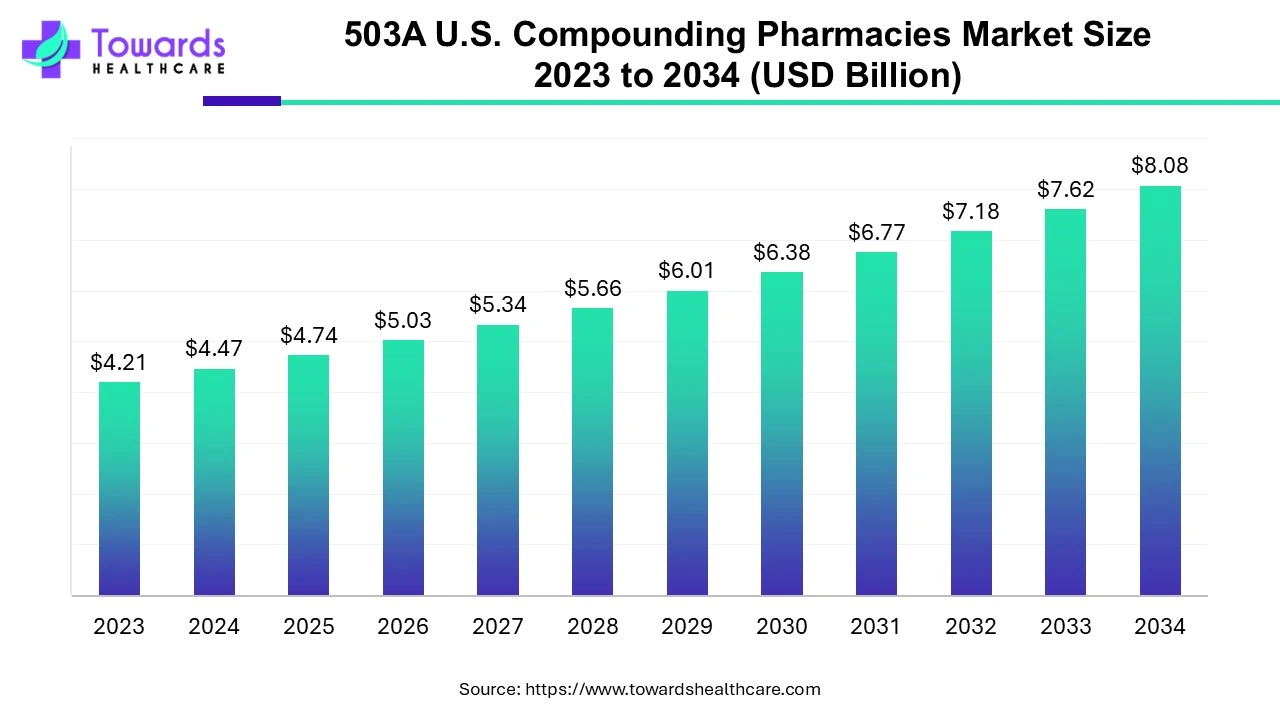

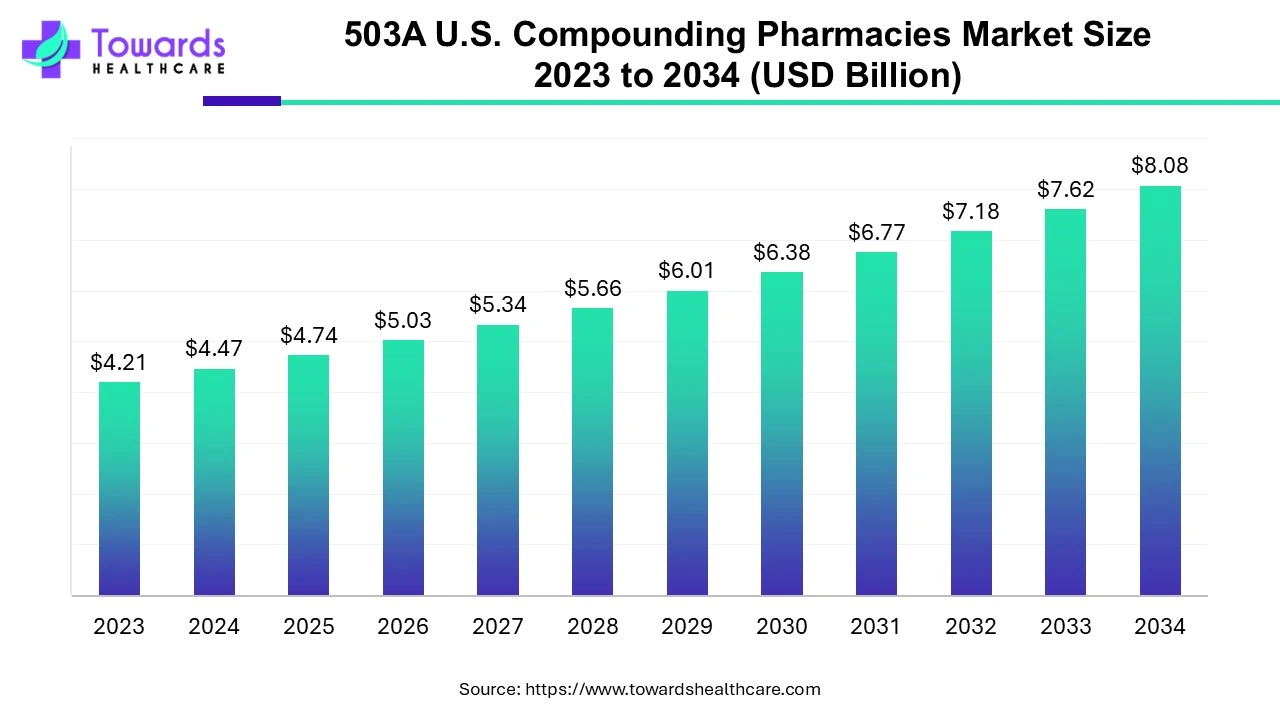

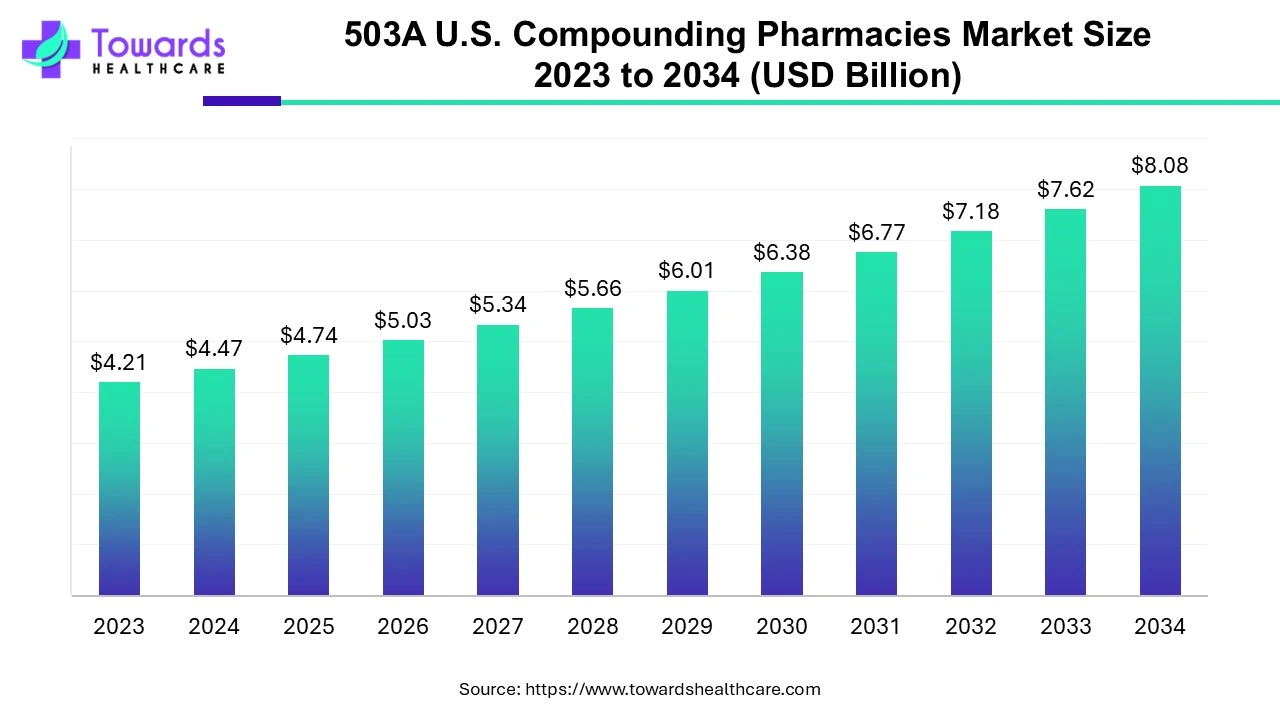

Future of 503A U.S. Compounding Pharmacies Market

According to Towards Healthcare, the 503A U.S. compounding pharmacies market is projected to reach USD 8.08 billion by 2034, growing from USD 4.74 billion in 2025, at a CAGR of 6.11% during the forecast period from 2025 to 2034, increasing demand for personalized, convenient and accessible care.

The FDA has elected 503A compounding pharmacies as those pharmacies that compound medicines as per prescriptions particular to patients and must adhere to USP and other regulations as mandated by state boards of pharmacy. 503A facilities are not allowed to manufacture in large batches and they are meant to produce and dispense for home use only. The government has employed some regulations for compounders to strictly follow while compounding pharmacies. Regulations suggested for 503A include USP <795> and <797> along with state board of pharmacy regulations.

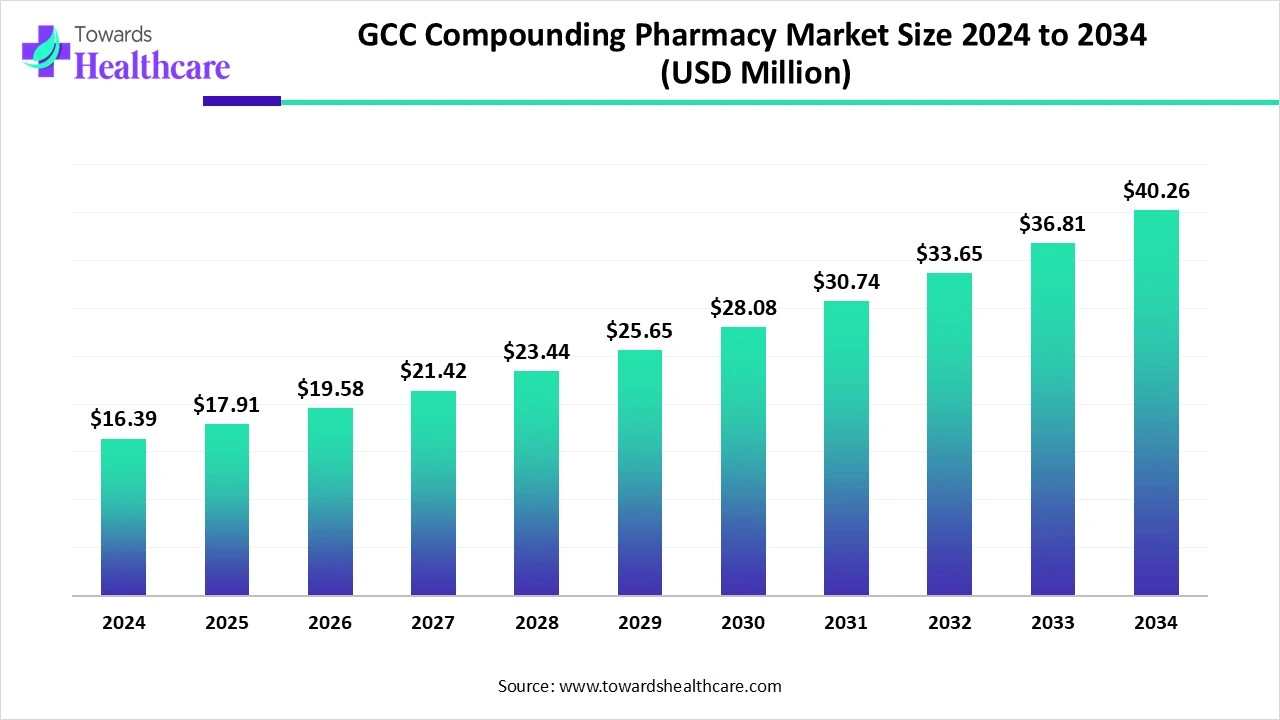

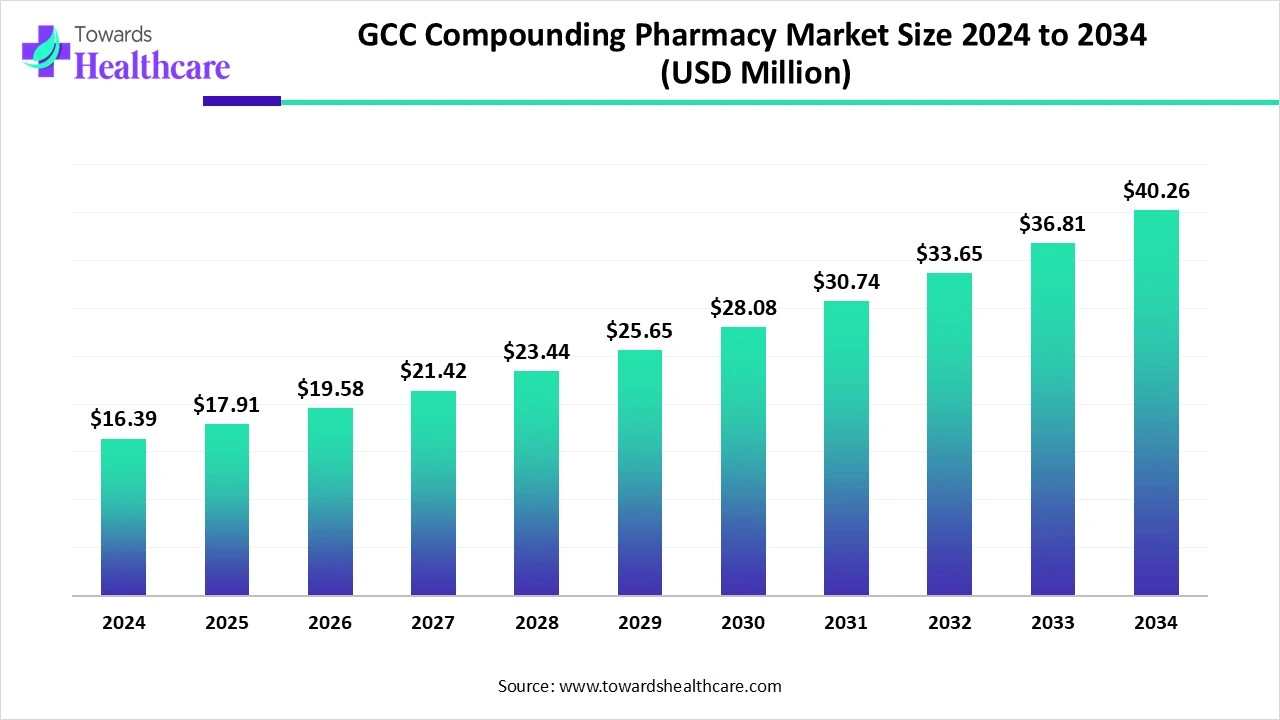

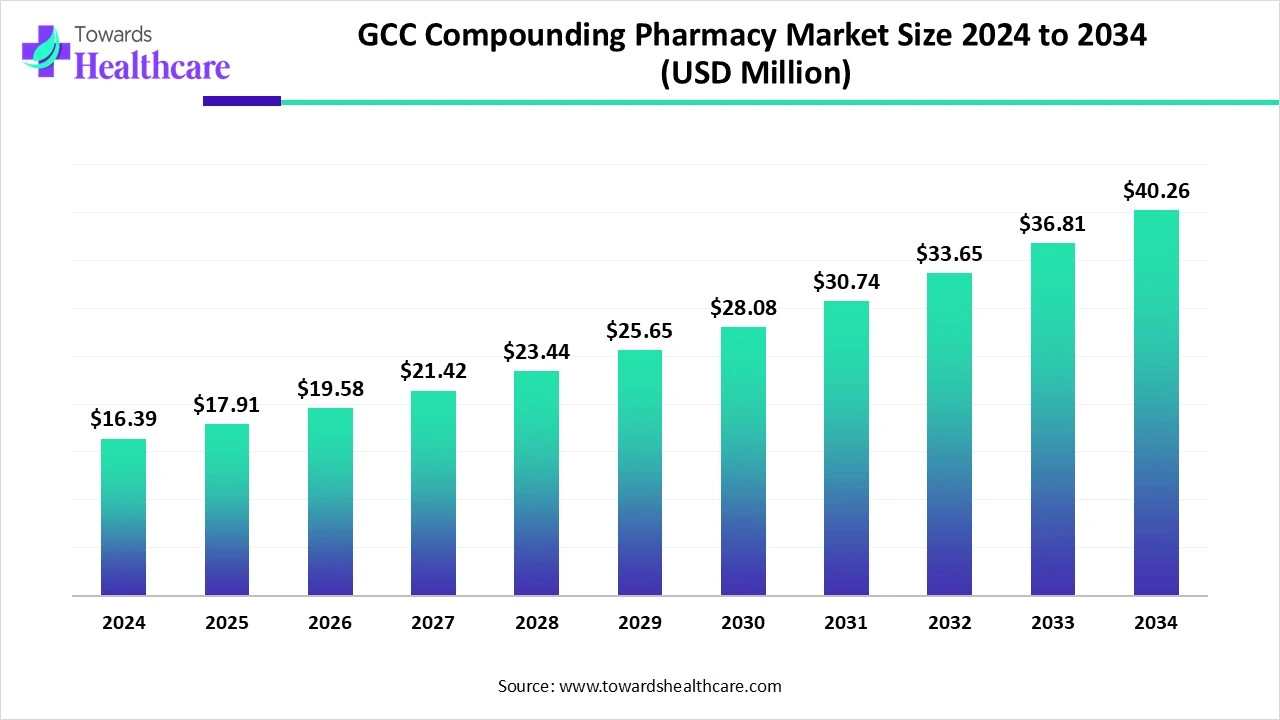

Future of GCC Compounding Pharmacy Market

According to Towards Healthcare, the global GCC compounding pharmacy market size is calculated at USD 16.39 million in 2024, grew to USD 17.91 million in 2025, and is projected to reach around USD 40.26 million by 2034. The market is expanding at a CAGR of 9.27% between 2025 and 2034.

The GCC compounding pharmacy market is primarily driven by the growing demand for personalized medicines. Approved products or medications may cause severe allergies or infections, necessitating pharmacists to provide compounded medications. Government support and increasing investments in compounding pharmacies potentiate market growth. The future looks promising with favorable regulatory policies and the adoption of advanced technologies.

Global Compound Pharmacy Packaging Market Players

Latest Announcements by Compound Pharmacy Packaging Industry Leaders

Chief Commercial Marketing & Innovation Officer Carole Grassi Mircich claims that SGD Pharma has a track record of promptly meeting its clients' changing pharmaceutical packaging requirements. The expansion of Sterinity range coincides with a boom in the demand for parenteral medications worldwide. For biologics and novel treatments that call for glass vials for parenteral administration, companies handy new 10ml and 20ml ISO molded glass vials in tray offer the best packaging option. SGD Pharma will be at the forefront of the worldwide business by innovating and producing superior primary glass packaging for companies clients and partners.

New Advancements in Compound Pharmacy Packaging Industry

- In May 2025, Aptar CSP Technologies, part of AptarGroup, revealed the expansion of its service range with the introduction of a cGMP-compliant manufacturing facility in New Jersey. Using Aptar CSP's own Activ-Polymer platform and Activ-Blister solutions, the new website will facilitate clinical packaging for oral solid dose (OSD) and capsule-based DPI medications. The expansion responds to the market's increasing need for improved medication stability and risk reduction from nitrosamines. By incorporating a highly-engineered active film material into thermoform and cold-form blister packaging configurations, Aptar CSP's Activ-Blister technology creates a microclimate that shields individual doses from oxygen, moisture, volatile organic compounds, and degradation, including lowering the possibility of N-nitrosamine formation.

- In January 2025, Cascade Specialty Pharmacy, located in Washington, was acquired by Revelation Pharma, a prominent nationwide network of 503A and 503B compounding pharmacies, today. Revelation Pharma's expanding portfolio benefits from Cascade Specialty Pharmacy's strong tradition of competence in ENT and animal health compounding.

Global Compound Pharmacy Packaging Market Segments

By Packaging Type

- Vials and Bottles

- Syringes and Cartridges

- Blister Packs

- Pouches and Sachets

By Material

- Glass

- Plastic

- Biodegradable Materials

By End-Use

- Sterile Compounding

- Non-Sterile Compounding

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait