Food Packaging Equipment Market Share, Trends and Export Import Analysis

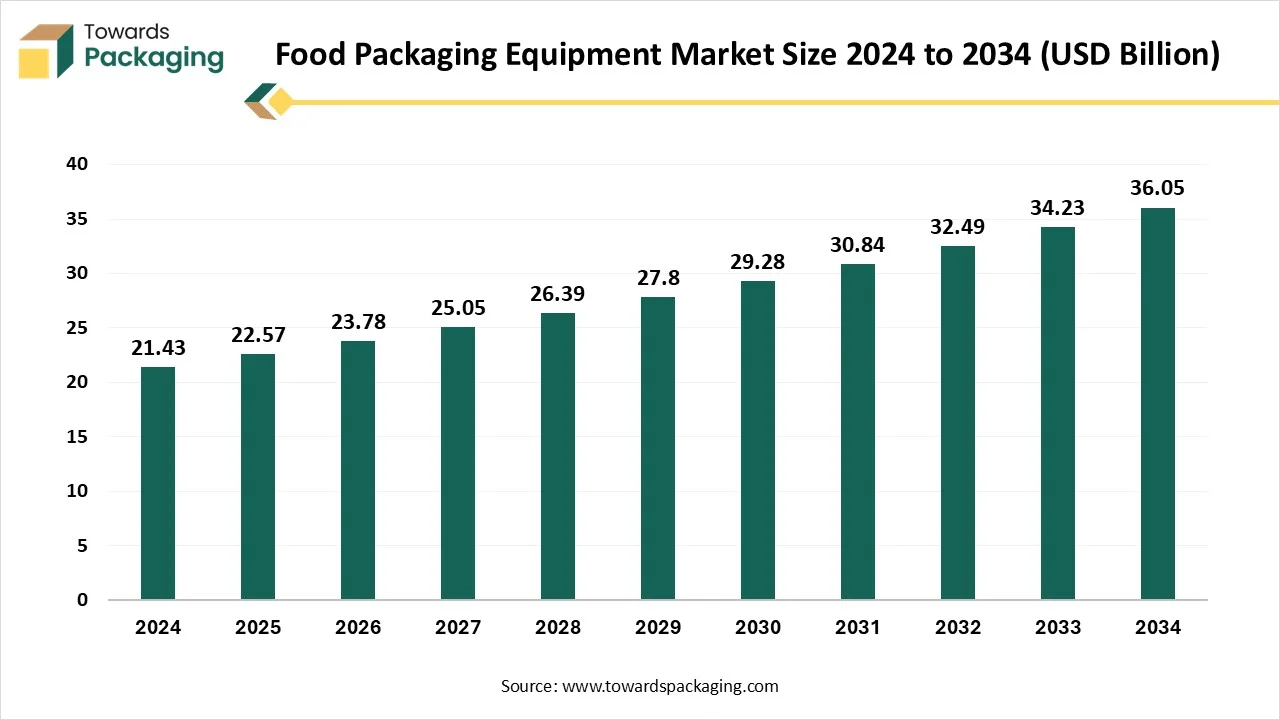

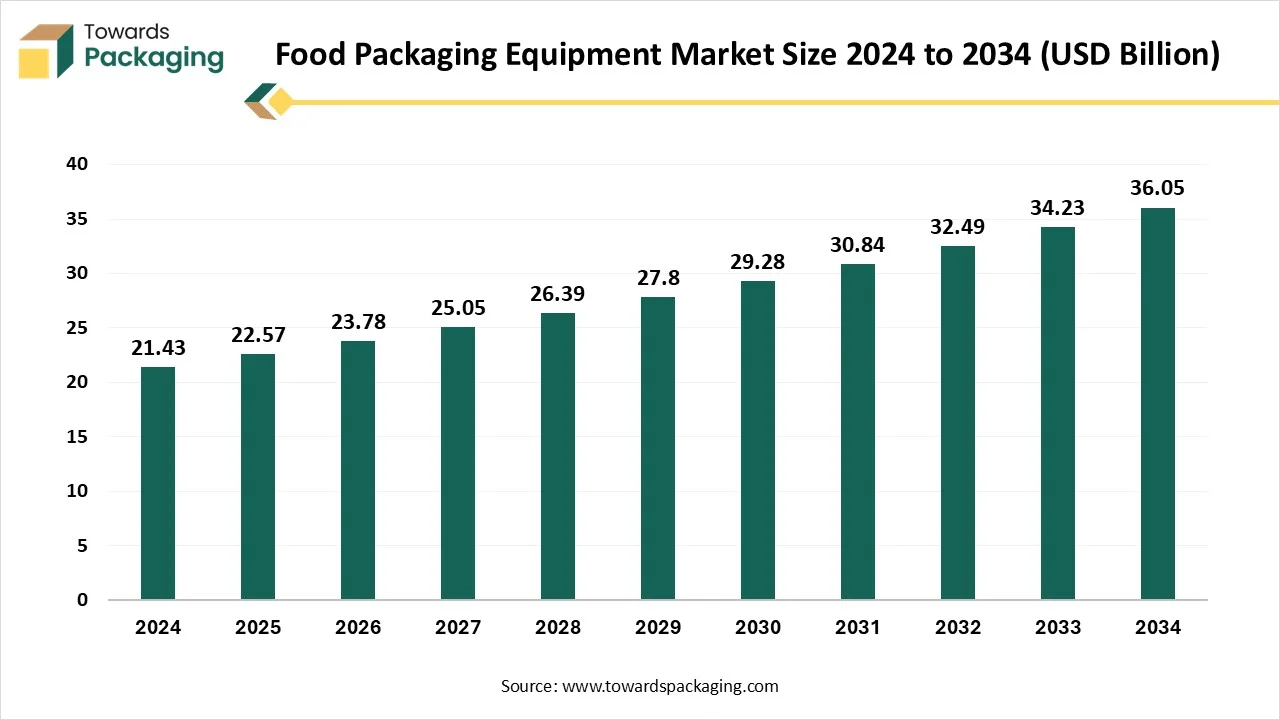

The food packaging equipment market is forecasted to expand from USD 23.78 billion in 2026 to USD 37.98 billion by 2035, growing at a CAGR of 5.34% from 2026 to 2035. This report includes statistical breakdowns, competitive profiling of leading companies like Krones, Tetra Pak, Fuji Machinery, and Marchesini Group, along with trade data, value chain analysis, import–export patterns, manufacturing activities, and supplier ecosystem insights.

Key Takeaways

- Asia Pacific led the food packaging equipment market with the highest share in 2024.

- By region, Europe is expected to witness the highest CAGR during the forecast period.

- By equipment type, the form-fill-seal (FFS) machines segment dominated the food packaging equipment market.

- By application type, the bakery and confectionery segment dominated the market share in 2024.

Market Overview

The food packaging equipment market is growing significantly due to the rising demand for packaged food products in several sectors. The food packaging machines utilises different types of packaging methods for high-quality packaging. Some of the major operations performed by these packaging machines such as labelling, palletizing, filling, wrapping, bagging, over-capping, decorating, cartoning, coding, and over-capping. Technological advancement in this field has played a crucial role in the packaging of food products as it preserves the quality and maintain the taste of the food items.

This equipment includes a wide variety of machinery intended for different kinds of food items, comprising frozen food, powders, solids, and liquids. The major market players such as Krones AG, Tetra Pak, Andy Pac, Inc, Marchesini Group, PAC Machinery Group, American-newlong, Inc, Mollers North America Inc, and many others are constantly working towards innovation in this market. In the production of food packages fully automated machines are highly preferred to avoid any error during packaging process.

Food Packaging Equipment Market Trends

- The rising demand to ensure the food safety and hygiene which is the major concern of the consumers.

- The continuous demand for enhancement in shelf life of the food products by vacuum packaging.

- The developing branding strategies and presentation of the products with well-sealed and consistent packaging.

- The growing demand for ecological sustainability of the packaging among consumers by using recyclable and biodegradable resources.

- Increasing innovation in the packaging of the food products has influenced the demand of the market.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 22.57 Billion |

| Projected Market Size in 2035 |

USD 37.98 Billion |

| CAGR (2025 - 2035) |

5.34% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Type, By Application and By Region Covered |

| Top Key Players |

Krones AG, Tetra Pak, Alliedflex Technologies, Inc, A.P. Pack Solutions, Fuji Machinery, Marchesini Group |

AI Integration in the Food Packaging Equipment Market

The growing concern for eco-friendly packaging required machinery which will produce packaging only by using renewable resources. By the incorporation advance technology such as machine learning has improved the efficiency and accuracy of the food packaging equipment. AI deliver the ability to diagnose and analyse the issues in making instant and real time adjustment. It enhances the productivity of the equipment and decrease the wastage of the packaging. The advancement in the technology has increased the traceability and heightened the safety of the food products.

Optimization of the food packaging resources in the equipment with artificial intelligence avoid any error in selection of materials. Advanced technology track packaging material, decrease waste, optimize supply chains, and gather data to reduce ecological impact. The incorporation of artificial intelligence in the packaging equipment for food packaging wastage reduction management has played a crucial role by identifying the demand of the market from gathered information.

Market Dynamics

Driver

Rising Consumption of Packaged and Processed Food: Market’s Largest Driver

There are several factors driving the food packaging equipment market such as production of huge amount of packaging, error-free packaging, packaging for enhancing shelf life of the food products, and many others. Technological advancement has caused in the expansion of exclusive food packaging equipment to enhance the efficiency, taste, and flavor of food products. Amplified consciousness of nourishing and hygienic food items, in addition to the anticipation that they are harmless for the packaging of products. The growing urbanization has influenced the demand for packaged food products.

The changing lifestyle of people in urban areas due to increasing number of working individuals has raised the demand for ready-to-eat packaged food which increase the demand for packaging and hence raise the need for food packaging equipment. This market is also influenced due to the advancement of technology in food packaging industry which is useful in choosing the quality of the packaging resource to error-free packaging to enhance the shelf life of the food products.

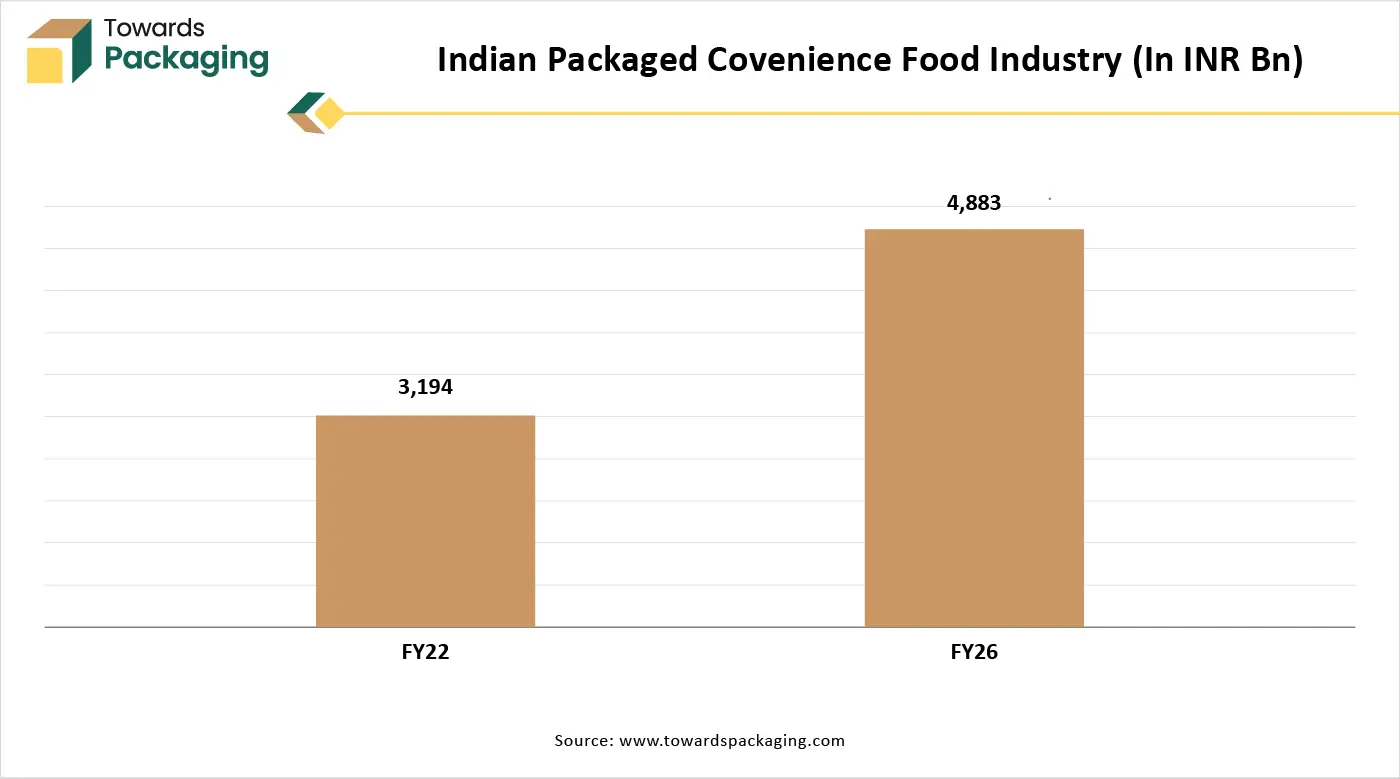

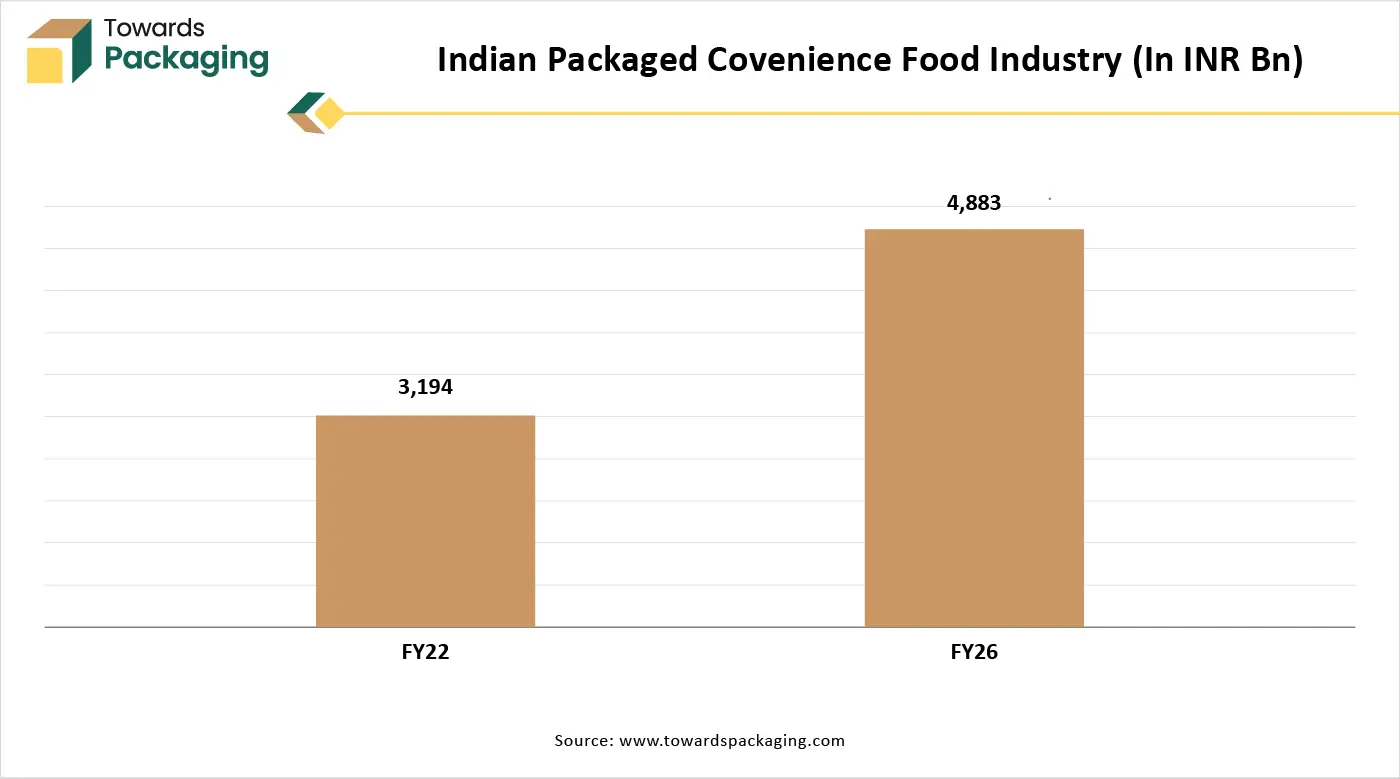

- For instance, according to BDO India 2023, by FY26, this industry is projected to become a colossal ~INR 4,883bn market. Notably, the top 15 companies operating in Indian packaged convenience food segment collectively account for ~INR 1,300bn revenue from packaged food.

Opportunity

Rising Demand for Automated and Robotic Packaging

The food packaging equipment market is growing significantly due to the rising adoption of robotics and automated facilities. Automated equipment can enhance the production process and increase the accuracy in packaging with enhanced quality. It decreases the labour charges, production timing, and human error during the packaging process which increase the demand of such equipment and raise the potential of the market. Developing robotics technology in this market has become the major concern among the market players and increasing the potential of the market.

These robotic operations are used for performing repetitive functions such as sealing, sorting, and filling process with precision. Machine learning algorithm can analyse historical information and regulate when upkeep is needed, decreasing downtime and enhancing maintenance plans, which progresses operative efficacy and confirms quality ruins constant in packing procedures. These inventions permit producers to reply to the rising requirement for packaged food products quickly and inexpensively, as well as hold shorter making runs and modified packing.

Restraint

Supply Chain Distribution Disturbance

Supply chain has a huge impact on the food packaging equipment market as it helps in the expansion of the industry. Due to the delay in the supply of the packaging material the distribution gets hampered which disturb the growth of the market. Such disturbance result in the rise of the charges of packaging equipment. It also hampers the reliability of the food packaging equipment market. This smooth supply of the packaging equipment is the major concern among the market players.

Segmental Insights

Ability, Efficacy, and Versatility: Form-Fill-Seal (FFS) Market Segment Led in 2024

The form-fill-seal (ffs) segment dominated the market in 2024 due to its ability, versatility, and efficiency of the equipment. This process comprises sealing, filling, and forming of the packages and avoid any kind of human error. Such properties influence the demand for this segment by attracting a huge number of consumers towards this market. This equipment is favored by several industries apart from food industry such as pharmaceutical companies, electronics industry, and many others. This segment supports the high quantity packaging production which ensure the integrity and shelf life of the food products. FSS can be used for the packaging of a variety of products such as powders, solids, and liquids. These are used for producing packaging of several shapes and sizes.

Rising Demand for Bakery Products: The Bakery & Confectionery Market Segment Led in 2024

The bakery & confectionery segment dominated the market in 2024 due to the rising demand for bakery products such as pastry, bread, cake, and several other products. There is a huge consumer demanding for ready-to-eat food items which raise the demand for packaging of bakery products with accuracy. The continuous development in the food packaging industry to enhance the shelf life of the food products. The advantages associate such as easy-to-consume, convenience in carrying while travelling, packed with nutritional properties, and many such factors influence people to use this packaging equipment for producing huge packaging. The expanding bakery supply chain distribution has fuelled the development of this bakery & confectionery segment.

Regional Insights

Urbanization and Economical Expansion: Asia Pacific to Sustain as a Leader

Asia Pacific held the largest share in 2024. This is due to the rapid shift towards urban areas and economic expansion has influenced the growth of the food packaging equipment market. The increasing number of working individuals are progressively shifting towards urban areas and relying on cooked packaged food for the availability of less time for food preparation. The increasing economic condition has also enhanced the inclination towards this market to fulfil the nutritional requirement.

In countries such as China, India, Japan, South Korea, Thailand, and several others has raised the demand for such packaging process with advanced technology due to the presence of several industries in this region. The increasing disposable earning has influenced the development of this market rapidly.

According to reports, agricultural production and food processing account for 30 percent of India’s GDP and employs more than 70 percent of its workforce. India’s total food market is estimated at USD 51 billion, of which USD 16.3 billion is the share of the value added food products.

Sustainable and Strict Food Packaging Regulation: Europe to Sustain as Fastest Growing Region

Europe is expected to grow at the fastest rate during the forecast period. This is due to the presence of sustainable and strict food packaging regulation. The rising demand for innovation in the field of packaging has raised the usage of packaging equipment for the production of advanced packages of food products. The growing issues of ecological damaged has attract huge number of consumers towards sustainable packaging choices and other alternative choices that required for eco-friendly packaging.

This enhanced focus towards efficiency and sustainability has influenced the food packaging equipment development. Enhanced packaging reduced the wastage of the food products significantly. According to the Industry Council for Packaging and the Environment (INCPEN), less than 1% of packaged food goes to waste, compared with between 10% and 20% of unpackaged food. The packaging of food products is for easy transportation of the food items to maintain the integrity of the product.

North America’s High Consumption of Packed Food to Promote Rapid Growth

North America is expected to grow with the fastest CAGR in the food packaging equipment market during the forecast period. Asia Pacific’s commitment to technological leadership is evident in the widespread adoption of automation and smart packaging solutions. Companies like GEA Group, Illinois Tool Works, and Krones have pioneered the development of highly efficient, automated packaging systems that enhance productivity, reduce costs, and maintain high-quality standards in food packaging. Technologies such as robotic arms, vision systems, and machine learning have been extensively integrated into packaging machinery to optimize packaging lines.

North America is witnessing a significant shift towards eco-friendly packaging solutions, driven by both consumer demand and regulatory actions. For instance, California's law mandating recyclable or compostable packaging by 2032 has spurred the adoption of biodegradable, compostable solutions, and recycled products. This regulatory push, coupled with rising consumer awareness, has led to increased investments in sustainable packaging technologies. The United States, in particular, boasts a strong manufacturing base with leading companies such as Tetra Pak, MULTIVAC, and Amcor operating within its borders. These companies not only cater to domestic needs but also serve as significant exporters of packaging machinery.

Sustainable and Strict Food Packaging Regulation: Europe to Sustain as Steady Steady-Growing Region

Europe is expected to grow at a notable rate in the foreseeable future. This is due to the presence of sustainable and strict food packaging regulations. The rising demand for innovation in the field of packaging has raised the usage of packaging equipment for the production of advanced packages of food products. The growing issues of ecological damaged have attracted a huge number of consumers towards sustainable packaging choices and other alternative choices that are required for eco-friendly packaging.

This enhanced focus on efficiency and sustainability has influenced the food packaging equipment development. Enhanced packaging reduced the wastage of food products significantly. According to the Industry Council for Packaging and the Environment (INCPEN), less than 1% of packaged food goes to waste, compared with between 10% and 20% of unpackaged food. The packaging of food products is for easy transportation of the food items to maintain the integrity of the product.

Latin America

The Latin American food and beverage sector experiences heavy pressure to accept eco-friendly packaging solutions, with several countries tightening regulations on plastic use. For example, Brazil and Mexico have used stricter regulations whose goal is to reduce single-use plastics. With feedback, producers are heavily shifting to aseptic packaging, which can be generated using renewable resources and serve a longer shelf life with lower environmental impact as compared to regular conventional packaging. As per the World Bank, Latin America is home to some of the largest plastic waste generation rates, making it a suitable opportunity for innovation in packaging materials.

Middle East and Africa

The development of the Middle East and Africa commercial food packaging equipment market is due to many potential factors. Fast Urbanization and growing disposable income in several countries are boosting the urge for processed and ready-to-eat meals that need specialized food equipment. The growing foodservice industry, including hotels, restaurants, and catering services, is fulfilling the demand for processing, advanced cooking, and packaging equipment. Automation and Technological growth in food processing develop product consistency, efficiency, and encourage market expansion too.

Top Players in Food Packaging Equipment Market

New Advancements in the Food Packaging Equipment Industry

- In February 2025, Manter, a weighing and packaging solutions specialist, broadens its product line by introducing the new Punnet Filler. This extremely user-friendly automatic packaging machine meets the expanding demands of the market, especially the growing demand for environmentally friendly punnet packaging. The newest Punnet Filler is made especially to package punnets effectively, as the name implies.

- In June 2025, Mondi, a world leader in environmentally friendly packaging, collaborated with French pet food producer Saga Nutrition to develop recyclable packaging for Saga's line of dry pet foods. By substituting mono-material for non-recyclable multi-material plastic, this creative design promotes a circular economy and guarantees the freshness of pet food. The partnership demonstrates Mondi and Saga Nutrition's mutual dedication to sustainability and the shift to a circular economy.

Recent Developments

- In May 2025, Cuica, a Brazilian foodtech that develops food and beverages with plant-based ingredients from Brazilian Homes, selected Tetra Pak, which is the top manufacturer in terms of food processing and packaging solutions, and has revealed its primary Amazon Nut milk.

- In March 2025, ULMA Packaging announced the launch of its new TFX series of thermoforming machines tailored for food packaging.

- In August 2024, GEA will showcase the current machine and control Technology for the Food Field at the Fachpack in Nuremberg, which takes place between September 24 and 26. The concentration will be on the latest PowerPak 1000 thermoformer for the packaging of Meat and Meat substitutes, cheese, or poultry that has been particularly developed as an entry-level for the thermoforming sector and serves high-level functions.

- In July 2024, Cama Group announced the launch of new top-loading packaging machine. It is to increase productivity and reducing machinery footprint in the multipack market.

- In June 2024, Mespack India announced the launch of innovative packaging solutions at Snack & BakeTec.

Food Packaging Equipment Market Segments

By Type

- Form-Fill-Seal

- Filling & Dosing

- Cartoning

- Case Packing

- Wrapping & Bundling

- Others

By Application

- Bakery & Confectionary

- Dairy Products

- Fruits, Nuts & Vegetables

- Meat, Poultry & Seafood

- Convenience Food

- Others

By Region Covered

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait