U.S. 503A Compounding Pharmacy Packaging Market Forecast, Supplier Ecosystem Review

The U.S. 503A compounding pharmacy packaging market presents a comprehensive view of market size trends from 2025 to 2034, highlighting a strong CAGR driven by personalized therapies, regulatory compliance needs, and advancements in sterile packaging. The report includes detailed segmentation by packaging type, material, and distribution channel, along with regional data across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. It also examines competitive dynamics among leading players such as Fagron, B. Braun SE, BioCare Inc., and Optum, supported by value chain analysis, import–export trade flows, and supplier/manufacturer mapping across global regions.

Major Key Insights of the U.S. 503A Compounding Pharmacy Packaging Market:

- The market is expected to grow at a CAGR from 2025 to 2034.

- By packaging type, the blister packs segment held the major market share in 2024.

- By type, the vials and ampoules segment is projected to grow at a CAGR in between 2025 and 2034.

- By material, the glass segment contributed the biggest market share in 2024.

- By material, the plastic segment is expanding at a significant CAGR in between 2025 and 2034.

- By distribution channel, the independent compounding pharmacies segment dominated the market in 2024.

- By distribution channel, the hospital pharmacies segment is expected to grow at a significant CAGR over the projected period.

Key Metrics and Overview

| Metric |

Details |

| Leading Packaging Type (2024) |

Blister Packs |

| Key Drivers |

Increase in chronic diseases and aging population

Regulatory compliance needs

Rise in personalized medicine |

| Market Segmentation |

By Packaging Type, By Material and By Distribution Channel |

| Top Key Players |

BioCare, Inc., Triangle Compounding, Fagron, B. Braun SE, Pencol Specialty Pharmacy, Vertisis Custom Pharmacy, Optum Inc. |

503A Compounding Pharmacy Packaging: Overview

503A compounding pharmacy packaging refers to the packaging standards and practices followed by 503A compounding pharmacies in the United States under the Drug Quality and Security Act (DQSA). Under Section 503A of the Federal Food, Drug, and Cosmetic Act, a 503A compounding pharmacy is: A state-licensed pharmacy (or a licensed physician) that compounds medications for an individual patient based on a prescription from a licensed practitioner. These pharmacies are regulated by state boards of pharmacy, not the FDA, but must still comply with certain federal standards. It refers to how medications compounded by a 503A pharmacy are prepared, labeled, and packaged, with emphasis on: Patient-Specific Packaging, Medications cannot be made in bulk for office use or wholesale (that’s 503B territory). 503A pharmacies follow USP guidance to determine how long a compounded drug can be used safely.

503A compounding pharmacies are defined by the FDA as those that compound medications based on patient prescriptions and are mandated by state pharmacy boards to adhere to UP and other regulations. 503B compounding pharmacies are defined by the FDA as those with outsourcing facilities that are permitted to produce large quantities of pharmaceuticals, with or without prescriptions, for sale to medical facilities solely for office use. 503B compounding pharmacies, as opposed to 503A facilities, are required to validate each procedure in accordance with CGMP. -> 503A pharmacies are required to do Environmental Monitoring every six months and adhere to USP <795> and <797> as well as state board of pharmacy rules. Stability-demonstrating internal or external scientific literature may be used to assign Beyond Use Dating (BUD).

What are New Trends in the 503A Compounding Pharmacy Packaging Market?

Personalized & Patient-Centric Packaging

Custom labeling and dosage formats tailored for individual patients, especially in pediatrics, geriatrics, and hormonal therapies. Growth in unit-dose packaging (blister packs, sachets) for better compliance and error reduction. Multilingual labels and visual aids to support diverse populations.

Enhanced Sterile Packaging Solutions

Rising demand for sterile compounded drugs (e.g., injectables, ophthalmics) is driving: use of closed-system vials and syringes, ready-to-administer (RTA) packaging for hospitals and clinics. Compliance with updated USP <797> standards is pushing adoption of higher-quality sterile packaging materials.

Sustainable & Eco-Friendly Packaging

Compounding pharmacies are starting to explore biodegradable and recyclable packaging materials in response to environmental concerns. Use of eco-conscious blister packs, compostable pouches, and reduced plastic alternatives.

Tamper-Evident & Safety-Enhanced Packaging

Increased use of: tamper-evident seals and shrink bands, child-resistant closures, senior-friendly dispensing systems. These measures enhance drug integrity and align with regulatory scrutiny from state boards.

Smart Packaging & Digital Integration

Adoption of QR codes on labels for: Patient instructions, BUD tracking and Refill reminders or online consultations.

Future potential: NFC-enabled labels for authentication and real-time monitoring (e.g., temperature-sensitive products).

Emphasis on Extended Shelf Life & Stability

Innovation in packaging materials that protect against light, moisture, and oxygen to improve beyond-use dating (BUD). Especially important for hormone replacement therapies, biologics, and dermatological compounds.

Automation & Labeling Efficiency

Integration of label automation systems to reduce manual errors and improve consistency. Compact label printers and auto-dispensers are being adopted even by smaller 503A pharmacies.

Regulatory-Driven Innovation

Compliance with USP <795>/<797>/<800> and state-specific packaging rules is forcing packaging innovation: Hazardous drug packaging (per USP <800>) requires specific containment solutions and Tracking and traceability systems to meet Drug Supply Chain Security Act (DSCSA).

Outsourcing to Specialized Packaging Vendors

503A pharmacies are increasingly outsourcing to GMP-compliant packaging suppliers for: Blistering, Cold-chain packaging and Custom containers with BUD extensions.

How Can AI Improve the 503A Compounding Pharmacy Packaging Industry?

Al algorithms can accurately measure and dispense medicinal components, guaranteeing consistency and accuracy in the finished result. This is just one advantage of integrating Al technology into pharmacy compounding procedures. This lessens the possibility that the patient will receive a dosage error. Real-time Monitoring: Al-driven systems are able to keep an eye on the compounding procedure all the time, identifying and fixing mistakes before they endanger patient safety. Al is able to continuously enhance the compounding process and lower the possibility of future errors by analyzing historical data to find trends and patterns.

Al has a lot of potential in the pharmacy industry, but it is still far from reaching its full potential. As technology advances, Al may be used to automate increasingly difficult processes, which would lessen the workload for human pharmacists and lower the possibility of mistakes. Al systems that can decipher intricate prescription instructions or even dispense drugs on their own, for example, may be developed.

Driver

Increase in Chronic Diseases and Aging Population

The growing prevalence of chronic conditions and an aging population in the U.S. have led to higher demand for customized treatments. This trend supports the expansion of 503A pharmacies and, consequently, the need for appropriate packaging that maintains medication integrity and facilitates patient adherence.

Regulatory Compliance and Safety Standards

Strict regulations, including USP <795>, <797>, and <800>, govern compounding pharmacy operations. Compliance with these standards requires packaging that ensures sterility, prevents contamination, and provides clear labelling, thereby driving innovation and growth in packaging solutions.

- For instance, in January 2025, Eli Lilly is attempting to safeguard its investment by pursuing a lawsuit that aims to permit compounding pharmacies to continue producing knockoffs of the well-known medications for diabetes and obesity, after investing billions in its manufacturing network to satisfy the soaring demand for Mounjaro and Zepbound. Lilly filed a move to intervene in a case in U.S. District Court in Fort Worth, Texas, on Wednesday. The complaint was launched by compounder FarmaKeio Custom Compounding and the compounding industry association the Outsourcing Facilities Association (OFA). The October complaint aims to convince the U.S. FDA to rescind its decision to legally proclaim a long-running shortage of Lilly's dual GIP/GLP-1 medications resolved. Defendants include the FDA and its current commissioner, Robert Califf, M.D.

Restraint

Restrictions on Bulk Compounding & Office Use and Product Variability Challenges

The key players operating in the market are facing issue due to product variability challenges and restriction on bulk compounding which has estimated to restrict the growth of the 503A compounding pharmacy packaging market. 503A pharmacies are prohibited from compounding for office use or bulk distribution (unlike 503B outsourcing facilities). This limits their customer base to individual patient prescriptions, reducing economies of scale in packaging. Smaller market reach reduces demand for large-scale packaging solutions. Wide variety of drug forms (creams, gels, capsules, injectables) and doses require customized packaging formats. This lack of standardization increases packaging complexity and inventory management difficulty. Makes automation and bulk material sourcing more difficult.

What are the Opportunity for the Growth of the U.S. 503A Compounding Pharmacy Packaging Market?

Advancements in Packaging Technologies

The adoption of advanced packaging technologies, such as tamper-evident seals, child-resistant containers, and smart labelling, enhances medication safety and tracking. These innovations contribute to the market's growth by improving patient confidence and adherence.

Expansion of Telehealth and Mail-Order Pharmacies

The rise of telehealth services and mail-order pharmacies has increased the demand for packaging that ensures medication stability during transit. This shift necessitates robust packaging solutions that protect medications from environmental factors and tampering.

For instance, in February 2025, Amazon is making an effort to offer healthcare services and products at affordable prices. For several forms of health, beauty, and lifestyle care, a newly introduced plan provides Prime members with fixed costs and reasonable monthly rates for telehealth appointments, treatment plans, and drug delivery. Amazon's entry into the medical field may have an effect on healthcare providers like anatomic pathology groups, clinical laboratories, and office-based doctors once more.

Rising Demand for Personalized Medications

503A pharmacies specialize in creating patient-specific medications, addressing unique needs such as allergies, dosage requirements, and alternative delivery methods. This personalization necessitates specialized packaging solutions that ensure safety, compliance, and ease of use.

Segmental Insights

Blister Packaging Led the Market in 2024,

The blister packs segment held a dominant presence in the U.S. 503A compounding pharmacy packaging market in 2024. Unit-dose packaging makes it easy for patients to take the right dose at the right time, especially for elderly or pediatric patients. Blister packs often include clearly labelled days/times, helping improve adherence in long-term therapies like hormone replacement or chronic pain management. Blister packs offer visible tamper resistance, which is crucial for medications compounded for individual patients. Ensures integrity of each dose, reducing the risk of contamination or accidental ingestion by children or others.

The vials and ampoules segment is expected to grow at the fastest rate in the U.S. market during the forecast period of 2024 to 2034. Vials and ampoules are the standard packaging for injectables, ophthalmic solutions, inhalables, and infusions, all of which often require sterile conditions.

Glass vials and ampoules offer excellent barrier protection against: oxygen and moisture, UV light (especially amber vials) and reactive interactions (minimizing contamination risk). The vials and ampoules helps maintain potency and stability for sensitive drugs, including compounded biologics. Multi-dose and single-dose vials allow exact drug withdrawal using syringes.

Which Material is Extensively Used for 503A Compounding Pharmacy Packaging?

Considering the material, the glass segment accounted for a significant share of the U.S. 503A compounding pharmacy packaging market in 2024. As glass is non-reactive with most pharmaceutical compounds, meaning it doesn’t leach chemicals, absorb drugs, or degrade active ingredients. This is critical for customized formulations in compounding pharmacies where drug interactions with packaging could alter potency or safety. The glass material packaging ensures drug purity and stability for sensitive preparations like hormones, biologics, and injectables. The glass material packaging preserves the integrity and shelf life of compounded medications. Glass vials and ampoules offer compatibility with: syringes, closed-system transfer devices (CSTDs) and automated filling machines.

The plastic segment is projected to expand rapidly in the U.S. 503A compounding pharmacy packaging market in the coming years. Plastic materials are used extensively in compounding pharmacy packaging due to their cost-efficiency, flexibility, and compatibility with a wide range of dosage forms. While glass is often used for high-stability and sterile needs, plastic offers practical advantages, especially for non-injectable, semi-solid, and bulk-use formulations. Plastic containers (bottles, tubes, jars) are cheaper to produce and transport compared to glass. Lightweight and durable, reducing breakage costs and shipping expenses.

Independent Compounding Pharmacies Segment Led the Market in 2024

The independent compounding pharmacies segment registered its dominance over the U.S. 503A compounding pharmacy packaging market in 2024. In April 2025, Novo Nordisk announced that it will make its weight-loss medication Wegovy available through telehealth providers Hims & Hers Health I, Ro, and LifeMD. This will increase access to the popular medicine, which is no longer in low supply in the United States.

Novo Nordisk's stock close up 4% and Hims & Hers' shares close up 23%. Given that, with very few exceptions, many compounding pharmacies are legally prohibited from producing cheaper, unapproved versions of Wegovy, the Danish pharmaceutical company is vying for more patients. When Wegovy was in low supply due to rapidly increasing demand, patients flocked to those compounded versions.

The hospital pharmacies segment is projected to expand rapidly in the 503A compounding pharmacy packaging market in the coming years. Hospitals often require customized dosages, allergy-safe alternatives, and non-commercially available drugs. 503A compounders can tailor medications to individual inpatients and outpatients, especially in: pediatrics, geriatrics, oncology and ICU and critical care.

Future of Compounding Pharmacy Market

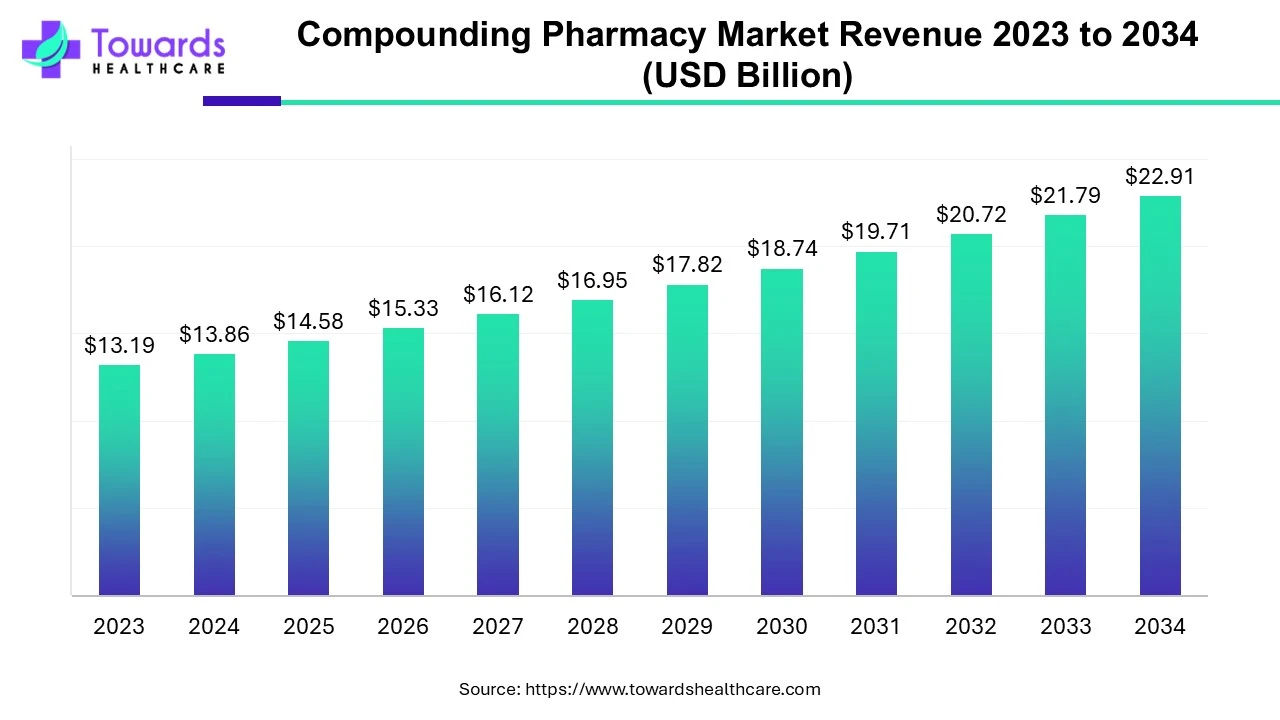

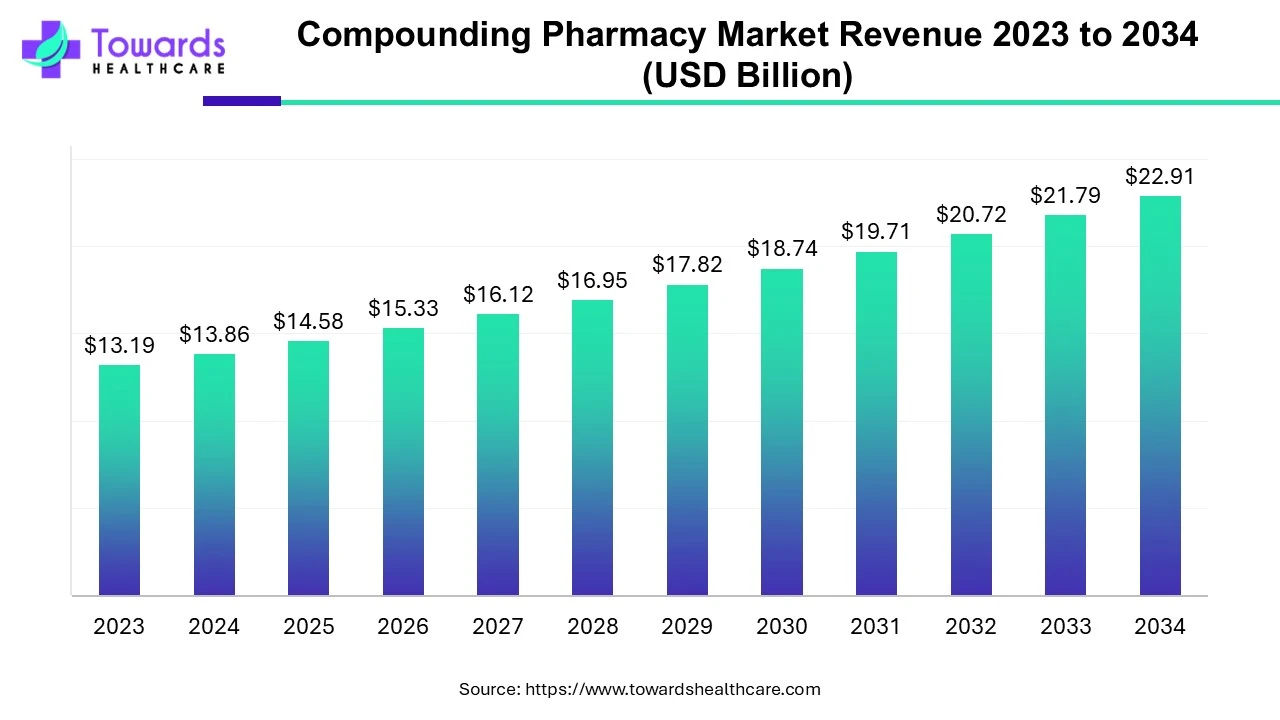

According to Towards Healthcare, the global compounding pharmacy market size was estimated at US$ 13.19 billion in 2023 and is projected to grow to US$ 22.91 billion by 2034, rising at a compound annual growth rate (CAGR) of 5.15% from 2024 to 2034. The growing demand for high-quality and highly-specified medicines is driving the growth of the market.

The production and distribution of compound medications to address the unique requirements of patients are the focus of the compound pharmacy industry. If a patient is unable to take an FDA-approved medication, such as a patient who has an allergy to a particular dye and requires a medication that doesn't contain it, or a child or elderly patient who can't swallow a tablet or capsule and requires medication in a liquid dosage form, a drug may be compounded for them. Patients may occasionally be prescribed compounded medications by medical professionals in clinics, hospitals, and other healthcare settings when an FDA-approved medication is not deemed medically necessary to treat them. Compounding may be able to meet a significant patient need in some circumstances.

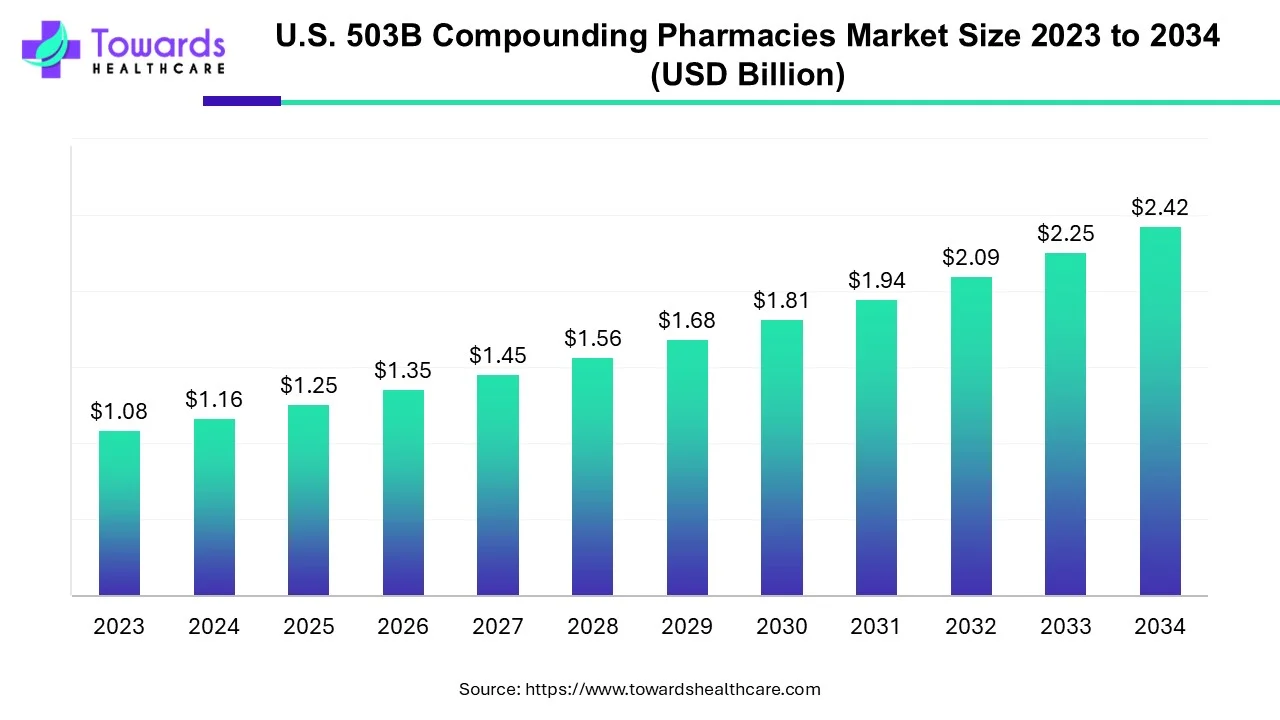

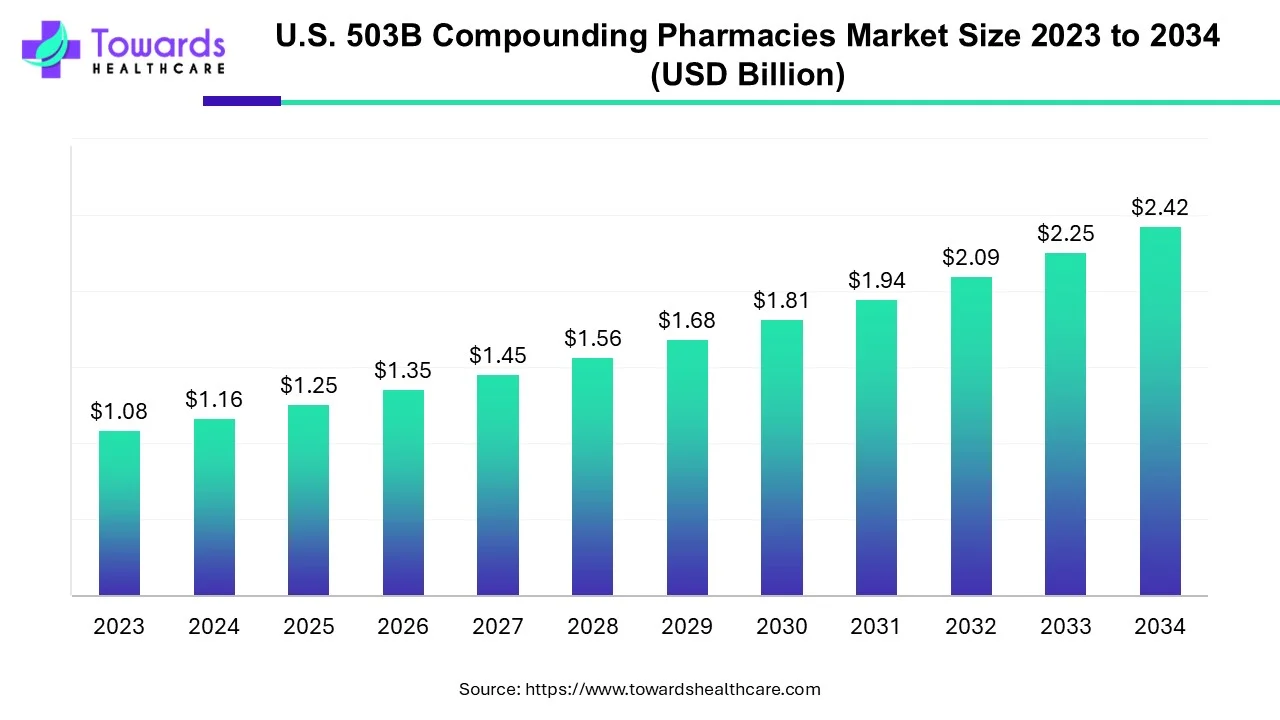

Future of U.S. 503B Compounding Pharmacies Market

According to Towards Healthcare, the U.S. 503B compounding pharmacies market size is predicted to expand from USD 1.25 billion in 2025 to USD 2.42 billion by 2034, growing at a CAGR of 7.63% during the forecast period from 2025 to 2034.

The FDA directly regulates 503B pharmacies through the use of CGMP regulations, which are the subject of the 503B compounding pharmacies market. Pharmaceutical firms also adhere to the same set of CGMP rules. As a result, a 503B pharmacy is a compounding pharmacy that follows the strict CGMP regulations.

The only pharmacies authorized to provide compounded pharmaceuticals for use in doctor's offices, clinics, and hospitals are these 503B outsourcing facilities. In recent times, the 503B U.S. compounding pharmacy market has undergone significant changes due to a number of key developments that will likely affect 503B outsourcing facilities in 2024 and beyond.

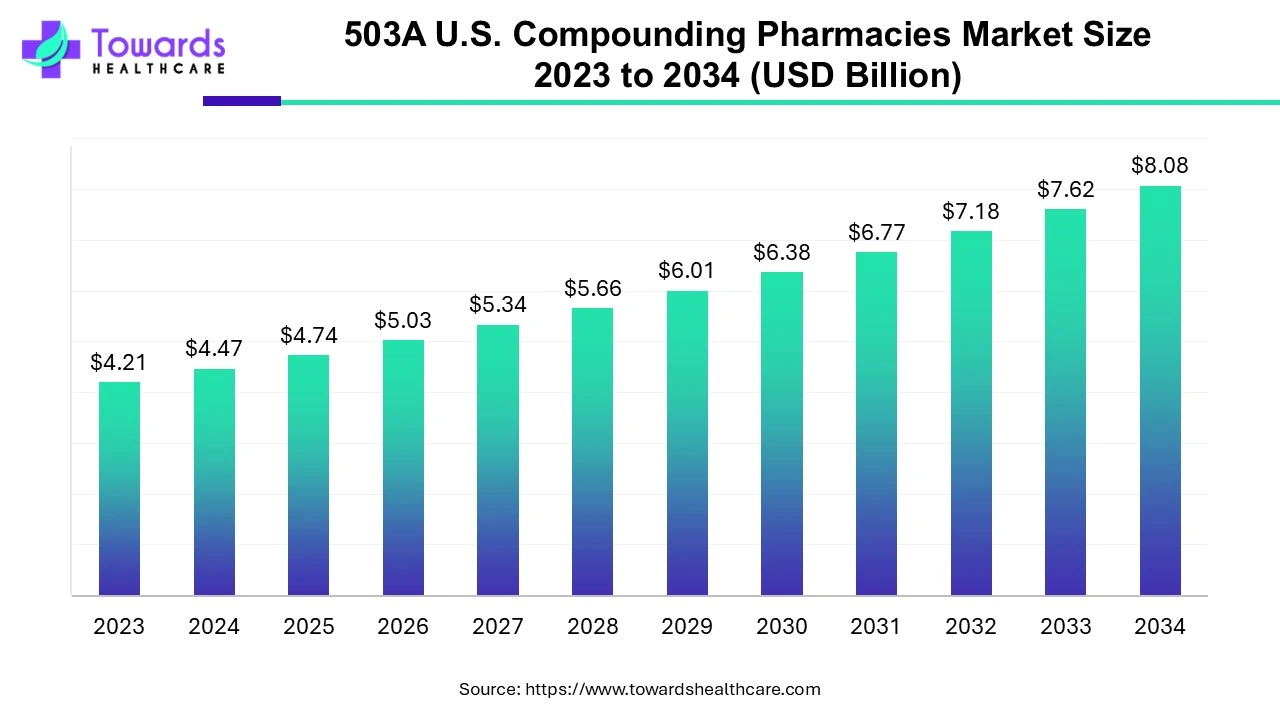

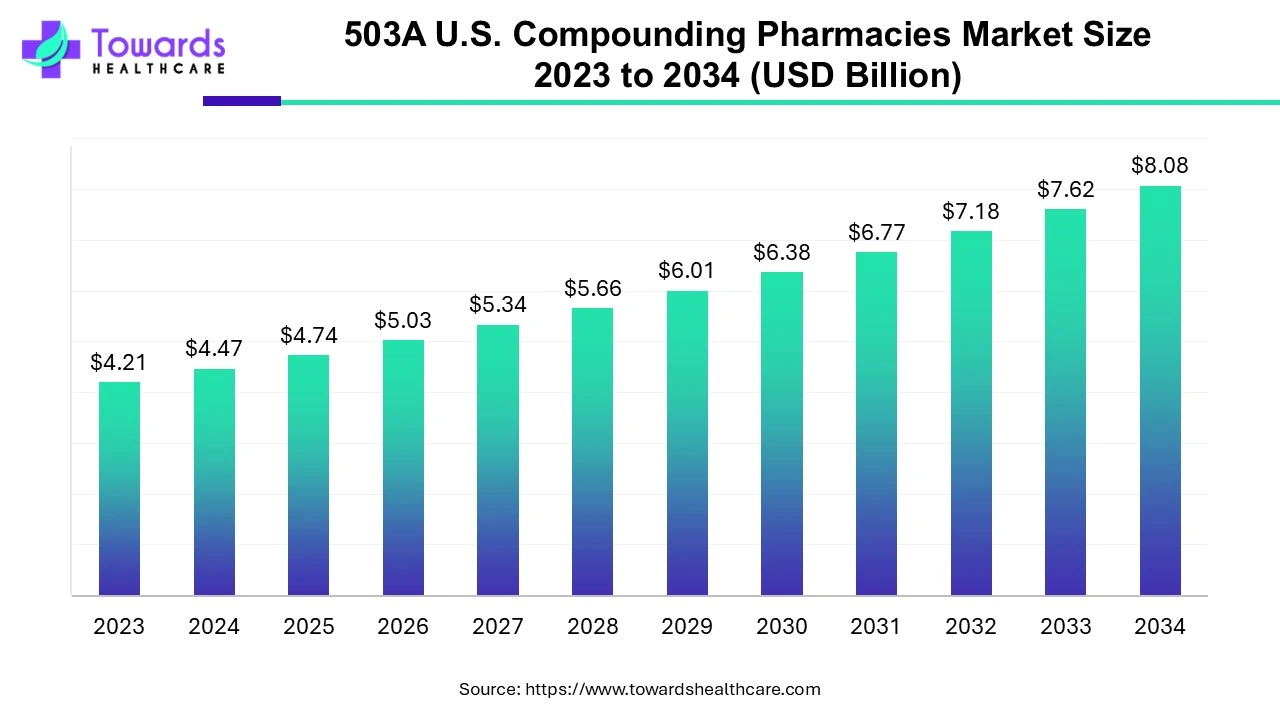

Future of 503A U.S. Compounding Pharmacies Market

According to Towards Healthcare, the 503A U.S. compounding pharmacies market is projected to reach USD 8.08 billion by 2034, growing from USD 4.74 billion in 2025, at a CAGR of 6.11% during the forecast period from 2025 to 2034, increasing demand for personalized, convenient and accessible care.

The FDA has elected 503A compounding pharmacies as those pharmacies that compound medicines as per prescriptions particular to patients and must adhere to USP and other regulations as mandated by state boards of pharmacy. 503A facilities are not allowed to manufacture in large batches and they are meant to produce and dispense for home use only. The government has employed some regulations for compounders to strictly follow while compounding pharmacies. Regulations suggested for 503A include USP <795> and <797> along with state board of pharmacy regulations.

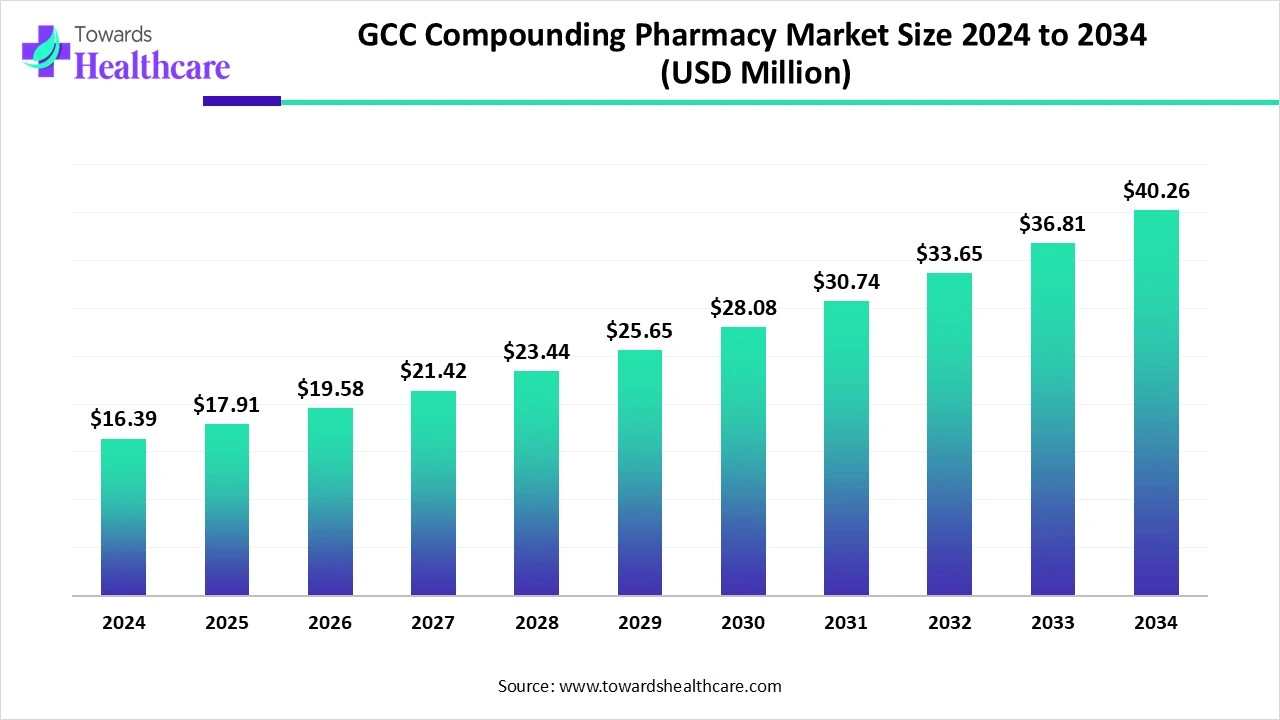

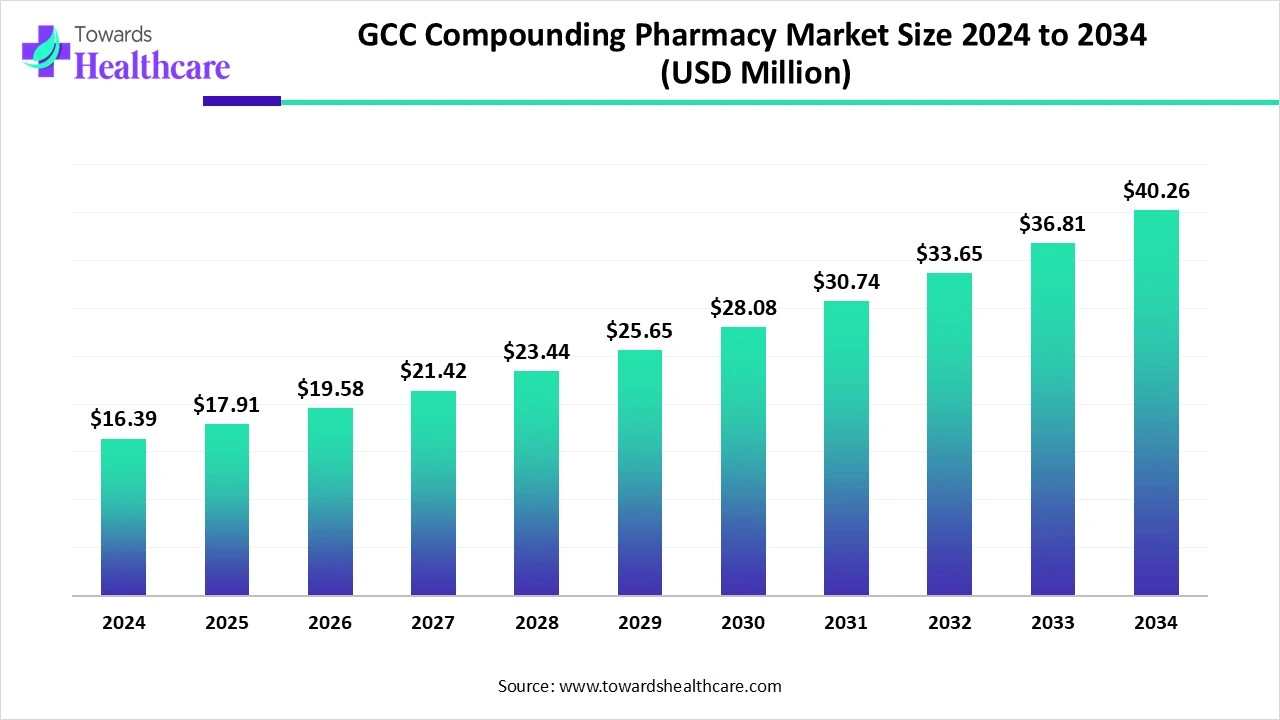

Future of GCC Compounding Pharmacy Market

According to Towards Healthcare, the global GCC compounding pharmacy market size is calculated at USD 16.39 million in 2024, grew to USD 17.91 million in 2025, and is projected to reach around USD 40.26 million by 2034. The market is expanding at a CAGR of 9.27% between 2025 and 2034.

The GCC compounding pharmacy market is primarily driven by the growing demand for personalized medicines. Approved products or medications may cause severe allergies or infections, necessitating pharmacists to provide compounded medications. Government support and increasing investments in compounding pharmacies potentiate market growth. The future looks promising with favorable regulatory policies and the adoption of advanced technologies.

U.S. 503A Compounding Pharmacy Packaging Market Players

- BioCare, Inc.

- Triangle Compounding

- Fagron

- B. Braun SE

- Pencol Specialty Pharmacy

- Vertisis Custom Pharmacy

- Optum Inc

- Pavilion Compounding Pharmacy, LLC.

- Village Compounding Pharmacy

- McGuff Compounding Pharmacy

- Wedgewood Pharmacy

- Seco Industries

- Yourway

- CareFirst Specialty Pharmacy

- McGuff Compounding Pharmacy

- Village Compounding Pharmacy

- Pavilion Compounding Pharmacy, LLC

Latest Announcements by 503A Compounding Pharmacy Packaging Industry Leaders:

- On January 07, 2025, U.S. FDA published guidelines on compounding with bulk drug substances for 503A pharmacies and 503B outsourcing facilities on January 7, 2025. While the FDA continues to assess products for inclusion on lists of materials that can be used in medication compounding, these guidelines offer security and assistance to pharmacies and outsourcing facilities that employ specific types of bulk drug substances. [Source: Frier Levitt.]

- In October 2024, The American Pharmacists Association stated that patients depend on compounding pharmacies, particularly those who require specialized prescription, are unable to tolerate a certain medication, or require medications that are currently in low supply. [Source: Pharmacy Times®]

New Advancements in 503A Compounding Pharmacy Packaging Industry

- In August 2024, Aleata Postell, Walmart's head of specialty pharmacy and group director of pharmacy business development, talked about the company's new autoimmune-focused specialty pharmacies of the community (SPOCs). According to Postell, these pharmacies serve patients with more complicated requirements by bringing high-touch specialty pharmacies into nearby areas. [Source: Pharmacy Times®]

- In February 2025, Empower, healthcare manufacturing company, revealed the launch of the unified the 503A compounding pharmacy, 503B outsourcing facilities and refreshed corporate logo under a single Empower brand. With a streamlined formulary and easy access to Empower's premium drugs, the unified brand will simplify services for patients, doctors, and pharmacists. The Empower company’s 380,000-square-foot production facility and more than 1,100 people are committed to offering individualized, reasonably priced, and easily accessible healthcare solutions. [Source: Empower Pharmacy]

U.S. 503A Compounding Pharmacy Packaging Market Segments

By Packaging Type

- Blister Packs

- Vials and Ampoules

- Syringes and IV Bags

- Bottles and Jars

- Unit-Dose Packaging

By Material

- Glass

- Plastic

- Aluminium

- Paper & Paperboard

By Distribution Channel

- Independent Compounding Pharmacies

- Hospital Pharmacies

- Veterinary Pharmacies