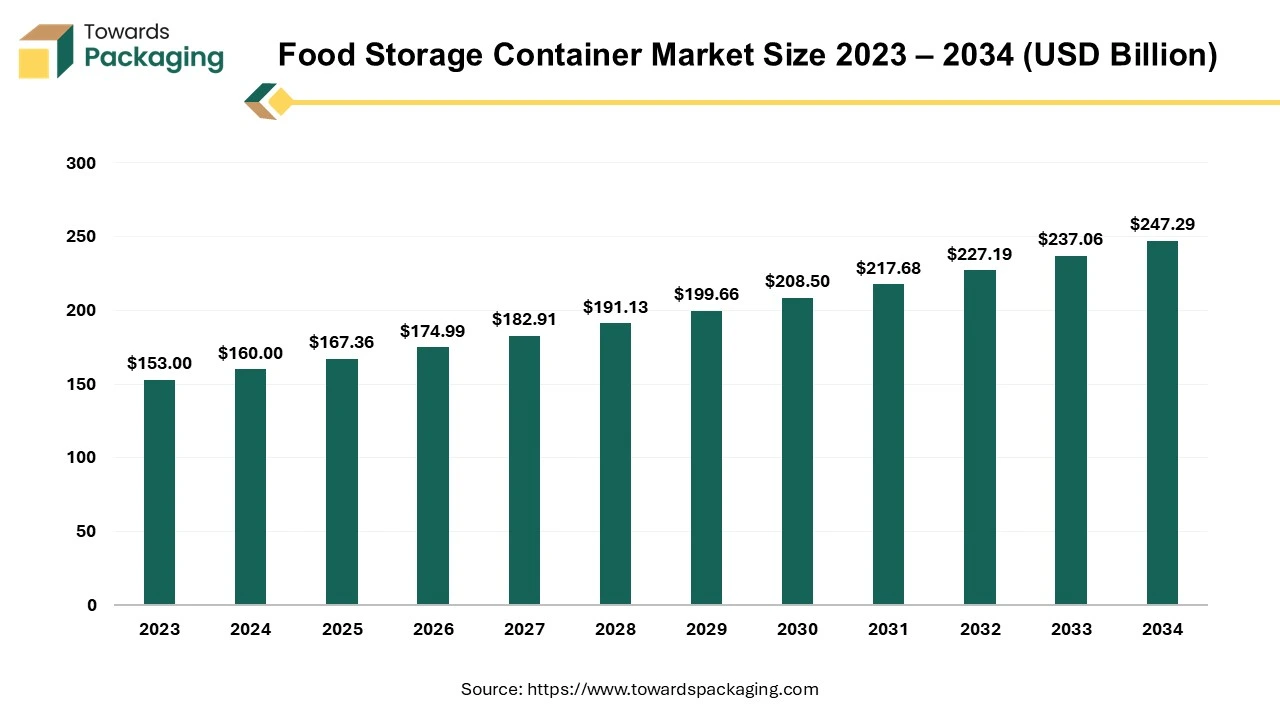

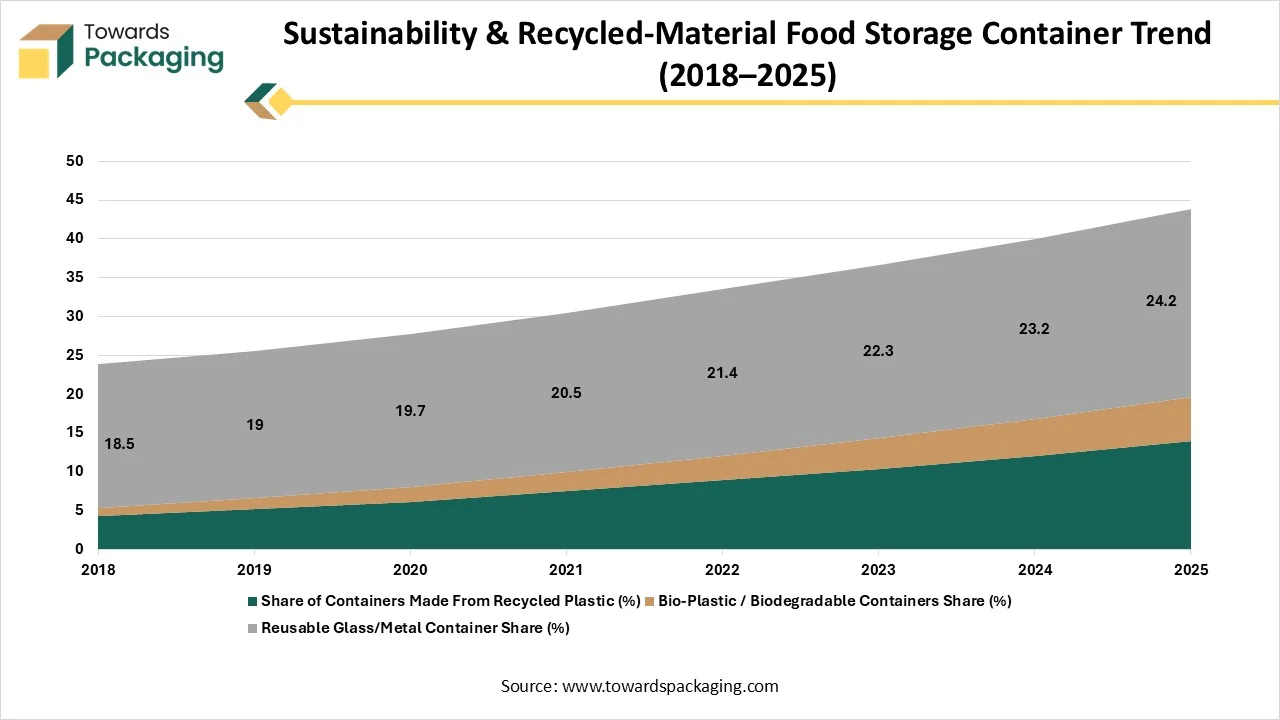

The food storage container market is forecasted to expand from USD 175.06 billion in 2026 to USD 262.40 billion by 2035, growing at a CAGR of 4.60% from 2026 to 2035. Sustainability adoption continues to accelerate, with recycled-plastic-based containers increasing from 4.3% in 2018 to 14% in 2025 and reusable glass/metal containers growing from 18.5% to 24.2%.

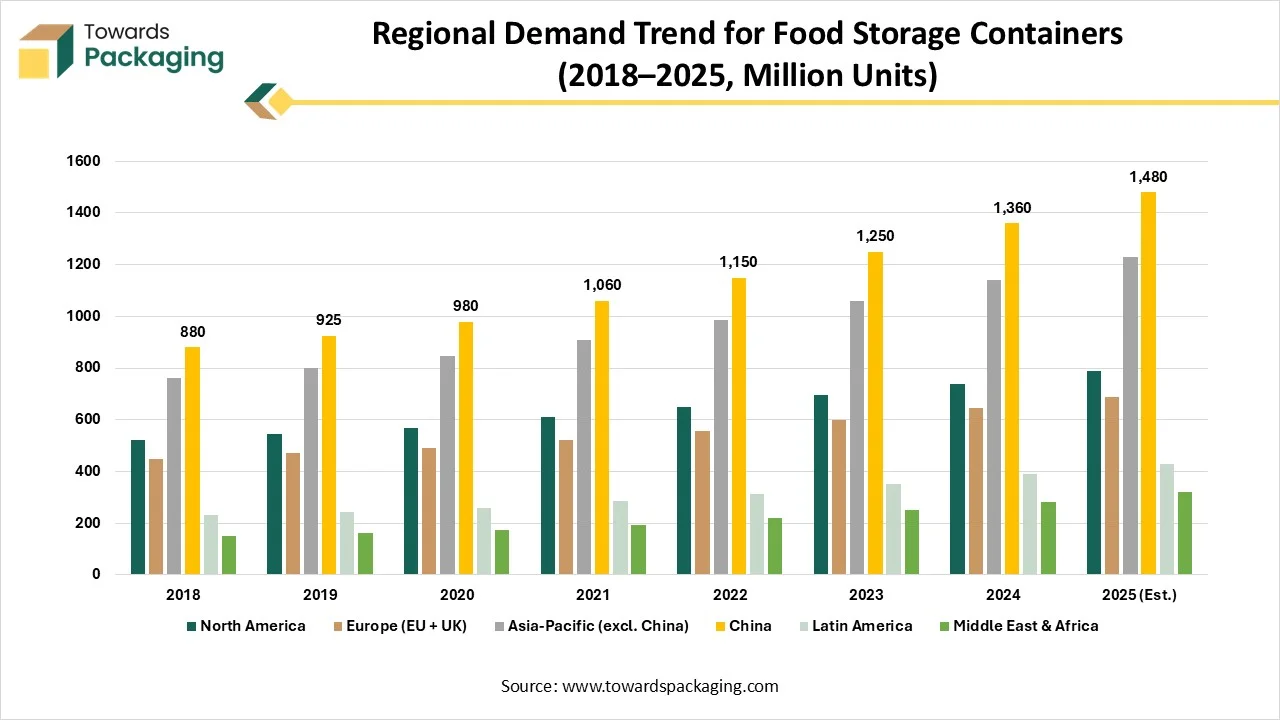

Regional consumption expanded significantly, with North America growing from 520 million units in 2018 to 790 million in 2025, and Europe from 450 to 690 million units, driven by e-commerce food deliveries and strict food safety standards. Competitive share analysis shows the top manufacturer increasing from 12.8% in 2018 to 16.8% in 2025, reflecting industry consolidation and innovation-led growth.

The food storage container market is growing significantly because of the increasing demand for packaged food supplied to various regions. These containers are mainly used for transportation purposes of packaged food products. The primary focus of the market players is to introduce storage containers that can keep food product quality intact and enhance its shelf life which helps to store products for a long time.

The growing online shopping of food products, groceries, and snacks has enhanced the demand for high-quality food storage containers. With the changing lifestyle of people and increasing party culture in corporate as well as private parties there is a huge demand and fuel the development of the market. The rate of consumption of packaged food and pre-cooked meals is growing significantly which enhances the focus on preparing packaging that can protect the nutritional quality of food products. There is a huge number of customers searching for convenience in the packaging of food products which increases the potential of this market.

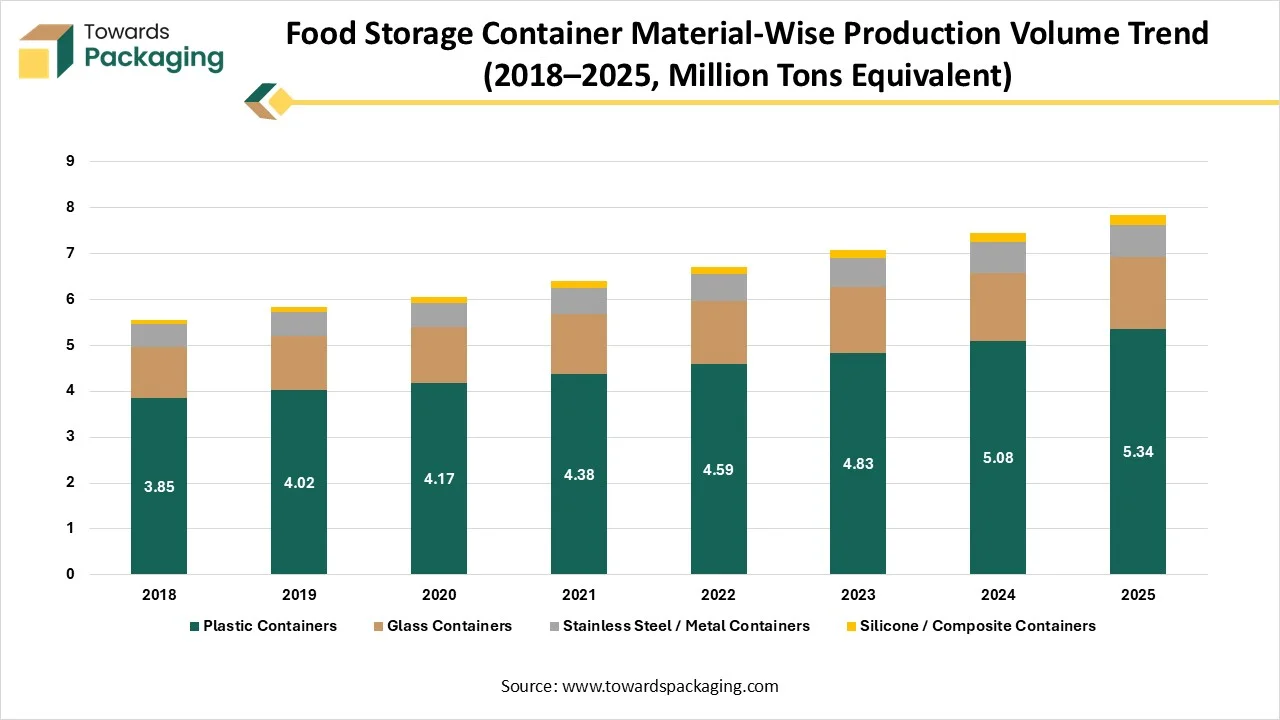

| Year | Plastic Containers | Glass Containers | Stainless Steel / Metal Containers | Silicone / Composite Containers |

| 2018 | 3.85 | 1.12 | 0.48 | 0.1 |

| 2019 | 4.02 | 1.18 | 0.51 | 0.11 |

| 2020 | 4.17 | 1.22 | 0.53 | 0.12 |

| 2021 | 4.38 | 1.3 | 0.57 | 0.14 |

| 2022 | 4.59 | 1.36 | 0.6 | 0.16 |

| 2023 | 4.83 | 1.43 | 0.63 | 0.18 |

| 2024 | 5.08 | 1.5 | 0.66 | 0.2 |

| 2025 | 5.34 | 1.57 | 0.7 | 0.22 |

| Year | Share of Containers Made From Recycled Plastic (%) | Bio-Plastic / Biodegradable Containers Share (%) | Reusable Glass/Metal Container Share (%) |

| 2018 | 4.3 | 1.1 | 18.5 |

| 2019 | 5.2 | 1.4 | 19 |

| 2020 | 6.1 | 1.9 | 19.7 |

| 2021 | 7.5 | 2.5 | 20.5 |

| 2022 | 8.9 | 3.2 | 21.4 |

| 2023 | 10.4 | 4 | 22.3 |

| 2024 | 12 | 4.8 | 23.2 |

| 2025 | 14 | 5.6 | 24.2 |

In the storage container industry, there is a huge impact on AI as it reduces the wastage of packaging products and improves sustainability in the food packaging industry. Artificial intelligence systems can predict the demand for containers in the market. These advanced technologies are useful in reducing the production cost of the containers by automatically controlling repetitive tasks and decreasing the requirement for human labour. It reduces overstocking of products by collecting information from gathered data.

With the incorporation of artificial intelligence by manufacturing companies it has become easy to predict the maintenance of the machineries which decrease the chances of irregular production as well as hampers in the quality of storage containers. It is widely known for improving hygiene and safety standards in the food packaging industry by continuous monitoring of the packaging process. Due to the presence of advanced technology food safety is maintained at every step of packaging which increases the reliability and demand of this market. AI is used in planning strategies for the growth of the market by analysing the data driven from the market.

The food storage container market is majorly driven by the convenience added to the food industry due to the storage containers. Several factors are increasing the demand of the market such as growing consumption of packaged food, changing lifestyles, growing working population, and many others. The rising demand for protecting the integrity of food products fuels the development of the industry. Food products are required to be delivered to long distances safely, and the major concern among various market players is the durability of the containers which can transport products without any damage.

Rapid shift towards urban areas has contributed significantly towards the growth of the food storage container market. Storage containers are mainly made up of silicon, glass, and plastic that cater to fulfil the demand of the consumer with durable quality and airtight seals to maintain the freshness of the food products. The growing trend for preparing meals in advance, rising interest in controlling portions and decreasing the wastage of food products has raised the demand for high-quality containers. Additionally, environment-conscious customers are inclined in the direction of sustainable, reusable, and eco-friendly substitutes.

The quality of food and its nutritional value is the primary concern among people choosing packaged food options which shift the focus of the market players towards manufacturing enhanced-quality food storage containers. These storage containers are widely used to keep food products fresh for longer periods as these are considered to be reliable storage in the food industry. The major market players are continuously introducing innovations in this market that have raised the demand for storage containers. There is a rising concern about health among customers which pushes market players to develop high-quality storage containers which should enhance the shelf life of food products.

Preserving the nutritional value of food products and effective storage choices is the major demand among consumers. Innovations in this industry such as temperature control, airtight seals, and vacuum technology have influenced the growth of this market. Moreover, several numbers of people store meals by preparing them in advance there is a huge variety of storage containers for microwave users, portion sizes, and many others which increases the potential of the market.

The food packaging industry has strict regulations which control the usage of several materials that can react with various food items. The increasing concentration on developing products that can maintain the freshness of the food products and be convenient for consumers has raised the food storage container market potential.

| Year | Company A | Company B | Company C | Company D | Company E | Others |

| 2018 | 12.8 | 9.5 | 8.7 | 7.4 | 6.1 | 55.5 |

| 2019 | 13.2 | 9.7 | 9 | 7.6 | 6.3 | 54.2 |

| 2020 | 13.5 | 10 | 9.2 | 7.8 | 6.5 | 53 |

| 2021 | 14 | 10.4 | 9.5 | 8 | 6.8 | 51.3 |

| 2022 | 14.6 | 10.9 | 9.9 | 8.3 | 7.1 | 49.2 |

| 2023 | 15.3 | 11.4 | 10.3 | 8.5 | 7.4 | 47.1 |

| 2024 | 16 | 11.9 | 10.8 | 8.8 | 7.7 | 44.8 |

| 2025 | 16.8 | 12.5 | 11.2 | 9.1 | 8 | 42.4 |

The flexible segment dominated the market in 2024 due to the single-serve and on-the-go food options. These are low-cost storage options available for consumers which have no such adverse impact on the environment which encourages the usage of such food packaging. These are light in weight which makes them suitable options for transportation of food products.

These flexible packaging such as plastic pouches, bags, and films are convenient for long-period storage of food products. The rise in online grocery and e-commerce platforms has resulted in growing demand for flexible storage containers. Features such as cost-effectiveness, sustainability, and functionality are the reasons behind the growth of this segment.

The meat processed goods storage container segment dominated the market in 2024 due to the growing demand for strong packaging solutions. With the rising demand for ready-to-cook meat products and convenience for working individuals, these types of packaging are highly influenced. The growing disposable earnings have also influenced this ready-to-cook-and-eat packaged food market.

Features such as temperature control, airtight seal, and vacuum sealing are playing a major role in the food storage and packaging industry. These containers prevent the development of microorganisms and extend the freshness of food products, household usage, and making them important for consumers. Additionally, the switch in the direction of sustainability has stimulated the growth of environment-friendly packaging resources.

The restaurant segment dominated the market in 2024 due to the growing demand for durability and efficiency. The requirement to preserve the safety and quality of food for both long-period and short-period storage influences their demand. With the growing concentration on preserving the freshness of food and decreasing food contamination. These packaging are important in food services, protecting food quality, and various others.

The importance of sustainability in the food packaging market inspires restaurants to accept environment-friendly storage resolutions, endorsing the usage of recyclable and decomposable resources. The growing usage of storage containers is mainly due to the growing demand for food products in restaurants and disposable earnings among the huge number of the population.

North America held the largest share in food storage container market in 2024. This is due to the growing demand for packaged and processed food products. The majority of people have a busy lifestyle in countries such as the U.S. and Canada which has led to the huge consumption of processed and packaged food products. The advancement in packaging technology and the robust importance of food sustainability and safety further enhance the industry. Food and beverage industries in this region increase the demand for storage containers to transport food products.

| Region / Market | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| North America | 520 | 545 | 570 | 610 | 650 | 695 | 740 | 790 |

| Europe (EU + UK) | 450 | 470 | 490 | 520 | 555 | 600 | 645 | 690 |

| Asia-Pacific (excl. China) | 760 | 800 | 845 | 910 | 985 | 1,060 | 1,140 | 1,230 |

| China | 880 | 925 | 980 | 1,060 | 1,150 | 1,250 | 1,360 | 1,480 |

| Latin America | 230 | 245 | 260 | 285 | 315 | 350 | 390 | 430 |

| Middle East & Africa | 150 | 162 | 175 | 195 | 220 | 250 | 283 | 320 |

The rising demand for ready-to-eat food products and convenience has enhanced the requirement for the food storage container market. The increasing online grocery shopping and delivery services in the U.S. have raised the need for efficient packaging. Innovation in this sector by major market players has enhanced the demand for this market. The growing ecological consciousness among companies has influenced the demand in this market.

The Europe food storage container market is steadily growing, motivated by a strong desire among consumers for eco–friendly reusable and sustainable products. Glass, stainless steel, and other recyclable materials are becoming more and more popular containers among customers. Stricter environmental regulations encourage the use of greener solutions, and manufacturers are concentrating on creative designs that blend practicality and aesthetic appeal.

Germany Food Storage Container Market Trends

Germany is growing in the food storage market, backed by environmentally conscious consumers and superior manufacturing. Reusable airtight containers are in high demand at home and in the food service industry. Customers prefer long-lasting, simple, and environmentally friendly products, which motivate businesses to provide high-end choices and cutting-edge designs. Container sales have also been boosted by the popularity of organized kitchens and meal preparation, and there is a growing need for smart storage solutions with modular features.

Asia Pacific is the fastest-growing market for food storage containers, fueled by urbanization, rising disposable incomes, and changing lifestyles. There is increasing demand for convenient, safe, and durable storage options. Growth is also supported by the boom in online retail and food delivery, as consumers seek containers that are practical for home use and on-the-go meals. The trends towards health-conscious eating and home-cooked meals are further encouraging purchases, and manufacturers are introducing multifunctional, space-saving designs to meet regional needs.

India Food Storage Container Market Trends

India is leading the market, motivated by changing lifestyles, growing interest in sustainable products, and increased health consciousness. Particularly among middle-class households, reusable. BPA-free plastic and glass containers are becoming increasingly popular. The demand for adaptable, user-friendly storage solutions is further increased by online shopping and food services. Adoption of containers is also being fueled by increased awareness of the need to reduce food waste and improve organized kitchen setups, as well as creative designs with airtight and modular features.

The food storage container market in Latin America is growing gradually. Urbanization and a growing preference for convenience are driving demand. Consumers are increasingly choosing microwave-safe, leak-proof, and stackable containers, reflecting busier lifestyles and a shift toward pre-prepared meals. Rising interest in sustainable and reusable products is also influencing purchasing decisions, and retailers are focusing on expanding product variety to meet changing consumer needs.

Brazil is leading in the food storage container market as demand is being supported by growing retail and foodservice industries, as well as growing awareness of food preservation. Households are drawn to sturdy and useful containers, and commercial use is growing in eateries and catering companies. The introduction of novel materials and designs is helping to draw in more customers, and convenience, hygiene, and functionality are important factors influencing purchases.

The Middle East & Africa market is growing steadily, though it currently represents a smaller share globally. Urbanization, higher food delivery consumption, and awareness of food safety are driving demand. There is a growing preference for airtight, heat-resistant, and premium storage solutions, with opportunities for further market expansion as infrastructure and retail networks improve. Consumers are showing more interest in multifunctional and stackable containers and rising disposable income levels are supporting the adoption of premium, durable products.

By Product Type

By Application

By End User

By Region Covered

January 2026

January 2026

January 2026

January 2026