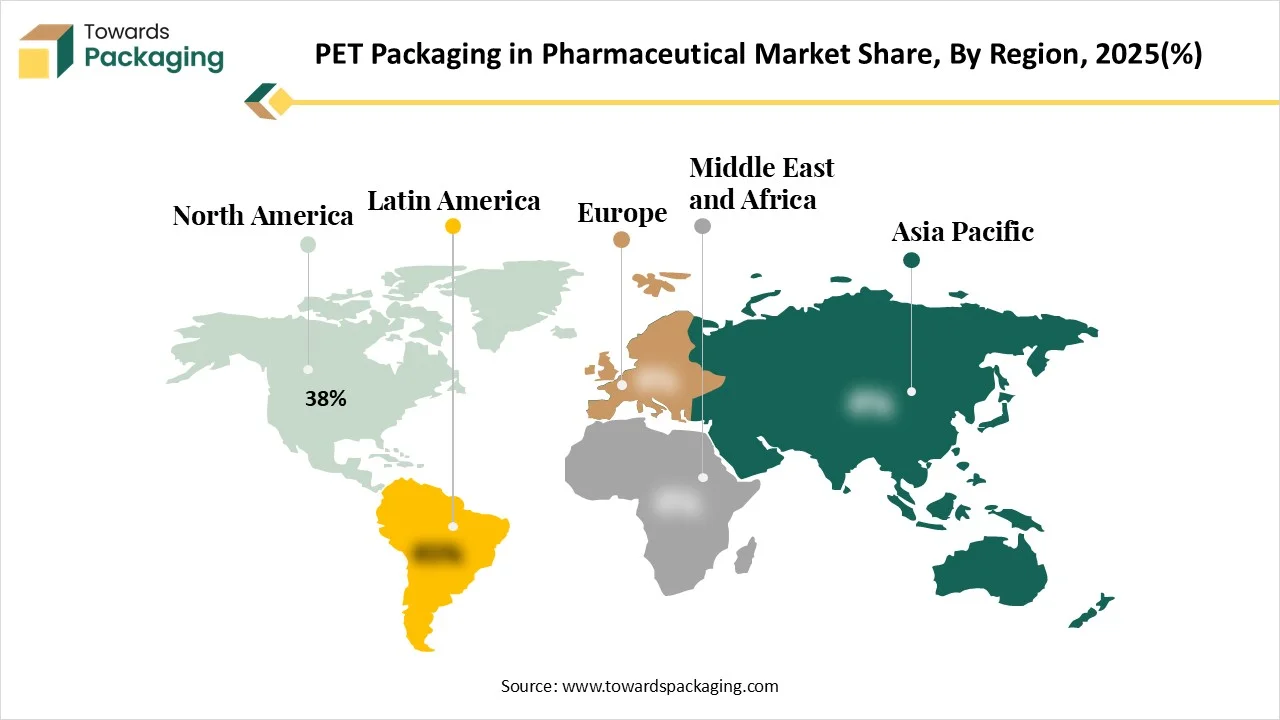

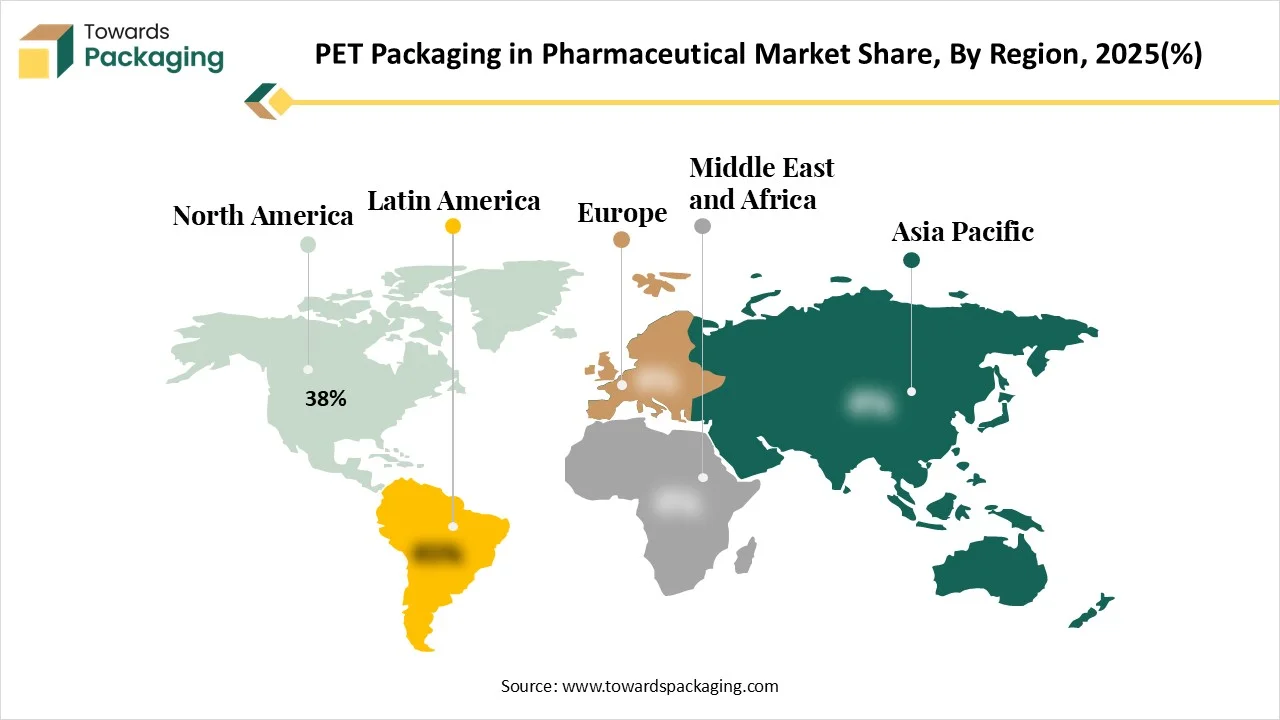

The PET packaging in pharmaceutical market presents a comprehensive analysis of global market size, growth forecasts from 2025 to 2034, major trends, detailed segmentation (by packaging type, technology, dosage form, end use, and channels), and full regional insights covering North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The report includes statistical data such as market share (North America at 38% in 2024, PET bottles at 60%, solid dosage at 55%, prescription drugs at 50%), fastest-growing segments, technology adoption trends like stretch blow molding at 40%, and emerging categories such as thermoforming and nutraceutical packaging. It also features competitive analysis of leading manufacturers Amcor, Gerresheimer, Sonoco, West Pharmaceutical Services, Bormioli Pharma and others along with value-chain mapping, trade flow insights, and supplier–manufacturer relationships shaping the PET pharmaceutical packaging ecosystem.

Polyethylene terephthalate (PET) packaging in the pharmaceutical market involves the use of PET plastic material for packaging pharmaceutical products. PET is a highly durable, transparent, and lightweight thermoplastic that offers excellent moisture and gas barrier properties, making it ideal for pharmaceutical applications. It is commonly used for packaging solid and liquid medicines such as tablets, capsules, syrups, and ophthalmic solutions. The demand for PET packaging is driven by its recyclability, cost-effectiveness, regulatory compliance, and safety in protecting drug stability and shelf life.

Pharmaceutical packaging is mainly in keeping medications effective and safe. PET Bottles are a standard choice for this purpose. They protect drugs perfectly, which makes them ideal for packaging. PET Bottles are strong, light, and cost-effective too. They also cluster out toxic substances well. These characteristics make them perfect for packing drugs efficiently and safely, too. Also, safety and compliance are important in the pharmaceutical industry. The PET Bottles should align with rigid standards. The FDA oversees PET bottle usage in packaging to make sure manufacturers follow the rules. The FDA gives importance to Current Good Manufacturing Practice for Pet drug safety. This includes aseptic areas, qualified staff, and quality checks. These steps help meet regulations.

The automation of pharmaceutical packaging serves accurate results and ensures security apart from its basic accuracy advantages. The pharmaceutical packaging sector benefits from AI-driven robotic automation of its complicated procedures through its highly precise and fast operation. Big data and AI Technologies allow pharmaceutical companies to examine large information sets, which leads to identifying useful patterns to improve their packaging inventions. Through AI expertise, the decision-making procedure becomes more cautious by identifying security threats before they materialise. Company security in pharmaceuticals benefits from machine learning by constructing adaptive package solutions that adapt to upcoming security threats.

PET has been a staple in the packaging sector globally. Hugely recognized for its durability, versatility, and recyclability, PET is used extensively in the pharmaceutical and personal care products, beverage containers, and food and beverage containers too. The bottle and container designs for PET Packaging have previously been heavier. But with the progress of manufacturing practice and consumer choices, producers are out there creatively, which makes lightweight PET Packaging without sacrificing functionality or strength. Lightweighting in PET Packaging means lowering the material's density and thickness while keeping the structural integrity of the container. Through current computer-aided design, state-of-the-art molding technologies, and high-performance materials, this procedure is achieved.

Although it's recyclable, PET Bottles contribute mainly to plastic pollution because of improper disposal and lower recycling rates in some regions. When PET Bottles are scraped inappropriately, they can result in landfills, or worse, in oceans, rivers, or other natural surroundings. These trashed bottles can take hundreds of years to decay, releasing microplastics which pose long-term environmental and health risks to wildlife and ecosystems. Handling PET waste also brings challenges. While recycling infrastructure exists in several places, it is not universally acceptable or effective. Contagion in recycling flow can reduce the quality of recycled PET (rPET), which makes it challenging to achieve a closed-loop recycling system in which bottles are constantly transformed into new bottles.

Polyethylene terephthalate (PET) in pharmaceutical packaging is braced for significant growth as the sector gives impotence to sustainability, safety, and growing patient engagement. Future developments are expected to include high-barrier PET containers with developed moisture and oxygen resistance, expanding shelf life for sensitive formulations. Shatter-resistant, lightweight PET is also likely to substitute heavier glass in several applications, lowering shipping costs and carbon footprint. With growing demand for eco-friendly solutions, recycled and bio-based PET Reasons will gain attention, allowing circular economy initiatives and compliance with rigid environmental regulations. As regulatory standards include pharmaceutical packaging formats, PET's versatility, safety profile, and recyclability will cement its role as a cornerstone material in the future generation of pharmaceutical packaging solutions.

PET Bottles have emerged as the most widely used format in pharmaceuticals PET packaging due to their combination of clarity, strength, and lightweight characteristics. Like glass, PET bottles are shatter-resistant, making them safer for transport and handling, specifically in hospitals and pharmacies. Their excellent barrier performance assists in protecting liquid formulations such as suspensions, syrups, and oral solutions from moisture and oxygen, protecting shelf life and efficacy. The bottles are also highly compatible with tamper-evident closures and child-resistant caps, solving regulatory and safety needs. Moreover, PET bottles are cost-effective to generate high volumes and can be molded into a variety of shapes and sizes, which assists brand differentiation and dosing precision.

Blister packs made from PET have become a popular choice in pharmaceutical packaging, especially for solid oral doses like tablets and capsules. PET Films serve clarity, enabling clear visibility of every dose, which enhances patient confidence and compliance. They also deliver strong barrier protection against oxygen, moisture, and contamination, protecting the stability and potency of medicines throughout their shelf life.PET blister packs are lightweight, easy to carry, and compatible with child-resistant and tamper-evident designs. Additionally, they assist with unit-dose packaging, which develops dosing accuracy and helps prevent medication errors. As sustainability becomes a higher priority, PET's recyclability compared to PVC is also driving more pharmaceutical manufacturers to shift toward PET-based blister solutions to meet environmental and regulatory goals.

Solid dosage forms -such as tablets, capsules, and caplets-have dominated PET packaging in the pharmaceutical sector due to their stability and compatibility with PET containers. PET Bottles and blister packs serve as excellent moisture and oxygen barriers, which are complicated for protecting solid drugs from degradation and tracking their potency over time. The Lightweight nature of PET reduces transportation costs and breakage risks as compared to glass, while the transparency of PET assists with easy visual identification and inventory control. Furthermore, PET packaging is cost-effective to produce at scale and is more easily recyclable than many traditional plastics, making it an attention-grabbing option for pharmaceutical companies focused on sustainability and compliance.

Ophthalmic and nasal solutions heavily depend on PET Packaging and its potential to track its clarity, chemical resistance, and its ability to track product sterility.PET bottles and containers protect sensitive formulations from light and moisture, assisting formulations from light and moisture, helping preserve the effectiveness of delicate solutions like eye drops and nasal sprays. These bottles are frequently paired with specialized closures and dispensing systems, such as a dropper, to minimize contamination risk. PET's lightweight and shatter-resistant properties improve patient safety and convenience during usage and transportation. Additionally, PET containers can be sterilized and comply with strict regulatory standards for pharmaceuticals, making them a perfect and cost-efficient choice for packaging ophthalmic and nasal products.

Stretch blow molding has specifically dominated PET packaging in the pharmaceutical industry because of its potential to generate durable, lightweight, and accurately shaped containers with excellent clarity and barrier characteristics. This production procedure allows PET Bottles to be molded with correct tolerances, making them perfect for pharmaceutical products that demand constant dosing and reliable sealing. Stretch blow molding develops the mechanical strength and impact resistance of PET containers, making sure they can withstand transport and handling without compromising product integrity. Additionally, the procedure assists high production speeds and cost-effectiveness, which is important for large-scale pharmaceutical packaging. Its reliability with sterile and tamper-evident closures further powers its suitability for liquid medications, ophthalmic solutions, and syrups. As pharmaceutical companies give importance to safety, regulatory compliance, and quality, stretch blow molding continues to lead as a selected technology in PET pharmaceutical packaging.

Thermoforming has also carved out a strong position in PET packaging for the pharmaceutical sector due to its versatility and cost-effectiveness. In this procedure, PET sheets are heated and formed into accurate shapes using molds, creating blister packs, trays, and clamshells ideal for protecting solid doses like tablets and capsules. Thermoformed PET packaging serves excellent barrier characteristics against moisture and oxygen, which assist in preserving the stability and shelf life of sensitive medications. It also allows clear, transparent packaging, which assists easy visual checking and compliance. Its scalability and suitability for high-volume production make thermoforming a dominant and perfect choice for pharmaceutical PET packaging.

Due to their need for packaging that balances product protection, compliance, and convenience, prescription medications have significantly dominated the usage of PET packaging in the pharmaceutical industry. Prescription drugs, such as pills, capsules, syrups, and liquid suspensions, are frequently packaged in PET bottles and containers. PET's superior moisture and oxygen barrier qualities, which support the stability and potency of active medicinal ingredients over extended shelf lifetimes, are primarily to blame for this. Additionally, PET packaging provides child-resistant caps, tamper-evident closures, and visible labeling all essential for prescription medications that have to meet strict safety regulations and regulatory standards.

Nutraceuticals and supplements have emerged as the fastest-growing segment for PET packaging in the pharmaceutical industry, thanks to rising consumer interest in health, wellness, and preventive care. These products including vitamins, dietary supplements, herbal formulations, and sports nutrition often come in tablet, capsule, gummy, or powder form, which are ideally suited to PET bottles and jars. PET packaging offers excellent protection against moisture, light, and oxygen, which is critical for preserving the efficacy and shelf life of sensitive nutraceutical ingredients. PET containers also provide clarity that allows consumers to see the product inside, building trust and reinforcing perceptions of quality. Brands favor PET because it supports lightweight, shatter-resistant packaging that reduces transportation costs and improves convenience for online and retail distribution.

Pharmaceutical manufacturers have dominated the distribution channel for PET packaging in the pharmaceutical sector primarily because they control most of the end-to-end packaging operations, from filling to labeling and sealing. By integrating PET packaging production and procurement directly into their manufacturing processes, they ensure tighter quality control, regulatory compliance, and supply chain efficiency. Many pharmaceutical companies prefer to manage PET packaging in-house or through closely partnered suppliers to maintain consistent standards, especially when dealing with prescription drugs, over-the-counter medications, and sensitive formulations like liquid suspensions or nutraceuticals. This approach allows them to implement tamper-evident features, serialization, and customized designs that reinforce brand identity and meet stringent safety requirements.

Contract packaging organizations (CPOs) are becoming more and more important in the pharmaceutical industry's PET packaging market. Under stringent regulatory compliance, these specialized service providers assist pharmaceutical companies with a range of packaging tasks, including filling, sealing, labeling, serialization, and acquiring PET bottles, jars, and containers. Mid-sized and up-and-coming pharmaceutical enterprises that lack the internal resources or financial commitment to establish specialized PET packaging facilities are particularly drawn to CPOs. Businesses can increase or decrease production, speed up time to market, and concentrate resources on marketing, research, and development instead of capital-intensive packaging activities by outsourcing to CPOs.

For a number of reasons, North America has become the leading region in PET packaging for the pharmaceutical industry. The area benefits from a sizable, well-established pharmaceutical sector that has a high need for PET containers that are lightweight, safe, and resistant to breaking. Strict regulatory requirements from organizations such as the FDA encourage the broad use of compliant, high-quality packaging solutions. Furthermore, effective production at scale is supported by North America's sophisticated manufacturing infrastructure, which includes the extensive usage of technologies like stretch blow molding and complex labeling systems. PET packaging's market position in the US and Canada has been further reinforced by growing trends in prescription medications, over-the-counter medications, and nutraceuticals, as well as increased sustainability initiatives to replace glass and heavier plastics.

PET packaging for the pharmaceutical industry is growing quickly in the Asia Pacific region due to factors like growing healthcare infrastructure, population expansion, and rising demand for reasonably priced, high-quality medications. PET bottles, jars, and blister packs are becoming more and more popular as a result of robust pharmaceutical manufacturing and exporting activities in nations like China, India, Japan, and South Korea. Because PET is lightweight, affordable, and tamper-evident—properties that meet patient safety standards and regulatory requirements—local producers are increasingly using it. Furthermore, the trend toward self-medication, the rise of online pharmacy channels, and investments in cutting-edge packaging technologies, such as stretch blow molding.

By Packaging Type

By Drug Form

By Technology

By End-Use

By Distribution Channel

By Region

March 2026

March 2026

February 2026

February 2026