Contract Packaging and Fulfilment Services Market Report: Size, Trends, Segments, Regional Data, Manufacturers & Trade Analysis

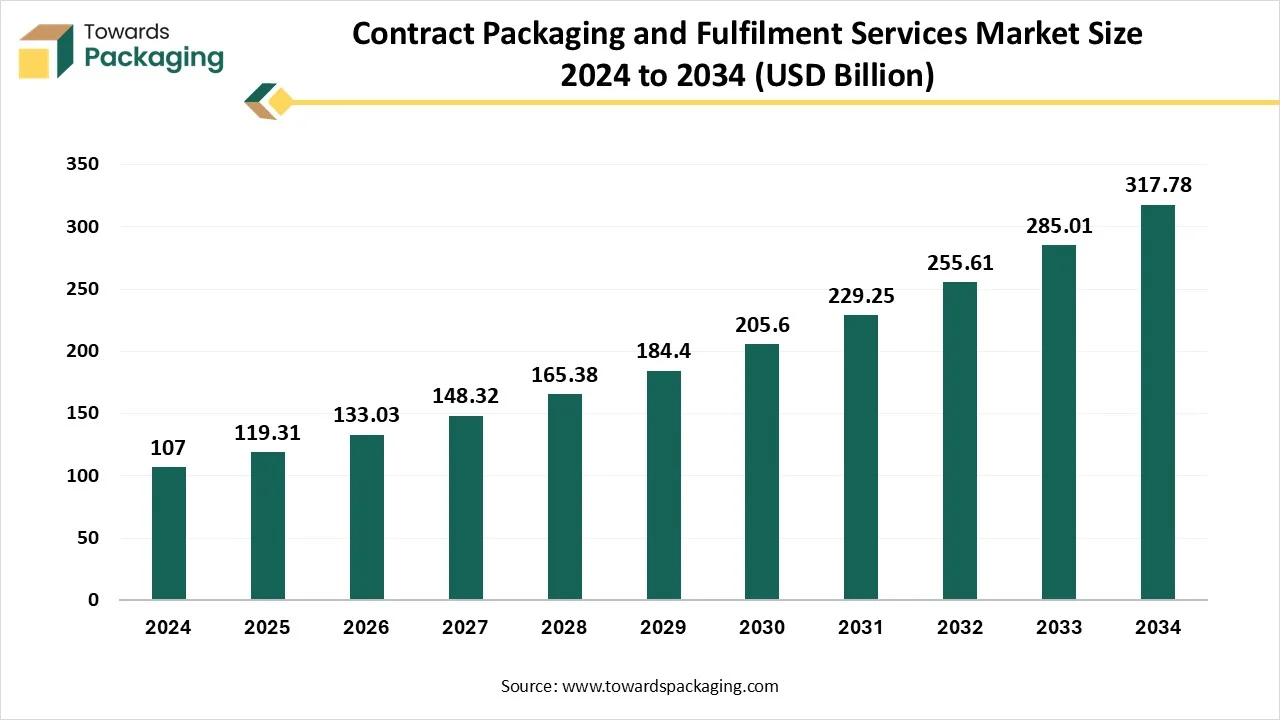

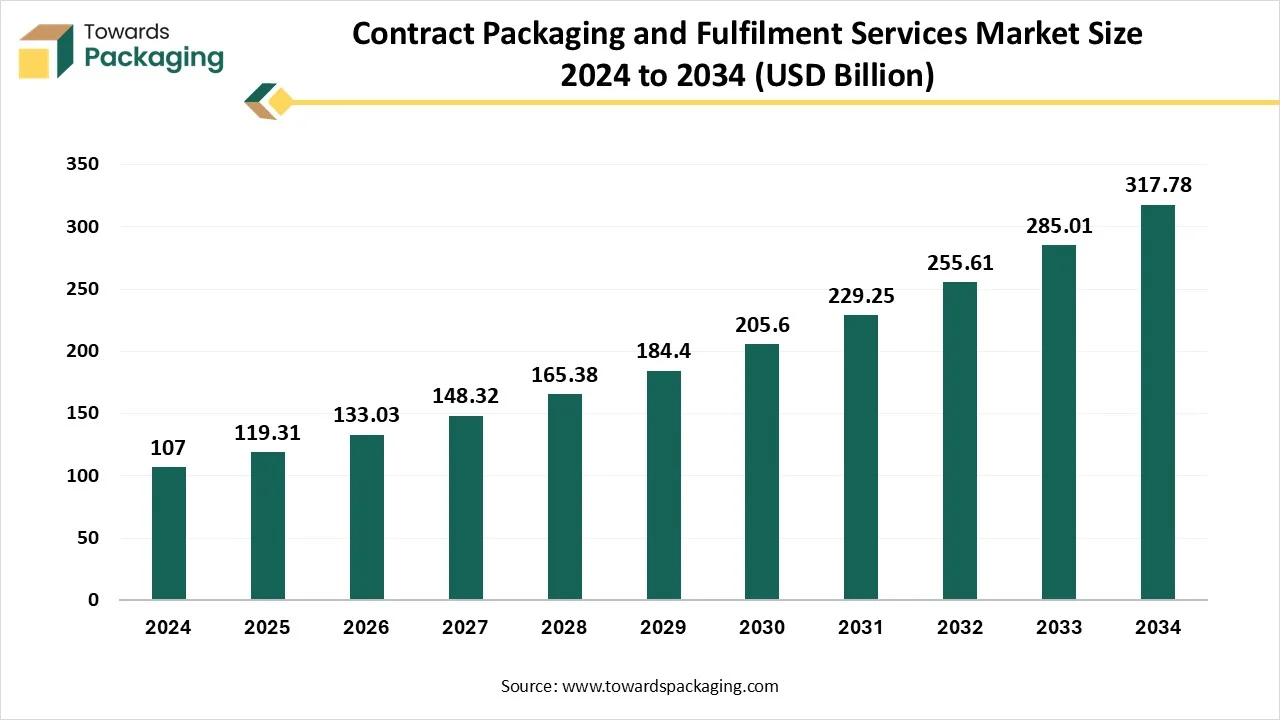

The contract packaging and fulfilment services market is forecasted to expand from USD 133.03 billion in 2026 to USD 354.33 billion by 2035, growing at a CAGR of 11.5% from 2026 to 2035. The report provides detailed insights into service types (contract packaging, fulfilment services), packaging materials (plastic 44%, biodegradable/compostable materials), business models (B2B fulfilment 40%, D2C), channel types (e-commerce, omnichannel), and end-use industries (food & beverage 35%, pharmaceuticals, personal care, electronics).

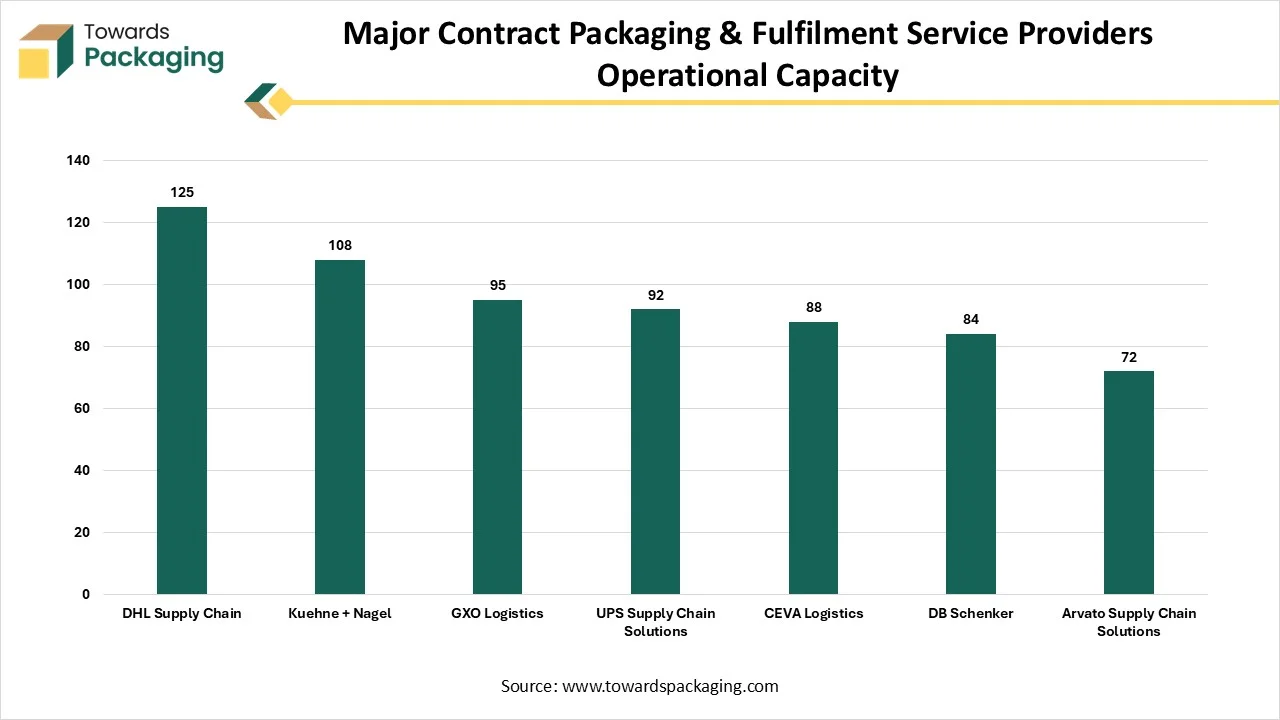

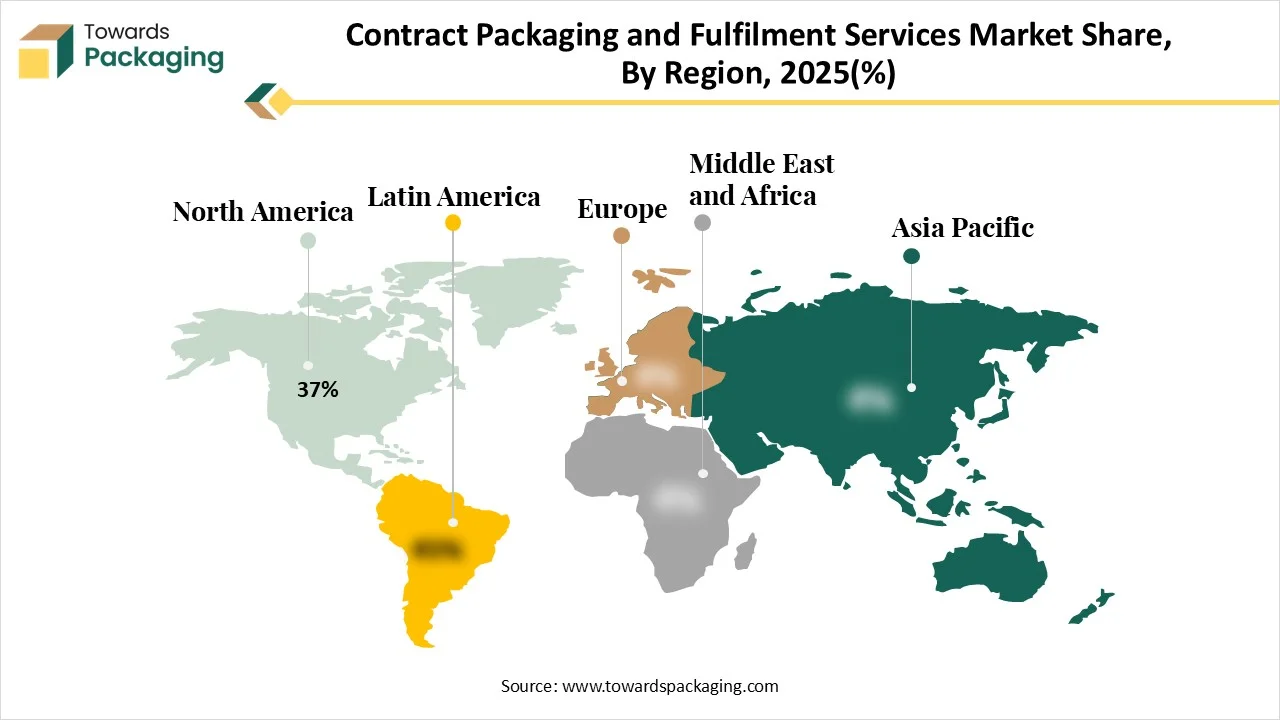

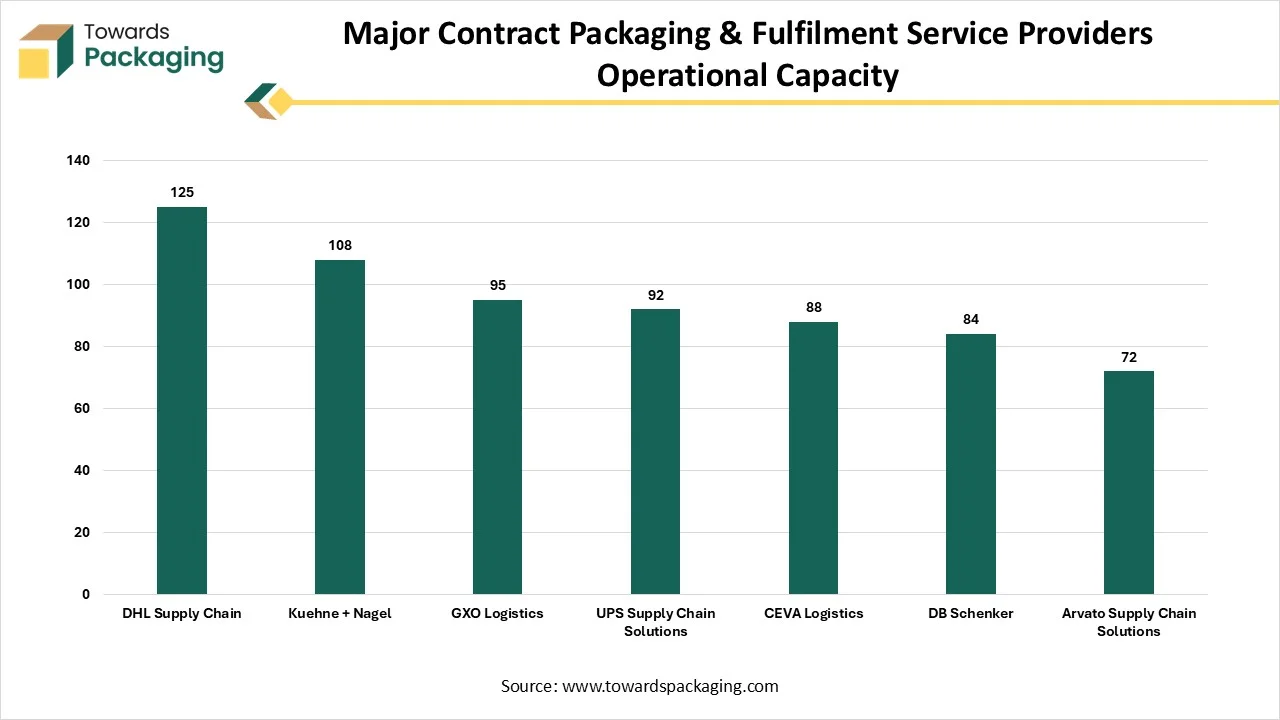

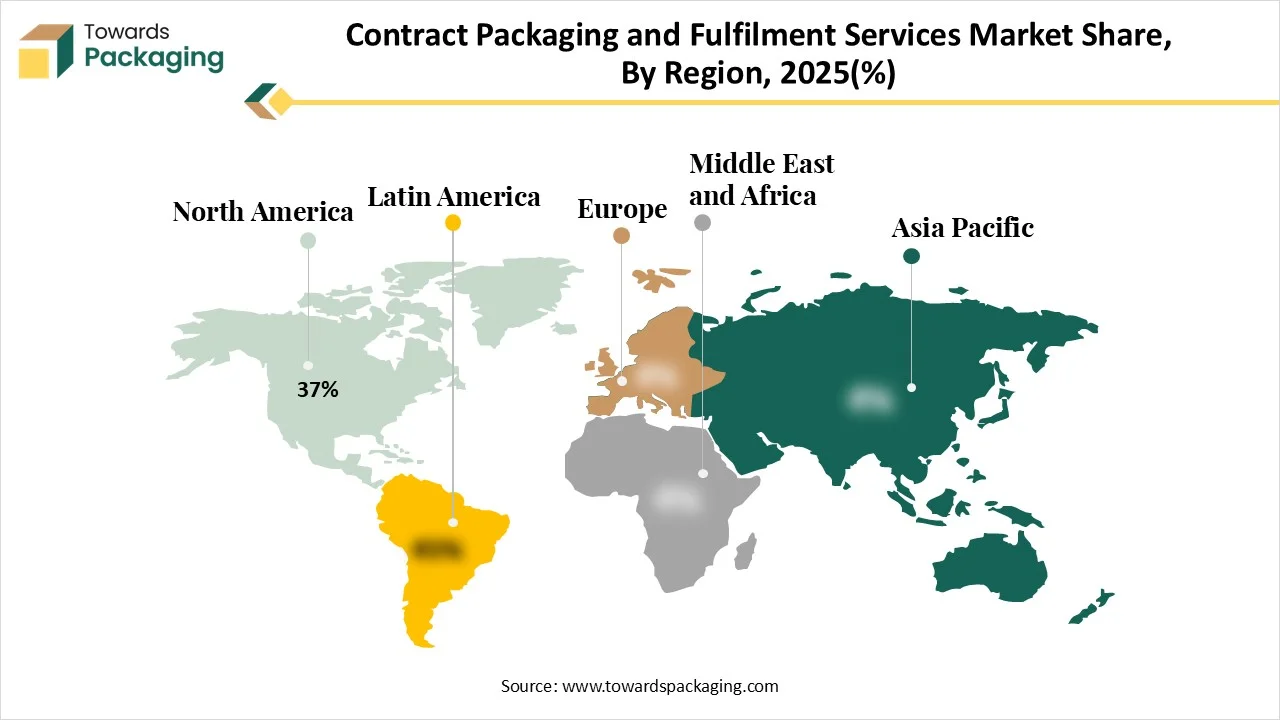

Regional coverage includes North America 37% share, Europe, Asia Pacific fastest-growing, Latin America, and MEA, along with competitive analysis of DHL Supply Chain, Kuehne + Nagel, GXO Logistics, UPS Supply Chain, CEVA Logistics, DB Schenker, Arvato, value chain mapping from primary to tertiary packaging, trade insights, and manufacturer capacities, e.g., DHL 125B units, Kuehne + Nagel 108B units annually.

Key Insights

- In terms of revenue, the market is valued at USD 119.31 billion in 2025.

- The market is projected to reach USD 354.33 billion by 2035.

- Rapid growth at a CAGR of 11.5% will be observed in the period between 2025 and 2034.

- North America held the largest share of 37% in the contract packaging and fulfilment services market in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By service type, the contract packaging segment accounted for the dominant share in 2024.

- By service type, the fulfilment services segment is expected to witness a significant share during the forecast period.

- By packaging material, the plastic segment held a dominant presence in the market in 2024, with 44%

- By packaging material, the biodegradable/compostable materials segment accounted for considerable growth in the global contract packaging and fulfillment services market over the forecast period.

- By business model, the B2B fulfilment segment registered its dominance with 40% over the global contract packaging and fulfilment services market in 2024.

- By business model, the D2C fulfilment segment is expected to grow significantly during the forecast period.

- By company size, the large enterprises segment contributed the biggest market share of 55% in 2024.

- By company size, the small and medium enterprises (SMEs) segment is expanding at a significant CAGR during the forecast period.

- By end-use industry, the food and beverage segment held the major market share of 35% in 2024.

- By end-use industry, the personal care and cosmetics segment is projected to grow at a CAGR of between 2025 and 2034.

- By channel type, the e-commerce segment accounted for the highest contract packaging and fulfilment services market share.

- By channel type, the omnichannel segment is expected to witness remarkable growth during the forecast period.

Market Overview

Contract packaging and fulfilment services refer to third-party services where companies outsource the packaging and/or order fulfillment processes of their products. These services include primary and secondary packaging, kitting, assembly, warehousing, labeling, distribution, and shipping. The industry serves various sectors such as food and beverage, pharmaceuticals, personal care, and electronics, offering scalability, cost-efficiency, and time-to-market advantages.

Global Operational Output in Contract Packaging and Fulfilment Services

| Indicator | Statistical Value |

| Global packaged consumer & healthcare units handled annually | 2.35 trillion units |

| Units processed through third-party contract packers | 34 to 37% |

| Contract-packaged units per year | 820 to 870 billion units |

| Orders processed by contract fulfilment providers | 185 to 210 billion shipments |

| Core service types | Packaging, labeling, kitting, warehousing, distribution |

What are the Latest Trends in the Contract Packaging and Fulfilment Services Market?

- The surge in online retail platforms creates demand for efficient packaging and fulfilment solutions, driving the market’s growth during the forecast period.

- The rising business need for supply chain optimization to reduce time and improve speed to market by leveraging third-party contract packaging services is expected to accelerate the market’s revenue during the forecast period.

- The evolving consumer preferences and increasing regulatory focus for sustainable packaging across various industries are likely to boost demand for recyclable, biodegradable, and compostable materials, which further support the market’s growth in the coming years.

- The growing trend of outsourcing among businesses across various industries is anticipated to promote the growth of the contract packaging and fulfilment services market.

- The rising shift in preference of manufacturing firms toward contract packagers, as they are strongly focusing on cost optimization to enhance their core competency, is expected to contribute to the overall growth of the contract packaging and fulfillment services market.

- The economic growth of the developing economies is expected to boost the growth of the contract packaging and fulfilment services market during the forecast period.

How Can Artificial Intelligence Improve the Contract Packaging and Fulfilment Services Market?

In today's rapidly evolving technological landscape, Artificial intelligence in contract packaging and fulfillment services holds great potential to transform the market by cost savings, optimizing the supply chain, enhancing logistics efficiency, complying with regulatory standards, improving customer satisfaction, and introducing innovative solutions across various operational areas. AI algorithms and Machine learning enable packaging companies and their manufacturing partners to efficiently automate complex and repetitive processes. Harnessing the power of AI in contract packaging and fulfilment services makes the operations faster, smarter, efficient, and adaptable. AI can significantly optimize production schedules to inventory management, minimize wastages, optimize processes, and improve efficiency.

Regional Distribution of Contract Packaging & Fulfilment Operations

| Region | Annual Units Processed (Billion Units) | Share (%) |

| North America | 305 | 35 |

| Europe | 270 | 31 |

| Asia-Pacific | 225 | 26 |

| Latin America | 45 | 5 |

| Middle East & Africa | 25 | 3 |

Market Dynamics

Driver

Rising Preference ofBusinesses Toward Contract Packaging and Fulfillment Services

The increasing preference of businesses toward contract packaging and fulfilment services is expected to boost the growth of the market during the forecast period. In recent years, the market has witnessed a rapid shift in the preference of business firms toward contract packaging and fulfilment services, to focus on their core competency, reduce costs, and improve efficiency. Several businesses across various industries are increasingly preferring to outsource their packaging operations to avoid high capital investments in infrastructure and specialized equipment. Contract packaging and fulfilment services providers offer expertise in different packaging types and technologies, enabling organizations to meet diverse needs.

Restraint

Stringent Regulatory Standards

The strict regulatory requirements are anticipated to hamper the market's growth. Several industries, particularly food and beverage and pharmaceuticals, often face stringent regulations regarding packaging and compliance, which can lead to increased operational costs for contract packagers. In addition, the rising competition from in-house packaging is likely to limit the expansion of the global contract packaging and fulfilment services market. Businesses often prefer to handle packaging internally to maintain good control and potentially reduce costs.

Opportunity

How is the Rising Expansion of the Food and Beverages and Pharmaceutical Industry Impacting the Market’s Growth?

The rising expansion of the food and beverages and pharmaceutical industry is projected to offer lucrative growth opportunities to the contract packaging and fulfilment services market during the forecast period. Food and beverages and the pharmaceutical industry increasingly prefer contract packaging and fulfilment services to prevent supply chain disruption and reduce the time to market by outsourcing the packaging activities. The food and beverage industry relies on these services to meet fluctuating demands, effectively handle promotional packaging, and manage the consumer demand for seasonal products.

Contract packaging and fulfilment services assist pharmaceutical firms in complying with the stringent regulatory requirements of authorized government bodies, including anti-counterfeiting measures and serialization. Therefore, the food and beverage and pharmaceutical industry can significantly enhance their operational efficiencies by leveraging third-party contract packaging and fulfilment services.

Industry-Wise Consumption of Contract Packaging Services

| End-Use Industry | Annual Units Outsourced (Billion Units) |

| Food & beverage | 285 |

| Pharmaceuticals | 215 |

| Consumer goods & personal care | 175 |

| Medical devices | 85 |

| Nutraceuticals | 65 |

| Industrial & others | 45 |

Segment Insights

What Causes the Contract Packaging Segment to Dominate the Market?

The contract packaging held a dominant presence in the contract packaging and fulfilment services market in 2024. Contract packaging involves the outsourcing of packaging services to specialized third-party providers, allowing businesses of various sectors, including food and beverage, pharmaceuticals, cosmetics, electronics, and others, to focus on their core competencies while leveraging the specialized expertise, equipment, and resources of these providers. In addition, the rapid innovation and automation in packaging technologies assist contract packagers in handling fluctuating volumes, reducing cost, and improving efficiency.

On the other hand, the fulfilment services segment is expected to grow at a notable rate. The segment fastest growth is mainly driven by the owing to the increasing trend of outsourcing among various businesses. Fulfilment services include order processing, warehousing, packaging, shipping, and other services for businesses, especially e-commerce companies. These services allow businesses to focus on core competencies or aspects of their operations.

The large enterprises segment registered its dominance in the market. Large enterprises increasingly prefer contract packaging and fulfilment services as a cost-effective way to access specialized packaging and fulfilment capabilities, meet the sustainability trends, and strongly focus on core competencies like new product development and marketing, which further assists them to compete in the market.

On the other hand, the small and medium enterprises (SMEs) segment is expected to grow at the fastest CAGR. Contract packaging and fulfilment services provide small and medium enterprises (SMEs) with access to sophisticated packaging and fulfilment capabilities, which they often lack due to high machinery cost or resource limitations. These services assist them in concentrating on core competencies and meeting diverse packaging requirements, including customized solutions for smaller production volumes.

E-Commerce dominated the Contract Packaging and Fulfilment Services Market in 2024

The e-commerce segment is expected to dominate the market with the largest share in 2024, owing to the rising expansion of online retail and increasing demand for specialized packaging across various industries. In the direct-to-consumer deliveries, the specialized packaging solutions play a crucial role in ensuring product safety and appeal. E-commerce businesses are increasingly preferring these services to significantly improve delivery times, manage fluctuating order volumes, and boost customer experience. These factors are supporting the segment’s growth during the forecast period.

On the other hand, the omnichannel segment is expected to witness remarkable growth. Omni channel’s business strategy focused on offering a seamless and consistent customer experience in both online and offline channels. The segment’s growth is driven by the rapid expansion of online and organized retail, which significantly increases the need for innovative, sustainable, and customized packaging solutions.

Which Segment is Dominating the Market by Business Model?

The B2B fulfilment segment registered its dominance over the global contract packaging and fulfilment services market in 2024. B2B fulfillment increasingly focuses on handling bulk orders between businesses, which often include order processing, packaging, labeling, inventory management, shipping, warehousing, and other services. B2B fulfillment is widely adopted by prominent businesses to ensure the timely delivery of goods to other businesses, to maintain smooth operations.

On the other hand, the D2C fulfilment is expected to grow significantly in the coming years, owing to the rapid expansion of the e-commerce platforms in developing and developed nations, along with increasing consumer demand for eco-friendly packaging. Companies are increasingly preferring D2C fulfillment to gain control over their customer experience, optimize their supply chains, and improve profitability margins.

How Plastic Segment Dominated the Market in 2024?

The plastic segment accounted for the dominating share in 2024. The growth of the segment is mainly driven by various benefits offered by the plastic materials, including durability, versatility, lightweight, and cost-effectiveness. Plastic packaging materials can be easily moulded into various shapes and sizes which making them an attractive option for various diverse industries to meet product needs.

On the other hand, the biodegradable/compostable materials segment is expected to witness a significant share during the forecast period, owing to the rising environmental awareness and regulatory pressure. Consumers are increasingly preferring biodegradable/compostable packaging solutions to reduce their carbon footprint in the environment.

How Food and Beverages Segment Dominated the Market in 2024?

The food and beverages segment held the majority of the market share in 2024. Outsourcing allows food and beverage companies to reduce overhead costs associated with labor, equipment, and infrastructure, and concentrate on their core competencies, like product development and marketing. Contract packagers in the food and beverage industry offer various services such as shrink wrapping, pouch filling, and other specialized packaging solutions for different food categories.

On the other hand, the personal care and cosmetics segment is projected to grow at a CAGR of between 2025 and 2034, owing to the rapid expansion of e-commerce and increasing emphasis on sustainable packaging practices. The personal care and cosmetics industry outsources various services such as serialization, sterilization, and adheres to compliance for meeting stringent industry regulations.

Major Contract Packaging & Fulfilment Service Providers Operational Capacity

| Company | Headquarters | Annual Unit Handling Capacity (Billion Units) |

| DHL Supply Chain | Germany | 125 |

| Kuehne + Nagel | Switzerland | 108 |

| GXO Logistics | United States | 95 |

| UPS Supply Chain Solutions | United States | 92 |

| CEVA Logistics | France | 88 |

| DB Schenker | Germany | 84 |

| Arvato Supply Chain Solutions | Germany | 72 |

Regional Insights

North America

North America held the dominant share of the contract packaging and fulfilment services market in 2024. North America, especially the U.S., has a presence of well-established food and beverage, pharmaceuticals, electronics, and cosmetics industries, which spurs the demand for contract packaging and fulfillment services solutions. Companies are increasingly outsourcing packaging and fulfilment services to specialized providers to improve efficiency, reduce costs, and focus on core business activities like product development and marketing. Business can significantly optimize their supply chains and enhance operational efficiencies by leveraging third-party services.

Factors such as the presence of a favourable regulatory environment, increasing demand for sustainable and customized packaging across various industries, the rising entry of key warehousing vendors in the field of contract packaging, growing demand for specialized packaging solutions, and increasing focus of businesses seeking to gain a competitive edge by outsourcing non-core operations. Moreover, the rapid growth of the e-commerce sector and the great focus on sustainability to align with the circular economy principle are expected to accelerate the revenue of the contract packaging and fulfilment services market in the coming years.

Asia Pacific

Asia Pacific growth is driven by the rapid expansion of the food and beverages industry, a rising shift towards digitization and technological advancement, rapid industrialization, increasing demand for specialized packaging solutions, increasing business need to optimize supply chain management, and growing focus on improving consumer engagement experiences. The strong presence of small and medium enterprises (SMEs), which have increasingly adopted contract packaging and fulfillment services to optimize their operations and compete with larger businesses in the market.

The expansion of the e-commerce sector, particularly in developing economies, and the increasing penetration of smartphones are anticipated to drive the market’s expansion during the forecast period. Several food and beverage, pharmaceuticals, and cosmetics companies operating in the region are employing contract packaging and fulfillment services solutions to focus on core competencies, optimize supply chain, enhance sustainability, reduce cost, combat counterfeiting, and improve speed to market.

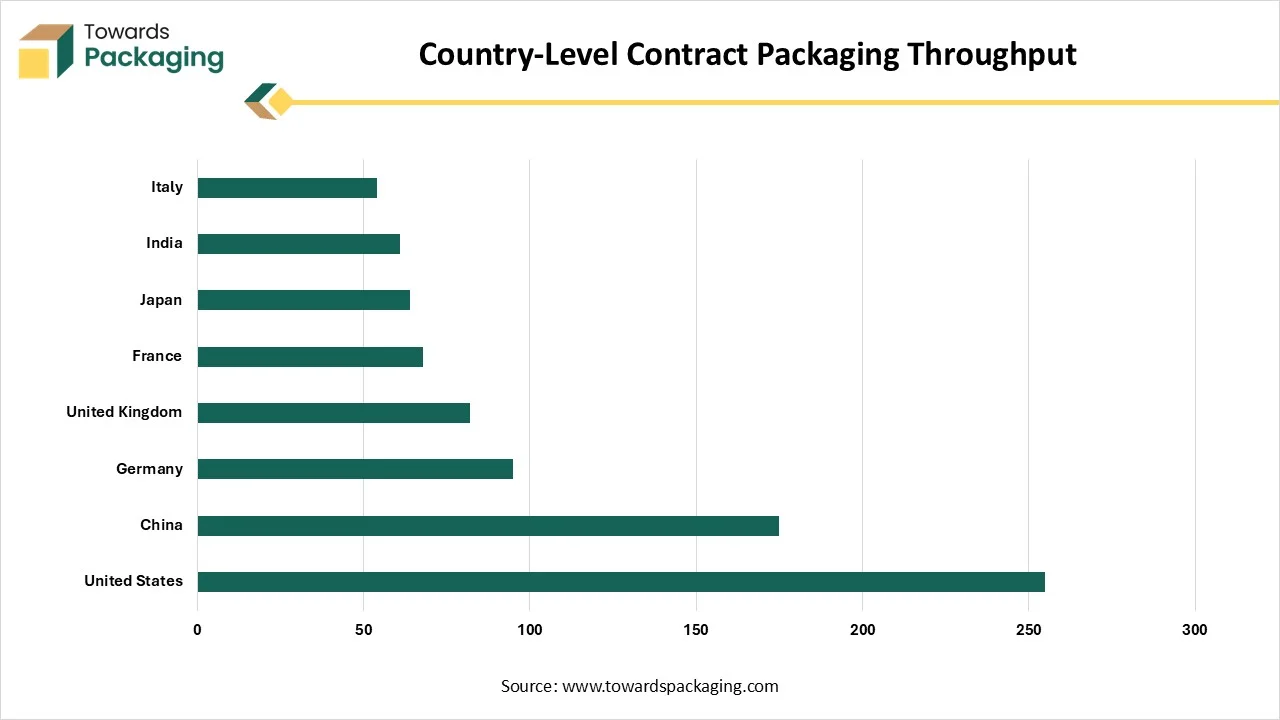

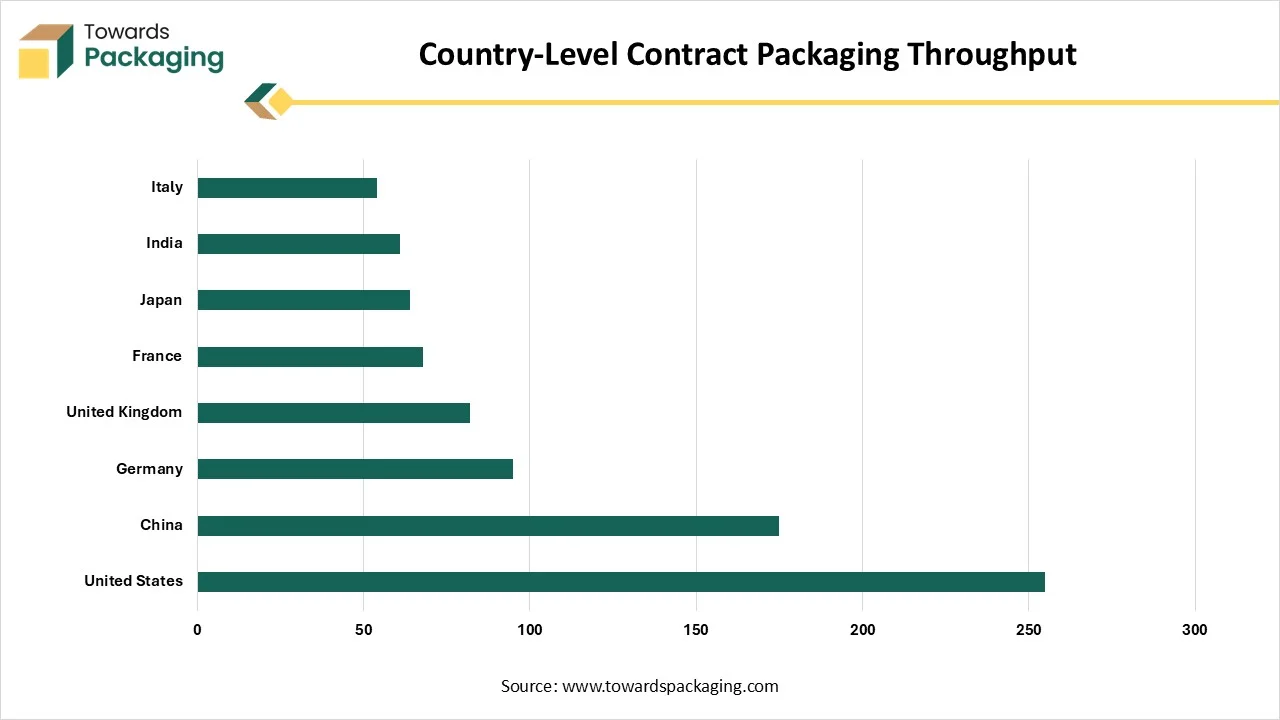

Country-Level Contract Packaging Throughput

| Country | Annual Units Processed (Billion Units) |

| United States | 255 |

| China | 175 |

| Germany | 95 |

| United Kingdom | 82 |

| France | 68 |

| Japan | 64 |

| India | 61 |

| Italy | 54 |

Contract Packaging and Fulfilment Services Market Key Players

- Sonoco Products Company

- Sonic Packaging Industries Inc.

- Deufol SE

- Unicep Packaging LLC

- Multipack Solutions LLC

- Stamar Packaging

- Assemblies Unlimited Inc.

- Green Packaging Asia

- Aaron Thomas Company Inc.

- Sharp Packaging Services

- Tjoapack Netherlands B.V.

- Jones Healthcare Group

- DHL Supply Chain (Fulfillment)

- Ryder System Inc.

- ShipBob Inc.

- FulfillmentCompanies.net

- Amcor plc (Contract Packaging arm)

- Catalent Pharma Solutions

- WePack Ltd.

- Merrill Corporation Shape, Picture

Latest Announcement by the Industry Leader

- In July 2025, Kenco, a leading third-party logistics (3PL) provider, announced the launch of their Contract Packaging Division, a strategic investment covering secondary packaging. This expansion of the company’s contract packaging offering will further simplify customers’ operations and strengthen Kenco’s position as a one-stop shop for supply chain management. (Source: Packaging Strategies)

Recent Developments

- In May 2025, Tjoapack, a global contract packaging organisation, launched its Customer Collaboration Dashboard, an innovative digital platform designed to streamline collaboration between Tjoapack and its clients. The new tool enhances efficiency and transparency in artwork management, file exchange, workflow creation, and order management, reinforcing Tjoapack’s commitment to providing seamless, customer-centric solutions. (Source: Pharmaceutical Manufacturer)

- In March 2025, FSK L&S, SK Square’s logistics subsidiary, it has secured a deal to operate fulfillment centers for three battery plants of BlueOvalSK, a joint venture between SK On and Ford Motor Company, in the US. The service involves packaging and delivering pre-stocked battery inventory. (Source: THE INVESTOR)

Contract Packaging and Fulfilment Services Market Segmentations

- By Service Type

- Contract Packaging

- Primary Packaging

- Blister Packaging

- Bottle Filling

- Sachet Packaging

- Strip Packaging

- Vial/Ampoule Packaging

- Pouch Packaging

- Secondary Packaging

- Cartoning

- Shrink Wrapping

- Labeling

- Overwrapping

- Bundle Packaging

- Tertiary Packaging

- Palletizing

- Crating

- Bulk Packaging

- Primary Packaging

- Fulfilment Services

- Order Fulfillment

- Warehousing and Inventory Management

- Kitting and Assembly

- Pick and Pack

- Reverse Logistics

- Subscription Box Fulfillment

- Drop Shipping

By Packaging Material

- Plastic

- Rigid

- Flexible

- Paper and Paperboard

- Glass

- Metal

- Biodegradable/Compostable Materials

- Foam

By End-Use Industry

- Food and Beverage

- Frozen Food

- Dairy

- Beverages

- Snacks and Confectionery

- Ready-to-eat Meals

- Pharmaceuticals

- Prescription Drugs

- OTC Medicines

- Nutraceuticals

- Personal Care and Cosmetics

- Skincare

- Haircare

- Toiletries

- Consumer Electronics

- Household Products

- Industrial Goods

- Apparel and Fashion

- Pet Care

By Business Model

- B2B Fulfilment

- B2C Fulfilment

- D2C Fulfilment

- Hybrid Models

By Company Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Channel Type

- E-commerce

- Retail (Offline)

- Omni-channel

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (5)