UAE Ampoules Packaging Market Global Manufacturing Insights

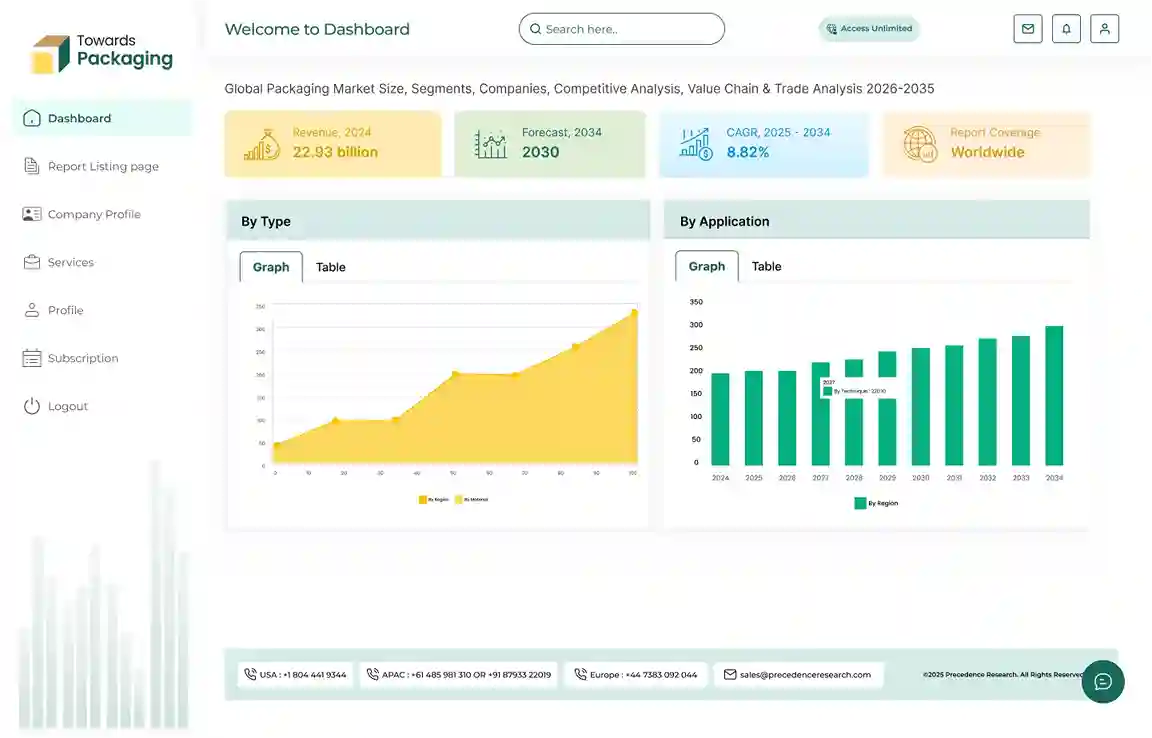

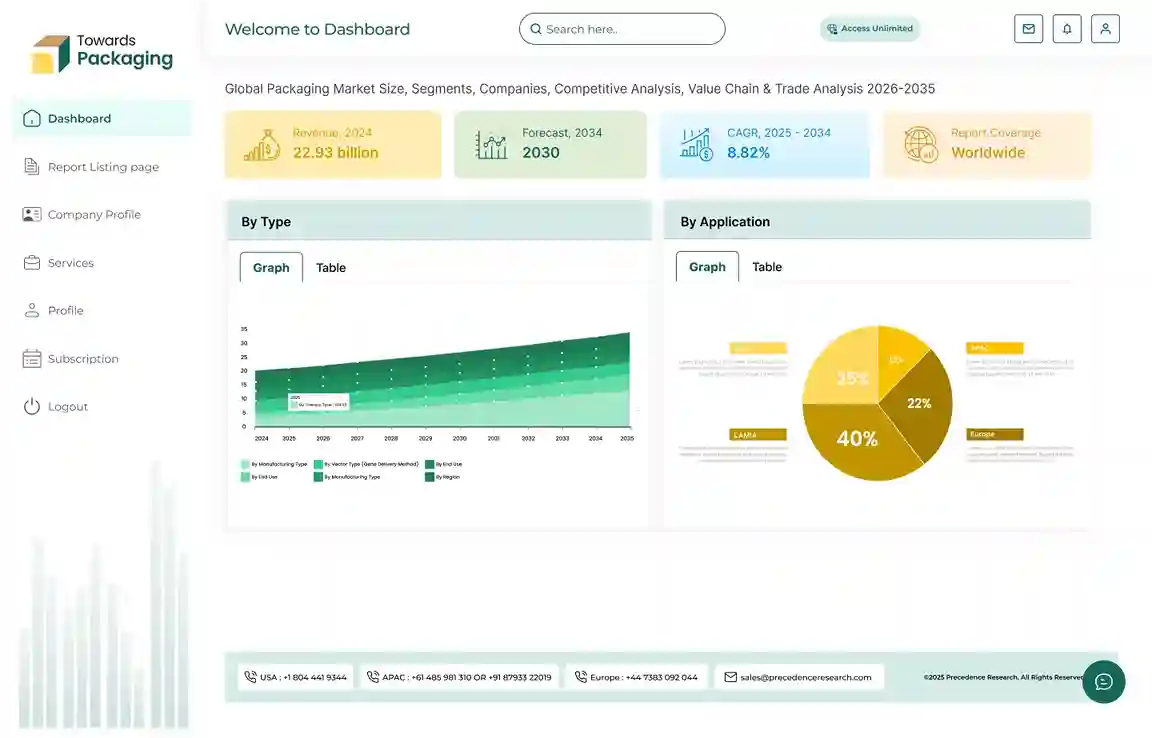

The UAE ampoules packaging market provides an in-depth examination of market size, revenue forecasts, demand growth, and evolving trends supported by complete segment analysis across material types, filling volumes, packaging formats, and end-user industries. The report covers detailed regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, showing how global dynamics influence UAE demand. It incorporates full competitive analysis, profiling key manufacturers, market shares, strategies, and supply-chain positioning. Additionally, the study includes comprehensive value chain mapping, price-trend analysis, trade statistics, import–export flows, and supplier/manufacturer databases, supported by all relevant quantitative data.

Key Insights

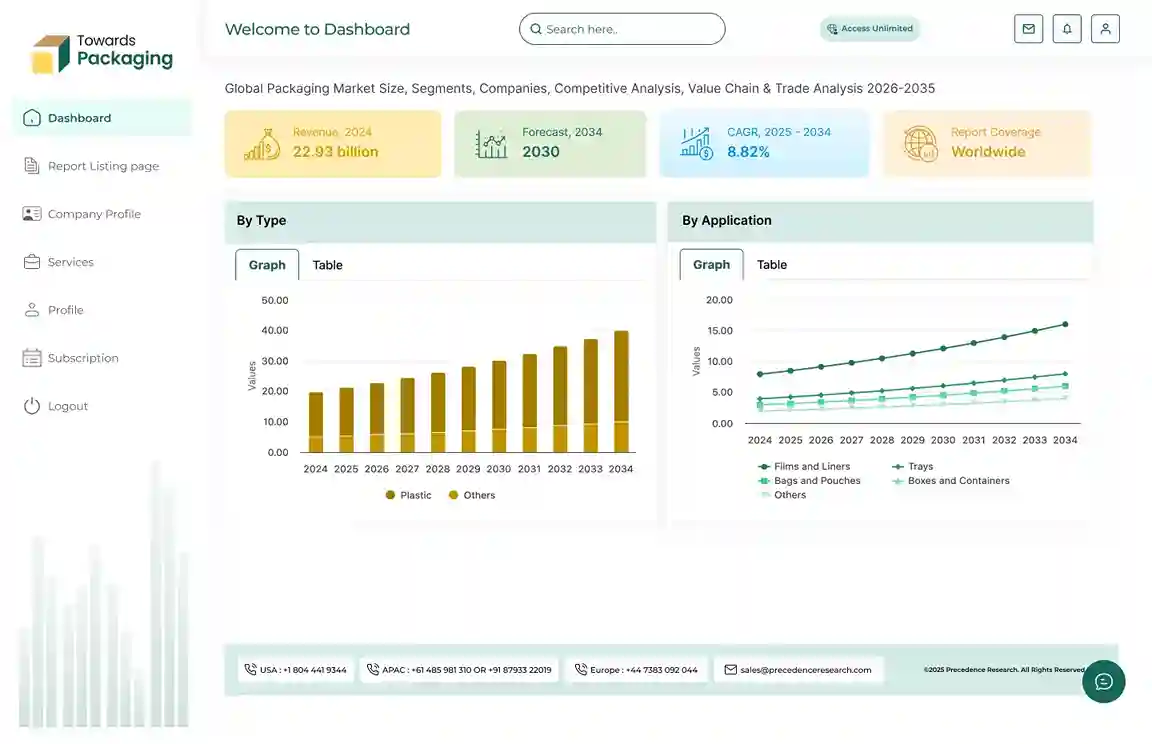

- By material, the glass segment dominated the market with the largest share in 2024.

- By material, the plastic segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By filling volume, the 2-5 ml segment dominated the market with the largest share in 2024.

- By filling volume, the 1-2 ml segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By packaging type, the bulk ampoules segment dominated the market in 2024.

- By packaging type, the ready-to-fill sterile segment is expected to grow at the fastest CAGR in the forecast period.

- By feature, the standard clear glass segment dominated the market with the largest share in 2024.

- By feature, the biodegradable coatings and UV-protected amber segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By end-user, the pharmaceutical segment dominated the market in 2024.

- By end-user, the cosmeceutical/diagnostics segment is expected to grow at the fastest CAGR in the forecast period.

What is Ampoule Packaging?

Ampoule packaging refers to a specialized form of packaging used primarily for storing and protecting pharmaceutical and cosmetic liquids. An ampoule is a small, sealed vial made usually of glass, and occasionally of plastic, designed to contain and preserve a sterile liquid product until it is opened. Ampoules are widely used to package injectable medicines, vaccines, serums, and other sensitive biological or chemical substances. This packaging method is highly valued for its ability to maintain product purity, as the contents remain completely sealed off from external contaminants such as air, moisture, or microbes. To access the contents, the ampoule must be broken at a designated neck or tip, ensuring that the seal remains unbroken until the moment of use. Ampoule packaging plays a crucial role in ensuring accurate dosage, long shelf life, and compliance with strict pharmaceutical regulations. It is also used in the cosmetic industry for packaging active ingredients and skincare serums.

What are the Latest Key Trends in the Ampoule Packaging Market?

Adoption of Plastic Ampoules

- Traditionally made from glass, ampoules are now increasingly being made from high-grade plastic materials like polyethylene and polypropylene. These plastic ampoules are shatterproof, lightweight, cost-effective, and offer better safety during transport and handling. They are especially gaining traction in over-the-counter (OTC) products and cosmetic applications.

Growth in Prefilled Ampoules

- Prefilled ampoules are rising in demand due to their convenience, accuracy in dosing, and reduced risk of contamination. These are especially popular in hospitals, emergency care, and cosmetic clinics where quick and sterile application is critical.

Eco-Friendly and Sustainable Packaging

- With the global shift towards sustainability, manufacturers are investing in recyclable and biodegradable ampoule materials. This includes the use of sustainable plastics and innovations in glass recycling methods to reduce environmental impact.

Anti-Counterfeiting Technologies

- To combat the rising issue of counterfeit drugs, advanced packaging features such as tamper-evident seals, holograms, QR codes, and RFID tags are being incorporated into ampoule packaging. These features help track and authenticate products through the supply chain.

Customized and Smart Packaging

- Customization in terms of labeling, shape, and color is becoming more common, especially in cosmetics and dermatological applications. Smart packaging with integrated sensors or indicators (like time-temperature indicators) is being explored to ensure product safety and efficacy.

Rise of Single-Dose Packaging

- Single-dose ampoules are becoming more popular due to increasing demand for unit-dose medication and patient-friendly packaging. They minimize wastage and reduce the risk of contamination, especially in vaccines and ophthalmic solutions.

Automation and Robotics in Manufacturing

- The use of advanced robotics and automation in the filling and sealing of ampoules is improving efficiency, precision, and hygiene. It also supports scalability for large-scale pharmaceutical operations.

Demand from Emerging Sectors

- Besides pharmaceuticals, sectors like personal care, nutraceuticals, and veterinary medicine are increasingly using ampoule packaging to deliver concentrated doses of products such as serums, vitamins, and essential oils.

How Can AI Improve the UAE Ampoules Packaging Market?

AI integration has the potential to significantly transform the ampoule packaging industry by enhancing efficiency, accuracy, and innovation across various stages of the production process. One of the most impactful applications is in quality control, where AI-powered vision systems can detect even the smallest defects in ampoules, such as cracks, air bubbles, or improper sealing, ensuring high product safety and consistency. Additionally, AI enables predictive maintenance by analyzing equipment data to anticipate potential machine failures, reducing downtime and enhancing productivity. In manufacturing, AI algorithms optimize parameters like temperature, pressure, and fill volume, resulting in greater precision, reduced material waste, and lower production costs.

AI plays a vital role in supply chain and inventory management by forecasting demand and streamlining procurement, which is especially crucial during high-demand periods. Moreover, it supports smart and personalized packaging, incorporating features like QR codes and sensors that track usage or provide alerts. Anti-counterfeiting efforts are also strengthened through AI integration with blockchain and serialization for improved traceability. Furthermore, AI helps manufacturers identify ways to minimize material usage and energy consumption, promoting sustainability and cost-efficiency. Overall, AI brings automation, intelligence, and adaptability to the ampoule packaging industry, driving innovation and ensuring compliance with stringent regulatory standards.

Which Factors Drive the Growth of the UAE Ampoules Packaging Market?

- Rapid expansion in pharmaceuticals and healthcare infrastructure

The UAE’s healthcare market is projected to reach as much as USD 71.5 billion by 2025 with an 8.5% CAGR, fueling demand for sterile, high-integrity ampoule packaging for injectable drugs and vaccines.

- Rising demand for injectable medications and vaccines

The pandemic has accelerated vaccine production and distribution, with injectable drug volumes in the UAE growing by ∼35%. This surge directly increases the need for ampoule packaging.

- Growth in pharmaceutical manufacturing and the “Made in UAE” initiative

Local manufacturing expansion, including generics and contract production hubs, supports consistent domestic demand for raw packaging like ampoules.

- In May 2024, the Ministry of Industry and Advanced Technology (MOAT), in collaboration with the Abu Dhabi Department of Economic Development and ADNOC, hosted the third edition of the Make it in the Emirates Forum in Abu Dhabi, where Dubai Industrial City and MD Pharma Factory signed an agreement. The agreement, which is valued at over AD 130 million, demonstrates Dubai Industrial City's increasing appeal to foreign manufacturers and investors.

Restraint

Fragility of Glass Ampoules and Competition from Alternative Packaging Formats

The manufacturing of ampoules, particularly glass ones, involves energy-intensive furnaces and specialized precision sealing machinery. Rising raw material and energy prices compound these costs, making it difficult for smaller players to compete. Glass ampoules remain dominant, but their tendency to break during transport or storage requires extra handling care and protective packaging. This fragility increases risks of waste and contamination and adds logistical complexity. Prefilled syringes, vials, and blister packs offer advantages like reusability, easier handling, more labeling space, and lower cost. As these alternatives gain traction, especially in self-administration contexts, they limit ampoule demand.

What are the Key Opportunities Driving the Growth of the UAE Ampoules Packaging Market?

- Expansion of Pharmaceutical and Cosmetic Manufacturing

UAE’s fast-growing pharmaceutical and personal-care sectors, supported by strategic initiatives like Dubai Industrial Strategy 2030 and Abu Dhabi Vision 2030, are fueling demand for glass ampoules for injectables, vaccines, serums, and premium cosmetics.

- In April 2025, BinSina Pharmacy, located in the United Arab Emirates, and L'Oréal Middle East signed a multi-year sustainable relationship. By incorporating more sustainable practices into the retail beauty and personal care industry, the partnership, which is formally established through a Memorandum of Understanding, aims to assist the nation's transition to a circular economy.

- Integration of Smart Packaging Technologies

Adoption of features like NFC/QR codes, RFID, and temperature sensors offers enhanced traceability, anti-counterfeiting, and consumer engagement key advantages for pharma companies operating in regulated environments.

- Regional Export Potential in GCC and Beyond

With GCC-wide public health expansion and the UAE’s positioning as a manufacturing hub, local producers can cater to both domestic and regional markets, offering compliant ampoule solutions.

Segment Outlook

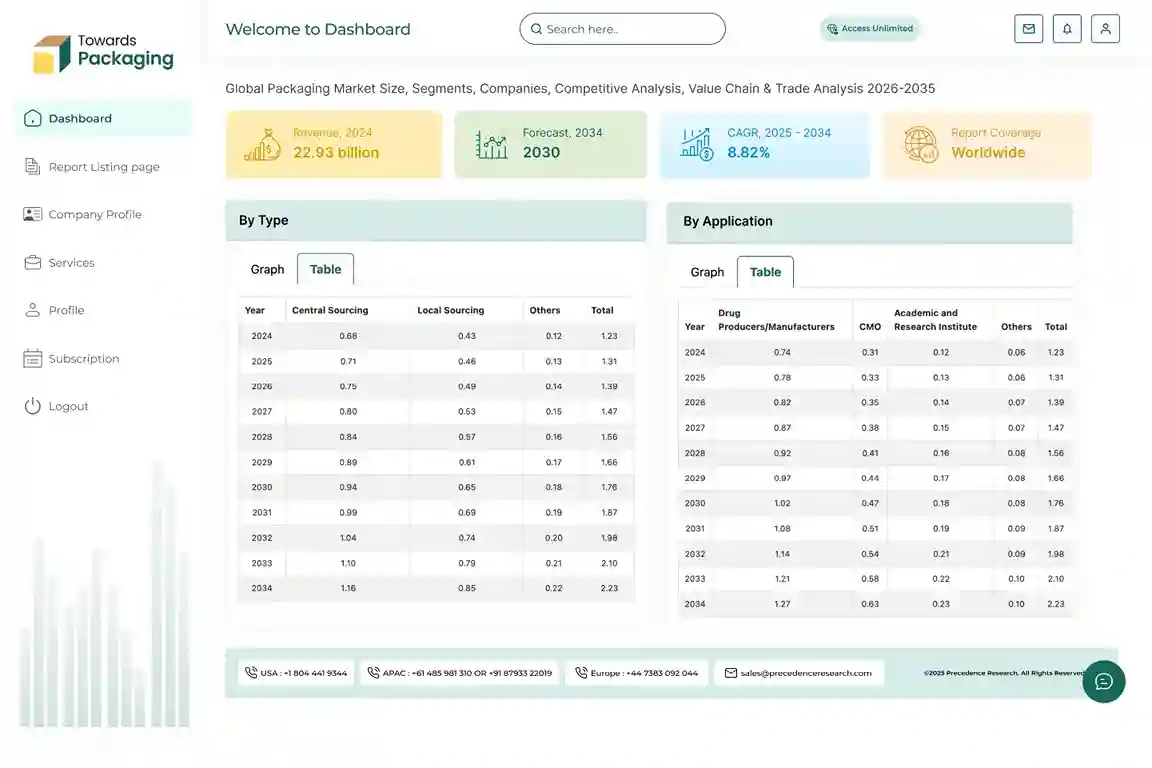

Why does the Glass Segment Dominate the UAE Ampoules Packaging Market?

In the UAE’s ampoule packaging market, glass leads due to its chemical inertness, offering excellent barrier protection against moisture, gases, and light, making it ideal for injectable pharmaceuticals and sensitive liquids. Glass also withstands high‑temperature sterilization, ensures sterility, and provides visible tamper evidence. Additionally, strong demand from a rapidly expanding pharmaceutical sector, driven by government healthcare initiatives and exports, bolsters glass uses for product integrity. Finally, rising regulatory and consumer emphasis on sustainability and premium quality reinforce glass’s dominance in UAE ampoule packaging.

In the UAE’s ampoule packaging market, plastic stands out as the fastest‑growing material segment due to several converging factors. Its lightweight, shatter‑resistant nature reduces breakage and decreases shipping costs while improving user safety. Plastic ampoules, especially polyethylene and polypropylene, are well suited for single‑use, sterile, unit‑dose applications in biopharmaceuticals and injectables. Advancements in blow‑fill‑seal and injection molding technologies have enhanced precision and productivity, supporting regulatory standards like GMP. Together, these qualities, durability, cost-efficiency, single-dose convenience, and tech-led compliance, have driven rapid plastic adoption in UAE ampoule packaging.

Why does the 2-5 ml filling-volume Segment Dominate the UAE Ampoules Packaging Market?

The 2–5 ml filling‑volume segment dominates the UAE ampoules packaging market because it perfectly balances functionality, versatility, and cost-efficiency. Volume sizes in this range meet the dosing needs of a wide array of pharmaceuticals, including vaccines, antibiotics, monoclonal antibodies, and serology reagents, while accommodating both single‑dose and small multi‑dose use. Globally and regionally, the 1–5 ml group constitutes nearly half of the market share, reflecting its broad applicability across end‑use industries. In the UAE and broader MEA region, growing healthcare infrastructure, rising injectable therapies, and stringent pharmaceutical standards further amplify demand for the 2–5 ml range, reinforcing its leading position.

The 1–2 ml filling volume segment is the fastest‑growing in the UAE ampoules packaging market due to several converging dynamics. Globally and within the Middle East and Africa, volumes up to 2 ml are expanding fastest, typically at an 8–9% CAGR, far outpacing larger sizes. This growth is fuelled by increasing demand for single‑unit dose injectables, particularly vaccines, biologics, insulin, and diagnostic reagents, where precision and sterility are essential. The small size minimizes waste, enables easier transport, and supports cost‑effective cold chain logistics. In the UAE and GCC region, rising healthcare infrastructure, chronic disease treatments, and regulatory emphasis on disposable, single‑dose formats further accelerate uptake of the 1–2 ml segment.

Which Packaging Type Industry Dominated the UAE Ampoules Packaging Market in 2024?

The bulk ampoule packaging type, which refers to packaging multiple ampoules together in trays, blisters, or cartons, is the dominant segment in the UAE ampoule packaging market due to several key factors. Firstly, economies of scale favour bulk packaging in large pharmaceutical production runs, reducing per-unit cost while enabling efficient logistics for hospital and clinic distribution. Secondly, regulatory and procurement frameworks in the UAE and GCC often require ampoules to be supplied in standardized trays or boxes to meet sterility handling protocols and inventory tracking requirements. Thirdly, high-volume demand from hospitals, labs, and export markets encourages bulk packaging formats that simplify storage, ordering, and usage in institutional settings. Finally, manufacturing technologies like BFS and tubular forming are optimized for bulk packaging, enabling streamlined filling and packaging workflows that reinforce their dominance.

Several key factors have propelled the ready‑to‑fill, sterile (EZ‑Fill) ampoule packaging type to become the fastest‑growing segment in the UAE market. First, it eliminates pre‑washing and depyrogenation tunnels, significantly lowering capital expenditure, utilities, and validation time, cutting total cost of ownership and simplifying regulatory compliance. Second, its flexibility via combo-fill equipment capable of handling nested containers like vials, cartridges, and ampoules supports both clinical and large-scale commercial production, accelerating deployments and easing format transitions. Third, the sterile, pre-validated supply format reduces breakage rates and enhances aseptic integrity while increasing clean‑room efficiency and line throughput. In the highly regulated UAE pharmaceutical environment with growing demand for injectable biologics, vaccines, and single‑dose therapies, EZ‑Fill’s efficiency, compliance, and flexibility advantages are driving its rapid market adoption.

Which Functionality / Feature Dominated the UAE Ampoules Packaging Market in 2024?

The standard clear glass segment dominates the UAE ampoules packaging market due to several compelling advantages. Clear glass offers excellent chemical inertness, ensuring no leaching or reaction with sensitive pharmaceutical formulations, thus preserving drug stability and potency. Its transparency enables easy visual inspection, critical for detecting particulates or dosing issues before use. Glass also provides superior barrier protection against moisture, gases, and light, essential for injectable medications and biologics. Additionally, clearness aligns with regulatory expectations for tamper-evident and sterile packaging, while hospitals and manufacturers trust its reliability in high-volume sterile applications. Combined with recyclable sustainability credentials, especially borosilicate Type I clear glass, remains the top choice in the UAE market.

The biodegradable coating and UV‑protected amber ampoule segment is growing fastest in the UAE market, driven by multiple compelling factors. Its amber hue delivers superior UV protection, blocking harmful light (especially UV up to ~450 nm) to safeguard sensitive pharmaceuticals and cosmeceuticals from degradation, preserving potency and shelf life. The addition of biodegradable coatings aligns with the UAE’s increasing focus on sustainability, offering eco‑friendly, low‑VOC alternatives that meet tight environmental regulations and brand reputation demands. Regulatory bodies and consumers in the UAE prefer packaging that balances high performance with recyclability. Additionally, the combination of light protection plus bio‑coating supports the growing biologics, diagnostics, and premium cosmeceutical sectors, making this hybrid segment the fastest‑rising choice for local and regional manufacturers.

Which End User Dominated the UAE Ampoules Packaging Market in 2024?

The pharmaceutical segment dominates the UAE ampoules packaging market due to the region’s increasing focus on healthcare infrastructure, government-led initiatives, and rising demand for injectable medications. Ampoules are preferred for their ability to maintain sterility, precise dosage, and protection from contamination, making them ideal for sensitive drugs, vaccines, and biologics. The UAE’s expanding pharmaceutical manufacturing base and strong export orientation further drive demand for high-quality packaging. Additionally, strict regulatory standards and the growing need for tamper-proof and traceable solutions in pharmaceuticals contribute to the reliance on ampoule packaging, solidifying the pharmaceutical segment as the leading end-user in the UAE market.

The cosmeceutical and diagnostic segment is the fastest‑growing end‑user category in the UAE ampoule packaging market, fuelled by rising demand for precision skincare treatments and rapid diagnostic testing. In the cosmeceutical space, consumers increasingly seek single‑dose high‑concentration formulations such as peptides, antioxidants, and hyaluronic acid delivered in ampoules for targeted anti‑aging and pigmentation care, reinforcing demand for convenient, hygienic packaging. Market trends in the UAE favour premium, halal‑certified, sustainable brands, and clinics offer medically formulated ampoules to affluent consumers, boosting uptake. For diagnostics, expanding healthcare infrastructure, medical tourism, and diagnostic consumables usage in labs and hospitals are driving high single‑use demand for sterile ampoules, particularly in tests, reagents, and serology accelerates packaging requirements.

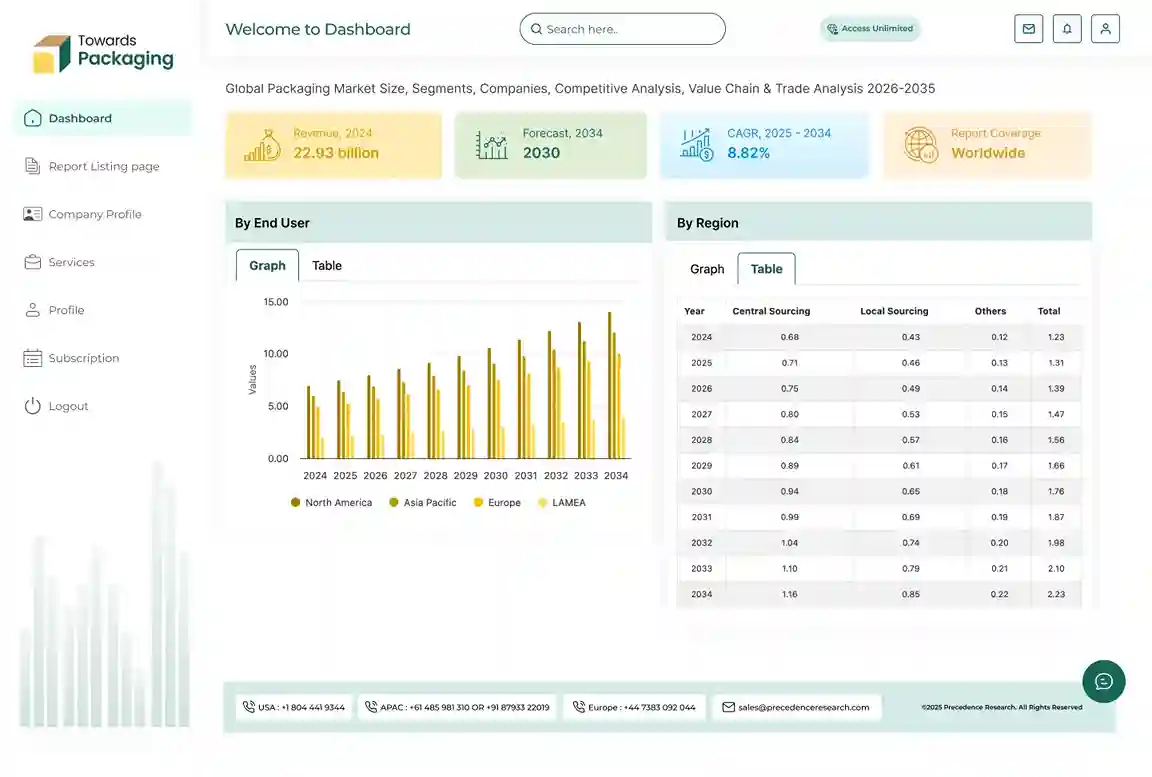

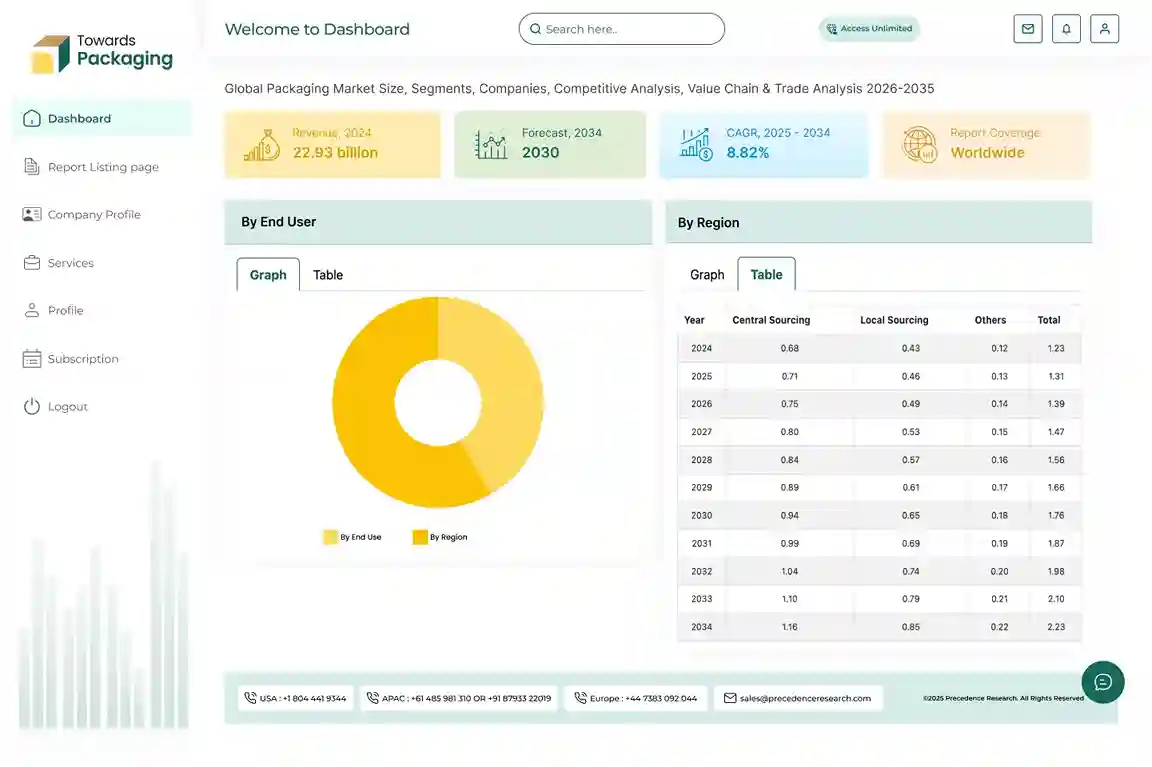

Regional Insights

The UAE is growing in the ampoule packaging market across the Middle East and Africa region, driven by a blend of strategic, economic, and industrial factors. A major contributor is the country’s robust pharmaceutical and healthcare infrastructure, supported by national initiatives like Vision 2030 and the Dubai Industrial Strategy 2030, which promote local pharmaceutical manufacturing and innovation. The UAE government’s strong regulatory framework ensures high standards for product safety and compliance, encouraging the widespread use of sterile, tamper-evident ampoule packaging. Additionally, high healthcare spending and the UAE’s rise as a medical tourism destination have increased the demand for injectable medicines, further fueling ampoule usage.

The country also boasts a rapidly expanding cosmetic and personal care industry, which utilizes ampoules for luxury serums and skincare treatments. Technological advancements, including automation and AI-driven production systems, have enhanced manufacturing efficiency and scale. Furthermore, the UAE’s strategic location and strong export networks allow it to serve as a key supplier of ampoule packaging across the GCC and African markets. With rising demand for biologics, vaccines, and single-dose medications, the UAE is well-positioned to lead the regional ampoule packaging industry in both growth and influence.

UAE Ampoules Packaging Market Key Players

- Arab Pharmaceutical Glass Co.

- Integrated Plastics Packaging

- Interplast Co. Ltd.

- Pack Art Packing & Packaging LLC

Latest Announcements by Industry Leaders

- In May 2025, at the 'Make it in the Emirates' forum, ADNOC stated that nine of its suppliers had been awarded contracts worth AED543 million (USD 147.8 million) for locally produced industrial goods that will be utilized throughout its value chain. The agreements, which cover a wide range of items, were made possible by ADNOC's In-Country Value (ICV) program. These consist of corrosion inhibitors, biofuels, valves, chemicals for drilling and production, and personal protective equipment (PPE)(Source: Zawya)

New Advancements in the Market

- In June 2025, Siegwerk, a prominent worldwide supplier of printing inks and coatings for labels and packaging applications, further expanded its footprint in the Middle East with the announcement of the inauguration of a new facility in Dubai, United Arab Emirates. Siegwerk's new site, which consists of an office complex and a warehouse, will increase logistical efficiency and service proximity, guaranteeing quicker delivery times and better customer assistance for clients throughout the Middle East.(Source: Siegwerk)

- As of June 2025, Optima Packaging Group has established a sales and service center in Riyadh, Saudi Arabia, in an effort to increase its market share in the Middle East. This action shows Optima's dedication to the region's increasing significance by enabling it to offer committed support to clients in Saudi Arabia and beyond.(Source: Optima)

UAE Ampoules Packaging Market Segments

By Material

- Glass

- Type I (Borosilicate)

- Type II (Treated SodaLime)

- Type III (SodaLime)

- Plastic

- EVA/PE/PET monolayer

- Co-extruded laminates (e.g., PETPE)

- Hybrid/Composite

- Glass inner + polymer overcoat

By Filling Volume

- 1–2 mL

- 2–5 mL

- 5–10 mL

- 10 mL

By Packaging Type

- Bulk ampoules

- Readytofill sterile (EZfill)

- Labeled / Over-labeled

- Tamper-evident sealed

By Functionality / Feature

- Standard glass/plastic

- Tamper-proof

- Childresistant

- UVprotected (amber)

- Biodegradable/purpose-built eco variants

By EndUser Industry

- Pharmaceuticals (vaccines, biologics, injectables)

- Cosmeceuticals (serums, beauty treatments)

- Diagnostics and Lab (reagents, analytical)

- Veterinary (animal injectables)

Tags

FAQ's

Select User License to Buy

Figures (1)