Comprehensive Review of the Corrugated Boxes Market Segments, Regional Growth, and Key Manufacturers

The corrugated boxes market was valued at USD 345.35 billion in 2026 and is projected to rise from USD 180.26 billion in 2025 to USD 537.58 billion by 2035 (CAGR 5.14%). Regionally, APAC holds 53% (2024), followed by North America 22%, Europe 15%, Latin America 5%, MEA 5%. By product, slotted boxes account for 52%, folder 18%, telescope 15%, rigid 15%; by material, linerboard 65%, medium 30%, others 5%; by printing, flexographic 52%, digital 25%, lithographic 15%, others 8%; by end use, food and beverages 37%, industrial 20%, home and personal care 12%, glassware and ceramics 10%, textiles 8%, e-commerce and parcel 6%, agri 5%, others 2%.

The competitive field features Smurfit WestRock (14.2% share; USD 21.1B sales), International Paper (10.4%), DS Smith (5.8%), PCA (5.6%), Nine Dragons (5.5%), Rengo (4.2%), Mondi (1.7%) with EBITDA benchmarks led by PCA 19.5%, Smurfit WestRock 15.2%, Mondi 14.2%, IP 10.4%, Nine Dragons 10.3%. We cover full value-chain mapping (containerboard to converting, printing, logistics, recycling) and trade flows (e.g., Qingdao to Oakland, Cartagena to San Juan) plus manufacturers and supplier landscapes.

Strategic Insights into the Global Corrugated Boxes Market

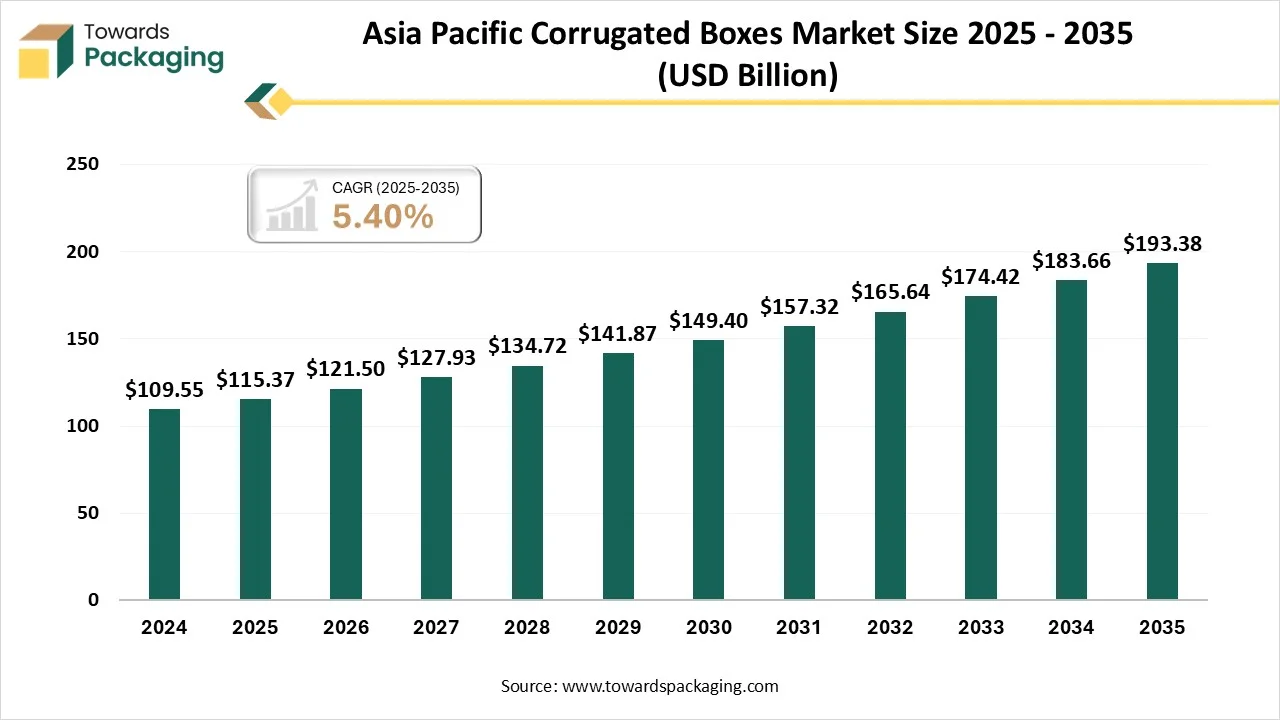

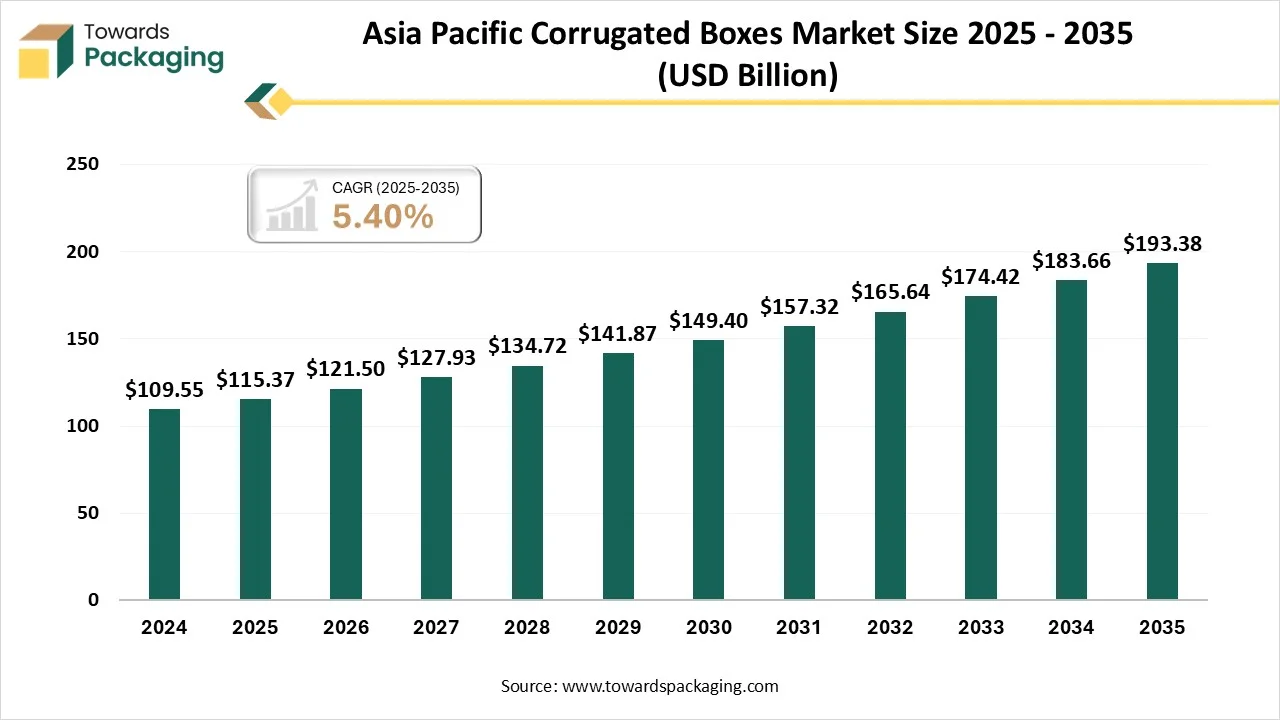

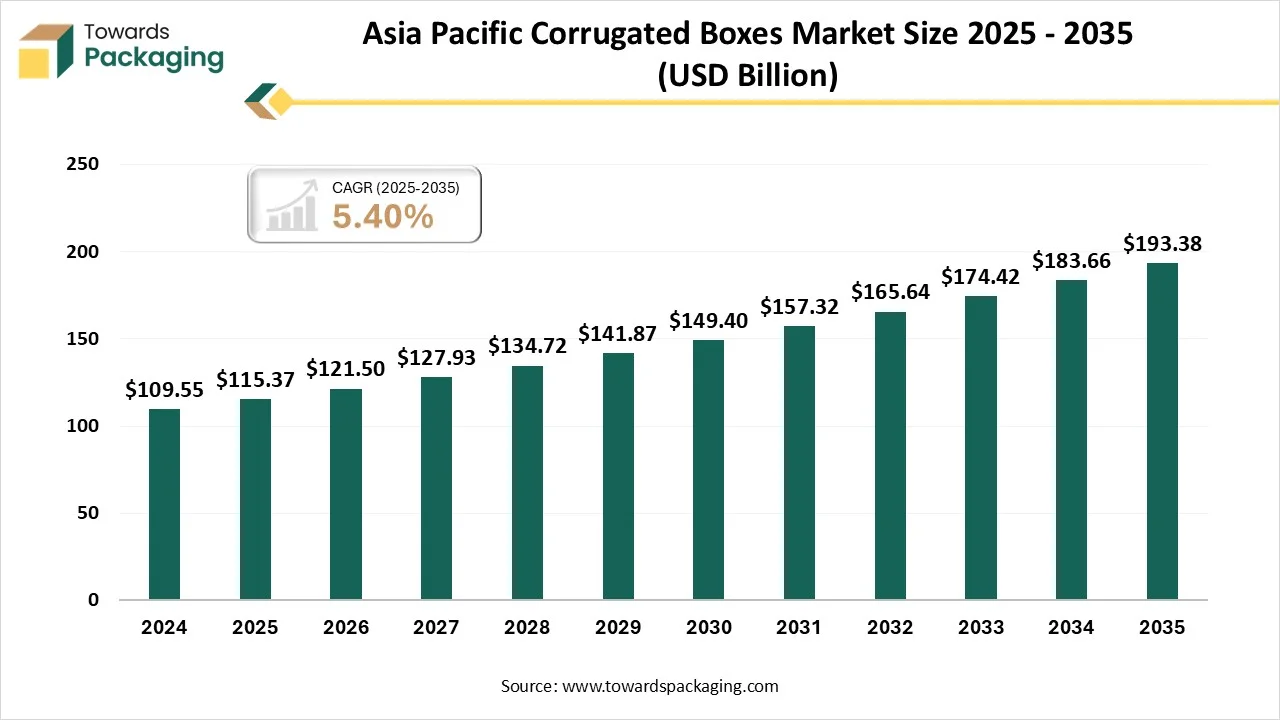

- Asia Pacific led the global corrugated boxes market with the largest market share of 53% in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By product type, the slotted boxes segment has contributed more than 52% of market share in 2024.

- By material type, the linerboard segment has recorded the biggest revenue share of 65% in 2024.

- By printing technology, the flexographic printing segment has held a major revenue share of 52% in 2024.

- By end use, the food & beverages segment accounted for the largest revenue share of 37% in 2024.

Optimizing Corrugated Box Design and Usage

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

Corrugated boxes are shipping containers with significant functional and financial implications that are used for transport packing. One common usage for corrugated boxes is as shipping containers. From product manufacture, to distribution, sale, and occasionally end-use, boxes must hold the product. While boxes can protect products to some extent on their own, they frequently need inside elements like blocking, bracing, and cushioning to help shield delicate contents. The specific logistics system in use determines a lot of the shipping risks.

Corrugated boxes vary in their qualities, applications, and strengths. To create corrugated packaging boxes, the corrugated sheets are cut and folded into a variety of sizes and shapes. Shipping boxes, pizza delivery boxes, retail packaging, and other uses for corrugated boxes are all possible. According to the data published by the National Center for Biotechnology Information, in the US, corrugated boxes are used for the shipment of almost 95% of all goods. In the US, about half of all recycled paper is made of corrugated paperboard.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 171.45 Billion |

| Projected Market Size in 2034 |

USD 283.02 Billion |

| CAGR (2025 - 2034) |

5.14% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Product Type, By Material Type, By Printing Technology, By End Use and By Region |

| Top Key Players |

International Paper, DS Smith, Smurfit Kappa, Rengo Co. Ltd, Mondi, Cascades Inc., Packaging Corporation of America. |

Growth Factors

- Corrugated boxes are witnessing a surge in demand driven by the development in e-commerce, sustainability goals, and smart packaging inventions. Brands are moving towards lightweight yet durable corrugated materials to reduce shipping costs and environmental impact.

- Digital printing on corrugated boxes is trending, serving customization and faster turnaround times for brands seeking unique, consumer-focused packaging. Additionally, biodegradable and recyclable corrugated solutions are being adopted widely, especially in the electronics, food, and personal care industries.

- The integration of QR codes and tracking technology is also helping companies enhance supply chain visibility and anti-counterfeit measures. Overall, the corrugated box industry is adapting quickly to meet the needs of sustainable, tech-savvy, and convenience-driven markets.

- Brands are shifting toward lightweight yet durable corrugated materials to lower shipping costs and environmental impact. Customization and branding through high-level flexographic and digital printing methods are assisting brands to stand out on shelves and in doorstep deliveries.

- With global e-commerce expansion, the urge for lightweight, crush-resistant, and tamper-evident corrugated designs continues to grow, pushing invention in structural engineering and material science in the corrugated box sector.

Boosting Corrugated Boxes Trends

Rising E-Commerce Demand

- Surge in online shopping globally is driving demand for durable, lightweight shipping solutions like corrugated boxes.

Sustainability Focus

Customized Packaging Growth

- Businesses are increasingly using custom-printed corrugated boxes for branding, especially in retail and D2C segments.

Advancements in Digital Printing

- Digital printing technologies allow for fast, cost-effective, and visually appealing short-run production with personalized designs.

Circular Economy Adoption

- Companies are investing in recycled corrugated materials to align with circular economy principles and meet ESG goals.

Industrial and FMCG Expansion

Driving Market Expansion with Innovative Corrugated Box Solutions

E-commerce Evolution and Brand-Centric Packaging Trends

The evolution in e-commerce logistics has significantly impacted packaging demands. The need for secondary corrugated board packaging that not only protects products but also enhances brand image during home delivery has become crucial. Converters in the packaging industry are adopting advanced technology to deliver high quality graphic designs as shipping boxes, as these packages serve as a direct representation of the brand in the consumer’s home, not just at the retailer store. This shift reflects a boarder trend towards ensuring that every touch point in the logistics chain reinforces brand identity and consumers experience. The key players in the market are focused on introduction of the innovative corrugated boxes to meet the demands of consumer which is estimated to drive the growth of the global corrugated boxes market over the forecast period.

For instance,

- In March 2024, DS Smith, paper mill company, revealed the introduction of the Shop.able Carriers recyclable box solution for shipping groceries. The newly launched Shop.able Carriers recyclable box is safe of storage of fruits and vegetables as well as it is water resistant.

Challenges to the Growth of the Corrugated Boxes Market

Competition from Plastic Packaging and Rising Raw Material Costs

The easy availability of the alternative of packaging options like plastic packaging and fluctuating raw material prices have imposed restriction on the growth of the corrugated boxes market over the forecast period. For manufacturers and retailers, flexible plastic packaging offers the biggest benefit since it can save shipping and warehousing costs by reducing the weight of the packaging, requiring a lot less space. As compared to rigid packaging, flexible packaging is 40% less expensive overall, resulting in a 50% decrease in landfill waste and a 62% reduction in greenhouse gas (GHG) emissions. Moreover, the cost for manufacturing the linerboard, flutes is higher as compared to the flexible plastic packaging.

Opportunities for Growth in the Corrugated Boxes Market

Inorganic Strategies and E-commerce Expansion

The expanding e-commerce sector is an additional catalyst boosting the demand for the corrugated boxes. To address the rising demand for the corrugated boxes, the key players operating in the market are focused on adopting inorganic growth strategies like acquisition, which is projected to create lucrative opportunity for the growth of the global corrugated boxes market over the forecast period.

South Korea's Elderly Poverty Crisis and the Harsh Reality of Cardboard Collecting

On the bustling streets of South Korea, older residents pushing carts laden with discarded cardboard have become a poignant symbol of the country's elderly poverty crisis. These seniors, often in their late 70s and 80s, roam the streets collecting cardboard boxes to sell to recycling centers in a bid to survive.

A recent report by the Ministry of Welfare highlighted the dire situation faced by these elderly cardboard collectors. The report, based on a nationwide survey, revealed that between February and May of this year, 14,831 South Koreans aged 65 or older were engaged in this activity. This figure translates to at least 1 out of every 650 seniors in the country. These elderly individuals have an average monthly income of 766,000 won ($553), which includes state livelihood subsidies and pensions. However, the ministry did not disclose how much of this income specifically comes from collecting and selling cardboard. The average age of these cardboard collectors is 78.1 years.

The survey, which is the first of its kind in South Korea, compiled data from the country's 229 local administrative entities, including city and county governments. It painted a bleak picture of regional disparities, with Seoul having the largest number of elderly cardboard collectors at 2,530, followed by Gyeonggi Province with 2,511, South Gyeongsang Province with 1,540, and Busan with 1,280.

In terms of personal wealth, those with assets of less than 25 million won comprised the largest group among the elderly cardboard collectors, making up 25.2 percent. This was followed by those with assets between 50 million and 100 million won at 19.9 percent, and those with assets between 100 million and 150 million won at 13.7 percent. Age-wise, the largest group of cardboard collectors were those aged 80-84, accounting for 28.2 percent of the total. They were followed by the 75-79 age group at 25.2 percent and the 70-74 age group at 17.6 percent.

Despite being the world's 13th-largest economy and boasting a per-capita income of $33,745, which ranks 22nd globally, South Korea faces a chilling problem of elderly poverty. According to the Organization for Economic Cooperation and Development (OECD), South Korea's elderly poverty ratio – the proportion of seniors with less than half of the median income – stood at 40.4 percent in 2020. This was the highest among the 37 OECD members and 2.8 times higher than the 14.4 percent average for the G5 advanced economies of the US, Japan, the UK, France, and Germany.

The plight of South Korea's elderly cardboard collectors underscores the broader issue of senior poverty in the nation. As these individuals continue to struggle for survival, their stories serve as a stark reminder of the challenges faced by the aging population in one of the world's most developed economies.

Exploring Key Market Segments in the Global Corrugated Boxes Market

Slotted and Rigid Box Growth Drivers and Innovations

The slotted boxes segment is held the dominating share of the global corrugated boxes market in 2024. The most common layouts and constructions of corrugated printed boxes are slotted carton boxes. Typically, corrugated board is used to make one or more pieces of slotted box types. To enable folding, the board is cut on the die-cutting machine. At the point where one side panel and one end panel are brought together, the die-cutter forms a joint. After that, flat boxes are sent to the factory to be packaged as products. Workers in the factory put together the box, load the goods inside, and shut the flaps. These types are referred labeled as Slotted-Type Carton Boxes by the International Fibreboard Case Code and as Conventional Slotted Carton Boxes by the carrier classifications. Storage bins, retail packaging, and product packaging, including food packaging design, can all be made with standard slotted containers.

The most common type of corrugated box with slots is the conventional slotted corrugated box. This has two exterior flaps that are half the width of a corrugated box and all of the flaps are the same length. It is simple to personalize slotted corrugated boxes in terms of size, strength, and printing choices. Their adaptability enables them to serve a broad spectrum of goods and sectors, encompassing everything from food and drink to electronics and car components. Increasing launch of the heavy electric equipment has risen the demand for the slotted boxes for packaging and transportation of equipments, which is estimated drive the growth of the segment over the forecast period.

- In April 2024, HPL Electric & Power Ltd., engineering and solutions providing company revealed the expansion of the comprehensive range of electrical equipment with the launch of HPL fans. These fans are sold in both domestic and foreign markets, including the Middle East, Africa, and SAARC (South Asian Association for Regional Cooperation) nations. They fall under the category of consumer electrical devices.

The rigid boxes segment is expected to grow at fastest rate over the forecast period. Compared to conventional paper boxes, rigid boxes are four times thicker and offer a far more sophisticated and robust feel to the packing. Strong protection and great strength are attributes of rigid boxes. Because of their distinct lid and base designs, they provide sturdy protection for bulky or fragile products during handling and transportation. They are perfect for packaging things that need special protection, such gift packaging, glassware, and car parts, because of this property. Moreover, increasing launch of the new design and sustainable material rigid boxes is expected to drive the growth of the segment over the forecast period.

- For instance, in July 2024, Procos S.P.A., Pharmaceutical company, revealed the introduction of the three new 2024 editions of its Grace Box, a durable rigid box made up of high-end mono-material rigid boxes.

Material Type in the Global Corrugated Boxes Market

The linerboard segment held the largest share of the global corrugated boxes market in 2024. The linerboard imparts strength to the corrugated boxes. The linerboard is derived from the kraft paper making process, using the woodfiber that offers strength properties. A linerboard is a flat piece of material that makes up a corrugated sheet’s upper and lower surfaces. It serves as a sandwich for the medium or flutes. For printing graphics, text, and product details on the exterior of corrugated boxes, linerboard offers a smooth surface. Additionally, it strengthens the box’s structural integrity and protective qualities, guaranteeing that the contents are safely enclosed and safeguarded throughout handling and transportation. Since linerboard makes up a large amount of corrugated boxes, it has a significant share.

Various types of linerboard are even present in several flute patterns. Each of these flute type differs across factors, including strength, durability, endurance, and thinness. They include B-flute, C-flute, E-flute, F-flute. Smaller flute profiles more flexible structural and graphic performance, while bigger flute profiles often offer superior cushioning and vertical compression strength.

Moreover, the key players operating in the market are focused on expansion of the manufacturing facility for linerboard production which is expected to drive the growth of the segment over the forecast period.

- In January 2024, Cascades, a company providing packaging solutions, revealed the launch of the recycled linerboard production facility at Bear Island paper mill in Hanover County, Virginia, US.

The medium segment is expected to progress at fastest rate over the forecast period. The kraft paper that is put in between the linerboards and shaped into arches is called medium. These flute tips produce robust columns that can support a great deal of weight when a flat surface board is placed on top of them. By maintaining their separation, the flutes strengthen the bending rigidity of the linerboard sheets.

Leveraging Flexographic Printing Technology for Competitive Advantage

The flexographic printing segment held the largest share of the global corrugated boxes market in 2024 owing to wide range of advantages provided by the flexographic printing technology. A cylinder, an imaged sleeve, or a plate are used in flexographic printing to apply text or graphics to a substrate. Flexographic is ideally suited for large-scale runs and offers crisp branding and printing on packaging as well. Its low setup time and low cost make it an even more advantageous solution, which helps explain its large market share. Flexography is a roll-feed web printing technique with high speed. It can move at up to 2000 feet per minute in linear feet. Flexible packaging and labels in large quantities are frequently printed with flexographic printing. Flexography is renowned for producing high-quality results quickly and efficiently. Even though many printing industries have fully embraced digitalization, this kind of printing is still very common. Since flexography lowers the cost per unit, it can produce prints with a consistently high quality on a variety of materials and substrates without the need for specific coatings. Compared to competing print solutions that might only work with a very limited range of substrates, this is a huge advantage.

Flexographic printing works quickly. The packaging printing business used presses built between 2000 and 2002 that could operate at 150 to 300 feet per minute (FPM) on average, with 400 FPM being considered the standard. This capacity has been boosted to over 600 FPM by modern Flexo presses, providing a significant advantage to companies that have made the decision to invest in more modern machinery. Printing continuous patterns is another innovation made feasible by the use of rotating print heads, which enables printers to finish complicated designs in a single print run. Numerous industries, such as textile, packaging, label, and more, can benefit from the use of flexographic printing. Because of the machines' adaptability, print enterprises can vary their market appeal and maintain their competitiveness by customizing presses to fit various order types.

Strategic Insights into Food & Beverages and E-Commerce Segments

The food & beverages segment dominated the corrugated boxes market in 2024. Food and beverages products need to be packaged with utmost care to maintain freshness, avoid contamination, and adhere to food safety regulations. Corrugated boxes offer superior protection for perishable goods during storage, transportation, and display, so they are an indispensable part of food packaging. Corrugated boxes are also widely used in retail settings for primary and secondary packaging of food and beverages products, and they are an integral part of food and beverages companies overall marketing and sales strategies. The corrugated boxes are mainly used for the transportation of the huge quantity of fruits, vegetables, packaged food and cereals as well as beverages bottles. The capacity of corrugated boxes to prevent foodborne pathogens makes them appealing to carry food items. Corrugated boxes are made by bonding materials together with intense heat. Most bacteria cannot withstand heat levels above 180 degree Fahrenheit, which might take place. The corrugated boxes act as barrier against light, oxygen and moisture, preventing damage and preserving the taste, aroma and texture of the food and beverages.

- Furthermore, in July 2022, according to the data published by the Packaging Corporation of America, non-profit organization, estimated that food and beverages industry reported fastest growing online sales category over the forecast period, with an annual growth rate of 75% over time period of 2021 to 2024.

Moreover, the key players operating in the market are focused on adopting inorganic strategies like partnership and collaboration to develop new paper based corrugated boxes for food packaging.

- In June, 2024, Saica Group, a company developing sustainable and innovative solutions signed collaboration with Mondelez International, Inc., consumer goods company, to innovate and introduce new paper-based corrugate boxes targeted to multipacks-products for the biscuits, chocolate, and confectionery markets. The newly launched package is developed to be recyclable and is suitable for heat sealable packaging process.

The e-commerce and parcel delivery segment is estimated to grow at fastest rate over the forecast period. The demand for the corrugated boxes has increased dramatically as people choose to buy online more and more. This trend was intensified by the COVID-19 epidemic, as more people started buying a variety of goods, such as groceries, gadgets, clothes, and more, online. Products are well cushioned and protected by corrugated boxes, which lowers the possibility of damage occurring during transit. Corrugated boxes are ideal choice for making sure that products reach customers in good conditions because of their strength and durability. Moreover, increasing online sale of liquor has risen the demand for the corrugated boxes for packaging of glass beverages bottles safely, which is estimated to drive the growth of the segment over the forecast period.

- In July 2024, according to the data published by the Indian Food & Beverage Association, non-profit organization supporting growth of food and beverage industry, revealed that online food delivery platforms like BigBasket, Zomato, Swiggy, and blinkit, are at initial stage of starting online liquor delivery in several Indian states.

The corrugated boxes are widely used as they are lightweight yet strong, allowing for easy transportation and handling. The use of corrugated boxes for online shopping and home delivery reduces shipping costs and minimizes the risk of damage during transit. In addition, the increase in the use online shopping stores has projected to rise in demand of the corrugated boxes, which is estimated to drive the growth of the segment over the forecast period.

- In March 2024, according to the data published by the National E-commerce Associations, non-profit organization, estimated that there is rise in the online shopping due to social media apps and the innovative and creative advertisement by the digital marketing for raising the sale of the products. The online shopping has increased the employment for product shipment and the packaging industry. It is estimated that share for online retail transactions will be increased upto 22.6%. The electronic items and clothes are the mostly sold online goods.

Regional Insights and Strategic Developments in the Corrugated Boxes Market

Asia Pacific & North America

Asia Pacific led the corrugated boxes market in 2024. The food and beverage, electronics, and personal care industries, particularly in India, Korea, Japan, and China have efficient demand and supply cycles, which is responsible for Asia Pacific strong market share. The growth of e-commerce is driving the local market. Its strong market share is also a result of the substantial presence of corrugated box makers in this area. Moreover, the key players operating in the Asia Pacific are focused on adopting advanced technology for expanding their product portfolio by deployment new packaging patterns which is estimated to fuel the growth of the corrugated boxes market in the Asia Pacific region.

For instance,

- HBD Packaging Pvt. Limited, packaging company based in India, announced the investment for deployment of fully automatic machine, twin line (DP4030M, designing top and bottom boxes in line) rigid box-manufacturing machine from Guangdong Hongming company, based in China. The HBD Packaging Pvt. Limited expanded its product portfolio by adding new pattern rigid box used for gift packaging and automotive parts packaging.

With companies like Bohui Group, Nine Dragons Worldwide (China) Investment Group Co., Ltd., and Lee & Man Paper Manufacturing Ltd. among others, the Chinese market is extremely competitive. Since Chinese firms produce large quantities, they get benefits through economies of scale. Because of this, they can manufacture corrugated boxes at a lower cost than other nations, giving them a significant competitive advantage in both home and foreign markets.

Additionally, a sizable amount of China's produced commodities is headed for foreign markets due to the country's export-oriented economy. Corrugated boxes are in greater demand as a result of the need for durable packaging solutions for these commodities to be transported safely. Moreover, increasing initiative by the government of China to produce sustainable packaging is estimated to drive the growth of the corrugated boxes market in the China region.

The expanding industrial sector in Japan is the main driver of the corrugated boxes market. The Japanese manufacturing industry is divided into four categories, according to the Ministry of Economy, Trade and Industry (METI) fabricated metals, industrial machinery, iron and steel, and chemicals. The demand for corrugated boxes to package goods for export is expected to rise as a result of the Japanese government's invitation to foreign direct investments to establish manufacturing facilities in the nation. The Japan External Trade Organization (JETRO) reports that foreign direct investment (FDI) into Japan increased by 8.5% in 2022 for transportation equipment and by 35.3% in 2022 for electrical machinery.

Top Asian Countries Corrugated Boxes Industry:

China

- World’s largest producer and consumer of corrugated boxes.

- Massive growth in e-commerce (e.g., Alibaba, JD.com) fuels demand for protective and branded shipping boxes.

- Strong government focus on green packaging and recycling infrastructure.

India

- Rapid urbanization and retail expansion increase demand for corrugated packaging, especially in FMCG and electronics.

- Shift from plastic to paper-based packaging due to environmental regulations and consumer pressure.

- Government’s “Make in India” and e-commerce boom (e.g., Flipkart, Amazon India) supporting packaging sector.

Japan

South Korea

- Growing online shopping and meal kit delivery services drive box demand.

- Focus on premium-quality, well-designed corrugated boxes for branding and customer experience.

- Eco-packaging policies pushing firms to shift to recyclable corrugated board.

North America is the most fastest growing and lucrative market, significantly driven by the rapid urbanization and development in the automation industries. North America's corrugated boxes market is anticipated to expand at the fastest rate possible between 2024 and 2030 because of the expansion of the e-commerce industry in the area. Customers now find it simpler to shop online due to advancements in digital infrastructure, such as increased internet speeds and the widespread use of mobile devices. Improved user interfaces, payment methods, and website designs all add to a smooth online buying experience, which in turn fuels the growth of online shopping and bodes well for the North American market.

The increasing prominence of e-commerce in the U.S. is estimated to drive the demand for corrugated boxes. In July 2024, according to the U.S. Department of Commerce, e-commerce’s share of total retail sales was 15.9% in the first quarter of 2024, reflecting a significant rise from second quarter of 2023. This surge suggests a robust market demand for corrugated boxes, essential for packaging goods in online retail transactions.

Moreover, increasing adoption of the inorganic growth strategies like collaboration by the key players operating in the U.S. to launch advanced technology automated machinery for developing corrugated printed box is estimated to fuel the growth of the corrugated boxes market over the forecast period.

For instance,

- In May 2024, Packsize International, Inc., packaging solution providing company, signed collaboration with Electronics for Imaging, Inc., technology company, to develop first on-demand box system which combines full-color printing on boxes utilizing a single automated solution. The Packsize International, Inc. company and Electronics for Imaging, Inc. company revealed the development of the X5 Nozomi system by integrating Packsize's X5 fully-automated, right-sized Packaging on Demand system, part of the Packsize X Series, with Electronics for Imaging, Inc. company's industry-leading Nozomi single-pass digital inkjet printer line for corrugated.

Why Is Europe Considered a Notable Region in the Corrugated Boxes Market?

The corrugated box market of Europe is expected to experience notable growth in the foreseeable future. This growth is mainly driven by the strong presence of manufacturing industries such as food processing, automotive, and electronics, alongside the expanding e-commerce sector. Additionally, the increasing focus on sustainable packaging favors corrugated boxes due to their recyclability and biodegradability. The booming online retail sector in Europe is a major factor propelling the demand for corrugated boxes, as these boxes are essential for shipping products purchased online. Different regions in Europe possess unique economic strengths, ranging from innovation and high-value products to cost-effective manufacturing hubs, resulting in diverse applications for corrugated boxes.

Germany Corrugated Boxes Market Trends

Germany plays a crucial role in the European corrugated packaging market as the largest market in the region. This prominence is linked to Germany's strong industrial base, particularly in the automotive and machinery sectors, as well as the growth of e-commerce. German companies are also leaders in adopting advanced technologies and focusing on sustainable packaging solutions. Additionally, Germany is a significant exporter of corrugated packaging, with a large portion of its production being shipped abroad.

- In October 2024, Palm acquired 100% of the shares in John Hargreaves (Collyhurst & Stalybridge) Ltd., a company that manufactures corrugated products such as single-face reels, double-face sheets, and fanfold. This acquisition allows Palm to expand the geographical reach of its corrugated division into the UK and enhances vertical integration, as John Hargreaves will receive recycled paper from Palm's containerboard mills in Germany and France, committing to continuing to serve loyal customers and build on a reputation for trust, quality, and service.

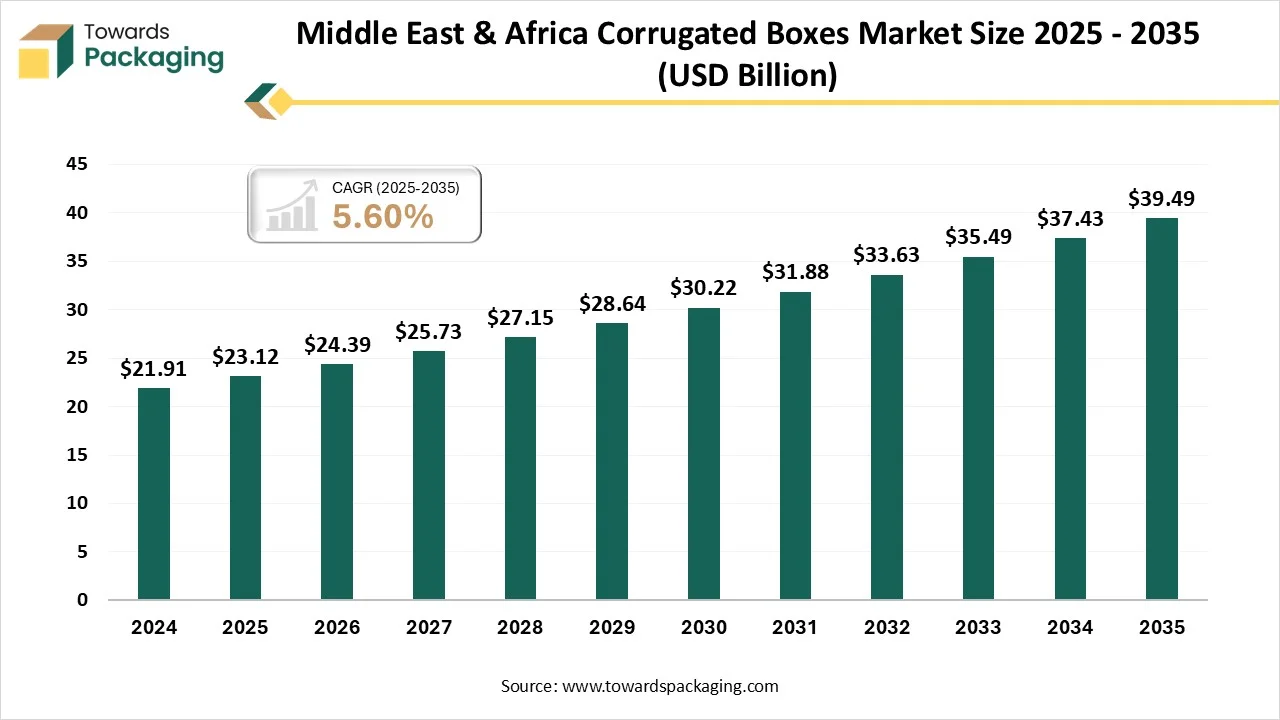

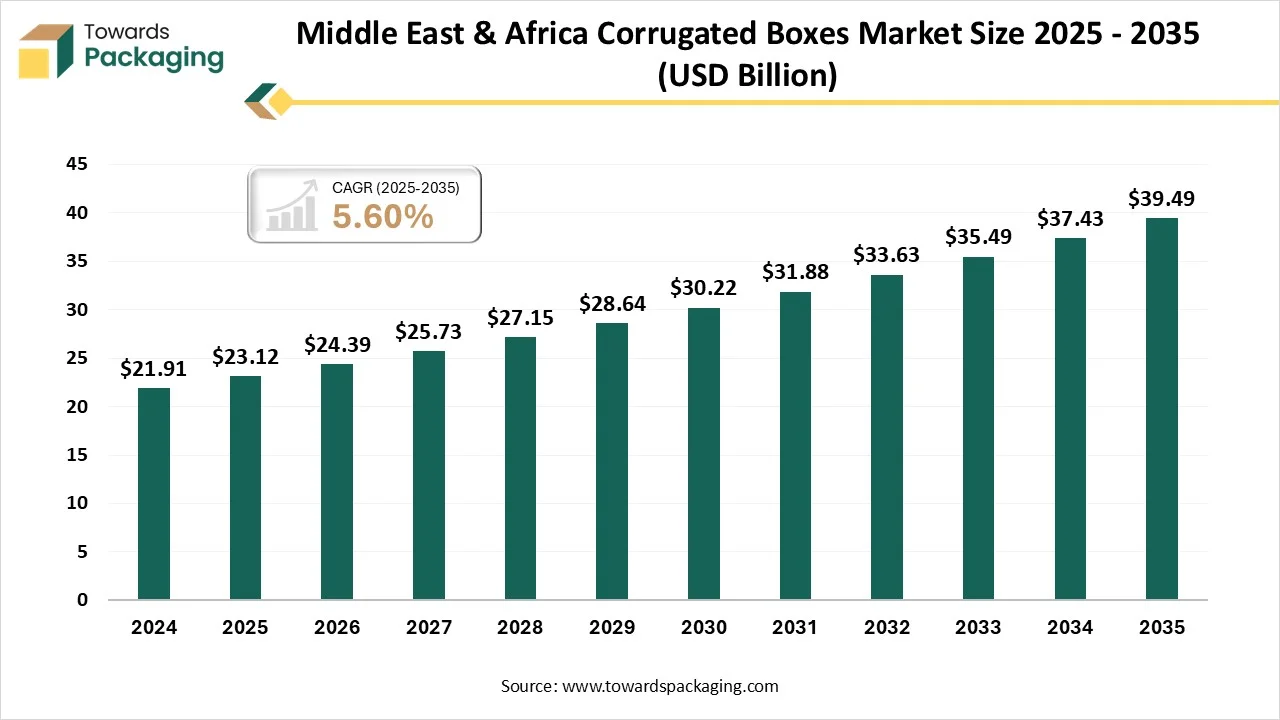

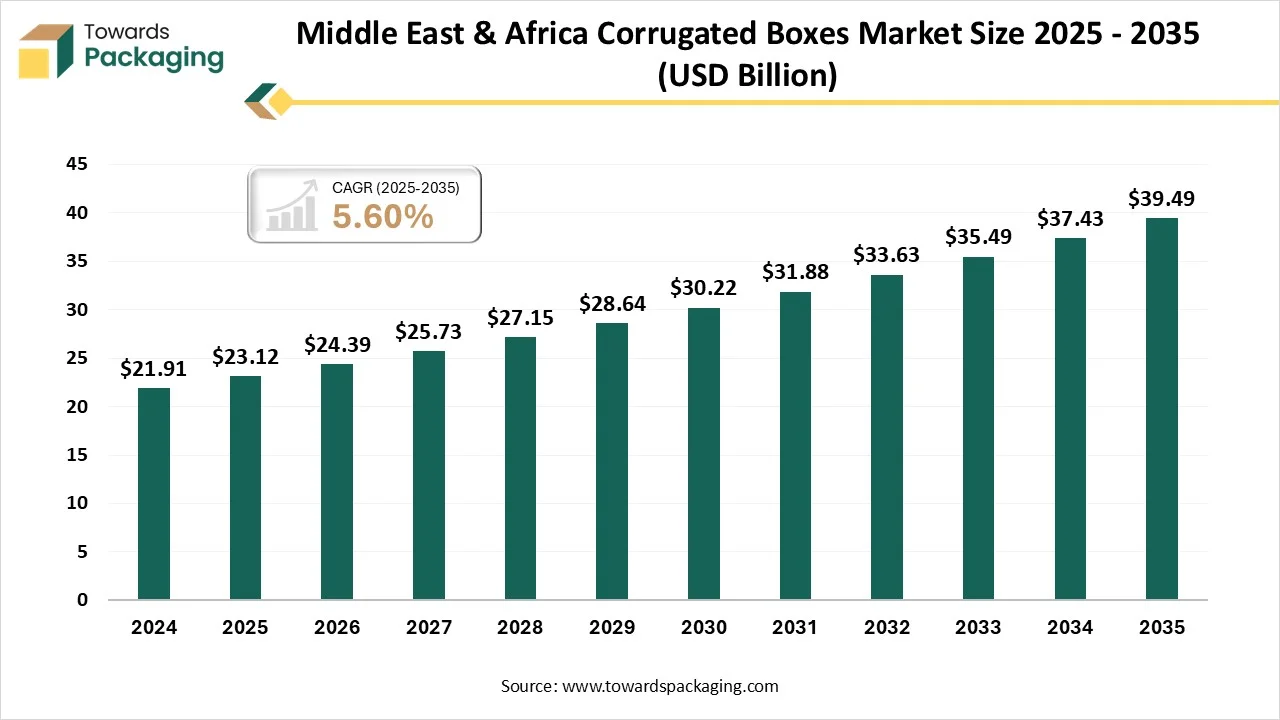

Middle East & Africa Corrugated Boxes Market Size 2025 - 2035 (USD Billion)

Future of Corrugated Packaging Market

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

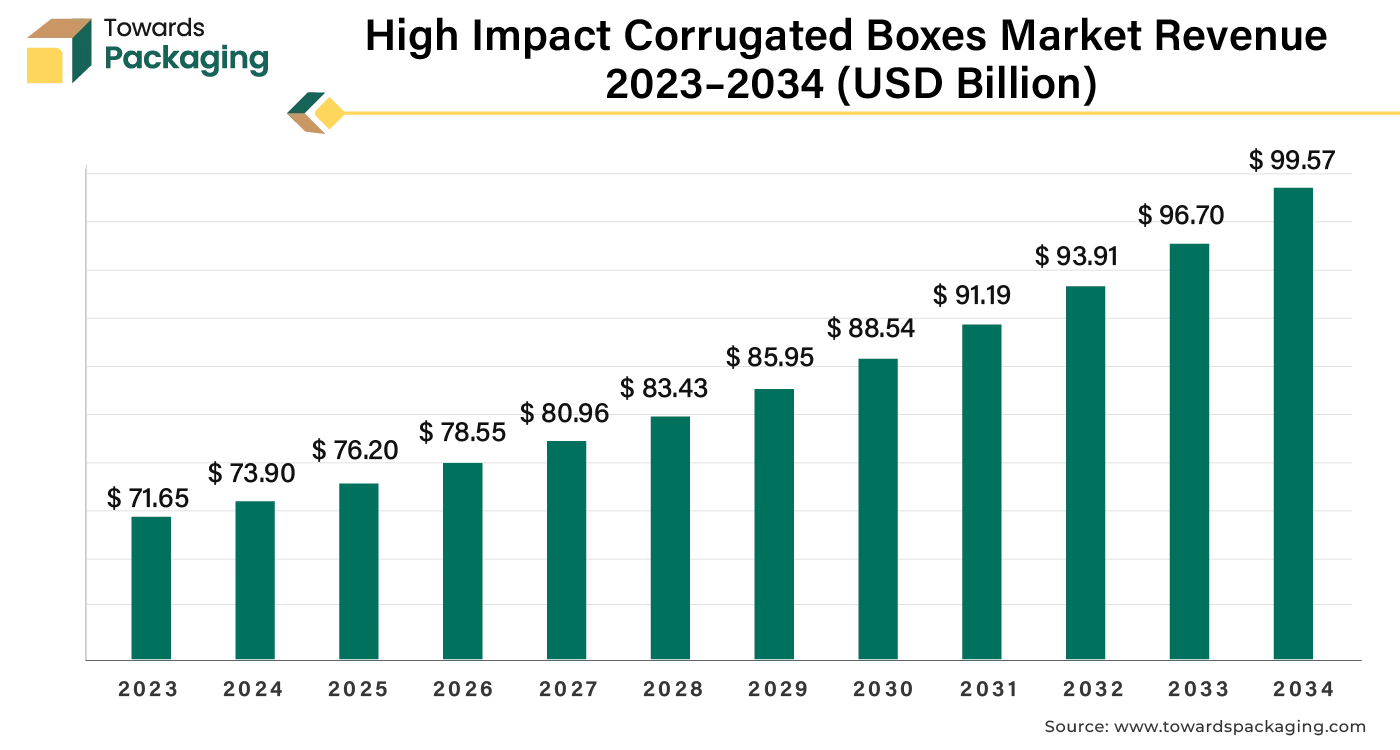

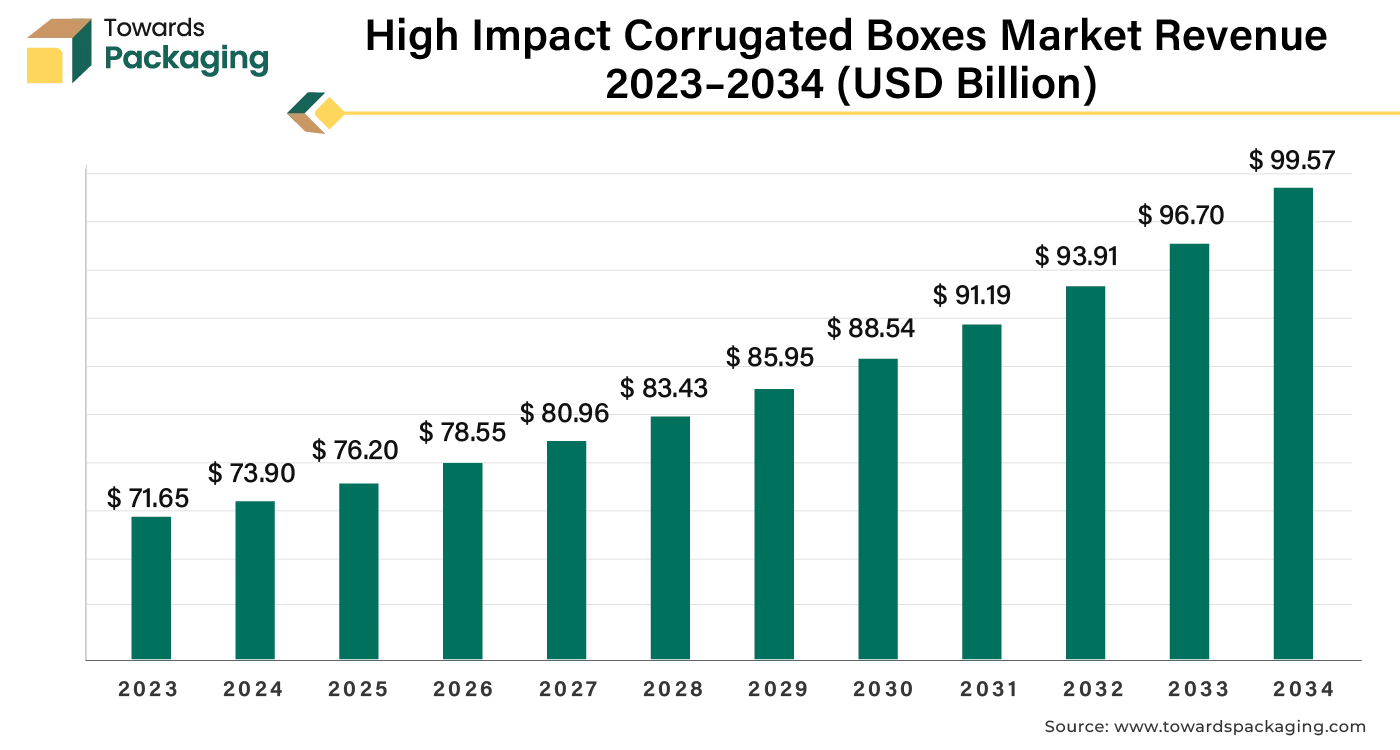

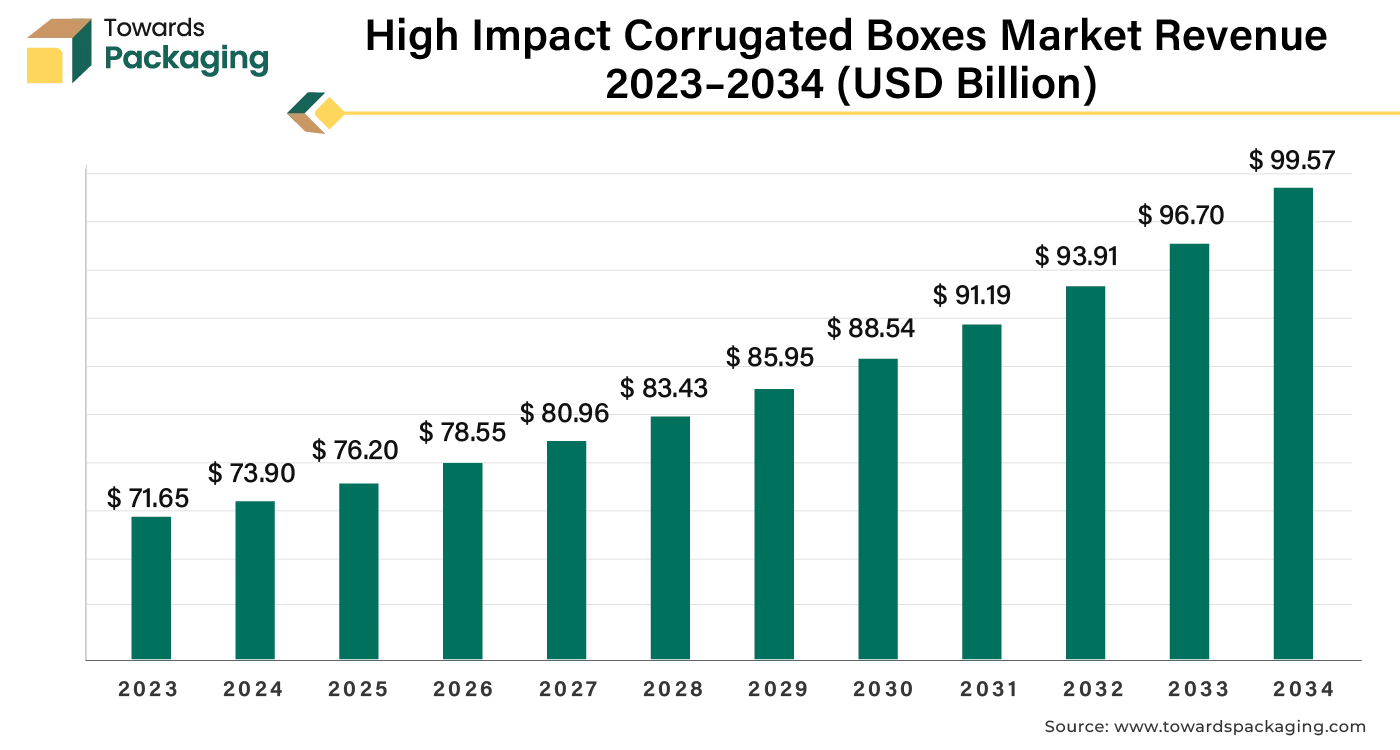

Future of High Impact Corrugated Boxes Market

The high impact corrugated boxes market is expected to increase from USD 76.20 billion in 2025 to USD 99.57 billion by 2034, growing at a CAGR of 3.04% throughout the forecast period from 2025 to 2034.

The market is proliferating due to the increasing business of food and beverages, cosmetics, and several e-commerce companies which require high-impact corrugated boxes for packaging. The growing trend of online ordering systems is boosting the high impact corrugated boxes market.

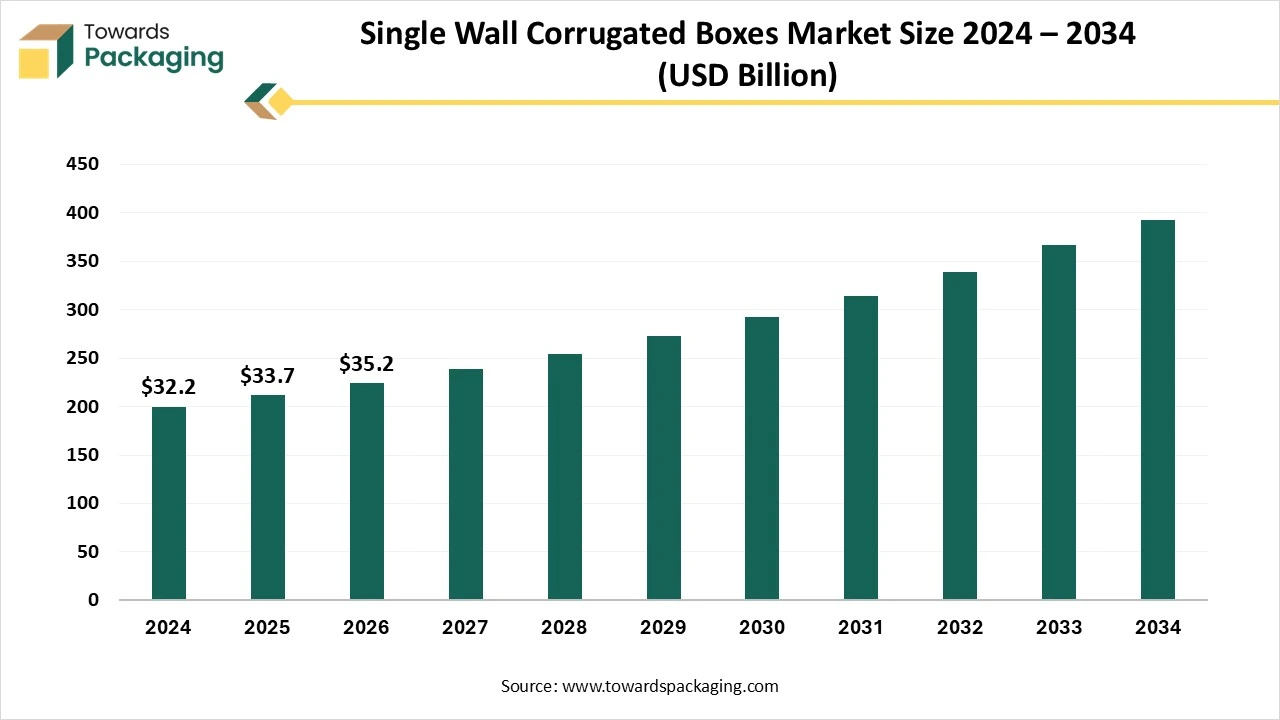

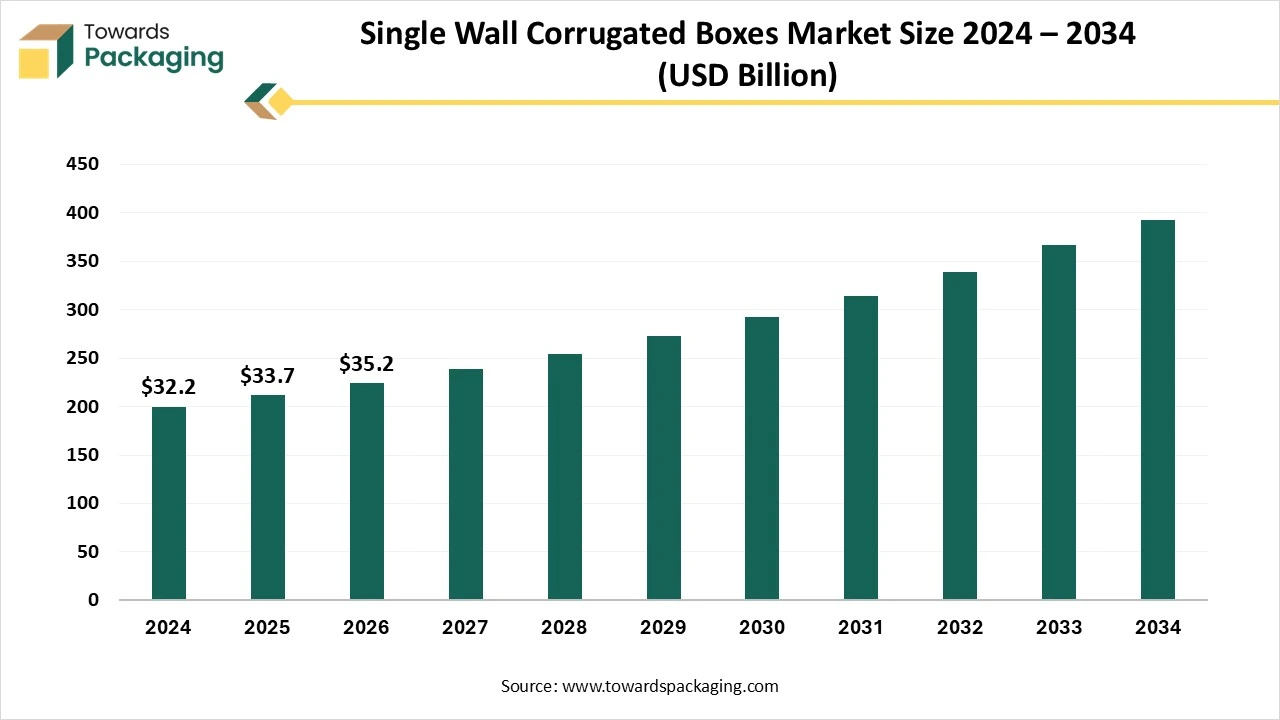

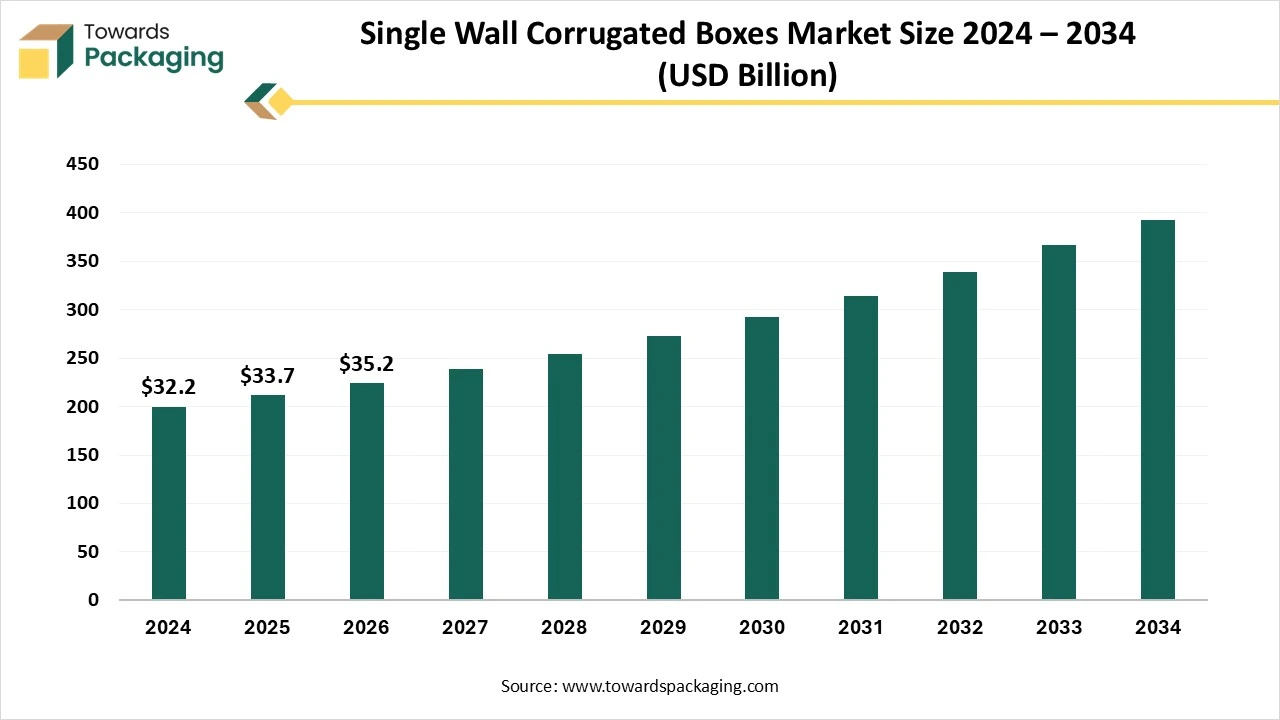

Future of Single Wall Corrugated Boxes Market

The global single-wall corrugated boxes market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The rising expansion of the retail and e-commerce sector is expected to drive the global single-wall corrugated boxes market over the forecast period.

In the packaging industry, Single-wall corrugated boxes are the most commonly used packaging solution, offering a good balance of cost-effectiveness and strength. Single-wall corrugated boxes generally consist of a single inner layer, a single outer layer, and a fluted medium sandwiched between the two. Single Wall Corrugated Boxes are widely used across various industries such as e-commerce and retail, food and beverage, consumer goods and electronics, and others. Single-wall boxes are lightweight and cheaper than double-wall or triple-wall boxes. They are well-suited for shipping lightweight or non-fragile items.

Recent Developements

- In April 2025, the China National Chemical Information Center and RX, two leading organizers of paper-making and packaging industry exhibitions, announced they will jointly host the Paper Chain Southeast Asia Expo + WEPACK Southeast Asia 2025 in Jakarta, Indonesia. This event aims to enhance the synergy between the upstream and downstream segments of the paper-making and packaging industrial chains across the region.On 31 January 2025, Biedronka joined forces with Mondi, a closed-loop programme to deliver, collect, and recycle its corrugated packaging in line with retailers’ plastic consumption and CO2 emission targets.

- In January 2025, HB Fuller is set to launch its new adhesive, Advantra 9217, at PrintPack India 2025. Specifically formulated for the production of mono cartons, the adhesive is designed to perform efficiently on both automatic and semi-automatic packaging lines. Ashwini Sonar, the company's marketing specialist, highlighted its versatility and suitability for various production environments in the packaging industry.

- On 10 September 2024, UK-headquartered power Adhesives revealed what has been disclosed to be the world’s first, and completely certified, biodegradable, designed for usage with cartons and shaped hot melt adhesive, corrugated packaging, and POS Converters, as well as contract packers.

- In December 2024, VTT Technical Research Centre of Finland, together with Aalto University and Finnish industry partners, introduced a groundbreaking technology that allows cardboard to be shaped continuously into origami-inspired structures using a reel-to-reel process. This innovative approach gives the fibre-based material new mechanical properties, making it both lightweight and durable, an ideal, visually appealing substitute for traditional protective packaging materials like plastic and expanded polystyrene. The unique design has also attracted attention from the design community for its aesthetic potential.

- In April 2024, Lieferando began supplying its partner restaurants with new corrugated paper delivery boxes developed by Huhtamaki and coated with Xampla’s plant-based polymer. These boxes aim to offer a ‘plastic-free’ and ‘biodegradable’ alternative for food delivery, aligning with the EU’s Single-Use Plastics Directive. Made from sustainably sourced materials, the packaging is fully recyclable and designed to handle a variety of foods, including greasy or hot items, thanks to its strong thermal insulation and high durability.

Corrugated Boxes Market Key Companies

- International Paper

- DS Smith

- Smurfit Kappa

- Rengo Co. Ltd

- Mondi

- Cascades Inc.

- Packaging Corporation of America

- Georgia-Pacific, LLC

- WestRock Company

- Nine Dragons Worldwide (China) Investment Group Co., Ltd.

- National Carton Factory (NCF)

- Australian Corrugated Packaging

- Visy

- GB Pack

- TGI Packaging Pvt. Ltd

- Trombini; NBM Pack

- Pretoria Box Manufacturers (Pty) Ltd

- Bohui Group

- Lee & Man Paper Manufacturing Ltd

- Shengli carton Equipment Manufacturing

- Dongguang Ruichang Carton Machinery

- EMBA Machinery

- Associated Industrial

- Mitsubishi Heavy Industries America

- Zemat Technology Group

- SUZHOU KOMAL MACHINERY

- MarquipWardUnited

- DING SHUNG MACHINERY

- Zhongke Packaging Machinery

- Serpa Packaging Solutions

- T-ROC EQUIPMENT

- Box On Demand

- Fosber Group

- Shanghai PrintYoung International Industry

- BCS Corrugated

- Packsize International

- Valco Melton

- Acme Machinery

- SUN Automation Group (Langston)

- XINTIAN CARTON MACHINERY MANUFACTURING

- Natraj Industries

Segments Covered in this Report

By Product Type

- Slotted Boxes

- Telescope Boxes

- Folder Boxes

- Rigid Boxes

By Material Type

By Printing Technology

- Digital Printing

- Flexographic Printing

- Lithographic Printing

- Others

By End Use

- Food & Beverage

- Industrial

- Home & Personal Care

- Textile Goods

- Glassware & Ceramics

- E-Commerce and Parcel Delivery

- Agricultural Produce

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait